Beruflich Dokumente

Kultur Dokumente

Cocept of FM

Hochgeladen von

Pranav BadhwarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cocept of FM

Hochgeladen von

Pranav BadhwarCopyright:

Verfügbare Formate

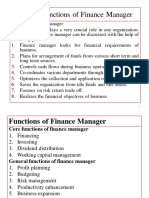

1.Objective of financial management Profit maximization Wealth maximization 2. Capital structure Financial BEP. Indifference point. 3.

Receivable Management Collection cost Capital cost Delinquency cost Default cost Del crede commission 4.Capital budgeting NPV IRR Capital Rationing ARR Payback period Discounted Payback period Discounted Cash flow Analysis Profitability index. 5.Working Capital Permanent working Capital Temporary working capital Hypothecation Pledge Mortgage Lien Charge 6.Cost of Capital Cost of Equity Cost of Capital Cost of Preference share Cost of Reserves Cost of Debt

7. Business restructing Merger Amalgamation Absorption Purchase consideration Joint venture Hostile take over Friendly take over Leverage Buy out Horizontal Merger Vertical Merger Conglomerate Merger Due Diligence 8.Cash Management Transaction Motive Precautionary Motive Speculative Motive Compensating Motive Baumol Model Miller-or-Model Concentration Banking Lock Box system Float and its Types 9. Leverage Leverage Financial leverage Operating leverage Margin of safety For 10 marks sources of fund (last chapter) and introduction to FM (chapter 1) is important

Das könnte Ihnen auch gefallen

- Mba III Advanced Financial Management NotesDokument49 SeitenMba III Advanced Financial Management NotesThahir Shah100% (2)

- Lost Secrets of Baseball HittingDokument7 SeitenLost Secrets of Baseball HittingCoach JPNoch keine Bewertungen

- Afin209 FPD 1 2017 1Dokument3 SeitenAfin209 FPD 1 2017 1Daniel Daka100% (1)

- Working Capital Cash ManagementDokument1 SeiteWorking Capital Cash ManagementmohamedNoch keine Bewertungen

- FM5.1 Working Capital MGTDokument20 SeitenFM5.1 Working Capital MGTAbdulraqeeb AlareqiNoch keine Bewertungen

- FM5.3 Cash ManagementDokument10 SeitenFM5.3 Cash ManagementAbdulraqeeb AlareqiNoch keine Bewertungen

- Unit 5Dokument78 SeitenUnit 5raqeebalareqi1998Noch keine Bewertungen

- Marketable SecuritiesDokument23 SeitenMarketable SecuritiesSunitha KarthikNoch keine Bewertungen

- Management of Working Capital M.B.A Third SemesterDokument23 SeitenManagement of Working Capital M.B.A Third SemesterRahul BisenNoch keine Bewertungen

- What Is A Management BuyoutDokument20 SeitenWhat Is A Management BuyoutTalha ImtiazNoch keine Bewertungen

- FM1 3Dokument10 SeitenFM1 3raqeebalareqi1998Noch keine Bewertungen

- Study Material-1 - Site: Course: Financial Management Book: Study Material-1 Printed By: Guest User Date: Sunday, 5 April 2015, 05:27 PMDokument191 SeitenStudy Material-1 - Site: Course: Financial Management Book: Study Material-1 Printed By: Guest User Date: Sunday, 5 April 2015, 05:27 PMShannon Patricia SepianNoch keine Bewertungen

- Capital StructureDokument8 SeitenCapital Structureibnebatuta103Noch keine Bewertungen

- CFMADokument36 SeitenCFMAArlan Joseph LopezNoch keine Bewertungen

- Workingcapitalmanagement-Lecture (Student)Dokument19 SeitenWorkingcapitalmanagement-Lecture (Student)Christoper SalvinoNoch keine Bewertungen

- Financial ManagementDokument145 SeitenFinancial Managementmanuj_uniyal89Noch keine Bewertungen

- Theory Notes of All ModulesDokument2 SeitenTheory Notes of All ModulesDarshan GowdaNoch keine Bewertungen

