Beruflich Dokumente

Kultur Dokumente

Calculation of Total Tax Incidence

Hochgeladen von

Ripul Nabi67%(3)67% fanden dieses Dokument nützlich (3 Abstimmungen)

8K Ansichten1 Seiteguide to Calculation of Total Tax Incidence

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenguide to Calculation of Total Tax Incidence

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

67%(3)67% fanden dieses Dokument nützlich (3 Abstimmungen)

8K Ansichten1 SeiteCalculation of Total Tax Incidence

Hochgeladen von

Ripul Nabiguide to Calculation of Total Tax Incidence

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

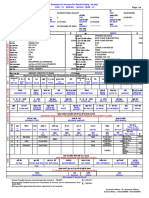

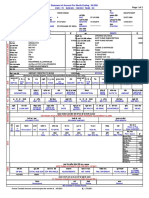

Calculation of Total Tax Incidence (TTI) for Import TTI

AV

= CD + RD + SDI + VATI + AIT + ATVI

= (Invoice value X 1.01) X 1.01 = 100 X 1.0201 = 102.01 = {(AV + CD + RD) X SD / 100} = {(AV + CD + RD + SDI) X VAT / 100} = [{(AV + CD + SDI) X 1.15} X ATV / 100]

SDI VATI ATVI

Notes and Abbreviation: AIT ATV ATVI AV CD RD SD SDI VAT VATI = Advance Income Tax = Advanced Trade Vat (rate) = ATV incidence = Assessable Value (base value to calculate all duties and taxes; conversion of CIF or CRF value into Taka) = Custom Duty (rate) = Regulatory Duty (rate) = Supplementary Duty (rate) = SD incidence = Value Added Tax (rate) = VAT incidence

Das könnte Ihnen auch gefallen

- July-Duty-Sheet-2017.. For Car Import - BangladeshDokument21 SeitenJuly-Duty-Sheet-2017.. For Car Import - Bangladeshomar_faruq_669% (13)

- Form No 16 in Excel With FormuleDokument3 SeitenForm No 16 in Excel With FormuleSayal Ji33% (6)

- Salary Slip CTC Calculator in ExcelDokument3 SeitenSalary Slip CTC Calculator in Exceljoamonsachin0% (1)

- Interview Letter From Tata Group - For Fist Batch - 011-1 PDFDokument3 SeitenInterview Letter From Tata Group - For Fist Batch - 011-1 PDFritesh shrivastav71% (7)

- Calculation of Total Tax Incidence (TTI) For ImportDokument4 SeitenCalculation of Total Tax Incidence (TTI) For ImportMd. Mehedi Hasan AnikNoch keine Bewertungen

- Fundamentals of Computation of Duties and Taxes For Imported GoodsDokument2 SeitenFundamentals of Computation of Duties and Taxes For Imported GoodsZy Depeña89% (9)

- Total Tax Incidence CalculationDokument1 SeiteTotal Tax Incidence CalculationMohtasim BillahNoch keine Bewertungen

- Computation Formulae For Imported GoodsDokument1 SeiteComputation Formulae For Imported GoodsMohamed AfkarNoch keine Bewertungen

- Custom Duty CalculetorDokument2 SeitenCustom Duty CalculetorVelayudham ThiyagarajanNoch keine Bewertungen

- Leverage: Capital StructureDokument20 SeitenLeverage: Capital StructureShohojShorolNoch keine Bewertungen

- Calculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageDokument3 SeitenCalculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageAccounts Pivot Engg50% (2)

- Formula SheetDokument1 SeiteFormula SheetZhi Cheng OngNoch keine Bewertungen

- ITC Related AspectsDokument21 SeitenITC Related AspectsRahul AkellaNoch keine Bewertungen

- BOC Tax ComputationDokument2 SeitenBOC Tax ComputationRom100% (1)

- Project's EconomicsDokument1 SeiteProject's EconomicsThe PieonicBritzNoch keine Bewertungen

- PPI-851712f Patient Advance Receipt PDFDokument1 SeitePPI-851712f Patient Advance Receipt PDFKian GonzagaNoch keine Bewertungen

