Beruflich Dokumente

Kultur Dokumente

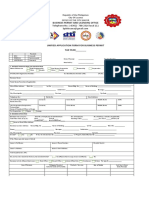

Pa Enterprise Registration Form: Section 1 - Reason For This Registration

Hochgeladen von

theclovermarketOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pa Enterprise Registration Form: Section 1 - Reason For This Registration

Hochgeladen von

theclovermarketCopyright:

Verfügbare Formate

PA-100 (1) 8-01

MAIL COMPLETED APPLICATION TO: DEPARTMENT OF REVENUE BUREAU OF BUSINESS TRUST FUND TAXES DEPT. 280901 HARRISBURG, PA 17128-0901 TELEPHONE (717) 787-1064 ext. 1

COMMONWEALTH OF PENNSYLVANIA

RECEIVED DATE

PA ENTERPRISE REGISTRATION FORM

DEPARTMENT USE ONLY

DEPARTMENT OF REVENUE & DEPARTMENT OF LABOR AND INDUSTRY

TYPE OR PRINT LEGIBLY, USE BLACK INK

SECTION 1 REASON FOR THIS REGISTRATION

REFER TO THE INSTRUCTIONS (PAGE 18) AND CHECK THE APPLICABLE BOX(ES) TO INDICATE THE REASON(S) FOR THIS REGISTRATION. 6. DID THIS ENTERPRISE: 1. NEW REGISTRATION YES NO ACQUIRE ALL OR PART OF ANOTHER BUSINESS? 2. ADDING TAX(ES) & SERVICE(S) YES NO RESULT FROM A CHANGE IN LEGAL STRUCTURE (FOR EXAMPLE, FROM INDIVIDUAL 3. REACTIVATING TAX(ES) & SERVICE(S) PROPRIETOR TO CORPORATION, PARTNERSHIP TO CORPORATION, CORPORATION TO LIMITED LIABILITY COMPANY, ETC)? 4. ADDING ESTABLISHMENT(S) YES NO UNDERGO A MERGER, CONSOLIDATION, DISSOLUTION, OR OTHER RESTRUCTURING? 5. INFORMATION UPDATE

SECTION 2 ENTERPRISE INFORMATION

1. DATE OF FIRST OPERATIONS 2. DATE OF FIRST OPERATIONS IN PA 3. ENTERPRISE FISCAL YEAR END

4. ENTERPRISE LEGAL NAME

5. FEDERAL EMPLOYER IDENTIFICATION NUMBER (EIN)

6. ENTERPRISE TRADE NAME (if different than legal name)

7. ENTERPRISE TELEPHONE NUMBER ( ) COUNTY STATE ZIP CODE + 4

8. ENTERPRISE STREET ADDRESS (do not use PO Box)

CITY/TOWN

9. ENTERPRISE MAILING ADDRESS (if different than street address)

CITY/TOWN

STATE

ZIP CODE + 4

10. LOCATION OF ENTERPRISE RECORDS (street address)

CITY/TOWN

STATE

ZIP CODE + 4

11. ESTABLISHMENT NAME (doing business as)

12. NUMBER OF ESTABLISHMENTS *

13. SCHOOL DISTRICT

14. MUNICIPALITY

* Enterprises with more than one establishment as defined in the general instructions must complete Section 17.

SECTION 3 TAXES AND SERVICES

ALL REGISTRANTS MUST CHECK THE APPLICABLE BOX(ES) TO INDICATE THE TAX(ES) AND SERVICE(S) REQUESTED FOR THIS REGISTRATION AND COMPLETE THE CORRESPONDING SECTIONS INDICATED ON PAGES 2 AND 3. IF REACTIVATING ANY PREVIOUS ACCOUNT(S), LIST THE ACCOUNT NUMBER(S) IN THE SPACE PROVIDED. PREVIOUS ACCOUNT NBR. CIGARETTE DEALERS LICENSE CORPORATION TAXES EMPLOYER WITHHOLDING TAX FUELS TAX PERMIT LIQUID FUELS TAX PERMIT LOCAL SALES, USE, HOTEL OCCUPANCY TAX MOTOR CARRIERS ROAD TAX/IFTA PROMOTER LICENSE PUBLIC TRANSPORTATION ASSISTANCE TAX LICENSE SALES TAX EXEMPT STATUS SALES, USE, HOTEL OCCUPANCY TAX LICENSE PREVIOUS ACCOUNT NBR.

