Beruflich Dokumente

Kultur Dokumente

Master Budget for Electronics Company Automated System

Hochgeladen von

René MorelOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Master Budget for Electronics Company Automated System

Hochgeladen von

René MorelCopyright:

Verfügbare Formate

Managerial Accounting Chapter 9

CHAPTER 9: CASE STUDY 9-45 Comprehensive Master Budget; Borrowing; Acquisition of Automated Material-Handling System Rene Morel Embry-Riddle Aeronautical University Online

MBAA 517 Instructor: Dr. Ana Machuca

Managerial Accounting Chapter 9 Activity 5.5 Case Study 5 9-45 In this activity, you will solve a case out of your textbook, Managerial Accounting. The intent of the Case Studies is to show how to analyze module related managerial accounting financial data in an organizations setting. For this case study, you will be able to demonstrate your ability to correctly calculate a master budget. Your fifth Case Study will be Case 9-45: Comprehensive Master Budget, Borrowing, Acquisition of Automated Material-Handling System. This case can be found at the end of Chapter 9. The primary focus of this case study is to develop a comprehensive master budget. Your assignment is to complete the requirements identified for Case 9-45: 1. Sales Budget, 2. Cash Receipts Budget, 3. Purchases Budget, and 4. Cash Disbursement Budget. This Case Study is due by the last day of Module 5.

We really need to get this new material-handling equipment in operation just after the new year begins. I hope we can finance it largely with cash and marketable securities, but if necessary we can get a short-term loan down at MetroBank. This statement by Beth DaviesLowry, president of Intercoastal Electronics Company, concluded a meeting she had called with the firms top management. Intercoastal is a small, rapidly growing wholesaler of consumer electronic products. The firms main product lines are small kitchen appliances and power tools. Marcia Wilcox, Intercoastals General Manager of Marketing, has recently completed a sales forecast. She believes the companys sales during the first quarter of 20x1 will increase by 10 percent each month over the previous months sales. Then Wilcox expects sales to remain constant for several months. Intercoastals projected balance sheet as of December 31, 20x10, is as follows:

INTERCOASTAL'S PROJECTED BALANCE SHEET Cash Accounts receivable Marketable Securities Inventory Buildings and Equipment Total Assets Accounts payable Bond interest payable property taxes payable Bonds payable (10% Due in 20x6) Common Stock Retained Earnings Total Liabilities and Stockholder's Equity $35,000.00 $270,000.00 $15,000.00 $154,000.00 $626,000.00 $1,100,000.00 $176,400.00 $12,500.00 $3,600.00 $300,000.00 $500,000.00 $107,500.00 $1,100,000.00

Managerial Accounting Chapter 9

Jack Hanson, the assistant controller, is now preparing a monthly budget for the first quarter of 20x1. In the process, the following information has been accumulated: 1. Projected sales for December of 20x0 are $400,000. Credit sales typically are 75% of total sales. Intercoastals credit experience indicates that 10 percent of the credit sales are collected during the month of sale, and the remainder are collected during the following month. 2. Intercoastals COGS generally runs at 70% of sales. Inventory is purchased on account, and 40% of each months purchases are paid during the month of purchase. The remainder is paid during the following month. In order to have adequate stocks of inventory on hand, the firm attempts to have inventory at the end of each month equal to half of the next months projected COGS. 3. Hanson has estimated that Intercoastals other monthly expenses will be as follows:

Sales salaries Advertising and promotion Administrative salaries Depreciation Interest on bonds Property taxes $21,000.00 $16,000.00 $21,000.00 $25,000.00 $2,500.00 $900.00

In addition, sales commissions run at the rate of 1 percent of sales.