- Capital Structures FormulaDokument2 SeitenCapital Structures FormulaSubrata HalderNoch keine Bewertungen

- Deferred Tax IAS 12Dokument5 SeitenDeferred Tax IAS 12prahladnair6Noch keine Bewertungen

- VAT Training Day 3Dokument31 SeitenVAT Training Day 3iftekharul alamNoch keine Bewertungen

- Costs: FinancingDokument6 SeitenCosts: FinancingIfraNoch keine Bewertungen

- Lecture Notes - Income Tax (PAS 12)Dokument25 SeitenLecture Notes - Income Tax (PAS 12)Alliah ArrozaNoch keine Bewertungen

- Customs Duty: 1) Trisha Company Imported A Machine From Europe. From The FollowingDokument32 SeitenCustoms Duty: 1) Trisha Company Imported A Machine From Europe. From The FollowingAneesh D'souzaNoch keine Bewertungen

- Return of Total Income/Statement of Final TaxationDokument1 SeiteReturn of Total Income/Statement of Final TaxationJazzy BadshahNoch keine Bewertungen

- Corporate FinanceDokument10 SeitenCorporate Financeandrea figueroaNoch keine Bewertungen

- Bcom CC 512 Semester V GST & Custom LawDokument6 SeitenBcom CC 512 Semester V GST & Custom LawSwetaNoch keine Bewertungen

- General JournalDokument3 SeitenGeneral JournalLyra Ivy ManaligodNoch keine Bewertungen

- Problem Fs - SolutionDokument5 SeitenProblem Fs - SolutionÁnh NguyễnNoch keine Bewertungen

- Practise 3Dokument3 SeitenPractise 3academic purpose Its forNoch keine Bewertungen

- AFM. Resources. Useful FormulasDokument4 SeitenAFM. Resources. Useful FormulasAnonymous MeNoch keine Bewertungen

- m3 Answer KeyDokument8 Seitenm3 Answer KeyLara Camille CelestialNoch keine Bewertungen

- Macroeconomics-1 by Prof. N.C.nayakDokument7 SeitenMacroeconomics-1 by Prof. N.C.nayakSomasish GhoshNoch keine Bewertungen

- ExercisesDokument4 SeitenExercisesLuân Nguyễn Đình ThànhNoch keine Bewertungen

- Sales Tax Return 16353854Dokument1 SeiteSales Tax Return 163538547799349Noch keine Bewertungen

- Ias. 11Dokument15 SeitenIas. 11Danyal ChaudharyNoch keine Bewertungen

- TAxa SolutionsDokument66 SeitenTAxa Solutionsprowess222Noch keine Bewertungen

- Ias. 11Dokument15 SeitenIas. 11Danyal ChaudharyNoch keine Bewertungen

- Calculation of Custom ValueDokument22 SeitenCalculation of Custom ValueTanzila SiddiquiNoch keine Bewertungen

- Jawaban Quiz3Dokument7 SeitenJawaban Quiz3cecep kNoch keine Bewertungen

- Import ClearanceDokument26 SeitenImport ClearanceSamNoch keine Bewertungen

- Washington CAD 2015Dokument16 SeitenWashington CAD 2015cutmytaxesNoch keine Bewertungen

- 06 Taxation - Deferred s20 Final-1Dokument44 Seiten06 Taxation - Deferred s20 Final-150902849Noch keine Bewertungen

- Math For Financial InstitutionsDokument14 SeitenMath For Financial InstitutionsMd Alim100% (3)

- Eva ProblemsDokument10 SeitenEva Problemsazam4989% (9)

- Thue CLC 1920 HK1 ML156 - Tax CalculationDokument3 SeitenThue CLC 1920 HK1 ML156 - Tax CalculationTrúc NguyễnNoch keine Bewertungen

- LU1 - Practical Questions - VAT SolutionsDokument10 SeitenLU1 - Practical Questions - VAT SolutionsVincent Mutumwa8oo9wooNoch keine Bewertungen

- Managerial FinanceDokument32 SeitenManagerial FinanceTahsin MusaNoch keine Bewertungen

