Beruflich Dokumente

Kultur Dokumente

Depreciation-Carrie Gray 08028-06 Ryan Bus Math

Hochgeladen von

carrie08Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Depreciation-Carrie Gray 08028-06 Ryan Bus Math

Hochgeladen von

carrie08Copyright:

Verfügbare Formate

Depreciation Schedule 1

RUNNING HEAD: REMAINING VALUE

Straight-line Method

Carrie Gray

April, 20, 2008

Phase-4 DB

MAT105-0802A-06

Professor: Kathy Ryan

Colorado Technical University Online

Depreciation Schedule 2

Straight-line Method

A. A $1,200 postage printing system depreciated using the straight-line method over 4

years. In your depreciation schedule, give the following information for each year: the year’s

depreciation, the accumulated depreciation, and the year’s end-of-book value.

Y Depreciation Accumulated End of Year

EAR Depreciation Book Value

1 $250 $250 $950

2 $250 $500 $700

3 $250 $750 $450

4 $250 $1000 $200

Cost of the asset $1200

Less: Expected salvage value – $200

Years of estimated useful life 4

Depreciation per year $ 250

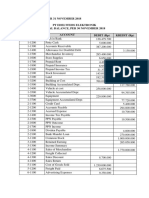

Scenario D

D. Consider a system of notebook computers for a college math laboratory. The set of

computers costs $10,000 and will be salvaged for $2,000 at the end of a 3-year period. Prepare a

depreciation schedule using a 150%-declining balance rate for the system. The depreciation

schedule should include the following information for each year: the year’s depreciation, the

accumulated depreciation, and the year’s end-of-book value.

Multiply (3years) 0.33333×(150%) 1.5=0.499999999 (round) 50%, accumulated, and

annual depreciation remain the same for year 1, for year 2, add 5000+2000=7,000=accumulated,

and end of year balance is 10,000-7500=2500. 3rd year end value is 10,000-8000=2000, and for

accumulated depreciation for the year is 2500x50=1250.

Depreciation Schedule 3

Depreciati Accumulated End of Year

Year

on Depreciation Book Value

1 $5000 $5000 $5000

$2500 $7500 $2500

2

3 $1250 $8000 $2000

Depreciation Schedule 4

References

Cleaves, C & Hobbs, M. (2005), Business Math (7th Ed.). Upper Saddle River, NJ. Prentice

Hall.

Das könnte Ihnen auch gefallen

- Ccs Sample QuestionsDokument20 SeitenCcs Sample Questionscarrie0875% (44)

- FDDGDokument7 SeitenFDDGlistenkidNoch keine Bewertungen

- Managerial Accounting Excel Project 2Dokument8 SeitenManagerial Accounting Excel Project 2John GuerreroNoch keine Bewertungen

- Chapter 6 - DepreciationDokument22 SeitenChapter 6 - DepreciationUpendra ReddyNoch keine Bewertungen

- Depreciation PDFDokument28 SeitenDepreciation PDFMominaNoch keine Bewertungen

- Original PDF Financial Statement Analysis and Security Valuation 5th Edition PDFDokument41 SeitenOriginal PDF Financial Statement Analysis and Security Valuation 5th Edition PDFgordon.hatley642100% (33)

- Advanced Accounting Baker Chapter 4 AnswersDokument58 SeitenAdvanced Accounting Baker Chapter 4 AnswersOksana McCord86% (7)

- 5 Year Financial PlanDokument20 Seiten5 Year Financial PlanNKITDOSHI100% (1)

- Session 23 DepreciationDokument12 SeitenSession 23 Depreciationol.iv.e.a.gui.l.ar412Noch keine Bewertungen

- Colorado Agriscience CurriculumDokument5 SeitenColorado Agriscience CurriculumjhouvanNoch keine Bewertungen

- L21-L24 - DepreciationDokument21 SeitenL21-L24 - DepreciationDpt HtegnNoch keine Bewertungen

- Cut - Off Grade Strategy PDFDokument13 SeitenCut - Off Grade Strategy PDFOlegario SosaNoch keine Bewertungen

- Double Declining-Balance Depreciation: Study TipDokument1 SeiteDouble Declining-Balance Depreciation: Study Tipjustine martinNoch keine Bewertungen

- Depn Handout 2Dokument4 SeitenDepn Handout 2Dave ChowtieNoch keine Bewertungen

- Assignment 5Dokument6 SeitenAssignment 5Helter SkelterNoch keine Bewertungen

- GRADE 11 Lesson Notes On Other Adjustments To Final Accounts ACCRUALS AND PREPAYMENTS SEPT 2023Dokument11 SeitenGRADE 11 Lesson Notes On Other Adjustments To Final Accounts ACCRUALS AND PREPAYMENTS SEPT 2023kxngdawkinz20Noch keine Bewertungen