SMALL GAMES OF CHANCE LIC./CERT. TRANSIENT VENDOR CERTIFICATE UNEMPLOYMENT COMPENSATION USE TAX VEHICLE RENTAL TAX WHOLESALER CERTIFICATE WORKERS COMPENSATION COVERAGE

SECTION 4 AUTHORIZED SIGNATURE

I, (WE) THE UNDERSIGNED, DECLARE UNDER THE PENALTIES OF PERJURY THAT THE STATEMENTS CONTAINED HEREIN ARE TRUE, CORRECT, AND COMPLETE. AUTHORIZED SIGNATURE (ATTACH POWER OF ATTORNEY IF APPLICABLE) DAYTIME TELEPHONE NUMBER ( TYPE OR PRINT NAME ) DATE TITLE

E-MAIL ADDRESS

TYPE OR PRINT PREPARERS NAME

TITLE

DAYTIME TELEPHONE NUMBER ( )

E-MAIL ADDRESS

DATE

PA-100 8-01

DEPARTMENT USE ONLY

ENTERPRISE NAME

SECTION 5 BUSINESS STRUCTURE

CHECK THE APPROPRIATE BOX FOR QUESTIONS 1, 2 & 3. IN ADDITION TO SECTIONS 1 THROUGH 10, COMPLETE THE SECTION(S) INDICATED. 1.

SOLE PROPRIETORSHIP (INDIVIDUAL)

CORPORATION (Sec. 11) GOVERNMENT (Sec. 13)

OR

GENERAL PARTNERSHIP (ex: husband/wife)

LIMITED PARTNERSHIP LIMITED LIABILITY PARTNERSHIP JOINT VENTURE PARTN BUSINESS TRUST ESTATE ASSOCIATION

LIMITED LIABILITY COMPANY STATE WHERE CHARTERED RESTRICTED PROFESSIONAL COMPANY STATE WHERE CHARTERED

2. 3.

PROFIT YES

NON-PROFIT NO

IS THE ENTERPRISE ORGANIZED FOR PROFIT OR NON-PROFIT? IS THE ENTERPRISE EXEMPT FROM TAXATION UNDER INTERNAL REVENUE CODE SECTION 501(C)(3)? IF YES, PROVIDE A COPY OF THE ENTERPRISE'S EXEMPTION AUTHORIZATION LETTER FROM THE INTERNAL REVENUE SERVICE.

SECTION 6 OWNERS, PARTNERS, SHAREHOLDERS, OFFICERS, AND RESPONSIBLE PARTY INFORMATION

PROVIDE THE FOLLOWING FOR ALL INDIVIDUAL AND/OR ENTERPRISE OWNERS, PARTNERS, SHAREHOLDERS, OFFICERS, AND RESPONSIBLE PARTIES. IF STOCK IS PUBLICLY TRADED, PROVIDE THE FOLLOWING FOR ANY SHAREHOLDER WITH AN EQUITY POSITION OF 5% OR MORE. ADDITIONAL SPACE IS AVAILABLE IN SECTION 6A, PAGE 11. 1. NAME 2. SOCIAL SECURITY NUMBER 3. DATE OF BIRTH * 4. FEDERAL EIN

5.

OWNER OFFICER PARTNER SHAREHOLDER RESPONSIBLE PARTY

6. TITLE

7. EFFECTIVE DATE OF TITLE CITY/TOWN COUNTY

8. PERCENTAGE OF OWNERSHIP % STATE

9. EFFECTIVE DATE OF OWNERSHIP ZIP CODE + 4

10. HOME ADDRESS (street)

11. THIS PERSON IS RESPONSIBLE TO REMIT/MAINTAIN:

SALES TAX

EMPLOYER WITHHOLDING TAX

MOTOR FUEL TAXES

WORKERS COMPENSATION COVERAGE * DATE OF BIRTH REQUIRED ONLY IF APPLYING FOR A CIGARETTE WHOLESALE DEALERS LICENSE, A SMALL GAMES OF CHANCE DISTRIBUTOR LICENSE, OR A SMALL GAMES OF CHANCE MANUFACTURER CERTIFICATE.