4. Intercoastals president, Davies-Lowry, has indicated that the firm should invest $125,000 in an automated inventory-handling system to control the movement of inventory in the firms warehouse just after the new year begins. These equipment purchases will be financed primarily from the firms cash and marketable securities. However, Davies-Lowry believes that Intercoastal needs to keep a minimum cash balance of $25,000.00. If necessary, the remainder of the equipment purchases will be financed using short-term credit from a local bank. The minimum period for such a loan is three months. Hanson believes short-term interest rates will be 10 percent per year at the time of the equipment purchases. If a loan is necessary, Davies-Lowry has decided it should be paid off by the end of the first quarter if possible. 5. Intercoastals board of directors has indicated an intention to declare and pay dividends of $50,000 on the last day of each quarter. 6. The interest on any short-term borrowing will be paid when the loan is repaid. Interest on Intercoastals bonds is paid semiannually on January 31 and July 31 for the preceding six-month period.

Managerial Accounting Chapter 9

7. Property taxes are paid semiannually on February 28 and August 31 for the preceding six-mont period. Required: Prepare Intercoastal Electronics Companys master budget for the first quarter of 20x1 completing the following schedules and statements.

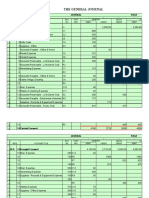

1. Sales Budget 20x0 20x1 December January February March 1st Quarter $400,000.00 $440,000.00 $484,000.00 $532,400.00 $1,456,400.00 $100,000.00 $110,000.00 $121,000.00 $133,100.00 $364,100.00 $300,000.00 $330,000.00 $363,000.00 $399,300.00 $1,092,300.00

Total Sales Cash sales Sales on account

2. Cash Receipts budget:

2011 January February March 1st Quarter $110,000.00 $121,000.00 $133,100.00 $364,100.00

Cash sales Cash collections from credit sales made during current month Cash collections from credit sales made during preceding month Total cash receipts

$33,000.00

$36,300.00

$39,930.00

$109,230.00

$270,000.00 $413,000.00

$297,000.00 $454,300.00

$326,700.00 $499,730.00

$893,700.00 $1,367,030.00

3. Purchases budget:

20x0 December $280,000.00 $154,000.00 $434,000.00 $140,000.00 $294,000.00 20x1 January $308,000.00 $169,400.00 $477,400.00 $154,000.00 $323,400.00 February $338,800.00 $186,340.00 $525,140.00 $169,400.00 $355,740.00 March $372,680.00 $186,340.00 $559,020.00 $186,340.00 $372,680.00 1st Quarter $1,019,480.00 $186,340.00 $1,205,820.00 $154,000.00 $1,051,820.00

Budgeted COGS Add: Desired ending inventory Total goods needed Less: Expected beginning Inventory Purchases

Managerial Accounting Chapter 9

4. Cash disbursements budget:

20x1 January Inventory purchases: Cash payments for purchases during the current month Cash payments for purchases during the preceding month Total cash payments for inventory purchases Other expenses: Sales salaries Advertising and promotion Administrative salaries Interest on bonds Property taxes Sales commissions Total cash payments for other expenses Total cash disbursements $129,360.00 February $142,296.00 March $149,072.00 1st Quarter $420,728.00

$176,400.00

$194,040.00

$213,444.00

$583,884.00

$305,760.00 $21,000.00 $16,000.00 $21,000.00 $15,000.00 $0.00 $4,400.00 $77,400.00 $383,160.00

$336,336.00 $21,000.00 $16,000.00 $21,000.00 $0.00 $5,400.00 $4,840.00 $68,240.00 $404,576.00

$362,516.00 $21,000.00 $16,000.00 $21,000.00 $0.00 $0.00 $5,324.00 $63,324.00 $425,840.00

$1,004,612.00 $63,000.00 $48,000.00 $63,000.00 $15,000.00 $5,400.00 $14,564.00 $208,964.00 $1,213,576.00

5. Complete the first three lines of the summary cash budget. Then do the analysis of shortterm financing needs in requirement 6. Then finish requirement 5.