- Dpreciation, Depletion and AmotizationDokument5 SeitenDpreciation, Depletion and AmotizationHelter SkelterNoch keine Bewertungen

- ACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleDokument8 SeitenACTG1054 Answers To Practice Exercises From Course Outline and Learning Activities On MoodleCoc AndreiNoch keine Bewertungen

- The Role of Working Capital: Bordenk@unk - EduDokument7 SeitenThe Role of Working Capital: Bordenk@unk - EduAntonio FrancoNoch keine Bewertungen

- Engineering Economics: Ali SalmanDokument16 SeitenEngineering Economics: Ali SalmanMuhammad atif latif0% (1)

- Kieso InterAcctg IFRS 11e 01Dokument4 SeitenKieso InterAcctg IFRS 11e 01Arini Geubri MaghfirahNoch keine Bewertungen

- Revision Questions - Q&ADokument3 SeitenRevision Questions - Q&Arosario correiaNoch keine Bewertungen

- Annual Cash Flow AnalysisDokument35 SeitenAnnual Cash Flow AnalysisMuhammad Kurnia SandyNoch keine Bewertungen

- SP Simple Example Financial Statement ModelDokument47 SeitenSP Simple Example Financial Statement ModelAmr El-BelihyNoch keine Bewertungen

- Investment Appraisal Camb AL New (1) RIKZY EESADokument14 SeitenInvestment Appraisal Camb AL New (1) RIKZY EESAAyesha ZainabNoch keine Bewertungen

- 07 Rate of Return AnalysisDokument34 Seiten07 Rate of Return AnalysisNadira Nanda Paringgusti WijNoch keine Bewertungen

- Cases&Exercises - Chapter 4Dokument3 SeitenCases&Exercises - Chapter 4Barbara AraujoNoch keine Bewertungen

- Ex09 Travel v2Dokument3 SeitenEx09 Travel v2MUNESH YADAVNoch keine Bewertungen

- AIC Mid TestDokument3 SeitenAIC Mid TestsinasreynethNoch keine Bewertungen

- 02 Cost Benefit AnalysisDokument4 Seiten02 Cost Benefit AnalysisMnM -Noch keine Bewertungen

- A Student's Guide To Cost-Benefit AnalysisDokument2 SeitenA Student's Guide To Cost-Benefit AnalysisAlbyziaNoch keine Bewertungen

- Cost of Owning and Operating Constructio PDFDokument10 SeitenCost of Owning and Operating Constructio PDFsunleon31Noch keine Bewertungen

- DepreciationDokument4 SeitenDepreciationMùhammad TàhaNoch keine Bewertungen

- Intermediate Accounting: Seventeenth EditionDokument38 SeitenIntermediate Accounting: Seventeenth Editionxuân huấn bùiNoch keine Bewertungen

- Chapter 7 Interest Formulas (Gradient Series)Dokument16 SeitenChapter 7 Interest Formulas (Gradient Series)ORK BUNSOKRAKMUNYNoch keine Bewertungen

- M3 CPRDokument4 SeitenM3 CPRAngela LapuzNoch keine Bewertungen

- Annual Cash Flow AnalysisDokument35 SeitenAnnual Cash Flow AnalysisNur Irfana Mardiyah DiyahlikebarcelonaNoch keine Bewertungen

- Annual Cash Flow AnalysisDokument35 SeitenAnnual Cash Flow AnalysisNur Irfana Mardiyah DiyahlikebarcelonaNoch keine Bewertungen

- Metode Straight Line 1/5 20%Dokument2 SeitenMetode Straight Line 1/5 20%Rifki AndriyanNoch keine Bewertungen

- ACCT1200 (Fall 20) Lecture & Tutorial 5 Accounting Cycle 3Dokument9 SeitenACCT1200 (Fall 20) Lecture & Tutorial 5 Accounting Cycle 3Lyaman TagizadeNoch keine Bewertungen

- Page 1 of 2Dokument2 SeitenPage 1 of 2Rohan SinghNoch keine Bewertungen

- Business Math Using Excel: Chapter 06 - Exercise 10Dokument4 SeitenBusiness Math Using Excel: Chapter 06 - Exercise 10CNoch keine Bewertungen

- Chapter 4 Economic EquivalentDokument22 SeitenChapter 4 Economic EquivalentORK BUNSOKRAKMUNYNoch keine Bewertungen

- Excercises and Answers Chapter 2Dokument22 SeitenExcercises and Answers Chapter 2MerleNoch keine Bewertungen

- Module 4 Chapt1 DepreciationDokument15 SeitenModule 4 Chapt1 DepreciationA To Z INFONoch keine Bewertungen

