Beruflich Dokumente

Kultur Dokumente

Gabriel Leverage

Hochgeladen von

sarangdharCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Gabriel Leverage

Hochgeladen von

sarangdharCopyright:

Verfügbare Formate

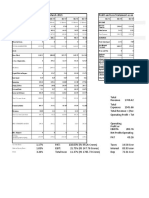

FINANCIAL & OPERATING LEVERAGE ANALYSIS

Particulars Rs.( crore)

Sales 580.37

(-)PBIT 26.15

Total cost 554.22

F.C. 65.81

V.C.(55%) 488.41

Debt 107.66

Equity 100.71

Interest 8.6

Tax 8.71

No. of Shares 71821970

Given Financing Debt+Equity

Sales 580.37

(-)V.C. 488.41

Contribution 91.96

(-)F.C. 65.81

PBIT 26.15

(-)Interest 8.6

PBT 17.55

(-)Tax 8.71

PAT 8.84

No. of Shares 71821970

EPS 1.23

Contribution Ratio 0.16

BEP 415.33

Margin of Safety 28.43%

DOL 3.52

DFL 1.49

DCL 5.24

Conclusions Drawn

1% decline in sales causes 3.52% decline in PBIT

Also, 100/3.52 = 28.41% decline will sales will wipe out PBIT

1% decline in sales causes 5.248% decline in EPS

REFERENCE

Profit & loss account: summary / mfg. cos.

Profit & loss account: summary / mfg. cos.

Mar 2001 Mar 2002 Mar 2003 Mar 2004 Mar 2005 Mar 2006

Rs. Crore (Non-Annualised) 12 mths 12 mths 12 mths 12 mths 12 mths 12 mths

-

Income

Sales 270.16 310.23 379.13 424.63 482.73 568.31

Other income 2.45 2.98 4.39 3.89 4.03 3.64

Change in stocks 1.48 -1.25 1.46 0.8 5.09 1.9

Non-recurring income 0.08 0.19 0.38 7 7.09 6.52

-

Expenditure

Raw materials, stores, etc. 132.65 150.31 208 213.52 262.01 313.64

Wages & salaries(FIXED) 18 19.21 24.05 27.65 31.98 38.32

Energy(FIXED) 7.88 8.21 9.9 10.18 10.9 12.28

Indirect taxes (excise, etc.) 36.52 42.23 52.55 58.75 66.59 80.92

Advertising & marketing expenses 7.26 13.31 11.84 13.93 11.26 16.74

Distribution expenses 3.51 3.78 4.26 4.48 5.1 6.49

Others 32.96 37.32 26.04 57.27 60.65 70.37

Less: expenses capitalised 0.63 0.33 0 0 0 0

Non-recurring expenses 0.38 0.62 0.98 1.04 0.04 0.15

Depreciation 10.87 12.21 13.7 14.58 14.74 15.31

TOTAL 249.4 286.87 351.32 401.4 463.27 554.22

Profits / losses

PBIT 24.77 25.28 34.04 34.92 35.67 26.15

Financial charges (incl. lease rent) 19.73 17.86 13.71 8.8 7.33 8.6

PBT 5.04 7.42 20.33 26.12 28.34 17.55

Tax provision 0.47 3.46 8.61 9.44 10.45 8.71

PAT 4.57 3.96 11.72 16.68 17.89 8.84

-

Das könnte Ihnen auch gefallen

- T V S Motor Co. LTD.: Profits & Its Appropriation: Mar 2017 - Mar 2021: Non-Annualised: Rs. CroreDokument4 SeitenT V S Motor Co. LTD.: Profits & Its Appropriation: Mar 2017 - Mar 2021: Non-Annualised: Rs. CroreRahul DesaiNoch keine Bewertungen

- India Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008Dokument6 SeitenIndia Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008amitkr91Noch keine Bewertungen

- Income Latest: Financials (Standalone)Dokument3 SeitenIncome Latest: Financials (Standalone)Vishwavijay ThakurNoch keine Bewertungen

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDokument12 SeitenMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNoch keine Bewertungen

- Moneycontrol. P&L of Liberty ShoesDokument2 SeitenMoneycontrol. P&L of Liberty ShoesSanket Bhondage100% (1)

