Beruflich Dokumente

Kultur Dokumente

Rate Sheet 5-27-09

Hochgeladen von

PFIOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Rate Sheet 5-27-09

Hochgeladen von

PFICopyright:

Verfügbare Formate

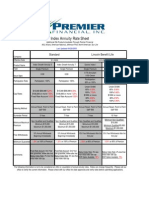

Fixed Annuity Rate Sheet

The following information is not to be considered an offer or a quotation of actual annuity rates. Rates can change frequently. Please call our office to verify the current information.

Date: 5/27/2009

Company Product Name stP Base Rate Effective Rate st Effective Rate

1P Year rate 1 Year rate

(includes bonus) (includes bonus)

Amounts Below Amounts Above

$100,000 $100,000

American National Palladium MYG 3 Year- 2.40% 2.40% 2.40% 3 Year-2.50% 2.50%

4 Year-2.70% 2.70% 2.70% 4 year -2.80% 2.80%

Effective 6/1/2009 5 year –4.05% 3.05% 3.25% 5 year – 4.15% 3.35%

Issue Ages 0-85 6 year- 3.70% 3.70% 3.70% 6 year –3.80% 3.80%

Not Available: UT 7 Year- 4.80% 3.80% 3.94% 7 year –4.90% 4.04%

Min. Dep-NQ&Q-$5,000 8 year – 4.15% 4.15% 4.15% 8 year –4.25% 4.25%

9 year – 5.65% 3.65% 3.87% 9 year –5.75% 3.97%

10 year – 5.00% 4.00% 4.10% 10 year-5.10% 4.20%

United Of Omaha Ultra Secure 5 Year

Effective 6/1/2009 5-Year 3.85% 2.85% 3.05% 4.00% 3.20%

Issue Ages 0-89

Min. Dep-NQ---Q-$5,000

Not Available: CT, MD, MA,

MN, NH, NJ, OK, OR, PA, PR,

Assurity Ascential Secure 3

Effective 6/1/2009 3 Year 3.00% 3.00% 3.00% 3.00% 3.00%

3 Year Surrender Period

Issue Ages 0-90

Min. Dep-NQ---Q-$2,000

Not Available: FL, IN, MD, NJ,

OR, TX, UT, WA

Principal Guar. Annuity Initial Base Rate Year 1 Premium Initial Premium GMIR

Credit Yield

Effective 6/1/2009 1-Year <100K 2.35% 1.00% 3.37% 3.00%

5 Year Surrender Period 1-Year 100K+ 2.35% 2.00% 4.39% 3.00%

Issue Ages: 0-90 Guar. Annuity Initial Base Rate Years 2-3 GMIR

Min. Dep-NQ-$5,000---Q$5,000 3-Year <100K 2.50% 2.50% 3.00%

Available: 1 Year All States 3-Year 100K+ 2.50% 2.50% 3.00%

Not Available: Initial Base Rate Years 2-5 GMIR

3 & 5 Year Guar. Periods: HI, 5-Year <100K 2.60% 2.60% 3.00%

MS, NV, NJ, NY, PA, OR 5-Year 100K+ 2.60% 2.60% 3.00%

Principal Secure Fixed Annuity Initial Base Rate Years 2-4

Effective 6/1/2009 4-Year 2.85% 2.85% 2.85% 2.85% 2.85%

4 Year Surrender Period

Issue Ages 0-90, 0-85 in OK

Min. Dep-NQ-$5,000---Q$5,000

Principal FPDA Annuity Initial Base Rate Year 1 Premium Initial Premium GMIR

Effective 6/1/2009 1-Year <100K 2.35% 1.00% 3.37% 3.00%

7 Year Surrender Period 1-Year 100K+ 2.35% 2.00% 4.39% 3.00%

Issue Ages: 0-90 Initial Base Rate Years 2-5 GMIR

Min. Dep-NQ-$5,000---Q$5,000 5-Year <100K 2.65% 2.65% 3.00%

Available: 1 Year Guar. Period- 5-Year 100K+ 2.65% 2.65% 3.00%

All States

Not Available: Initial Base Rate Years 2-7 GMIR

3 & 5 Year Guar. Periods: HI, 7-Year <100K 2.55% 2.55% 3.00%

MS, NV, NJ, NY, PA, OR 7-Year 100K+ 2.55% 2.55% 3.00%

American General Horizon Select

Effective 5/28/09 5 Year 3.85% 3.85% 3.85% 3.85% 3.85%

5 Year Surrender Period

Not Available:AK, MN, NJ, NY,

OR, PA, UT, WA Issue Ages 0-85

Min. Dep.-$5,000

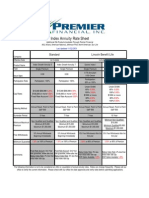

Company Product Name Base Rate Effective Rate st Effective Rate

1PstP Year rate 1 Year rate

(includes bonus) (includes bonus)

Amounts Below Amounts Above

$100,000 $100,000

Genworth Financial SecureLiving Liberty

Effective 4/15/2009 100K-249.999K Eff.Rate-100-

6 Year Surrender Period Years 1-5 249,999K

Issue Age-0-85 5-Year Yr. 1 Yr. 2-5 3.80% 3.73%

Min.Dep-NQ-$5,000---Q-$2,000 3.65% 3.65% 3.61% Bailout

Not Available: MN, MS, Bailout Rate: 3.40% 250K + Years 1-5 Eff. Rate-250K +

NV 1 and 3 Year

3.90% 3.82%

Bailout Rate:

