Beruflich Dokumente

Kultur Dokumente

The Time Value of Money Report

Hochgeladen von

Jessica HunterOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Time Value of Money Report

Hochgeladen von

Jessica HunterCopyright:

Verfügbare Formate

THE TIME VALUE OF MONEY IN GENERAL BUSINESS TERMS, INTEREST IS DEFINED AS THE COST OF USING MONEY OVER TIME.

INTEREST IS THE EXCESS OF RESOURCES (USUALLY CASH) RECEIVED OR PAID OVER THE AMOUNT OF RESOURCES LOANED OR BORROWED IS CALLED THE PRINCIPAL. TIME VALUE OF MONEY INVOLVES TWO MAJOR CONCEPTS: 1. FUTURE VALUE 2. PRESENT VALUE BOTH CONCEPTS THREE FACTORS 1. PRINCIPAL 2. INTEREST RATE 3. TIME PERIOD BUSINESS TRANSACTIONS SUBJECT TO INTEREST STATE WHETHER: 1. SIMPLE INTEREST- IS THE PRODUCT OF THE PRINCIPAL AMOUNT MULTIPLIED BY THE PERIODS INTEREST RATE ( a one year rate is standard) 2. COMPOUND INTEREST-IS THE INTEREST PAID ON THE BOTH THE PRINCIPAL AND THE AMOUNT OF INTEREST ACCUMULATED IN PRIOR PERIODS. COMPOUNDING- IS THE PROCESS OF DETERMINING FUTURE VALUE WHEN COMPOUND INTEREST IS APPLIED.

EXAMPLE OF SIMPLE INTEREST: ABC CORPORATION DEPOSITS P10,000.00 IN A BANK AT 10% INTEREST A YEAR. ONE YEAR LATER THE P10,000.00 WILL HAVE GROWN TO P11,000.00:P10,000 IS PRINCIPAL AND P1000 IS INTEREST. THE AMOUNT OF INTEREST IS DETERMINED BY MULTIPLYING THE INTEREST RATE OF 10% (0.10 IN DECIMAL NOTATION) BY THE PRINCIPAL OF P10,000 (0.10 X P10,000= P1,000). THUS, THE VALUE OF A PESO TODAY CAN INCREASE IN THE FUTURE BECAUSE OF THE INTEREST. PRINCIPAL (beginning balance) INTEREST for year 1 to present (0.10x P1,000= P100.00) Future value at the end of year 1 P10,000.00 1,000.00 P11,000.00

EXAMPLE OF COMPOUND INTEREST: NOW SUPPOSE THAT ABC CORPORATION LEAVES ITS P10,000 ON DEPOSIT FOR TWO YEARS IN A BANK PAYING 10 % ANNUAL INTEREST. AT THE END OF THE FIRST YEAR, THE INITIAL DEPOSIT BECOMES P11,000. DURING THE SECOND YEAR, THE FIRM WILL EARN 10% ON THIS P10,000, OR AN ADDITIONAL P1,100 IN INTEREST. THE FIRM IS EARNING INTEREST ON THE CHARGING BALANCE. HENCE, AT THE END OF THE SECOND YEAR, THE FIRM WILL HAVE P12,100 IN ITS ACCOUNT. Balance at the beginning of year 2 Interest for year 2 at 10% (.10. x P1,100 = P110.00) Future value at the end of year 2 P11,000.00 1,000.00 P12,100.00

FUTURE VALUE DETERMINATION OF FUTURE VALUE USING A TABLE INSTEAD OF COMPUTING THE VALUE OF THE TERM (1+i ) n, YOU CAN USE A TABLE TO FIND THIS VALUE. THE VALUE IS CALLED THE FUTURE VALUE INTEREST FACTOR or FVIFi,n AND MAY BE VIEWED AS THE RESULT OF INVESTING OR LENDING P1 AT INTEREST RATE (i) for (n) PERIODS. THE VALUES OF THE FVIFs FOR DIFFERENT INTEREST RATES AND TIME PERIODS FVn = PV (FVIFi,n) USING THE EQUATION ABOVE THE VALUE OF P1,000 COMPOUNDED FOR FIVE YEARS AT 10% INTEREST RATES IS COMPUTED AS FOLLOWS: FIRST, WE NEED TO FIND THE VALUE THAT CORRESPONDS TO THE INTERSECTION OF A 10% INTEREST RATE WITH COMPOUNDING FOR FIVE YEARS, THAT IS, FVIF 0,10,5. THIS VALUE IS 1.611 (1.61051) AND REPRESENTS THE CALCULATION (1.10)5. NOW, SUBSITUTE 1.611 IN THE ABOVE EQUATION TO FIND THE FUTURE VALUE.