- LeverageDokument22 SeitenLeverageShubham AryaNoch keine Bewertungen

- Formula SheetDokument9 SeitenFormula Sheetrocky2219Noch keine Bewertungen

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts Practice NotesDokument3 SeitenACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts Practice NotesMuhammad AzamNoch keine Bewertungen

- 19.2 818,142,400 VND 268,372,720 VND: Taxable Value of Excise DutyDokument2 Seiten19.2 818,142,400 VND 268,372,720 VND: Taxable Value of Excise Dutyacademic purpose Its forNoch keine Bewertungen

- Document PDFDokument2 SeitenDocument PDFSamson SeidNoch keine Bewertungen

- Income Tax Proj Nov09Dokument530 SeitenIncome Tax Proj Nov09nilesh_jain27Noch keine Bewertungen

- IT Return IT1 WithAnnexure 23454434Dokument3 SeitenIT Return IT1 WithAnnexure 23454434khurramacaaNoch keine Bewertungen

- Im Anti ExDokument3 SeitenIm Anti Exacademic purpose Its forNoch keine Bewertungen

- Document PDFDokument2 SeitenDocument PDFSamson SeidNoch keine Bewertungen

- Problem Set 5 Solution-2 CopieDokument5 SeitenProblem Set 5 Solution-2 CopieCarol VarelaNoch keine Bewertungen

- 145.ASX IAW Feb 28 2012 19.21 Half Yearly Report & AccountsDokument29 Seiten145.ASX IAW Feb 28 2012 19.21 Half Yearly Report & AccountsASX:ILH (ILH Group)Noch keine Bewertungen

- Calculation of Customs DutyDokument3 SeitenCalculation of Customs DutyRavi KasaudhanNoch keine Bewertungen

- Problem FS - SOLUTIONDokument6 SeitenProblem FS - SOLUTIONhuyenvtk.tfacNoch keine Bewertungen

- Resumo Fiscal OKDokument1 SeiteResumo Fiscal OKbergsonbarnardNoch keine Bewertungen

- Rent 1150 Council Tax 110 Utility 150 Trimmer Sky 31 Ticket Food 153 Mobile Total 1594 Oyster My Part 797 DrivingDokument2 SeitenRent 1150 Council Tax 110 Utility 150 Trimmer Sky 31 Ticket Food 153 Mobile Total 1594 Oyster My Part 797 DrivingRipul NabiNoch keine Bewertungen

- FlashCards Barron 3200Dokument400 SeitenFlashCards Barron 3200annukiitNoch keine Bewertungen

- RTI Act in Bangladesh: Challanges of ImplementationDokument72 SeitenRTI Act in Bangladesh: Challanges of ImplementationRipul NabiNoch keine Bewertungen

- Gyn ' Rvdi Bkevj Iwpz Eb Qi ZVWJKV 2013 (156wu) : MV Qý WDKKBDokument2 SeitenGyn ' Rvdi Bkevj Iwpz Eb Qi ZVWJKV 2013 (156wu) : MV Qý WDKKBRipul NabiNoch keine Bewertungen

- Factors Influencing Employee Motivation:: A Perception Based Investigation Among The Private Health Service ProvidersDokument8 SeitenFactors Influencing Employee Motivation:: A Perception Based Investigation Among The Private Health Service ProvidersRipul NabiNoch keine Bewertungen

- Groups Assignment EcoDokument4 SeitenGroups Assignment Ecorobel pop100% (1)

- Prelim Lecture 1 Assignment: Multiple ChoiceDokument4 SeitenPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNoch keine Bewertungen

- TAX - Quiz 1Dokument6 SeitenTAX - Quiz 1KriztleKateMontealtoGelogo100% (1)

- IT Card SaneepDokument4 SeitenIT Card Saneephajabarala2008Noch keine Bewertungen

- HSRPM9590K Q3 2023-24Dokument3 SeitenHSRPM9590K Q3 2023-24jishna mathewNoch keine Bewertungen

- 2020 Bonitas 18062020143403 Tax CertificateDokument2 Seiten2020 Bonitas 18062020143403 Tax CertificateCharles MutetwaNoch keine Bewertungen

