Beruflich Dokumente

Kultur Dokumente

T4 B7 Dam - Financial War FDR - Entire Contents - 1-29-02 Kenneth W Dam Statement To Senate Banking Committee - 1st PG Scanned For Reference 451

Hochgeladen von

9/11 Document ArchiveOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

T4 B7 Dam - Financial War FDR - Entire Contents - 1-29-02 Kenneth W Dam Statement To Senate Banking Committee - 1st PG Scanned For Reference 451

Hochgeladen von

9/11 Document ArchiveCopyright:

Verfügbare Formate

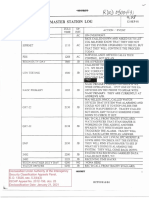

Testimony — Dam Page 1 of 14

U.S. SENATE COMMITTEE ON

BANKING, HOUSING, AND URBAN AFFAII

Hearing on "The Financial War on Terrorism and the Administration's

Implementation

of the Anti-Money Laundering Provisions of the USA Patriot Act."

Prepared Statement of the Honorable Kenneth W. Dam

Deputy Secretary

Department of the Treasury

10:00 a.m., Tuesday, January 29, 2002 - Dirksen 538

Chairman Sarbanes and distinguished members of the Senate Banking Committee, thank

you for inviting me to testify about the Treasury Department's efforts to disrupt terrorist

financing and, in particular, the steps we are taking to implement the provisions of the

International Counter-Money Laundering and Financial Anti-Terrorism Act of 2001.1

have asked Under Secretary for Enforcement Jimmy Gurule to join me today.

On September 24, 2001, President Bush stated, "we will direct every resource at our

command to win the war against terrorists, every means of diplomacy, every tool of

intelligence, every instrument of law enforcement, every financial influence. We will

starve the terrorists of funding." The Treasury Department is determined to help make

good on this promise. I am here today to tell you about the progress we have made and

some of the complexities we still face.

Much of our progress is directly attributable to the Congress and this Committee. The

swift passage of the USA PATRIOT Act and, in particular, Title HI of that Act - the

International Counter-Money Laundering and Financial Anti-Terrorism Act of 2001,

have given us important new tools in the financial front of the war on terrorism. To

highlight just two aspects of the Act:

• The Act requires financial institutions to terminate correspondent accounts

maintained for foreign shell banks and to take reasonable steps to ensure that they

do not indirectly provide banking services to foreign shell banks. Treasury provided

immediate, interim guidance to financial institutions, suggesting that they obtain

certification from all foreign banks with correspondent accounts that they were not

shells and that the foreign banks did not themselves maintain correspondent

accounts for shell banks.

• The Act requires all financial institutions to have an anti-money laundering program

http ://banking. senate.gov/02_01 hrg/012902/dam.htm 4/3 0/2003

Das könnte Ihnen auch gefallen

- T4 B11 Thompson FDR - Entire Contents - 10-3-02 Larry D Thompson Prepared Statement - Senate Banking 899Dokument1 SeiteT4 B11 Thompson FDR - Entire Contents - 10-3-02 Larry D Thompson Prepared Statement - Senate Banking 8999/11 Document ArchiveNoch keine Bewertungen

- T4 B7 Dam - National FDR - Entire Contents - 10-3-02 Kenneth W Dam Statement To Senate Banking Committee - 1st PG Scanned For Reference 453Dokument1 SeiteT4 B7 Dam - National FDR - Entire Contents - 10-3-02 Kenneth W Dam Statement To Senate Banking Committee - 1st PG Scanned For Reference 4539/11 Document ArchiveNoch keine Bewertungen

- T4 B9 Newcomb FDR - Entire Contents - 5-10-01 and 7-31-03 R Richard Newcomb Statements To Senate - 1st Pgs Scanned For Reference 665Dokument2 SeitenT4 B9 Newcomb FDR - Entire Contents - 5-10-01 and 7-31-03 R Richard Newcomb Statements To Senate - 1st Pgs Scanned For Reference 6659/11 Document ArchiveNoch keine Bewertungen