- Sourses of Funds: Balance Sheet 2010 2009Dokument4 SeitenSourses of Funds: Balance Sheet 2010 2009Deven PipaliaNoch keine Bewertungen

- Shree Cement Financial Model Projections BlankDokument10 SeitenShree Cement Financial Model Projections Blankrakhi narulaNoch keine Bewertungen

- RD AdjustmentDokument16 SeitenRD AdjustmentBrian AlmeidaNoch keine Bewertungen

- Ruchi, Purvi & Anam (FM)Dokument7 SeitenRuchi, Purvi & Anam (FM)045Purvi GeraNoch keine Bewertungen

- Profit and Loss Account of Akzo NobelDokument15 SeitenProfit and Loss Account of Akzo NobelKaizad DadrewallaNoch keine Bewertungen

- United Breweries Holdings LimitedDokument7 SeitenUnited Breweries Holdings Limitedsalini sasiNoch keine Bewertungen

- Particulars Mar'21 Mar'20 Mar'19 Mar'18 Mar'17 Mar'21 Mar'20 Mar'19 IncomeDokument4 SeitenParticulars Mar'21 Mar'20 Mar'19 Mar'18 Mar'17 Mar'21 Mar'20 Mar'19 IncomeShruti SrivastavaNoch keine Bewertungen

- Particulars Mar 2019 Mar 2018 Mar 2017 Mar 2016 Mar 2015 .CR .CR .CR .CR .CRDokument12 SeitenParticulars Mar 2019 Mar 2018 Mar 2017 Mar 2016 Mar 2015 .CR .CR .CR .CR .CRChandan KumarNoch keine Bewertungen

- Valuation: Beta and WACCDokument4 SeitenValuation: Beta and WACCnityaNoch keine Bewertungen

- Company 1 Yr1 Yr2 EPS 10 11 Price 100 110Dokument38 SeitenCompany 1 Yr1 Yr2 EPS 10 11 Price 100 110Bhaskar RawatNoch keine Bewertungen

- Symphony - DCF Valuation - Group6Dokument17 SeitenSymphony - DCF Valuation - Group6Faheem ShanavasNoch keine Bewertungen

- P and L - Dabur IndiaDokument2 SeitenP and L - Dabur IndiaRaja NatarajanNoch keine Bewertungen

- DBP Sheet Nexa FinalDokument26 SeitenDBP Sheet Nexa FinalSameer AgrawalNoch keine Bewertungen

- Compa Ny Profile - Bata India LTD.: Amarbir - Anand@bata - Co.in WWW - Bata.inDokument5 SeitenCompa Ny Profile - Bata India LTD.: Amarbir - Anand@bata - Co.in WWW - Bata.inSachin Kumar BassiNoch keine Bewertungen

- Less Than 5 Cr-UpdatedDokument21 SeitenLess Than 5 Cr-Updated2702275Noch keine Bewertungen

- 32 - Akshita - Sun Pharmaceuticals Industries.Dokument36 Seiten32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNoch keine Bewertungen

- Hero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17Dokument25 SeitenHero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17pranav sarawagiNoch keine Bewertungen

- Hero MotoCorp LTDDokument10 SeitenHero MotoCorp LTDpranav sarawagiNoch keine Bewertungen

- Apollo Hospitals Enterprise LimitedDokument4 SeitenApollo Hospitals Enterprise Limitedpaigesh1Noch keine Bewertungen

- Industry Segment of Bajaj CompanyDokument4 SeitenIndustry Segment of Bajaj CompanysantunusorenNoch keine Bewertungen

- Managerial P&L For Analysis Particulars 2008 2009 2010Dokument3 SeitenManagerial P&L For Analysis Particulars 2008 2009 2010Nimit ParekhNoch keine Bewertungen

- Income Statement 2018-2019 %: Sources of FundsDokument8 SeitenIncome Statement 2018-2019 %: Sources of FundsDebanjan MukherjeeNoch keine Bewertungen

- T Hi Liv S: - Ouc NG e OverDokument9 SeitenT Hi Liv S: - Ouc NG e OverRavi AgarwalNoch keine Bewertungen

- Ashok Leyland DCF TempletDokument9 SeitenAshok Leyland DCF TempletSourabh ChiprikarNoch keine Bewertungen