- Introduction To FMDokument70 SeitenIntroduction To FMRashika JainNoch keine Bewertungen

- P8a Financial ManagementDokument133 SeitenP8a Financial Managementharshrathore17579Noch keine Bewertungen

- Cash Management 11012018Dokument41 SeitenCash Management 11012018narunsankarNoch keine Bewertungen

- Smpe 202 Financial ManagementDokument131 SeitenSmpe 202 Financial Managementfmebirim100% (2)

- S 1 - Introduction To Corporate FinanceDokument8 SeitenS 1 - Introduction To Corporate FinanceAninda DuttaNoch keine Bewertungen

- Corprate Finance - REVISION - IDokument11 SeitenCorprate Finance - REVISION - IAmbika SharmaNoch keine Bewertungen

- Fin MGT Theory QtnsDokument2 SeitenFin MGT Theory QtnsSonal MestryNoch keine Bewertungen

- Capital StructureDokument20 SeitenCapital StructureBhavya GuptaNoch keine Bewertungen

- Finance in A Canadian SettingDokument27 SeitenFinance in A Canadian SettingPianist CapuchinauticsNoch keine Bewertungen

- Capital StructureDokument4 SeitenCapital StructurenaveenngowdaNoch keine Bewertungen

- S 1 - Introduction To Corporate Finance, Financial Markets and Indian Financial SystemDokument8 SeitenS 1 - Introduction To Corporate Finance, Financial Markets and Indian Financial SystemAninda DuttaNoch keine Bewertungen

- Mba-III-Advanced Financial Management m1Dokument6 SeitenMba-III-Advanced Financial Management m1KedarNoch keine Bewertungen

- O Variations in Accounting Methods o TimingDokument8 SeitenO Variations in Accounting Methods o TimingAeris StrongNoch keine Bewertungen

- Module in Financial Management - 10Dokument8 SeitenModule in Financial Management - 10Karla Mae GammadNoch keine Bewertungen

- Corporate Finance - UoJDokument63 SeitenCorporate Finance - UoJAbraham KuolNoch keine Bewertungen

- 06 BSIS 2 Financial Management Week 12 13Dokument5 Seiten06 BSIS 2 Financial Management Week 12 13Ace San GabrielNoch keine Bewertungen

- Corporate Finance ManagementDokument9 SeitenCorporate Finance Managementtrustmakamba23Noch keine Bewertungen

- 21MGH202T FM Unit IV Study MaterialsDokument19 Seiten21MGH202T FM Unit IV Study Materialslogashree175Noch keine Bewertungen

- Unit 3 FMDokument8 SeitenUnit 3 FMpurvang selaniNoch keine Bewertungen

- Financial ManagementDokument17 SeitenFinancial ManagementANAND100% (1)

- FM Notes Unit 3&4Dokument36 SeitenFM Notes Unit 3&4prem nathNoch keine Bewertungen

- Slide CfaDokument295 SeitenSlide CfaLinh HoangNoch keine Bewertungen

- Working Capital Management MergedDokument24 SeitenWorking Capital Management MergedBarnabasNoch keine Bewertungen

- Focus PointsDokument2 SeitenFocus PointsCandice WrightNoch keine Bewertungen

- Financial Management in AgribusinessDokument10 SeitenFinancial Management in AgribusinessNidhi NairNoch keine Bewertungen

- Accountancy Paper III Advance Financial Management Final BookDokument395 SeitenAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- Week 4 5 Ulob - Working Capital ManagementDokument7 SeitenWeek 4 5 Ulob - Working Capital ManagementKezzi Ervin UngayNoch keine Bewertungen

- Financialmanagementofbanks 151021134204 Lva1 App6892Dokument41 SeitenFinancialmanagementofbanks 151021134204 Lva1 App6892ManavAgarwalNoch keine Bewertungen

- Working Capital Management Notes PDFDokument40 SeitenWorking Capital Management Notes PDFBarakaNoch keine Bewertungen

- Financial Management-2Dokument292 SeitenFinancial Management-2benard owinoNoch keine Bewertungen

