Beruflich Dokumente

Kultur Dokumente

Kittitas County Assessed Valuations in 2008

Hochgeladen von

Ellensburg Daily Record0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

16 Ansichten2 SeitenKittitas County Hospital districts information and hospital valuations

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PPT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenKittitas County Hospital districts information and hospital valuations

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

16 Ansichten2 SeitenKittitas County Assessed Valuations in 2008

Hochgeladen von

Ellensburg Daily RecordKittitas County Hospital districts information and hospital valuations

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PPT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

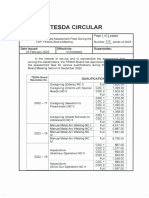

2008

Kittitas County Assessed Valuations & Levies

Hospital District Valuations Levy Local Tax Timber Total Tax

#1 / KVCH per $1,000 Yield Tax

valuation

Lower County Area $2,973,752,404 $0.0021 $6,247.85

Regular Levy

General Obligation $2,948,158,889 $0.2890 $852,023.82

Bond-New construct.

100% TAV $ 41,435,112 $0.2890 $11,974.83

TOTAL $0.2911 $858,271.67 $11,974.83 $870,246.50

Hospital District Valuations Levy Local Tax Timber Total Tax

#2 per $1,000 Yield Tax

valuation

Upper County Area $1,990,894,871 $0.2152 $428,520.21

Regular Levy

EMS Regular Levy $1,990,894,871 $0.1938 $385,781.67

2004-2009

TOTAL $0.4090 $814,301.88 $814,301.88

Kittitas Valley Community Hospital – 2008 & 2009

Activity Measure 2008 2009

Actual Budgeted

Admissions 1,339 1,389

Average Length of Stay 2.89 2.89

Births 336 324

Surgery Minutes 114,181 118,526

ER Visits 12,322 12,645

Outpatient Visits 75,929 79,631

Das könnte Ihnen auch gefallen

- Houston County Budget PresentationDokument7 SeitenHouston County Budget PresentationJohn S KeppyNoch keine Bewertungen

- Gross Reciepts of Odessa Allergy ClinicDokument1 SeiteGross Reciepts of Odessa Allergy Clinicatharrana1823Noch keine Bewertungen

- Guidelines For Estimating 2018: Aquaculture Production CostsDokument16 SeitenGuidelines For Estimating 2018: Aquaculture Production CostsboonyongchiraNoch keine Bewertungen

- Salinan Dari Monthly Expense Report TemplateDokument170 SeitenSalinan Dari Monthly Expense Report TemplateAgus Putra AdnyanaNoch keine Bewertungen

- ListDokument4 SeitenListdonbabich8Noch keine Bewertungen

- Wellness Life On ToursDokument3 SeitenWellness Life On Toursana maria pulgarin vesgaNoch keine Bewertungen

- Master Planning Workshop Results DraftDokument106 SeitenMaster Planning Workshop Results DraftMaruf HasanNoch keine Bewertungen

- 2021 Regional Hospital District BudgetDokument3 Seiten2021 Regional Hospital District BudgetTom SummerNoch keine Bewertungen

- Data Name of The WorkDokument6 SeitenData Name of The WorkAbhaya SethyNoch keine Bewertungen

- Jpmorgan Chase Bank, N.A. P O Box 182051 Columbus, Oh 43218 - 2051 June 09, 2021 Through July 09, 2021 Primary AccountDokument8 SeitenJpmorgan Chase Bank, N.A. P O Box 182051 Columbus, Oh 43218 - 2051 June 09, 2021 Through July 09, 2021 Primary AccountJoshua WeinmanNoch keine Bewertungen

- EastGate at GreyHawk Analysis 3.20.17Dokument11 SeitenEastGate at GreyHawk Analysis 3.20.17vobhoNoch keine Bewertungen

- Feb 2020Dokument4 SeitenFeb 2020andreaNoch keine Bewertungen

- Healthcare UsageDokument81 SeitenHealthcare UsageglasscityjungleNoch keine Bewertungen

- Radio 1 Financial AnalysisDokument5 SeitenRadio 1 Financial AnalysisFahad AliNoch keine Bewertungen

- Cop Agrienergy 3.5kwwindturbineDokument7 SeitenCop Agrienergy 3.5kwwindturbineK Divakara RaoNoch keine Bewertungen

- Property Report - 2312 Daisy RD Killeen TXDokument63 SeitenProperty Report - 2312 Daisy RD Killeen TXReia LewisNoch keine Bewertungen

- Salesperson Ellis Barrow HammondDokument7 SeitenSalesperson Ellis Barrow HammondRohan Chatterjee100% (1)

- Lehigh County 2008 BudgetDokument75 SeitenLehigh County 2008 BudgetMyLehighCountyNoch keine Bewertungen