20x1 January February March 1st Quarter $413,000.00 $454,300.00 $499,730.00 $1,367,030.00 ($383,160.00) $29,840.00 $15,000.00 $100,000.00 ($125,000.00) ($100,000.00) ($2,500.00) ($50,000.00) ($100,000.00) ($2,500.00) ($50,000.00) ($9,046.00) $35,000.00 $25,954.00 ($404,576.00) $49,724.00 ($425,840.00) ($1,213,576.00)

Cash receipts (from schedule 2) Less: Cash disbursements (from schedule 4) Change in cash balance during period due to operations Sale of marketable securities (1/2/x1) Proceeds from bank loan (1/2/x1) Purchase of equipment Repayment of bank loan (3/31/x1) interest on bank loan payment of dividends Change in cash balance during first quarter Cash balances, 1/1/x1 Cash balance, 3/31/x1

Managerial Accounting Chapter 9

6. Analysis of short-term financing needs:

Projected cash balance as of December 31, 20x0 Less: Minimum cash balance Cash available for equipment purchases Projected proceeds from sale of marketable securities Cash available Less: Cost of investment in equipment Required short-term borrowing $35,000.00 $25,000.00 $10,000.00 $15,000.00 $25,000.00 $125,000.00 ($100,000.00)

7.Prepare Intercoastal Electronics budgeted income statement for the first quarter of 20x1. (Ignore Income taxes)

Income Statement Revenue COGS Gross Margin Expenses: Sales salaries Advertising and promotion Administrative salaries Interest on bonds Property taxes Sales commissions Interest on bank loan Depreciation Total expenses: Net Income: $1,456,400.00 $1,019,480.00 $436,920.00

$63,000.00 $48,000.00 $63,000.00 $7,500.00 $2,700.00 $14,564.00 $2,500.00 $75,000.00 $276,264.00 $160,656.00

Managerial Accounting Chapter 9

8. Prepare Intercoastal Electronics budgeted statement of retained earnings for the first quarter of 20x1.

Retained Earnings Retained Earnings as of December Net Income Dividends Retained Earnings as of March $107,500.00 $160,656.00 ($50,000.00) $218,156.00

9. Prepare Intercoastal Electronics budgeted balance sheet as of March, 20x1.

Balance Sheet as of March 31st Cash Accounts receivable Marketable Securities Inventory Buildings and Equipment Total Assets Accounts payable Bond interest payable property taxes payable Bonds payable (10% Due in 20x6) Common Stock Retained Earnings Total Liabilities and Stockholder's Equity $25,954.00 $359,370.00 $0.00 $186,340.00 $676,000.00 $1,247,664.00 $223,608.00 $5,000.00 $900.00 $300,000.00 $500,000.00 $218,156.00 $1,247,664.00

Das könnte Ihnen auch gefallen

- Management AccountingDokument5 SeitenManagement AccountingHamdan SheikhNoch keine Bewertungen

- Calculate Working Capital Cycle & Cash Operating CycleDokument6 SeitenCalculate Working Capital Cycle & Cash Operating CyclethomaspoliceNoch keine Bewertungen

- Management Accounting SundayDokument5 SeitenManagement Accounting SundayAhsan MaqboolNoch keine Bewertungen

- Financial Accounting11Dokument14 SeitenFinancial Accounting11AleciafyNoch keine Bewertungen

- ACCT5101Pretest PDFDokument18 SeitenACCT5101Pretest PDFArah OpalecNoch keine Bewertungen

- C 10chap10Dokument103 SeitenC 10chap10Aya ObandoNoch keine Bewertungen

- HI5017 Progressive Tutorial Question Assignment T2 2020 PDFDokument8 SeitenHI5017 Progressive Tutorial Question Assignment T2 2020 PDFIkramNoch keine Bewertungen

- Chapter 04 - 12thDokument16 SeitenChapter 04 - 12thSarah JamesNoch keine Bewertungen

- Week17 2010 CorDokument20 SeitenWeek17 2010 CormdafeshNoch keine Bewertungen

- Seminar 11answer Group 10Dokument75 SeitenSeminar 11answer Group 10Shweta Sridhar40% (5)

- Master Budget ASISTENSI 3 AKUNTANSI MANAJEMENDokument4 SeitenMaster Budget ASISTENSI 3 AKUNTANSI MANAJEMENLupita WidyaningrumNoch keine Bewertungen