- Section 3: The Tax System and The Philippines Development ExperienceDokument13 SeitenSection 3: The Tax System and The Philippines Development ExperiencePearl ArcamoNoch keine Bewertungen

- Cir v. St. Lukes and Dlsu v. CirDokument4 SeitenCir v. St. Lukes and Dlsu v. CirRem SerranoNoch keine Bewertungen

- PWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 NotifiedDokument9 SeitenPWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 Notifiedsujit guptaNoch keine Bewertungen

- Application One-Time Taxpayer Philippine BIR Form No. 1904Dokument1 SeiteApplication One-Time Taxpayer Philippine BIR Form No. 1904Edd N Ros Adlawan100% (2)

- RMC No. 8-2024 - Annex ADokument1 SeiteRMC No. 8-2024 - Annex AAnostasia NemusNoch keine Bewertungen

- Rental Property Statement Tax Year: Physical Address (Street, Suburb) : Property TypeDokument14 SeitenRental Property Statement Tax Year: Physical Address (Street, Suburb) : Property TypeSenapati Prabhupada DasNoch keine Bewertungen

- Course: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 HourDokument5 SeitenCourse: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 Houranis izzatiNoch keine Bewertungen

- MBA FIN QuizDokument1 SeiteMBA FIN QuizPercy JacksonNoch keine Bewertungen

- Presentation On Income TaxDokument9 SeitenPresentation On Income TaxUnnati GuptaNoch keine Bewertungen

- FabHotels Invoice WVHGJCDokument1 SeiteFabHotels Invoice WVHGJCSimran MehrotraNoch keine Bewertungen

- Coral ServiceDokument25 SeitenCoral ServiceNicolas ErnestoNoch keine Bewertungen

- Final Account: With AdjustmentDokument49 SeitenFinal Account: With AdjustmentPandit Niraj Dilip Sharma100% (1)

- Orange - Equity Research ReportDokument6 SeitenOrange - Equity Research Reportosama aboualamNoch keine Bewertungen

- BCOM-502 CourseHandout IncomeTaxDokument11 SeitenBCOM-502 CourseHandout IncomeTaxLoket SinghNoch keine Bewertungen

- Adjustments To Final Account Format1Dokument2 SeitenAdjustments To Final Account Format1KANGOMA FODIE MansarayNoch keine Bewertungen

- Bsbfim601 Manage Finances Prepare BudgetsDokument9 SeitenBsbfim601 Manage Finances Prepare BudgetsAli Butt100% (4)

- Central Investigation & Security Services LTD Security Guard Board Rates For Mumbai & Thane DistDokument2 SeitenCentral Investigation & Security Services LTD Security Guard Board Rates For Mumbai & Thane DistPradeep PanigrahiNoch keine Bewertungen

- MPS 30122021 174453Dokument2 SeitenMPS 30122021 174453dawaresuraj9Noch keine Bewertungen

- Theory Questions For PracticeDokument2 SeitenTheory Questions For Practice04 Sourabh BaraleNoch keine Bewertungen

- BIR Ruling DA-C-133 431-08Dokument5 SeitenBIR Ruling DA-C-133 431-08Lee Anne YabutNoch keine Bewertungen

- Adjusting EntriesDokument38 SeitenAdjusting EntriesKae Abegail GarciaNoch keine Bewertungen

- Purchase Order Goods Vat or Non Vat With 2306 and 2307Dokument17 SeitenPurchase Order Goods Vat or Non Vat With 2306 and 2307marivic dyNoch keine Bewertungen

- Date of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDokument2 SeitenDate of Issue 07/03/2022: Address of Property To Which Tax Relates 16 Southey Road RugbyDaniel HollandsNoch keine Bewertungen

- Statement of Account For Month Ending: 05/2021 PAO: 72 SUS NO.: 1951051 TASK: 33Dokument2 SeitenStatement of Account For Month Ending: 05/2021 PAO: 72 SUS NO.: 1951051 TASK: 33Ranjeet RajputNoch keine Bewertungen