Beruflich Dokumente

Kultur Dokumente

IPCC Costing

Hochgeladen von

Esukapalli Siva ReddyOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IPCC Costing

Hochgeladen von

Esukapalli Siva ReddyCopyright:

Verfügbare Formate

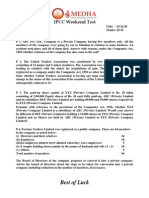

DATE: 29-08-10.

Subject: IPCC Costing

1.

Ph:- 0866 305 43 43, 9246 22 22 23.

A factory uses a job costing system . the following cost data are available from the books for the year ended 31st March, 1998: Direct material 9,00,000 Direct wages 7,50,000 Profit 6,09,000 Selling and Distribution Overhead 5,25,000 Administration Overhead 4,20,000 Factory overhead 4,50,000 Required: a. Prepare a cost sheet indicating the Prime Cost, Work Cost, Production Cost, Cost of Sales and Sales. b. In 1998-99 , the factory has received an order for a number of jobs. It is estimated that the direct material would be Rs. 12,00,000 and direct labour would be price for these jobs if the factory intends to earn the same rate of profit on sales, assuming that the selling and distribution overhead has gone up by 15%. The factory recovers factory overhead as a percentage of direct wages and administration and selling and distribution overheads as a percentage of works cost, based, on the cost rates prevalent in the previous year. Mr. Gopal furnished the following data relating to the manufacture, of a standard product during the month of April 1999: Raw material consumed Rs. 15,000 Direct labour charges Rs. 9,000 Machine hour worked Rs. 900 Machine hour rate Rs.5 Administrative overheads 20% on works cost Selling over heads Re.0.50 per unit Units produced 17,100 Units sold 16,000 t Rs. 4 per unit You are required to prepare a Cost Sheet from the above, showing: a) The cost per unit; b) Profit per unit sold and profit for the period. A manufacture company has an installed capacity of 1,20,000 units per annum. The cost structure of the products manufactured is as Under: 1. Variable cost per unit: Materials Rs. 8.00 Labour Rs. 8.00 (subject to a minimum of Rs. 56,000 per month) Over head Rs. 3.00 2. Fixed overheads Rs. 1,04,000 per annum. 3. Semi variable overheads Rs. 48,000 per annum at 60% capacity which increase by Rs. 6,000 per annum for increase of every 10% of the capacity utilization or any part thereof. The capacity utilization for the next year is estimated at 60% for 2 months, 75% for 6 months and 80% of the balance. The company is planning to have a profit of 25% on the selling price. Calculate the estimated selling price for each unit of production. Assume there is no opening or closing stock.

2.

3.

Das könnte Ihnen auch gefallen

- Cost Accounting RTP CAP-II June 2016Dokument31 SeitenCost Accounting RTP CAP-II June 2016Artha sarokarNoch keine Bewertungen

- Assignment Cost Sheet SumsDokument3 SeitenAssignment Cost Sheet SumsMamta PrajapatiNoch keine Bewertungen

- 68957Dokument9 Seiten68957Mehar WaliaNoch keine Bewertungen

- Marginal Costing Problems SolvedDokument29 SeitenMarginal Costing Problems SolvedUdaya ChoudaryNoch keine Bewertungen

- Working Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadDokument26 SeitenWorking Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadsajedulNoch keine Bewertungen

- Marginal AbsorptionDokument4 SeitenMarginal Absorptionbalachmalik100% (1)

- Cost Accounting Question BankDokument6 SeitenCost Accounting Question BankAnkit Goswami100% (1)

- 38 Marginal CostingDokument9 Seiten38 Marginal CostingAbhishek SinhaNoch keine Bewertungen

- Cost Accounting Past Paper 2016 B Com Part 2Dokument4 SeitenCost Accounting Past Paper 2016 B Com Part 2Sana BudhwaniNoch keine Bewertungen

- PricingDokument7 SeitenPricingarshdeep1990Noch keine Bewertungen

- Management Accounting 21.1.11 QuestionsDokument5 SeitenManagement Accounting 21.1.11 QuestionsAmeya TalankiNoch keine Bewertungen

- Costing Test Book ProblemsDokument29 SeitenCosting Test Book ProblemsSameer Krishna100% (1)

- Marginal Costing and Break-Even AnalysisDokument6 SeitenMarginal Costing and Break-Even AnalysisPrasanna SharmaNoch keine Bewertungen

- Accounting Techniques For Decision MakingDokument24 SeitenAccounting Techniques For Decision MakingRima PrajapatiNoch keine Bewertungen

- Management Accounting ProblemsDokument14 SeitenManagement Accounting ProblemsAnupam DeNoch keine Bewertungen

- Cost Sheet: Particulars Job 101 Job 102Dokument12 SeitenCost Sheet: Particulars Job 101 Job 102vishal soniNoch keine Bewertungen

- 52 Resource 7Dokument4 Seiten52 Resource 7gurudevgaytri0% (1)

