Beruflich Dokumente

Kultur Dokumente

Lim Vs CA

Hochgeladen von

charie2Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lim Vs CA

Hochgeladen von

charie2Copyright:

Verfügbare Formate

Lim vs CA/PP GRN L- 48134-37 Fernan, J.: Facts: Petitioner Spouses (Lim) were engaged in a Lendership business.

A Raid was made on their promises and seized were business and accounting records which served as bases for an investigation by BIR. Findings reveal that income tax filed for 1958/1959 were false or fraudulent. BIR referred the case to Manila for investigation and prosecution. RTC found spouses guilty but Emilio Lim died and CA resolved that counsel petitioners should inform the court as to who are the heirs of Emilio. October 18, 1990

Issue: Whether or not the civil obligation arising from the crime charged was extinguished by his death. Ruling: Indubitably, petitioners had filed false and fraudulent income tax returns for the years 1958 and 1959 by non-disclosure of sales in the aggregate amount of P 2,197,742.92 thereby depriving the government in the amount of P 1,237,190.55 representing deficiency income taxes inclusive of interest, surcharges and compromise penalty for the late payment. Considering it occurred in the 50s the defraudation was on a massive scale. It is clear that criminal conviction for a violation of any penal provision in the tax code does not mount at the same time to a decision for a payment of the unpaid taxes in as much as there is no specific provision in the tax code prior to its amendment. The trial court did not order the payment of the unpaid taxes as a part of the sentence. The supervening death of Emilio has extinguished his liability with regard to the pecuniary penalty of fine imposed on the deceased. The crime of filling false return can be considered discovered only after the manner of commission and the nature and extent of the fraud have been definitely ascertained. It was only Oct. 10, 1967 when the BIR rendered its decision holding that there was no ground for the reversal of the assessment and therefore required the petitioners to pay deficiency taxes that the tax infractions were discovered

Das könnte Ihnen auch gefallen

- CIR v. Enron Subic Power CorporationDokument2 SeitenCIR v. Enron Subic Power CorporationGain DeeNoch keine Bewertungen

- Masikip Vs City of PasigDokument2 SeitenMasikip Vs City of PasigEm Asiddao-DeonaNoch keine Bewertungen

- Case DigestDokument3 SeitenCase DigestLourdes GuidaoenNoch keine Bewertungen

- Bache vs. Ruiz DigestDokument3 SeitenBache vs. Ruiz DigestJay EmNoch keine Bewertungen

- Phil. Match vs. City of CebuDokument1 SeitePhil. Match vs. City of CebuPilyang SweetNoch keine Bewertungen

- GR 185023 DigestDokument6 SeitenGR 185023 DigestYvet KatNoch keine Bewertungen

- Abella Vs NLRCGDokument1 SeiteAbella Vs NLRCGanne_ganzanNoch keine Bewertungen

- Reyes vs. CADokument1 SeiteReyes vs. CAJerry SerapionNoch keine Bewertungen

- Juan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeDokument2 SeitenJuan vs. Ca: DOCTRINE/S: The Disallowance of ISSUE/S: Whether An Interest Can BeLucifer MorningNoch keine Bewertungen

- 73-Country Bankers Insurance Corporation vs. Lianga Bay and Community Multi-Purpose Cooperative, 374 SCRA 653 (2002)Dokument6 Seiten73-Country Bankers Insurance Corporation vs. Lianga Bay and Community Multi-Purpose Cooperative, 374 SCRA 653 (2002)Jopan SJNoch keine Bewertungen

- Feeder Int'l v. CADokument2 SeitenFeeder Int'l v. CAJoycee ArmilloNoch keine Bewertungen

- Republic v. PLDT, 26 Scra 620Dokument6 SeitenRepublic v. PLDT, 26 Scra 620Anonymous 33LIOv6LNoch keine Bewertungen

- Tio Vs VRB DigestDokument2 SeitenTio Vs VRB Digestjimart10Noch keine Bewertungen

- GR No. 91271 Oct 3 1991 Rizon vs. SandiganbayanDokument6 SeitenGR No. 91271 Oct 3 1991 Rizon vs. SandiganbayanEppie SeverinoNoch keine Bewertungen

- GR No. L-18840 Kuenzle & Streiff V CirDokument7 SeitenGR No. L-18840 Kuenzle & Streiff V CirRene ValentosNoch keine Bewertungen

- 03 CIR Vs British Overseas Airways CorpDokument2 Seiten03 CIR Vs British Overseas Airways CorpCP LugoNoch keine Bewertungen

- Social Justice SocietyDokument13 SeitenSocial Justice SocietyInnah Agito-RamosNoch keine Bewertungen

