Beruflich Dokumente

Kultur Dokumente

Analyses of Production Costs, Aluminium Journal, July 2012

Hochgeladen von

gordjuOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Analyses of Production Costs, Aluminium Journal, July 2012

Hochgeladen von

gordjuCopyright:

Verfügbare Formate

Analysis of production costs in the aluminium smelting industry

G. Djukanovic, Podgorica

When talking about production costs in the aluminium smelting industry it is inevitable to refer to research companies such as Brook Hunt and CRU Group, both from UK, or the Australian AME Group and Harbor Intelligence from USA. They are world leaders in metals smelters production costs analyses, including power tariffs, raw materials and other costs. At current market price (around USD1,880/ t on the LME in mid-July) at least 60% of world smelters (or more precisely: world aluminium production) have production costs above market price. However, due to record-high aluminium premiums (over USD200/t in Europe and Asia and around USD250/t in USA) and power supply contracts with tariffs linked to the LME price, the percentage of currently loss-making smelters is significantly lower. Moreover, many companies have hedged their sales prices for the entire year 2012 and beyond at levels higher than the current LME price and even higher than their production costs; therefore, they are protected from falling aluminium price. In any case, there is no doubt that margins are positive for smelters in the Persian Gulf, Canada, Russia, Iceland and South Africa, whereas a significant number of those in China, USA and Europe are cash negative, even

Aluminium cost curve lifted by cost pressure

Goran Djukanovic is an aluminium market analyst with focus on aluminium and other non-ferrous metals, and energy markets. He represents the Central Bank of Montenegro in Reuters base metals polls and is the only analyst from southeastern Europe to participate in the poll. He is one of the speakers at the Aluminium Conference 2012 in Dsseldorf in October. Mr Djukanovic is located in Podgorica, Montenegro. Email: gordju@t-com.me.

if taken into account that the aluminium price is several hundred euros higher at the Chinese market compared with the LME price. Those smelters who tied their sales to LME prices (cash seller and settlement or 3-month price), and now confronted with production costs higher than the current LME price, are losing money. Smelters with production costs in the range of 90 percentile on the cost curve and sales tied to the LME price were able to make profit only during the period 2005 to 2008. Production costs are directly related to the economic environment, and during economic crises, as in 2009, a sharp decline in the aluminium price is followed by a significant fall of raw material prices, power tariffs and shipping rates (though with a lag of several months for some raw materials prices). Since all input costs were lower in 2009 compared to recordhigh costs in 2008, production costs decreased between 30 and 40% that year. With the economic recovery in the following two years, input costs generally increased even though to a level below that in 2008, with the result that smelters production costs were somewhat lower in 2011 than in 2008. A devaluated US dollar against the Euro in 2011 also contributed to lower input costs for smelters outside USA. CRU calculated that a 20% swing in the value of the US dollar resulted in a 10.9% swing in the world average business costs, which points to the large amount of production costs that are incurred in US dollars. Following a sharp decline in 2009, world smelter business costs rebounded significantly in 2010, by over 20%, and are expected to keep on rising a further 7% between 2010 and 2012, according to CRU. These increases are due to the progressive rise of most raw material prices and energy costs. In the period of 2002 to 2008, aluminium smelter business

costs rose 111% from the bottom in the last cycle (USD962/t) to a peak at USD2,032/t, again according to CRU. Costs are expected to stagnate or even decrease this year and to rise again next year. New aluminium smelters will naturally be set up in regions where production costs are at the lower end. In the near term, Russia and the Middle East will most likely see new production capacities being built up, whereas in the long term Malaysia, Angola, Paraguay and Greenland could be further candidates. Brazil has become less attractive due to high power tariffs, and Australia is affected by the introduction of carbon tax. Several industry experts expect that the world primary aluminium production is expected to rise to over 70m tonnes by the end of this decade. The aluminium demand during this period will be driven by further urbanisation and industrialisation in China and India and by the dynamic growth of the transportation sector. Structural changes of aluminium industry costs The aluminium industry has gone through a significant structural change in its operating costs between 2005 and 2008. As a result, by the end of this decade operating costs are likely to remain at levels 80 to 100% higher than those experienced in the beginning of this century. In 2012 the Gulf region is likely to become the lowest cost region in the world. Also, due to the start up of new capacities and expansions, the aluminium output in the Middle East is expected to grow from around 4m tonnes this year to some 6m tonnes by the end of 2015 after new projects in Abu Dhabi and Saudi Arabia are completed.

