Beruflich Dokumente

Kultur Dokumente

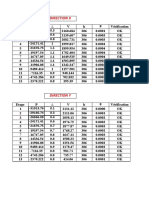

Ishares US ETFs - Dividends and Implied Volatility Surfaces Parameters

Hochgeladen von

Q.M.S Advisors LLCOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ishares US ETFs - Dividends and Implied Volatility Surfaces Parameters

Hochgeladen von

Q.M.S Advisors LLCCopyright:

Verfügbare Formate

26.03.

2013

At The Money Implied Volatilities by

Terms

ATM Ref

Dividend

Yield

ATM

Vol - 6M

ATM

Vol 12M

OEF US Equity

ISHARES S&P 100 INDEX FUND

ETP

US4642871010

70.26

2.49%

26.06.2013

11.82

12.46

13.09

13.83

15.15

-0.247 -0.316 -0.383 -0.315 -0.197 -0.176 -0.157 0.002

0.006

0.009

0.005

IVV US Equity

ISHARES CORE S&P 500 ETF

ETP

US4642872000

156.56

2.26%

26.06.2013

12.51

12.94

13.43

14.15

-0.346 -0.249 -0.297 -0.197

0.004

0.003

0.006

0.004

IVW US Equity

ISHARES S&P 500 GROWTH INDEX

ETP

US4642873099

81.93

1.96%

26.06.2013

11.90

12.23

12.71

13.67

-0.259 -0.308 -0.317 -0.301

0.003

0.005

0.007

0.006

IVE US Equity

ISHARES S&P 500 VALUE INDEX

ETP

US4642874089

73.44

2.60%

26.06.2013

13.02

13.56

13.81

14.56

-0.282 -0.322 -0.363 -0.290

0.004

0.006

0.010

0.005

IJH US Equity

ISHARES CORE S&P MIDCAP ETF

ETP

US4642875078

113.71

1.46%

26.06.2013

13.79

14.51

15.10

16.08

-0.398 -0.355 -0.313 -0.216

0.008

0.009

0.008

0.004

IJK US Equity

ISHARES S&P MIDCAP 400/GRWTH

ETP

US4642876068

126.48

1.02%

26.06.2013

13.71

14.41

15.13

16.01

-0.336 -0.304 -0.319 -0.262

0.006

0.004

0.006

0.005

IJJ US Equity

ISHARES S&P MIDCAP 400/VALUE

ETP

US4642877058

99.81

1.89%

26.06.2013

13.57

14.45

15.29

-0.216 -0.196 -0.158

0.002

0.001

0.000

IJR US Equity

ISHARES CORE S&P SMALL-CAP E

ETP

US4642878049

86.80

1.23%

26.06.2013

14.77

15.45

16.09

17.22

-0.362 -0.357 -0.325 -0.248

0.006

0.007

0.008

0.004

IJT US Equity

ISHARES S&P SMALLCAP 600/GRO

ETP

US4642878874

93.34

0.89%

26.06.2013

13.23

13.97

14.41

15.17

-0.172 -0.109 -0.225 -0.147

0.002

0.001

0.006

0.003

IJS US Equity

ISHARES S&P SMALLCAP 600/VAL

ETP

US4642878791

89.81

1.56%

26.06.2013

15.04

16.04

16.76

17.93

-0.419 -0.429 -0.402 -0.284

0.008

0.010

0.008

0.003

ICF US Equity

ISHARES COHEN & STEERS RLTY

ETP

US4642875649

82.03

3.43%

27.06.2013

10.85

11.55

12.14

13.16

-0.188 -0.309 -0.350 -0.219

0.002

0.006

0.010

0.007

IYM US Equity

ISHARES DJ US BASIC MATERIAL

ETP

US4642878387

69.76

2.55%

26.06.2013

17.21

17.92

18.58

19.64

-0.268 -0.295 -0.257 -0.247

0.004

0.005

0.005

0.005

IYC US Equity

ISHARES DJ US CNSMER SERVICE

ETP

US4642875805

96.78

1.51%

26.06.2013

IYK US Equity

ISHARES DJ US CONSMR GOODS

ETP

US4642878122

84.34

2.55%

26.06.2013

IYE US Equity

ISHARES DJ US ENERGY SECTOR

ETP

US4642877967

44.93

2.18%

26.06.2013

15.79

16.16

16.42

17.38

-0.207 -0.261 -0.285 -0.240

0.002

0.005

0.008

0.005

IYF US Equity

ISHARES DJ US FINANCIAL SECT

ETP

US4642877884

67.70

2.08%

26.06.2013

14.55

15.22

15.81

16.96

-0.206 -0.231 -0.256 -0.204

0.003

0.004

0.006

0.004

IYG US Equity

ISHARES DJ US FINANCIAL SVCS

ETP

US4642877702

66.15

1.81%

26.06.2013

16.90

16.61

16.88

17.80

-0.203 -0.303 -0.281 -0.242

0.004

0.006

0.006

0.004

IYH US Equity

ISHARES DJ US HEALTHCARE SEC

ETP

US4642877629

94.66

1.92%

26.06.2013

10.90

11.40

11.65

12.28

-0.168 -0.116 -0.223 -0.130

0.002

0.001

0.005

0.002

IYJ US Equity

ISHARES DJ US INDUSTRIAL SEC

ETP

US4642877546

80.97

2.10%

26.06.2013

14.21

14.93

15.36

16.28

-0.289 -0.277 -0.305 -0.210

0.004

0.004

0.007

0.004

IYR US Equity

ISHARES DJ US REAL ESTATE

ETP

US4642877397

69.07

3.89%

26.06.2013

10.08

10.87

11.50

12.78

-0.526 -0.465 -0.416 -0.304 -0.221 -0.191

0.015

0.013

0.011

0.007

IYW US Equity

ISHARES DJ US TECHNOLOGY SEC

ETP

US4642877215

73.33

1.76%

26.06.2013

13.92

14.77

15.27

16.32

-0.115 -0.146 -0.270 -0.274

0.000

0.003

0.008

0.005

IYZ US Equity

ISHARES DJ US TELECOMMUNICAT

ETP

US4642877132

24.21

3.03%

26.06.2013

14.20

14.25

14.81

15.23

-0.030 -0.128 -0.199 -0.261

0.000

0.002

0.004

0.007

IYT US Equity

ISHARES DJ US TRANSPORT AVG

ETP

US4642871929

109.54

1.50%

26.06.2013

16.18

16.65

16.97

17.68

-0.386 -0.370 -0.350 -0.263 -0.223 -0.203

0.007

0.008

0.007

0.007

IDU US Equity

ISHARES DJ US UTILITIES SECT

ETP

US4642876977

95.50

3.84%

26.06.2013

9.94

10.05

10.22

10.53

-0.155 -0.212 -0.333 -0.259

0.001

0.003

0.008

0.007

IYY US Equity

ISHARES DJ US INDEX FUND

ETP

US4642878460

78.55

2.14%

26.06.2013

IGE US Equity

ISHARES S&P NA NAT RES S I F

ETP

US4642873743

40.25

2.12%

26.06.2013

14.54

15.36

15.86

17.67

-0.108 -0.183 -0.185 -0.174

0.002

0.004

0.003

0.002