SECTION 7 ESTABLISHMENT BUSINESS ACTIVITY INFORMATION

REFER TO THE INSTRUCTIONS TO COMPLETE THIS SECTION. COMPLETE SECTION 17 FOR MULTIPLE ESTABLISHMENTS. 1. ENTER THE PERCENTAGE THAT EACH PA BUSINESS ACTIVITY REPRESENTS OF THE TOTAL RECEIPTS OR REVENUES AT THIS ESTABLISHMENT. LIST ALL PRODUCTS OR SERVICES ASSOCIATED WITH EACH BUSINESS ACTIVITY. ENTER THE PERCENTAGE THAT THE PRODUCTS OR SERVICES REPRESENT OF THE TOTAL RECEIPTS OR REVENUES AT THIS ESTABLISHMENT.

PA BUSINESS ACTIVITY

Accommodation & Food Services Agriculture, Forestry, Fishing, & Hunting Art, Entertainment, & Recreation Services Communications/Information Construction (must complete question 3) Domestics (Private Households) Educational Services Finance Health Care Services Insurance Management of Companies & Enterprises Manufacturing Mining, Quarrying, & Oil/Gas Extraction Other Services Professional, Scientific, & Technical Services Public Administration Real Estate

PRODUCTS OR SERVICES

ADDITIONAL PRODUCTS OR SERVICES

R e t a i l Tr a d e

Sanitary Service Social Assistance Services Transportation Utilities Warehousing Wholesale Trade TOTAL

100%

2. ENTER THE PERCENTAGE THAT THIS ESTABLISHMENTS RECEIPTS OR REVENUES REPRESENT OF THE TOTAL PA RECEIPTS OR REVENUES OF THE ENTERPRISE. _ 3. ESTABLISHMENTS ENGAGED IN CONSTRUCTION MUST ENTER THE PERCENTAGE OF CONSTRUCTION ACTIVITY THAT IS NEW AND/OR RENOVATIVE AND THE PERCENTAGE OF CONSTRUCTION ACTIVITY THAT IS RESIDENTIAL AND/OR COMMERCIAL. __________________ % RENOVATIVE = 100% ___________________ % NEW + __________________ % COMMERCIAL = 100% ___________________ % RESIDENTIAL +

100 %

DEPARTMENT USE ONLY ENTERPRISE NAME

SECTION 8 ESTABLISHMENT SALES INFORMATION

1.

q YES X

YES

NO

2.

q NO X

IS THIS ESTABLISHMENT SELLING TAXABLE PRODUCTS OR OFFERING TAXABLE SERVICES TO CONSUMERS FROM A LOCATION IN PENNSYLVANIA? IF YES, COMPLETE SECTION 18. IS THIS ESTABLISHMENT SELLING CIGARETTES IN PENNSYLVANIA? IF YES, COMPLETE SECTIONS 18 AND 19.

3. LIST EACH COUNTY IN PENNSYLVANIA WHERE THIS ESTABLISHMENT IS CONDUCTING TAXABLE SALES ACTIVITY(IES). COUNTY COUNTY COUNTY COUNTY ATTACH ADDITIONAL 8 1/2 X 11 SHEETS IF NECESSARY. COUNTY COUNTY

SECTION 18 SALES USE AND HOTEL OCCUPANCY TAX LICENSE, PUBLIC TRANSPORTATION ASSISTANCE TAX LICENSE, VEHICLE RENTAL TAX, TRANSIENT VENDOR CERTIFICATE, PROMOTER LICENSE, OR WHOLESALER CERTIFICATE PART 1

