Beruflich Dokumente

Kultur Dokumente

Minutes of The Meeting26 Jan 08

Hochgeladen von

Zubair BaigOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Minutes of The Meeting26 Jan 08

Hochgeladen von

Zubair BaigCopyright:

Verfügbare Formate

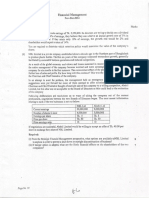

Al-Zamin Leasing Modaraba

Minutes of the Meeting

Held at Time Subject Khi Head office 12.45 Date Attended By 26 January 2008 BAC, NA, DH, ZB

Portfolio Redesigning and Strategy

BAC reviewed the overall structure of the portfolio and focused on the AFS and HFT portfolios simultaneously. Takaful fund It was principally agreed that First Dawood Mutual fund and Meezan Balanced Fund will be off loaded slowly and gradually. A daily trench of 10,000 8,000 shares will be sold. PICIC Energy fund will be sold at available price, and the payout ratio of Picic Growth Fund will be reviewed. It was not sure at the time of meeting that whether we have received the dividend or not. Individual shares were discussed and decisions taken regarding shares is mentioned below Medium Term Investments FFBL PIOC AMZV KESC MLCF DFML NCL PPTA MEBL Averaging of FFBL should be done, and at least 12000 shares of FFBL should buy to average out the existing shares bought by FNEL. sell Existing share of PIOC. sell AMZV Sell KESC Average MLCF on existing rates. sell DFML sell sell buy

Investment Portfolio Trading Portfolio

Some scrips were considered for medium to long term holdings, NIB 20,000 below Rs 22 BIPL 20,000 below Rs 18 BAFL 10,000 below 51 HBL 10,000 below 250 OGDC 15000 below 115

Al-Zamin Leasing Modaraba

Das könnte Ihnen auch gefallen

- Presentation On HDFC Mutual FundDokument19 SeitenPresentation On HDFC Mutual Fundvishwa_85Noch keine Bewertungen

- Ch.16 - 14ed Supply Chain Work Cap MGMT - StudentDokument59 SeitenCh.16 - 14ed Supply Chain Work Cap MGMT - StudentLinh Ha Nguyen KhanhNoch keine Bewertungen

- Finding Rs 20 Lakh Crs TO Stimulate Sans Fiscal Orthodoxy'Dokument10 SeitenFinding Rs 20 Lakh Crs TO Stimulate Sans Fiscal Orthodoxy'Dilli RajNoch keine Bewertungen

- Working Capital ManagementDokument27 SeitenWorking Capital ManagementNamir RafiqNoch keine Bewertungen

- 82 Working Capital ManagementDokument25 Seiten82 Working Capital ManagementPrashant SharmaNoch keine Bewertungen

- Working Capital and Current Assets ManagementDokument72 SeitenWorking Capital and Current Assets ManagementRimpy SondhNoch keine Bewertungen

- FCCBDokument20 SeitenFCCBHitesh MulaniNoch keine Bewertungen

- Unit 4 Presentation - Part ADokument49 SeitenUnit 4 Presentation - Part AMebin MathewNoch keine Bewertungen

- A Case Study On Sources OF Financing: IISWBM, Batch 4th SemesterDokument39 SeitenA Case Study On Sources OF Financing: IISWBM, Batch 4th SemesterAindrila BeraNoch keine Bewertungen

- Financial Analysis:: Pipavav Shipyard LimitedDokument24 SeitenFinancial Analysis:: Pipavav Shipyard LimitedVasim MemonNoch keine Bewertungen

- Seminar On Corporate Restructuring: Topic: Leveraged BuyoutDokument24 SeitenSeminar On Corporate Restructuring: Topic: Leveraged BuyoutNIDHI SAROANoch keine Bewertungen

- Principles of Working Capital ManagementDokument23 SeitenPrinciples of Working Capital ManagementThiru MuruganNoch keine Bewertungen

- Daily Performance Sheet 7th November 2019 (With SIP Returns)Dokument489 SeitenDaily Performance Sheet 7th November 2019 (With SIP Returns)Prasanta Kumar GoswamiNoch keine Bewertungen

- Working CapitalDokument111 SeitenWorking Capitalshehjadi918Noch keine Bewertungen

- Workingcapitalmanagement 120729142538 Phpapp01Dokument32 SeitenWorkingcapitalmanagement 120729142538 Phpapp01Vikas BansalNoch keine Bewertungen