FV5 = (P1,000)(1.611) = P1,611.00 USING TABLE 1, HOW LONG WOULD IT TAKE TO DOUBLE MONEY AT A 10% INTEREST RATE? THE FIRST STEP WOULD BE TO SEARCH THE 10% COLUMN IN TABLE 1 TO LOCATE THE FUTURE VALUE INTEREST FACTOR THAT IS CLOSEST TO 2.0 THE CLOSEST NUMBER IS 1.949 (1.94872). HENCE, MONEY DOUBLES IN SLIGHTLY OVER SEVEN YEARS WHEN COMPOUNDED AT 10% ANNUALLY.

FUTURE VALUE (WITH INTRAPERIOD COMPOUNDING) COMPOUNDING THAT OCCURS MORE THAN ONCE A YEAR IS CALLED INTERPERIOD COMPOUNDING. THE CALENDAR PERIOD OVER WHICH COMPOUNDING OCCURS IS CALLED THE COMPOUNDING PERIOD. FOR EXAMPLE, COMPOUNDING MAY OCCUR ANNUALLY, SEMIANNUALLY,QUARTERLY, OR MONTHLY. WHEN USING INTRAPERIOD COMPOUNDING, THE FUTURE VALUE FORMULA MUST BE MODIFIED TO REFLECT THE NUMBER OF TIMES PER YEAR COMPOUNDING OCCURS, DENOTED BY m.

INSTEAD OF PLACING P1,000 IN ATLANTA BANK THAT PLAYS 10% INTEREST ANNUALLY, THE FINANCIAL MANAGER DECIDES TO PUT THE MONEY IN NATIONAL BANK THAT PAYS 10% INTEREST COMPOUNDED SEMI-ANNUALLY, BETWEEN THE TWO BANKS, THERE WOULD BE A DIFFERENCE IN THE FUTURE VALUE OF YOUR INVESTMENT AFTER ONE YEAR.

NOW, SUBTRACT P1,100 FROM P1,102.50 TO FIND THE DIFFERENCE IN FUTURE VALUES OF P2.50. THUS, MORE INTEREST IS EARNED WITH SEMIANNUAL COMPOUNDING THAN WITH ANNUAL COMPOUNDING. INCREASING THE FREQUENCY OF THE COMPOUNDING PERIOD MAKES THE FUTURE VALUE GROW MORE RAPIDLY BECAUSE MORE INTEREST IS EARNED ON THE CHARGING BALANCE.

NOMINAL INTEREST RATE COMPARED WITH EFFECTIVE INTEREST RATE THE NOMINAL INTEREST RATE IS SIMPLY THE STATE RATE, SUCH AS 10%. THE EFFECTIVE INTEREST RATE ALSO CALLED THE ANNUAL PERCENTAGE RATE OF APR, IS THE TRUE INTEREST RATE MAY DIFFER FROM THE NOMINAL RATE DEPENDING ON THE FREQUENCY IN COMPOUNDING.

THE EQUATION ABOVE IS USED TO FIND THE EFFECTIVE INTEREST RATE. IN THIS EQUATION, i IS THE NOMINAL RATE AND m IS THE NUMBER OF COMPOUNDING PERIODS PER YEAR.

Example: DISNEY INC. DEPOSITS MONEY IN A BANK THAT PAYS A 10% NOMINAL INTEREST RATE AND COMPOUNDS INTEREST SEMIANNUALLY.

DETERMINATION OF THE FUTURE VALUE OF A STREAM OF PAYMENTS THE CONCEPT OF FUTURE VALUE CAN BE EXTENDED BEYOND COMPOUNDING A SINGLE PAYMENT TO COMPOUNDING A SERIES, OR STREM OF PAYMENTS.