SALES USE AND HOTEL OCCUPANCY TAX, PUBLIC TRANSPORTATION ASSISTANCE TAX, VEHICLE RENTAL TAX, OR WHOLESALER CERTIFICATE

ENTERPRISES APPLYING FOR A SALES, USE AND HOTEL OCCUPANCY TAX LICENSE, PUBLIC TRANSPORTATION ASSISTANCE TAX LICENSE, VEHICLE RENTAL TAX, AND/OR WHOLESALER CERTIFICATE. COMPLETE PART 1. SALES TAX COLLECTED MUST BE SEGREGATED FROM OTHER FUNDS AND MUST REMAIN IN THE COMMONWEALTH OF PENNSYLVANIA UNTIL REMITTED TO THE DEPARTMENT OF REVENUE. IF THE ENTERPRISE IS: SELLING TAXABLE PRODUCTS OR SERVICES TO CONSUMERS IN PENNSYLVANIA, ENTER DATE OF FIRST TAXABLE SALE PURCHASING TAXABLE PRODUCTS OR SERVICES FOR ITS OWN USE IN PENNSYLVANIA AND INCURRING NO SALES TAX, ENTER DATE OF FIRST PURCHASE SELLING NEW TIRES TO CONSUMERS IN PENNSYLVANIA, ENTER DATE OF FIRST SALE LEASING OR RENTING MOTOR VEHICLES, ENTER DATE OF FIRST LEASE OR RENTAL RENTING FIVE OR MORE MOTOR VEHICLES, ENTER DATE OF FIRST RENTAL

CONDUCTING RETAIL SALES IN PENNSYLVANIA AND NOT MAINTAINING A PERMANENT LOCATION IN PA, ENTER DATE OF FIRST TAXABLE SALE (COMPLETE PART 2)

ACTIVELY PROMOTING SHOWS IN PENNSYLVANIA WHERE TAXABLE PRODUCTS WILL BE OFFERED FOR RETAIL SALE, ENTER . (COMPLETE PART 3) DATE OF FIRST SHOW ENGAGED SOLELY IN THE SALE OF TANGIBLE PERSONAL PROPERTY AND/OR SERVICES FOR RESALE OR RENTAL. ENTER DATE OF FIRST PURCHASE.

PART 2

IF THE ENTERPRISE PARTICIPATES IN ANY SHOWS OTHER THAN THOSE LISTED, PROVIDE THE NAME(S) OF THE SHOW(S) AND INFORMATION ABOUT THE SHOW(S) TO THE DEPARTMENT OF REVENUE AT LEAST 10 DAYS PRIOR TO THE SHOW. PROVIDE THE FOLLOWING INFORMATION FOR EACH SHOW: 1. PROMOTER NUMBER 2. SHOW NAME 4. SHOW ADDRESS (STREET, CITY, STATE, ZIP) 1. PROMOTER NUMBER 2. SHOW NAME

3. COUNTY 5. START DATE 3. COUNTY 5. START DATE 6. END DATE 6. END DATE

4. SHOW ADDRESS (STREET, CITY, STATE, ZIP)

93-00548-8

Das könnte Ihnen auch gefallen

- Application For Tata Genuine Parts Distributorship For Commercial VehiclesDokument17 SeitenApplication For Tata Genuine Parts Distributorship For Commercial VehiclesNayaz UddinNoch keine Bewertungen

- BusinesslicenseappDokument2 SeitenBusinesslicenseappapi-253134164Noch keine Bewertungen

- National Taxation (Income & Business Tax) OCTOBER 1, 2014Dokument39 SeitenNational Taxation (Income & Business Tax) OCTOBER 1, 2014Eliza Corpuz GadonNoch keine Bewertungen

- Atf F 5630 7Dokument2 SeitenAtf F 5630 7bcyboronNoch keine Bewertungen

- May 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasDokument18 SeitenMay 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasgoerginamarquezNoch keine Bewertungen

- Application For Registration As A Vendor: Next PageDokument4 SeitenApplication For Registration As A Vendor: Next PageMark KNoch keine Bewertungen

- BUSLIC Business Licence FormDokument10 SeitenBUSLIC Business Licence Formcrew242Noch keine Bewertungen

- Filling Instructions 03Dokument1 SeiteFilling Instructions 03Abdurrehman ShaheenNoch keine Bewertungen

- Form 46G: Return of Third Party Information For The Year 2010Dokument4 SeitenForm 46G: Return of Third Party Information For The Year 2010billyhorganNoch keine Bewertungen

- General Instructions: Stock Corporation: General Information Sheet (Gis) General Information Sheet (Gis)Dokument8 SeitenGeneral Instructions: Stock Corporation: General Information Sheet (Gis) General Information Sheet (Gis)JoVic2020Noch keine Bewertungen

- PCC Merger Notification FormDokument7 SeitenPCC Merger Notification Formskylark74Noch keine Bewertungen

- IA 843 Claim For Refund: Sales, Use, Excise, and Local Option TaxDokument2 SeitenIA 843 Claim For Refund: Sales, Use, Excise, and Local Option TaxbolinagNoch keine Bewertungen

