Beruflich Dokumente

Kultur Dokumente

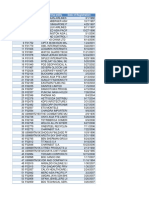

FCCB List

Hochgeladen von

luvisfact7616Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FCCB List

Hochgeladen von

luvisfact7616Copyright:

Verfügbare Formate

Appendix 2: Universe of FCCBs By Issuer

Universe of FCCBs By Issuer

ISSUE SIZE ($M)

AMOUNT O/S ($M)

MATURITY DATE

3I INFOTECH LTD

COMPANY NAME

38

38

4/3/2012

REDM. AMT ($m)

53

3I INFOTECH LTD

50

22

3/17/2011

31

141

3I INFOTECH LTD

100

100

7/27/2012

ABAN OFFSHORE LTD

119

4/15/2011

ACC LTD

60

23

3/19/2009

24

ADANI ENTERPRISES LTD

250

250

1/27/2012

250

ADLABS FILMS LTD

107

107

1/26/2011

130

AFTEK LTD

35

34

6/25/2010

44

AKSH OPTIFIBRE LTD

1/29/2010

11

ALOK INDUSTRIES LTD

45

24

5/27/2010

31

AMTEK AUTO LTD

150

18

6/3/2010

23

336

AMTEK AUTO LTD

250

250

6/16/2011

AMTEK INDIA LTD

100

44

11/12/2010

59

ANKUR DRUGS & PHARMA LTD

16

15

5/27/2011

21

100

ASHOK LEYLAND LTD

100

100

4/30/2009

ASSAM COMPANY LTD

48

45

11/30/2011

68

AUROBINDO PHARMA LTD

60

56

8/11/2010

78

219

AUROBINDO PHARMA LTD

150

150

5/17/2011

AUROBINDO PHARMA LTD

50

50

5/17/2011

73

BAJAJ HINDUSTHAN LTD

50

50

5/14/2010

68

BAJAJ HINDUSTHAN LTD

120

120

2/2/2011

160

BALLARPUR INDUSTRIES LTD

60

60

7/13/2010

82

BARTRONICS INDIA LTD

25

6/11/2012

BARTRONICS INDIA LTD

50

50

1/4/2013

72

BHARAT FORGE LTD

40

40

4/28/2012

57

BHARAT FORGE LTD

40

40

4/28/2013

63

BHARAT FORGE LTD

60

60

4/20/2010

76

BHARAT FORGE LTD

60

60

4/20/2010

78

BHARATI SHIPYARD LTD

20

12/13/2008

BHARATI SHIPYARD LTD

80

47

12/13/2010

67

BHARTI AIRTEL LTD

115

107

5/12/2009

119

BILCARE LTD

50

41

12/22/2010

60

BRUSHMAN INDIA LTD

12

12

6/13/2013

15

CORE PROJECTS & TECHNOLOGIES

80

25

5/12/2012

37

COUNTRY CLUB INDIA LTD

25

25

11/12/2009

31

CRANES SOFTWARE INTL LTD

42

42

3/18/2011

47

DECCAN CHRONICLE HLDGS LTD

54

20

3/17/2011

28

DISHMAN PHARMACEUTICALS & CH

50

8/19/2010

EDUCOMP SOLUTIONS LTD

80

79

7/26/2012

111

ELECTROSTEEL CASTINGS LTD

75

75

5/26/2011

101

112

ERA INFRA ENGINEERING LTD

75

75

1/25/2012

EVEREST KANTO CYLINDER LTD

35

35

10/10/2012

50

FINANCIAL TECHN (INDIA) LTD

100

100

12/21/2011

147

383

FIRSTSOURCE SOLUTIONS LTD

275

275

12/4/2012

GAYATRI PROJECTS LTD

32

32

8/3/2012

38

GEMINI COMMUNICATIONS LTD

19

19

7/17/2012

20

GEODESIC LTD

125

125

1/18/2013

173

125

Appendix 2: Universe of FCCBs By Issuer

Universe of FCCBs By Issuer

ISSUE SIZE ($M)

AMOUNT O/S ($M)

MATURITY DATE

GHCL LTD

COMPANY NAME

81

80

3/21/2011

REDM. AMT ($m)

111

GITANJALI GEMS LTD

110

74

11/25/2011

105

GLENMARK PHARMACEUTICALS LTD

20

2/16/2010

GLENMARK PHARMACEUTICALS LTD

50

49

2/16/2010

66

GLENMARK PHARMACEUTICALS LTD

30

30

1/11/2011

42

GRABAL ALOK IMPEX LTD

20

20

4/5/2012

28

GRAPHITE INDIA LTD

40

35

10/20/2010

42

GREMACH INFRASTRUCTURE EQUIP

50

50

2/13/2013

69

GTL INFRASTRUCTURE LTD

300

268

11/29/2012

376

GUJARAT NRE COKE LTD

55

Blank

4/12/2011

GUJARAT NRE COKE LTD

60

Blank

3/14/2010

H.E.G. LTD

29

18

7/30/2010

24

HELIOS & MATHESON INFO TECH

20

20

7/15/2011

28

HINDUSTAN CONSTRUCTION CO

100

100

4/1/2011

138

HOTEL LEELAVENTURE LTD

89

54

9/16/2010

68

HOTEL LEELAVENTURE LTD

100

100

4/25/2012

147

139

HOUSING DEVELOPMENT FINANCE

500

111

9/27/2010

ICSA INDIA LTD

22

10

3/10/2012

14

ICSA INDIA LTD

24

13

4/28/2012

18

INDIA CEMENTS LTD

75

75

5/12/2011

111

IVRCL INFRASTRUCTURES & PROJ

65

65

12/9/2010

93

JAIN IRRIGATION SYSTEMS LTD

60

60

3/30/2011

84

JAIN IRRIGATION SYSTEMS LTD

210

13

3/9/2013

17

583

JAIN IRRIGATION SYSTEMS LTD

400

395

9/12/2012

JAIN IRRIGATION SYSTEMS LTD

100

2/17/2010

JBF INDUSTRIES LTD

35

35

12/1/2010

47

JCT LTD

35

26

4/8/2011

31

JINDAL SAW LTD

93

60

7/1/2011

70

JSL LTD

60

55

12/24/2009

72

464

JSW STEEL LTD

325

325

6/28/2012

JUBILANT ORGANOSYS LTD

75

63

5/24/2010

87

JUBILANT ORGANOSYS LTD

200

200

5/20/2011

285

JUBILANT ORGANOSYS LTD

35

5/15/2009

KARUTURI GLOBAL LTD

50

50

10/19/2012

71

KEI INDUSTRIES LTD

36

35

11/30/2011

51

KLG SYSTEL LTD

22

19

3/27/2012

27

KOHINOOR FOODS LTD

20

9/5/2010

12

LARSEN & TOUBRO LTD

150

150

11/30/2009

172

LARSEN & TOUBRO LTD

119

Blank

1/28/2011

LUPIN LTD

100

80

1/7/2011

108

MAHARASHTRA SEAMLESS LTD

75

75

7/30/2010

102

MAHINDRA & MAHINDRA LTD

200

200

4/14/2011

256

MAN INDUSTRIES (INDIA) LTD

50

50

5/23/2012

73

MARKSANS PHARMA LTD

55

55

11/9/2010

80

MASCON GLOBAL LTD

50

50

12/28/2012

65

MERCATOR LINES LTD

60

4/27/2010

10

MONNET ISPAT & ENERGY LTD

60

58

3/3/2011

85

126

Appendix 2: Universe of FCCBs By Issuer

Universe of FCCBs By Issuer

ISSUE SIZE ($M)