- T4 B7 Eizenstat National FDR - Entire Contents - 9-26-01 Stuart E Eizenstat Testimony To Senate Banking Committee - 1st PG Scanned For Reference 464Dokument1 SeiteT4 B7 Eizenstat National FDR - Entire Contents - 9-26-01 Stuart E Eizenstat Testimony To Senate Banking Committee - 1st PG Scanned For Reference 4649/11 Document ArchiveNoch keine Bewertungen

- 8th April 2003 - Anti-Money Laundering Training Seminar For Prosecutors, Public Legal Attorney General's Speech - Author AG Judith Jones-MorganDokument5 Seiten8th April 2003 - Anti-Money Laundering Training Seminar For Prosecutors, Public Legal Attorney General's Speech - Author AG Judith Jones-MorganLogan's LtdNoch keine Bewertungen

- T4 B12 Winer - National Money FDR - Entire Contents - 9-26-01 Jonathan M Winer Senate Banking Testimony - 1st PG Scanned For Reference 028Dokument1 SeiteT4 B12 Winer - National Money FDR - Entire Contents - 9-26-01 Jonathan M Winer Senate Banking Testimony - 1st PG Scanned For Reference 0289/11 Document ArchiveNoch keine Bewertungen

- T4 B6 Dam - Financial Front FDR - Entire Contents - 6-8-02 Kenneth W Dam Speech To CFR - 1st PG Scanned For Reference 450Dokument1 SeiteT4 B6 Dam - Financial Front FDR - Entire Contents - 6-8-02 Kenneth W Dam Speech To CFR - 1st PG Scanned For Reference 4509/11 Document ArchiveNoch keine Bewertungen

- Unregulated Markets: How Regulatory Reform Will Shine A Light in The Financial SectorDokument83 SeitenUnregulated Markets: How Regulatory Reform Will Shine A Light in The Financial SectorScribd Government Docs100% (1)

- Senate Hearing, 109TH Congress - Combating Child Pornography by Eliminating Pornographers' Access To The Financial Payment SystemDokument111 SeitenSenate Hearing, 109TH Congress - Combating Child Pornography by Eliminating Pornographers' Access To The Financial Payment SystemScribd Government DocsNoch keine Bewertungen

- T4 B7 Dam - Role FDR - Entire Contents - 8-1-02 Kenneth W Dam Statement To Senate Banking Committee - 1st PG Scanned For Reference 452Dokument1 SeiteT4 B7 Dam - Role FDR - Entire Contents - 8-1-02 Kenneth W Dam Statement To Senate Banking Committee - 1st PG Scanned For Reference 4529/11 Document ArchiveNoch keine Bewertungen

- Senate Hearing, 113TH Congress - Creating A Housing Finance System Built To Last: Ensuring Access For Community InstitutionsDokument77 SeitenSenate Hearing, 113TH Congress - Creating A Housing Finance System Built To Last: Ensuring Access For Community InstitutionsScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 109TH Congress - Money Laundering and Terror Financing Issues in The Middle EastDokument103 SeitenSenate Hearing, 109TH Congress - Money Laundering and Terror Financing Issues in The Middle EastScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 108TH Congress - Bank Secrecy Act EnforcementDokument124 SeitenSenate Hearing, 108TH Congress - Bank Secrecy Act EnforcementScribd Government DocsNoch keine Bewertungen

- USA Patriot Act - 2001Dokument105 SeitenUSA Patriot Act - 2001Nazneen SabinaNoch keine Bewertungen

- National Bank ChronologyDokument11 SeitenNational Bank Chronologysevee2081Noch keine Bewertungen

- Senate Hearing, 111TH Congress - The Administration's Proposal To Modernize The Financial Regulatory SystemDokument92 SeitenSenate Hearing, 111TH Congress - The Administration's Proposal To Modernize The Financial Regulatory SystemScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 111TH Congress - The Economy and Fraud: Protecting Consumers During Downward Economic TimesDokument74 SeitenSenate Hearing, 111TH Congress - The Economy and Fraud: Protecting Consumers During Downward Economic TimesScribd Government DocsNoch keine Bewertungen

- T4 B6 Chertoff FDR - Entire Contents - 1-29-02 Michael Chertoff Testimony To Senate Banking Committee - 1st PG Scanned For Reference 437Dokument1 SeiteT4 B6 Chertoff FDR - Entire Contents - 1-29-02 Michael Chertoff Testimony To Senate Banking Committee - 1st PG Scanned For Reference 4379/11 Document ArchiveNoch keine Bewertungen