- 2015 Instructions For Schedule E (Form 1040) : Supplemental Income and LossDokument12 Seiten2015 Instructions For Schedule E (Form 1040) : Supplemental Income and LossManish KotharyNoch keine Bewertungen

- PRINT in BLACK INK. Ovals Must Be Filled in Completely.Dokument2 SeitenPRINT in BLACK INK. Ovals Must Be Filled in Completely.mik2bgNoch keine Bewertungen

- BIR Form 1600Dokument39 SeitenBIR Form 1600maeshach60% (5)

- Schedule C Instructions 2012Dokument13 SeitenSchedule C Instructions 2012Dunk7Noch keine Bewertungen

- VAT 101e: Value-Added TaxDokument5 SeitenVAT 101e: Value-Added TaxKuben NaidooNoch keine Bewertungen

- National Pavilions - Manufacturing Application Form - Oct'13Dokument6 SeitenNational Pavilions - Manufacturing Application Form - Oct'13Durban Chamber of Commerce and IndustryNoch keine Bewertungen

- GIS_FOREIGNDokument3 SeitenGIS_FOREIGNgoodboiNoch keine Bewertungen

- Acord 125 (Updated) PDFDokument3 SeitenAcord 125 (Updated) PDFAnonymous 14ZyLfZjuDNoch keine Bewertungen

- Ms Withholding ApplicationDokument4 SeitenMs Withholding ApplicationBilal ChoudhryNoch keine Bewertungen

- Form 1594777111Dokument1 SeiteForm 1594777111Evcillove Mangubat100% (1)

- Certificate of Registration With The Sec On The Case of A Corporation or PartnershipDokument23 SeitenCertificate of Registration With The Sec On The Case of A Corporation or PartnershipanneNoch keine Bewertungen

- Panasonic vs. CIRDokument6 SeitenPanasonic vs. CIRLeBron DurantNoch keine Bewertungen

- Documents Required For VatDokument2 SeitenDocuments Required For VatswaroopcharmiNoch keine Bewertungen

- Business Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Dokument2 SeitenBusiness Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Ren Michelle Villaverde PaleracioNoch keine Bewertungen

- 111 Tax GuideDokument81 Seiten111 Tax Guideavelito bautistaNoch keine Bewertungen

- Tax Return - 2018-2019Dokument30 SeitenTax Return - 2018-2019kutner8181Noch keine Bewertungen

- NTN Document FinalDokument13 SeitenNTN Document FinalZahid MunirNoch keine Bewertungen

- Salvage Restoration PacketDokument5 SeitenSalvage Restoration Packettmbleweed100% (1)

- Application Form Business PermitDokument4 SeitenApplication Form Business PermitJanine LagutanNoch keine Bewertungen

- Form 11: Tax Return and Self-Assessment For The Year 2014Dokument32 SeitenForm 11: Tax Return and Self-Assessment For The Year 2014garyjenkins82Noch keine Bewertungen

- 2013 Financial StatementsDokument31 Seiten2013 Financial Statementsapi-307029847100% (1)

- 2012 Instructions For Schedule F: Profit or Loss From FarmingDokument20 Seiten2012 Instructions For Schedule F: Profit or Loss From FarmingRonnie QuimioNoch keine Bewertungen

- Asf-Vendor Prequalification FormDokument9 SeitenAsf-Vendor Prequalification FormMd Abdullah ChowdhuryNoch keine Bewertungen

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Dokument9 SeitenGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresNoch keine Bewertungen

- PhilHealth Revised Employer Remittance Report-RF-1 PDFDokument2 SeitenPhilHealth Revised Employer Remittance Report-RF-1 PDFYvan Jackson Marquez NacionalesNoch keine Bewertungen

- Application-Form-for-Business-PermitDokument13 SeitenApplication-Form-for-Business-PermitKimBabNoch keine Bewertungen

- Pinamungajan Business PermitDokument2 SeitenPinamungajan Business PermitHannah PanaresNoch keine Bewertungen

- Application For Business License and PermitDokument2 SeitenApplication For Business License and PermitEdward Aguirre PingoyNoch keine Bewertungen

- Application Form For Bus Permit v2Dokument2 SeitenApplication Form For Bus Permit v2Victor B. Diosaban Jr.Noch keine Bewertungen