- Mba-III-Advanced Financial Management (14mbafm304) - NotesDokument49 SeitenMba-III-Advanced Financial Management (14mbafm304) - NotesAnilKotthur100% (1)

- Babu KPCL Final ProjectDokument95 SeitenBabu KPCL Final ProjectLucky Yadav100% (1)

- Chapter - Iv Theoretical FrameworkDokument10 SeitenChapter - Iv Theoretical FrameworkNahidul Islam IUNoch keine Bewertungen

- MB20202 Corporate Finance Unit III Study MaterialsDokument24 SeitenMB20202 Corporate Finance Unit III Study MaterialsSarath kumar CNoch keine Bewertungen

- Dcom505 Working Capital Management PDFDokument242 SeitenDcom505 Working Capital Management PDFRaj KumarNoch keine Bewertungen

- 01 Fin - Introduction To Financial ManagementDokument19 Seiten01 Fin - Introduction To Financial Managementshahin shekhNoch keine Bewertungen

- Business Finance Lesson 234Dokument9 SeitenBusiness Finance Lesson 234Lester MojadoNoch keine Bewertungen

- Assignment 1 FMDokument8 SeitenAssignment 1 FMSopnobaz FakirNoch keine Bewertungen

- Course Code: COM-405 Course Title: Credit Hours: 3 (3-0) : Introduction To Business FinanceDokument20 SeitenCourse Code: COM-405 Course Title: Credit Hours: 3 (3-0) : Introduction To Business FinanceSajjad AhmadNoch keine Bewertungen

- Solution Manual For Contemporary Financial Management 12th Edition by MoyerDokument24 SeitenSolution Manual For Contemporary Financial Management 12th Edition by MoyerMatthewGarciaqmen100% (48)

- 1 W C ChapDokument11 Seiten1 W C ChappoovarasnNoch keine Bewertungen

- Course Outline - Fin 223Dokument3 SeitenCourse Outline - Fin 223DenisNoch keine Bewertungen

- The Portfolio Management Revolution Maximize Your Profits TodayVon EverandThe Portfolio Management Revolution Maximize Your Profits TodayNoch keine Bewertungen

- Tybms Sem 5: Human Resource Management Question Bank: C CC C CCDokument17 SeitenTybms Sem 5: Human Resource Management Question Bank: C CC C CCPranav BadhwarNoch keine Bewertungen

- Industry: Automation Channels in BankingDokument5 SeitenIndustry: Automation Channels in BankingPranav BadhwarNoch keine Bewertungen

- Designing The Data Warehouse - Part 1Dokument45 SeitenDesigning The Data Warehouse - Part 1Pranav BadhwarNoch keine Bewertungen

- WH - DesigncontrolDokument19 SeitenWH - DesigncontrolAnonymous 1gbsuaafddNoch keine Bewertungen

- Special Studies in MarketingDokument35 SeitenSpecial Studies in MarketingPranav BadhwarNoch keine Bewertungen

- Asst. Prof Mrs. Iram ShaikhDokument18 SeitenAsst. Prof Mrs. Iram ShaikhPranav BadhwarNoch keine Bewertungen

- Total Revenues 0 0 0Dokument25 SeitenTotal Revenues 0 0 0Pranav BadhwarNoch keine Bewertungen

- Yahoo Tab NotrumpDokument139 SeitenYahoo Tab NotrumpJack Forbes100% (1)

- NURS 406 Concept Map HyperparathyroidismDokument1 SeiteNURS 406 Concept Map HyperparathyroidismshyannNoch keine Bewertungen

- Improving Hands-On Experimentation Through Model Making and Rapid Prototyping: The Case of The University of Botswana's Industrial Design StudentsDokument6 SeitenImproving Hands-On Experimentation Through Model Making and Rapid Prototyping: The Case of The University of Botswana's Industrial Design StudentsnaimshaikhNoch keine Bewertungen

- Lesson Plan 2 Revised - Morgan LegrandDokument19 SeitenLesson Plan 2 Revised - Morgan Legrandapi-540805523Noch keine Bewertungen

