Beruflich Dokumente

Kultur Dokumente

Vancouver Sun Mutual Fund Table

Hochgeladen von

The Vancouver SunOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Vancouver Sun Mutual Fund Table

Hochgeladen von

The Vancouver SunCopyright:

Verfügbare Formate

1

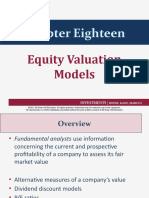

|| Mutual Funds

BREAKING NEWS: VANCOUVERSUN.COM | Saturday, April 13, 2013

How to read the mutual funds tables

Mutual fund rate of return figures

1

1. 52-week high/low: Represents the highest

and lowest price the fund has reached in the

last year

2. Fund: Names of the funds

3. NAVPS: The previous days price.

4. Dollar Change: The change the fund has

grown or declined compared to the previous

week.

52W

52W

Friday

High

Low

Fund

9.51

6.63

Global Equity

NAVPS

3.41

Distributed by Fundata Canada

Hi

Low Fund

Price $Chg

-ABC Funds

7.72

6.56 ynDeep-Value

7.22

_

9.27

8.20 ynDirt-Cheap Fund 8.99

_

8.63

7.66 ynFully-Mgd

8.63

_

18.19 15.19 ynFund-Value

18.19

_

AEGON imaxxFunds

9.89

9.27 yoimaxxCdnFPayFdA 9.32 +.05

AGF Management Ltd.

9.34

9.18 oAGF InfPlusBond

9.26 unch

6.02

5.59 oAGF Trad Bal

5.88 -.01

24.01 19.92 oAggrUSGwthFd

23.26 +.44

17.40 14.14 oAllC30CdnEqFd

14.26 -.12

23.11 19.55 oAmerGwthCl MF 22.74 +.37

24.74 22.05 oCdn Asst Alloc

24.65 +.16

6.07

5.78 oCdn Bond Fd

5.89 unch

53.38 47.70 oCdn Gro Eq Cl A

49.20 -.11

41.40 36.06 oCdnLCDvFClassic 40.27 +.36

9.79

8.52 oCdnLCDvFd

9.52 +.09

13.72 11.96 oCdnLCpDivCl

13.34 +.11

49.60 41.45 oCdnResCl A

42.65 -.15

7.56

6.80 oCdnSmallCapFd

7.09 +.06

47.40 41.64 oCdnStockFd MFS 45.98 +.10

18.52 15.08 oChinaFocusCl

16.72 +.34

11.21 10.34 oConservAAFd

11.06 +.04

15.31 14.63 oDiversifIncFdMF 15.08 +.10

8.20

6.81 oEAFEEquityFdMFS 7.98 +.10

10.61

9.04 oElem Gbl Pt MFS 10.45 +.13

11.34 10.73 oElemConsPt MFS 11.32 +.04

11.58 10.71 oElementsBaPtMFS 11.49 +.06

11.79 10.39 oElemGrowthPtMFS 11.65 +.10

9.85

9.62 oElemYieldPt MFS

9.76 +.02

18.13 15.32 oEmergMktsClMFS 17.43 +.22

11.87 10.22 oEmergMktsFdMF 11.41 +.15

10.31

9.32 oEmerMktsBalFdMF 10.09 +.07

21.15 15.10 oEuro Equ Cl

19.56 +.61

12.10 11.75 oFixeIncPlusFdMF 12.10 unch

10.20

9.76 oFloatRateIncFdA 10.20 +.02

11.57 11.04 oGbGovtBondFd

11.56 +.01

10.79

8.75 oGbl Equ Cl

10.77 +.25

5.28

3.99 oGbl Val Cl

5.13 +.13

24.79 20.20 oGbResourceCl

21.39 +.01

17.28 14.56 oGlobalDivFdMFS 17.25 +.26

21.23 17.17 oGlobalEquFd

21.18 +.48

27.88 21.48 oGlobalValFd

27.05 +.63

11.00

9.81 oHighIncomeFd

9.86 +.05

6.03

5.75 oHighYldBndFd

5.93 +.03

9.75

6.92 oIntlStockCl

8.95 +.29

10.83 10.13 oMthlyHiIncFdMFS 10.67 +.07

33.94 21.76 oPreciouMetalFd

21.76 -1.57

11.59 10.73 oTactical Income

11.17 +.09

3.37

3.25 oTotRetBondFdMF 3.37 +.01

10.73

9.88 oTraditionInFdMF 10.53 -.01

16.50 13.58 oWorldBalFd

16.19 +.31

AGF Management Ser F C$

12.57 10.80 nEmergMktsFdF

12.10 +.16

AGF Management Ser T C$

13.20 12.42 oMthlyHiIncFdT

12.97 +.08

AGF Investments

16.69 14.32 oAggr Growth

16.34 +.15

13.93 12.87 oCons Growth

13.89 +.07

16.34 14.36 oGrowth

16.07 +.13

10.53 10.21 oIncome

10.39 +.01

15.79 14.31 oMod Growth

15.63 +.09

AGF Management - Pooled

18.11 16.94 PoolDiversiInc

17.96 +.11

24.52 19.51 PooledCdnSmCpFd 20.31 -.30

16.47 15.94 PooledFixedInFd

16.37 +.01

16.66 15.35 PooledHighIncFd 15.43 +.08

AGF Group C$ Series B

12.47 11.32 oDividendIncFd

11.92 +.03

-Arrow Income Series

9.48

9.30 y ECoaInvGraFd A

9.41

_

6.83

6.62 yz HighYieldFd A

6.64

_

-Arrow North American Ser

12.33 11.45 y CurvatMNeutFd A 12.04

_

10.42 10.08 y RavenRockIncA 10.16

_

-Beutel Goodman

9.34

7.51 Amer Equity D

9.28 +.15

17.89 15.85 Balanced D

17.72 +.18

27.09 22.31 Cdn Equity D

26.53 +.30

5.46

5.30 Crp/ProvActBd D

5.35 -.01

12.17

9.69 Global Equity D

12.11 +.24

12.63 12.31 Income D

12.41 -.01

4.38

3.53 Intl Equity D

4.33 +.11

6.18

5.85 L/T Bond D

6.01 -.02

19.64 17.17 Small Cap D

19.25 +.07

9.87

9.76 ST Bond B

9.79 +.00

BlackRock Asset Mgmt Can

20.12 19.68 n1-5LaGovBICLF.A 19.76 +.01

20.34 20.08 n1-5YLadCBICBO.A 20.19 +.01

6.63

5.90 nCdnFinMIncFIE.A 6.40 +.06

6.84

5.39 nEqWeighB&LCEW.A 6.49 +.08

23.72 20.91 nS&PTSXCDAICDZ.A 22.70 +.19

17.39 16.98 nS/TCPShIx-CPD.A 17.33 -.03

BlackRock Asset Mgmt Can

31.79 30.87 niShares XBB

31.58 -.01

21.69 20.99 niShares XCB

21.69 .00

15.73 13.63 niShares XCS

14.17 -.09

22.58 19.55 niShares XDV

21.97 +.22

17.05 13.79 niShares XEG

15.35 +.12

20.56 18.03 niShares XEI

20.11 +.20

25.56 21.40 niShares XEM

23.92 -.01

25.32 20.83 niShares XFN

24.34 +.35

20.15 20.07 niShares XFR

20.15 +.01

22.19 21.49 niShares XGB

21.91 -.01

22.02 13.36 niShares XGD

13.36 -1.38

21.46 20.63 niShares XHB

21.46 +.00

22.13 18.75 niShares XHD

22.13 +.54

20.41 17.82 niShares XIC

19.49 +.01

19.92 15.10 niShares XIN

19.87 +.53

18.68 16.11 niShares XIU

17.72 +.01

23.88 22.64 niShares XLB

23.49 -.09

19.36 14.11 niShares XMA

14.11 -.92

22.08 19.35 niShares XMD

21.38 +.01

20.52 19.46 niShares XPF

20.50 +.01

26.50 24.50 niShares XRB

25.76 -.05

17.69 16.20 niShares XRE

17.33 +.13

29.17 28.77 niShares XSB

28.97 +.02

18.25 14.61 niShares XSP

18.20 +.41

20.45 15.82 niShares XSU

20.25 +.42

12.62 12.05 niShares XTR

12.54 +.05

21.58 19.31 niShares XUT

20.37 +.21

27.23 22.20 niShares XWD

27.21 +.47

21.90 19.78 nUS H-Yld Bd

21.90 +.17

23.69 22.08 nUS IG CorpBd Id

23.52 +.11

BlackRock Asset Mgmt Can

20.13 19.70 n1-5LaGovBICLF

19.78 +.02

20.35 20.09 n1-5YLadCBICBO

20.20 +.01

21.07 20.51 nAdvCdnBd-CAB

20.89 -.01

20.21 19.49 nAdvConvBIxCVD 19.57 +.04

20.33 19.50 nAdvSDHI-CHCSD 20.33 +.04

21.46 19.59 nAUSHYBI-CHCHB 21.41 +.15

20.52 18.88 nBalIncCoPt-CBD 20.52 +.15

26.54 21.93 nBRICIdxFd-CBQ

23.32 +.22

31.00 26.84 nBroadEmMktCWO 28.98 +.16

23.50 21.36 nBroComIxCHCBR 21.82 +.01

12.61 10.65 nCdnFdamIdxCRQ 12.02 +.04

6.83

6.04 nCdnFinMIncFIE

6.60 +.06

25.70 19.92 nGbAgricIdxCOW 24.92 +.04

16.25 13.64 nGbMthADIdxCYH 16.17 +.30

16.02 13.71 nGoldBu(CH)-CGL 13.71 -.29

13.79 10.85 nIntlFdamIxCIE

13.62 +.43

50.04 50.00 nPrem MMkt - CMR 50.02 +.01

23.81 20.98 nS&PTSXCDAICDZ 22.78 +.20

26.73 21.06 nS&PUSDGICHCUD 26.68 +.57

17.42 17.00 nS/TCPShIx-CPD

17.36 -.03

20.38 15.55 nSilver Bull SVR

15.90 +.26

21.64 16.58 nUSFdaIdxCHCLU 21.57 +.48

18.35 14.38 nUSFdaIdxNHCLU.C 18.33 +.28

BMO Funds - Advisor

25.47 23.24 oAssetAllocFd-Ad 25.34 +.14

23.62 20.69 oCdnLgCapEqFd-Ad 22.57 +.07

18.79 16.39 oDividend Fd -Ad

18.45 +.19

15.33 12.19 zoEnterpriseFd-Ad 15.30 +.14

10.56

9.89 ouUSD Mtly Inc-Ad 10.56 +.12

-BMO ETFs

11.54 10.43 oBalETFPtCl -Adv 11.51 +.08

11.97 10.81 nBalETFPtCl A

11.94 +.08

11.55 10.09 nGro ETF Pt Cl A

11.37 +.06

11.01 10.54 oSec ETF Prt-Adv

10.98 .00

9.64

9.37 oSec ETF Prt-T6

9.39 .00

11.17 10.70 nSec ETF Pt Cl A

11.14 .00

10.37

9.77 nTarEnhYldETFPt 10.32 +.05

10.23

9.96 nTargYldETFPort

10.21 +.00

BMO Funds - Mutual Series

14.01 12.89 oGbStraBondFd-Ad 13.58 +.09

8.93

7.88 oGwth&IncFd -Adv 8.73 +.10

7.02

6.79 oHigYldBondFd-Ad 6.93 +.01

9.58

9.08 oMthly Div - Adv

9.54 +.02

14.24 12.66 oMthy HiInc II-A

14.06 +.15

BMO Funds - Mutual Series

17.64 14.36 oAsiaGw&InFd-Adv 17.48 +.21

11.72 10.96 oCdnDvrMIncFd-Ad 11.66 +.06

-BMO Funds R

7.26

7.16 nMonthly Inc R

7.19 +.03

BMO Investment Inc.