AMOUNT O/S ($M)

MATURITY DATE

MONNET ISPAT & ENERGY LTD

COMPANY NAME

60

16

2/24/2010

REDM. AMT ($m)

21

MOSER BAER INDIA LTD

75

75

6/21/2012

101

MOSER BAER INDIA LTD

75

75

6/21/2012

105

MOTHERSON SUMI SYSTEMS LTD

64

64

7/16/2010

81

MSK PROJECTS INDIA LTD

5/4/2011

MURLI INDUSTRIES LTD

23

23

2/6/2012

34

NAHAR INDUSTRIAL ENTERPRISES

45

45

2/16/2011

61

NAVA BHARAT VENTURES LTD

62

52

9/30/2011

66

NECTAR LIFESCIENCES LTD

35

33

4/26/2011

50

OK PLAY INDIA LTD

10

10

7/24/2012

15

ORCHID CHEMICALS & PHARMA

43

17

11/3/2010

25

ORCHID CHEMICALS & PHARMA

175

175

2/28/2012

250

250

PANACEA BIOTEC LTD

175

175

2/14/2011

PARAMOUNT COMMUNICATION LTD

27

27

11/23/2011

39

PLETHICO PHARMACEUTICALS LTD

75

75

10/23/2012

109

PRIME FOCUS LTD

55

55

12/13/2012

79

PSL LTD

40

40

9/7/2010

57

PUNJ LLOYD LTD

125

50

4/8/2011

63

123

PYRAMID SAIMIRA THEATRE LTD

90

90

7/4/2012

RADICO KHAITAN LTD

50

50

7/27/2011

65

RAJESH EXPORTS LTD

150

150

2/21/2012

222

558

RANBAXY LABORATORIES LTD

440

440

3/18/2011

RASANDIK ENGINEERING INDS

10

10

4/8/2009

11

RELIANCE COMMUNICATIONS LTD

500

297

5/10/2011

374

1264

RELIANCE COMMUNICATIONS LTD

1000

990

3/1/2012

RELIANCE INFRASTRUCTURE LTD

178

100

3/24/2009

111

RELIANCE NATURAL RESOURCES L

300

300

10/17/2011

300

209

ROLTA INDIA LTD

150

150

6/29/2012

RUCHI INFRASTRUCTURE LTD

40

40

2/3/2012

58

S. KUMARS NATIONWIDE LTD

50

50

4/8/2011

65

SAKTHI SUGARS LTD

20

20

5/30/2009

25

SAKTHI SUGARS LTD

40

40

5/31/2011

59

SHAKTI PUMPS (INDIA) LTD

5/10/2012

10

SHREE ASHTAVINYAK CINEVISION

33

28

12/22/2012

35

102

SICAL LOGISTICS LTD

75

75

4/19/2011

SIMBHAOLI SUGAR LTD

33

33

3/11/2011

45

SINTEX INDUSTRIES LTD

50

50

10/25/2010

70

SINTEX INDUSTRIES LTD

225

225

3/13/2013

291

6/12/2012

11

STERLING BIOTECH LTD

SRI ADHIKARI BROS TELE NTWRK

250

250

5/16/2012

342

234

STERLING BIOTECH LTD

175

175

9/30/2010

STERLING BIOTECH LTD

50

50

9/30/2009

53

STRIDES ARCOLAB LTD

100

100

6/27/2012

145

STRIDES ARCOLAB LTD

40

40

4/19/2010

55

SUBEX LTD

180

180

3/9/2012

245

SURYAJYOTI SPINNING MILLS

10

10

2/17/2012

14

SUZLON ENERGY LTD

300

300

6/12/2012

436

127

Appendix 2: Universe of FCCBs By Issuer

Universe of FCCBs By Issuer

ISSUE SIZE ($M)

AMOUNT O/S ($M)

MATURITY DATE

SUZLON ENERGY LTD

COMPANY NAME

200

200

10/11/2012

REDM. AMT ($m)

290

TATA CHEMICALS LTD

150

150

2/1/2010

181

118

TATA MOTORS LTD

119

119

3/21/2011

TATA MOTORS LTD

100

4/27/2009

TATA MOTORS LTD

490

490

7/12/2012

646

TATA MOTORS LTD

300

300

4/27/2011

365

TATA POWER CO LTD

200

200

2/25/2010

231

1079

TATA STEEL LTD

875

875

9/5/2012

TATA TELESERVICES MAHARASHTR

125

13

6/2/2009

16

TULIP TELECOM LTD

150

150

8/26/2012

217

UFLEX LTD

85

69

3/9/2012

84

UNITED PHOSPHORUS LTD

80

80

1/7/2011

105

127

UNITED SPIRITS LTD

100

100

3/30/2011

UTTAM GALVA STEELS LTD

25

25

8/10/2010

33

VARDHMAN TEXTILES LTD

60

60

2/17/2011

81

VENUS REMEDIES LTD

12

12

5/4/2009

14

VIDEOCON INDUSTRIES LTD

105

67

7/25/2011

86

VIDEOCON INDUSTRIES LTD

90

43

3/7/2011

50

VIVIMED LABS LTD

15

15

4/19/2012

15

WELSPUN-GUJARAT STAHL LTD

75

75

11/29/2010

107

WOCKHARDT LTD

110

108

10/25/2009

140

29

XL TELECOM AND ENERGY LTD

40

20

10/23/2012

ZEE ENTERTAINMENT ENTERPRISE

100

4/29/2009

ZENITH INFOTECH LTD

33

30

9/21/2011

40

ZENITH INFOTECH LTD

45

45

8/17/2012

55

Source: Bloomberg

128

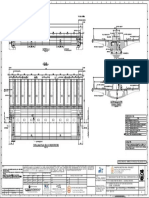

Appendix 3: FCCB Universe

In the Table, "Universe of Indian FCCBs" the highlighted companies symbolises risk of non conversion of FCCBs as the stock prices more than 200% below the conversion price.

The FCCBs which face high risk of non redemption have been put in bold letter. As these companies have high capital gearing.

Universe of FCCBs By Issuer

COMPANY NAME

ISSUE SIZE

AMOUNT

CONV.

Share Price

CON.

MATURITY

REDEM

REDEMPTION

CUR MKT

Avg. Daily Val.