IGN US Equity

ISHARES S&P NA TEC-MUL N IF

ETP

US4642875318

29.25

0.87%

26.06.2013

soxx us EQUITY

ISHARES PHLX SOX SEMICONDUCT

ETP

US4642875235

58.53

2.07%

26.06.2013

19.09

19.84

19.89

20.44

-0.117 -0.207 -0.252 -0.225

0.002

0.005

0.006

0.004

IGV US Equity

ISHARES S&P NA TECH-SOFT IF

ETP

US4642875151

68.18

0.59%

26.06.2013

12.76

13.39

14.09

15.20

-0.137 -0.176 -0.182 -0.120

0.002

0.004

0.004

0.001

IGM US Equity

ISHARES S&P NA TEC SEC IND F

ETP

US4642875490

72.18

1.47%

26.06.2013

IBB US Equity

ISHARES NASDAQ BIOTECH INDX

ETP

US4642875565

155.11

15.79

16.35

16.57

17.30

-0.319 -0.235 -0.368 -0.272 -0.243 -0.205

0.005

0.003

0.007

0.004

ITA US Equity

ISHARES DJ US AEROSPACE & DF

ETP

US4642887602

74.31

1.81%

26.06.2013

IAI US Equity

ISHARES DJ US BROKER DEALERS

ETP

US4642887941

27.74

1.81%

26.06.2013

18.03

18.10

17.83

18.49

-0.069 -0.179 -0.229 -0.135

0.001

0.002

0.003

0.003

IHF US Equity

ISHARES DJ US HEALTH CAR PRO

ETP

US4642888287

75.73

0.70%

26.06.2013

13.39

13.88

14.33

15.13

-0.384 -0.465 -0.393 -0.254

0.007

0.011

0.011

0.005

ITB US Equity

ISHARES DJ US HOME CONSTRUCT

ETP

US4642887529

24.06

0.50%

26.06.2013

26.82

27.06

27.15

28.12

-0.419 -0.448 -0.371 -0.280 -0.190 -0.159

0.008

0.009

0.006

0.003

IAK US Equity

ISHARES DJ US INSURANCE IND

ETP

US4642887867

37.71

1.86%

26.06.2013

IHI US Equity

ISHARES DJ US MEDICAL DEVICE

ETP

US4642888105

75.33

0.87%

26.06.2013

IEZ US Equity

ISHARES DJ US OIL EQUIP & SV

ETP

US4642888444

56.76

1.17%

26.06.2013

21.98

22.21

22.51

23.52

-0.283 -0.308 -0.293 -0.217

0.005

0.006

0.005

0.004

IEO US Equity

ISHARES DJ US OIL & GAS EXPL

ETP

US4642888519

72.73

1.14%

26.06.2013

19.53

19.92

20.36

21.86

-0.289 -0.282 -0.325 -0.273

0.004

0.006

0.007

0.003

IHE US Equity

ISHARES DJ US PHARMA INDEX F

ETP

US4642888360

94.75

1.63%

26.06.2013

IAT US Equity

ISHARES DJ US REGIONAL BANKS

ETP

US4642887784

27.05

2.51%

26.06.2013

16.08

16.52

16.62

17.36

-0.022 -0.084 -0.116 -0.114

0.000

0.001

0.001

0.002

REM US Equity

ISHARES FTSE NAREIT MORTGAGE

ETP

US4642885390

15.43

11.15%

26.06.2013

13.48

12.99

12.00

12.14

0.000 -0.096 -0.273 -0.315

0.000

0.003

0.009

0.012

FTY US Equity

ISHARES FTSE NAREIT REAL EST

ETP

US4642885218

42.06

3.97%

26.06.2013

REZ US Equity

ISHARES FTSE NAREIT RESIDENT

ETP

US4642885622

51.28

3.75%

26.06.2013

RTL US Equity

ISHARES FTSE NAREIT RETAIL

ETP

US4642885473

37.56

3.47%

26.06.2013

IWV US Equity

ISHARES RUSSELL 3000 INDEX

ETP

US4642876894

92.78

2.11%

02.07.2013

12.53

13.09

13.63

14.52

-0.278 -0.323 -0.331 -0.251

0.004

0.006

0.007

0.004

IWZ US Equity

ISHARES RUSSELL 3000 GROWTH

ETP

US4642876712

57.97

1.75%

02.07.2013

IWW US Equity

ISHARES RUSSELL 3000 VALUE

ETP

US4642876639

105.60

2.45%

02.07.2013

IWB US Equity

ISHARES RUSSELL 1000 INDEX

ETP

US4642876225

86.70

2.18%

02.07.2013

12.34

13.25

13.58

13.79

-0.203 -0.307 -0.313 -0.222

0.002

0.005

0.007

0.006

IWF US Equity

ISHARES RUSSELL 1000 GROWTH

ETP

US4642876142

70.90

1.84%

02.07.2013

11.89

12.58

13.11

14.08

-0.229 -0.314 -0.358 -0.293

0.003

0.006

0.007

0.005

IWD US Equity

ISHARES RUSSELL 1000 VALUE

ETP

US4642875987

80.75

2.48%

02.07.2013

12.44

13.09

13.62

14.57

-0.290 -0.321 -0.337 -0.282

0.004

0.006

0.007

0.004

IWR US Equity

ISHARES RUSSELL MIDCAP INDEX

ETP

US4642874998

126.05

1.65%

02.07.2013

13.00

13.69

14.32

15.26

-0.350 -0.351 -0.318 -0.208

0.006

0.007

0.007

0.003

IWP US Equity

ISHARES RUSSELL MIDCAP GRWTH

ETP

US4642874816

69.07

1.11%

02.07.2013

13.26

14.12

14.79

15.87

-0.268 -0.240 -0.329 -0.260

0.003

0.003

0.006

0.004

IWS US Equity

ISHARES RUSSELL MIDCAP VALUE

ETP

US4642874733

56.63

2.08%

02.07.2013

13.14

13.98

14.68

15.58

-0.294 -0.325 -0.346 -0.221

0.004

0.006

0.007

0.005

IWM US Equity

ISHARES RUSSELL 2000

ETP

US4642876555

93.96

1.38%

02.07.2013

15.50

16.39

17.05

17.92

-0.555 -0.409 -0.372 -0.299 -0.223 -0.173

0.016

0.009

0.006

0.003

IWO US Equity

ISHARES RUSSELL 2000 GROWTH

ETP

US4642876480

106.94

0.72%

02.07.2013

15.11

16.17

16.85

18.02

-0.438 -0.419 -0.384 -0.260

0.008

0.008

0.007

0.003

IWN US Equity

ISHARES RUSSELL 2000 VALUE

ETP

US4642876308

83.71

2.04%

02.07.2013

14.61

15.64

16.26

17.26

-0.321 -0.327 -0.355 -0.299

0.006

0.008

0.008

0.004

IWC US Equity

ISHARES RUSSELL MICROCAP INX

ETP

US4642888691

58.61

1.35%

02.07.2013

15.05

15.77

16.38

16.94

-0.252 -0.214 -0.323 -0.149

0.003

0.004

0.009

0.003

IWL US Equity

ISHARES RUSSELL TOP 200 INDE

ETP

US4642894467

35.38

2.40%

02.07.2013

IWX US Equity

ISHARES RUSSELL TOP 200 VALU

ETP