Lincoln Benefit Life Tactician Plus 5 Year-5.00% 3.00% 3.40% 5 Year-6.00% 3.60%

Effective 5/4/09 6 Year-3.75% 3.75% 3.75% 6 Year -4.75% 3.92%

Issue Ages 0-90 7 Year-4.40% 3.40% 3.54% 7 year – 5.40% 3.69%

Minimum Deposit 8 Year-4.90% 3.40% 3.59% 8 year – 5.90% 3.71%

Non Qualified-$10,000 9 Year-7.50% 3.50% 3.94% 9 year –8.50% 4.06%

Qualified-$3,000 10 Year-4.60% 3.60% 3.70% 10 year – 5.60% 3.80%

Lincoln Benefit Life T-Link Annuity

Effective 3/16/09

Issue Ages 0-90

ROP option receives 15 basis Less than $100,000 2.15%

points less

Min. Dep- NQ-$5,000--- $100,000 or more 2.40%

Q$3,000

Not Available: CT, MA, OR, WA

Lincoln Benefit Life Sure Horizon II

Effective 4/13/09 1-Year 3.50% 2.00% 4.50%

Issue Ages 0-90 3-Year 4.00% 2.50% 5.00%

Min. Dep-NQ-$10,000---Q$3,000 6-Year 4.20% 2.70% 5.20%

ROP option receives .50 less

Not Available: NY

West Coast Life Sure Advantage

Effective 5/19/2009 2-Year 1.50% 1.50% 1.50% 2.01% 1.75%

Issue Ages 0-85 3-Year 2.60% 2.60% 2.60% 3.11% 2.77%

4-Year 3.15% 3.15% 3.15% 3.67% 3.28%

Min. Dep- NQ & Q-$10,000 5-Year 3.40% 3.40% 3.40% 4.43% 3.61%

Not Available: DE, MN, NY, VT 6-Year 3.65% 3.65% 3.65% 4.69% 3.82%

Standard Insurance Company Focus Growth

Annuity

Effective 5/27/2009 FGA 5 5 year –3.65% 3.65% 3.65% 5 year –3.75% 3.75%

Issue Ages 0-90 FGA 6 6 year –3.70% 3.70% 3.70% 6 year –3.80% 3.80%

Min. Dep-NQ&Q-$15,000

Not Available: MA, NJ, NY, PA,

UT

Standard Insurance Company Secure Rate Annuity

Effective 5/27/2009 SRA 1 4.05% 4.15%

Issue Ages 0 – 90 SRA 3 2.20% 2.20% 2.20% 2.30% 2.30%

Minimum Deposit SRA 5 3.30% 3.30% 3.30% 3.40% 3.40%

Non qualified and Qualified- SRA 6 3.40% 3.40% 3.40% 3.50% 3.50%

$15,000

Not Available: NY, PA, UT

Transamerica Savers Choice

Effective 4/22/2009 1-Year NA NA NA NA NA

Issue Ages 0-85 2-Year 1.60% 1.60% 1.60% 1.85% 1.85%

Min. Dep- NQ---Q-$10,000 3-Year 2.30% 2.30% 2.30% 2.55% 2.55%

ROP Option Available 4-Year 2.55% 2.55% 2.55% 2.80% 2.80%

Call Premier for ROP Rates 5-Year 2.95% 2.95% 2.95% 3.20% 3.20%

Not Available:GA, MS, NY, OR 6-Year 3.20% 3.20% 3.20% 3.45% 3.45%

*Interest rates are expressed as Annual Effective Yield Rates. Any partial or systematic withdrawal(s) will reduce the actual rate of return. All companies quoted have

different rules when rate changes occur. It is your responsibility to understand these rules when quoting rates. If you do not know the rules call our office.

Das könnte Ihnen auch gefallen