DEBT to

EQUITY

YTM (%)

($M)

O/S ($M)

PRICE

PREM (%)

DATE

VAL

AMT. ($m)

CAP ($m)

Traded 3M ($)

SICAL LOGISTICS LTD

75

75

564

26

2101

4/19/2011

136

102

21

158,817

1.7

57.8

SUBEX LTD

180

180

656

34

1824

3/9/2012

136

245

24

2,797,630

1.2

49.1

GEMINI COMMUNICATIONS LTD

19

19

257

19

1229

7/17/2012

105

20

38

164,894

1.6

21.2

NECTAR LIFESCIENCES LTD

35

33

260

20

1187

4/26/2011

151

50

63

966,259

1.6

24.7

GREMACH INFRASTRUCTURE EQUIP

50

50

376

33

1044

2/13/2013

137

69

10

68,238

1.8

39.3

38.1

BAJAJ HINDUSTHAN LTD

120

120

456

48

857

2/2/2011

134

160

138

6,589,800

2.4

AMTEK AUTO LTD

250

250

459

49

846

6/16/2011

134

336

139

1,077,251

0.6

36.3

PYRAMID SAIMIRA THEATRE LTD

90

90

386

44

783

7/4/2012

136

123

25

914,563

N/A

46.3

SIMBHAOLI SUGAR LTD

33

33

153

18

769

3/11/2011

137

45

7,809

2.3

90.2

AUROBINDO PHARMA LTD

150

150

1,014

121

735

5/17/2011

146

219

133

696,102

1.3

51.4

SAKTHI SUGARS LTD

40

40

283

38

649

5/31/2011

148

59

24

103,036

2.1

28.8

AUROBINDO PHARMA LTD

50

50

879

121

624

5/17/2011

147

73

133

696,102

1.3

44.5

PRIME FOCUS LTD

55

55

1,387

192

622

12/13/2012

144

79

50

44,907

0.2

OK PLAY INDIA LTD

10

10

98

14

619

7/24/2012

146

15

6,436

0.7

47.5

SAKTHI SUGARS LTD

20

20

271

38

618

5/30/2009

123

25

24

103,036

2.1

65.5

TATA MOTORS LTD

119

119

1,001

140

617

3/21/2011

99

118

1,281

11,659,429

1.4

21.9

SUZLON ENERGY LTD

200

200

372

52

610

10/11/2012

145

290

1,599

48,388,678

0.7

36.2

FIRSTSOURCE SOLUTIONS LTD

275

275

92

13

591

12/4/2012

139

383

117

1,784,315

1.5

38.4

TATA MOTORS LTD

490

490

961

140

588

7/12/2012

132

646

1,281

11,659,429

1.4

28.4

SUZLON ENERGY LTD

300

300

360

52

588

6/12/2012

145

436

1,599

48,388,678

0.7

35.7

BHARAT FORGE LTD

40

40

690

102

575

4/28/2013

156

63

464

1,650,837

0.8

14.2

BHARATI SHIPYARD LTD

80

47

498

74

573

12/13/2010

143

67

42

333,380

0.3

28.2

NAHAR INDUSTRIAL ENTERPRISES

45

45

200

31

550

2/16/2011

136

61

22

20,065

1.5

42.8

SRI ADHIKARI BROS TELE NTWRK

94

15

530

6/12/2012

134

11

3,950

0.3

35.3

MOSER BAER INDIA LTD

75

75

364

59

518

6/21/2012

135

101

202

6,756,922

1.2

60.0

MOSER BAER INDIA LTD

75

75

364

59

518

6/21/2012

139

105

202

6,756,922

1.2

58.0

HELIOS & MATHESON INFO TECH

20

20

130

22

505

7/15/2011

139

28

10

46,136

0.3

38.2

BHARAT FORGE LTD

40

40

604

102

491

4/28/2012

143

57

464

1,650,837

0.8

14.9

47.2

MARKSANS PHARMA LTD

55

55

34

485

11/9/2010

145

80

42

816,614

2.2

BHARATI SHIPYARD LTD

20

422

74

471

12/13/2008

120

42

333,380

0.3

34.8

GHCL LTD

81

80

161

28

470

3/21/2011

139

111

58

1,586,269

6.1

48.3

HINDUSTAN CONSTRUCTION CO

100

100

248

44

462

4/1/2011

138

138

231

4,787,007

2.5

19.7

129

Appendix 3: FCCB Universe

Universe of FCCBs By Issuer

COMPANY NAME

ISSUE SIZE

AMOUNT

CONV.

Share Price

CON.

MATURITY

REDEM

REDEMPTION

CUR MKT

Avg. Daily Val.

DEBT to

EQUITY

YTM (%)

($M)

O/S ($M)

PRICE

PREM (%)

DATE

VAL

AMT. ($m)

CAP ($m)

Traded 3M ($)

TATA MOTORS LTD

300

300

780

140

459

4/27/2011

122

365

1,281

11,659,429

1.4

26.9

KEI INDUSTRIES LTD

36

35

86

17

421

11/30/2011

146

51

21

107,125

1.5

32.7

AFTEK LTD

35

34

75

15

419

6/25/2010

128

44

28

390,688

(0.4)

38.7

PARAMOUNT COMM. LTD

27

27

43

417

11/23/2011

146

39

14

62,317

1.5

40.2

WOCKHARDT LTD

110

108

486

97

403

10/25/2009

130

140

216

382,551

2.0

26.2

36.7

STRIDES ARCOLAB LTD

100

100

462

95

386

6/27/2012

145

145

78

300,666

4.8

VIVIMED LABS LTD

15

15

185

39

377

4/19/2012

100

15

10,373

1.1

ALOK INDUSTRIES LTD

45

24

72

15

371

5/27/2010

129

31

61

546,975

3.0

COUNTRY CLUB INDIA LTD

25

25

103

22

370

11/12/2009

123

31

35

85,669

(0.3)

34.0

36.6

PLETHICO PHARMACEUTICALS LTD

75

75

605

133

354

10/23/2012

146

109

92

101,721

0.1

28.5

VARDHMAN TEXTILES LTD

60

60

253

56

350

2/17/2011

134

81

66

38,342

1.9

44.0

TATA STEEL LTD

875

875

756

168

349

9/5/2012

123

1,079

2,508

53,183,578

1.7

12.5

AMTEK AUTO LTD

150

18

210

49

333

6/3/2010

130

23

139

1,077,251

0.6

28.0

AUROBINDO PHARMA LTD

60

56

522

121

330

8/11/2010

140

78

133

696,102

1.3

39.2

VIDEOCON INDUSTRIES LTD

105

67

477

111

329

7/25/2011

128

86

521

1,218,524

0.7

44.6

KLG SYSTEL LTD

22

19

400

94

328

3/27/2012

144

27

24

329,783

0.5

28.4

BARTRONICS INDIA LTD

50

50

290

68

326

1/4/2013

143

72

40

723,418

1.1

29.5

3I INFOTECH LTD

100

100

166

39

325

7/27/2012

141

141

104

538,759

1.6

31.2

XL TELECOM AND ENERGY LTD

40

20

260

61

325

10/23/2012

144

29

23

483,727

1.8

22.6

AMTEK INDIA LTD

100

44

120

28

325

11/12/2010

134

59

65

366,606

0.4

31.1

GITANJALI GEMS LTD

110

74

275

65

323

11/25/2011

142

105

113

1,406,227

0.3

25.2

MURLI INDUSTRIES LTD

23

23

565

137

314

2/6/2012

150

34

29

17,974

3.1

30.6

JCT LTD

35

26

12

311

4/8/2011

120

31

21

12,518

2.4

33.7

SURYAJYOTI SPINNING MILLS

10

10

42

10

310

2/17/2012

140

14

2,504

3.0

37.2

TATA MOTORS LTD

100

573

140

310

4/27/2009

95

1,281

11,659,429

1.4

35.8

VIDEOCON INDUSTRIES LTD

90

43

452

111

307

3/7/2011

117

50

521

1,218,524

0.7

47.9

RAJESH EXPORTS LTD

150

150

96

24

304

2/21/2012

148

222

121

1,133,091

(5.3)

25.2

3I INFOTECH LTD

38

38

154

39

296

4/3/2012

140

53

104

538,759

1.6

30.4

55

14

290

1/29/2010

121

11

16

14,887

0.6

50.1

JSW STEEL LTD

AKSH OPTIFIBRE LTD

325

325

953

246

287

6/28/2012

143

464

938

10,592,748

1.8

29.8

ORCHID CHEMICALS & PHARMA

175

175

348

91

283

2/28/2012

143

250

131

1,089,187

2.9

28.6

GAYATRI PROJECTS LTD

32

32

378

99

283

8/3/2012

120

38

20

78,037

3.1

24.8

STRIDES ARCOLAB LTD

40

40

359

95

278

4/19/2010

137

55

78

300,666

4.8

37.0

130

Appendix 3: FCCB Universe

Universe of FCCBs By Issuer

COMPANY NAME

ISSUE SIZE

AMOUNT

CONV.