US4642894202

34.35

2.66%

02.07.2013

IWY US Equity

ISHARES RUSSELL TOP 200 GROW

ETP

US4642894384

37.33

2.12%

02.07.2013

FCHI US Equity

ISHARES FTSE CHINA INDEX FD

ETP

US4642881902

46.72

FXI US Equity

ISHARES FTSE CHINA 25 INDEX

ETP

US4642871846

37.30

3.49%

25.06.2013

21.13

21.33

21.26

21.15

22.18

22.37

-0.393 -0.324 -0.261 -0.174 -0.152 -0.133

0.015

0.010

0.007

EWA US Equity

ISHARES MSCI AUSTRALIA INDEX

ETP

US4642861037

26.99

4.33%

27.06.2013

16.66

16.54

16.77

17.02

16.67

15.72

-0.255 -0.227 -0.229 -0.277 -0.181 -0.144

0.005

0.005

0.004

EWO US Equity

ISHARES MSCI AUSTRIA CAPPED

ETP

US4642862027

17.29

2.81%

27.06.2013

EWK US Equity

ISHARES MSCI BELGIUM CAPPED

ETP

US4642863017

14.17

4.11%

27.06.2013

EWZ US Equity

ISHARES MSCI BRAZIL CAPPED I

ETP

US4642864007

53.98

3.03%

27.06.2013

19.42

19.18

19.18

20.18

21.55

22.43

-0.277 -0.298 -0.320 -0.251 -0.217 -0.176

0.011

0.008

EWZS US Equity

ISHARES MSCI BRAZIL SMALL CA

ETP

US4642891315

27.22

1.40%

27.06.2013

EWC US Equity

ISHARES MSCI CANADA

ETP

US4642865095

28.28

3.06%

27.06.2013

12.43

13.13

13.59

14.25

-0.005 -0.214 -0.410 -0.280

-0.002 0.005

ECH US Equity

ISHARES MSCI CHILE CAPPED IN

ETP

US4642866408

64.78

1.92%

27.06.2013

13.08

12.95

13.23

14.04

-0.066 -0.132 -0.105 -0.088

0.001

MCHI US Equity

ISHARES MSCI CHINA INDEX FD

ETP

US46429B6719

45.70

3.12%

27.06.2013

19.19

19.12

18.85

19.08

-0.199 -0.203 -0.128 -0.048

0.003

ECNS US Equity

ISHARES MSCI CHINA SMALL CAP

ETP

US46429B2007

42.52

2.21%

27.06.2013

EWQ US Equity

ISHARES MSCI FRANCE INDEX FD

ETP

US4642867075

23.41

3.54%

27.06.2013

25.35

24.66

24.02

22.84

EWG US Equity

ISHARES MSCI GERMANY INDEX

ETP

US4642868065

24.74

3.36%

27.06.2013

21.90

21.71

21.08

21.83

23.39

23.83

-0.261 -0.226 -0.266 -0.248 -0.220 -0.185

EWH US Equity

ISHARES MSCI HONG KONG INDEX

ETP

US4642868719

19.70

2.68%

27.06.2013

15.97

15.05

14.59

15.55

17.12

18.57

-0.063 -0.244 -0.347 -0.184 -0.158 -0.137

EIDO US Equity

ISHARES MSCI INDONESIA INVES

ETP

US46429B3096

34.09

1.98%

27.06.2013

EIRL US Equity

ISHARES MSCI IRELAND CAPPED

ETP

US46429B5075

28.25

EIS US Equity

ISHARES MSCI ISRAEL CPD INVS

ETP

US4642866325

45.41

2.76%

27.06.2013

EWI US Equity

ISHARES MSCI ITALY CAPPED IN

ETP

US4642868552

11.97

3.64%

27.06.2013

32.00

31.01

28.96

29.76

-0.251 -0.350 -0.305 -0.248

0.005

EWJ US Equity

ISHARES MSCI JAPAN INDEX FD

ETP

US4642868487

10.74

1.87%

27.06.2013

15.96

16.05

15.45

16.21

17.29

18.43

-0.054 -0.152 -0.284 -0.125 -0.063 -0.048

0.000

SCJ US Equity

ISHARES MSCI JAPAN SM CAP

ETP

US4642865822

50.62

1.87%

27.06.2013

EWM US Equity

ISHARES MSCI MALAYSIA

ETP

US4642868305

14.77

3.24%

27.06.2013

12.70

13.19

14.19

14.74

-0.064 -0.109 -0.190 -0.182

EWW US Equity

ISHARES MSCI MEXICO CAPPED I

ETP

US4642868222

73.08

1.29%

27.06.2013

16.45

16.61

17.04

17.95

EWN US Equity

ISHARES MSCI NETHERLANDS INV

ETP

US4642868149

20.59

2.70%

27.06.2013

ENZL US Equity

ISHARES MSCI NEW ZEALAND CAP

ETP

US4642891232

36.50

4.86%

27.06.2013

EPU US Equity

ISHARES MSCI PERU CAPPED

ETP

US4642898427

43.77

13.72

14.10

14.52

15.10

EPHE US Equity

ISHARES MSCI PHILIPPINES

ETP

US46429B4086

39.70

1.67%

27.06.2013

EPOL US Equity

ISHARES MSCI POLAND CAPPED I

ETP

US46429B6065

25.32

4.15%

27.06.2013

ERUS US Equity

ISHARES MSCI RUSSIA

ETP

US46429B7055

21.71

1.00%

27.06.2013

EWS US Equity

ISHARES MSCI SINGAPORE

ETP

US4642866739

13.83

3.25%

27.06.2013

13.33

14.66

14.35

14.27

EZA US Equity

ISHARES MSCI SOUTH AFRICA

ETP

US4642867802

64.22

3.28%

27.06.2013

18.99

20.26

20.78

22.27

EWY US Equity

ISHARES MSCI SOUTH KOREA CAP

ETP

US4642867729

59.28

1.11%

27.06.2013

20.20

20.02

19.80

21.03

EWP US Equity

ISHARES MSCI SPAIN CAPPED IN

ETP

US4642867646

28.62

5.30%

27.06.2013

31.52

29.77

29.55

EWD US Equity

ISHARES MSCI SWEDEN INDEX FD

ETP

US4642867562

32.40

3.65%

27.06.2013

18.92

19.45

EWL US Equity

ISHARES MSCI SWITZERLAND CAP

ETP

US4642867497

29.26

2.91%

27.06.2013

14.97

EWT US Equity

ISHARES MSCI TAIWAN INDEX FD

ETP

US4642867315

13.28

3.25%

27.06.2013

15.65

THD US Equity

ISHARES MSCI THAILAND CAPPED

ETP

US4642866242

91.10

2.73%

27.06.2013

TUR US Equity

ISHARES MSCI TURKEY INVSTBLE

ETP

US4642867158

69.60

2.36%

27.06.2013

EWU US Equity

ISHARES MSCI UNITED KINGDOM

ETP

US4642866994

18.16

3.79%

27.06.2013

INDY US Equity

ISHARES S&P INDIA NIFTY 50 I

ETP

US4642895290

23.79

1.47%

25.06.2013

ITF US Equity

ISHARES S&P/TOPIX 150 INDEX

ETP

US4642873826

46.71

1.90%

25.06.2013

IFSM US Equity

ISHARES FTSE DEVELOPED SMALL

ETP

US4642884971

38.65