- Oblicon Case 01 - de Guiya v. Manila Electric Co - DigestDokument2 SeitenOblicon Case 01 - de Guiya v. Manila Electric Co - DigestMichaelVillalonNoch keine Bewertungen

- Manila Surety vs. LimDokument7 SeitenManila Surety vs. LimTia RicafortNoch keine Bewertungen

- 142-Heng Tong Textiles Co., Inc. v. CIR, August 26, 1968Dokument2 Seiten142-Heng Tong Textiles Co., Inc. v. CIR, August 26, 1968Jopan SJNoch keine Bewertungen

- Acar Vs RosalDokument2 SeitenAcar Vs RosalJean HerreraNoch keine Bewertungen

- CIR Vs Central Luzon Drug CorpDokument8 SeitenCIR Vs Central Luzon Drug CorpCollen Anne PagaduanNoch keine Bewertungen

- Bolastig v. Sandiganbayan, 235 SCRA 103Dokument5 SeitenBolastig v. Sandiganbayan, 235 SCRA 103Karen Patricio LusticaNoch keine Bewertungen

- CD - 6. Tio v. Videogram Regulatory BoardDokument1 SeiteCD - 6. Tio v. Videogram Regulatory BoardAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CIR vs. ENRON Subic Power Corp, GR No. 166368, January 19, 2009Dokument2 SeitenCIR vs. ENRON Subic Power Corp, GR No. 166368, January 19, 2009Aldrin TangNoch keine Bewertungen

- Cabanlig vs. SB - Self DefenseDokument11 SeitenCabanlig vs. SB - Self DefensehlcameroNoch keine Bewertungen

- 17.manliclic vs. Calaunan (FLORES)Dokument2 Seiten17.manliclic vs. Calaunan (FLORES)Camille Flores100% (1)

- 037 Pepsi Cola vs. City of ButuanDokument2 Seiten037 Pepsi Cola vs. City of ButuanlorenbeatulalianNoch keine Bewertungen

- Genato v. Silapan, AC 4078, 2003Dokument6 SeitenGenato v. Silapan, AC 4078, 2003Vincent TanNoch keine Bewertungen

- City of Manila DigestDokument12 SeitenCity of Manila DigestArthur John GarratonNoch keine Bewertungen

- Pelizloy Realty vs. Province of Benguet G.R. No. 183137, April 10, 2013Dokument2 SeitenPelizloy Realty vs. Province of Benguet G.R. No. 183137, April 10, 2013Joshua BacarroNoch keine Bewertungen

- 10 Chavez Vs CA 24 Scra 663Dokument19 Seiten10 Chavez Vs CA 24 Scra 663LalaLanibaNoch keine Bewertungen

- Philreca Vs SecDokument2 SeitenPhilreca Vs SecBianca Viel Tombo CaligaganNoch keine Bewertungen

- 12 Lorenzo vs. PosadasDokument2 Seiten12 Lorenzo vs. PosadasJoshua Erik MadriaNoch keine Bewertungen

- Digest People Vs NazarioDokument2 SeitenDigest People Vs NazarioTenten Belita PatricioNoch keine Bewertungen

- REM CASE For WritingDokument31 SeitenREM CASE For WritingUPDkathNoch keine Bewertungen

- 02-CIR v. Pineda G.R. No. L-22734 September 15, 1967Dokument3 Seiten02-CIR v. Pineda G.R. No. L-22734 September 15, 1967Jopan SJNoch keine Bewertungen

- CIR v. Hon. CA, CTA and Fortune Tobacco CorpDokument2 SeitenCIR v. Hon. CA, CTA and Fortune Tobacco CorpEdvangelineManaloRodriguezNoch keine Bewertungen

- Rem DigestDokument20 SeitenRem DigestOppa KyuNoch keine Bewertungen

- 2018 IRR of The CLAS Rules FINAL 05 10 18 With e Signature PDFDokument16 Seiten2018 IRR of The CLAS Rules FINAL 05 10 18 With e Signature PDFAlfred Bryan AspirasNoch keine Bewertungen

- Tiu Vs CA - Case DigestDokument2 SeitenTiu Vs CA - Case DigestimXinY33% (3)

- Petron Corporation V CIRDokument2 SeitenPetron Corporation V CIRiciamadarangNoch keine Bewertungen

- Lim vs. DBP (For Civ Digest)Dokument23 SeitenLim vs. DBP (For Civ Digest)Kevin BonaobraNoch keine Bewertungen

- Summons Personally Must Be Narrated in The ReturnDokument3 SeitenSummons Personally Must Be Narrated in The ReturnmoniquehadjirulNoch keine Bewertungen