17.99 16.42 nAssetAllocFd A

17.90 +.10

14.37 13.98 nBond Fund A

14.27 -.01

27.18 23.74 nCDN Equ ETF

26.12 +.03

36.90 29.47 nCdn Sml Cp Eq

35.89 +.12

6.43

6.02 nDiv In Pt Sr A

6.42 +.08

47.88 41.70 nDividend Fd A

47.05 +.49

13.01 11.17 nDividendCl A

12.79 +.13

14.42 12.13 nEmerMktFd A

14.23 +.17

29.25 24.86 nEquity Fund A

28.86 +.29

19.65 15.18 nEuropeanFd A

19.59 +.38

10.24

9.25 nFS Bal Port

10.23 +.07

9.56

8.20 nFS Gro Port

9.52 +.10

10.67 10.07 nFS Sec Port

10.67 +.02

6.29

5.06 nGbl Equity Cl

6.28 +.13

8.08

7.52 nGbl Str Bnd A

7.88 +.05

4.16

3.72 nGlo Mthly Inc

3.85 +.03

15.44 12.34 nGreaterChina Cl 14.82 +.20

10.10

9.82 nLS Plus 2015 Fd

10.10 +.00

12.10 11.58 nLS Plus 2017 Fd

12.10 +.01

9.60

9.11 nLS Plus 2020 Fd

9.60 +.01

13.49 12.56 nLS Plus 2022 Fd

13.44 +.06

8.94

8.33 nLS Plus 2025 Fd

8.91 +.04

1.00

1.00 nMonMktFd (Prem) 1.00 unch

7.54

7.09 nMonthly Income

7.19 +.03

11.38 11.22 nMtg&STIncFd

11.33 +.01

26.00 16.42 nPrec Metals

16.42 -1.22

36.34 29.98 nResource

34.70 +.13

15.45 12.93 nSelCl AggGro

15.31 +.18

14.17 12.75 nSelCl Bal

14.14 +.08

10.97 10.36 nSelCl Bal T6

10.90 +.06

14.74 12.84 nSelCl Gro

14.66 +.13

12.92 12.12 nSelCl Secur

12.92 +.03

9.97

9.83 nSelCl Secur T6

9.92 +.02

16.36 13.65 nUS Equ

16.36 +.27

11.09

8.79 nUS Equ ETF

11.03 +.26

6.60

6.15 nuUS Mthly Income 6.45 +.07

10.63 10.05 nWorld Bond Fd

10.37 -.06

BMO Investment Inc. Ser F

16.41 13.38 nAsiaGw&InFd-F

16.28 +.20

16.63 14.57 nMthy HiInc II-F

16.45 +.18

Brandes Funds

8.11

7.48 Corp Foc Bond

8.05 -.02

20.82 16.89 oEmerging Mkt Eq 19.66 +.25

13.82

9.80 oGlo Sm Cap Equ

13.72 +.12

8.43

6.69 oGlobalEquFd A

8.43 +.23

9.42

7.64 oIntlEquFd A

9.42 +.27

7.50

5.67 oU.S. Equity

7.46 +.13

Brandes Sionna Funds

8.68

7.68 oDivers Inc

8.61 +.11

13.15 11.69 oSioCdnBalanFdA 13.01 +.09

10.89

9.23 oSionnaCdnEqFdA 10.51 +.04

Bullion Mgmt Services Inc

13.82 11.29 uBMG BullionFdU$ 11.33 -.06

13.57 11.46 BMG BullionFund 11.49 -.13

6.27

5.46 Gold Bullion A

5.46 -.16

6.39

5.39 uGold BullionAU$

5.39 -.12

Canada Life Funds 100/100

12.51 10.90 ygBal (BT)100/100 12.50 +.13

11.25 10.21 ygBal (GS)100/100 11.16 +.09

11.93 10.30 ygBal (IVZ)100/10 11.83 +.16

11.99 10.85 ygBal All 100/100

11.97 +.10

10.92 10.12 ygCAA (F) 100/100 10.85 +.10

10.93

9.57 ygCE (LK) 100/100 10.63 +.12

11.98 10.33 ygCLF TN 100/100 11.83 +.13

11.10 10.64 ygCon All 100/100 11.09 +.02

12.57 10.43 ygCRs (M) 100/100 11.33 +.27

13.14 11.26 ygED (LK) 100/100 12.95 +.10

11.45 11.01 ygFI (LK) 100/100 11.41 -.01

Canada Life 100/100 (PS1)

10.33

9.99 y FI(LK)100/100

10.29 -.01

Canada Life Funds 100/100

10.53 10.35 ygG B (G) 100/100 10.47 .00

Canada Life 100/100 (PS1)

10.12 10.00 y GB100/100 PS1

10.11 .00

Canada Life Funds 100/100

13.17 10.87 ygGE (IVZ) 100/10 13.11 +.16

12.69 10.13 ygGE (S) 100/100

12.69 +.25

11.44

9.97 ygHC (CI) 100/100 11.22 +.11

10.97

9.89 ygHG&I(CI)100/100 10.80 +.09

11.33 10.96 ygICB (TD)100/100 11.29 -.01

11.79 11.14 ygIO (LC)100/100 11.77 +.02

11.35 10.28 ygMan (LK) 100/10 11.30 +.10

10.04 10.03 ygMM (LK) 100/100 10.04 +.00

Canada Life 100/100 (PS1)

10.00 10.00 y MM 100/100-PS1 10.00 +.00

Canada Life Funds 100/100

11.34 10.62 ygMod All 100/100 11.33 +.05

13.22 11.85 ygRE (GR) 100/100 13.22 +.03

14.66 11.69 ygSCE (BT)100/100 14.66 +.26

Canada Life Funds 75/100

12.60 10.97 ygBal (BT) 75/100 12.59 +.13

11.31 10.25 ygBal (GS) 75/100 11.23 +.10

12.02 10.36 ygBal (IVZ) 75/10

11.92 +.16

12.05 10.89 ygBal All 75/100

12.03 +.10

11.02 10.19 ygCAA (F) 75/100

10.95 +.10

11.04

9.65 ygCE (LK) 75/100

10.75 +.12

12.09 10.41 ygCLF TN 75/100

11.95 +.13

11.15 10.68 ygCon All 75/100

11.14 +.02

12.71 10.54 ygCRs (M) 75/100 11.49 +.27

13.36 11.40 ygED (LK) 75/100

13.17 +.11

11.47 11.03 ygFI (LK) 75/100

11.43 -.01

Canada Life 75/100 (PS1)

10.34

9.99 y FI(LK)75/100PS1 10.31 -.01

Canada Life Funds 75/100

10.52 10.34 ygG B (G) 75/100

10.47 .00

Canada Life 75/100 (PS1)

10.13 10.00 y G B75/100 PS1

10.13 .00

Canada Life Funds 75/100

13.32 10.97 ygGE (IVZ) 75/100 13.26 +.16

12.78 10.19 ygGE (S) 75/100

12.78 +.25

11.53 10.04 ygHC (CI) 75/100

11.32 +.12

11.03

9.93 ygHG&I (CI)75/100 10.86 +.09

11.35 10.97 ygICB (TD) 75/100 11.31 -.01

11.83 11.18 ygIO (LC)75/100

11.81 +.02

11.37 10.29 ygMan (LK) 75/100 11.32 +.10

10.04 10.03 ygMM (LK) 75/100 10.04 +.00

Canada Life 75/100 (PS1)

10.01 10.00 y MM 75/100 (PS1) 10.01 +.00

Canada Life Funds 75/100

11.39 10.66 ygMod All 75/100

11.38 +.05

13.40 11.97 ygRE (GR) 75/100

13.40 +.03

14.86 11.81 ygSCE (BT) 75/100 14.86 +.26

Canada Life Funds 75/75

12.63 10.99 ygBal (BT) 75/75

12.63 +.13

11.31 10.24 yoBal (GS) 75/75

11.22 +.10

12.02 10.36 ygBal (IVZ) 75/75

11.93 +.16

12.08 10.91 ygBal All 75/75

12.06 +.10

11.02 10.19 ygCAA (F) 75/75

10.96 +.10

11.12

9.70 ygCE (LK) 75/75

10.82 +.12

12.17 10.46 ygCLF TN 75/75

12.03 +.13

11.17 10.70 ygCon All 75/75

11.16 +.02

12.82 10.62 ygCRs (M) 75/75

11.60 +.28

13.39 11.42 ygED (LK) 75/75

13.21 +.11

11.48 11.03 ygFI (LK) 75/75

11.44 -.01

Canada Life 75/75 (PS1)

10.35

9.99 y FI(LK)75/75-PS1 10.32 -.01

Canada Life Funds 75/75

10.55 10.37 ygG B (G) 75/75

10.50 .00

Canada Life 75/75 (PS1)

10.13 10.00 y G B 75/75 PS1

10.13 .00

Canada Life Funds 75/75

13.38 11.01 ygGE (IVZ) 75/75

13.33 +.16

12.90 10.26 ygGE (S) 75/75

12.90 +.26

11.60 10.09 ygHC (CI) 75/75

11.39 +.12

11.05

9.94 ygHG&I (CI) 75/75 10.88 +.09

11.38 11.00 ygICB (TD) 75/75

11.34 -.01

11.88 11.21 ygIO (LC) 75/75

11.86 +.02

11.38 10.30 ygMan (LK) 75/75 11.33 +.10

10.05 10.03 ygMM (LK) 75/75

10.05 +.00

Canada Life 75/75 (PS1)