- Draft CIS For MonetizerDokument8 SeitenDraft CIS For MonetizerElwin arifin100% (1)

- Title ApplicationDokument2 SeitenTitle ApplicationZaki ZahidNoch keine Bewertungen

- Chapter 7Dokument15 SeitenChapter 7Jaren Ann DeangNoch keine Bewertungen

- RR No. 16-18Dokument5 SeitenRR No. 16-18Ckey ArNoch keine Bewertungen

- Tax relief for employment expensesDokument4 SeitenTax relief for employment expensesKen Smith0% (1)

- Explanatory Notes TF2011 2Dokument16 SeitenExplanatory Notes TF2011 2Ili AmirahNoch keine Bewertungen

- Webtc1 Tax Clearance CertDokument2 SeitenWebtc1 Tax Clearance Certtempest8Noch keine Bewertungen

- 1 Independant Contractor InformationDokument6 Seiten1 Independant Contractor InformationJosue LopezNoch keine Bewertungen

- Application Format For Non Individual Applicants Oct 2010Dokument8 SeitenApplication Format For Non Individual Applicants Oct 2010Tarun ChaudharyNoch keine Bewertungen

- HarrisCountyTaxAbatementApplication PDFDokument7 SeitenHarrisCountyTaxAbatementApplication PDFO'Connor AssociateNoch keine Bewertungen

- ANNEX D TAX CLEARANCE CERTIFICATEDokument1 SeiteANNEX D TAX CLEARANCE CERTIFICATEIdan Aguirre50% (2)

- RFQ115!18!19airqualitymanagement SupportprogrammesDokument47 SeitenRFQ115!18!19airqualitymanagement SupportprogrammesIoio92Noch keine Bewertungen

- LPGApplication PDFDokument17 SeitenLPGApplication PDFAnkur MongaNoch keine Bewertungen

- Panasonic Vs CIRDokument7 SeitenPanasonic Vs CIRMelo Ponce de LeonNoch keine Bewertungen

- This Form May Be Photocopied - Void Unless Complete Information Is SuppliedDokument2 SeitenThis Form May Be Photocopied - Void Unless Complete Information Is SuppliedCristian De la cruz cantilloNoch keine Bewertungen

- Pa Rev-72Dokument12 SeitenPa Rev-72Nick Rosati0% (1)

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- 6-7-15 Bryn Mawr VendorsDokument1 Seite6-7-15 Bryn Mawr VendorstheclovermarketNoch keine Bewertungen

- 5-17-15 Bryn Mawr Market VendorsDokument1 Seite5-17-15 Bryn Mawr Market VendorstheclovermarketNoch keine Bewertungen

- 4-26-15 Bryn Mawr Market Vendor LocationsDokument1 Seite4-26-15 Bryn Mawr Market Vendor LocationstheclovermarketNoch keine Bewertungen

- 9 28 14VendorLocations Space AssignmentsDokument1 Seite9 28 14VendorLocations Space AssignmentstheclovermarketNoch keine Bewertungen

- Sept 14, 2014 Vendor ListDokument1 SeiteSept 14, 2014 Vendor ListtheclovermarketNoch keine Bewertungen

- Bryn Mawr MapDokument1 SeiteBryn Mawr MaptheclovermarketNoch keine Bewertungen

- 4 12 15CHVendorLocationsDokument1 Seite4 12 15CHVendorLocationstheclovermarketNoch keine Bewertungen

- 9 28 14 Vendor Locations - Ardmore MarketDokument1 Seite9 28 14 Vendor Locations - Ardmore MarkettheclovermarketNoch keine Bewertungen

- Vendor Rules&Regulations 2015Dokument6 SeitenVendor Rules&Regulations 2015theclovermarketNoch keine Bewertungen

- 11-2-14 Ardmore Vendor LocationsDokument4 Seiten11-2-14 Ardmore Vendor LocationstheclovermarketNoch keine Bewertungen

- 10 19 14CHVendorLocationsDokument1 Seite10 19 14CHVendorLocationstheclovermarketNoch keine Bewertungen

- Chestnut Hill Market MapDokument1 SeiteChestnut Hill Market MaptheclovermarketNoch keine Bewertungen