Share Price

CON.

MATURITY

REDEM

REDEMPTION

CUR MKT

Avg. Daily Val.

DEBT to

YTM (%)

($M)

O/S ($M)

PRICE

PREM (%)

DATE

VAL

AMT. ($m)

CAP ($m)

Traded 3M ($)

EQUITY

FINANCIAL TECHN (INDIA) LTD

100

100

2,362

648

264

12/21/2011

147

147

607

2,631,477

(0.1)

20.9

JAIPRAKASH ASSOCIATES LTD

400

395

248

70

256

9/12/2012

148

583

1,676

43,436,230

1.8

30.4

GEODESIC LTD

125

125

302

85

256

1/18/2013

138

173

160

547,127

(0.3)

28.9

INDIA CEMENTS LTD

75

75

306

87

253

5/12/2011

148

111

498

1,742,269

0.4

22.1

JSL LTD

60

55

120

34

253

12/24/2009

130

72

112

235,475

2.7

33.4

RUCHI INFRASTRUCTURE LTD

40

40

43

12

249

2/3/2012

145

58

51

5,833

1.4

26.3

MAN INDUSTRIES (INDIA) LTD

50

50

115

33

247

5/23/2012

147

73

36

143,083

0.4

32.2

HOTEL LEELAVENTURE LTD

100

100

72

21

245

4/25/2012

147

147

161

1,086,543

1.9

27.8

ABAN OFFSHORE LTD

119

2,789

810

244

4/15/2011

122

624

18,908,060

24.1

25.2

CORE PROJECTS & TECHNOLOGIES

80

25

165

49

241

5/12/2012

146

37

85

11,631,263

0.3

24.9

SINTEX INDUSTRIES LTD

225

225

580

173

236

3/13/2013

129

291

481

2,042,171

0.3

18.1

BHARAT FORGE LTD

60

60

336

102

229

4/20/2010

127

76

464

1,650,837

0.8

16.4

BHARAT FORGE LTD

60

60

336

102

229

4/20/2010

130

78

464

1,650,837

0.8

16.8

ADLABS FILMS LTD

107

107

543

168

224

1/26/2011

122

130

158

9,898,443

1.3

21.9

RANBAXY LABORATORIES LTD

440

440

716

223

221

3/18/2011

127

558

1,912

27,863,892

1.3

14.2

50

50

148

48

209

5/14/2010

138

68

138

6,589,800

2.4

1,000

990

661

218

204

3/1/2012

128

1,264

9,158

58,102,999

0.9

BAJAJ HINDUSTHAN LTD

RELIANCE COMMUNICATIONS LTD

25.4

3I INFOTECH LTD

50

22

115

39

195

3/17/2011

140

31

104

538,759

1.6

29.9

MAHINDRA & MAHINDRA LTD

200

200

922

316

192

4/14/2011

128

256

1,667

6,145,649

1.4

20.3

17.6

ADANI ENTERPRISES LTD

250

250

1,066

370

188

1/27/2012

100

250

1,861

2,235,969

2.3

UNITED PHOSPHORUS LTD

80

80

272

96

185

1/7/2011

131

105

854

3,178,311

0.4

21.0

ASSAM COMPANY LTD

48

45

29

10

182

11/30/2011

150

68

65

124,442

0.8

31.8

28.8

RADICO KHAITAN LTD

50

50

159

57

179

7/27/2011

130

65

119

417,477

2.2

PANACEA BIOTEC LTD

175

175

358

130

175

2/14/2011

143

250

177

1,068,974

0.4

26.5

ORCHID CHEMICALS & PHARMA

43

17

244

91

168

11/3/2010

147

25

131

1,089,187

2.9

24.6

BRUSHMAN INDIA LTD

12

12

129

48

168

6/13/2013

128

15

11

156,028

1.9

21.3

JUBILANT ORGANOSYS LTD

200

200

413

155

168

5/20/2011

142

285

467

292,445

1.1

27.8

UFLEX LTD

85

69

164

62

166

3/9/2012

122

84

82

27,707

1.6

32.8

50

MASCON GLOBAL LTD

50

GUJARAT NRE COKE LTD

55

14

159

12/28/2012

129

65

41

72,931

0.5

32.4

63

25

153

4/12/2011

139

235

5,239,861

0.3

24.6

24.7

GRABAL ALOK IMPEX LTD

20

20

136

54

152

4/5/2012

142

28

19,834

3.2

VENUS REMEDIES LTD

12

12

437

175

150

5/4/2009

119

14

30

51,784

1.1

75.4

ELECTROSTEEL CASTINGS LTD

75

75

42

17

148

5/26/2011

134

101

98

401,601

0.4

25.8

131

Appendix 3: FCCB Universe

Universe of FCCBs By Issuer

COMPANY NAME

ISSUE SIZE

AMOUNT

CONV.

Share Price

CON.

MATURITY

REDEM

REDEMPTION

CUR MKT

Avg. Daily Val.

DEBT to

YTM (%)

($M)

O/S ($M)

PRICE

PREM (%)

DATE

VAL

AMT. ($m)

CAP ($m)

Traded 3M ($)

EQUITY

JINDAL SAW LTD

93

60

675

277

144

7/1/2011

118

70

294

1,687,739

N/A

S. KUMARS NATIONWIDE LTD

50

50

57

24

136

4/8/2011

129

65

106

1,259,998

1.7

23.0

JBF INDUSTRIES LTD

35

35

90

38

136

12/1/2010

134

47

48

28,825

1.6

27.2

DECCAN CHRONICLE HLDGS LTD

54

20

105

45

132

3/17/2011

140

28

225

676,049

(0.1)