- Senate Hearing, 111TH Congress - Enhancing Investor Protection and The Regulation of Securities MarketsDokument347 SeitenSenate Hearing, 111TH Congress - Enhancing Investor Protection and The Regulation of Securities MarketsScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 111TH Congress - Over-The-Counter Derivatives: Modernizing Oversight To Increase Transparency and Reduce RisksDokument193 SeitenSenate Hearing, 111TH Congress - Over-The-Counter Derivatives: Modernizing Oversight To Increase Transparency and Reduce RisksScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 113TH Congress - Examining The Gao Report On Government Support For Bank Holding CompaniesDokument140 SeitenSenate Hearing, 113TH Congress - Examining The Gao Report On Government Support For Bank Holding CompaniesScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 114TH Congress - The Role of Bankruptcy Reform in Addressing Too Big To FailDokument145 SeitenSenate Hearing, 114TH Congress - The Role of Bankruptcy Reform in Addressing Too Big To FailScribd Government DocsNoch keine Bewertungen

- Oversight of The Financial Rescue Program: A New Plan For The TarpDokument81 SeitenOversight of The Financial Rescue Program: A New Plan For The TarpScribd Government DocsNoch keine Bewertungen

- House Hearing, 111TH Congress - The Global Financial Crisis and Financial Reforms in NigeriaDokument70 SeitenHouse Hearing, 111TH Congress - The Global Financial Crisis and Financial Reforms in NigeriaScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 110TH Congress - Turmoil in The U.S. Credit Markets: Examining Recent Regulatory ResponsesDokument166 SeitenSenate Hearing, 110TH Congress - Turmoil in The U.S. Credit Markets: Examining Recent Regulatory ResponsesScribd Government DocsNoch keine Bewertungen

- Money Laundering Report - FinalDokument49 SeitenMoney Laundering Report - Finalkalyan9746960% (1)

- Money Laundering: Its History, Evolution and Deterrents: Carla Gilpin, CPA Patriot Act Compliance Manager ManheimDokument30 SeitenMoney Laundering: Its History, Evolution and Deterrents: Carla Gilpin, CPA Patriot Act Compliance Manager ManheimSushil DhampalwarNoch keine Bewertungen

- Senate Hearing, 111TH Congress - Holding Banks Accountable: Are Treasury and Banks Doing Enough To Help Families Save Their Homes?Dokument58 SeitenSenate Hearing, 111TH Congress - Holding Banks Accountable: Are Treasury and Banks Doing Enough To Help Families Save Their Homes?Scribd Government DocsNoch keine Bewertungen

- Senate Hearing, 109TH Congress - The Need For Comprehensive Immigration Reform: Securing The Cooperation of Participating CountriesDokument36 SeitenSenate Hearing, 109TH Congress - The Need For Comprehensive Immigration Reform: Securing The Cooperation of Participating CountriesScribd Government DocsNoch keine Bewertungen

- Financial Regulatory Reform: Protecting Taxpayers and The EconomyDokument61 SeitenFinancial Regulatory Reform: Protecting Taxpayers and The EconomyScribd Government DocsNoch keine Bewertungen

- Current Issues in Deposit Insurance: HearingDokument59 SeitenCurrent Issues in Deposit Insurance: HearingScribd Government DocsNoch keine Bewertungen

- The Stimulus Law & Health CareDokument16 SeitenThe Stimulus Law & Health CareTimothyNoch keine Bewertungen

- Anti Money LaunderingDokument1 SeiteAnti Money LaunderingvirtulianNoch keine Bewertungen

- Senate Hearing, 112TH Congress - Protecting American Taxpayers: Significant Accomplishments and Ongoing Challenges in The Fight Against FraudDokument102 SeitenSenate Hearing, 112TH Congress - Protecting American Taxpayers: Significant Accomplishments and Ongoing Challenges in The Fight Against FraudScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 112TH Congress - Oversight of The Financial Fraud Enforcement Task ForceDokument53 SeitenSenate Hearing, 112TH Congress - Oversight of The Financial Fraud Enforcement Task ForceScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 112TH Congress - International Harmonization of Wall Street Reform: Orderly Liquidation, Derivatives, and The Volcker RuleDokument86 SeitenSenate Hearing, 112TH Congress - International Harmonization of Wall Street Reform: Orderly Liquidation, Derivatives, and The Volcker RuleScribd Government DocsNoch keine Bewertungen