- Vendor Rules&Regulations Updated 2014Dokument6 SeitenVendor Rules&Regulations Updated 2014theclovermarketNoch keine Bewertungen

- 6-22-14 Vendor Locations Ardmore MarketDokument1 Seite6-22-14 Vendor Locations Ardmore MarkettheclovermarketNoch keine Bewertungen

- 9 14 14 Vendor Locations - Chestnut HillDokument1 Seite9 14 14 Vendor Locations - Chestnut HilltheclovermarketNoch keine Bewertungen

- ChestnutHillLayout PDFDokument1 SeiteChestnutHillLayout PDFtheclovermarketNoch keine Bewertungen

- Clover & Pucci Manuli Scavenger HuntDokument1 SeiteClover & Pucci Manuli Scavenger HunttheclovermarketNoch keine Bewertungen

- 6 22 14VendorLocationsArdmoreDokument1 Seite6 22 14VendorLocationsArdmoretheclovermarketNoch keine Bewertungen

- 2014 Winter Market Vendor LayoutDokument2 Seiten2014 Winter Market Vendor Layouttheclovermarket100% (1)

- May 18, 2014 VendorLocations (Ardmore)Dokument1 SeiteMay 18, 2014 VendorLocations (Ardmore)theclovermarketNoch keine Bewertungen

- 2013 Vendor MapDokument1 Seite2013 Vendor MaptheclovermarketNoch keine Bewertungen

- June 8 2014 Vendor List (Chestnut Hill)Dokument1 SeiteJune 8 2014 Vendor List (Chestnut Hill)theclovermarketNoch keine Bewertungen

- 4 27 14VendorLocationsArdmoreDokument1 Seite4 27 14VendorLocationsArdmoretheclovermarketNoch keine Bewertungen

- Nov 3, 2013 Vendor LocationsDokument1 SeiteNov 3, 2013 Vendor LocationstheclovermarketNoch keine Bewertungen

- 4 13 14CHVendorLocationsDokument1 Seite4 13 14CHVendorLocationstheclovermarketNoch keine Bewertungen

- Oct 2013 Vendor LocationsDokument1 SeiteOct 2013 Vendor LocationstheclovermarketNoch keine Bewertungen

- Chestnut Hill Map - 2014Dokument1 SeiteChestnut Hill Map - 2014theclovermarketNoch keine Bewertungen

- Oct 13, 2013 Vendors (Ardmore) AlphaDokument1 SeiteOct 13, 2013 Vendors (Ardmore) AlphatheclovermarketNoch keine Bewertungen

- Oct 27 2013 Market Vendor List (Chestnut Hill)Dokument1 SeiteOct 27 2013 Market Vendor List (Chestnut Hill)theclovermarketNoch keine Bewertungen

- 2013 Vendor MapDokument1 Seite2013 Vendor MaptheclovermarketNoch keine Bewertungen

- ACC 4711 ACC 4611 AY 2021-2022 S1 Detailed Weekly Schedule - Updated 31 Jul 2021Dokument2 SeitenACC 4711 ACC 4611 AY 2021-2022 S1 Detailed Weekly Schedule - Updated 31 Jul 2021Chloe NgNoch keine Bewertungen

- Chapter 6, 7Dokument12 SeitenChapter 6, 7Joey TanNoch keine Bewertungen

- Action Director AgreementDokument11 SeitenAction Director AgreementabishekburnerNoch keine Bewertungen

- Briaso v. Mariano, GR 137265, Jan. 31, 2003Dokument10 SeitenBriaso v. Mariano, GR 137265, Jan. 31, 2003Leizl A. VillapandoNoch keine Bewertungen

- Philip Morris, Inc. vs. CA (G.R. No. 91332 July 16, 1993)Dokument5 SeitenPhilip Morris, Inc. vs. CA (G.R. No. 91332 July 16, 1993)ellavisdaNoch keine Bewertungen

- WWW Learninsta Com Extra Questions For Class 10 Social Science Civics Chapter 1Dokument10 SeitenWWW Learninsta Com Extra Questions For Class 10 Social Science Civics Chapter 1Mala DeviNoch keine Bewertungen

- SCO-MX315-JETA1 - Thalamus-G2 Veracrux FOB v2Dokument4 SeitenSCO-MX315-JETA1 - Thalamus-G2 Veracrux FOB v2Leather BredBoiNoch keine Bewertungen