20.4

22.3

ZENITH INFOTECH LTD

45

45

522

225

132

8/17/2012

123

55

56

99,183

1.4

24.3

HOTEL LEELAVENTURE LTD

89

54

47

21

124

9/16/2010

126

68

161

1,086,543

1.9

28.5

RELIANCE COMMUNICATIONS LTD

500

297

481

218

121

5/10/2011

126

374

9,158

58,102,999

0.9

22.8

ERA INFRA ENGINEERING LTD

75

75

159

72

120

1/25/2012

149

112

170

1,196,416

2.4

34.6

SHAKTI PUMPS (INDIA) LTD

153

70

119

5/10/2012

141

10

3,080

3.7

30.7

MSK PROJECTS INDIA LTD

96

44

117

5/4/2011

100

21

80,459

0.7

19.5

MONNET ISPAT & ENERGY LTD

60

58

317

150

111

3/3/2011

145

85

151

1,023,571

0.7

20.2

MERCATOR LINES LTD

60

60

28

111

4/27/2010

125

10

136

3,392,356

1.0

29.3

ASHOK LEYLAND LTD

100

100

31

15

108

4/30/2009

100

100

404

1,505,878

0.4

33.2

BILCARE LTD

50

41

880

427

106

12/22/2010

145

60

150

140,189

1.3

26.1

BARTRONICS INDIA LTD

25

140

68

105

6/11/2012

143

40

723,418

1.1

22.5

RELIANCE INFRASTRUCTURE LTD

178

100

1,007

490

105

3/24/2009

110

111

2,321

74,822,093

0.2

24.4

PSL LTD

40

40

188

92

105

9/7/2010

144

57

80

181,834

0.8

25.0

ROLTA INDIA LTD

150

150

369

184

100

6/29/2012

139

209

604

6,859,690

0.1

25.2

GUJARAT NRE COKE LTD

60

48

25

94

3/14/2010

127

235

5,239,861

0.3

39.6

IVRCL INFRASTRUCTURES & PROJ

65

65

234

125

87

12/9/2010

143

93

339

8,416,481

0.4

24.4

EVEREST KANTO CYLINDER LTD

35

35

271

152

79

10/10/2012

143

50

313

759,010

0.3

20.1

GLENMARK PHARMACEUTICALS LTD

30

30

583

326

79

1/11/2011

140

42

1,665

6,277,395

0.5

19.4

JUBILANT ORGANOSYS LTD

75

63

273

155

77

5/24/2010

138

87

467

292,445

1.1

26.1

ZEE ENTERTAINMENT ENTERPRISE

100

198

113

76

4/29/2009

116

996

6,023,680

0.1

25.8

MAHARASHTRA SEAMLESS LTD

75

75

253

151

68

7/30/2010

136

102

217

699,770

(0.1)

21.5

PUNJ LLOYD LTD

125

50

273

164

67

4/8/2011

126

63

1,011

33,822,909

0.4

16.6

JAIPRAKASH ASSOCIATES LTD

210

13

112

70

61

3/9/2013

132

17

1,676

43,436,230

1.8

11.3

MONNET ISPAT & ENERGY LTD

60

16

237

150

58

2/24/2010

132

21

151

1,023,571

0.7

20.2

BALLARPUR INDUSTRIES LTD

60

60

35

23

53

7/13/2010

136

82

262

282,413

1.7

23.2

2.2

WELSPUN-GUJARAT STAHL LTD

75

75

163

108

51

11/29/2010

143

107

409

3,897,450

TATA CHEMICALS LTD

150

150

231

154

50

2/1/2010

121

181

738

4,006,720

1.2

17.8

UTTAM GALVA STEELS LTD

25

25

45

30

49

8/10/2010

131

33

70

535,995

1.7

13.8

H.E.G. LTD

29

18

192

131

47

7/30/2010

134

24

118

415,779

1.2

21.4

132

Appendix 3: FCCB Universe

Universe of FCCBs By Issuer

COMPANY NAME

ISSUE SIZE

AMOUNT

CONV.

Share Price

CON.

MATURITY

REDEM

REDEMPTION

CUR MKT

Avg. Daily Val.

DEBT to

EQUITY

YTM (%)

($M)

O/S ($M)

PRICE

PREM (%)

DATE

VAL

AMT. ($m)

CAP ($m)

Traded 3M ($)

GRAPHITE INDIA LTD

40

35

53

36

47

10/20/2010

122

42

112

137,931

0.9

23.4

ANKUR DRUGS & PHARMA LTD

16

15

165

112

47

5/27/2011

145

21

43

205,026

2.8

22.0

MOTHERSON SUMI SYSTEMS LTD

64

64

74

51

45

7/16/2010

127

81

371

631,242

0.6

28.2

GTL INFRASTRUCTURE LTD

300

268

53

37

45

11/29/2012

140

376

577

3,097,169

1.3

27.4

KARUTURI GLOBAL LTD

50

50

12

42

10/19/2012

141

71

57

650,916

0.6

26.6

ICSA INDIA LTD

22

10

250

180

39

3/10/2012

136

14

162

1,524,496

0.4

17.7

ICSA INDIA LTD

24

13

250

180

39

4/28/2012

136

18

162

1,524,496

0.4

17.4

ZENITH INFOTECH LTD

33

30

310

225

38

9/21/2011

132

40

56

99,183

1.4

12.4

NAVA BHARAT VENTURES LTD

62

52

137

103

33

9/30/2011

126

66

164

409,008

0.1

18.5

CRANES SOFTWARE INTL LTD

42

42

115

92

25

3/18/2011

113

47

215

404,398

0.6

16.3

EDUCOMP SOLUTIONS LTD

80

79

2,950

2,374

24

7/26/2012

141

111

836

33,169,196

0.3

14.9

TATA TELESERVICES MAHARASHTR

125

13

24

20

20

6/2/2009

119

16

793

4,026,446

(12.8)

13.2

15.0

JAIN IRRIGATION SYSTEMS LTD

60

60

346

298

16

3/30/2011

139

84

440

1,849,678

1.4

DISHMAN PHARMACEUTICALS & CH

50

172

150

15

8/19/2010

129

247

404,015

1.1

STERLING BIOTECH LTD

250

250

205

181

13

5/16/2012

137

342

886

2,805,020

0.9

18.9

SINTEX INDUSTRIES LTD

50

50

184

173

10/25/2010

140

70

481

2,042,171

0.3

14.0

JUBILANT ORGANOSYS LTD

35

163

155

5/15/2009

114

467

292,445

1.1

LUPIN LTD

100

80

567

546

1/7/2011

135

108

923

2,911,138

0.8

9.1

HOUSING DEVELOPMENT FINANCE

500

111

1,399

1,443

-3

9/27/2010

126

139

8,372

80,553,244

5.5

6.6

UNITED SPIRITS LTD

100

100

781

806

-3

3/30/2011

127

127

1,633

8,723,058

0.6

12.2

ACC LTD

60

23

374

422

-11

3/19/2009

108

24

1,614

4,955,602

(0.3)

22.0

SHREE ASHTAVINYAK CINEVISION

33

28

440

499

-12

12/22/2012

126

35

105

1,191,871

1.8

TATA POWER CO LTD

200

200

591

697

-15

2/25/2010

116

231

3,149

18,212,254

1.1

11.2

STERLING BIOTECH LTD

175

175

153

181

-16

9/30/2010

134

234

886

2,805,020

0.9

14.7

KOHINOOR FOODS LTD

20

85

109

-22

9/5/2010

131

12

60

388,274

3.2

5.0

GLENMARK PHARMACEUTICALS LTD

50

49

253

326

-22

2/16/2010

134

66

1,665

6,277,395

0.5

7.9

LARSEN & TOUBRO LTD

150

150

561

771

-27

11/30/2009

115

172

9,218

91,177,213

1.0

JAIPRAKASH ASSOCIATES LTD

100

47

70

-32

2/17/2010

132

1,676

43,436,230

1.8

(9.5)

(0.8)

GLENMARK PHARMACEUTICALS LTD

20

216

326

-34

2/16/2010

134

1,665

6,277,395

0.5

RELIANCE NATURAL RESOURCES L

300

300

26

47

-45

10/17/2011

100

300

1,567

52,819,094

(0.8)

TULIP TELECOM LTD

150

150

137

560

-75

8/26/2012

145

217

331

606,684

0.7

29.0

Source: Bloomberg

133

Appendix - 4 : GA FCCB Picks

The initial booklet covers 14 FCCB Reports. We are hoping to cover all the following FCCBs and update this booklet over the coming

weeks. We urge investors to let us know any other FCCBs that require our critical analysis techniques as a service to institutional clients:

Appendix

Bond Name

STOCK

PRICE

IND.

PARITY

YTM

BOND

ISSUE

AMOUNT

GA CREDIT

Avg. FCCB

SIZE ($m)

O/S ($m)

SCORE

Redemp.