- Ratio Analysis of Asian PaintsDokument52 SeitenRatio Analysis of Asian PaintsM43CherryAroraNoch keine Bewertungen

- Balance Sheet (In Crores) - MSN LABORATARIESDokument3 SeitenBalance Sheet (In Crores) - MSN LABORATARIESnawazNoch keine Bewertungen

- Asian P & L CapitaTemplate1Dokument1 SeiteAsian P & L CapitaTemplate1vinoth_kannan149058Noch keine Bewertungen

- Dion Global Solutions LimitedDokument10 SeitenDion Global Solutions LimitedArthurNoch keine Bewertungen

- Sunpharma EditedDokument6 SeitenSunpharma EditedBerkshire Hathway coldNoch keine Bewertungen

- Ratios WorksheetDokument8 SeitenRatios WorksheetSakshi GargNoch keine Bewertungen

- (Billions) : Q2 2012 Data, Except Where NotedDokument17 Seiten(Billions) : Q2 2012 Data, Except Where Notedchatterjee rikNoch keine Bewertungen

- Lakme: Latest Quarterly/Halfyearly As On (Months)Dokument7 SeitenLakme: Latest Quarterly/Halfyearly As On (Months)Vikas UpadhyayNoch keine Bewertungen

- (XI) Bibliography and AppendixDokument5 Seiten(XI) Bibliography and AppendixSwami Yog BirendraNoch keine Bewertungen

- Comparative Statement of Profit and LossDokument2 SeitenComparative Statement of Profit and LossAnindya BatabyalNoch keine Bewertungen

- DSP Merrill Lynch LTD Industry:Securities/Commodities Trading ServicesDokument8 SeitenDSP Merrill Lynch LTD Industry:Securities/Commodities Trading Servicesapi-3699305Noch keine Bewertungen

- HUL FinancialsDokument5 SeitenHUL FinancialstheNoch keine Bewertungen

- Key Financial Ratios of HCL TechnologiesDokument9 SeitenKey Financial Ratios of HCL TechnologiesshirleyNoch keine Bewertungen

- Binani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomeDokument8 SeitenBinani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomemrupaniNoch keine Bewertungen

- UTV Software Communications LTDDokument4 SeitenUTV Software Communications LTDNeesha PrabhuNoch keine Bewertungen

- GilletteDokument14 SeitenGilletteapi-3702531Noch keine Bewertungen

- Full Yr IndexingDokument1 SeiteFull Yr IndexingbhuvaneshkmrsNoch keine Bewertungen

- FM Cce2Dokument7 SeitenFM Cce2shrutiNoch keine Bewertungen

- Maruti Suzuki: Submitted byDokument17 SeitenMaruti Suzuki: Submitted byMukesh KumarNoch keine Bewertungen

- Reliance Chemotex P and LDokument2 SeitenReliance Chemotex P and LRushil GabaNoch keine Bewertungen

- AsahiDokument2 SeitenAsahiABHAY KUMAR SINGHNoch keine Bewertungen

- Vodafone Idea Limited: PrintDokument1 SeiteVodafone Idea Limited: PrintPrakhar KapoorNoch keine Bewertungen

- Moneycontrol. P&L BataDokument2 SeitenMoneycontrol. P&L BataSanket BhondageNoch keine Bewertungen

- Kalyani HW - Danaysha TulsianiDokument10 SeitenKalyani HW - Danaysha TulsianiAryaman JainNoch keine Bewertungen

- Group - 4 PPT DraftDokument15 SeitenGroup - 4 PPT Draftrufus carvalhoNoch keine Bewertungen

- Book 2Dokument18 SeitenBook 2Aishwarya DaymaNoch keine Bewertungen

- Data Patterns Income&CashFlow - 4 Years - 19052020Dokument8 SeitenData Patterns Income&CashFlow - 4 Years - 19052020Sundararaghavan RNoch keine Bewertungen

- Case On UTV Software Communications LTDDokument5 SeitenCase On UTV Software Communications LTDShail MalviyaNoch keine Bewertungen