- Del Mundo Vs CapistranoDokument4 SeitenDel Mundo Vs CapistranoRmLyn MclnaoNoch keine Bewertungen

- Jose Juan Tong Vs Go Tiat KunDokument9 SeitenJose Juan Tong Vs Go Tiat KunLyceum LawlibraryNoch keine Bewertungen

- 16 Carabeo Vs DingcoDokument2 Seiten16 Carabeo Vs DingcoGyelamagne EstradaNoch keine Bewertungen

- 106 Pilipinas Total Gas Vs CIRDokument3 Seiten106 Pilipinas Total Gas Vs CIRPia100% (1)

- Castellvi de Higgins CaseDokument2 SeitenCastellvi de Higgins CaserengieNoch keine Bewertungen

- Tax Remedies DigestsDokument19 SeitenTax Remedies DigestsHiedi SugamotoNoch keine Bewertungen

- Cir Vs Enron Subic Power CorpDokument7 SeitenCir Vs Enron Subic Power Corpjan panerioNoch keine Bewertungen

- LBP Vs OngDokument6 SeitenLBP Vs OngMaLizaCainapNoch keine Bewertungen

- Cajucom, VII vs. TPI Phils. Cement Corporation, Et Al., G.R. No. 149090, February 11, 2005Dokument12 SeitenCajucom, VII vs. TPI Phils. Cement Corporation, Et Al., G.R. No. 149090, February 11, 2005Mark Anthony RefugiaNoch keine Bewertungen

- Taxation: SEC 1-83 p347Dokument347 SeitenTaxation: SEC 1-83 p347ArtLayeseNoch keine Bewertungen

- Jurisprudence - ListDokument4 SeitenJurisprudence - ListmYedaadNoch keine Bewertungen

- Republic vs. Heirs of JalandoniDokument2 SeitenRepublic vs. Heirs of JalandoniJo BudzNoch keine Bewertungen

- GR 120935 - Adamson Vs CIRDokument11 SeitenGR 120935 - Adamson Vs CIRJane MarianNoch keine Bewertungen

- CIR Vs Benguet Corp. - GR 145559, 14 July 2006Dokument2 SeitenCIR Vs Benguet Corp. - GR 145559, 14 July 2006ewnesssNoch keine Bewertungen

- Lim, Sr. vs. Court of Appeals, 190 SCRA 616, G.R. Nos. 48134-37. October 18, 1990Dokument4 SeitenLim, Sr. vs. Court of Appeals, 190 SCRA 616, G.R. Nos. 48134-37. October 18, 1990Pilyang SweetNoch keine Bewertungen

- Cases in Ethics 1Dokument22 SeitenCases in Ethics 1Maria Jobbel PachecoNoch keine Bewertungen

- Criminal Law Self-Defense Elements of Self-DefenseDokument2 SeitenCriminal Law Self-Defense Elements of Self-Defensecharie2Noch keine Bewertungen

- Deed of Absolute Sale A SampleDokument3 SeitenDeed of Absolute Sale A Samplecharie20% (1)

- Rule 64Dokument3 SeitenRule 64charie2Noch keine Bewertungen

- Team Building QuestionnaireDokument5 SeitenTeam Building Questionnairecharie2100% (1)

- Justification LetterDokument2 SeitenJustification Lettercharie2Noch keine Bewertungen

- Spa - Abet PabzDokument3 SeitenSpa - Abet Pabzcharie2Noch keine Bewertungen

- Back Front Ladies Shirt Size Medium Shirt Color Yellow 60% Cotton ShirtDokument3 SeitenBack Front Ladies Shirt Size Medium Shirt Color Yellow 60% Cotton Shirtcharie2Noch keine Bewertungen

- Taxation 1 Case DigestDokument1 SeiteTaxation 1 Case Digestcharie2Noch keine Bewertungen

- Faculty Summary SheetDokument4 SeitenFaculty Summary Sheetcharie2Noch keine Bewertungen

- Fecal ImpactionDokument5 SeitenFecal Impactioncharie2Noch keine Bewertungen

- 3days Baguio ItineraryDokument4 Seiten3days Baguio Itinerarycharie2Noch keine Bewertungen

- MECARAL Vs Atty. VelasquezDokument1 SeiteMECARAL Vs Atty. Velasquezcharie2Noch keine Bewertungen

- Charlson IndexDokument1 SeiteCharlson Indexcharie2Noch keine Bewertungen

- Hepatico JDokument4 SeitenHepatico Jcharie2Noch keine Bewertungen

- People V SabioDokument1 SeitePeople V SabioPNP MayoyaoNoch keine Bewertungen

- Democracy, Elections and Governance - ENGLISH BOOKDokument70 SeitenDemocracy, Elections and Governance - ENGLISH BOOKNothingNoch keine Bewertungen