28

Djukanovic

ALUMINIUM 7-8/2012

Hydro

According to a recent research by CRU, the Sohar aluminium smelter in Oman is the low cost benchmark in 2012 with corporate costs of less than USD1,200/t, while the Middle East would represent 34% of the production in the second lowest cost category (USD1,2001,399/t). The Qatalum smelter in Qatar will be second best on a corporate costs basis of USD1,272/t. Argentinas Aluar (Puerto Madrin) as well as Indias Nalco and Vedanta are producers with the next lowest business costs in the world, in the range of USD1,3501,400/t in 2012. On the opposite side, Kombinat Aluminijuma Podgorica (KAP) in Montenegro and Talum in Slovenia mark the top end with the highest smelter costs in 2012. However,

Chinese smelters such as Qinghai Investment Group and Guangxi Investment Group have the largest increase of costs and worldwide highest production costs of USD2,800/t and above this year, according to CRU. Main costs of an aluminium smelter Alumina, electricity and, in many cases, carbon costs represent the three major cost factors of every smelter. While alumina and carbon costs hardly differ for most smelters, electricity costs differ dramatically. Labour and other costs also vary widely depending on the region but are of minor importance in relation to the total cost structure. Though the alumina price at the spot mar-

Comparison of global aluminium cash costs (USD/t)

ket was around USD320/t in recent months, or usually 15.5-17% of the LME price in long term contracts, smelters who have to buy alumina pay around USD400/t currently, after transportation, port services and customs are included, and over USD450/t in China. Given that almost two tonnes of alumina are needed to produce a tonne of primary aluminium, input costs for alumina vary between USD800900 in each tonne of aluminium produced. According to CRU alumina costs accounted for 39% on average of world smelters production costs in 2011. Electricity costs vary widely depending on region, with power tariffs around USD20/ MWh in the Middle East, USD35-40/MWh in the USA and Europe, and around USD70/ MWh in China. So smelters in the Gulf region spend around USD300 for power to produce one tonne of primary aluminium, while Russian smelters have to pay almost USD400/t after recent increases of power prices, and smelters in Western Europe around USD650/t. Chinese smelters pay an average of USD1,020/ t of primary aluminium produced. Anode prices, after an increase to over USD800/t in 2008, returned to around

Anzeige 1/2

Antaike

Aluminium smelter cost structure, 2011

USD650/t in Europe and USD70-80/t lower in China in 2012. The carbon anode manufacturers are mainly exposed to global oil and coal costs. Anodes are made from petroleum coke and recycled carbon mixed with liquid pitch. A significant amount of heat is used as the anodes are baked for 18 to 20 days at over 1,000 C. As the oil and coal prices have tumbled in recent months, so has the cost base of anode makers. Highest labour costs in the aluminium industry are in Australia, Canada, Norway and in the European Union in general while the lowest are in China and India (from bigger producers). Labour costs will fall due to higher productivity. Between 2010 and 2016, Brook Hunt expects that labour costs will fall by 17% to USD89/t of aluminium produced. Brook Hunt forecasts that the global weighted average depreciation charge will rise by 17% to USD112/t of aluminium, reflecting the large wave of new capacity, greenfield and brownfield due on stream by 2016, which will outweigh the impact of a number of facilities becoming over 20 years old. Shipping costs are significantly lower this year compared with record costs in 2008, mostly due to rapid ship building in China in recent years. Power prices for smelters rising Worldwide power prices for aluminium smelters on average increased over 100% over the last decade, while total smelters cash costs on average increased around 90%. Worlds average power tariffs increased from USD19/ MWh in 2001 to USD43/MWh in 2011. Average power costs increased from USD300/t of primary aluminium produced at the beginning of the century to over USD650/t in 2011, representing about one third of world average smelters production costs. Long term power contracts for smelters that expired re-