10.01 10.00 y MM(LK)75/75-PS1 10.01 +.00

Canada Life Funds 75/75

11.42 10.68 ygMod All 75/75

11.41 +.05

13.50 12.04 ygRE (GR) 75/75

13.50 +.03

14.99 11.90 ygSCE (BT) 75/75

14.99 +.27

-Canso Fund Management Ltd

11.49 10.77 nCorp Val Bond F

11.45 +.02

Capital Intl Funds

17.11 13.84 Global Equ A

17.11 +.43

Capital Intl Class I

18.14 14.60 nGlobal Equity I

18.13 +.47

Capital Intl Class H

10.94

9.58 nEmMktTotOpp H 10.63 +.04

14.14 11.39 nGlobal Equ H

14.14 +.36

Capital International F

17.77 14.30 nGlobal Equ F

17.76 +.45

Castlerock Investments

11.67

9.75 BCGblBalFd A

11.54 +.18

11.49

9.58 gBCGblBalFd B

11.36 +.18

9.34

7.18 BCGblLdrsFd A

9.11 +.18

8.93

6.87 gBCGblLdrsFd B

8.71 +.18

11.37

8.61 BCGblLdrsFd I

11.12 +.23

17.05 12.71 BCIntlEquFd I

16.68 +.47

14.72 13.23 gCdn Div Fd B

14.38 +.12

17.26 15.11 zgCdnDivGrowthFdB 16.87 +.11

15.74 11.39 CdnGwComFd A

15.66 +.21

15.72 11.36 gCdnGwComFd B 15.64 +.21

10.35

9.46 gEnh Yld Fd B

10.35 +.11

11.35 10.33 Enh Yld Fd I

11.35 +.12

-Chou Associates

92.48 71.02 Associates

91.49 +.72

28.06 19.62 RRSP

27.33 -.04

CI Investments Inc. C$

18.95 15.85 oAmer Value Fd A 18.93 +.41

7.48

6.18 oCamAmerEqFd A

7.41 +.13

23.50 19.65 oCdn Invest Fd A

23.03 +.24

26.25 23.36 oCdn Small/Mid

25.80 +.15

7.00

6.15 oGbHiDivAdvFdA

7.00 +.14

26.80 21.85 oGblSmlCompFdA 26.43 +.45

12.35

9.77 oGlobal Fd A

12.19 +.26

10.03

9.71 oIncAdvantageFdA 10.03 +.05

10.57

9.86 oIncome

10.51 +.11

5.40

5.34 oS-Term Bond

5.38 unch

5.92

5.74 oSigCdnBondFd A

5.86 -.01

17.36 13.95 oSigEmMktsFd A

16.53 +.21

10.98

9.96 oSigGloDivFd A

10.87 +.18

CI Cambridge Funds C$

12.17 10.69 oCamCdnAACC A 12.15 +.16

13.21 10.58 oCamCdnEquCC A 13.19 +.21

12.31

9.87 oCamGblEquCC A 12.23 +.28

CI Corporate Class C$

12.25 10.31 oAmer Val CC A

12.24 +.27

12.75 10.53 oAmerMgrsCC A

12.72 +.27

7.99

6.40 oAmSmlCompCC A 7.92 +.14

13.02 10.02 oBCGblLdrsCC A

12.70 +.25

13.79 10.13 oBCIntlEquCC A

13.46 +.37

5.12

4.23 oCamAmerEqCC A 5.07 +.09

18.50 15.58 oCdn Inv CC A

18.14 +.19

10.27

8.60 oGbHiDivAdvCCA 10.27 +.21

34.37 23.22 oGblHlthSciCCA

34.37 +.93

26.30 23.07 oHarbCorpCl A

25.59 +.04

13.58 11.50 oHarbFgnG&ICCA 13.53 +.22

11.25 10.16 oHarbGw&InCC A 11.01 +.02

12.42 10.23 oHarForeEqCC A

12.35 +.22

11.01

9.99 oIncome CC A

10.99 +.13

11.93

9.57 oIntlValueCC A

11.89 +.29

10.22 10.17 oSh-TrmAdvCC A 10.21

_

17.55 15.00 oSig Div CC A

17.42 +.19

9.60

7.74 oSig Intl CC A

9.47 +.23

15.28 14.63 oSigCdnBondCCA 15.28 unch

39.28 33.21 oSigCdnResCC A

35.73 -.10

15.79 14.65 oSigCorpBndCCA 15.79 +.02

12.94 11.57 oSigDvrYldCC A

12.94 +.13

16.12 13.03 oSigEmMktsCC A 15.36 +.20

47.12 37.64 oSigGbEnergCCA 45.29 +.43

11.04

9.33 oSigGbIn&GwCCA 10.95 +.16

16.89 13.61 oSigGbSc&TeCCA 16.26 +.43

24.61 22.04 oSigHighIncCCA

24.59 +.16

15.67 13.78 oSigInc&GwCC A

15.48 +.14

21.59 18.26 oSigSelCdnCC A

21.04 +.23

11.80

9.67 oSynAmerCC A

11.76 +.24

4.95

3.89 oSynGlobalCC A

4.94 +.13

CI Investments Inc. Cl F

21.26 18.19 Harbour Fund F

20.68 +.04

CI Investments Inc. Cl I

23.20 19.33 nAmer Value Fd I

23.18 +.51

14.66 11.50 nCamCdnEquCC I 14.64 +.24

14.43 11.33 nCamGblEquCC I

14.34 +.34

12.94 11.56 nCdn Sm/Mid

12.70 +.08

7.32

6.41 nGbHiDivAdvFd I

7.32 +.16

17.45 15.69 nHarbGw&IncFd I 17.10 +.04

23.49 19.87 nHarbour Fund I

22.88 +.06

11.08

9.92 PSBaGrowthFdI

11.05 +.13

26.07 23.23 PSBalancedFdI

26.03 +.29

11.08 10.26 PSConserBaFdI

11.07 +.11

13.93 12.84 PSConservFd I

13.92 +.12

15.69 13.78 PSGrowthFd I

15.63 +.22

10.94 10.40 PSIncomeFund I

10.94 +.09

11.49

9.65 PSMaxGwthFd I

11.41 +.18

11.81 10.78 nSeIncAdvMgCCI 11.81 +.05

9.21

8.58 nSigCdnBalFd I

9.11 +.08

15.07 14.19 nSigCdnBondCCI

15.07 unch

10.75 10.44 nSigCdnBondFd I

10.69 unch

10.68 10.31 nSigCorpBondFd I 10.68 +.02

10.92

9.50 nSigDividendFd I

10.81 +.12

13.97 12.22 nSigDvrYldCC I

13.97 +.14

8.03

7.72 nSigGbBondFd I

8.03 +.01

8.00

6.95 nSigGbIn&GwFd I

7.91 +.12

16.15 14.27 nSigHighIncCCI

16.14 +.11

13.26 12.28 nSigHighIncFd I

13.20 +.09

9.54

8.72 SigInc&GwFd I

9.38 +.09

13.82 11.54 nSynCdnCorpClI

13.62 +.16

10.21

9.10 nTactical AA I

10.12 +.09

CI Investments Inc. Cl Z

12.31 10.36 oSeCdnEqMgdCC Z 12.15 +.08

11.25 10.46 oSeIncAdvMgCCZ 11.25 +.04

11.67

9.12 oSeIntlEqMgdCC Z 11.67 +.37

13.06 10.76 oSelUSEqMgdCC Z 13.03 +.27

12.44 10.59 oSynCdnCorpClZ

12.24 +.15

CI Harbour Funds C$

18.92 16.91 oHarbGw&IncFd A 18.49 +.03

15.62 13.98 oHarbGw&IncFd Z 15.28 +.03

22.24 19.20 oHarbour Fund

21.62 +.04

CI Investments Corp Cl E

11.20 10.44 oSeIncAdvMgCCE 11.20 +.05

CI Investments CC O

11.54 10.55 oSeIncAdvMgCCO 11.54 +.05

12.82 11.24 oSigDvrYldCC O

12.82 +.13

12.44 11.01 oSigHighIncCCO

12.43 +.08

CI Investments Inc. Cl T5

10.96 10.20 oSigDvrYldCC T5

10.96 +.10

10.57

9.82 oSigHighIncCCAT5 10.52 +.07

CI Investments Inc. Cl T8

9.90

9.44 oSigDvrYldCC T8

9.90 +.10

8.79

8.35 oSigHighIncCCAT8 8.73 +.05

CI Opps Funds C$

247.20 228.12 ynTri Glo Opp C$ 247.20

_

CI Portfolio Select Ser A

11.04

9.51 oSe30i70eMPCCA 11.02 +.15

11.31

9.88 oSe40i60eMPCCA 11.30 +.14

11.56 10.24 oSe50i50eMPCCA 11.55 +.13

11.79 10.58 oSe60i40eMPCCA 11.79 +.12

12.07 10.97 oSe70i30eMPCCA 12.07 +.10

12.32 11.33 oSe80i20eMPCCA 12.32 +.08

11.24 10.47 oSeIncAdvMgCCA 11.24 +.04

CI Portfolio Funds

13.52 11.76 oPSBaGrowthFdA 13.48 +.16

24.59 21.82 oPSBalancedFdA

24.55 +.27

13.53 12.18 oPSConserBaFdA 13.51 +.13

14.07 12.93 oPSConservFd A

14.06 +.11

13.09 11.20 oPSGrowthFd A

13.02 +.17

11.55 11.00 oPSIncomeFund A 11.55 +.08

12.51 10.44 oPSMaxGwthFd A 12.40 +.20

CI Corporate Class F

26.45 23.58 nSigHighIncCCF

26.43 +.18

CI Signature Class F

10.59

9.86 nSigDvsYldFd F

10.59 +.11

13.23 12.27 nSigHighIncFd F

13.17 +.08

4.92

4.50 SigInc&GwFd F

4.83 +.04

CI Signature Funds C$

17.81 14.53 oCan-AmSmCpCCA 17.48 +.06

19.36 16.37 oSig CdnRessFd A 17.66 -.06

15.93 14.40 oSigCdnBalFd A

15.72 +.13

11.50 10.40 oSigCdnBalFd U

11.35 +.10

10.40

9.43 nSigCdnBalFd Z

10.26 +.08

10.10

9.79 bSigCorpBondFd A 10.10 +.02

13.11 11.42 oSigDividendFd A 12.97 +.14

11.02

9.60 oSigDividendFd X 10.91 +.12

11.10

9.66 oSigDividendFd Z 10.98 +.11

10.57

9.85 oSigDvsYldFd A

10.57 +.10

7.96

6.94 oSigGbIn&GwFdA

7.86 +.11

14.51 13.46 oSigHighIncFd A

14.44 +.09

4.70

4.32 oSigInc&GwFd A

4.62 +.04

20.11 16.89 oSigSelCdnFd A

19.59 +.22

CI-Synergy Mutual Funds

13.28 10.86 oSyn Amer Fd A

13.24 +.27

14.86 12.65 oSynCdnCorpClA 14.62 +.17

-CI-SW Essent Retail Inc

11.53 10.22 oCIHarbBdl Inc

11.28 +.02

11.87 10.50 oHrbDvrsBdlInc

11.66 +.04

11.66 10.07 oSigSelCdnBdlInc 11.46 +.09

CIBC Funds

9.58

7.94 nAsia Pacific Fd

9.46 +.09

17.70 16.29 nBalanced

17.46 +.10

14.23 13.83 nCanadian Bond

14.21 +.01

23.68 20.81 nCdn Equity Fund 22.61 +.01

17.02 14.62 nCdn Equity Val

16.19 +.06

27.07 23.69 nCdn Real Estate

27.01 +.32

33.42 28.01 nCdn Sm Cap

29.39 +.02

31.94 27.62 nDividend Growth 31.12 +.21

9.92

9.21 nDividend Income

9.75 +.05

12.14 10.34 nEmerging Mkts

11.23 +.03

30.98 23.25 nEnergy

25.76 +.40

14.29 10.99 nEuropean Equ

14.03 +.15

17.74 14.66 nFinancial Co

17.42 +.25

8.52

7.81 nGlo Monthly Inc

8.47 +.08

11.25 10.40 nGlobal Bond

11.17 .00

9.11

7.09 nIntl Equity Fd

9.10 +.18

12.97 12.34 nMonthly Income 12.70 +.05

20.27 12.10 nPrec Metals

12.10 -.88

12.03 11.89 nS-TermIncFd A

11.97 +.01

10.64

9.27 nU.S. Equity

10.57 +.22

13.52

9.99 nUSSmallComp A 13.07 +.28

CIBC Managed Portfolios

11.40 10.19 nMgd Bal Port A

11.34 +.09

10.91 10.46 nMgd Inc Port A

10.91 +.04

11.16

9.39 nMgdAggGwthPt A 11.00 +.13

11.39

9.90 nMgdBalGwthPt A 11.28 +.11

11.36

9.71 nMgdGrowthPort A 11.21 +.12

11.12 10.39 nMgdIncPlusPt A

11.11 +.06

8.57

8.10 nMgdMthlyInBaPtA 8.48 +.04

CIBC U$ Mgd Portfolios

15.18 13.45 nuManaged Bal

15.14 +.12

12.54 12.00 nuManaged Income 12.54 +.04

CIBC Index Funds

23.91 20.87 nCanadian Index

22.97 +.01

11.35 11.01 nCdn Bond Index

11.21 -.01

10.19 10.08 nCdn ST Bnd Ind

10.15 +.01

17.17 14.65 nEmergMksIndex-A 16.16 +.08

9.16

7.27 nIntl Index - A

9.16 +.21

10.36

8.46 nU.S. Index Fund

10.36 +.20

23.76 19.43 nUSBMktIndx-A

23.76 +.45

Compass Portfolio Series

16.14 13.89 y Bal Growth Pt

16.14 +.21

16.86 14.54 ynBal Growth Pt

16.86 +.23

15.81 15.08 ynBal Port F1

15.81 +.15

16.30 14.42 ynBalanced Pt

16.30 +.16

15.74 13.90 y Balanced Pt

15.74 +.14

14.53 13.32 y Con Balanced Pt 14.53 +.10

15.04 13.78 ynCon Balanced Pt 15.04 +.11

14.60 14.03 ynCons Bal Pt F1

14.60 +.10

12.63 11.95 ynConservative Pt 12.63 +.05

12.47 11.78 y Conservative Pt 12.47 +.05

16.40 13.74 y Growth Pt

16.40 +.26

16.65 13.98 ynGrowth Pt

16.65 +.27

Counsel Portfolio Service