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeVon EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNoch keine Bewertungen

- Rate Sheet 5-11-09Dokument2 SeitenRate Sheet 5-11-09PFINoch keine Bewertungen

- Fixed deposit interest ratesDokument1 SeiteFixed deposit interest ratesP K MahatoNoch keine Bewertungen

- Cho RM 73 2020-21Dokument1 SeiteCho RM 73 2020-21Steve WozniakNoch keine Bewertungen

- Bond ValuationDokument17 SeitenBond ValuationMatthew RyanNoch keine Bewertungen

- The Jammu & Kashmir Bank LTD: AccountDokument5 SeitenThe Jammu & Kashmir Bank LTD: AccountĒxçlūsìvē SympãthētìçNoch keine Bewertungen

- Interest Rates On FDR: Monthly Benefit PlanDokument2 SeitenInterest Rates On FDR: Monthly Benefit Planmushfik arafatNoch keine Bewertungen

- Index Rate Sheet 4-29-09Dokument2 SeitenIndex Rate Sheet 4-29-09PFINoch keine Bewertungen

- Capital Alert - 5/30/2008Dokument1 SeiteCapital Alert - 5/30/2008Russell KlusasNoch keine Bewertungen

- Tenure General Public FD Rate Senior Citizens FD RateDokument9 SeitenTenure General Public FD Rate Senior Citizens FD Rateisha jsNoch keine Bewertungen

- Capital Alert - 2/1/2008Dokument1 SeiteCapital Alert - 2/1/2008Russell KlusasNoch keine Bewertungen

- 1ST Jun 2017Dokument2 Seiten1ST Jun 2017Bhavani BhushanNoch keine Bewertungen

- Capital Markets - 4/18/2008Dokument1 SeiteCapital Markets - 4/18/2008Russell KlusasNoch keine Bewertungen

- Multi-Family Loan Programs $3 MillionDokument1 SeiteMulti-Family Loan Programs $3 MillionRussell KlusasNoch keine Bewertungen

- Capital Markets - 5/16/2008Dokument1 SeiteCapital Markets - 5/16/2008Russell KlusasNoch keine Bewertungen

- Capital Alert - 8/29/2008Dokument1 SeiteCapital Alert - 8/29/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 3/14/2008Dokument2 SeitenCapital Markets - 3/14/2008Russell KlusasNoch keine Bewertungen

- Product of Insurance CoDokument43 SeitenProduct of Insurance Coapi-3800339100% (1)

- CapAlertPDF 072508Dokument1 SeiteCapAlertPDF 072508Russell KlusasNoch keine Bewertungen

- Capital Markets - 2/29/2008Dokument1 SeiteCapital Markets - 2/29/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 4/25/2008Dokument1 SeiteCapital Markets - 4/25/2008Russell KlusasNoch keine Bewertungen

- North Dec 23 - BMDokument28 SeitenNorth Dec 23 - BMSanjeetNoch keine Bewertungen

- Capital Alert - 8/22/2008Dokument1 SeiteCapital Alert - 8/22/2008Russell KlusasNoch keine Bewertungen

- Capital Alert - 6/20/2008Dokument1 SeiteCapital Alert - 6/20/2008Russell KlusasNoch keine Bewertungen