- Data of BhartiDokument2 SeitenData of BhartiAnkur MehtaNoch keine Bewertungen

- Assignment On Analysis of Annual Report ofDokument9 SeitenAssignment On Analysis of Annual Report oflalagopgapangamdas100% (1)

- Discounted Cash Flow: A Theory of the Valuation of FirmsVon EverandDiscounted Cash Flow: A Theory of the Valuation of FirmsNoch keine Bewertungen

- POTERS FIVE MODEL OF TATA TELE, Mba, NIT DURGAPURDokument14 SeitenPOTERS FIVE MODEL OF TATA TELE, Mba, NIT DURGAPURsarangdhar100% (1)

- HCL PPT, Mba, NIT DURGAPURDokument12 SeitenHCL PPT, Mba, NIT DURGAPURsarangdhar67% (3)

- Seni AnyamanDokument1 SeiteSeni Anyamanauni dalilah100% (1)

- Pantaloon Excel Sheet, Mba, NIT DURGAPURDokument17 SeitenPantaloon Excel Sheet, Mba, NIT DURGAPURsarangdharNoch keine Bewertungen

- Sarangdhar 2Dokument10 SeitenSarangdhar 2sarangdharNoch keine Bewertungen

- Fundamental Analysis of Pantaloon, Mba, NIT DURGAPURDokument26 SeitenFundamental Analysis of Pantaloon, Mba, NIT DURGAPURsarangdhar100% (2)

- Min Constraint: Max Constraint: Current Units: Product NameDokument30 SeitenMin Constraint: Max Constraint: Current Units: Product NamesarangdharNoch keine Bewertungen

- Technical Analysis of Indian Stock Market and SharesDokument42 SeitenTechnical Analysis of Indian Stock Market and Sharessarangdhar100% (14)

- Credit Policy,,NIT DURGAPURDokument12 SeitenCredit Policy,,NIT DURGAPURsarangdharNoch keine Bewertungen

- Sell off,,NIT DURGAPURDokument10 SeitenSell off,,NIT DURGAPURsarangdharNoch keine Bewertungen

- Ratio Analysis,,NIT DURGAPURDokument9 SeitenRatio Analysis,,NIT DURGAPURsarangdharNoch keine Bewertungen

- QuestionnaireDokument2 SeitenQuestionnairesarangdharNoch keine Bewertungen

- Points On Agriculture RetailDokument9 SeitenPoints On Agriculture RetailsarangdharNoch keine Bewertungen

- Portfolio Monitoring,,NIT DURGAPURDokument11 SeitenPortfolio Monitoring,,NIT DURGAPURsarangdharNoch keine Bewertungen

- Bond Yield CalculatorDokument1 SeiteBond Yield CalculatorsarangdharNoch keine Bewertungen

- TATA CHEMICALS-Operating CycleDokument4 SeitenTATA CHEMICALS-Operating CyclesarangdharNoch keine Bewertungen

- Optimal Hedging Strategy,,NIT DURGAPURDokument1 SeiteOptimal Hedging Strategy,,NIT DURGAPURsarangdharNoch keine Bewertungen

- Cost of Caital - Tata ChemicalsDokument7 SeitenCost of Caital - Tata ChemicalssarangdharNoch keine Bewertungen

- Tata ChemicalsL LEVERAGEDokument2 SeitenTata ChemicalsL LEVERAGEsarangdharNoch keine Bewertungen

- Gross Fixed Assets: Gabriel India LTDDokument3 SeitenGross Fixed Assets: Gabriel India LTDsarangdharNoch keine Bewertungen

- DavidDokument2 SeitenDavidsarangdharNoch keine Bewertungen

- Dependent Indep1 Indep2 Indep3: No. of Variables No. of ObservationsDokument29 SeitenDependent Indep1 Indep2 Indep3: No. of Variables No. of ObservationssarangdharNoch keine Bewertungen

- Cost of Caital - Tata ChemicalsDokument7 SeitenCost of Caital - Tata ChemicalssarangdharNoch keine Bewertungen

- Cost of Caital - Gabriel IndiaDokument26 SeitenCost of Caital - Gabriel IndiasarangdharNoch keine Bewertungen

- TATA CHEMICALS-Operating CycleDokument4 SeitenTATA CHEMICALS-Operating CyclesarangdharNoch keine Bewertungen