- Rate Year 2020-21 Hospital Directed Payment Program Payments by ProviderDokument3 SeitenRate Year 2020-21 Hospital Directed Payment Program Payments by ProviderJason DelgadoNoch keine Bewertungen

- ChaseDokument6 SeitenChasepeter hammerNoch keine Bewertungen

- Statements 5013Dokument6 SeitenStatements 5013ytprem agu100% (1)

- TESDA Circular No. 010-2023Dokument7 SeitenTESDA Circular No. 010-2023Ime De la CruzNoch keine Bewertungen

- CorrespondenceDokument5 SeitenCorrespondenceUsakikamiNoch keine Bewertungen

- Salient Features May Week 2 Fy2023Dokument1 SeiteSalient Features May Week 2 Fy2023Mike ChiguwareNoch keine Bewertungen

- NPV CalculationDokument14 SeitenNPV CalculationMLastTryNoch keine Bewertungen

- October 5,2018 E-Dbs GomezDokument2 SeitenOctober 5,2018 E-Dbs GomezJescilyn Kate MaggayNoch keine Bewertungen

- Income For The MonthDokument2 SeitenIncome For The MonthRayad AliNoch keine Bewertungen

- Financial Statement AND Ratio Analysis TablesDokument46 SeitenFinancial Statement AND Ratio Analysis TablesRanjani KSNoch keine Bewertungen

- 2011-2012 County ExpendituresDokument55 Seiten2011-2012 County ExpendituresMichael ToddNoch keine Bewertungen

- ButlerLumberCompany Session4 Group9Dokument5 SeitenButlerLumberCompany Session4 Group9IEUveNoch keine Bewertungen

- September StatementDokument4 SeitenSeptember Statementdonbabich8Noch keine Bewertungen

- Utilities Infrastructure 2008Dokument3 SeitenUtilities Infrastructure 2008credcNoch keine Bewertungen

- Bank Statement 1)Dokument4 SeitenBank Statement 1)hbh2n8tgs4Noch keine Bewertungen

- January 2024Dokument6 SeitenJanuary 2024donbabich8Noch keine Bewertungen

- This Budget Is Interactive: INPUT DATA: Your Values in The Unprotected or Highlighted CellsDokument15 SeitenThis Budget Is Interactive: INPUT DATA: Your Values in The Unprotected or Highlighted CellsGeros dienosNoch keine Bewertungen

- Aero LogDokument13 SeitenAero LogEMMANUELNoch keine Bewertungen

- Revised 52371-E 52087-E: Cal. P.U.C. Sheet No. Cancelling Revised Cal. P.U.C. Sheet NoDokument6 SeitenRevised 52371-E 52087-E: Cal. P.U.C. Sheet No. Cancelling Revised Cal. P.U.C. Sheet NoshadabNoch keine Bewertungen

- 4:30:21 PaystubDokument1 Seite4:30:21 PaystubRhoderlande JosephNoch keine Bewertungen

- Statement of Account: Energy Consumptions For The Last 6 MonthsDokument1 SeiteStatement of Account: Energy Consumptions For The Last 6 MonthsSterben ShouchiNoch keine Bewertungen

- Sec-504 July 2022Dokument2 SeitenSec-504 July 2022Ramu MylaramNoch keine Bewertungen

- C1 - Rosemont MANAC SolutionDokument13 SeitenC1 - Rosemont MANAC Solutionkaushal dhapare100% (1)

- Check N GoDokument1 SeiteCheck N GoJessica LongoriaNoch keine Bewertungen

- Bergessssssrac D3D3D3Systems: The Challenge of Backward IntegrationDokument4 SeitenBergessssssrac D3D3D3Systems: The Challenge of Backward IntegrationZee ShanNoch keine Bewertungen

- December 2023Dokument6 SeitenDecember 2023donbabich8Noch keine Bewertungen

- Amount Due:: Service At: 101 Sample StreetDokument1 SeiteAmount Due:: Service At: 101 Sample StreetEarl IneNoch keine Bewertungen

- ListDokument4 SeitenListNgeleka kalalaNoch keine Bewertungen

- Costos de ProducciónDokument21 SeitenCostos de ProducciónLondres RDNoch keine Bewertungen

- Wal-Mart Stores, Inc.: Notes To Consolidated Financial Statements 7 Stock-Based Compensation PlansDokument5 SeitenWal-Mart Stores, Inc.: Notes To Consolidated Financial Statements 7 Stock-Based Compensation PlansNamitNoch keine Bewertungen

- Rental Property Income Statement and Balance SheetDokument1 SeiteRental Property Income Statement and Balance SheetCentury 21 Sweyer and Associates71% (7)

- SOBO Sept 6, 2017 AgendaDokument11 SeitenSOBO Sept 6, 2017 AgendaOaklandCBDsNoch keine Bewertungen