IFGL US Equity

ISHARES FTSE NAREIT DEV EX U

ETP

US4642884898

33.96

3.31%

IFNA US Equity

ISHARES FTSE NAREIT NA

ETP

US4642884559

50.55

IFEU US Equity

ISHARES FTSE NAREIT DEV EURO

ETP

US4642884716

29.68

IFAS US Equity

ISHARES FTSE NAREIT DEV ASIA

ETP

US4642884633

35.43

AAXJ US Equity

ISHARES MSCI ASIA EX-JAPAN

ETP

US4642881829

58.85

ACWI US Equity

ISHARES MSCI ACWI INDEX FUND

ETP

US4642882579

50.57

BKF US Equity

ISHARES MSCI BRIC INDEX FUND

ETP

US4642866572

38.74

EFA US Equity

ISHARES MSCI EAFE INDEX FUND

ETP

US4642874659

EFG US Equity

ISHARES MSCI EAFE GROWTH INX

ETP

EFV US Equity

ISHARES MSCI EAFE VALUE INX

ETP

SCZ US Equity

ISHARES MSCI EAFE SMALL CAP

EEM US Equity

ISHARES MSCI EMERGING MKT IN

EZU US Equity

ISHARES MSCI EMU

TOK US Equity

iShares - United States Exchange Traded Products

Ticker

Name

Security

Type

ISIN

ATM

Vol 30D

ATM

Vol 60D

ATM

Vol 90D

Option Implied Volatility Skew Parameters by Terms:

IVt = atx + btx2 + ct

Next ExDividend

Date

ATM

Vol 18M

ATM

Vol 24M

Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew

(a) (a) (a) (a) (a) (a) (a) (b) (b) (b) (b) (b) (b) (b) 30D

60D

90D

6M

12M

18M

24M

30D

60D

90D

6M

12M

18M

24M

15.76

16.35

0.004

0.004

0.004

0.002

0.001

0.001

0.002

0.001

0.002

0.001

0.002

0.000

0.003

0.002

0.002

0.006

0.003

0.006

0.010

0.004

0.002

0.001

0.011

0.007

0.001

0.001

0.002

0.004

0.001 -0.001

0.002

0.007

0.011

0.006

0.001

0.002

0.005

0.004

0.001

0.001

-0.001 0.006

0.012

0.005

0.004

0.002

0.011

0.012

0.004

0.003

0.008

0.006

0.003

0.002

0.000

0.002

0.003

0.003

-0.533 -0.408 -0.341 -0.289 -0.238 -0.200

0.018

0.011

0.008

0.004

0.001

0.001

-0.038 -0.068 -0.080 -0.091

0.001

0.001

0.001

0.000

-0.127 -0.278 -0.171 -0.081

0.001

0.003

0.002

0.001

-0.272 -0.293 -0.247 -0.218

0.004

0.005

0.004

0.005

-0.363 -0.228 -0.219 -0.209 -0.178 -0.152

0.018

0.006

0.005

0.003

0.001

0.001

28.89

-0.218 -0.107 -0.241 -0.166

0.005

0.000

0.003

0.000

19.82

19.89

-0.493 -0.454 -0.424 -0.285

0.012

0.011

0.009

0.005

14.15

13.32

13.77

-0.012 -0.070 -0.133 -0.137

0.000

0.000

0.002

0.003

15.83

16.57

18.05

-0.053 -0.187 -0.219 -0.203 -0.111 -0.086

0.000

0.003

0.005

0.006

0.003

0.002

16.38

16.69

16.11

16.66

0.004 -0.007 -0.041 -0.049

0.000

0.000

0.001

0.001

25.06.2013

11.71

11.92

11.97

12.37

-0.070 -0.056 -0.090 -0.180

0.000

0.001

0.001

0.004

2.49%

27.06.2013

15.19

15.07

15.42

16.32

-0.264 -0.367 -0.348 -0.176

0.003

0.008

0.009

0.002

2.65%

27.06.2013

11.81

11.90

12.20

13.37

-0.238 -0.177 -0.313 -0.303

0.003

0.002

0.008

0.006

2.98%

27.06.2013

58.91

3.25%

27.06.2013

15.07

15.17

15.22

15.81

-0.607 -0.481 -0.402 -0.288 -0.234 -0.197

0.017

0.011

0.009

0.006

0.002

0.002

US4642888857

62.99

2.44%

27.06.2013

12.53

12.72

12.77

13.40

-0.252 -0.286 -0.229 -0.120

0.003

0.004

0.003

0.002

US4642888774

49.87

4.10%

27.06.2013

25.28

30.74

24.21

23.77

0.053 -0.394 -0.766 -0.054

-0.008 0.002

0.016

0.002

ETP

US4642882736

43.87

2.63%

27.06.2013

12.09

12.20

12.21

11.89

-0.090 -0.196 -0.206 -0.134

0.001

0.003

0.003

0.002

ETP

US4642872349

42.45

2.66%

27.06.2013

15.31

16.25

16.80

17.71

-0.511 -0.474 -0.412 -0.291 -0.221 -0.193

0.023

0.015

0.010

0.004

0.002

0.002

ETP

US4642866085

32.96

3.59%

27.06.2013

19.26

19.49

19.60

20.13

-0.311 -0.347 -0.363 -0.296

0.004

0.007

0.008

0.006

ISHARES MSCI KOKUSAI

ETP

US4642882652

45.57

2.72%

27.06.2013

EPP US Equity

ISHARES MSCI PACIFIC EX JPN

ETP

US4642866655

49.57

3.84%

27.06.2013

14.92

15.26

15.28

15.86

-0.251 -0.282 -0.285 -0.240

0.004

0.005

0.006

0.004

AIA US Equity

ISHARES S&P ASIA 50 INDEX FD

ETP

US4642884302

46.43

IEV US Equity

ISHARES S&P EUROPE 350

ETP

US4642878619

39.79

3.74%

25.06.2013

17.95

17.53

17.24

16.64

-0.191 -0.207 -0.238 -0.143

0.001

0.001

0.003

0.001

ILF US Equity

ISHARES S&P LATIN AMERICA 40

ETP

US4642873909

43.23

3.07%

25.06.2013

15.79

15.66

15.71

16.57

-0.142 -0.268 -0.280 -0.256

0.002

0.006

0.010

0.004

WPS US Equity

ISHARES S&P DLVP EX-US PRPTY

ETP

US4642884229

37.81

3.27%

25.06.2013

ESR US Equity

AGG US Equity

ISHARES MSCI EASTERN EUROPE

ISHARES CORE TOTAL US BOND M

ETP

ETP

US4642865665

US4642872265

24.70

110.46

4.16%

27.06.2013

3.20

3.23

3.27

3.58

0.000 -0.002 -0.005 -0.004

0.000

0.000

0.000

0.000

13.88

19.16

18.60

28.49

19.09

14.91

19.77

19.22

28.90

20.48

-0.253 -0.387 -0.378 -0.252

19.28

23.19

19.23

18.00

19.93

20.40

24.28

19.69

18.44

20.74

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

0.003

26.03.2013

Option Implied Volatility Skew Parameters by Terms:

IVt = atx + btx2 + ct

At The Money Implied Volatilities by

Terms

iShares - United States Exchange Traded Products

Ticker

MBB US Equity

SHV US Equity

SHY US Equity

IEI US Equity

IEF US Equity

TLH US Equity

TLT US Equity

TIP US Equity

AGZ US Equity

CFT US Equity

CSJ US Equity

CIU US Equity

LQD US Equity

HYG US Equity

GBF US Equity

GVI US Equity

MUB US Equity

SUB US Equity

CMF US Equity

NYF US Equity

MUAB US Equity

MUAC US Equity

MUAD US Equity

MUAE US Equity

MUAF US Equity

EMB US Equity

CLY US Equity

STIP US Equity

GTIP US Equity

ITIP US Equity

FLOT US Equity

IOO US Equity

RXI US Equity

KXI US Equity

IXC US Equity

IXG US Equity

IXJ US Equity

EXI US Equity

IGF US Equity

MXI US Equity

IXN US Equity

IXP US Equity

JXI US Equity

EMFN US Equity

EMMT US Equity

EUFN US Equity

FEFN US Equity

AXDI US Equity

AXEN US Equity

AXFN US Equity

AXHE US Equity

AXID US Equity

AXIT US Equity

AXMT US Equity

AXSL US Equity

AXTE US Equity

AXUT US Equity

EMIF US Equity

DSI US Equity

KLD US Equity

DVY US Equity

HDV US Equity

IDV US Equity

PFF US Equity

NYC US Equity

NY US Equity

JKD US Equity

JKE US Equity

JKF US Equity

JKG US Equity

JKH US Equity

JKI US Equity

JKJ US Equity

JKK US Equity

JKL US Equity

EUSA US Equity

VEGI US Equity

FILL US Equity

RING US Equity

PICK US Equity

SLVP US Equity

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Name

ISHARES BARCLAYS MBS BOND FD

ISHARES BARCLAYS SHORT TREAS

ISHARES BARCLAYS 1-3 YEAR TR

ISHARES BARCLAYS 3-7 YEAR

ISHARES BARCLAYS 7-10 YEAR

ISHARES BARCLAYS 10-20 YEAR

ISHARES BARCLAYS 20+ YEAR TR

ISHARES BARCLAYS TIPS BOND

ISHARES BARCLAYS AGENCY BOND

ISHARES BARCLAYS CREDIT BOND

ISHARES BARCLAYS 1-3 YEAR CR

ISHARES INTERMEDIATE CREDIT

ISHARES IBOXX INV GR CORP BD

ISHARES IBOXX H/Y CORP BOND

ISHARES BARCLAYS GOVERNMENT

ISHARES INTERMEDIATE GOV/CR

ISHARES S&P NAT AMT-FREE MUN

ISHARES S&P S/T NATL AMT

ISHARES S&P CALI AMT-FREE

ISHARES S&P NY AMT-FREE MUNI

ISHARES 2013 S&P AMT-FREE MU

ISHARES 2014 S&P AMT-FREE MU

ISHARES 2015 S&P AMT-FREE MU

ISHARES 2016 S&P AMT-FREE MU

ISHARES 2017 S&P AMT-FREE MU

ISHARES JP MORGAN EM BOND FD

ISHARES 10+ YEAR CREDIT BOND

ISHARES BARCLAYS 0-5 YR TIPS

ISHARES GLOBAL INFL-LINKED

ISHARES INT INFL-LINKED BOND

ISHARES FLOATING RATE NOTE

ISHARES S&P GLOBAL 100

ISHARES S&P CONSUMER DISCRET

ISHARES S&P CONSUMER STAPLES

ISHARES S&P GLBL ENERGY SECT

ISHARES S&P GLBL FINL SECTOR

ISHARES S&P GLBL HEALTHCARE

ISHARES GLOBAL INDUSTRIALS S

ISHARES S&P GLOBAL INFRASTR

ISHARES S&P GLOBAL MATERIALS

ISHARES S&P GLBL TECH SECTOR

ISHARES S&P GLBL TELECOMM SE

ISHARES S&P GLOBAL UTILITIES

ISHARES MSCI EM FINANCIALS

ISHARES MSCI EM MATERIALS

ISHARES MSCI EUR FINANCIALS

ISHARES MSCI FAR E F S IN FD

ISHARES MSCI ACWI EX US CONS

ISHARES MSCI ACWI EX US ENER

ISHARES MSCI EX US FN IND FD

ISHARES MSCI ACWI EX US HEAL

ISHARES MSCI ACWI EX US INDU

ISHARES MSCI ACWI EX US INFO

ISHARES MSCI ACWI EX US MATE

ISHARES MSCI ACWI EX US CONS

ISHARES MSCI ACWI EX US TELE

ISHARES MSCI ACWI EX US UTIL

ISHARES S&P EM MKTS INFRASTR

ISHARES MSCI KLD 400 SOCIAL

ISHARES MSCI USA ESG SELECT

ISHARES DJ SELECT DIVIDEND

ISHARES HIGH DIVIDEND EQ FD

ISHARES DJ INTL SELECT DIV

ISHARES S&P PREF STK INDX FN

ISHARES NYSE COMPOSITE INDEX

ISHARES NYSE 100 INDEX FUND

ISHARES MORNINGSTAR LG CO IN

ISHARES MORNINGSTAR LG GR IN

ISHARES MORNINGSTAR LG VAL I

ISHARES MORNINGSTAR MID CO I

ISHARES MORNINGSTAR MID GR I

ISHARES MORNINGSTAR MID VL I

ISHARES MORNINGSTAR SM CO ID

ISHARES MORNINGSTAR SM GR ID

ISHARES MORNINGSTAR SM VAL I

ISHARES MSCI USA INDEX FUND

ISHARES MSCI GLOBAL AGRICULT

ISHARES MSCI GLOBAL ENERGY P

ISHARES MSCI GLBL GOLD MNRS

ISHARES MSCI GLBL MTLS & MNR

ISHARES MSCI GLBL SILVER MNR

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid Security

ATM

Vol 30D

ATM

Vol 60D

ATM

Vol 90D

ATM

Vol - 6M

ETP

US4642885887

107.92

3.00

ETP

US4642886794

110.24

ETP

US4642874576

84.43

1.81

ETP

US4642886612

123.30

2.68

ETP

US4642874402

106.97

5.35

ETP

US4642886539

133.01

5.94

ETP

US4642874329

117.31

11.81

ETP

US4642871762

120.84

4.29

ETP

US4642881662

113.26

ETP

US4642886208

112.21

ETP

US4642886463

105.47

4.83

ETP

US4642886380

110.95

ETP

US4642872422

119.43

5.12

ETP

US4642885135

94.34

5.91

ETP

US4642885960

114.22

ETP

US4642886125

112.11

ETP

US4642884146

109.89

5.02

ETP

US4642881589

106.42

ETP

US4642883569

114.69

ETP

US4642883239

110.89

ETP

US4642893881

50.29

ETP

US4642893626

51.39

ETP

US4642893394

53.27

ETP

US4642893139

53.51

ETP

US4642892719

55.58

ETP

US4642882819

117.62

5.42

ETP

US4642895118

60.26

ETP

US46429B7477

103.35

ETP

US46429B8129

53.97

ETP

US46429B7709

50.08

ETP

US46429B6552

50.64

ETP

US4642875722

67.80

3.29%

25.06.2013 12.44

ETP

US4642887453

67.00

ETP

US4642887370

82.00

2.77%

25.06.2013

ETP

US4642873412

39.95

3.24%

25.06.2013 14.45

ETP

US4642873339

48.43

2.98%

25.06.2013