PRICE *

Cover

ADANI ENTERPRISE $ 6.000 '12

384.4

42.0

5.6

54.9

250.0

250.0

8.2

(0.1)

ALOK INDUSTRIES $ 1.000 '10

16.9

81.0

20.7

34.0

45.0

23.8

7.1

(0.3)

AMTEK AUTO $ 0.500 '10

60.1

89.5

27.3

33.9

150.0

18.0

8.4

0.9

AMTEK AUTO LTD $ 0.000 '11

60.1

57.0

12.8

29.0

250.0

250.0

8.4

0.9

AUROBINDO PHARMA $ 0.000 '11

128.3

55.5

12.9

47.2

150.0

150.0

8.8

(0.1)

AUROBINDO PHARMA $ 0.000 '11

128.3

52.0

14.8

41.6

50.0

50.0

8.8

(0.1)

BARTRONICS INDIA $ 0.000 '12

75.2

67.0

44.5

22.5

25.0

6.0

8.2

(0.2)

BARTRONICS INDIA $ 0.000 '13

75.2

46.0

20.9

29.5

50.0

50.0

8.2

(0.2)

BHARATI SHIPYARD $ 0.000 '10

79.8

85.5

16.7

28.0

80.0

47.0

10.6

0.3

CORE PROJECTS $ 0.000 '12

54.2

68.0

30.1

24.5

80.0

25.2

11.7

0.7

CRANES SOFTWARE EUR 2.500 '11

87.0

83.0

66.0

16.2

53.0

53.0

8.3

1.0

EDUCOMP SOLUTION $ 0.000 '12

FLEX INDUSTRIES $ 4.000 '12

2,426.3

84.5

68.2

14.9

80.0

78.5

9.8

1.9

62.5

55.0

34.2

32.8

85.0

69.0

6.7

0.9

1.6

GITANJALI GEMS $ 1.000 '11

72.6

74.5

30.1

23.5

110.0

73.9

11.9

GTL INFRASTRUCTR $ 0.000 '12

36.3

52.0

54.0

28.1

300.0

267.7

6.0

HOTEL LEELA VENT $ 0.000 '12

22.2

60.0

26.3

27.8

100.0

100.0

5.8

0.0

HOTEL LEELA VENT EUR 1.000 '10

22.2

78.5

41.4

28.5

89.0

54.0

5.8

0.0

111.0

1,558.7

118.5

114.1

3.2

500.0

JAIN IRR SYT LTD $ 0.000 '11

HOUSING DEV FIN $ 0.000 '10

296.8

100.0

80.7

14.5

60.0

60.0

9.1

1.6

JAIPRAKASH ASSO $ 0.000 '12

73.4

53.8

24.9

30.4

400.0

395.0

6.5

(1.2)

MAHINDRA & MAHIN $ 0.000 '11

333.6

80.5

32.2

20.3

200.0

200.0

9.4

2.2

MAN INDUSTRIES $ 0.000 '12

32.7

55.0

23.0

32.2

50.0

50.0

9.3

1.3

MARKSANS PHARMA $ 0.000 '10

6.6

64.0

21.4

45.8

55.0

55.0

7.5

0.1

(1.1)

MOSER BAER INDIA $ 0.000 '12

68.2

25.0

15.4

60.0

75.0

75.0

6.6

PUNJ LLOYD LTD $ 0.000 '11

182.9

86.0

62.7

15.2

125.0

49.7

10.3

4.0

PYRAMID SAIMIRA $ 1.750 '12

44.1

35.0

12.3

44.1

90.0

90.0

7.5

0.4

RELIANCE COMM $ 0.000 '11

218.9

74.0

39.7

24.7

500.0

297.0

5.1

1.6

RELIANCE COMM $ 0.000 '12

218.9

58.0

28.7

24.7

1,000.0

990.0

5.1

1.6

ROLTA INDIA LTD $ 0.000 '12

166.6

62.0

37.5

25.2

150.0

150.0

8.2

0.9

SICAL LOGISTICS $ 0.000 '11

27.3

42.0

5.6

54.9

75.0

75.0

6.1

0.2

SUZLON ENERGY LT $ 0.000 '12

54.6

45.0

12.5

35.7

300.0

300.0

9.3

2.0

SUZLON ENERGY LT $ 0.000 '12

54.6

43.5

11.8

36.2

200.0

200.0

9.3

2.0

TATA MOTORS LTD $ 0.000 '12

137.2

50.0

12.9

28.4

490.0

490.0

7.9

1.2

1.2

TATA MOTORS LTD $ 1.000 '11

137.2

67.5

17.2

26.9

300.0

300.0

7.9

TATA POWER CO $ 1.000 '10

746.7

122.0

119.9

(3.2)

200.0

200.0

6.0

TULIP IT SRVCS $ 0.000 '12

615.1

50.0

45.1

30.2

150.0

150.0

9.8

0.5

VIDEOCON INDUS $ 4.500 '11

112.2

45.0

21.5

47.5

90.0

43.0

8.9

3.0

VIDEOCON INDUS $ 5.000 '11

112.2

45.0

21.7

44.3

105.0

67.0

8.9

3.0

* Ind. Bond Price: Indicative Bond Price represents the Ask Price on the Bond

Share price as on 14th Nov.08

134

Das könnte Ihnen auch gefallen

- Tamil Nadu Company 1 PDFDokument1.238 SeitenTamil Nadu Company 1 PDFDebraj GoswamiNoch keine Bewertungen

- LC Details Dec 11Dokument21 SeitenLC Details Dec 11callvkNoch keine Bewertungen

- 1uan11 15Dokument224 Seiten1uan11 15Kasturi VenkateswarluNoch keine Bewertungen

- Pension FundDokument14 SeitenPension Fundanon-798814Noch keine Bewertungen

- Andhra Pradesh Company 1 PDFDokument354 SeitenAndhra Pradesh Company 1 PDFkrishna prasadNoch keine Bewertungen

- PN 16 2023Dokument105 SeitenPN 16 2023Ravi KumarNoch keine Bewertungen

- Andhra Pradesh Company 1Dokument354 SeitenAndhra Pradesh Company 1Siraj Royal100% (1)

- West Bengal Company 1 PDFDokument2.485 SeitenWest Bengal Company 1 PDFAaquib HussainNoch keine Bewertungen

- LC Details Jan 12Dokument4 SeitenLC Details Jan 12callvkNoch keine Bewertungen

- Mizoram Company 1Dokument1 SeiteMizoram Company 1Yakshit JainNoch keine Bewertungen

- List of Alloted Properties Department Name-Institutional: S# Rid Property No. Applicant Name AreaDokument24 SeitenList of Alloted Properties Department Name-Institutional: S# Rid Property No. Applicant Name AreaArsh AhmadNoch keine Bewertungen

- DCRP Oman ContractorsDokument14 SeitenDCRP Oman ContractorsAlphatech133% (3)

- Market Data2011Dokument20 SeitenMarket Data2011Richard DablahNoch keine Bewertungen

- Meghalaya Company 1Dokument14 SeitenMeghalaya Company 1akki07Noch keine Bewertungen

- Whole Year AP PaymentsDokument397 SeitenWhole Year AP PaymentsspydraNoch keine Bewertungen

- Guia Sanitaria de MedicamentosDokument1.176 SeitenGuia Sanitaria de Medicamentosyfrythjtryjrtyjrje100% (1)

- List of CoDokument687 SeitenList of Comadeelhassan67% (3)