- Ascend Solar - 08.04.21Dokument5 SeitenAscend Solar - 08.04.21Benjamin BakerNoch keine Bewertungen

- CH SolutionsDokument6 SeitenCH SolutionsPink MagentaNoch keine Bewertungen

- AccountingAssigment1 CalculationsDokument4 SeitenAccountingAssigment1 CalculationsAmir ShahzadNoch keine Bewertungen

- Balance SheetDokument1 SeiteBalance Sheetshahinalam98marketplace23Noch keine Bewertungen

- Atlantic Bundle - Group3Dokument7 SeitenAtlantic Bundle - Group3Bikasita TalukdarNoch keine Bewertungen

- SOBO Jan 9, 2018 Agenda PacketDokument19 SeitenSOBO Jan 9, 2018 Agenda PacketOaklandCBDsNoch keine Bewertungen

- StatementDokument1 SeiteStatementWaifubot 2.1Noch keine Bewertungen

- Sample: Earnings StatementDokument1 SeiteSample: Earnings Statementashlei100% (1)

- Diokno 12.15.21Dokument1 SeiteDiokno 12.15.21MACN ASSROBNoch keine Bewertungen

- Nomination Form American Red Cross Kittitas County Chapter Real Heroes 2010Dokument1 SeiteNomination Form American Red Cross Kittitas County Chapter Real Heroes 2010Ellensburg Daily RecordNoch keine Bewertungen

- 2010 Central Washington University Football RecruitsDokument1 Seite2010 Central Washington University Football RecruitsEllensburg Daily RecordNoch keine Bewertungen

- Kittitas County Comprehensive Plan Meeting ScheduleDokument1 SeiteKittitas County Comprehensive Plan Meeting ScheduleEllensburg Daily RecordNoch keine Bewertungen

- Title: Ordinance AN City Amending Municipal A AND AND ANDDokument16 SeitenTitle: Ordinance AN City Amending Municipal A AND AND ANDEllensburg Daily RecordNoch keine Bewertungen

- Centers For Disease Control Risk Factors For Heart Disease For WomenDokument3 SeitenCenters For Disease Control Risk Factors For Heart Disease For WomenEllensburg Daily RecordNoch keine Bewertungen

- Centers For Disease Control Risk Factors For Heart Disease For MenDokument2 SeitenCenters For Disease Control Risk Factors For Heart Disease For MenEllensburg Daily Record100% (1)

- Centers For Disease Control National Vital Statistics For 2005Dokument121 SeitenCenters For Disease Control National Vital Statistics For 2005Ellensburg Daily RecordNoch keine Bewertungen

- Transmission of The Chewing Louse, From Columbian Black-Tailed Deer To Rocky Mountain Mule Deer and Its Role in Deer Hair-Loss Syndrome By: Jason A. RobisonDokument92 SeitenTransmission of The Chewing Louse, From Columbian Black-Tailed Deer To Rocky Mountain Mule Deer and Its Role in Deer Hair-Loss Syndrome By: Jason A. RobisonEllensburg Daily Record100% (2)

- Desert Claim Farm Map - Original - Map 2006Dokument1 SeiteDesert Claim Farm Map - Original - Map 2006Ellensburg Daily RecordNoch keine Bewertungen

- Washington State Department of Health 2007 Coronary Heart Disease StatsDokument6 SeitenWashington State Department of Health 2007 Coronary Heart Disease StatsEllensburg Daily RecordNoch keine Bewertungen

- Kittitas Valley Community Hospital ServicesDokument3 SeitenKittitas Valley Community Hospital ServicesEllensburg Daily RecordNoch keine Bewertungen

- Kittitas Valley Community Hospital Economic ImpactDokument1 SeiteKittitas Valley Community Hospital Economic ImpactEllensburg Daily RecordNoch keine Bewertungen

- EnXco Press ReleaseDokument2 SeitenEnXco Press ReleaseEllensburg Daily Record100% (1)

- Yakima and Kittitas County Deer Mortality - Hair Slip Fact SheetDokument1 SeiteYakima and Kittitas County Deer Mortality - Hair Slip Fact SheetEllensburg Daily RecordNoch keine Bewertungen

- Desert Claim Wind Farm Map - Re Configured - Feb 2009Dokument1 SeiteDesert Claim Wind Farm Map - Re Configured - Feb 2009Ellensburg Daily Record100% (1)

- Kittitas County Department of Public Works Fllod Damage Recovery MemoDokument6 SeitenKittitas County Department of Public Works Fllod Damage Recovery MemoEllensburg Daily Record100% (1)

- Piercy Complaint Against CommissionersDokument2 SeitenPiercy Complaint Against CommissionersEllensburg Daily Record100% (3)