- BootstrappingDokument34 SeitenBootstrappingHarshit DwivediNoch keine Bewertungen

- Capital Markets - 6/30/2008Dokument1 SeiteCapital Markets - 6/30/2008Russell KlusasNoch keine Bewertungen

- NRB Bank Bangladesh Deposit RateDokument2 SeitenNRB Bank Bangladesh Deposit RateAlamin AlexNoch keine Bewertungen

- FD Rate Card - Oct 2022Dokument2 SeitenFD Rate Card - Oct 2022Deepak SuyalNoch keine Bewertungen

- Interest Rate RetailDokument6 SeitenInterest Rate RetailYashaswi SharmaNoch keine Bewertungen

- Changes to interest rates on Fixed Deposits and Savings AccountsDokument5 SeitenChanges to interest rates on Fixed Deposits and Savings AccountsK NkNoch keine Bewertungen

- Brac Bank Deposit Interest RateDokument2 SeitenBrac Bank Deposit Interest RateSohel RanaNoch keine Bewertungen

- Rs1,000.00 - Rs1,257.30: Bonds and Bonds ValuationDokument76 SeitenRs1,000.00 - Rs1,257.30: Bonds and Bonds ValuationMomna ShahzadNoch keine Bewertungen

- BoostrappingDokument23 SeitenBoostrappingHarshit DwivediNoch keine Bewertungen

- HDFC FD Rate - 10.11.20Dokument2 SeitenHDFC FD Rate - 10.11.20Chandan SahaNoch keine Bewertungen

- Capital Markets - 8/15/2008Dokument2 SeitenCapital Markets - 8/15/2008Russell KlusasNoch keine Bewertungen

- Capital Markets - 4/11/2008Dokument1 SeiteCapital Markets - 4/11/2008Russell KlusasNoch keine Bewertungen

- FD Leaflet - A5 - 13 Dec 23Dokument2 SeitenFD Leaflet - A5 - 13 Dec 23Shaily SinhaNoch keine Bewertungen

- Age 31-1M Elite 5 & 500K Elite 10Dokument2 SeitenAge 31-1M Elite 5 & 500K Elite 10jihn isis tengcoNoch keine Bewertungen

- Interest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresDokument3 SeitenInterest Rates On Deposits: Card Rates For Domestic, NRE & NRO Deposits Less Than INR 2 CroresHemant KhanNoch keine Bewertungen

- RevisionInterestRates CircularDokument5 SeitenRevisionInterestRates CircularPrashantGuptaNoch keine Bewertungen

- Rates of Return On PLSDeposits OtherDepositsDokument2 SeitenRates of Return On PLSDeposits OtherDepositsranamkhan553Noch keine Bewertungen

- Capital Markets - 3/07/2008Dokument1 SeiteCapital Markets - 3/07/2008Russell KlusasNoch keine Bewertungen

- Capital Alert 6/13/2008Dokument1 SeiteCapital Alert 6/13/2008Russell KlusasNoch keine Bewertungen

- Mortgage Loan Rate Sheet: Product & Term Adjustment Schedule & Loan Amount Discount Points Rate AprDokument2 SeitenMortgage Loan Rate Sheet: Product & Term Adjustment Schedule & Loan Amount Discount Points Rate AprConnie BronnerNoch keine Bewertungen

- One Pager-NR Initiative - Sep'23Dokument2 SeitenOne Pager-NR Initiative - Sep'23JereenNoch keine Bewertungen

- Revision of Interest Rate On Term Deposits Wef 04.08.2022 1Dokument2 SeitenRevision of Interest Rate On Term Deposits Wef 04.08.2022 1Anu BhandariNoch keine Bewertungen

- Fixed Deposit Interest RatesDokument2 SeitenFixed Deposit Interest Ratessasi 'sNoch keine Bewertungen

- Interest Rates For Fixed DepositsDokument2 SeitenInterest Rates For Fixed DepositsD SunilNoch keine Bewertungen

- Capital Alert - 7/3/2008Dokument1 SeiteCapital Alert - 7/3/2008Russell KlusasNoch keine Bewertungen

- Loans and AdvancveDokument15 SeitenLoans and AdvancveLeo SaimNoch keine Bewertungen