- Topic 1 SolutionsDokument14 SeitenTopic 1 SolutionsPhan Phúc NguyênNoch keine Bewertungen

- Straight - Line Method: Cost - Estimated Residual Value Estimated Life Annual DepreciationDokument4 SeitenStraight - Line Method: Cost - Estimated Residual Value Estimated Life Annual DepreciationHiền NguyễnNoch keine Bewertungen

- Solution Manual For Accounting For Decision Making and Control 9th Edition Jerold ZimmermanDokument7 SeitenSolution Manual For Accounting For Decision Making and Control 9th Edition Jerold Zimmermanfuze.riddle.ghik9100% (46)

- Cambridge International General Certificate of Secondary EducationDokument20 SeitenCambridge International General Certificate of Secondary Educationsarah huksNoch keine Bewertungen

- Credit RiskDokument78 SeitenCredit RiskcarinaNoch keine Bewertungen

- Class Test 1Dokument3 SeitenClass Test 1Shriyansh ShuklaNoch keine Bewertungen

- Straight-Line Depreciation: ExpenseDokument3 SeitenStraight-Line Depreciation: ExpenseGhulam-ullah KhanNoch keine Bewertungen

- Engineering Economics - DepreciationDokument13 SeitenEngineering Economics - DepreciationAbdulrahman HaidarNoch keine Bewertungen

- MM 5007 - Financial Management - Mid Term PDFDokument33 SeitenMM 5007 - Financial Management - Mid Term PDFA. HanifahNoch keine Bewertungen

- Mid Term2006Dokument3 SeitenMid Term2006api-26315128Noch keine Bewertungen

- Property, Plant and Equipment: PurchaseDokument27 SeitenProperty, Plant and Equipment: PurchaseTNoch keine Bewertungen

- How Much Is Next Year's Money Worth Today? Double Checking From Value Today To Next YearDokument7 SeitenHow Much Is Next Year's Money Worth Today? Double Checking From Value Today To Next Yearamaresh mahapatraNoch keine Bewertungen

- The Numbers Add UpDokument1 SeiteThe Numbers Add UpjewilsonadvisorsNoch keine Bewertungen

- DepreciationDokument33 SeitenDepreciationKleeanne Nicole UmpadNoch keine Bewertungen

- Cost Benefit Analysis Dashboard Template: Employee SalariesDokument10 SeitenCost Benefit Analysis Dashboard Template: Employee SalariesKarthik HegdeNoch keine Bewertungen

- Key Concepts and Skills: Discounted Cash Flow ValuationDokument4 SeitenKey Concepts and Skills: Discounted Cash Flow Valuationnida younasNoch keine Bewertungen

- Answers To Extra QuestionsDokument8 SeitenAnswers To Extra QuestionsHashani KumarasingheNoch keine Bewertungen

- Assignment DepreciationDokument2 SeitenAssignment DepreciationAreeba NaeemNoch keine Bewertungen

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Von EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Noch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Ethics CarrieGray Callender Phase2 Task1DBDokument4 SeitenEthics CarrieGray Callender Phase2 Task1DBcarrie08Noch keine Bewertungen

- HIT120 P2ip1Dokument1 SeiteHIT120 P2ip1carrie08100% (1)

- Graphic CreditDokument1 SeiteGraphic Creditcarrie08Noch keine Bewertungen

- HIT120 P2ip1Dokument1 SeiteHIT120 P2ip1carrie08100% (1)

- Ethics CarrieGray Callender Phase2 Task1DBDokument4 SeitenEthics CarrieGray Callender Phase2 Task1DBcarrie08Noch keine Bewertungen

- CCSP Sample QuestionsDokument14 SeitenCCSP Sample Questionscarrie0871% (7)

- A Hurricane Is A Huge StormDokument1 SeiteA Hurricane Is A Huge Stormcarrie08Noch keine Bewertungen

- HIPAA CarrieGray McClain DB 1Dokument4 SeitenHIPAA CarrieGray McClain DB 1carrie08Noch keine Bewertungen

- Function+of+Cells BIO141-0804B-03 CarrieGray Task1Dokument4 SeitenFunction+of+Cells BIO141-0804B-03 CarrieGray Task1carrie08Noch keine Bewertungen

- Heart+and+Blood+Flow CarrieGray Bhatt Individ Phase2Dokument11 SeitenHeart+and+Blood+Flow CarrieGray Bhatt Individ Phase2carrie08100% (1)

- Diabetes CarrieGray Bhatt Individ 1Dokument6 SeitenDiabetes CarrieGray Bhatt Individ 1carrie08Noch keine Bewertungen

- Jamies Expense Income Balance PlanCarrieGrayDokument8 SeitenJamies Expense Income Balance PlanCarrieGraycarrie08100% (5)