13.12 12.53 oCGF Fixed Inc A

12.75 +.02

Counsel Portfolio Serie E

12.76 10.93 nCGF Growth Pt E 12.73 +.18

12.95 11.61 nCGFBalancedPt E 12.94 +.14

6.86

6.34 nIncomeMgdPt E

6.36 +.02

Counsel Portfolio Series

13.48 12.47 oCGF ConservPt A 13.48 +.10

12.50 10.68 oCGF Growth Pt A 12.47 +.17

13.42 12.24 oCGF ManagedPt A 13.28 +.09

13.24 11.85 oCGFBalancedPt A 13.22 +.14

6.71

6.17 oIncomeMgdPt A

6.19 +.02

7.45

7.09 oRegularPayPt A

7.36 +.08

-Desj Fin Secur-Helios

7.49

6.87 yoGIF CdnBalFid 5

7.45 +.05

Desjardins Fin Security

14.62 11.79 ynBGoodmanCdnEqFd 14.39 +.19

12.18 11.75 ynBGoodmanIncomFd 12.14 -.01

27.29 23.41 y BlackRActCdnEqu 26.65 +.27

17.65 16.72 y BlacRUniBIndxFd 17.59 -.01

17.00 13.70 y BlacRUSEquIdxFd 17.00 +.30

10.17

9.91 ynDGAM U Bond Idx 10.13 -.01

307.53 275.86 y Fiera BalDiv

305.92 +2.17

610.59 576.36 y Fiera Bond

608.61 +.40

22.20 20.64 y Fiera LT Bd

22.00 -.07

685.86 598.23 y FieraCanEqGr

667.19 +8.59

15.90 13.04 y Hexavest Glo Eq 15.90 +.37

18.48 15.88 y JF Balanced

18.48 +.20

26.86 21.96 y JF Cdn Equity

26.57 +.41

44.61 39.00 y MFSMB BalGro

44.32 +.37

18.13 16.64 y Multi-Mgt 35/65 18.13 +.10

18.28 16.44 y Multi-Mgt 50/50 18.28 +.14

19.15 16.88 y Multi-Mgt 65/35 19.15 +.20

19.77 17.04 y Multi-Mgt 80/20 19.76 +.26

Desjardins Investments

10.88 10.05 nBal Inc Pt

10.88 +.06

11.08 10.05 nBalGroPt

11.07 +.07

11.14 10.05 nCCBalGroPt

11.13 +.07

10.91 10.04 nCCBalIncPt

10.90 +.05

10.75 10.05 nCCConsPt

10.75 +.04

10.19

9.89 nCCConsT4Pt

10.19 +.04

11.42 10.16 nCCGroPt

11.40 +.08

10.71 10.07 nConsPt

10.71 +.04

15.46 12.85 nDiv Growth Fd

15.32 +.22

11.28 10.05 nGro Pt

11.26 +.09

11.68 10.15 nHgGroPt

11.65 +.11

12.58 10.04 nOverseas EqGro 12.29 +.25

12.93 11.92 nSocTerBal

12.90 +.07

14.64 12.65 nSocTerGro+

14.50 +.13

12.17 11.60 nSocTerSecMkt

12.17 +.04

Dynamic Alt Strategies

8.00

7.55 yoAlphaPerfFd A

7.78

_

Dynamic Aurion

11.06 10.64 yoAurTReBondClA 11.04 unch

10.00

9.58 yoAurTReBondFdA 9.68 -.01

10.15

9.79 ynAurTReBondFdF 9.91 -.01

Dynamic Blue Chip Funds

13.05 12.08 yoBlue Chip Bal-G 12.41 +.12

13.02 12.06 yoBlue Chip Blncd 12.40 +.12

13.26 12.36 yoBlue Chip Eqty

13.10 +.21

Dynamic Funds Class F

13.28 12.54 ynAdv Bond Cl F

13.28 +.01

5.22

5.13 ynAdvantBondFd F 5.21 unch

7.15

6.71 ynAlphaPerfFd F

6.98

_

6.27

5.16 ynEnergyIncFd F

5.38 +.09

8.26

7.63 ynEquityIncomeFdF 8.16 +.07

2.42

2.34 ynHigYldBondFdF

2.36 +.01

63.75 52.10 ynPwr Hedge Fd FC 56.13

_

8.72

7.00 ynPwrAmeGwthFdF 7.91 +.09

15.21 13.86 ynStratYieldCl F

15.16 +.08

14.40 13.55 ynStratYieldFd F

14.31 +.07

Dynamic Income Funds

9.44

9.44 yo$-CostAveragFdA 9.44 unch

13.18 12.52 yoAdv Bond Cl A

13.17 +.01

10.84 10.66 yoAdv Bond Cl T

10.81 +.01

5.22

5.14 yoAdvantBondFd A 5.21 unch

5.24

5.15 yoAdvantBondFd G 5.23 unch

5.97

5.85 yoCanadianBondFdA 5.95 unch

5.98

5.85 yoCanadianBondFdG 5.96 unch

13.16 12.17 yoCdnDividendFd G 12.86 +.14

10.34

9.95 yoCorpBdStratFd A 10.20

_

12.39 11.51 yoDiv Income Cl A 12.34 +.05

10.19

9.02 yoDividend Fund A 10.08 +.13

13.64 12.79 yoDividendIncFd A 13.56 +.06

13.69 12.82 yoDividendIncFd G 13.61 +.06

6.77

5.56 yoEnergyIncFd A

5.77 +.09

17.91 16.56 yoEquityIncomeFdA 17.70 +.14

17.97 16.60 yoEquityIncomeFdG 17.75 +.14

2.23

2.17 yoHigYldBondFd G 2.18 +.01

2.22

2.15 yoHigYldBondFdA

2.16 +.01

10.09

9.97 yoShtTermBndFdA 10.00 unch

10.94 10.23 yoSmall Bus Fd A

10.91 +.09

10.98 10.26 yoSmall Bus Fd G

10.95 +.10

14.56 13.39 yoStratYieldCl A

14.51 +.07

14.63 13.44 yoStratYieldCl G

14.58 +.07

11.57 11.06 yoStratYieldCl T

11.42 +.06

14.24 13.44 yoStratYieldFd A

14.15 +.07

14.29 13.47 yoStratYieldFd G

14.20 +.07

Dynamic Managed Portfolio

21.96 10.50 y ResourceClass A 10.74 +.24

Dynamic Power Funds

7.48

5.88 yoAmer Curr Neut

6.58 +.09

9.62

7.68 yoPwrAmeGwthFd 8.64 +.10

7.31

5.87 yoPwrAmGwthCl A 6.63 +.08

8.40

7.65 yoPwrBalancedFd A 8.29 +.15

8.41

7.66 yoPwrBalancedFd G 8.30 +.15

19.03 16.39 yoPwrCdnGwthFd A 18.46 +.50

19.10 16.44 yoPwrCdnGwthFd G 18.54 +.51

8.69

7.39 yoPwrGbGwthCl A 8.20 -.02

15.39 12.84 yoPwrSmallCapFd A 14.78 +.10

Dynamic Specialty Funds

10.72

9.98 yoAlt Yld A

10.72 +.11

8.87

7.93 yoDiveReaAssetFdA 8.06 +.13

23.17 15.38 yoFoc+ResourcFd 15.80 +.36

22.97 15.23 yoFoc+ResourcFd G 15.65 +.36

25.34 22.63 yoGbReaEstateFd A 25.32 +.40

Dollar

chg

+1.31

Abbreviations

n - no sales charge

g - redemption

charge

o - optional front

end or redemption charge

y - delayed NAVPS

z - not available

for purchase

13.10 11.44 yoGlo Infrastruct

13.10 +.17

8.56

4.96 yoPrecMetalsFd A

5.00 +.04

8.58

4.97 yoPrecMetalsFd G

5.02 +.05

14.35 13.00 yoRE&Infr Inc Fd

14.35 +.17

14.06

9.62 yoStratGoldCl A

9.68 +.06

Dynamic Strategic Port

5.55

5.33 yoStrat Inc Pt A

5.55 +.04

14.14 12.76 yoStratGrowthPt A 14.00 +.16

Dynamic Value Funds

15.84 14.03 yoAmerValueFd A 15.68 +.27

13.11 12.13 yoCdnDividendFd A 12.80 +.13

12.96 10.33 yoCdnValueClass A 12.80 +.28

11.78

9.97 yoDiv Advant Fd A 11.71 +.24

11.92 10.22 yoDiv Advtg Cl A

11.88 +.22

21.27 16.51 yoFarEastVaFd

20.41 +.11

10.80

9.75 yoGbAsseAlloFdA 10.65 +.07

11.39 10.24 yoGblDivFdA

11.39 +.15

17.70 13.43 yoGblValueFd A

17.53 +.29

17.29 14.94 yoGlobalDiscFd G 17.08 +.35

17.20 14.88 yoGlobalDiscFdA

16.99 +.35

11.89 10.18 yoValue Bal Cl A

11.82 +.16

19.08 16.81 yoValue Bal Fd A

18.93 +.27

19.13 16.85 yoValue Bal Fd G

18.98 +.27

38.42 30.68 yoValueFdOfCan A 37.93 +.82

38.53 30.75 yoValueFdOfCan G 38.05 +.83

DynamicEdge Portfolios A

11.52 10.68 yoBalancedPort G 11.50 +.09

11.50 10.66 yoBalancedPortA 11.47 +.08

11.75 10.85 yoBalClPort A

11.72 +.09

11.31 10.29 yoBalGroClPt A

11.26 +.11

11.32 10.21 yoBalGrowthPt A

11.27 +.11

11.34 10.23 yoBalGrowthPt G

11.29 +.11

10.60

9.11 yoEquityPort A

10.46 +.15

11.15

9.82 yoGrowthPort A

11.06 +.13

-EdgePoint Wealth Mgmt

19.29 16.74 Canadian Pt

19.10 +.20

16.51 14.74 Cdn Gr & Inc Pt

16.41 +.14

16.28 13.50 Glo Gr&Inc Pt

16.03 +.18

18.58 14.31 Global Pt

18.17 +.28

-EdgePoint B

19.11 16.60 gCanadian Pt B

18.91 +.20

16.47 14.70 gCdn Gro & Inc B

16.36 +.14

16.17 13.42 gGlo Gr&Inc Pt B

15.94 +.18

18.41 14.20 gGlobal Pt B

18.01 +.27

-EdgePoint F

18.97 14.52 nGlobal Pt F

18.58 +.29

-EdgePoint I

19.24 14.64 nGlobal Pt I

18.85 +.29

Educators Financial Group

16.76 15.63 nBalanced

16.63 +.04

19.89 17.34 nDividend

19.52 +.16

18.78 15.73 nGrowth

18.52 +.17

11.56 11.45 nMortgage&Income 11.56 +.01

15.77 13.88 nN.A.Diversified

15.49 +.15

-Empire Fincncial Group G

11.69 10.22 oAggGrowthPt - G 11.48 +.10

24.64 22.18 oAsset Alloc - G

24.40 +.22

41.82 38.65 oBalanced - G

41.65 +.27

11.84 10.94 oBalanced Port-G 11.81 +.05

46.46 44.34 oBond - G

46.39 -.07

11.74 10.55 oDiv Balance - G

11.63 +.12

11.53 10.33 oElite Balance-G

11.41 +.11

11.70 10.48 oGrowth Port - G

11.56 +.08

16.25 15.45 oIncome Fund - G 16.25 +.03

11.63 10.57 oMod Growth Pt-G 11.56 +.08

-Empire Financial Group A

12.46 10.82 AggGrowthPt - H

12.25 +.11

Empire Life Investments A

10.54

9.44 oCdnEquMutFd A 10.26 +.09

10.85

9.58 oDivGwMutFd A

10.72 +.13

Empire Life Investments T

10.16

9.33 oDivGwMutFd T6

9.99 +.12

Empire Life Investments A

10.59

9.82 oEmb Bal Port A

10.58 +.07

11.06

9.59 oEmbAgGwthPt A 10.92 +.14

10.39

9.96 oEmbConserPt A

10.39 +.05

10.74

9.69 oEmbGrowthPt A 10.64 +.11

10.69

9.78 oEmbModerGwPt A 10.65 +.10

Empire Life Investments T

10.00

9.50 oEmbModerGwPt T6 9.91 +.09

9.85

9.40 oEmbModerGwPt T8 9.61 +.09

Empire Life Investments A

5.00

5.00 xoMonMktMutFd A 5.00 +.00

10.00

9.59 oMthIncMutFd A

9.92 +.06

Empire Life Investments T

9.89

9.52 oMthIncMutFd T6

9.70 +.06

Empire Life Investments A

9.95

8.54 oSmCapEqMutFd A 9.05 -.09

Ethical Funds

12.08 11.62 oCdn Bond Fund A 11.81 -.01

15.34 12.73 oEth Growth Fd A

15.01 +.15

15.73 14.15 oEthicalBalFd A

14.19 +.04

19.89 17.29 oEthicCdnDivFd A 19.57 +.16

10.46 10.12 oEthSelConsPt A

10.44 +.04

Excel Funds Management

5.36

4.88 oEM HgIncA

5.35 +.05

20.81 16.24 oIndia Fund

18.68 -.10

-Exemplar Portfolios

15.16 13.34 Cdn Focus Pt A

15.10 +.13

Fidelity Capital Struct

11.26 10.12 gBal Cl Pt A

11.25 +.09

10.55

9.88 gCdn AA Cl A

10.43 +.05

19.94 18.42 gCdn Bal Cl A

19.78 +.09

12.00 11.09 gDividend Cl A

11.94 +.12

11.87 11.00 gInc Cl Pt A

11.87 +.06

Fidelity Invest C$ Ser A

9.32

8.72 gAmHiYldCurNtrlA 9.32 +.05

10.40

9.34 gBal Port A

10.39 +.08

20.94 19.49 gCdn Bal Fd A

20.73 +.09

14.44 14.02 gCdn Bond

14.43 -.02

35.30 27.87 gCdn GrowthFd A 34.51 +.55

25.18 23.38 gCdnAAllocatFdA 24.93 +.13

28.00 24.14 gCdnDiscEquFd A 27.07 +.13

33.35 28.25 gCdnLargeCapFdA 33.14 +.22

12.76 10.56 gCdnLgCapCl A

