Beruflich Dokumente

Kultur Dokumente

Presentation On Insurance Mgmt.

Hochgeladen von

Priyanka BhatiOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Presentation On Insurance Mgmt.

Hochgeladen von

Priyanka BhatiCopyright:

Verfügbare Formate

PRESENTED BY: PRIYANKA BHATI JYOTI GUPTA

INSURANCE IS DEFINED AS THE EQUITABLE TRANSFER OF LOSS FROM INSURED TO INSURER IN EXCHANGE FOR PAYMENT. AN INSURER IS THE COMPANY SELLING THE INSURANCE,INSURED IS THE PERSON BUYING THE INSURANCE POLICY.THE AMOUNT TO BE CHARGED FOR A CERTAIN AMOUNT OF INSURANCE IS CALLED INSURANCE PREMIUM.

RISK SHARINNG & RISK TRANSFER COOPERATIVE DEVICE CALCULATE RISK IN ADVANCE PAYMENT OF CLIM AT THE OCCURANCE OF CONTIGENCY AMOUNT OF PAYMENT LARGE NO. OF INSURED PERSON IT MUST NOT BE CONFUSED WITH CHARITY OR GAMBLING.

INSURANCE MANAGEMENT IS CONCERNED WITH PLANNING AND CONTROLLING INSURANCE PLANS & POLICIES ISSUED BY LIFE AND NONLIFE INSURANCE COMPANIES,AS PER THE NEEDS OF THE CUSTOMERS. THE MAIN AIM OF INSURANCE MANAGEMENT IS TO PROVIDE THE BEST INSURANCE SERVICES TO THE CUSTOMERS SOTHAT THE CO.CAN EARN AND RETAIN THEM.

PLANNING

CONTROLLING

Planning is a process for accomplishing purpose. It is blue print of business growth and a road map of development. It is setting of goals on the basis of objectives and keeping in view the resources.

ACTURIAL UNDERWRITING SALES AND MARKETING ACCOUNTING INVESTING AND FINANCING LEGAL CLAIMS OTHER DEPARTMENT:ENGINEERING ADMINISTRATIVE/PERSONNE STATISTICAL

AN ACTUARY IS AN EXPERT WHO APPLIES STATISTICAL AND MATHEMATICAL METHODS TO ASSESS FINANCIAL AND OTHER RISKS RELATED TO VARIOUS CONTIGENT EVENTS SUCH AS MORTALITY, SICKNESS, INJURY, RETIREMENT, PROPERTY LOSS FROM THEFT.

A financial professional that evaluates the risks of insuring a particular person or asset and uses that information to set premium pricing for insurance policies. Insurance underwriters are employed by insurance companies to help price life insurance, health insurance, property/casualty insurance and homeowners insurance, among others. Underwriters use computer programs and actuarial data to determine the likelihood and magnitude of a payout over the life of the policy. Higher-risk individuals and assets will have to pay more in premiums to receive the same level of protection as a (perceived) lower-risk person or assests.

UNDERWRITING IN LIFE INSURANCE COMPANY

UNDERWRITING IN NON LIFE INSURANCE COMPNY

IT IS MAINLY CONCERNED WITH MORTALITY. MORTALITY RISK FOR AN INSURER IS THAT THE INSURED WILL DIE PRIOR TO THE STIPULATED LIFE.

AGE GENDER HEIGHT & WEIGHT HEALTH HISTORY PURPOSE OF THE INSURANCE MARITAL STATUS NO OF CHILDREN OCCUPATION INCOME

THE UNDERWRITING OF COMMERCIAL, BUSINESS INSURANCES IS MUCH MORE COMPLICATED THAN THAT OF LIFE INSURANCE.COMMERCIAL INSURANCE RANGESNFROM SMALL SHOP TO LARGE MULTINATIONAL CORPORATIONS.

SALES DEPARTMENT MAKES SURE THAT ACTUAL LOSSES WILL NOT BE MORE THAN THE PREDICTED LOSSES. MARKETING DEPT. CONDUCTS RESEARCH FOR IDENTIFICATION OF TARGET CUSTOMERS,HELPS IN MAINTAINING & PROMOTING THE DISTRIBUTION SYSTEM.

A TYPICAL PROBLEM IN ACCOUNTING FOR INSURANCE COMPANIES PERTAINS TO CREATION OF RESERVES FOR CONTIGENCIES WHICH ARE PROBABILISTIC AND THERFORE DIFFICULT TO PREDICT.

EVERY INSURANCE COMPANY HAVE TO BE ENGAGED IN FINANCING AND INVESTMENT ACTIVITIES.

INSURNCE ,BEING A CONTRACT ESSENTIALLY REQUIRES A LEGAL DEPT. TO HANDLE VARIOUS ISSUES.

THE MAIN FUNCTION OF CLAIM DEPT. IS TO VERIFY AND SETTLE THE CLAIMS PRESENTED.THIS REQUIRES AN AWARENESS OF RESPECTIVE COVERAGES,ABILITY TO QUANTIFY THE LOSSES & CAPACITY TO SETTLE THE CLAIMS ON A FAIR BASIS.