- Philippines Housing LawsDokument2 SeitenPhilippines Housing LawsMykel King NobleNoch keine Bewertungen

- Statutory Construction Case Digests 565b189496cdeDokument245 SeitenStatutory Construction Case Digests 565b189496cdeMary Jean BartolomeNoch keine Bewertungen

- Kaiserslautern District School Bus Discipline MatrixDokument2 SeitenKaiserslautern District School Bus Discipline Matrixapi-189966073Noch keine Bewertungen

- Alschner AmericanizationDokument32 SeitenAlschner AmericanizationNishantNoch keine Bewertungen

- Law On Sales - CasesDokument9 SeitenLaw On Sales - CasesSyrille ClementineNoch keine Bewertungen

- Cambridge Secondary Checkpoint - Science (1113) April 2019 Paper 2 Mark Scheme PDF Renewable Energy ChemistryDokument1 SeiteCambridge Secondary Checkpoint - Science (1113) April 2019 Paper 2 Mark Scheme PDF Renewable Energy ChemistryJo KyurNoch keine Bewertungen

- .Archivetempethical Issues APA PDFDokument18 Seiten.Archivetempethical Issues APA PDFnimra naeemNoch keine Bewertungen

- Rajat AcDokument5 SeitenRajat AcAbhishek ChoudharyNoch keine Bewertungen

- G.R. No. 181235 July 22, 2009 BANCO DE ORO-EPCI, INC. (Formerly Equitable PCI Bank), Petitioner, JOHN TANSIPEK, RespondentDokument6 SeitenG.R. No. 181235 July 22, 2009 BANCO DE ORO-EPCI, INC. (Formerly Equitable PCI Bank), Petitioner, JOHN TANSIPEK, RespondentMichael GruspeNoch keine Bewertungen

- Table of CasesDokument12 SeitenTable of CasesIsabel HigginsNoch keine Bewertungen

- P K Tripathi-Art 254 The Text Is ExplicitDokument14 SeitenP K Tripathi-Art 254 The Text Is ExplicitAnushri BhutaNoch keine Bewertungen

- GST Registration CertificateDokument3 SeitenGST Registration Certificatedavid petersonNoch keine Bewertungen

- Hearsay Evidence ExplainedDokument142 SeitenHearsay Evidence ExplainedA.100% (1)

- Digest - CHUA - QUA vs. CLAVE G.R. No. L-49549 August 30, 1990 (Case DigestDokument7 SeitenDigest - CHUA - QUA vs. CLAVE G.R. No. L-49549 August 30, 1990 (Case DigestLolph Manila100% (1)

- Remittances To Ethiopia - World Bank Survey ResultsDokument36 SeitenRemittances To Ethiopia - World Bank Survey Resultseconomicus35Noch keine Bewertungen

- Attempts To Set Aside An Award: Chapter NineDokument9 SeitenAttempts To Set Aside An Award: Chapter NineDhwajaNoch keine Bewertungen

- Murder and Attempted Murder CaseDokument15 SeitenMurder and Attempted Murder CaseServienrey TanoNoch keine Bewertungen

- Test Bank For Chemistry For Changing Times, 15Th Edition, John W. Hill, Terry W. Mccreary, Rill Ann Reuter, Marilyn D. DuerstDokument36 SeitenTest Bank For Chemistry For Changing Times, 15Th Edition, John W. Hill, Terry W. Mccreary, Rill Ann Reuter, Marilyn D. Duersthausseenfetter.owpt100% (12)

- 93077410e008438cbee5400bdbed5a4bDokument42 Seiten93077410e008438cbee5400bdbed5a4bsaifulla saikhNoch keine Bewertungen

- Application for plot allotment in favour of legal heirsDokument15 SeitenApplication for plot allotment in favour of legal heirsPraveen RanaNoch keine Bewertungen

- Plato Laws Book 4Dokument18 SeitenPlato Laws Book 4Leon LerborgNoch keine Bewertungen

- Auditing and Assurance Services 14th e Chapter 3Dokument13 SeitenAuditing and Assurance Services 14th e Chapter 3Test 37Noch keine Bewertungen

- Bright Network - Commercial Law NotesDokument12 SeitenBright Network - Commercial Law NotesJinal SanghviNoch keine Bewertungen