cently put them often in an unpleasant position since new contracts are offered at much higher prices, resulting in several closures recently in Europe. Excluding China, world power tariffs increased from USD16/MWh in 2001 to USD27/MWh in 2011. Outside China, the highest power tariffs in the world in 2011 had smelters in Brazil, Alumar and Albras, of around USD54/MWh. Although the Chinese industry tends to occupy much of the third and fourth quartile on the cost curve, the most smelters at risk remain those located in Europe and the USA. Whilst some producers in these regions have managed to negotiate more favourable power contracts, many smelters will remain at the high end of the cost curve and may become the swing smelters for the industry. The highest power costs in the USA for aluminium smelters in 2011 had Century Aluminiums 224,000 tpy Mount Holly smelter in South Carolina (USD52/MWh), compared with the average cost of USD37.57/MWh in the USA. Centurys 244,000 tpy smelter in Hawesville, Kentucky, is on the brink of closure after its power supplier, Big River Electric, recently increased the power price to over USD48/MWh. More than half of the global aluminium is produced using renewable and environmentally friendly hydropower. The share of hydropower usage is particularly high in Latin America, Canada and Russia, while all smelters in the Middle East are powered on gas. Smelters using latest technology consume as low as 12.2-12.5 MWh/t of primary aluminium produced whereas on average smelters

consume 14.5-15 MWh/t. Many smelters have variable power costs, when rates are a fixed percentage of the LME aluminium price. Cost trends in some major producing regions CHINA: Smelters in China have been known as occupying the very top of the cost curve, but pinpointing the exact position of the countrys giant aluminium sector on the global cost curve is no easy task because Chinese smelter costs are variable, as higher-cost capacity gradually closes in the east of the country and is replaced by lower-cost capacity in northwestern provinces. New production capacities are set up with more efficient technology while inefficient and costly smelters in the east are closed. As China is building up capacity at lower costs, it is likely that aluminium prices will come further under pressure in view of the current economic situation. Moreover, aluminium smelters in Chinas major producing regions such as Henan province, accounting for about 20% of the countries smelting capacity of over 23m tonnes receive governmentally approved discounts on power of 0.08 yuan/KWh (1.265 US cents/KWh), a move that could delay production cuts and keep prices down. Smelters will continue to pay preferential rates until the aluminium price reaches 17,500 yuan/t (USD2,767/t), and if its above 18,000 yuan/t (USD2,846/t), they will pay back the 0.08 yuan preferential rate, according to SMM Information & Technology. The subsidy will cut production costs for