- Statewidejobsin TNDokument4 SeitenStatewidejobsin TNcarrie08Noch keine Bewertungen

- Blank ScheduleDokument2 SeitenBlank Schedulecarrie08100% (14)

- INTD-111 Chat 2 0704aDokument24 SeitenINTD-111 Chat 2 0704acarrie08Noch keine Bewertungen

- Electronic Portfolio For StudentsDokument10 SeitenElectronic Portfolio For Studentscarrie08100% (4)

- M3 - Nila Savitri - 21221488 - 2EB09 (AKM 1)Dokument6 SeitenM3 - Nila Savitri - 21221488 - 2EB09 (AKM 1)rully movizarNoch keine Bewertungen

- DuPont Analysis - Wikipedia, The Free EncyclopediaDokument3 SeitenDuPont Analysis - Wikipedia, The Free EncyclopediaidradjatNoch keine Bewertungen

- Far 03-06 SolmanDokument14 SeitenFar 03-06 SolmanBaby BubotNoch keine Bewertungen

- Financial Modeling GuideDokument15 SeitenFinancial Modeling GuidemotebangNoch keine Bewertungen

- Basic Terms in AccountingDokument8 SeitenBasic Terms in AccountingAmrita TatiaNoch keine Bewertungen

- Daftar Saldo Dan Kartu Pembantu PT EdelweissDokument3 SeitenDaftar Saldo Dan Kartu Pembantu PT EdelweissalifaNoch keine Bewertungen

- XYZ Trading Exercise: Balance Sheet Class Notes Business TransactionsDokument3 SeitenXYZ Trading Exercise: Balance Sheet Class Notes Business TransactionsMisu NguyenNoch keine Bewertungen

- Aishwaraya Srivastava 23MS1002Dokument19 SeitenAishwaraya Srivastava 23MS1002Aishwarya SrivastavaNoch keine Bewertungen

- This Study Resource Was: ExercisesDokument9 SeitenThis Study Resource Was: ExercisesNah HamzaNoch keine Bewertungen

- Income StatementDokument13 SeitenIncome StatementShakir IsmailNoch keine Bewertungen

- Chart of Accounts: Appendix UDokument3 SeitenChart of Accounts: Appendix Ujawadr218Noch keine Bewertungen

- Equity Research: BUY Case On UBS HOLD CSDokument47 SeitenEquity Research: BUY Case On UBS HOLD CScormacleechNoch keine Bewertungen

- FSA Midterm Exam FormattedDokument8 SeitenFSA Midterm Exam Formattedkarthikmaddula007_66Noch keine Bewertungen

- RaymondDokument3 SeitenRaymondAkankshaNoch keine Bewertungen

- Week 1 - AEC 201 - Activities-PrelimDokument12 SeitenWeek 1 - AEC 201 - Activities-PrelimMaria Jessa HernaezNoch keine Bewertungen

- CHAPTER 14 Business Combination PFRS 3Dokument3 SeitenCHAPTER 14 Business Combination PFRS 3Richard DuranNoch keine Bewertungen

- ReceivablesDokument20 SeitenReceivablesGemmalyn FolguerasNoch keine Bewertungen

- Business Mathematics Lesson 3 Key Concepts in Buying and Selling Part 1 Mark-Up, Markdown, and Mark-On (Week6)Dokument18 SeitenBusiness Mathematics Lesson 3 Key Concepts in Buying and Selling Part 1 Mark-Up, Markdown, and Mark-On (Week6)Dearla Bitoon100% (5)

- Gilbert Company-WPS OfficeDokument17 SeitenGilbert Company-WPS OfficeTrina Mae Garcia100% (1)

- NajeebRehman 1505 14145 1/AFN ExamplesDokument47 SeitenNajeebRehman 1505 14145 1/AFN ExamplesQazi JunaidNoch keine Bewertungen

- Daily Edge 01122014Dokument41 SeitenDaily Edge 01122014Mad ViruzNoch keine Bewertungen

- 7169 - Noncurrent Asset Held For Sale and Discountinued OperationDokument2 Seiten7169 - Noncurrent Asset Held For Sale and Discountinued Operationjsmozol3434qcNoch keine Bewertungen

- 12 Accountancy Lyp 2017 Foreign Set3Dokument41 Seiten12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNoch keine Bewertungen

- 01 CHED COURSE OUTLINE Acctg 15ADokument3 Seiten01 CHED COURSE OUTLINE Acctg 15APat TabujaraNoch keine Bewertungen

- Pas 1 CfasDokument10 SeitenPas 1 CfasPinero JatheuzelNoch keine Bewertungen

- Chapter 14 Firms in Competitive MarketsDokument33 SeitenChapter 14 Firms in Competitive MarketsThanh NguyenNoch keine Bewertungen