ETP

US4642873255

72.72

2.40%

25.06.2013

ETP

US4642887297

59.27

ETP

US4642883726

36.93

4.33%

25.06.2013

ETP

US4642886950

59.30

2.72%

25.06.2013

ETP

US4642872919

69.85

1.71%

25.06.2013

ETP

US4642872752

59.85

4.40%

25.06.2013

ETP

US4642887115

42.75

10.29

ETP

US4642891729

26.86

ETP

US4642891984

19.29

2.81%

27.06.2013

ETP

US4642891802

19.49

3.99%

27.06.2013

ETP

US4642892149

28.73

2.27%

27.06.2013

ETP

US4642896363

70.42

2.24%

27.06.2013

ETP

US4642895944

52.64

4.14%

27.06.2013

ETP

US4642891646

24.44

ETP

US4642895522

72.44

2.85%

27.06.2013

ETP

US4642896108

60.11

ETP

US4642895860

57.46

1.69%

27.06.2013

ETP

US4642895787

51.66

ETP

US4642896280

77.00

2.68%

27.06.2013

ETP

US4642895605

53.24

4.41%

27.06.2013

ETP

US4642895456

41.52

ETP

US4642882165

35.30

ETP

US4642885705

57.70

2.11%

26.06.2013

ETP

US4642888022

66.03

2.11%

26.06.2013

ETP

US4642871689

62.88

3.85%

26.06.2013

9.18

ETP

US46429B6636

64.85

4.02%

26.06.2013

7.87

ETP

US4642884484

34.28

5.75%

25.06.2013 14.62

ETP

US4642886877

40.48

5.44

ETP

US4642871432

82.56

2.68%

27.06.2013

ETP

US4642871358

73.69

2.64%

27.06.2013

ETP

US4642871275

91.37

2.52%

26.06.2013

ETP

US4642871192

81.32

1.57%

26.06.2013

ETP

US4642881092

70.63

3.01%

26.06.2013

ETP

US4642882082

110.34

1.59%

26.06.2013

ETP

US4642883072

117.02

0.61%

26.06.2013

ETP

US4642884062

93.71

2.45%

26.06.2013

ETP

US4642885051

107.42

1.25%

26.06.2013

ETP

US4642886042

103.99

0.48%

26.06.2013

ETP

US4642887032

103.03

2.34%

26.06.2013

ETP

US4642866812

33.54

1.64%

27.06.2013

ETP

US4642863504

27.72

ETP

US4642863439

24.21

ETP

US4642863355

15.96

ETP

US4642863686

19.80

ETP

US4642863272

18.00

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

#N/A Invalid #N/A

Security

Invalid Security#N/A Invalid Security

#N/A Invalid Security

2.98

3.00

3.67

-0.006 -0.006 -0.007 -0.017

0.000

0.000

0.000

0.000

1.81

2.63

5.56

6.14

12.07

4.60

1.81

2.68

5.75

6.24

12.23

4.50

1.78

2.86

6.40

6.73

13.16

4.58

0.000

0.000

-0.038

-0.012

-0.029

0.018

0.000

-0.001

-0.064

-0.018

-0.043

-0.039

-0.001

-0.005

-0.071

-0.002

-0.012

-0.073

-0.023

-0.014

-0.073

-0.015

-0.050 -0.050 -0.023

-0.042

0.000

0.000

0.000

0.000

0.009

0.000

0.000

0.000

0.001

0.000

0.010

0.001

0.000

0.000

0.001

0.000

0.011

0.001

0.000

0.000

0.002

0.000

0.003

0.001

4.85

4.87

4.92

0.004

0.004

0.004

0.004

0.000

0.000

0.000

0.000

4.88

5.65

4.69

6.30

4.52

6.51

-0.109 -0.142 -0.165 -0.206

-0.121 -0.152 -0.151 -0.181 -0.114 -0.036

0.001

0.001

0.002

0.002

0.003

0.003

0.006

0.005

5.59

5.73

5.75

-0.064 -0.059 -0.058 -0.053

0.001

0.002

0.002

0.001

5.91

6.24

6.61

-0.123 -0.148 -0.115 -0.126

0.002

0.003

0.002

0.002

12.80

12.61

13.21

-0.111 -0.144 -0.244 -0.263

0.001

0.001

0.005

0.007

15.09

14.99

15.31

-0.064 -0.094 -0.184 -0.239

0.001

0.001

0.002

0.005

10.18

10.97

11.36

-0.038 -0.125 -0.133 -0.143

0.000

0.001

0.002

0.003

9.59

7.85

14.38

4.88

10.03

7.73

13.59

5.21

9.99

7.26

13.40

5.12

-0.189

-0.138

-0.101

-0.029

0.002

0.001

0.001

0.000

0.006

0.002

0.001

0.001

0.008

0.003

0.005

0.001

0.008

0.003

0.007

0.003

Security

Type

ISIN

ATM Ref

Dividend

Yield

Next ExDividend

Date

ATM

Vol 12M

13.85

7.07

ATM

Vol 18M

14.17

8.70

ATM

Vol 24M

Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew Skew

(a) (a) (a) (a) (a) (a) (a) (b) (b) (b) (b) (b) (b) (b) 30D

60D

90D

6M

12M

18M

24M

30D

60D

90D

6M

12M

18M

24M

-0.305

-0.156

-0.119

-0.088

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

-0.361

-0.186

-0.200

-0.089

-0.318

-0.123

-0.277

-0.142

0.003

0.003

0.004

0.003

Das könnte Ihnen auch gefallen

- Determinants of The Bank PerformanceDokument8 SeitenDeterminants of The Bank Performancelucksia thayanithyNoch keine Bewertungen

- LT05 L1TP 125060 20040720 20161130 01 T1 VerDokument5 SeitenLT05 L1TP 125060 20040720 20161130 01 T1 Verstudio surakartaNoch keine Bewertungen

- Year Asian Paintsaxis Bank Cipla Ltd. G A I L Ltd. Index: Average Return StdevDokument4 SeitenYear Asian Paintsaxis Bank Cipla Ltd. G A I L Ltd. Index: Average Return StdevZeusNoch keine Bewertungen

- Table: Load Assignments - Point Loads Point Loadpat FX Fy Fgrav MX My MZDokument11 SeitenTable: Load Assignments - Point Loads Point Loadpat FX Fy Fgrav MX My MZCarlos SatornicioNoch keine Bewertungen

- MMult Function and Demo of ROIDokument6 SeitenMMult Function and Demo of ROIJITESHNoch keine Bewertungen

- Estacion Meteorologica Pachacoto Analisis Estadistico de Datos MeteorologicosDokument4 SeitenEstacion Meteorologica Pachacoto Analisis Estadistico de Datos MeteorologicosVictor Reyes100% (1)

- 2008 Harsh KadamDokument54 Seiten2008 Harsh KadamhiremeNoch keine Bewertungen

- Practica Macro 22Dokument9 SeitenPractica Macro 22JHON JUVER AMAO LLANTOYNoch keine Bewertungen