- Statistical TestsDokument47 SeitenStatistical TestsUche Nwa ElijahNoch keine Bewertungen

- Ms Cell Theory TestDokument6 SeitenMs Cell Theory Testapi-375761980Noch keine Bewertungen

- Development of A Single Axis Tilting QuadcopterDokument4 SeitenDevelopment of A Single Axis Tilting QuadcopterbasavasagarNoch keine Bewertungen

- Finding Roots of Equations Bracketing MethodsDokument11 SeitenFinding Roots of Equations Bracketing MethodsmebrahtenNoch keine Bewertungen

- Catibayan Reflection AR VRDokument6 SeitenCatibayan Reflection AR VRSheina Marie BariNoch keine Bewertungen

- CM PhysicalDokument14 SeitenCM PhysicalLulu Nur HidayahNoch keine Bewertungen

- A Management and Leadership TheoriesDokument43 SeitenA Management and Leadership TheoriesKrezielDulosEscobarNoch keine Bewertungen

- Performance Task in Mathematics 10 First Quarter: GuidelinesDokument2 SeitenPerformance Task in Mathematics 10 First Quarter: Guidelinesbelle cutiee100% (3)

- Mount Athos Plan - Healthy Living (PT 2)Dokument8 SeitenMount Athos Plan - Healthy Living (PT 2)Matvat0100% (2)

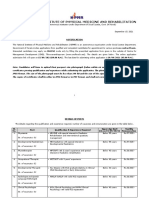

- NIPMR Notification v3Dokument3 SeitenNIPMR Notification v3maneeshaNoch keine Bewertungen

- Chiraghe Roshan Wa Amali Taweel - Nasir Khusrau PDFDokument59 SeitenChiraghe Roshan Wa Amali Taweel - Nasir Khusrau PDFJuzer Songerwala100% (1)

- Reviewer in Auditing Problems by Reynaldo Ocampo PDFDokument1 SeiteReviewer in Auditing Problems by Reynaldo Ocampo PDFCarlo BalinoNoch keine Bewertungen

- Fabre, Intro To Unfinished Quest of Richard WrightDokument9 SeitenFabre, Intro To Unfinished Quest of Richard Wrightfive4booksNoch keine Bewertungen

- Appendix H Sample of Coded Transcript PDFDokument21 SeitenAppendix H Sample of Coded Transcript PDFWahib LahnitiNoch keine Bewertungen

- Simple Linear Regression Analysis: Mcgraw-Hill/IrwinDokument16 SeitenSimple Linear Regression Analysis: Mcgraw-Hill/IrwinNaeem AyazNoch keine Bewertungen

- Consumer Trend Canvas (CTC) Template 2022Dokument1 SeiteConsumer Trend Canvas (CTC) Template 2022Patricia DominguezNoch keine Bewertungen

- An Improved Version of The Skin Chapter of Kent RepertoryDokument6 SeitenAn Improved Version of The Skin Chapter of Kent RepertoryHomoeopathic PulseNoch keine Bewertungen

- Presente Progresive TenseDokument21 SeitenPresente Progresive TenseAriana ChanganaquiNoch keine Bewertungen

- Common RHU DrugsDokument56 SeitenCommon RHU DrugsAlna Shelah IbañezNoch keine Bewertungen

- Erythrocyte Sedimentation RateDokument16 SeitenErythrocyte Sedimentation Rateapi-3823785100% (2)

- Worksheet WH QuestionsDokument1 SeiteWorksheet WH QuestionsFernEspinosaNoch keine Bewertungen

- Domestic ViolenceDokument2 SeitenDomestic ViolenceIsrar AhmadNoch keine Bewertungen

- 4.dynamic Analysis of Earth Quake Resistante Steel FrameDokument28 Seiten4.dynamic Analysis of Earth Quake Resistante Steel FrameRusdiwal JundullahNoch keine Bewertungen

- Shostakovich: Symphony No. 13Dokument16 SeitenShostakovich: Symphony No. 13Bol DigNoch keine Bewertungen