- Budget and Budgetary ControlDokument7 SeitenBudget and Budgetary ControlAkash GuptaNoch keine Bewertungen

- Marginal Costing ApplicationsDokument2 SeitenMarginal Costing ApplicationsRatan GohelNoch keine Bewertungen

- Take Home Quiz UasDokument6 SeitenTake Home Quiz UasNadya Priscilya HutajuluNoch keine Bewertungen

- Rev PB SheetDokument10 SeitenRev PB SheetPatriqKaruriKimbo100% (1)

- Malaysia) Past Paper Series 2 2010Dokument7 SeitenMalaysia) Past Paper Series 2 2010Fong Yee JeeNoch keine Bewertungen

- 8508 Managerial AccountingDokument10 Seiten8508 Managerial AccountingHassan Malik100% (1)

- Bep AnalysisDokument13 SeitenBep Analysisanujain1990Noch keine Bewertungen

- MANAC QuestionsDokument4 SeitenMANAC QuestionsPrakhar SethiNoch keine Bewertungen

- ALl Questions According To TopicsDokument11 SeitenALl Questions According To TopicsHassan KhanNoch keine Bewertungen

- Job and Batch CostingDokument7 SeitenJob and Batch CostingDeepak R GoradNoch keine Bewertungen

- Cost AssignmentDokument4 SeitenCost AssignmentSYED MUHAMMAD MOOSA RAZANoch keine Bewertungen

- Case Studies of Cost and Works AccountingDokument17 SeitenCase Studies of Cost and Works AccountingShalini Srivastav50% (2)

- 30784rtpfinalnov2013 5Dokument0 Seiten30784rtpfinalnov2013 5kamlesh1714Noch keine Bewertungen

- Cost SheetDokument4 SeitenCost SheetQuestionscastle FriendNoch keine Bewertungen

- Group II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksDokument23 SeitenGroup II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksMahesh BabuNoch keine Bewertungen

- COST AND MANAGEMENT ACCOUNTING ASSIGNMENTDokument16 SeitenCOST AND MANAGEMENT ACCOUNTING ASSIGNMENTAasim Shakeel100% (1)

- Mid Assignment - ACT 202Dokument4 SeitenMid Assignment - ACT 202ramisa tasrimNoch keine Bewertungen

- Quality Cost Report ClassificationsDokument4 SeitenQuality Cost Report ClassificationsPopol KupaNoch keine Bewertungen

- BudgetDokument9 SeitenBudgetDrBharti KeswaniNoch keine Bewertungen

- Marginal CostingDokument9 SeitenMarginal CostingSharika EpNoch keine Bewertungen

- Assignment 1-Winter2024-Ch-Cost and Job Order QuestionDokument6 SeitenAssignment 1-Winter2024-Ch-Cost and Job Order Questionstudent.devyankgosainNoch keine Bewertungen

- Paper - 4: Cost Accounting and Financial ManagementDokument20 SeitenPaper - 4: Cost Accounting and Financial ManagementdhilonjimyNoch keine Bewertungen

- (8)BATCH COSTING_0a298a02-916c-43a0-87ae-013083fd5c66Dokument8 Seiten(8)BATCH COSTING_0a298a02-916c-43a0-87ae-013083fd5c66Varun TiwariNoch keine Bewertungen

- 1Dokument8 Seiten1Snehak KadamNoch keine Bewertungen

- D10 CaDokument4 SeitenD10 CaaskermanNoch keine Bewertungen

- Adms2510f FL95Dokument9 SeitenAdms2510f FL95rabeya26Noch keine Bewertungen

- SMA Notes (Imp. Problems)Dokument26 SeitenSMA Notes (Imp. Problems)Naresh GuduruNoch keine Bewertungen

- 2.guess Questions - Problems - QuestionsDokument34 Seiten2.guess Questions - Problems - QuestionsKrishnaKorada67% (9)

- Paper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsDokument22 SeitenPaper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsSneha VermaNoch keine Bewertungen

- Cost Volume Profit Analysis For Paper 10Dokument6 SeitenCost Volume Profit Analysis For Paper 10Zaira Anees100% (1)

- Revalidation Test Paper Intermediate Group II: Revised Syllabus 2008Dokument6 SeitenRevalidation Test Paper Intermediate Group II: Revised Syllabus 2008sureka1234Noch keine Bewertungen

- Cost AccountingDokument14 SeitenCost AccountingAdv Kamran Liaqat50% (2)

- 97 ZaDokument7 Seiten97 ZaMeow Meow HuiNoch keine Bewertungen

- Cost and Management Accounting June 2023Dokument8 SeitenCost and Management Accounting June 2023Shalaka YadavNoch keine Bewertungen

- Cost Accounting 2013Dokument3 SeitenCost Accounting 2013GuruKPO0% (1)