12.68 +.08

18.89 16.43 gCdnOpportFd A

18.24 +.02

10.68 10.55 gCdnShtTrmBndFdA 10.67 +.00

11.84 11.05 gClrPath2010PtA

11.84 +.06

12.20 11.21 gClrPath2015PtA

12.19 +.07

12.36 11.26 gClrPath2020PtA

12.36 +.08

12.64 11.26 gClrPath2025PtA

12.61 +.10

12.70 11.23 gClrPath2030PtA

12.67 +.11

15.22 13.79 gDividend Fd A

15.15 +.15

15.76 13.87 gDividendPsFd A

15.75 +.21

10.27

9.11 gGlo Bal Pt A

10.26 +.09

13.91 13.08 gInc Alloc Fd A

13.91 +.04

10.69

9.95 gInc Port A

10.69 +.05

14.91 13.64 gMthly Inc Fd A

14.89 +.07

11.55 10.45 gMthlyIncCl A

11.54 +.06

16.21 12.79 gNorthStarFd A

16.21 +.18

33.82 25.81 gSmCapAmerFdA 33.41 +.49

18.95 15.07 gSpecSituaFd A

18.51 +.25

10.18

9.89 gTacFixIncFd A

10.06 -.01

30.62 26.18 gTrueNorthFd A

30.11 +.23

16.14 14.76 gUSMthlyIncA

16.14 +.14

Fidelity Invest U$ Ser A

11.14

9.74 guBal Cl Pt A U$

11.10 +.12

10.75

9.57 guCdn AA Cl A U$

10.29 +.08

19.99 17.84 guCdn Bal Cl A U$ 19.51 +.13

12.58 10.29 guCdnLgCapCl A U$ 12.51 +.11

11.76 10.60 guInc Cl Pt A U$

11.71 +.09

11.42 10.05 guMthlyIncCl A U$ 11.38 +.08

15.99 12.60 guNorthStarFd AU$ 15.99 +.22

33.16 25.19 guSmCapAmerFdAU$ 32.95 +.57

18.56 14.49 guSpecSituaFd AU$ 18.26 +.29

15.93 14.74 guUSMthlyIncA$U 15.92 +.18

Fidelity Invest C$ Ser F

10.68 10.55 nCdnShtTrmBndFdF 10.66 +.00

14.91 13.64 nMthly Inc Fd F

14.89 +.08

11.57 10.45 nMthlyIncCl F

11.56 +.06

Fidelity Capital Str B

11.37 10.22 Bal Cl Pt B

11.35 +.09

10.61

9.93 Cdn AA Cl B

10.48 +.05

20.03 18.51 Cdn Bal Cl B

19.87 +.09

24.09 20.80 CdnDiscEquClB

23.29 +.11

12.02 11.11 Dividend Cl B

11.96 +.12

11.93 11.05 Inc Cl Pt B

11.93 +.06

16.56 13.26 NorthStarCl B

16.56 +.18

-Fidelity Investments S5

15.75 15.19 BalIncPvPl S5

15.66 +.08

16.04 14.61 uBalIncPvPl S5U$ 15.45 +.12

14.61 13.76 Mthly Inc Fd S5

14.60 +.07

16.21 15.20 MthlyIncCl S5

16.19 +.08

16.06 14.62 uMthlyIncCl S5U$ 15.97 +.12

Fidelity Invest Series T8

10.48

9.95 gCdn Bal Fd T8

10.00 +.04

14.25 13.79 gInc Alloc Fd T8

14.12 +.04

12.78 12.27 gMthly Inc Fd T8

12.73 +.06

Fidelity Series B C$

11.57

9.66 AmDiscEqFd B

11.57 +.26

7.64

6.94 AmerHiYldFd B

7.56 +.02

9.32

8.73 AmHiYldCurNtrlB

9.32 +.05

11.00 10.15 AssetAlloPP B

10.98 +.06

11.71 10.79 BaIncCurNeuPPB 11.69 +.07

10.41

9.35 Bal Port B

10.40 +.08

13.66 12.25 BalancPvPl B

13.56 +.11

12.05 10.78 BalCurNeutPP B

12.00 +.11

12.97 11.99 BalIncPvPl B

12.95 +.07

20.95 19.50 Cdn Bal Fd B

20.73 +.09

14.44 14.02 Cdn Bond B

14.42 -.02

25.19 23.40 CdnAAllocatFdB

24.94 +.13

28.30 24.36 CdnDiscEquFd B

27.37 +.14

35.73 28.16 CdnGwthCompFd B 34.93 +.56

33.44 28.34 CdnLargeCapFdB 33.23 +.22

12.78 10.56 CdnLgCapCl B

12.70 +.08

19.00 16.51 CdnOpportFd B

18.36 +.02

10.69 10.56 CdnShtTrmBndFdB 10.67 +.00

11.78 11.07 ClearPathInPt B

11.78 +.05

11.85 11.06 ClrPath2010PtB

11.85 +.06

12.20 11.21 ClrPath2015PtB

12.19 +.07

12.37 11.27 ClrPath2020PtB

12.36 +.08

12.67 11.29 ClrPath2025PtB

12.64 +.10

12.80 11.32 ClrPath2030PtB

12.77 +.11

15.22 13.79 Dividend Fd B

15.15 +.15

15.77 13.87 DividendPsFd B

15.76 +.21

26.43 20.22 Europe Fd B

25.81 +.57

38.30 30.56 Far East Fd B

36.25 +.38

18.14 15.90 GbAAllocatFdB

18.13 +.22

10.27

9.11 Glo Bal Pt B

10.27 +.10

27.70 23.11 Global Fund B

27.58 +.65

10.68

9.18 Growth Pt B

10.66 +.12

13.91 13.08 Inc Alloc Fd B

13.91 +.04

10.69

9.95 Inc Port B

10.69 +.05

14.91 13.64 Mthly Inc Fd B

14.89 +.08

11.56 10.45 MthlyIncCl B

11.54 +.06

16.35 12.91 NorthStarFd B

16.35 +.18

11.20 10.68 PreFxInCpYPPB

11.19 -.01

10.17

9.87 PreTFxICYldPP B 10.04 -.01

34.44 26.24 SmCapAmerFdB

34.03 +.50

19.12 15.18 SpecSituaFd B

18.68 +.25

10.19

9.92 TacFixIncFd B

10.09 -.01

30.98 26.45 TrueNorthFd B

30.48 +.23

20.39 16.91 US Foc Stock B

20.22 +.48

16.15 14.76 USMthlyIncB

16.15 +.14

Fidelity Series B U$

11.45

9.31 uAmDiscEqFd B U$ 11.41 +.29

7.46

6.88 uAmerHiYldFd BU$ 7.46 +.04

10.87

9.83 uAssetAlloPP BU$ 10.83 +.09

11.25

9.84 uBal Cl Pt B U$

11.20 +.12

13.48 11.82 uBalancPvPl B U$ 13.38 +.15

12.92 11.58 uBalIncPvPl B U$ 12.77 +.10

10.82

9.62 uCdn AA Cl B U$

10.34 +.08

20.11 17.93 uCdn Bal Cl B U$

19.60 +.14

23.81 20.00 uCdnDiscEquClBU$ 22.97 +.17

12.60 10.29 uCdnLgCapCl B U$ 12.53 +.12

26.11 19.46 uEurope Fd B U$

25.46 +.62

u - US currency

x - ex-dividend

m - minimum purchase of $150,000

B - both front and

back end fee

(-) - non-member of

Investment Funds

Institute of Canada

37.16 29.40 uFar East Fd BU$

35.76 +.47

17.91 15.34 uGbAAllocatFdBU$ 17.89 +.27

27.28 22.23 uGlobal Fund BU$ 27.20 +.71

11.81 10.66 uInc Cl Pt B U$

11.77 +.09

11.42 10.05 uMthlyIncCl B U$ 11.39 +.09

16.34 13.07 uNorthStarCl BU$ 16.34 +.22

16.13 12.72 uNorthStarFd BU$ 16.13 +.22

11.04 10.69 uPreFxInCpYPPBU$ 11.04 +.02

33.78 25.62 uSmCapAmerFdBU$ 33.57 +.58

18.72 14.60 uSpecSituaFd BU$ 18.43 +.30

19.99 16.31 uUS Foc Stoc BU$ 19.94 +.52

15.94 14.74 uUSMthlyIncA$U 15.93 +.18

Fidelity Series I

13.40 11.73 uBalancPvPl I U$

13.29 +.14

12.81 11.47 uBalIncPvPl I U$

12.66 +.10

Fidelity Invest Series S8

10.61 10.10 Cdn Bal Fd S8

10.15 +.04

8.14

7.57 CdnAAllocatFdS8

7.61 +.04

12.99 12.49 Mthly Inc Fd S8

12.97 +.07

-Fidelity Investment T5

14.40 13.58 gMthly Inc Fd T5

14.38 +.07

16.16 15.18 gMthlyIncCl T5

16.14 +.08

16.04 14.61 guMthlyIncCl T5U$ 15.92 +.12

Fidelity Funds U$ Serie F

11.43 10.05 nuMthlyIncCl F U$ 11.40 +.09

-First Asset Funds Inc.

9.69

8.98 nCan Adv Convert

9.00 +.02

8.59

7.74 nCan-60 Inc Corp

8.06 -.05

11.35 10.46 oCdn Div Opp A

11.27 +.13

11.22 10.47 znCdnConDeb-NL 10.57 +.08

11.65 10.88 oCdnConvBd A

10.94 +.05

17.88 16.24 nDivers Conv Deb 16.30 +.04

10.07

9.37 nJFT Strateg A

10.06 +.04

9.02

8.52 nNA Adv Convert

8.58 +.04

11.27 10.95 nPref ShInvestTr

10.99 -.02

13.40 12.14 ynREIT Inc

13.39

_

-Formula Growth

4,483.21 3,713.78 yznForm Growth 4,672.27 _

FrnklnTmpltn-Bissett-F C$

92.57 75.02 nBiss Cdn Eq F

91.30 +1.14

29.28 24.40 nBiss Microcap F

27.91 +.22

17.67 15.79 nCan High Div-F

17.33 +.10

32.60 28.21 nCdn Bal F

32.54 +.27

FrnklnTmpltn-Bissett-A

29.33 26.15 oBis Div Inc A

29.18 +.34

79.64 65.20 oBiss Cdn Eq A

78.47 +.96

9.70

9.58 oBiss Cdn ST B A

9.62 unch

15.02 13.01 oBissCdnDiv A

14.83 +.20

13.00 12.67 oBissett Bond A

12.89 -.01

15.63 13.94 oCan High Div-A

15.17 +.09

27.85 24.39 oCdn Bal A

27.81 +.23

10.98 10.06 oStratIncFd A

10.95 +.04

Frnklin Tmpltn Class F C$

10.61

9.84 nGlobalBondFd F

10.53 +.04

Frnkln Tmpltn-TempletonC$

16.26 13.19 oBRICCorpCl A

14.68 +.07

8.72

7.80 oCdn Bal Fd A

8.47 +.05

12.56 10.62 oCdnStockFd A

12.00 +.11

10.18

8.38 oEmergMktsFd A

9.49 +.02

18.08 13.83 oGbSmlCompFd A 17.97 +.47

10.72

9.56 oGlo BdHdgYldClA 10.70 +.08

9.94

9.26 oGlobalBondFdA

9.87 +.05

11.44

8.97 oGrowthFd,LtdA

11.31 +.26

14.69 11.76 oIntlStockFd A

14.36 +.27

FrnklnTmpltn-MutualSer C$

17.82 14.11 oGbDiscoverCCA

17.71 +.29

14.81 11.88 oGbDiscoverFdA

14.72 +.24

FrnklnTempltn Investments

8.66

8.14 oBal Growth Pt T

8.54 +.07

9.71

9.33 oBal Income Pt T

9.62 +.05

FrnklnTempltn Investments

6.97

6.15 oBal Growth Pt A

6.91 +.05

6.72

6.17 oBal Income Pt A

6.70 +.03

12.99 11.54 oBalGrowthCCPt A 12.89 +.11

13.25 11.99 oBalIncomeCCPt A 13.21 +.07

11.20 10.57 oDivers Inc Pt A

11.20 +.05

4.48

4.34 oDivers Inc Pt T

4.42 +.02

14.44 13.30 oDvrsfIncCCPtA

14.44 +.07

7.42

6.12 oGbl Gro Pt A

7.36 +.12

12.07 10.40 oGrowth CCPt A

11.92 +.13

6.48

5.53 oGrowth Port A

6.40 +.07

Franklin Templeton T

9.74

9.13 oBalGrowthCCPt T 9.51 +.08

13.76 13.20 oDvrsfIncCCPtT

13.71 +.06

-Front Street Capital

15.03 13.53 y Cdn Hedge Fd B

14.12 +.14

8.22

7.52 gDvrsfIncCl A LL

7.53 -.02

8.28

7.59 DvrsfIncCl B FE

7.60 -.02

7.45

5.86 gGrowth Fund A

6.08 +.04

7.45

5.85 Growth Fund B

6.07 +.04

11.11

7.62 y MLPIncFdIILtd C 10.99 +.29

8.81

6.35 Resource Cl BFE

6.42 +.00

7.56

5.77 gSpecOppCl A(LL)

6.39 +.07

7.56

5.77 SpecOppCl B(FE)

6.39 +.07

7.80

5.95 SpecOppCl Y(FE)

6.63 +.07

-GBC Funds

21.86 18.09 ynGBC Amer Gro

21.39 -.42

18.51 14.88 ynGBC Intl Gro

18.24 -.15

58.39 47.58 ynGBCCdnGrowth 57.70 +.08

Great-West Life 100/100

12.29 11.03 ygBal Pt 100/100

12.29 +.12

13.32 10.65 ygG E (S) 100/100 13.32 +.26

12.19

9.67 ygIE (J)100/100

12.03 +.30

Great-West Life 75/100

12.61 10.94 ygAdv Pt 75/100

12.58 +.16

13.57 10.81 ygG E (S) 75/100

13.57 +.27

12.39

9.79 ygIE (J) 75/100

12.24 +.31

Great-West Life 75/75

13.60 10.82 ygG E (S) 75/75

13.60 +.27

12.49

9.85 ygIE (J) 75/75

12.33 +.31

12.68 11.78 ygInc (M) 75/75

12.67 +.05

12.62 11.74 ygMod Pt 75/75

12.62 +.06

-GrowthWorks Managed Funds

6.20

5.53 ynWOF Balanced 2 6.11

_

Harmony Investment Pools

11.99 11.50 oCdn FixInc(EFE)