- Micron Technology, Inc. (MU) - Data-AnnualDokument13 SeitenMicron Technology, Inc. (MU) - Data-AnnualwillyNoch keine Bewertungen

- CTV 5Dokument22 SeitenCTV 5Nemanja PapricaNoch keine Bewertungen

- PT Bank Mitraniaga TBKDokument35 SeitenPT Bank Mitraniaga TBKannisa mNoch keine Bewertungen

- AutocorrelacionDokument120 SeitenAutocorrelacionChristian SánchezNoch keine Bewertungen

- Converting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxDokument4 SeitenConverting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxShNoch keine Bewertungen

- Converting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxDokument4 SeitenConverting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxShNoch keine Bewertungen

- Converting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxDokument4 SeitenConverting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxShNoch keine Bewertungen

- BERK iNAĞDokument31 SeitenBERK iNAĞHaydar Eren UyanikerNoch keine Bewertungen

- ReportOptimizer-11446975 54 Ativos 3 Anos Max Min FreeDokument4 SeitenReportOptimizer-11446975 54 Ativos 3 Anos Max Min FreeMaiquel de CarvalhoNoch keine Bewertungen

- OUTPUTDokument16 SeitenOUTPUTsehu falahNoch keine Bewertungen

- BT 3Dokument8 SeitenBT 3Linh VuNoch keine Bewertungen

- Calculation ExampleDokument4 SeitenCalculation ExampleChe TaNoch keine Bewertungen

- Geoquimica de SuperficieDokument7 SeitenGeoquimica de SuperficieAlejandro MalagaNoch keine Bewertungen

- Go Ahead For F&O Report 04 February 2013 Mansukh Investment and Trading SolutionDokument5 SeitenGo Ahead For F&O Report 04 February 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Verification P DeltaDokument4 SeitenVerification P DeltaBADRA NOUR BOUABDALLAHNoch keine Bewertungen

- Farmasi DataDokument1 SeiteFarmasi DataSaya DiaNoch keine Bewertungen

- RS - Heat Map - Major IndicesDokument1 SeiteRS - Heat Map - Major IndicesAmiya KumarNoch keine Bewertungen

- ANALYSISDokument8 SeitenANALYSISPrem BhandariNoch keine Bewertungen

- Coporate Finance1Dokument10 SeitenCoporate Finance1T TakashiNoch keine Bewertungen

- Year Asian Paintaxis Bank Cipla Ltd. G A I L Ltdindex ReturnsDokument12 SeitenYear Asian Paintaxis Bank Cipla Ltd. G A I L Ltdindex ReturnsZeusNoch keine Bewertungen

- Rep 02 NexDokument3 SeitenRep 02 NexYELLICSANoch keine Bewertungen

- Rep 02Dokument3 SeitenRep 02YELLICSANoch keine Bewertungen

- Hind Oil IndustriesDokument6 SeitenHind Oil IndustriesNitish NairNoch keine Bewertungen

- Objective Function Explicit ConstraintsDokument16 SeitenObjective Function Explicit ConstraintsSinteya YeoNoch keine Bewertungen

- Aits Part Test - II (Jee Main)Dokument5 SeitenAits Part Test - II (Jee Main)pravat DashNoch keine Bewertungen

- Var 3Dokument2 SeitenVar 3Livia PiolaNoch keine Bewertungen

- Diseño ZapataDokument147 SeitenDiseño ZapataAlexander Gómez LlallahuiNoch keine Bewertungen

- Book 1Dokument4 SeitenBook 1dewot999Noch keine Bewertungen

- Data Stock PricesDokument6 SeitenData Stock PriceskhalidhamdanNoch keine Bewertungen

- AnalysisDokument5 SeitenAnalysisPrem BhandariNoch keine Bewertungen

- 1 2 3 4 5 6 7 - Deg Deg Deg - - - C α ∆α a C ∆C C: NACA4412 i D di DDDokument18 Seiten1 2 3 4 5 6 7 - Deg Deg Deg - - - C α ∆α a C ∆C C: NACA4412 i D di DDJandrew TanNoch keine Bewertungen

- Go Ahead For F&O Report 04 March 2013 Mansukh Investment and Trading SolutionDokument5 SeitenGo Ahead For F&O Report 04 March 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNoch keine Bewertungen

- Scores and EigenvaluesDokument8 SeitenScores and EigenvaluesShiela BelandresNoch keine Bewertungen

- B2B 012024 27CDLPS0496J1ZV GSTR2B 24032024Dokument29 SeitenB2B 012024 27CDLPS0496J1ZV GSTR2B 24032024praveensolnki6789Noch keine Bewertungen

- Sep MRP Stay Activity8867295Dokument167 SeitenSep MRP Stay Activity8867295Vivekananda Reddy PoluNoch keine Bewertungen

- FM 1-1Dokument25 SeitenFM 1-1Utkarsh BalamwarNoch keine Bewertungen

- AWT Investments Limited: Validity Date Navs Navs Return KSE Kse RetuenDokument4 SeitenAWT Investments Limited: Validity Date Navs Navs Return KSE Kse RetuenHamxa SajjadNoch keine Bewertungen

- NeryDokument2 SeitenNeryBeto Pacichana DominguezNoch keine Bewertungen

- Tabela Normal ExtendidaDokument2 SeitenTabela Normal ExtendidaAlessandra Noronha100% (1)

- Capital Asset Pricing Model: India Govt Bond Generic Bid Yield 10 YearDokument17 SeitenCapital Asset Pricing Model: India Govt Bond Generic Bid Yield 10 YearKaran VermaNoch keine Bewertungen

- MRP Stay Activity8867295 (Aug)Dokument96 SeitenMRP Stay Activity8867295 (Aug)Vivekananda Reddy PoluNoch keine Bewertungen

- Date HP - Price SP500 - Price T-Bills (Adj. Close) (Adj. Close) (%, APR) Stock Return Excess Return HP Market Index HP Market IndexDokument16 SeitenDate HP - Price SP500 - Price T-Bills (Adj. Close) (Adj. Close) (%, APR) Stock Return Excess Return HP Market Index HP Market IndexAlfieNoch keine Bewertungen

- Calculation of Beta For Jindal Power and Steel StockDokument6 SeitenCalculation of Beta For Jindal Power and Steel Stockvikas_lakraNoch keine Bewertungen

- Nifty Futre RulesDokument21 SeitenNifty Futre RulessandNoch keine Bewertungen

- Hardy CrossDokument2 SeitenHardy CrossHugo ESCALANTENoch keine Bewertungen

- Calc. HidraulicoDokument4 SeitenCalc. HidraulicocesarNoch keine Bewertungen

- Beta FundamentalDokument27 SeitenBeta FundamentalDAPNoch keine Bewertungen

- Load TransferDokument193 SeitenLoad TransferJanine Mykka Raga - ReyesNoch keine Bewertungen

- Aggregate - Purchases - Full - Info vUGDokument1.615 SeitenAggregate - Purchases - Full - Info vUGug8Noch keine Bewertungen

- Control Room Report PDFDokument38 SeitenControl Room Report PDFAbhishek ChappaNoch keine Bewertungen