FUTURE VALUE DETERMINATION INVOLVING STREAM OF UNEQUAL PAYMENTS

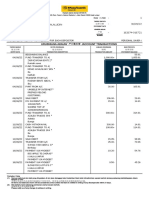

EXAMPLE: FUTURE VALUE DETERMINATION INVOLVING STREAM OF UNEQUAL PAYMENTS: A FIRM PLANS TO DEPOSIT P2,000 TODAY AND P1,500 ONE YEAR FROM NOW AT MOUNT CARMEL RURAL BANK. NO FUTURE DEPOSITS OF WITHDRAWALS ARE MADE AND THE BANK PAYS 10% INTEREST COMPOUNDED ANNUALLY. THE FUTURE VALUE OF THE ACCOUNT AT THE END OF FOUR YEARS IS COMPUTED TO BE:

FUTURE VALUE DETERMINATION INVOLVING STREAM OF EQUAL PAYMENTS A stream of equal payments made at regular time intervals is an ANNUITY, Sometimes called FIXED ANNUITY. There are 2 types of fixed annuities. 1. ORDINARY ANNUITY- IS ONE IN WHICH THE PAYMENTS OR RECEIPTS OCCURS AT THE END OF THE PERIOD. THIS TYPE OF ANNUITY IS ALSO CALLED A REGULAR or DEFFERED ANNUITY.

EXAMPLE: CRYSTAL CORPORATION DEPOSITS P1,000 AT THE END OF EACH OF THREE CONSECUTIVE YEARS IN A BANK ACCOUNT PAYING 10% INTEREST COMPOUNDED ANNUALLY. THE VALUE OF THE ACCOUNT AT THE END OF THE THIRD YEAR IS COMPUTED BY, FIRST, SUBSTITUTING A = P1,000 , I =1.10, AND N = 3.

2. ANNUITY DUE-IS ONE WHICH PAYMENTS OR RECEIPTS OCCUR AT THE BEGINNING OF EACH PERIOD.

FVADn = A (FVIFAi,n) (1 + i) FVADn = future value of an annuity due

EXAMPLE: INSTEAD OF DEPOSITING P1,000 AT THE END OF EACH YEAR FOR THREE CONSECUTIVE YEARS, THE FIRM MAKES DEPOSITS AT THE BEGINNING OF EACH YEAR. INTEREST IS COMPOUNDED ANNUALLY AT 10%. HOW MUCH WILL THE FIRM HAVE IN ACCOUNT AFTER 3 YEARS? Substitute A= P1,000 , i = 0.10 and n = 3.

FVAD3= (P1,000) (3.310) (1.10) = (P1,000) (3.641) = P3,641 THE FUTURE VALUE FOR THE ANNUITY DUE (P3,641) IS GREATER THAN THAT FOR THE ORDINARY ANNUITY (P3,310) BECAUSE EACH DEPOSIT IS MADE ONE YEAR EARLIER AND CONSEQUENTLY EARNS INTEREST ONE YEAR LONGER.

PRESENT VALUE

THE SECOND KEY CONCEPT REGARDING THE TIME VALUE OF MONEY IS PRESENT VALUE. PRESENT VALUE - IS THE CURRENT VALUE OF A FUTURE AMOUNT OF MONEY, OR SERIES OF PAYMENTS, EVALUATED AT AN APPROPRIATE DISCOUNT RATE. DISCOUNT RATE, SOMETIMES CALLED THE REQUIRED RATE OF RETURN, -- IS RATE OF INTEREST THAT IS USED TO FIND PRESENT VALUES. - THE PROCESS OF DETERMINING THE PRESENT VALUE OF A FUTURE AMOUNT IS CALLED DISCOUNTING.

EXAMPLE OF PRESENT VALUE DISCOUNTING BLUEBERRY COMPANY EXPECTS TO RECEIVE P1,100 ONE YEAR FROM NOW. WHAT IS THE PRESENT VALUE OF THIS AMOUNT IF THE DISCOUNT RATE IS 10%?

DETERMINATION OF PRESENT VALUE USING A TABLE PVIFi,n is called PRESENT VALUE INTEREST FACTOR for discount rate i and time period n . EXAMPLE: JGC COMPANY EXPECTS TO RECEIVE P1,000 FIVE YEARS FROM NOW AND WANTS TO KNOW WHAT THIS MONEY IS WORTH TODAY. THE VALUE TODAY OF P1,000 TO BE RECEIVED FIVE YEARS FROM NOW DISCOUNTED AT 10% IS CALCULATED AS FOLLOWS: PV= FVn (PVIFi,n)

Substitute: i = 0.10 and n = 5, PV5 = P1,000 PV = (P1,000) (0.21) = P621.00

PRESENT VALUE DETERMINATION INVOLVING STREAM OF UNEQUAL PAYMENTS To find the present value of an unequal, or mixed, stream of payments, simply calculate the present value of each future amount separately and then add these present value together.