11.74 -.01

Harmony One Ticket

11.53 10.59 oBalanced Pt E

11.50 +.05

11.38 10.85 oConserv Pt E

11.38 +.02

11.23 10.01 oGrowth Pt E

11.15 +.07

-Highstreet Asset Mgmt

15.25 14.05 nBalanced

15.16 +.12

11.46 11.09 nCdn Bond

11.27 -.01

25.04 22.13 nCdn Equity

24.48 +.14

9.60

8.18 nUS Equity

9.58 +.18

HSBC Funds Advisor Ser C$

9.63

9.28 yoMonthly Income 9.59 +.03

HSBC Funds Inv Ser C$

9.25

7.57 ynBRICEquFd Inv

8.54 +.07

13.78 13.33 ynCdn Bond Inv Sr 13.74 -.01

22.74 20.43 ynCdnBalFdInvSr 22.55 +.19

19.42 14.93 ynChinEquFd InvSr 17.51 -.11

29.66 25.54 ynDivIncFd InvSr

29.02 +.27

10.90 10.03 ynEMDebt Inv

10.89 +.15

36.98 31.96 ynEquityFd InvSr

35.90 +.29

9.72

9.23 ynMonthly Income 9.68 +.03

11.63 11.59 ynMortgage Inv

11.62 +.00

34.86 27.69 ynSmlCpGwFd InvSr 34.86 +.40

11.23 10.43 ynuUSD MthlyInc In 11.23 +.07

12.04 10.77 ynWSDvrBalFd Inv 11.97 -.05

11.46 10.86 ynWSDvrConsFdInv 11.43 -.01

12.39 10.71 ynWSDvrGwthFd Inv 12.28 -.08

11.57 10.75 ynWSDvrMConFd Inv 11.53 -.02

IAClarington Investments

14.34 12.81 yoBalancedPort A 14.32 +.15

12.82 12.47 yoBond Fund A

12.77 -.02

26.53 23.41 yoCdnConserEqFd A 26.01 +.35

13.08 11.27 yoCdnLeadersFd A 12.69 +.15

7.78

7.18 yoDivGrowthFd T10 7.46 +.07

10.04

9.14 yoDivGrowthFd T6 9.76 +.09

10.79 10.04 yoInhanMInSRIFdT6 10.74 +.09

5.95

5.59 yoMonthlyIncBalT8 5.77 +.06

IA Clarington Invest F

4.78

3.80 ynSarUSEquFd F

4.78 +.07

IAClarington Investments

22.06 19.23 yoStrat Equ Inc Y

22.05 +.30

IA Clarington Invest C$

4.22

3.76 yzoCdn Dividend A 3.82 +.03

24.50 20.90 yoCdn Growth A

23.80 +.27

19.29 17.09 yoCdnBalancedFd A 19.20 +.13

40.56 33.47 yoCdnSmallCapFd A 40.56 +.44

11.81

9.91 yoFocBalanceFd A 11.54 +.17

12.51

9.86 yoFocCdnEquCl A 11.99 +.16

13.58 12.23 yoGbTacIncFd A

13.58 +.13

14.45 10.53 yoGlobalOppFd A 14.29 +.43

12.91 11.99 yoReaRetBondFdAC$ 12.44 -.01

4.21

3.39 yoSarUSEquFd A

4.21 +.06

4.76

4.48 yoStrat Income Y

4.74 +.05

11.60 10.35 yoStrategIncFd A 11.60 +.11

10.77 10.23 yoStrCorpBondFd A 10.76 +.02

11.91 11.38 yzoTact Inc Cl T6

11.66 +.08

11.15 10.53 yzoTact Inc Cl T8

10.64 +.08

12.57 11.79 yoTact Inc Fd A

12.53 +.09

9.43

9.03 yoTact Inc Fd T6

9.32 +.07

12.60 12.32 yoTrgtClick2015 A 12.59 +.01

13.86 13.03 yoTrgtClick2020 A 13.86 +.04

14.13 12.90 yoTrgtClick2025 A 14.13 +.07

IA Clarington Series T

7.82

7.23 yoGbTacIncFd T6

7.81 +.08

10.81 10.25 yoTact Inc Fd T8

10.38 +.08

-IA Clarington X

3.89

3.52 yzoCdn Dividend X 3.62 +.03

Ind Alliance - Cdn Equity

16.58 14.43 yoIASRPDivGwth

16.21 +.14

Ind Alliance- Diversified

37.88 34.07 yoIASRP Diversif

37.52 +.32

16.60 15.33 yoIASRPTactInc-AH 16.53 +.12

15.60 14.41 yoxtraTactInc AH 15.55 +.11

IA - Focus

19.78 17.69 yoIASRPFocusBal 19.65 +.17

Ind Alliance - Income

32.31 31.09 yoIASRP Bonds

32.19 -.05

IA -Cdn Hybrid

10.89

9.77 yoIASRPDvGwHy7/2 10.72 +.07

IA - Glo Hybrid

11.56

9.86 yoIASRPUSE-SH7/2 11.56 +.11

Invesco Canada Core C$

15.83 13.77 oCoreCdnBalCl A

15.48 +.12

Invesco Canada Ltd

9.61

7.37 oCanadian Cl A

9.10 +.12

32.10 28.46 oCanadianBaFd A 31.73 +.14

14.50 12.04 oCdnPremGwCl A 14.03 +.12

23.64 19.66 oCdnPremGwthFd A 23.08 +.20

12.43 10.25 oDvrsYieldCl A

12.19 +.07

7.31

6.01 oGblGrowthCl A

7.21 +.12

12.74 10.44 oIncome Class

12.45 +.07

3.33

2.91 oIncome Class T8

3.28 +.02

10.73

8.65 oIntlGrowthClA

10.62 +.20

Invesco Canada Ltd U$

7.15

5.79 ouGblGrowthCl AU$ 7.11 +.13

10.50

8.32 ouIntlGrowthClAU$ 10.48 +.22

10.47

9.94 ouIntStraYldPtAU 10.18 +.05

Invesco Canada Ltd

4.55

4.40 oAdvantBondFd A

4.52 +.01

6.37

6.19 oCanadian Bond

6.36 -.01

22.26 18.21 Canadian SC

21.51 +.28

23.64 19.32 oCanadian Sr A

22.83 +.30

6.75

6.40 oCdn Bond Cl P

6.74 -.01

12.76

9.93 oCdn Endeav

12.61 +.21

11.51

8.89 oCdn Pl Div Cl A

11.13 +.10

8.20

7.23 oCdn Small Co

8.02 +.11

10.05

7.58 oEuroplus

10.03 +.21

9.91

7.29 ouEuroplus U$

9.90 +.24

8.45

8.28 oFlRateInc A

8.44 +.01

8.68

7.98 ouFlRateIncFd AU$ 8.32 +.03

15.42 12.51 oGbFdamEqFd A

15.42 +.33

15.26 12.03 ouGbFdamEqFd AU$ 15.21 +.36

3.48

3.33 oGl High Yld Bd

3.40 +.01

10.02

8.49 oGlo Div Cl A

10.02 +.18

9.90

9.17 ouGlo Div Cl A U$

9.88 +.20

15.59 13.21 oGlo Endeavour

15.58 +.33

15.43 12.74 ouGlo EndeavourU$ 15.36 +.36

9.07

7.95 oGlobalBalFd A

9.07 +.16

8.97

7.65 ouGlobalBalFd AU$ 8.94 +.18

17.40 14.77 oGlobalEndCl A

17.39 +.37

17.22 14.23 ouGlobalEndCl AU$ 17.14 +.41

4.85

4.79 oGovPlusIncFd A

4.81 +.00

11.66 10.07 oIncome Gro A

11.52 +.11

11.20

9.67 Income Gro SC

11.08 +.11

10.95 10.31 oIntaBalIncPt A

10.94 +.02

11.35 10.39 oIntacBalGwPt A

11.32 +.05

11.83 10.50 oIntactGwthPt A

11.77 +.07

10.42

9.93 oIntDvrsIncPt A

10.42 +.01

10.43 10.01 oIntStraYldPtA

10.32 +.02

18.03 14.04 oResources Fund

15.40 -.29

14.00 11.60 oSelCdnEquFd A

13.58 +.12

10.52

8.71 oSelectBalFd A

10.30 +.10

30.51 25.46 Trimark C$ SC

30.42 +.47

31.26 26.01 oTrimark C$ Sr A

31.13 +.47

30.11 24.49 uTrimark U$ SC

29.99 +.53

30.82 25.01 ouTrimark U$ Sr A 30.70 +.54

6.55

5.35 ouU.S. Comp U$

6.52 +.15

6.70

5.53 oU.S. Companies

6.61 +.13

9.84

8.12 oU.S.CompCl A

9.71 +.19

9.63

7.85 ouU.S.CompCl A U$ 9.58 +.21

21.67 17.50 oUS Sm Co Cl A

21.27 +.36

21.21 16.92 ouUS Sm Co Cl U$ 20.97 +.41

Invesco Canada Series F

12.26 12.22 nS-TermIncCl F

12.26 +.00

Invesco Canada Ltd F U$

12.64 11.75 nuS-TermIncCl FU$ 12.09 +.03

Invesco Canada Series P

10.83 10.12 oIntaBaIncPClP

10.80 +.02

11.47 10.78 oIntaBalIncPt P

11.46 +.02

11.69 10.68 oIntacBalGwPt P

11.66 +.05

11.90 10.54 oIntactGwthPt P

11.83 +.07

Investors Group

15.76 13.96 iCanadian Equity

15.24 +.05

13.21 12.07 iCdn Balanced

12.76 +.07

11.69 11.40 iCdn Bond

11.61 .00

10.86 10.41 iCdn H.Y. Income

10.86 +.03

18.27 14.95 iCdn Large Cp Vl

17.67 +.16

21.92 14.80 iCdn Nat Res

14.80 -.46

31.47 26.37 iCdn Small Cap

26.37 -.21

14.90 12.68 iCdn Sml Cap Gro 13.37 +.01

10.59 10.29 iCdnCpBdFdC

10.59 +.00

11.36 10.00 iCdnEqIncFd C

11.06 +.10

10.50

9.37 iCorCdnEqtyFdC

9.83 -.02

12.41 10.40 iCoreUSEquFdSrC 12.41 +.24

10.12 10.08 iCornStonIIIPC

10.12 +.00

10.12 10.08 iCornStonIPC

10.11 +.00

22.27 19.31 iDividend

21.70 +.27

20.46 15.76 iEuro MC Equity

20.22 +.45

10.98

8.47 iEuropean Equity

10.81 +.18

10.31 10.15 iFixed IncFlex C

10.31 +.01

9.80

8.06 iGlo Real Est

9.80 +.23

7.32

6.30 iGlo Sci & Tech

6.62 +.11

13.67 10.79 iGlobal

13.56 +.35

5.25

5.02 iGlobal Bond

5.25 +.01

7.47

6.36 iGlobal Dividend

7.46 +.15

12.10

9.71 iGreater China

10.94 +.21

10.83

9.01 hGrowth

10.70 +.18

9.56

8.53 iGrowth Plus

9.51 +.10

12.36

9.93 iIG Cdn Gro

9.93 -.10

6.15

6.06 iIncome

6.15 +.00

7.66

7.24 bIncome Plus

7.62 +.03

6.15

4.61 iJapanese Equity

6.15 +.31

9.28

7.88 iMergers & Acq

9.08 +.10

5.11

5.08 iMtg&ShTrmInc

5.09 +.00

17.89 15.87 iMutual of Cda

17.56 +.11

20.04 17.74 iNorth Amer Equ

19.72 +.28

10.65

8.98 iPacific Intl

10.29 +.15

10.51

8.78 iPan Asian Gro

10.51 +.31

12.58 10.57 iPutnam USGroFdC 12.55 +.28

21.01 18.32 iQuebec Ent

20.42 +.34

8.52

7.14 iRetire Gro

8.25 +.07

6.81

6.27 iRetire Plus

6.71 +.03

12.03 10.49 iSumma SRI

11.70 +.10

11.68

9.64 gUS Div Growth

11.67 +.22

61.80 51.09 iUS LgCap Val

61.80 +1.23

19.79 15.94 iUS Opport

19.71 +.33

Investors Group Series A

13.74 13.16 gCap Yld A