- Accounting For Managers-Assignment MaterialsDokument4 SeitenAccounting For Managers-Assignment MaterialsYehualashet TeklemariamNoch keine Bewertungen

- F7 Revision Test Section A and B 1Dokument15 SeitenF7 Revision Test Section A and B 1Farman ShaikhNoch keine Bewertungen

- Master budget for electronics companyDokument8 SeitenMaster budget for electronics companyBlackBunny103Noch keine Bewertungen

- ACC 421 Week+5+Team+AssignmentsDokument19 SeitenACC 421 Week+5+Team+AssignmentsBabay Taz0% (2)

- Handout: Course Code and Name: Unit Code: Unit TitleDokument10 SeitenHandout: Course Code and Name: Unit Code: Unit TitleGabriel ZuanettiNoch keine Bewertungen

- SITXFIN003 - Student Assessment v3.1Dokument11 SeitenSITXFIN003 - Student Assessment v3.1Esteban BuitragoNoch keine Bewertungen

- MACP.L II Question April 2019Dokument5 SeitenMACP.L II Question April 2019Taslima AktarNoch keine Bewertungen

- Solution and AnswerDokument4 SeitenSolution and AnswerMicaela EncinasNoch keine Bewertungen

- Master Budget Case: Toyworks Ltd. (A)Dokument4 SeitenMaster Budget Case: Toyworks Ltd. (A)RIKUDO SENNIN100% (1)

- IMAC Budgeting Project Semester 2 2021Dokument4 SeitenIMAC Budgeting Project Semester 2 2021TashaNoch keine Bewertungen

- Cash Budgets 2Dokument9 SeitenCash Budgets 2Kopanang LeokanaNoch keine Bewertungen

- MNTC Ltd. monthly master budgetDokument4 SeitenMNTC Ltd. monthly master budgetdelgermurun deegiiNoch keine Bewertungen

- Financial Management PORTFOLIO MidDokument8 SeitenFinancial Management PORTFOLIO MidMyka Marie CruzNoch keine Bewertungen

- Financial Management PORTFOLIO MidDokument8 SeitenFinancial Management PORTFOLIO MidMyka Marie CruzNoch keine Bewertungen

- TACC507GroupAssignmentReportandPresentation 82339240Dokument6 SeitenTACC507GroupAssignmentReportandPresentation 82339240Zain NaeemNoch keine Bewertungen

- 202E06Dokument21 Seiten202E06foxstupidfoxNoch keine Bewertungen

- AE24 Lesson 5Dokument9 SeitenAE24 Lesson 5Majoy BantocNoch keine Bewertungen

- Practice Exam 1 - With SolutionsDokument36 SeitenPractice Exam 1 - With SolutionsMd Shamsul Arif KhanNoch keine Bewertungen

- Business Finance Note 2Dokument19 SeitenBusiness Finance Note 2Ruth MuñozNoch keine Bewertungen

- Financial AssumptionsDokument13 SeitenFinancial AssumptionsnorlieNoch keine Bewertungen

- Fin 370-Week 1-5 W/final Exam - Updated June 8 2014Dokument5 SeitenFin 370-Week 1-5 W/final Exam - Updated June 8 2014Rambo Gant75% (4)

- Managerial Accounting Exam CHDokument17 SeitenManagerial Accounting Exam CH808kailuaNoch keine Bewertungen

- Acca f5 2012 DecDokument8 SeitenAcca f5 2012 DecgrrrklNoch keine Bewertungen

- Financial Forecasting: SIFE Lakehead 2009Dokument7 SeitenFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNoch keine Bewertungen

- Managerial Budget Master ProjectDokument2 SeitenManagerial Budget Master Projectapi-340156713Noch keine Bewertungen

- Chapter 7-QuestionsDokument8 SeitenChapter 7-Questionssunnitd10Noch keine Bewertungen

- BudgetDokument6 SeitenBudgetshobuzfeni100% (1)