CRU

Endangered primary smelters

Blue: mainly due to the existence of long term contracts

30

ALUMINIUM 7-8/2012

EAA

smelters by around 1,000 yuan/t (USD158/t), local sources say. News of the subsidy dragged the most-active October aluminium contract on the Shanghai Futures Exchange (SHFE) down as much as 3.38% to 14,990 yuan/t (USD2,370/t) at the end of June, the lowest since April 2009. Aluminium is attractive at these levels of the price with 20% of Chinas production losing money, says Goldman Sachs Group. Up to 30% of the aluminium output outside of China is loss-making, Goldman Sachs said in a report early in July. According to the Chinese Aluminium Association, in the provinces Henan, Sichuan, Yunnan and Guizhou and Guangxi Zhuang autonomous region, the power tariff for smelters (prior to the governments discounts on power costs) is more than 0.6 yuan/KWh (9.5 USc/KWh), which raises production costs of aluminium up to 18,400 yuan/t (USD2,909/t). However, despite losses, there are few companies that plan to curtail output. In other regions, most smelters pay 0.45 yuan/KWh (7.1 USc /KWh), which results in cost of produced tonne of aluminium of 16,400 yuan (USD2,593/t). EUROPE: There are a number of smelters in Europe at high risk to be closed due to high power prices after old power contracts expired and Germany decided to close its nuclear plants by the end of the decade. Especially under threat are smelters in Germany, south and south east Europe. In purpose to prevent further closures, the European Commission decided in May that EU countries will be allowed to compensate some big energy users, including aluminium producers, for extra costs resulting from changes to the EU Emissions Trading Scheme (ETS) as from next year. A recent draft has already shown that EU member states would be allowed to shield big industries as from 2013, to prevent so-called carbon leakage, which happens when rising costs could drive business out of Europe. If production shifts from the EU to third countries with less environmental regulation, this could undermine our objective of a global reduction of greenhouse gas emissions, Competition Commissioner Joaquin Almunia said in a statement. RUSSIA: UC Rusal had production cash costs of USD1,950/t in the first quarter of 2012, according to a companys official. In order to further cut costs it delayed the construction of the Taishet smelter (750,000 tpy), which was expected to produce first metal in 2013. The declining aluminium price also helped Rusal to cut costs since its energy supply contracts are linked to the LME price.

Rusal has long term contracts to supply power from low cost hydro power plants in Siberia. Electricity accounts for about 20% of the companys production costs. A weak Russian rouble and lower oil prices have also contributed to cost reduction in the second quarter of this year. This means that, at current aluminium prices, Rusals production costs are lower than USD1,900/t. However, due to higher power rates recently introduced, which did not exempt the Russian aluminium industry, Rusals power costs recently increased and are expected to further rise in coming years. In 2010 the Bratsk smelter had the lowest power tariff in Russia, of around USD13.3/MWh, according to Brook Hunt data. CANADA: Canada is a country with plenty of low cost energy and home of several smelters with the lowest power costs in the world, mostly generated from hydro power plants. The Kitimat smelter (200,000 tpy) has the lowest power tariff of USD5.3/MWh, followed by Alma, Grande Baie, Shawinigan and several other smelters with power tariffs of USD6.8/ MWh, again according to Brook Hunt. A recent CRU study entitled Primary Aluminium Smelting Cost concludes that production costs at Rio Tinto Alcans Alma smelter (438,000 tpy) was approx. USD1,442/t in 2011, whereas the lowest production costs in China was USD2,085/t. Based on production costs, the Alma plant ranks 27th in the world out of 176 smelters surveyed by CRU, and 7th out of 19 in North America. The Alma smelter operates with two third of its full capacity since the beginning of 2012 and will soon return to full capacity after a tentative settlement was reached in July, ending a 6-month labour dispute. Production cuts with no effect so far Aluminium producers around the world, excluding China, have cut production by around 1.3m tonnes since the summer 2011. Still, latest data from the International Aluminium Institute show that global production (ex. China) for the first five months in 2012 amounted to 10.404m tonnes, against 10.532m tonnes during the same period last year, a decrease of 1.2% y-o-y. The statistics of IAI, which started in 1973, show that the historic maximum of the global aluminium production was 71 tonnes/day in October 2011. In China, average daily volume of the aluminium production by the end of May 2012 reached a new historic record with 54.1 tonnes/ day (IAI statistics). For the first five months in 2012, primary aluminium production in China reached 7.838m tonnes against 6.995m tonnes

during the same period last year. Thus, from the beginning of the year aluminium production in China rose 12.1% y-o-y. These figures show that despite the closure of around 1.3m tonnes of annual production since the summer 2011, newly started production capacities, especially in the Middle East and India, have compensated aluminium production losses. China has cut around 1m tonnes of unprofitable production, but production from January to the end of May 2012 has increased by 0.85m tonnes y-o-y in other words: China added almost 2m tonnes of new production over that period. The aluminium price has not got much support by production cuts so far, and at least 3m tonnes of annual production has to be taken off the market to back and stabilise the price above USD2,000/t. Final remarks The aluminium industry is going through a difficult time again, with many smelters around