- U.S. Senate On CurrencyDokument4 SeitenU.S. Senate On Currencyrichardck61Noch keine Bewertungen

- An Examination of The National Flood Insurance ProgramDokument158 SeitenAn Examination of The National Flood Insurance ProgramScribd Government DocsNoch keine Bewertungen

- Hearing: Promoting Small and Micro Enterprise in HaitiDokument191 SeitenHearing: Promoting Small and Micro Enterprise in HaitiScribd Government DocsNoch keine Bewertungen

- The State of Securitization Markets: HearingDokument254 SeitenThe State of Securitization Markets: HearingScribd Government DocsNoch keine Bewertungen

- Bogus Audit of US GoldDokument64 SeitenBogus Audit of US Goldkaren hudesNoch keine Bewertungen

- House Hearing, 110TH Congress - The Impact of Foreign Ownership and Foreign Investment On The Security of Our Nation's Critical InfrastructureDokument39 SeitenHouse Hearing, 110TH Congress - The Impact of Foreign Ownership and Foreign Investment On The Security of Our Nation's Critical InfrastructureScribd Government DocsNoch keine Bewertungen

- STATEMENTS OF COMMITTEE MEMBERS File Appropriately Short For "CHARGE" US - CHRG-112shrg73847Dokument53 SeitenSTATEMENTS OF COMMITTEE MEMBERS File Appropriately Short For "CHARGE" US - CHRG-112shrg73847Lisa Stinocher OHanlonNoch keine Bewertungen

- Turmoil in U.S. Credit Markets: Examining Proposals To Mitigate Foreclosures and Restore Liquidity To The Mortgage MarketsDokument93 SeitenTurmoil in U.S. Credit Markets: Examining Proposals To Mitigate Foreclosures and Restore Liquidity To The Mortgage MarketsScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 112TH Congress - Commercial Real Estate's Impact On Bank StabilityDokument176 SeitenSenate Hearing, 112TH Congress - Commercial Real Estate's Impact On Bank StabilityScribd Government DocsNoch keine Bewertungen

- Foreign Policy Implications of U.S. Efforts To Address The International Financial Crisis: Tarp, Talf and The G-20 PlanDokument89 SeitenForeign Policy Implications of U.S. Efforts To Address The International Financial Crisis: Tarp, Talf and The G-20 PlanScribd Government DocsNoch keine Bewertungen

- Levi LaunderingDokument117 SeitenLevi LaunderingAshok V PatilNoch keine Bewertungen

- Senate Hearing, 112TH Congress - Enhancing Safety and Soundness: Lessons Learned and Opportunities For Continued ImprovementDokument77 SeitenSenate Hearing, 112TH Congress - Enhancing Safety and Soundness: Lessons Learned and Opportunities For Continued ImprovementScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 113TH Congress - Helping Homeowners Harmed by Foreclosures: Ensuring Accountability and Transparency in Foreclosure ReviewsDokument65 SeitenSenate Hearing, 113TH Congress - Helping Homeowners Harmed by Foreclosures: Ensuring Accountability and Transparency in Foreclosure ReviewsScribd Government DocsNoch keine Bewertungen

- Foreign Policy and The Global Economic Crisis: HearingDokument42 SeitenForeign Policy and The Global Economic Crisis: HearingScribd Government DocsNoch keine Bewertungen

- House Hearing, 109TH Congress - Treasury's Report To Congress On The Terrorism Risk Insurance Act (Tria)Dokument61 SeitenHouse Hearing, 109TH Congress - Treasury's Report To Congress On The Terrorism Risk Insurance Act (Tria)Scribd Government DocsNoch keine Bewertungen

- Senate Hearing, 109TH Congress - A Review of The Anticorruption Strategies of The African Development Bank, Asian Development Bank, and European Bank On Reconstruction and DevelopmentDokument83 SeitenSenate Hearing, 109TH Congress - A Review of The Anticorruption Strategies of The African Development Bank, Asian Development Bank, and European Bank On Reconstruction and DevelopmentScribd Government DocsNoch keine Bewertungen