- ACCT504 Practice Case Study 3 SolutionDokument2 SeitenACCT504 Practice Case Study 3 SolutionRegina Lee FordNoch keine Bewertungen

- IPE 481 - Term Final Question - January 2020Dokument6 SeitenIPE 481 - Term Final Question - January 2020Shaumik RahmanNoch keine Bewertungen

- BudgetingDokument9 SeitenBudgetingshobi_300033% (3)

- Lecture-7 Overhead (Part 1)Dokument22 SeitenLecture-7 Overhead (Part 1)Nazmul-Hassan Sumon100% (2)

- Exam161 10Dokument7 SeitenExam161 10patelp4026Noch keine Bewertungen

- Sales-BudgetDokument57 SeitenSales-BudgetBea NicoleNoch keine Bewertungen

- IF2 - Project 1 PDFDokument6 SeitenIF2 - Project 1 PDFBillNoch keine Bewertungen

- Business Finance Module 2Dokument18 SeitenBusiness Finance Module 2moonlitbibliophileNoch keine Bewertungen

- Accounting 201 Midterm Practice ProblemsDokument9 SeitenAccounting 201 Midterm Practice ProblemsLương Thế CườngNoch keine Bewertungen

- Assignment # 2 MBA Financial and Managerial AccountingDokument7 SeitenAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNoch keine Bewertungen

- Master BudgetDokument32 SeitenMaster BudgetxodiacNoch keine Bewertungen

- Exercises On Accounting RatiosDokument7 SeitenExercises On Accounting RatiosDiannaNoch keine Bewertungen

- Cost and Management Accounting -II - Work SheetDokument7 SeitenCost and Management Accounting -II - Work SheetBeamlak WegayehuNoch keine Bewertungen

- Connick Company Sells Its Product For 22 Per Unit ItsDokument2 SeitenConnick Company Sells Its Product For 22 Per Unit ItsAmit PandeyNoch keine Bewertungen

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDokument31 SeitenPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamNoch keine Bewertungen

- Financial Planning Tools and Concepts: Lesson 3Dokument21 SeitenFinancial Planning Tools and Concepts: Lesson 3chacha caberNoch keine Bewertungen

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDokument7 Seiten# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuNoch keine Bewertungen

- Hillyard CompanyDokument18 SeitenHillyard CompanyShellyn Erespe Gomez100% (4)

- Assignment Brief - Assignment 02 - Accounting Principles - April-July2022Dokument12 SeitenAssignment Brief - Assignment 02 - Accounting Principles - April-July2022manojNoch keine Bewertungen

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesVon EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNoch keine Bewertungen

- Solution Manual09Dokument69 SeitenSolution Manual09ULank 'zulhan Darwis' Chullenk100% (1)

- Activity 6.2Dokument1 SeiteActivity 6.2René MorelNoch keine Bewertungen

- At Least Two of Your Classmates in The Forum.: Flexible BudgetsDokument1 SeiteAt Least Two of Your Classmates in The Forum.: Flexible BudgetsRené MorelNoch keine Bewertungen

- 11 55Dokument7 Seiten11 55René Morel100% (2)

- Standard Quantity Unit Cost Total Cost Cost Item: Static Budget Actual VarianceDokument3 SeitenStandard Quantity Unit Cost Total Cost Cost Item: Static Budget Actual VarianceRené MorelNoch keine Bewertungen

- 9 45Dokument10 Seiten9 45René MorelNoch keine Bewertungen

- 16 58Dokument3 Seiten16 58René MorelNoch keine Bewertungen

- Banking Company QuestionDokument11 SeitenBanking Company QuestionOmkar VichareNoch keine Bewertungen

- Module 9 PAS 32Dokument5 SeitenModule 9 PAS 32Jan JanNoch keine Bewertungen

- FIN 420 Chapter 3 (Financial Ratio and Analysis)Dokument20 SeitenFIN 420 Chapter 3 (Financial Ratio and Analysis)Izzati Abd Rahim100% (1)

- Assessment of Working CapitalDokument72 SeitenAssessment of Working Capitaladil sheikhNoch keine Bewertungen