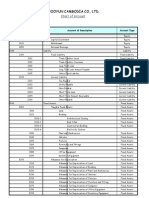

Costing methodology

according to Brook Hunt

Cash cost (C1) represents the cash cost incurred at each processing stage, from the start of production process to delivered metal to market, minus net byproduct credits (if any). The M1 margin is defined as aluminium price received minus C1. Production cost (C2), also known as operating cost, is the sum of cash costs (C1) and depreciation, depletion and amortisation. The M2 margin is defined as aluminium price received minus C2. Fully allocated cost (C3) is the sum of the operating cost (C2), indirect costs and net interest charges. The M3 margin is defined as aluminium price received minus C3. Business costs are the sum of all costs (variable and fixed) in a particular business function of the value chain. CRU defines business costs as sum of site costs and realisations costs. Site costs comprise raw material and conversion costs. Raw material costs include: royalties (mines), raw materials (smelters) and financing of raw material stocks. Conversion costs include: energy costs, labour, consumables, maintenance, plant management, financing of VIP, stores etc, and sustaining capital expenditures. Realisations costs include: sales and marketing costs, freight to markets, premium/discount adjustment and financing of inventory/receivables. According to CRU, C1 costs consist of: energy costs, labour, raw materials, consumables, maintenance, mine/plant management, freight to markets, and sales and marketing costs.

ALUMINIUM 7-8/2012

31

the world struggling to survive in view of weak aluminium prices both on the LME and Shanghai Futures Exchange. There is a trend towards smelter concentration in the low-cost Gulf region and smelters in China moving from higher cost eastern provinces to lower cost provinces in the West and Northwest.

World smelters production costs are expected to gradually decrease from the 2011 level by the end of this decade, as new and cheap producing capacities will replace old and high cost smelters. Production costs, together with the aluminium price, will grow only in extreme situations of political tensions or natural disasters, when supplies are interrupted (raw

materials, energy, shipping routes). However, bauxite and alumina prices will most likely increase in coming years but the alumina price should not exceed values already seen in the past. Higher alumina costs will be offset by lower other costs (energy, labour) resulting in stable or decreasing total smelters production costs.

32

ALUMINIUM 7-8/2012

Das könnte Ihnen auch gefallen

- Market Research, Global Market for Germanium and Germanium ProductsVon EverandMarket Research, Global Market for Germanium and Germanium ProductsNoch keine Bewertungen

- EU China Energy Magazine 2022 November Issue: 2022, #10Von EverandEU China Energy Magazine 2022 November Issue: 2022, #10Noch keine Bewertungen

- Project Report On: Oligopoly Market Structure of Aluminium Industry in IndiaDokument5 SeitenProject Report On: Oligopoly Market Structure of Aluminium Industry in IndiaShruti SharmaNoch keine Bewertungen

- Business Talk: - Namita NaikDokument5 SeitenBusiness Talk: - Namita NaikakmullickNoch keine Bewertungen

- Aluminium and Challenges For SustainabilityDokument4 SeitenAluminium and Challenges For SustainabilityNarasimharaghavanPuliyurKrishnaswamyNoch keine Bewertungen

- Current State of The World and Domestic AluminiumDokument7 SeitenCurrent State of The World and Domestic AluminiumHanna FloresNoch keine Bewertungen

- 0909 PDFDokument3 Seiten0909 PDFCris CristyNoch keine Bewertungen

- Consolidated Sectors Report.Dokument68 SeitenConsolidated Sectors Report.Neeraj PartetyNoch keine Bewertungen

- Aluminiu M: Research It! Sector Info July 13, 2009Dokument4 SeitenAluminiu M: Research It! Sector Info July 13, 2009vinodmaliwalNoch keine Bewertungen

- Executive Summary: Chart 1. Lead Prices 2008-2011Dokument4 SeitenExecutive Summary: Chart 1. Lead Prices 2008-2011FransiscaBerlianiDewiThanjoyoNoch keine Bewertungen

- PH3 30 Iron SteelDokument142 SeitenPH3 30 Iron SteelMouna GuruNoch keine Bewertungen