- Presented By: 03-Zaid Mohd. Shabbir 06-Priya Periwal 14-Malvi Gupta 21-Kamal Kishore Nag 26-Alka Rani Hembrom 42-Abhishek SinghDokument22 SeitenPresented By: 03-Zaid Mohd. Shabbir 06-Priya Periwal 14-Malvi Gupta 21-Kamal Kishore Nag 26-Alka Rani Hembrom 42-Abhishek SinghMalvi GuptaNoch keine Bewertungen

- Working Capital and Financing DecisionDokument28 SeitenWorking Capital and Financing DecisionMarriel Fate CullanoNoch keine Bewertungen

- Chapte R: Principles of Working Capital ManagementDokument24 SeitenChapte R: Principles of Working Capital Managementmylyf12Noch keine Bewertungen

- MOSt Market Outlook 20 TH February 2024Dokument10 SeitenMOSt Market Outlook 20 TH February 2024Sandeep JaiswalNoch keine Bewertungen

- Notes Economy - Current - Affairs Lecture 4 - 17 Sept 22Dokument9 SeitenNotes Economy - Current - Affairs Lecture 4 - 17 Sept 22Tanay BansalNoch keine Bewertungen

- J M Financials: Investment Banking/ Securities /research / Financing and Distribution / Wealth MGNT/ Asset MGNTDokument29 SeitenJ M Financials: Investment Banking/ Securities /research / Financing and Distribution / Wealth MGNT/ Asset MGNTJisha Puthanveettil MuraleedharanNoch keine Bewertungen

- Fm-Nov-Dec 2014Dokument14 SeitenFm-Nov-Dec 2014banglauserNoch keine Bewertungen

- 03 Gilbert Lumber CompanyDokument36 Seiten03 Gilbert Lumber CompanyEkta Derwal PGP 2022-24 BatchNoch keine Bewertungen

- FCCB Bonds ArenaDokument14 SeitenFCCB Bonds ArenaAmanNoch keine Bewertungen

- Working CapitalDokument26 SeitenWorking Capitalosworld100223Noch keine Bewertungen

- Credit Memorandum: Situation OverviewDokument2 SeitenCredit Memorandum: Situation OverviewAlbert JonesNoch keine Bewertungen

- By: Jawaid Iqbal: Al-Sadiq (A.S) Institute of Islamic Banking, Finance & TakafulDokument33 SeitenBy: Jawaid Iqbal: Al-Sadiq (A.S) Institute of Islamic Banking, Finance & TakafulsjawaidiqbalNoch keine Bewertungen

- Week 2 Working Capital Tutorial Questions-1Dokument1 SeiteWeek 2 Working Capital Tutorial Questions-1Tran NguyenNoch keine Bewertungen

- Mas 3 - Group 3Dokument86 SeitenMas 3 - Group 3Mayrelene PadaoanNoch keine Bewertungen

- SCR-Characteristics, Stages and Role of LBOs.Dokument12 SeitenSCR-Characteristics, Stages and Role of LBOs.DEEPALI ANANDNoch keine Bewertungen

- MFRS 123 - Borrowing CostsDokument28 SeitenMFRS 123 - Borrowing CostseeyleesaNoch keine Bewertungen

- UNIT V: Working Capital Management and Contemporary Issues in FinanceDokument56 SeitenUNIT V: Working Capital Management and Contemporary Issues in FinanceSantosh DhakalNoch keine Bewertungen

- Principles of Working Capital ManagementDokument24 SeitenPrinciples of Working Capital ManagementdevrajkinjalNoch keine Bewertungen

- ECN 3422 - Lecture 2 - 2021.09.23Dokument28 SeitenECN 3422 - Lecture 2 - 2021.09.23Cornelius MasikiniNoch keine Bewertungen

- Credit Memorandum: Situation OverviewDokument2 SeitenCredit Memorandum: Situation OverviewAlbert JonesNoch keine Bewertungen

- P1.T3. Financial Markets & Products Chapter 3. Fund Management Bionic Turtle FRM Study NotesDokument23 SeitenP1.T3. Financial Markets & Products Chapter 3. Fund Management Bionic Turtle FRM Study NotesChristian Rey MagtibayNoch keine Bewertungen

- RBS Round Up: 09 December 2010Dokument8 SeitenRBS Round Up: 09 December 2010egolistocksNoch keine Bewertungen

- Ross 11e Chap016 PPT AccessibleDokument35 SeitenRoss 11e Chap016 PPT AccessibleIvan FongNoch keine Bewertungen