- Financial Statements and Ratio AnalysisDokument47 SeitenFinancial Statements and Ratio AnalysisYunita AngelicaNoch keine Bewertungen

- Contoh AnalisisDokument17 SeitenContoh AnalisisNurnazihaNoch keine Bewertungen

- PAS 1 Presentation of Financial StatementsDokument18 SeitenPAS 1 Presentation of Financial Statementslyzza joice javierNoch keine Bewertungen

- Career Paths Accounting SB-33Dokument1 SeiteCareer Paths Accounting SB-33YanetNoch keine Bewertungen

- Financial Analysis Sample 5Dokument10 SeitenFinancial Analysis Sample 5throwawayyyNoch keine Bewertungen

- FM - 200 MCQDokument41 SeitenFM - 200 MCQmangesh75% (12)

- New MHRD FormatDokument114 SeitenNew MHRD Formatapk576563Noch keine Bewertungen

- Corporate Expansion and Accounting For Business Combination: Mcgraw-Hill/ IrwinDokument36 SeitenCorporate Expansion and Accounting For Business Combination: Mcgraw-Hill/ IrwinYudhi SutanaNoch keine Bewertungen

- MGT - 101 Short Notes by Vu - ToperDokument37 SeitenMGT - 101 Short Notes by Vu - ToperBisma AmjaidNoch keine Bewertungen

- Birla RatioDokument22 SeitenBirla RatioveeraranjithNoch keine Bewertungen

- Consolidated Financial Statement From BPCL Website - 2019 - 20Dokument10 SeitenConsolidated Financial Statement From BPCL Website - 2019 - 20Mahesh RamamurthyNoch keine Bewertungen

- Ge MMWDokument7 SeitenGe MMWJunjie Dela RamosNoch keine Bewertungen

- Funds Flow StatementDokument5 SeitenFunds Flow StatementAshfaq ZameerNoch keine Bewertungen

- Kieso Inter Ch22 - IfRS (Accounting Changes)Dokument59 SeitenKieso Inter Ch22 - IfRS (Accounting Changes)Restika FajriNoch keine Bewertungen

- Partnership Accounting Quiz Submissions: Standalone AssessmentDokument5 SeitenPartnership Accounting Quiz Submissions: Standalone AssessmentChesca Alon100% (1)

- Loan Amortization Schedule ABC LoanDokument8 SeitenLoan Amortization Schedule ABC LoanThalia SandersNoch keine Bewertungen

- Exercise On Csofp - Mixed TartDokument3 SeitenExercise On Csofp - Mixed TartNoor ShukirrahNoch keine Bewertungen

- Cash and Accrual BasisDokument4 SeitenCash and Accrual BasisSeulgi KangNoch keine Bewertungen

- Week 10 - CE40Dokument2 SeitenWeek 10 - CE40Mhel CenidozaNoch keine Bewertungen

- Guyon-Dj Big EdDokument30 SeitenGuyon-Dj Big EdJazzlynn GuytonNoch keine Bewertungen

- Assignment Chapter 2 SOLUTIONDokument6 SeitenAssignment Chapter 2 SOLUTIONBeatrice BallabioNoch keine Bewertungen

- Partnership Liquidation NotesDokument7 SeitenPartnership Liquidation NotesMary Rica DublonNoch keine Bewertungen

- Depreciation Methods For Engineering EconomyDokument18 SeitenDepreciation Methods For Engineering EconomyKasih Liyana0% (1)

- CA Intermediate Accounting Chapter 3 QuestionsDokument15 SeitenCA Intermediate Accounting Chapter 3 QuestionsKabiir RathodNoch keine Bewertungen

- Quant Factor Library BrochureDokument4 SeitenQuant Factor Library BrochureAyush dhimanNoch keine Bewertungen

- HKFRS for Private Entities: Nelson Lam Nelson Lam 林智遠 林智遠Dokument77 SeitenHKFRS for Private Entities: Nelson Lam Nelson Lam 林智遠 林智遠ChanNoch keine Bewertungen