13.74 +.01

12.32 11.52 gRRBond A

12.03 -.02

11.91 11.64 gShTermCapYld A 11.91 +.01

Inv Group/Bissett Ser C

12.09

9.79 iIG Biss CdnEquC

11.90 +.14

Investors Grp Corp Class

16.69 13.54 gCdn Large Cp Vl

16.14 +.15

22.12 18.97 gCdn Sml Cap

18.97 -.16

20.24 15.37 gEuro Mid-Cap Eq 20.01 +.44

14.10 10.74 gGlo Health Care

14.10 +.28

27.09 20.44 gGlo Nat Res

20.72 +.06

14.49 11.44 gGlobal Class

14.36 +.36

22.12 19.16 gIG FI CdnEqu Cl

21.38 +.11

23.93 18.39 gIntl Sml Cap

23.76 +.58

13.78 11.89 gMac Ivy For Eq

13.78 +.17

27.45 22.93 gMac Unv Em Mkts 26.14 +.29

10.74

9.21 gMac Unv US GrLd 10.74 +.30

12.80

7.91 gMacGlPreMetClA 7.91 -.65

11.22

9.28 gUS Large Cp Vl

11.22 +.22

Inv Group/AGF

19.63 17.55 iCdn Balanced

19.55 +.14

16.39 14.70 iCdn Div Grow

15.21 -.07

18.18 15.36 iCdn Growth

17.64 +.05

12.09

9.91 iGlobal Equity

12.08 +.29

6.29

5.34 iUS Growth

6.22 +.12

Investors Group/Allegro

8.99

7.73 bAggr Cda Focus

8.80 +.08

8.36

7.32 iAggressive

8.19 +.09

10.55 10.14 gConservative

10.55 +.04

9.91

8.84 iMod Agg Cda Foc

9.81 +.09

9.76

9.18 gModConsPt C

9.73 +.06

9.57

8.75 gModerate

9.48 +.07

9.86

8.72 iModerate Agg

9.82 +.12

Inv Group/Allegro Ser A

11.91 10.63 gBal Port Cl A

11.82 +.08

12.19 10.52 gBalGroPortClA

12.07 +.13

Inv Group/Alto Ser C

8.80

7.80 iAggr Can Foc C

8.52 +.06

10.58

9.14 iAggressive Pt C

10.38 +.14

10.40

9.96 iConservative C

10.40 +.04

9.56

8.20 iMlyInc&GlGro C

9.50 +.14

9.05

8.30 iMod AggCanFocC 8.80 +.05

9.95

8.93 iModerate Agg C

9.84 +.11

10.38

9.76 iModerate Cons C 10.38 +.07

9.85

9.03 iModerate Port C

9.74 +.08

10.40

9.91 iMonthly Inc C

10.38 +.04

10.54

9.61 iMthly Inc&EGr

10.45 +.09

10.54

9.82 iMthlyInc&Gr C

10.46 +.06

Inv Group/Beutel

16.59 14.71 iCdn Balanced

16.46 +.15

21.17 17.36 iCdn Equity

20.80 +.28

23.30 19.97 iCdn Small Cap

22.83 +.08

Inv Group/FI

13.73 11.93 iCdn Equity

13.28 +.07

12.82 11.07 iFI US LgCpEqFdC 12.82 +.30

13.86 12.88 iIG FI Cdn Alloc

13.73 +.08

Inv Group/Goldmansachs

10.02

8.50 iUS Equity Fd C

10.01 +.21

Inv Group/Mackenzie

16.94 14.70 iDividend Growth 16.55 +.11

11.58 11.26 oIncome

11.52 .00

11.61

9.84 iIvy European

11.57 +.20

Inv Group/Mackenzie Ser C

9.88

8.85 iCdn Equ Gro

9.57 +.04

9.13

6.88 gCundill GlVal C

9.02 +.17

Inv Group/Sceptre/Putnam

10.61

9.77 gPutUSHgYldInc C 10.61 +.07

Inv Group/Templeton

9.11

6.94 iIntl Equity

8.90 +.19

Lakeview Asset Mgmt

13.42 12.72 oHigh Income

13.36 +.13

-Leith Wheeler

37.83 31.10 nCdn Equity B

36.94 +.41

London Life Funds 100/100

11.87 10.68 yg2030 Pr 100/100 11.83 +.10

12.04 10.72 yg2035 Pro100/100 11.98 +.12

11.91 10.58 ygAdv Pro 100/100 11.82 +.15

12.09 10.41 ygAgg Pro 100/100 11.93 +.19

14.19 12.07 ygAGr (A) 100/100 14.03 +.31

11.42

9.57 ygAsG (A) 100/100 10.81 -.03

12.33 10.83 ygBal (B) 100/100 12.27 +.11

11.80 10.74 ygBal Pro 100/100 11.76 +.11

11.48 11.07 ygBd (LC) 100/100 11.45 -.01

11.44 10.61 ygC B (M) 100/100 11.32 +.06

12.87 10.52 ygC E (B) 100/100 12.68 +.17

12.16 10.76 ygC E (G) 100/100 11.98 +.16

10.48

9.17 ygC E (LC)100/100 10.12 +.10

12.45 10.34 ygC Rs (M) 100/10 11.21 +.26

11.35 10.16 ygCEG (M) 100/100 11.09 +.11

11.64

9.73 ygCEG(IVZ)100/100 11.46 +.17

11.40 10.84 ygCon Pro 100/100 11.40 +.03

12.98 11.08 ygDiv (LC)100/100 12.76 +.11

11.72 10.14 ygDiv (M) 100/100 11.56 +.10

11.20 10.18 ygDvs (LC) 100/10 11.10 +.09

12.07 10.87 ygE/B (G) 100/100 12.03 +.15

12.83 11.26 ygEq (M) 100/100 12.75 +.15

12.38 11.18 ygG&I (M)100/100 12.30 +.12

10.90

9.78 ygGr E (A)100/100 10.22 +.14

11.29

8.97 ygI S (M) 100/100

11.25 +.22

11.21

8.89 ygIE (JPM)100/100 11.07 +.27

12.01 11.16 ygInc (M) 100/100 12.00 +.04

13.44 11.93 ygMCC (G)100/100 13.15 +.17

10.04 10.03 ygMM (LC) 100/100 10.04 +.00

11.47 10.72 ygMod Pro 100/100 11.47 +.06

10.83 10.66 ygMtg (LC)100/100 10.82 +.00

11.43 10.44 ygNAB (LC)100/100 11.33 +.08

London Life Funds 75/100

12.01 10.79 yg2030 Pro 75/100 11.97 +.10

12.17 10.80 yg2035 Pro 75/100 12.11 +.12

12.05 10.66 ygAdv Pro 75/100 11.95 +.15

12.24 10.50 ygAgg Pro 75/100 12.08 +.19

14.37 12.21 ygAGr (A) 75/100

14.22 +.32

11.62

9.70 ygAsG (A) 75/100

11.00 -.03

12.40 10.87 ygBal (B) 75/100

12.34 +.12

11.84 10.76 ygBal Pro 75/100

11.80 +.11

11.50 11.08 ygBd (LC) 75/100

11.46 -.01

11.49 10.65 ygC B (M) 75/100

11.38 +.06

12.31 10.86 ygC E (G) 75/100

12.14 +.16

10.60

9.26 ygC E (LC) 75/100 10.24 +.10

12.62 10.47 ygC Rs (M) 75/100 11.40 +.27

11.48 10.25 ygCEG (M) 75/100 11.21 +.11

11.76

9.81 ygCEG(IVZ) 75/100 11.58 +.17

11.45 10.87 ygCon Pro 75/100 11.44 +.04

13.13 11.18 ygDiv (LC) 75/100 12.92 +.11

11.84 10.22 ygDiv (M) 75/100

11.68 +.10

12.12 10.91 ygE/B (G) 75/100

12.09 +.15

12.98 11.36 ygEq (M) 75/100

12.90 +.15

12.54 11.01 ygEth (G) 75/100

12.35 +.17

13.03 11.25 ygF E (M) 75/100

13.03 +.14

12.44 11.22 ygG&I (M) 75/100 12.36 +.12

12.24 10.05 ygGE (LC) 75/100

12.15 +.26

10.97

9.85 ygGr E (A) 75/100

10.30 +.14

11.35

8.97 ygIE(JPM)75/100

11.21 +.28

11.92 11.27 ygInc (LC) 75/100 11.90 +.02

13.59 12.04 ygMCC (G) 75/100 13.30 +.17

10.03 10.02 ygMM (LC) 75/100 10.03 +.00

11.52 10.75 ygMod Pro 75/100 11.51 +.06

10.85 10.67 ygMtg (LC) 75/100 10.84 +.00

11.47 10.47 ygNAB (LC) 75/100 11.37 +.08

London Life Funds 75/75

12.18 10.81 yg2035 Pro 75/75

12.12 +.12

12.09 10.69 ygAdv Pro 75/75

12.00 +.15

12.28 10.53 ygAgg Pro 75/75

12.12 +.19

14.45 12.28 ygAGr (A) 75/75

14.30 +.32

11.67

9.73 ygAsG (A) 75/75

11.05 -.03

12.43 10.89 ygBal (B) 75/75

12.37 +.12

11.86 10.78 ygBal Pro 75/75

11.82 +.11

11.52 11.10 ygBd (LC) 75/75

11.48 -.01

11.51 10.66 ygC B (M) 75/75

11.40 +.06

13.06 10.64 ygC E (B) 75/75

12.87 +.17

12.35 10.89 ygC E (G) 75/75

12.18 +.16

10.65

9.29 ygC E (LC) 75/75

10.29 +.10

12.70 10.53 ygC Rs (M) 75/75

11.49 +.27

11.52 10.27 ygCEG (M) 75/75

11.25 +.11

11.84

9.86 ygCEG(IVZ) 75/75 11.66 +.17

11.47 10.88 ygCon Pro 75/75

11.47 +.04

13.18 11.21 ygDiv (LC) 75/75

12.96 +.12

11.92 10.27 ygDiv (M) 75/75

11.76 +.10

12.14 10.92 ygE/B (G) 75/75

12.10 +.15

13.02 11.39 ygEq (M) 75/75

12.95 +.15

12.59 11.05 ygEth (G) 75/75

12.40 +.17

13.11 11.31 ygF E (M) 75/75

13.11 +.14

12.46 11.23 ygG&I (M) 75/75

12.38 +.12

11.04

9.91 ygGr E (A) 75/75

10.39 +.14

11.43

9.02 ygIE (JPM) 75/75

11.30 +.28

11.94 11.29 ygInc (LC) 75/75

11.93 +.02

12.05 11.19 ygInc (M) 75/75

12.04 +.04

13.69 12.11 ygMCC (G) 75/75

13.41 +.17

10.03 10.02 ygMM (LC) 75/75

10.03 +.00

10.87 10.68 ygMtg (LC) 75/75

10.86 +.00

11.48 10.48 ygNAB (LC) 75/75 11.38 +.08

London Life 75/75 (PS1)

11.18

9.84 y AP 75/75 PS1

11.10 +.14

11.44

9.77 y AR 75/75 PS1

11.30 +.18

10.31 10.00 y BD(LC)75/75 PS1 10.28 -.01

10.94

9.89 y BP 75/75 PS1

10.91 +.10

10.55

9.97 y CP 75/75 PS1

10.55 +.03

10.32

9.96 y FP 75/75 PS1

10.29 +.00

10.55

9.96 y IN(LC)75/75 PS1 10.54 +.02

10.03 10.00 y MM(LC)75/75 PS1 10.03 +.00

10.70

9.94 y MP 75/75 PS1

10.70 +.06

London Life 100/100 (PS1)

11.15

9.84 y AP 100/100 PS1

11.06 +.14

11.40

9.77 y AR 100/100 PS1

11.25 +.18

10.29

9.99 y BD(LC)10/10 PS1 10.26 -.01

10.92

9.89 y BP 100/100 PS1

10.88 +.10

10.52

9.97 y CP 100/100 PS1

10.52 +.03

10.30

9.99 y FP 100/100 PS1

10.27 +.00

10.03 10.00 y MM(LC)10/10 PS1 10.03 +.00

10.68

9.94 y MP 100/100 PS1 10.68 +.06

London Life 75/100 (PS1)