- Principles of Working CapitalDokument24 SeitenPrinciples of Working CapitalAnuj VyasNoch keine Bewertungen

- Liquidation Based Valuation 03.06.2023Dokument6 SeitenLiquidation Based Valuation 03.06.2023Ivan Jay E. EsminoNoch keine Bewertungen

- FIM - Special Class - 4 - 2020 - OnlineDokument42 SeitenFIM - Special Class - 4 - 2020 - OnlineMd. Abu NaserNoch keine Bewertungen

- QPB Dec 20 Mock AnswersDokument14 SeitenQPB Dec 20 Mock AnswersBernice Chan Wai WunNoch keine Bewertungen

- Products and Practices in Investment Management Industry in BangladeshDokument26 SeitenProducts and Practices in Investment Management Industry in BangladeshRedwan Hossain ShovonNoch keine Bewertungen

- Course: FINC6001 Effective Period: September2019: Managing Cash Flow, Sales Collection, Credit CollectionDokument27 SeitenCourse: FINC6001 Effective Period: September2019: Managing Cash Flow, Sales Collection, Credit Collectionsalsabilla rpNoch keine Bewertungen

- Sabbath CompanyDokument5 SeitenSabbath CompanyMarsa Syahda NabilaNoch keine Bewertungen

- Print PageDokument3 SeitenPrint PagesathymyindiaNoch keine Bewertungen

- Chap 016Dokument26 SeitenChap 016Deni Danial Kesa M.B.A 151103032Noch keine Bewertungen

- Working Capital ITCDokument75 SeitenWorking Capital ITCsaur1Noch keine Bewertungen

- Presentation On Working CapitalDokument124 SeitenPresentation On Working Capitalbeboliya100% (1)

- Working Capital ManagementDokument20 SeitenWorking Capital Managementsmwanginet7Noch keine Bewertungen

- Short-Term Financial Decisions - SlidesDokument43 SeitenShort-Term Financial Decisions - SlidesAlexandre SilvaNoch keine Bewertungen

- Working Capital Decision (Autosaved)Dokument27 SeitenWorking Capital Decision (Autosaved)Ashish SinghNoch keine Bewertungen

- Capital Structure CSDokument26 SeitenCapital Structure CSFALCO1234Noch keine Bewertungen

- Chapter 16 Working Capital ManagementDokument11 SeitenChapter 16 Working Capital ManagementAnaNoch keine Bewertungen

- Credit 5Dokument7 SeitenCredit 5Maria SyNoch keine Bewertungen

- Central Coalfields LimitedDokument13 SeitenCentral Coalfields LimitedManjeet KumarNoch keine Bewertungen

- RJR Nabisco 1Dokument6 SeitenRJR Nabisco 1gopal mundhraNoch keine Bewertungen

- FMP Lecture - Working CapitalDokument31 SeitenFMP Lecture - Working CapitalFatima ZehraNoch keine Bewertungen

- RBS Round Up: 07 December 2010Dokument8 SeitenRBS Round Up: 07 December 2010egolistocksNoch keine Bewertungen

- Item Stock Report: Report Parameters Organization: Location: Customer Group: Sub-Inventory: DomesticDokument2 SeitenItem Stock Report: Report Parameters Organization: Location: Customer Group: Sub-Inventory: DomesticZubair BaigNoch keine Bewertungen

- Weekly Report and Activities20 MarchDokument1 SeiteWeekly Report and Activities20 MarchZubair BaigNoch keine Bewertungen

- Compasion With 30 Sep06Dokument8 SeitenCompasion With 30 Sep06Zubair BaigNoch keine Bewertungen

- Rental Lease Schedule Invest Capital Investment Bank LimitedDokument1 SeiteRental Lease Schedule Invest Capital Investment Bank LimitedZubair BaigNoch keine Bewertungen

- Aportization Sche IBDokument2 SeitenAportization Sche IBZubair BaigNoch keine Bewertungen

- Principal of ManagementDokument16 SeitenPrincipal of ManagementZubair BaigNoch keine Bewertungen

- Business Studies NotesDokument20 SeitenBusiness Studies NotesZubair BaigNoch keine Bewertungen

- Islamic Syndication Vs ConventionalDokument67 SeitenIslamic Syndication Vs ConventionalZubair BaigNoch keine Bewertungen

- Scheme of WorkDokument45 SeitenScheme of WorkZubair BaigNoch keine Bewertungen