- Intermediate Group II Test Papers (Revised July 2009)Dokument55 SeitenIntermediate Group II Test Papers (Revised July 2009)Sumit AroraNoch keine Bewertungen

- MAS 2nd Summative TestDokument16 SeitenMAS 2nd Summative TestNovie Abel BolivarNoch keine Bewertungen

- Machine Hours RateDokument15 SeitenMachine Hours RateRatnakar PatilNoch keine Bewertungen

- Infosys LTD Standalone Audit Report To Shareholders For FY 2019Dokument3 SeitenInfosys LTD Standalone Audit Report To Shareholders For FY 2019Sundarasudarsan RengarajanNoch keine Bewertungen

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageVon EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageBewertung: 5 von 5 Sternen5/5 (1)

- Radha - Java With 2 Yrs of ExpDokument3 SeitenRadha - Java With 2 Yrs of ExpEsukapalli Siva ReddyNoch keine Bewertungen

- Vijay Agarwal Q.P. Nov Batch On (18!02!11)Dokument1 SeiteVijay Agarwal Q.P. Nov Batch On (18!02!11)Esukapalli Siva ReddyNoch keine Bewertungen

- Quetion Paper by Kiran Sir On (25!12!10)Dokument1 SeiteQuetion Paper by Kiran Sir On (25!12!10)Esukapalli Siva ReddyNoch keine Bewertungen

- IPCC Accounts 31-10-10Dokument1 SeiteIPCC Accounts 31-10-10Esukapalli Siva ReddyNoch keine Bewertungen

- Ipcc Tax 9-1-11Dokument1 SeiteIpcc Tax 9-1-11Esukapalli Siva ReddyNoch keine Bewertungen

- Law QP 20-02-10Dokument3 SeitenLaw QP 20-02-10Esukapalli Siva ReddyNoch keine Bewertungen

- IPCC Law Test: Shares, Certs, WarrantsDokument1 SeiteIPCC Law Test: Shares, Certs, WarrantsEsukapalli Siva ReddyNoch keine Bewertungen

- Ipcc Tax - Law Q (1) - P (22-5-2011)Dokument1 SeiteIpcc Tax - Law Q (1) - P (22-5-2011)Esukapalli Siva ReddyNoch keine Bewertungen

- Law QP 6-2-11Dokument1 SeiteLaw QP 6-2-11Esukapalli Siva ReddyNoch keine Bewertungen

- IPCC Weekend Exam: 7 Social Sins, Ethics, CSRDokument1 SeiteIPCC Weekend Exam: 7 Social Sins, Ethics, CSREsukapalli Siva ReddyNoch keine Bewertungen

- Ipcc QP 15.05Dokument2 SeitenIpcc QP 15.05Esukapalli Siva ReddyNoch keine Bewertungen

- Ipcc Tax - Law Q. P (22-5-2011)Dokument2 SeitenIpcc Tax - Law Q. P (22-5-2011)Esukapalli Siva ReddyNoch keine Bewertungen

- IPCC COSTING MarksDokument1 SeiteIPCC COSTING MarksEsukapalli Siva ReddyNoch keine Bewertungen

- Ipcc Law 7.08.2011Dokument1 SeiteIpcc Law 7.08.2011Esukapalli Siva ReddyNoch keine Bewertungen

- Ipcc QP 6-03-11Dokument2 SeitenIpcc QP 6-03-11Esukapalli Siva ReddyNoch keine Bewertungen

- Ipcc Accounting 9-1-11Dokument1 SeiteIpcc Accounting 9-1-11Esukapalli Siva ReddyNoch keine Bewertungen

- Ipcc LawwDokument2 SeitenIpcc LawwEsukapalli Siva ReddyNoch keine Bewertungen

- Ipcc Law QP 13-02-11Dokument1 SeiteIpcc Law QP 13-02-11Esukapalli Siva ReddyNoch keine Bewertungen

- IPCC Accounts Gropup2Dokument4 SeitenIPCC Accounts Gropup2Esukapalli Siva ReddyNoch keine Bewertungen

- IPCC Accounts QP 30-1-11Dokument1 SeiteIPCC Accounts QP 30-1-11Esukapalli Siva ReddyNoch keine Bewertungen

- Ipcc Costing 24.04.11Dokument1 SeiteIpcc Costing 24.04.11Esukapalli Siva ReddyNoch keine Bewertungen

- Ipcc Accounts QP 9-1-11Dokument1 SeiteIpcc Accounts QP 9-1-11Esukapalli Siva ReddyNoch keine Bewertungen

- Ipcc Accounts Ipcc 24.04.11Dokument1 SeiteIpcc Accounts Ipcc 24.04.11Esukapalli Siva ReddyNoch keine Bewertungen

- Interview QDokument3 SeitenInterview QEsukapalli Siva ReddyNoch keine Bewertungen

- SivaDokument1 SeiteSivaEsukapalli Siva ReddyNoch keine Bewertungen