- Brighter Prospects For Aluminium Extruders?Dokument2 SeitenBrighter Prospects For Aluminium Extruders?James WarrenNoch keine Bewertungen

- CMR Jan 13Dokument7 SeitenCMR Jan 13James WarrenNoch keine Bewertungen

- Indian Aluminium IndustryDokument6 SeitenIndian Aluminium IndustryAmrisha VermaNoch keine Bewertungen

- Indian Aluminium - Rising International Trade at Slower PaceDokument3 SeitenIndian Aluminium - Rising International Trade at Slower PaceSiddharth PatroNoch keine Bewertungen

- Outlook AluminumDokument4 SeitenOutlook AluminumrivrsideNoch keine Bewertungen

- Scope and Potential of Indian Aluminium Industry: An Indepth AnalysisDokument11 SeitenScope and Potential of Indian Aluminium Industry: An Indepth Analysisvivekjain007Noch keine Bewertungen

- The Future of The European Steel Industry - VFDokument22 SeitenThe Future of The European Steel Industry - VFEric PhanNoch keine Bewertungen

- Resources and Energy Quarterly Dec 2020 AluminiumDokument10 SeitenResources and Energy Quarterly Dec 2020 Aluminiumthị thảo vân phạmNoch keine Bewertungen

- Turkish Metal Industry Report: Republic of Turkey Prime MinistryDokument25 SeitenTurkish Metal Industry Report: Republic of Turkey Prime MinistryRoman SuprunNoch keine Bewertungen

- Iif Aluminium Day Chennai 16th April 2011Dokument44 SeitenIif Aluminium Day Chennai 16th April 2011etamil87Noch keine Bewertungen

- IEA Coal Medium TermDokument4 SeitenIEA Coal Medium Termtimnorris1Noch keine Bewertungen

- Metals AluminiumDokument28 SeitenMetals AluminiumSatyabrata BeheraNoch keine Bewertungen

- Do April'11Dokument7 SeitenDo April'11Satyabrata BeheraNoch keine Bewertungen

- DOMAINS - EconomicDokument2 SeitenDOMAINS - Economicvictoria kairooNoch keine Bewertungen

- Resources and Energy Quarterly March 2018 Aluminium Alumina and BauxiteDokument9 SeitenResources and Energy Quarterly March 2018 Aluminium Alumina and Bauxitethị thảo vân phạmNoch keine Bewertungen

- Harga MethanolDokument1 SeiteHarga MethanolYuli NugraheniNoch keine Bewertungen

- Shanghai Apr 14Dokument7 SeitenShanghai Apr 14Baldomero El MontañeroNoch keine Bewertungen

- Energy & Commodities - November 16, 2012Dokument4 SeitenEnergy & Commodities - November 16, 2012Swedbank AB (publ)Noch keine Bewertungen

- Power Costs in The Production of Primary AluminumDokument2 SeitenPower Costs in The Production of Primary AluminumHariadiNoch keine Bewertungen

- Focus ON Catalysts: July 2020Dokument1 SeiteFocus ON Catalysts: July 2020Zohaib AhmedNoch keine Bewertungen

- Aluminium Industry CARE 060112Dokument5 SeitenAluminium Industry CARE 060112kavspopsNoch keine Bewertungen

- Faqs:: Natural GasDokument8 SeitenFaqs:: Natural GasBalamurali BalamNoch keine Bewertungen

- Copper Smelter TC and RCDokument2 SeitenCopper Smelter TC and RCcbqucbquNoch keine Bewertungen

- Aluminium Industry in IndiaDokument9 SeitenAluminium Industry in IndiaPartha Sarathi MohapatraNoch keine Bewertungen

- MS 2012 Outlook: Base MetalsDokument11 SeitenMS 2012 Outlook: Base Metalsz2009z2009Noch keine Bewertungen

- Article 1. The Future of CoalDokument4 SeitenArticle 1. The Future of Coalwisnu fitraddyNoch keine Bewertungen