HERE COTROL CYCLE REFERS TO STAGES THROUGH WHICH A INSURANCE COMPANY ENSURES THAT WHATEVER IS BEING PLANNED WILL BE DEFINITELY ACHIEVED.

The management process that involves an organizations engaging in strategic planning and then acting on those plans.

THANKS FOR LISTENING

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 8.31.21 Boa STMNTDokument6 Seiten8.31.21 Boa STMNTAnthony VinsonNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- What Is CreditDokument5 SeitenWhat Is CreditKamil Aswad ElNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Bank Version Personal Financial StatementDokument9 SeitenBank Version Personal Financial StatementJk McCrea100% (1)

- Ambrish Gupta - Financial Accounting For Management - An Analytical Perspective (2016, Pearson Education) PDFDokument759 SeitenAmbrish Gupta - Financial Accounting For Management - An Analytical Perspective (2016, Pearson Education) PDFManirul100% (6)

- What Are The 5 C's of Credit?: Key TakeawaysDokument3 SeitenWhat Are The 5 C's of Credit?: Key TakeawaysUSMANNoch keine Bewertungen

- Sample Buyer Presentation - 2Dokument13 SeitenSample Buyer Presentation - 2mauricio0327Noch keine Bewertungen

- What Is MoneyDokument9 SeitenWhat Is Moneymariya0% (1)

- Fedai Daily Quiz Questions Archives - Bank Accounts: Correct Answer: 2 Correct Answer: 2Dokument22 SeitenFedai Daily Quiz Questions Archives - Bank Accounts: Correct Answer: 2 Correct Answer: 2Somdutt Gujjar100% (2)

- Statement DEC PDFDokument14 SeitenStatement DEC PDFUmay Delisha0% (1)

- Dec Salary SlipsDokument1 SeiteDec Salary Slipsrakeshsingh9811Noch keine Bewertungen

- AssessmentDokument20 SeitenAssessmentJenecil JavierNoch keine Bewertungen

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDokument5 SeitenAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNoch keine Bewertungen

- Duration 2 Hours Max Marks 70Dokument25 SeitenDuration 2 Hours Max Marks 70AgANoch keine Bewertungen

- BIS CDO Rating MethodologyDokument31 SeitenBIS CDO Rating Methodologystarfish555Noch keine Bewertungen

- UNIT 3 InsuranceDokument10 SeitenUNIT 3 InsuranceAroop PalNoch keine Bewertungen

- SPI Global - SolutionDokument6 SeitenSPI Global - SolutionSaduNoch keine Bewertungen

- CORPO Case ListDokument7 SeitenCORPO Case Listjheanniver nabloNoch keine Bewertungen

- ITC Corporate ValuationDokument6 SeitenITC Corporate ValuationSakshi Jain Jaipuria JaipurNoch keine Bewertungen

- 2015 Park High GraduationDokument20 Seiten2015 Park High GraduationaddisonindependentNoch keine Bewertungen

- Accounting Mnemonics DR CR Rules Accounting Mnemonics DR CR RulesDokument31 SeitenAccounting Mnemonics DR CR Rules Accounting Mnemonics DR CR Ruleswiz wizNoch keine Bewertungen

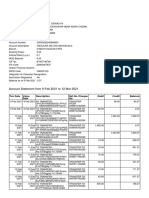

- Account Statement From 9 Feb 2021 To 12 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument5 SeitenAccount Statement From 9 Feb 2021 To 12 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceABHINAV DEWALIYANoch keine Bewertungen

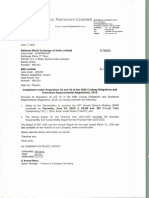

- Sundram Fasteners Annual Report 2023Dokument247 SeitenSundram Fasteners Annual Report 2023vijayNoch keine Bewertungen

- NSMID&SMALLCAPDokument2 SeitenNSMID&SMALLCAPRealm PhangchoNoch keine Bewertungen

- Timelines: 4 Working Days: Consolidating Bank Account Within HDFC Bank Consolidating Bank Account - Other BankDokument4 SeitenTimelines: 4 Working Days: Consolidating Bank Account Within HDFC Bank Consolidating Bank Account - Other Bankfeel the cosmosNoch keine Bewertungen

- Business Combinations : Ifrs 3Dokument45 SeitenBusiness Combinations : Ifrs 3alemayehu100% (1)

- About: Prudential PLCDokument8 SeitenAbout: Prudential PLCMillton LucanoNoch keine Bewertungen

- Answer Key Quiz 1Dokument8 SeitenAnswer Key Quiz 1Shaira Mae ManalastasNoch keine Bewertungen

- AF205 Assignment 2 - Navneet Nischal Chand - S11157889Dokument3 SeitenAF205 Assignment 2 - Navneet Nischal Chand - S11157889Shayal ChandNoch keine Bewertungen

- Customer Satisfaction On Housing Loan in SBI BankDokument23 SeitenCustomer Satisfaction On Housing Loan in SBI BankDebjyoti Rakshit100% (2)

- Reflection Paper 1Dokument2 SeitenReflection Paper 1Dela Peña, Rey Igino K.Noch keine Bewertungen