- Interest Rates For Fixed DepositsDokument2 SeitenInterest Rates For Fixed Depositssaurav katarukaNoch keine Bewertungen

- Interest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveDokument5 SeitenInterest Rates On Deposits - Domestic, NRE, NRO - Rs. 2 Crore and AboveParasjkohli6659Noch keine Bewertungen

- Interest Rates For Fixed DepositsDokument2 SeitenInterest Rates For Fixed DepositsY_AZNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledഓൺലൈൻ ആങ്ങളNoch keine Bewertungen

- Interest Rates For Fixed DepositsDokument2 SeitenInterest Rates For Fixed DepositsAkhilesh VijayaKumarNoch keine Bewertungen

- Interest Rates For Fixed DepositsDokument2 SeitenInterest Rates For Fixed DepositsV NaveenNoch keine Bewertungen

- IDFC Bank Interest RateDokument6 SeitenIDFC Bank Interest RateA BNoch keine Bewertungen

- Current and Savings Account Interest Rate: Personal AccountsDokument2 SeitenCurrent and Savings Account Interest Rate: Personal AccountsMd.Rashidul Alam Sorker RifatNoch keine Bewertungen

- Capital Alert - 7/12/2008Dokument1 SeiteCapital Alert - 7/12/2008Russell KlusasNoch keine Bewertungen

- Living Care Annuity Z1538Dokument1 SeiteLiving Care Annuity Z1538PFINoch keine Bewertungen

- Index Rate Sheet 11-02-09Dokument3 SeitenIndex Rate Sheet 11-02-09PFINoch keine Bewertungen

- Tax UpdateDokument2 SeitenTax UpdatePFI100% (3)

- Rate Sheet 5-27-09Dokument2 SeitenRate Sheet 5-27-09PFINoch keine Bewertungen

- LifePipe With iGODokument2 SeitenLifePipe With iGOPFI100% (2)

- AG01119Dokument7 SeitenAG01119PFINoch keine Bewertungen

- Index Rate Sheet 4-29-09Dokument2 SeitenIndex Rate Sheet 4-29-09PFINoch keine Bewertungen

- RIC RiderDokument16 SeitenRIC RiderPFINoch keine Bewertungen

- Living Care® Annuity Sales Solution: The "3X Guarantee" in Long-Term Care BenefitsDokument1 SeiteLiving Care® Annuity Sales Solution: The "3X Guarantee" in Long-Term Care BenefitsPFINoch keine Bewertungen

- AG01119Dokument7 SeitenAG01119PFINoch keine Bewertungen

- SM 0708 Issue 11 Resources For Buy Sell AgreementsFINALDokument27 SeitenSM 0708 Issue 11 Resources For Buy Sell AgreementsFINALPFINoch keine Bewertungen

- TCSuite 5Dokument5 SeitenTCSuite 5PFINoch keine Bewertungen

- MS230552IBD-0108 VA Product GuideDokument2 SeitenMS230552IBD-0108 VA Product GuidePFINoch keine Bewertungen

- E SymbiosysFiles Generated OutputSIPDF 10200001420020721Dokument6 SeitenE SymbiosysFiles Generated OutputSIPDF 10200001420020721Sankalp SrivastavaNoch keine Bewertungen

- Chapter 7Dokument31 SeitenChapter 7Manoj SolankarNoch keine Bewertungen

- Manual For SOA Exam MLC.: Chapter 5. Life Annuities Actuarial ProblemsDokument60 SeitenManual For SOA Exam MLC.: Chapter 5. Life Annuities Actuarial ProblemsBoi HutagalungNoch keine Bewertungen

- APGLI A.P.G.L.I. Age Limit Up To 58 YearsDokument3 SeitenAPGLI A.P.G.L.I. Age Limit Up To 58 YearsSEKHARNoch keine Bewertungen

- Hedging ApolloDokument3 SeitenHedging ApolloAnish Tirkey 1910125Noch keine Bewertungen

- Information For Persons With HOSPITA SEMI-PRIVATE/PRIVATE Supplementary Hospitalisation Insurance.Dokument4 SeitenInformation For Persons With HOSPITA SEMI-PRIVATE/PRIVATE Supplementary Hospitalisation Insurance.docas123Noch keine Bewertungen