- Delivered P.O. Monitoring May 12-27, 2010Dokument3 SeitenDelivered P.O. Monitoring May 12-27, 2010sarmzNoch keine Bewertungen

- Event Study M&a TargetsDokument323 SeitenEvent Study M&a Targetspvkoganti1Noch keine Bewertungen

- Contractor FirmsDokument681 SeitenContractor FirmsMaryam Faisal64% (11)

- Date Name of Script Sector Opeaning Price Closing Price Quantity Price Volume High LowDokument8 SeitenDate Name of Script Sector Opeaning Price Closing Price Quantity Price Volume High LowPATELSHANINoch keine Bewertungen

- Inv DetailDokument50 SeitenInv DetailxxErikaNoch keine Bewertungen

- Computer Is Ed Cheque Print 2530Dokument63 SeitenComputer Is Ed Cheque Print 2530Ravinder ChauhanNoch keine Bewertungen

- Cost Sheet of TFA Project Up To 31.12.2007: SR - No P.O.NO P.O.Date V.Code Vendor NameDokument21 SeitenCost Sheet of TFA Project Up To 31.12.2007: SR - No P.O.NO P.O.Date V.Code Vendor NameSarah DeanNoch keine Bewertungen

- Srno Part No Part Name Qut Date TAK BookDokument7 SeitenSrno Part No Part Name Qut Date TAK Bookmannu_pathakNoch keine Bewertungen

- List of All Sales Vouchers 1-Jul-2021 To 31-Jul-2021: ParticularsDokument6 SeitenList of All Sales Vouchers 1-Jul-2021 To 31-Jul-2021: Particularssachin tiwariNoch keine Bewertungen

- Diesel Locomotive Works, Varanasi Item Position: PrintDokument1 SeiteDiesel Locomotive Works, Varanasi Item Position: Printa k singhNoch keine Bewertungen

- 1B DamanDokument12 Seiten1B Damananon_981731217Noch keine Bewertungen

- NYS Democratic Housekeeping Expenses 2009 To 2013Dokument24 SeitenNYS Democratic Housekeeping Expenses 2009 To 2013michelle_breidenbachNoch keine Bewertungen

- Reg San Med Importado ModificadoDokument2.051 SeitenReg San Med Importado ModificadoGrizNoch keine Bewertungen

- List of Companies/Llps Registered During The Year 2005Dokument964 SeitenList of Companies/Llps Registered During The Year 2005Avinash TiwariNoch keine Bewertungen

- Requisition Status 10 YearsDokument67 SeitenRequisition Status 10 Yearsashish.itbhuNoch keine Bewertungen

- Latest 9COM Regulated Vendors ListDokument105 SeitenLatest 9COM Regulated Vendors Listsheth_parag1100% (7)

- VendorsDokument172 SeitenVendorsoezidonye50% (2)

- Whole Year AP PaymentsDokument45 SeitenWhole Year AP PaymentsspydraNoch keine Bewertungen

- Akreditasi 23 April 2013Dokument12 SeitenAkreditasi 23 April 2013Rachmat AdimasNoch keine Bewertungen

- Reference List-Oil & Gas SectorDokument6 SeitenReference List-Oil & Gas SectorSathish LingamNoch keine Bewertungen

- Subhsh KumarDokument174 SeitenSubhsh KumarSubhash KumarNoch keine Bewertungen

- Suspension of Certificate of Incorporation of 2008 Registered CorporationsDokument469 SeitenSuspension of Certificate of Incorporation of 2008 Registered Corporationskis100% (1)

- Teps Dues-23 11 2012Dokument2 SeitenTeps Dues-23 11 2012kambledip1Noch keine Bewertungen

- National Institute of Technology Durgapur: PLACEMENT RECORDS - B.TECH.: 2010-2011 (Dokument4 SeitenNational Institute of Technology Durgapur: PLACEMENT RECORDS - B.TECH.: 2010-2011 (Soham TalukdarNoch keine Bewertungen

- List of Known Consignors Effective From 31 October 2021 OnwardsDokument8 SeitenList of Known Consignors Effective From 31 October 2021 OnwardsWeiLing Stephanie KongNoch keine Bewertungen

- Placement Record Btech 2011batch Mca WebDokument4 SeitenPlacement Record Btech 2011batch Mca WebSujoy BanikNoch keine Bewertungen

- DLW Purchase OrdersDokument26 SeitenDLW Purchase OrdersSdspl DelhiNoch keine Bewertungen

- CF Report Up To 26 08 16 PDFDokument67 SeitenCF Report Up To 26 08 16 PDFHafizur RahmanNoch keine Bewertungen

- Creditors Statement DetailsDokument168 SeitenCreditors Statement DetailsHii PingNoch keine Bewertungen

- GrantedAppeal CorporationswithApprovedPetitionsDokument110 SeitenGrantedAppeal CorporationswithApprovedPetitionsMhinda ArmyNoch keine Bewertungen

- Motor PH KDW1003 5015B Spare Parts Catalog PacliteDokument54 SeitenMotor PH KDW1003 5015B Spare Parts Catalog PacliteJessica Tatiana Muñoz OrtizNoch keine Bewertungen

- Rhodia Polyamide Poster AutoDokument10 SeitenRhodia Polyamide Poster AutoRafa SorianoNoch keine Bewertungen

- Kasus 1Dokument40 SeitenKasus 1Maria MarselinNoch keine Bewertungen

- AutomobileDokument386 SeitenAutomobileNaresh KumarNoch keine Bewertungen

- Vol 25, Issue No 23, DataBankDokument32 SeitenVol 25, Issue No 23, DataBankAshish RanjanNoch keine Bewertungen

- Analis StokDokument266 SeitenAnalis StokFebri AdiNoch keine Bewertungen

- Delivered P.O. Monitoring April 16 - 29, 2010Dokument2 SeitenDelivered P.O. Monitoring April 16 - 29, 2010sarmzNoch keine Bewertungen

- Danh Sach DN Nuoc Ngoai Dua Len Website 10.2009Dokument69 SeitenDanh Sach DN Nuoc Ngoai Dua Len Website 10.2009Ngoc Oanh TranNoch keine Bewertungen

- Man Hours HistogramDokument1 SeiteMan Hours HistogramMostafa Elkadi0% (1)

- Book 1Dokument1 SeiteBook 1shailja007Noch keine Bewertungen

- Compendium of Atomic Alkali Resistant Optical Thin Films, Diffusion and Electrical Mobility in Diode Pumped Alkali Lasers (DPALs)Von EverandCompendium of Atomic Alkali Resistant Optical Thin Films, Diffusion and Electrical Mobility in Diode Pumped Alkali Lasers (DPALs)Noch keine Bewertungen

- Fluid Analysis for Mobile Equipment: Condition Monitoring and MaintenanceVon EverandFluid Analysis for Mobile Equipment: Condition Monitoring and MaintenanceNoch keine Bewertungen

- IM ChecklistDokument4 SeitenIM Checklistluvisfact7616Noch keine Bewertungen

- Note On Waaree Renewable Technologies LTDDokument5 SeitenNote On Waaree Renewable Technologies LTDluvisfact7616Noch keine Bewertungen

- Reliance Monthly Portfolios 31 03 2013 FinalDokument292 SeitenReliance Monthly Portfolios 31 03 2013 Finalluvisfact7616Noch keine Bewertungen

- Stock Data ResultsDokument11 SeitenStock Data Resultsluvisfact7616Noch keine Bewertungen

- Reliance Monthly Portfolios 28 02 2013Dokument280 SeitenReliance Monthly Portfolios 28 02 2013luvisfact7616Noch keine Bewertungen