- Essar Steel Limited Annual ReportDokument10 SeitenEssar Steel Limited Annual Reportjagdish62103Noch keine Bewertungen

- Conference9MagALLOY Paper Vancouver July2012Dokument9 SeitenConference9MagALLOY Paper Vancouver July2012tarasasankaNoch keine Bewertungen

- Market Analysis 538Dokument7 SeitenMarket Analysis 538checkoutdanielNoch keine Bewertungen

- Carbon Products - A Major ConcernDokument3 SeitenCarbon Products - A Major ConcernjaydiiphajraNoch keine Bewertungen

- Aluminum FramesDokument26 SeitenAluminum FramesMahnoor KhanNoch keine Bewertungen

- A Price Forecasting Model of Iron Ore andDokument30 SeitenA Price Forecasting Model of Iron Ore andGaurav VermaNoch keine Bewertungen

- Rain Industries - Fundamental AnalysisDokument7 SeitenRain Industries - Fundamental AnalysisKhushal SinghNoch keine Bewertungen

- The Changing Global Market For Australian Coal PDFDokument12 SeitenThe Changing Global Market For Australian Coal PDFMecha ErcilaNoch keine Bewertungen

- 7-80-91 Caspian ReportDokument12 Seiten7-80-91 Caspian ReportRasul AghayevNoch keine Bewertungen

- Source: Resources Vs Reserves, Oil and Gas Operations and MarketsDokument5 SeitenSource: Resources Vs Reserves, Oil and Gas Operations and MarketsfrenzybabyNoch keine Bewertungen

- H1 Case Study Question 1 AnswersDokument6 SeitenH1 Case Study Question 1 AnswersAnika SuganNoch keine Bewertungen

- Aluminium ExtrusionsDokument7 SeitenAluminium Extrusionsvinitb_3Noch keine Bewertungen

- UK Energy Mix March 14Dokument15 SeitenUK Energy Mix March 14demoneskoNoch keine Bewertungen

- EURACOAL Market Report 2015 1 PDFDokument21 SeitenEURACOAL Market Report 2015 1 PDFRamo KissNoch keine Bewertungen

- Alcoa SwotDokument44 SeitenAlcoa SwotKURATHEESH1Noch keine Bewertungen

- Aluminum Market Industrial ReportDokument20 SeitenAluminum Market Industrial ReportProvocateur SamaraNoch keine Bewertungen

- Production and Consumption Trends in The Total Finished Steel Market (In Million Tonnes)Dokument6 SeitenProduction and Consumption Trends in The Total Finished Steel Market (In Million Tonnes)Monish RcNoch keine Bewertungen

- Commodity Research Report: Copper Fundamental AnalysisDokument18 SeitenCommodity Research Report: Copper Fundamental AnalysisarathyachusNoch keine Bewertungen

- European Aniline ProductionDokument2 SeitenEuropean Aniline ProductionheliselyayNoch keine Bewertungen

- Hindalco Industries Initiating CoverageDokument24 SeitenHindalco Industries Initiating CoveragePankaj Kumar BothraNoch keine Bewertungen

- Gold Price Framework Vol 2 EnergyDokument14 SeitenGold Price Framework Vol 2 Energyhnif2009Noch keine Bewertungen

- Feasibility Report On The Production of Direct Reduced IronDokument5 SeitenFeasibility Report On The Production of Direct Reduced IronEngr Faiq ChauhdaryNoch keine Bewertungen

- AnswersDokument28 SeitenAnswersfmdeen100% (1)

- Salesprocess - Io Action Plan (Request Access To View)Dokument20 SeitenSalesprocess - Io Action Plan (Request Access To View)ravi susmithNoch keine Bewertungen

- Worksheet in Chart AccountDokument3 SeitenWorksheet in Chart AccountthorseiratyNoch keine Bewertungen

- ho.br.docxDokument16 Seitenho.br.docxjuennaguecoNoch keine Bewertungen

- Accounting For OverheadsDokument21 SeitenAccounting For OverheadsTsikoane Peka KolbereNoch keine Bewertungen