- CRS Report On Basel EndgameDokument22 SeitenCRS Report On Basel EndgameMitul PatelNoch keine Bewertungen

- TVM - Practice QuestionsDokument66 SeitenTVM - Practice QuestionsImran MobinNoch keine Bewertungen

- Sarazan Corp Purchased A 1 Million Four Year 7 5 Fixed Rate Interest Only PDFDokument1 SeiteSarazan Corp Purchased A 1 Million Four Year 7 5 Fixed Rate Interest Only PDFLet's Talk With HassanNoch keine Bewertungen

- Chapter 4: Life AnnuitiesDokument36 SeitenChapter 4: Life AnnuitiesKen NuguidNoch keine Bewertungen

- Foreign Currency Transactions and Hedging RiskDokument53 SeitenForeign Currency Transactions and Hedging RiskTam29100% (10)

- Chapter One:: Prepared by Md. Sagar Rana Lecturer Banking and Insurance University of RajshahiDokument15 SeitenChapter One:: Prepared by Md. Sagar Rana Lecturer Banking and Insurance University of RajshahiMd Daud HossianNoch keine Bewertungen

- Health Recharge - Single SheeterDokument2 SeitenHealth Recharge - Single SheeterChinmoy BaruahNoch keine Bewertungen

- Ya Dut Iya Sir: Compount InterestDokument6 SeitenYa Dut Iya Sir: Compount InterestadiNoch keine Bewertungen

- Blawreg 1Dokument5 SeitenBlawreg 1Sammylyn Dela CruzNoch keine Bewertungen

- WL4955W67QDokument5 SeitenWL4955W67Qaman khatriNoch keine Bewertungen

- Strategies to Reduce Expenses for InsurersDokument77 SeitenStrategies to Reduce Expenses for InsurersSinclair GwazaNoch keine Bewertungen

- Economic Analysis of Banking Regulation: © 2005 Pearson Education Canada IncDokument15 SeitenEconomic Analysis of Banking Regulation: © 2005 Pearson Education Canada IncMuntazir HussainNoch keine Bewertungen

- PV, Annuity PV, Annuity PV, Lump Sum PV, Annuity, Lump Sum: Rate: Period: Payment: Future Value: Type: Present ValueDokument6 SeitenPV, Annuity PV, Annuity PV, Lump Sum PV, Annuity, Lump Sum: Rate: Period: Payment: Future Value: Type: Present ValueDreamer_ShopnoNoch keine Bewertungen

- Insurance Assignment QuizDokument3 SeitenInsurance Assignment QuizMotiram paudel100% (1)

- How to Read Options ChainDokument13 SeitenHow to Read Options Chainscriberone50% (8)

- The Art of Alternative Risk Transfer Methods of InsuranceDokument10 SeitenThe Art of Alternative Risk Transfer Methods of Insurancelaura melissaNoch keine Bewertungen

- Shakti Pumps - Regarding Insurance Security BondDokument3 SeitenShakti Pumps - Regarding Insurance Security Bondsachin GourNoch keine Bewertungen

- Futures and ForwardsDokument39 SeitenFutures and Forwardskamdica100% (1)

- Comparison of PoliciesDokument2 SeitenComparison of PoliciesRukshar AbbasNoch keine Bewertungen

- Tyfm Derivative Markets Question BankDokument4 SeitenTyfm Derivative Markets Question BankSmith ShettyNoch keine Bewertungen

- AidsDokument9 SeitenAidsKhushi GuptaNoch keine Bewertungen

- GOV AND NON-PROFIT ACCOUNTING DERIVATIVESDokument13 SeitenGOV AND NON-PROFIT ACCOUNTING DERIVATIVESDeo Corona100% (1)

- Shriram General Insurance Co. Ltd. claim discharge voucher formatDokument1 SeiteShriram General Insurance Co. Ltd. claim discharge voucher formatmjanifa67% (6)

- Subrogation in Insurance Law - A Critical EvaluationDokument24 SeitenSubrogation in Insurance Law - A Critical EvaluationJiaNoch keine Bewertungen