EXAMPLE: MNM COMPANY EXPECTS TO RECEIVE PAYMENTS OF P1,000, P1,500, AND P2,000 AT THE END OF ONE, TWO AND THREE YEARS. RESPECTIVELY, THE PRESENT VALUE OF THIS STREAM OF PAYMENTS DISCOUNTED AT 10% IS COMPUTED AS FOLLOWS. Substitute: i = 0.10 and t = 1,2,3 and solve the problem. PV = (P1,000) (0.909) + (P1,500) (0.826) + (P2,000) (0.751) = P909 + P1,239 + 1,502 = P 3,650.00

PRESENT VALUE DETERMINATION INVOLVES STREAM OF EQUAL PAYMENTS

EXAMPLE: SUMMER CORPORATION EXPECTS TO RECEIVE P1,000 AT YEARS END FOR THE NEXT THREE YEARS. THE PRESENT VALUE OF THIS ANNUITY DISCOUNTED AT 10% IS COMPUTED AS FOLLOWS: Substitute: i = 0.10 and n = 3, and A = P1,000. PVOA3 = (P1,000) (PVIFA0,10,3) =(P1,00) (2.487) =P2,487.00

DETERMINATION OF THE PRESENT VALUE OF A PERPETUITY PERPETUITY IS ANNUITY WITH AN INFINITE LIFE; THAT IS, THE PAYMENTS CONTINUE INDEFINITELY. THE PRESENT VALUE OF A PERPETUITY IS FOUND BY USING THE EQUATION BELOW.

EXAMPLE HONEY DEW CORPORATION WANTS TO DEPOSIT AN AMOUNT OF MONEY IN A BANK ACCOUNT THAT WILL ALLOW IT TO WITHDRAW P1,000 INDEFINITELY AT THE END OF THE YEAR WITHOUT REDUCING THE AMOUNT OF THE INITIAL DEPOSIT. IF A BANK GUARANTEES TO PAY THE FIRM 10% INTEREST ON ITS DEPOSITS, THE AMOUNT OF MONEY THE FIRM HAS TO DEPOSIT IS COMPUTED AS FOLLOWS: Substitute = A = P1,000 and i = 0.10 and solve.

GROWTH RATES

EXAMPLE: SUGAR COMPANY HAS STEADILY INCREASED ITS DIVIDENDS PER SHARE FROM P1,000 IN 2007 TO P1.36 IN 2011. THE ANNUAL COMPOUND GROWTH RATE OF THESE DIVIDEND PAYMENTS OVER THE FOUR YEARS IS COMPUTED AS FOLLOWS.

BOND IS A DEBT INSTRUMENT ISSUED BY GOVERNMENTS, CORPORATIONS AND OTHER ENTITIES IN ORDER TO FINANCE PROJECTS OR ACTIVITIES. - IN ESSENCE, A BOND IS A LOAN THAT INVESTORS MAKE TO THE BONDS ISSUER. PARTS OF A BOND: 1. FACE VALUE 2. COUPON 3. MATURITY

STOCKS A SHARE OF THE OWNERSHIP OF A COMPANY

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Parliamentary Note - Raghuram RajanDokument17 SeitenParliamentary Note - Raghuram RajanThe Wire100% (22)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Constitutional Law ReviewerDokument93 SeitenConstitutional Law ReviewerPopo Tolentino100% (30)

- Capstone Rehearsal Guide to TacticsDokument10 SeitenCapstone Rehearsal Guide to TacticsAbhishek Singh ChauhanNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- MBBsavings - 162674 016721 - 2022 09 30 PDFDokument3 SeitenMBBsavings - 162674 016721 - 2022 09 30 PDFAdeela fazlinNoch keine Bewertungen

- Essay - Education Should Be FreeDokument2 SeitenEssay - Education Should Be FreeRuthie CamachoNoch keine Bewertungen

- Barton InteriorsDokument36 SeitenBarton InteriorsAhmed MasoudNoch keine Bewertungen