- Chapter 4 - Financial AspectDokument143 SeitenChapter 4 - Financial AspectPiolen NicaNoch keine Bewertungen

- Internship 4Dokument4 SeitenInternship 4Hirschmann Andro BoquilaNoch keine Bewertungen

- CHAPTER I PPT EditedDokument45 SeitenCHAPTER I PPT EditedgereNoch keine Bewertungen

- ACT 600 Advanced Managerial Accounting: Accumulating and Assigning Costs To ProductsDokument43 SeitenACT 600 Advanced Managerial Accounting: Accumulating and Assigning Costs To ProductsAli H. AyoubNoch keine Bewertungen

- Chap 003Dokument72 SeitenChap 003Hà PhươngNoch keine Bewertungen

- Cat/fia (Ma2)Dokument12 SeitenCat/fia (Ma2)theizzatirosli50% (2)

- AP 2020 - Inventories 2Dokument9 SeitenAP 2020 - Inventories 2Lora Mae JuanitoNoch keine Bewertungen

- DAIBB MA Math Solutions 290315Dokument11 SeitenDAIBB MA Math Solutions 290315joyNoch keine Bewertungen

- Answers OPERATIONDokument6 SeitenAnswers OPERATIONAltea AroganteNoch keine Bewertungen

- Io73moh25 - ACTIVITY - CHAPTER 4 - TYPES OF MAJOR ACCOUNTS.Dokument4 SeitenIo73moh25 - ACTIVITY - CHAPTER 4 - TYPES OF MAJOR ACCOUNTS.James CastañedaNoch keine Bewertungen

- Cost ManagementDokument46 SeitenCost ManagementAjinkya Pawar100% (2)

- Variable Costing and Segmented Reporting ConvertDokument7 SeitenVariable Costing and Segmented Reporting ConvertallysaallysaNoch keine Bewertungen

- Inventories Ch9IDokument2 SeitenInventories Ch9Isamia.aliNoch keine Bewertungen

- BACC 200 Chapter 6 Questions & AnswersDokument18 SeitenBACC 200 Chapter 6 Questions & AnswersMoe BuisiniessNoch keine Bewertungen

- 151 0106Dokument37 Seiten151 0106api-27548664Noch keine Bewertungen

- Chapter 3 Accounting For Merchandising OperationsDokument10 SeitenChapter 3 Accounting For Merchandising OperationsSKY StationeryNoch keine Bewertungen

- Cost Accounting (1) First Grade: Inventories For A Manufacturing BusinessDokument3 SeitenCost Accounting (1) First Grade: Inventories For A Manufacturing BusinessAmer Wagdy GergesNoch keine Bewertungen

- AcumaticaERP ManufacturingDokument263 SeitenAcumaticaERP ManufacturingcrudbugNoch keine Bewertungen

- MAS - Financial Statement Analysis PDFDokument5 SeitenMAS - Financial Statement Analysis PDFKathleen Ann PereiraNoch keine Bewertungen

- Updated Prob Set, Mang Acc (New)Dokument24 SeitenUpdated Prob Set, Mang Acc (New)Nazmul Bashar SamiNoch keine Bewertungen

- Test Canvas: C1: FMGT123Dokument162 SeitenTest Canvas: C1: FMGT123Illion IllionNoch keine Bewertungen

- Xin ChaoDokument10 SeitenXin ChaoQuế Hoàng Hoài ThươngNoch keine Bewertungen

- BAU Manufacturing Corporation Trial Balance December 31, 2020Dokument10 SeitenBAU Manufacturing Corporation Trial Balance December 31, 2020Kim FloresNoch keine Bewertungen

- Pamantasan NG Lungsod NG Pasig: - MULTIPLE CHOICE (20 Points)Dokument4 SeitenPamantasan NG Lungsod NG Pasig: - MULTIPLE CHOICE (20 Points)RogelynCodillaNoch keine Bewertungen

- Managerial Accounting 10Dokument63 SeitenManagerial Accounting 10Dheeraj Suntha100% (3)