- 17.b. Digest Bartolome Vs SSSDokument2 Seiten17.b. Digest Bartolome Vs SSSWhoopiJaneMagdozaNoch keine Bewertungen

- Anti-Suffragists Student MaterialsDokument4 SeitenAnti-Suffragists Student MaterialsKaren IdkNoch keine Bewertungen

- UDHR CardsDokument5 SeitenUDHR Cardsalonsovalpo216981Noch keine Bewertungen

- D D M M Y Y Y Y: Credit Card Services Form - 1Dokument4 SeitenD D M M Y Y Y Y: Credit Card Services Form - 1Zaiedul HoqueNoch keine Bewertungen

- Tayag Vs Benguet ConsolidationDokument2 SeitenTayag Vs Benguet ConsolidationAnneNoch keine Bewertungen

- Penny v. Little 3 Scam. 301, 1841 WL 3322 Scam ErrorDokument5 SeitenPenny v. Little 3 Scam. 301, 1841 WL 3322 Scam ErrorThalia SandersNoch keine Bewertungen

- 9 Go V Colegio de San Juan de LetranDokument9 Seiten9 Go V Colegio de San Juan de LetranDebbie YrreverreNoch keine Bewertungen

- Case #2 PT&T DigestDokument2 SeitenCase #2 PT&T DigestKayeCie RLNoch keine Bewertungen

- Central Bank Employees Association vs. BSP: G.R. NO. 148208: December 15, 2004Dokument3 SeitenCentral Bank Employees Association vs. BSP: G.R. NO. 148208: December 15, 2004A M I R ANoch keine Bewertungen

- 3 Things To Know About SNAPDokument4 Seiten3 Things To Know About SNAPHamilton Place StrategiesNoch keine Bewertungen

- Quiz - No. - 2 Daily, Ma. Jhoan A.Dokument2 SeitenQuiz - No. - 2 Daily, Ma. Jhoan A.Ma. Jhoan DailyNoch keine Bewertungen

- 10 Misconceptions About ParalegalsDokument4 Seiten10 Misconceptions About ParalegalssonkitaNoch keine Bewertungen

- Preliminary Injunction CASESDokument11 SeitenPreliminary Injunction CASESCarl MontemayorNoch keine Bewertungen

- Cheveux Corp. v. Three Bird Nest - ComplaintDokument32 SeitenCheveux Corp. v. Three Bird Nest - ComplaintSarah BursteinNoch keine Bewertungen

- Musicians' Union: Standard Live Engagement Contract L2Dokument2 SeitenMusicians' Union: Standard Live Engagement Contract L2Vishakh PillaiNoch keine Bewertungen

- Oblicon - PrescriptionDokument32 SeitenOblicon - PrescriptionrapturereadyNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)ZomatoswiggyNoch keine Bewertungen

- Berrien County, Michigan August 2, 2022 - UNOFFICIAL Candidate ListDokument6 SeitenBerrien County, Michigan August 2, 2022 - UNOFFICIAL Candidate ListWXMINoch keine Bewertungen

- Taxation Law Internal Assignment Utkarsh DixitDokument5 SeitenTaxation Law Internal Assignment Utkarsh DixitAshish RajNoch keine Bewertungen

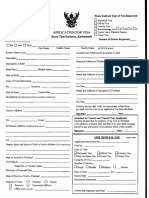

- Thailand VISA Application Form PDFDokument2 SeitenThailand VISA Application Form PDFnimesh gautam0% (1)

- Riassunto IngleseDokument3 SeitenRiassunto IngleseSofia PeperoniNoch keine Bewertungen

- Local Government ActDokument450 SeitenLocal Government ActvictorNoch keine Bewertungen

- DAR Clearance Application Form (Blank)Dokument1 SeiteDAR Clearance Application Form (Blank)Adonis Zoleta Aranillo50% (4)

- Motion To Dismiss FL 120731Dokument6 SeitenMotion To Dismiss FL 120731Robert Lee ChaneyNoch keine Bewertungen

- CIR V Petron CorpDokument15 SeitenCIR V Petron CorpChristiane Marie BajadaNoch keine Bewertungen

- Dacasin Vs DacasinDokument5 SeitenDacasin Vs DacasinHerbert JavierNoch keine Bewertungen

- ContractDokument8 SeitenContractsamarth agrawalNoch keine Bewertungen

- The Importance of Governance and Development and Its Interrelationship (Written Report)Dokument6 SeitenThe Importance of Governance and Development and Its Interrelationship (Written Report)Ghudz Ernest Tambis100% (3)