- CC Stat222Dokument2 SeitenCC Stat222darshil thakkerNoch keine Bewertungen

- Consumer Awareness of Shri Ram Life InsuranceDokument99 SeitenConsumer Awareness of Shri Ram Life InsuranceAshish Agarwal100% (1)

- What Are The Main Characteristics of Good Governance?Dokument2 SeitenWhat Are The Main Characteristics of Good Governance?Jessica HunterNoch keine Bewertungen

- Blue Sky MarketingPlanDokument7 SeitenBlue Sky MarketingPlanMBA103003Noch keine Bewertungen

- Darag Native ChickenDokument6 SeitenDarag Native ChickenJessica Hunter100% (1)

- Productioninventory Planning and ControlDokument6 SeitenProductioninventory Planning and ControlJessica HunterNoch keine Bewertungen

- Soal Ch. 15Dokument6 SeitenSoal Ch. 15Kyle KuroNoch keine Bewertungen

- Cola Wars and Porter Five Forces AnalysisDokument10 SeitenCola Wars and Porter Five Forces Analysisshreyans_setNoch keine Bewertungen

- Prequalified Consultants Other ServicesDokument3 SeitenPrequalified Consultants Other Servicesgeorgemuchira1386Noch keine Bewertungen

- Human Resource ManagementDokument3 SeitenHuman Resource ManagementQuestTutorials BmsNoch keine Bewertungen

- Sec 5.3 MC Three Applications of Supply, Demand, and Elasticity-Dokument9 SeitenSec 5.3 MC Three Applications of Supply, Demand, and Elasticity-Lại Nguyễn Hoàng Phương VyNoch keine Bewertungen

- ZAP BI For AXDokument4 SeitenZAP BI For AXShivshankar IyerNoch keine Bewertungen

- Audi N Suzuki PDFDokument12 SeitenAudi N Suzuki PDFSrikant SahuNoch keine Bewertungen

- Allied Bank ProjectDokument47 SeitenAllied Bank ProjectChaudry RazaNoch keine Bewertungen

- Strategic Management IntroductionDokument59 SeitenStrategic Management IntroductionDrSivasundaram Anushan SvpnsscNoch keine Bewertungen

- Who Should Tata Tea Target?: Arnab Mukherjee Charu ChopraDokument7 SeitenWho Should Tata Tea Target?: Arnab Mukherjee Charu Chopracharu.chopra3237Noch keine Bewertungen

- Analyst PresentationDokument59 SeitenAnalyst Presentationsoreng.anupNoch keine Bewertungen

- Introduction to Corporate FinanceDokument89 SeitenIntroduction to Corporate FinanceBet NaroNoch keine Bewertungen

- Prestige Telephone CompanyDokument13 SeitenPrestige Telephone CompanyKim Alexis MirasolNoch keine Bewertungen

- CA Final Direct Tax Suggested Answer Nov 2020 OldDokument25 SeitenCA Final Direct Tax Suggested Answer Nov 2020 OldBhumeeka GargNoch keine Bewertungen

- Are Timeshares An Asset or Liability - Timeshare Freedom GroupDokument4 SeitenAre Timeshares An Asset or Liability - Timeshare Freedom Groupد. هيثم هاشم قاسم سلطان الخفافNoch keine Bewertungen

- Standardization and GradingDokument26 SeitenStandardization and GradingHiral JoysarNoch keine Bewertungen

- Skill DevlopmentDokument11 SeitenSkill DevlopmentAmiteshAwasthi100% (1)

- Chemicals and Fertilizers Industry: Group-3Dokument11 SeitenChemicals and Fertilizers Industry: Group-3Kavya DaraNoch keine Bewertungen

- XPO LogisticDokument12 SeitenXPO LogisticPunam bhagatNoch keine Bewertungen

- Accounting Ratios Information: An Instrument For Business Performance AnalysisDokument6 SeitenAccounting Ratios Information: An Instrument For Business Performance AnalysisEditor IJTSRDNoch keine Bewertungen

- How Cincinnati Zoo Increased Revenue 30% With BI InsightsDokument2 SeitenHow Cincinnati Zoo Increased Revenue 30% With BI InsightsJerril100% (1)

- Micro Economics I NoteDokument161 SeitenMicro Economics I NoteBinyam Regasa100% (1)

- Management Accounting: An OverviewDokument12 SeitenManagement Accounting: An Overviewahmed arfanNoch keine Bewertungen