- Write Up - Public LTD CompanyDokument1 SeiteWrite Up - Public LTD Companyluvisfact7616Noch keine Bewertungen

- Analysis of Form 15CA & 15CB Requirement For Payments Made For Import of GoodsDokument4 SeitenAnalysis of Form 15CA & 15CB Requirement For Payments Made For Import of Goodsluvisfact7616Noch keine Bewertungen

- SPADokument4 SeitenSPAluvisfact7616Noch keine Bewertungen

- Business Plan StepsDokument1 SeiteBusiness Plan Stepsluvisfact7616Noch keine Bewertungen

- Due Deligence Scope of WorkDokument1 SeiteDue Deligence Scope of Workluvisfact7616Noch keine Bewertungen

- Minutes FormatDokument1 SeiteMinutes Formatluvisfact7616Noch keine Bewertungen

- Renewable Energy Machinery Depreciation RatesDokument1 SeiteRenewable Energy Machinery Depreciation Ratesluvisfact7616Noch keine Bewertungen

- SPADokument4 SeitenSPAluvisfact7616Noch keine Bewertungen

- Filing Fees Under Direct TaxesDokument4 SeitenFiling Fees Under Direct Taxesluvisfact7616Noch keine Bewertungen

- GST Sector - Ward - Circle RangeDokument682 SeitenGST Sector - Ward - Circle Rangeluvisfact761650% (10)

- Angel Investor ListDokument10 SeitenAngel Investor Listluvisfact7616Noch keine Bewertungen

- Rajasthan Tourism: Vasundhara Raje, Chief Minister, Rajasthan (Budget 2015-16)Dokument2 SeitenRajasthan Tourism: Vasundhara Raje, Chief Minister, Rajasthan (Budget 2015-16)luvisfact7616Noch keine Bewertungen

- GST Sector - Ward - Circle RangeDokument682 SeitenGST Sector - Ward - Circle Rangeluvisfact761650% (10)

- GST Sector - Ward - Circle RangeDokument682 SeitenGST Sector - Ward - Circle Rangeluvisfact761650% (10)

- List of Investor For Wind Energy Power - Maharashtra EnergyDokument78 SeitenList of Investor For Wind Energy Power - Maharashtra Energyluvisfact7616Noch keine Bewertungen

- AutoComp SectorDokument5 SeitenAutoComp Sectorluvisfact7616Noch keine Bewertungen

- Deed of Hypothecation - Draft TemplateDokument18 SeitenDeed of Hypothecation - Draft Templateluvisfact7616Noch keine Bewertungen

- Agriculture Income TaxabilityDokument15 SeitenAgriculture Income Taxabilityluvisfact7616Noch keine Bewertungen

- MFGDokument16 SeitenMFGluvisfact7616Noch keine Bewertungen

- FisDokument1 SeiteFisluvisfact7616Noch keine Bewertungen

- Schedule IDokument6 SeitenSchedule IHanu4abapNoch keine Bewertungen

- Schedule IDokument6 SeitenSchedule IHanu4abapNoch keine Bewertungen

- Mumbai Companies 2008Dokument4 SeitenMumbai Companies 2008luvisfact7616Noch keine Bewertungen

- Solar Power ArticleDokument3 SeitenSolar Power Articleluvisfact7616Noch keine Bewertungen

- KLG SystelDokument203 SeitenKLG Systelluvisfact7616Noch keine Bewertungen

- InsctMfg PDFDokument13 SeitenInsctMfg PDFMain Sanatani Hun100% (1)

- RSI Above 70, Technical Analysis ScannerDokument8 SeitenRSI Above 70, Technical Analysis Scannersiva8000Noch keine Bewertungen

- Design of 4L 31.25m SpanDokument1 SeiteDesign of 4L 31.25m Spanarif_rubinNoch keine Bewertungen

- Announcement Rtl2Dokument2 SeitenAnnouncement Rtl2Navtesh BajpaiNoch keine Bewertungen

- 34 Thane EmpDokument808 Seiten34 Thane EmpStone_786Noch keine Bewertungen

- Ceat TubeDokument3 SeitenCeat TubeRanjith KumarNoch keine Bewertungen

- 27-Villages Development Plan Modifications List PDFDokument13 Seiten27-Villages Development Plan Modifications List PDFVikrant PatilNoch keine Bewertungen

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument17 SeitenStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceShafeya SulemanNoch keine Bewertungen

- Sek M Haniph 01042021 Till 31032022Dokument29 SeitenSek M Haniph 01042021 Till 31032022Sujat KhanNoch keine Bewertungen

- SR - No. Boiler Manufacturer Approval Granted For 2010 2011Dokument5 SeitenSR - No. Boiler Manufacturer Approval Granted For 2010 2011IKNoch keine Bewertungen

- List of Thermal Power Plants in India With Capacity PDF - CrackuDokument3 SeitenList of Thermal Power Plants in India With Capacity PDF - CrackuAngela JacksonNoch keine Bewertungen

- Rev 1wp Name Contribution 1000Dokument22 SeitenRev 1wp Name Contribution 1000Vilas ParabNoch keine Bewertungen

- Phuket - Flight Timing - SummaryDokument1 SeitePhuket - Flight Timing - SummaryAtul JainNoch keine Bewertungen

- Anand MahindraDokument8 SeitenAnand Mahindrarupali maratheNoch keine Bewertungen

- ChemicalsDokument2 SeitenChemicalsravishankarNoch keine Bewertungen

- List of Companies Havin G SAP at NagpurDokument3 SeitenList of Companies Havin G SAP at NagpurPallavi ChawlaNoch keine Bewertungen

- CZ Category Wise ResultDokument92 SeitenCZ Category Wise ResultNayan Kumar SoniNoch keine Bewertungen

- LIST OF DPD IMPORTERS NHAVA SHEVA Till 05-04-18 PDFDokument23 SeitenLIST OF DPD IMPORTERS NHAVA SHEVA Till 05-04-18 PDFNikhil ChaudharyNoch keine Bewertungen

- Compounding Charges For Deviations in Building PlanDokument2 SeitenCompounding Charges For Deviations in Building PlanNirajNoch keine Bewertungen

- Patalganga Factory ListDokument11 SeitenPatalganga Factory Listbombonde_79746970% (30)

- DR List Format p1.Xlsx123Dokument134 SeitenDR List Format p1.Xlsx123Poonam Kapadia75% (4)

- Telephone Directory Ministers LandlinesDokument63 SeitenTelephone Directory Ministers Landlinesardhranair7Noch keine Bewertungen

- Manufactures in ChinchwadDokument15 SeitenManufactures in Chinchwadkomal LPS0% (1)

- Navi Mumbai MidcDokument132 SeitenNavi Mumbai MidcKedar Parab67% (15)

- Store Name Store Address City State PincodeDokument24 SeitenStore Name Store Address City State PincodeSanmati RandiveNoch keine Bewertungen

- SBI BC DataDokument170 SeitenSBI BC DataAbhishek SinghNoch keine Bewertungen

- Placement 2017Dokument15 SeitenPlacement 2017Maulik MulaniNoch keine Bewertungen

- Important InformationDokument193 SeitenImportant InformationDharmendra KumarNoch keine Bewertungen

- Tata AigDokument96 SeitenTata AigSandeep SairiNoch keine Bewertungen

- Nse Future Lot SizeDokument10 SeitenNse Future Lot SizePrasanta DebnathNoch keine Bewertungen