11.17

9.84 y AP 75/100 PS1

11.09 +.14

11.43

9.77 y AR 75/100 PS1

11.29 +.18

10.30 10.00 y BD(LC)75/10 PS1 10.27 -.01

10.93

9.89 y BP 75/100 PS1

10.90 +.10

10.53

9.97 y CP 75/100 PS1

10.53 +.03

10.31

9.99 y FP 75/100 PS1

10.28 +.00

10.03 10.00 y MM(LC)75/100PS1 10.03 +.00

10.69

9.94 y MP 75/100 PS1

10.69 +.06

Mackenzie Cundill Cl F

24.42 19.16 nCdl RecovFd F

22.84 +.13

23.78 18.56 nuCdl RecovFd FU$ 22.52 +.17

7.87

5.83 nCdlValueFd F

7.78 +.15

7.74

5.60 nuCdlValueFd FU$

7.67 +.16

Mackenzie Cundill Cl O

14.99 12.61 CdlCdnBalFd O

14.74 +.17

17.28 13.92 oCdlCdnSecuFd O 17.07 +.28

7.39

5.41 CdlValueFd O

7.31 +.14

Mackenzie Ivy Class F

9.05

7.86 IvyForEquFd F

9.05 +.11

8.94

7.56 uIvyForEquFd FU$ 8.92 +.13

Mackenzie Ivy Class O

10.42

9.02 IvyForEquFd O

10.42 +.13

Mackenzie Universal Cl O

23.67 18.85 UnvAmGwCl O

23.21 +.40

Mackenzie Sentinel C$ F

5.05

4.82 SentCorBondFdF

5.05 +.01

14.48 12.94 SentNACorBClF

14.48 +.06

14.41 12.47 uSentNACorBClFU$ 14.27 +.09

Mackenzie Cundill C$

12.96 10.19 oCdl RecovFd C

12.10 +.07

17.43 13.03 oCdl Value Cl A

17.21 +.33

9.05

7.62 oCdlCdnBalFd C

8.89 +.10

9.38

8.36 oCdlCdnBalFd T8

9.15 +.10

11.39

9.10 oCdlCdnSecuFd C 11.23 +.18

6.99

5.42 oCdlEmMktVaClA

6.68 +.09

6.86

5.37 ouCdlEmMktVaClAU$ 6.59 +.10

6.37

5.00 oCdlGbBalFd C

6.32 +.09

24.47 18.24 CdlValueFd A

24.18 +.46

10.00

7.47 oCdlValueFd C

9.88 +.19

16.64 12.92 oCdn Sec Cl A

16.33 +.28

Mackenzie Cundill U$

12.62

9.90 ouCdl RecovFd CU$ 11.93 +.09

6.27

4.81 ouCdlGbBalFd CU$ 6.23 +.10

9.83

7.19 ouCdlValueFd CU$ 9.74 +.20

Mackenzie Funds

12.03

9.72 oFdrsGbEquCl A

12.00 +.19

11.90

9.35 ouFdrsGbEquCl AU$ 11.84 +.21

11.42 10.05 oFdrsIn&GwFdA

11.39 +.09

11.29

9.67 ouFdrsIn&GwFdAU$ 11.23 +.11

10.42

8.65 oFounders Fd A

10.31 +.13

10.24

8.32 ouFounders Fd AU$ 10.16 +.15

15.20 12.84 oGrowth

14.75 +.19

Mackenzie Focus Funds C$

17.65 13.66 oFocFE Cl A

17.33 +.33

8.17

6.75 oFocus Fund A

8.12 +.17

Mac Focus Funds Ser O

4.93

3.99 Focus Fund O

4.91 +.10

Mackenzie Focus Funds U$

17.13 13.14 ouFocFE Cl A U$

17.08 +.36

8.04

6.49 ouFocus Fund A U$ 8.01 +.18

Mackenzie Ivy Funds C$

28.72 24.81 oIvy Cdn Fd A

28.42 +.23

7.50

6.56 oIvy Glo Bal A

7.50 +.08

6.29

5.30 oIvyEnterprise A

6.21 .00

12.79 10.80 oIvyForEqCurNeuA 12.75 +.16

15.40 13.24 oIvyForEquCl A

15.40 +.19

34.25 29.80 oIvyForEquFd A

34.25 +.43

22.84 20.34 oIvyGwth&InFd A 22.58 +.14

Mackenzie Ivy Funds U$

7.42

6.31 ouIvy Glo Bal AU$

7.40 +.10

15.22 12.73 ouIvyForEquCl AU$ 15.18 +.22

33.85 28.65 ouIvyForEquFd AU$ 33.77 +.49

Mackenzie MAXXUM

13.14 12.16 oMax CdnBal Fd A 12.95 +.04

14.61 13.10 oMax CdnEqCl A

13.97 +.02

23.43 20.86 oMax CdnEqGwFd A 22.71 +.10

16.63 14.77 oMaxDivGwthFd A 16.26 +.11

13.73 11.80 oMaxDividendCl A 13.48 +.08

18.33 16.00 oMaxDividendFd A 18.00 +.11

8.98

8.42 oMaxMthlyIncFd A 8.88 +.04

-Mackenzie Saxon Funds

12.49

9.59 oCdl World A

12.45 +.37

17.24 14.29 oSax Stock Fd A

16.73 +.12

12.89 11.37 oSaxBalanceFd A 12.66 +.06

12.41 10.65 oSaxDivIncCl A

12.11 +.03

18.69 16.29 oSaxDivIncFd A

18.21 +.05

20.53 16.89 oSaxSmallCap A

20.19 +.17

Mackenzie Sentinel C$

3.99

3.78 bGlobalBond A

3.95 +.01

11.73 10.95 oSenNACpBdFdA 11.73 +.05

14.14 13.76 oSentBondFd A

14.10 .00

10.51 10.22 oSentBondFd SC

10.47 .00

11.10 11.10 oSentCdnSTYCl A 11.10 unch

4.81

4.60 oSentCorBondFdA 4.81 +.01

2.34

2.24 oSentIncomeFd A

2.28 +.01

8.00

7.75 oSentIncomeFd B

7.91 +.02

5.32

4.45 oSentIncomeFd C

4.54 +.01

16.77 15.85 oSentNACorBCl T6 16.77 +.07

14.03 12.63 oSentNACorBClA

14.03 +.06

14.48 13.48 oSentRRBondFd A 14.08 -.03

2.07

2.05 oSentS-TIncFd A

2.07 +.00

10.09

9.98 oSentS-TIncFd SC 10.07 +.01

9.85

9.43 oSentStraIncFdA

9.81 +.05

16.36 15.64 oSentStraInCl T6

16.28 +.08

13.33 12.16 oSentStraInClA

13.31 +.06

15.22 14.57 oSMR Cl A

15.22 +.01

Mackenzie Sentinel U$

3.94

3.70 ouGlobalBond A U$ 3.90 +.02

11.70 11.23 ouSenNACpBdFdAU$ 11.56 +.07

13.99 12.17 ouSentNACorBClAU$ 13.83 +.09

13.19 11.70 ouSentStraInClAU$ 13.12 +.09

Mackenzie Symmetry

13.77 12.87 oSymBalPortFdA

13.59 +.13

13.72 12.64 oSymConsPort ClA 13.71 +.09

13.23 12.35 oSymConsPt A

12.75 +.09

10.13

8.34 oSymEquPortCl A

9.95 +.19

10.76 10.35 oSymFixeIncPt A

10.59 +.00

12.66 12.12 oSymFixIncPCl A

12.66 unch

15.67 13.36 oSymGwth Pt A

15.49 +.23

14.85 13.34 oSymModGrPtA

14.75 +.17

10.52

9.50 zoSymModGrPtB

10.44 +.12

15.09 13.26 oSymModGwPtCl A 14.99 +.17

Mackenzie Universal C$

14.94 12.51 oEm Mkts Cl A

14.19 +.12

12.41

9.86 oIntl Stock A

12.36 +.19

11.93 10.02 oIvy Euro Fd A

11.89 +.21

17.95 14.21 oUnvAGrCuNeuCA 17.67 +.33

22.96 18.66 oUnvAmGwClA

22.47 +.38

8.90

8.02 oUnvCdnBalFd A

8.89 +.09

22.00 19.27 oUnvCdnGwthFdA 21.82 +.27

26.02 21.54 oUnvCdnResFd A

23.15 -.12

12.42 10.76 oUnvGbInfrFd A

12.42 +.17

14.20 12.15 oUnvGoldBulClA

12.15 -.63

12.77 10.50 oUnvNAmGwthClA 12.46 +.22

18.55 11.69 oUnvPreMetalsA

11.69 -.92

8.06

6.62 oUUSBC Cl A

8.03 +.16

31.53 24.78 oWld Res Cl A

28.93 -.15

Mackenzie Universal U$

14.72 12.03 ouEm Mkts Cl A U$ 13.99 +.14

11.74

9.65 ouEuro Fd AU$

11.73 +.23

12.25

9.49 ouIntl Stock A U$

12.19 +.21

22.52 17.95 ouUnvAmGwClAU$ 22.15 +.41

8.78

7.71 ouUnvCdnBalFd AU$ 8.76 +.11

21.66 18.54 ouUnvCdnGwthFdAU$ 21.52 +.31

26.78 21.04 ouUnvCdnResFd AU$ 22.83 -.07

12.28 10.35 ouUnvGbInfrFd AU$ 12.24 +.19

14.48 11.98 ouUnvGoldBulClAU$ 11.98 -.60

12.44 10.10 ouUnvNAmGwthClAU$ 12.29 +.24

19.04 11.53 ouUnvPreMetalsAU$ 11.53 -.88

7.95

6.47 ouUUSBCCl A U$

7.91 +.17

31.45 24.12 ouWld Res Cl A U$ 28.53 -.09

Manulife Advisor

6.16

5.95 yoBond Fund Adv

6.14 .00

14.02 12.38 yoCdn Stock

13.63 +.16

8.63

6.94 yoCdnFocusedFdAdv 8.43 -.09

11.99

9.91 yoCdnInvestCl Adv 11.88 +.17

11.99 10.39 yoCdnOpportFd Adv 11.81 +.22

9.75

9.42 ybCorpBondFd Adv 9.75 +.01

12.66 11.08 yoDvrsInvesFd Adv 12.64 +.09

10.29

9.75 yoFloRateIncFdAdv 10.29 +.02

13.10 10.22 yoGbFocusCl Adv 13.01 +.31

12.26

9.71 yoGbFocusFd Adv 12.17 +.29

38.29 32.82 yoGrowthOppFd Adv 36.45 +.70

6.38

5.64 yoMthHiIncClAdv

6.37 +.03

14.13 13.41 yoMthHiIncFdAdv 14.11 +.08

10.64 10.35 yoPref Inc Fd Adv 10.60 .00

13.11 11.84 yoSimp Bal Pt Adv 13.08 +.11

12.63 11.14 yoSimpGwthPt Adv 12.56 +.13

11.63 10.56 yoStrateIncCl Adv 11.62 +.05

11.88 11.05 yoStratIncFdAdv

11.86 +.05

10.92

9.32 yoStrBaYldFdAdv 10.87 +.13

5.11

4.10 yoUSOpportFdAdv 5.09 +.09

12.11 10.77 yoYieldOppCl Adv 12.11 +.05

10.37

9.61 yoYieldOppFd Adv 10.37 +.04

Manulife Series B

13.94 13.24 yoMthHiIncFdB

13.91 +.07

Manulife Class I

12.24 10.93 ynStrateIncCl I

12.24 +.06

13.56 10.57 ynWorldInvCl I

13.52 +.23

Manulife Class T

14.87 14.13 yoStrateIncCl T

14.80 +.07

Manulife Class F

11.95 10.75 ynStrateIncCl F

11.94 +.05

11.92 11.08 ynStratIncFdF

11.89 +.05

Manulife - Pension Build

10.52 10.00 yoPenBuildFd 8325 10.50 +.00

10.73 10.19 yoPensionBuilder 10.71 +.00

Manulife MIX Funds

10.02

8.51 yoGlobalOppCl Adv 9.47 +.08

14.08 13.43 yoStructBondClAdv 14.06 +.02

11.75

9.34 yoWorldInvCl Adv 11.69 +.19

Manulife GIF Select

12.44 11.34 yoBaIncPtGIFSel

12.43 +.11

11.91 10.43 yoCICamBdlGIFSe 11.91 +.18

10.49 10.34 yoGIF Sel Advant

10.49 +.00

12.27 10.13 ygGIFSeEInvCPGwCl 12.07 +.17

11.74 10.01 ygGIFSeEMaxDvGw-M 11.56 +.12

11.74 10.85 yoGIFSelCIBCMthIn 11.61 +.06

12.92 11.31 yoGIFSelCICamBndl 12.92 +.20

11.22 10.06 yoGIFSelCIHarG&I 11.05 +.09

12.79 11.20 yoGIFSelCISigI&G 12.67 +.13

11.14 10.28 yoGIFSelFidCdnAA 11.08 +.11

11.61 11.14 yoGIFSelFidCdnBnd 11.56 -.01

13.83 12.49 yoGIFSelFidMInc

13.81 +.08

11.14

9.81 yoGIFSelMHIncIncP 11.12 +.06

12.93 11.39 yoGIFSelMthlyHIn 12.91 +.07

11.89 11.09 yoGIFSelSentInc

11.87 +.04

11.85 10.65 yoGIFSelSimBalPt 11.83 +.10

11.80 10.79 yoGIFSelSimModPt 11.80 +.07

12.67 11.50 yoGIFSelStrateInc 12.66 +.05

11.32 10.05 yoOppBdlGIFSel

11.01 +.10

10.72

9.52 yoOppBdlGIFSel

10.43 +.09

Marquis Institutional A

5.67

5.56 yoInst Bond Pt A

5.63 unch

6.29

5.73 yoInstBalancedPtA 6.29 +.07

6.80

6.07 yoInstBalGwthPt A 6.79 +.10

Marquis Port Solutions A

14.18 12.57 yoBal Growth Pt A 14.15 +.15

5.12

4.91 yoBal Income Pt A

5.11 +.03

7.65

7.09 yoBalanced Port A

7.65 +.07

14.87 12.51 yoEquity Port A

14.77 +.23

7.84

6.96 yoGrowth Port A

7.80 +.10

Matrix Asset Management

6.28

5.45 oMonthlyPayFd A

5.49 +.04

Mawer Investment Mgmt Ltd

18.82 16.47 nBalan Fd Cl A

18.80 +.11