- Fundamental Equity Analysis - Euro Stoxx 50 Index PDFDokument103 SeitenFundamental Equity Analysis - Euro Stoxx 50 Index PDFQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110Dokument227 SeitenFundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110Q.M.S Advisors LLCNoch keine Bewertungen

- qCIO Global Macro Hedge Fund Strategy - November 2014Dokument31 SeitenqCIO Global Macro Hedge Fund Strategy - November 2014Q.M.S Advisors LLCNoch keine Bewertungen

- Directory - All ETC Exchange Traded Commodities - Worldwide PDFDokument40 SeitenDirectory - All ETC Exchange Traded Commodities - Worldwide PDFQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110 PDFDokument227 SeitenFundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110 PDFQ.M.S Advisors LLCNoch keine Bewertungen

- TPX 1000 Index - Dividends and Implied Volatility Surfaces Parameters PDFDokument8 SeitenTPX 1000 Index - Dividends and Implied Volatility Surfaces Parameters PDFQ.M.S Advisors LLCNoch keine Bewertungen

- Financial Analysis - MTN Group Limited provides a wide range of communication services. The Company's services include cellular network access and business solutions. MTN Group is a multinational telecommunications group.pdfDokument8 SeitenFinancial Analysis - MTN Group Limited provides a wide range of communication services. The Company's services include cellular network access and business solutions. MTN Group is a multinational telecommunications group.pdfQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis - SPI Index - Swiss Performance Index Top 100 CompaniesDokument205 SeitenFundamental Equity Analysis - SPI Index - Swiss Performance Index Top 100 CompaniesQ.M.S Advisors LLC100% (1)

- Fundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryDokument205 SeitenFundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis - Euro Stoxx 50 Index PDFDokument103 SeitenFundamental Equity Analysis - Euro Stoxx 50 Index PDFQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapDokument205 SeitenFundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Analysis & Analyst Recommendations - QMS Global Agribusiness FlexIndexDokument103 SeitenFundamental Analysis & Analyst Recommendations - QMS Global Agribusiness FlexIndexQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis & Recommandations - The Hang Seng Mainland 100 - 100 Largest Companies Which Derive The Majority of Their Sales Revenue From Mainland ChinaDokument205 SeitenFundamental Equity Analysis & Recommandations - The Hang Seng Mainland 100 - 100 Largest Companies Which Derive The Majority of Their Sales Revenue From Mainland ChinaQ.M.S Advisors LLCNoch keine Bewertungen

- Financial Analysis - Molycorp, Inc. Produces Rare Earth Minerals. the Company Produces Rare Earth Products, Including Oxides, Metals, Alloys and Magnets for a Variety of Applications Including Clean Energy TechnologiesDokument8 SeitenFinancial Analysis - Molycorp, Inc. Produces Rare Earth Minerals. the Company Produces Rare Earth Products, Including Oxides, Metals, Alloys and Magnets for a Variety of Applications Including Clean Energy TechnologiesQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Analysis & Analyst Recommendations - EM Frontier Myanmar BasketDokument25 SeitenFundamental Analysis & Analyst Recommendations - EM Frontier Myanmar BasketQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapDokument205 SeitenFundamental Equity Analysis and Analyst Recommandations - MSCI Emerging Market Index - Top 100 Companies by Market CapQ.M.S Advisors LLCNoch keine Bewertungen

- Fundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryDokument205 SeitenFundamental Equity Analysis - QMS Gold Miners FlexIndex - The QMS Advisors' Gold Miners Flexible Index Tracks Companies Involved in The Gold Mining IndustryQ.M.S Advisors LLCNoch keine Bewertungen

- Financial Analysis - EDF SA (Electricite de France) Produces, Transmits, Distributes, Imports and Exports Electricity. the Company, Using Nuclear Power, Coal and Gas, Provides Electricity for French Energy ConsumersDokument8 SeitenFinancial Analysis - EDF SA (Electricite de France) Produces, Transmits, Distributes, Imports and Exports Electricity. the Company, Using Nuclear Power, Coal and Gas, Provides Electricity for French Energy ConsumersQ.M.S Advisors LLCNoch keine Bewertungen

- Company Analysis - Overview: Nuance Communications IncDokument8 SeitenCompany Analysis - Overview: Nuance Communications IncQ.M.S Advisors LLCNoch keine Bewertungen

- Exchange Traded Products Based On MSCI IndicesDokument36 SeitenExchange Traded Products Based On MSCI IndicesCurve123Noch keine Bewertungen

- MonitorDokument63 SeitenMonitorJi YanbinNoch keine Bewertungen

- 80 FF 75 C 92 C 69 FFB 5Dokument71 Seiten80 FF 75 C 92 C 69 FFB 5deekshaNoch keine Bewertungen

- Barcap ETF ListDokument4 SeitenBarcap ETF ListjustincthomasNoch keine Bewertungen

- Estimated Changes For MSCI FM 100 Index in Nov SAIRDokument2 SeitenEstimated Changes For MSCI FM 100 Index in Nov SAIRHiep KhongNoch keine Bewertungen

- MS Nov 14 2006 ETF QuarterlyDokument268 SeitenMS Nov 14 2006 ETF Quarterlyapi-3838885100% (1)

- Ejemplo Datos VentasDokument836 SeitenEjemplo Datos VentasJhordi reategui rosalesNoch keine Bewertungen

- Ishares U.S. ETF Product ListDokument12 SeitenIshares U.S. ETF Product ListFedeGarayNoch keine Bewertungen

- Myeeugbar-Gbaruakaaaidooshaciuaerahanmaor Umace Keng Keng Man A Lu Vough YôDokument9 SeitenMyeeugbar-Gbaruakaaaidooshaciuaerahanmaor Umace Keng Keng Man A Lu Vough YôwiredpsycheNoch keine Bewertungen

- ETF Full ListDokument10 SeitenETF Full Lista pNoch keine Bewertungen

- Agentes Autorizados ETF Site 05out21Dokument5 SeitenAgentes Autorizados ETF Site 05out21Daniel EliasNoch keine Bewertungen

- Ishares Product List en UsDokument15 SeitenIshares Product List en UsLeonardo CardosoNoch keine Bewertungen

- FIP506 ZKK Investment Recommendations ListDokument8 SeitenFIP506 ZKK Investment Recommendations Listsomya sharmaNoch keine Bewertungen

- Ishares Product List en UsDokument12 SeitenIshares Product List en UsMitulsinh M RavaljiNoch keine Bewertungen

- Etfs Details Type Fund FlowDokument19 SeitenEtfs Details Type Fund FlowAdam EssakhiNoch keine Bewertungen

- NonArcaETFs ETNs090808Dokument5 SeitenNonArcaETFs ETNs090808mgarrett00Noch keine Bewertungen

- 2.4 Ishares Product List PDFDokument12 Seiten2.4 Ishares Product List PDFVijay YadavNoch keine Bewertungen

- Ishares US ETFs - Dividends and Implied Volatility Surfaces ParametersDokument2 SeitenIshares US ETFs - Dividends and Implied Volatility Surfaces ParametersQ.M.S Advisors LLCNoch keine Bewertungen

- List of Exchange Traded FundsDokument2 SeitenList of Exchange Traded FundssankhaginNoch keine Bewertungen