- Senate Hearing, 112TH Congress - Enhanced Oversight After The Financial Crisis: The Wall Street Reform Act at One YearDokument209 SeitenSenate Hearing, 112TH Congress - Enhanced Oversight After The Financial Crisis: The Wall Street Reform Act at One YearScribd Government DocsNoch keine Bewertungen

- Roy Memo On Mayorkas ImpeachmentDokument13 SeitenRoy Memo On Mayorkas ImpeachmentFox NewsNoch keine Bewertungen

- Did You KnowDokument18 SeitenDid You KnowAnon Mus100% (1)

- Senate Hearing, 111TH Congress - Treasury's Use of Contracting Authority Under TarpDokument127 SeitenSenate Hearing, 111TH Congress - Treasury's Use of Contracting Authority Under TarpScribd Government DocsNoch keine Bewertungen

- FY22 Border Wall Funding LetterDokument2 SeitenFY22 Border Wall Funding LetterFox NewsNoch keine Bewertungen

- Regulating Hedge Funds and Other Private Investment Pools: HearingDokument108 SeitenRegulating Hedge Funds and Other Private Investment Pools: HearingScribd Government DocsNoch keine Bewertungen

- BWABanking On NeverDokument7 SeitenBWABanking On Neverrhawk301Noch keine Bewertungen

- The Dirty Dozen: How Twelve Supreme Court Cases Radically Expanded Government and Eroded FreedomVon EverandThe Dirty Dozen: How Twelve Supreme Court Cases Radically Expanded Government and Eroded FreedomNoch keine Bewertungen

- Commission Meeting With The President and Vice President of The United States 29 April 2004, 9:25-12:40Dokument31 SeitenCommission Meeting With The President and Vice President of The United States 29 April 2004, 9:25-12:409/11 Document Archive100% (1)

- PIDB Potus Letter 9 11 Recommendations Final 1Dokument2 SeitenPIDB Potus Letter 9 11 Recommendations Final 19/11 Document ArchiveNoch keine Bewertungen

- 2012-163 (Larson) NARA (CLA) Decision (Personal Info Redacted) 9/11 Commission Interview of Bush Cheney - Zelikow MFRDokument3 Seiten2012-163 (Larson) NARA (CLA) Decision (Personal Info Redacted) 9/11 Commission Interview of Bush Cheney - Zelikow MFR9/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 19Dokument1 Seite2012-156 Doc 199/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 18Dokument6 Seiten2012-156 Doc 189/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 20Dokument1 Seite2012-156 Doc 209/11 Document Archive0% (1)

- 2012-156 Larson NARA-CLA Release Signed Copy2Dokument7 Seiten2012-156 Larson NARA-CLA Release Signed Copy29/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 23Dokument3 Seiten2012-156 Doc 239/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 26Dokument20 Seiten2012-156 Doc 269/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 24Dokument1 Seite2012-156 Doc 249/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 25Dokument3 Seiten2012-156 Doc 259/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 22Dokument2 Seiten2012-156 Doc 229/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 11 Part 4Dokument16 Seiten2012-156 Doc 11 Part 49/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 15Dokument10 Seiten2012-156 Doc 159/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 21Dokument23 Seiten2012-156 Doc 219/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 11 Part 2Dokument24 Seiten2012-156 Doc 11 Part 29/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 17Dokument5 Seiten2012-156 Doc 179/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 12 Part 1Dokument26 Seiten2012-156 Doc 12 Part 19/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 11 Part 1Dokument27 Seiten2012-156 Doc 11 Part 19/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 14 Part 1Dokument18 Seiten2012-156 Doc 14 Part 19/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 13 Part 2Dokument27 Seiten2012-156 Doc 13 Part 29/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 14 Part 2Dokument22 Seiten2012-156 Doc 14 Part 29/11 Document Archive100% (1)

- 2012-156 Doc 13 Part 1Dokument25 Seiten2012-156 Doc 13 Part 19/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 11 Part 3Dokument23 Seiten2012-156 Doc 11 Part 39/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 12 Part 3Dokument33 Seiten2012-156 Doc 12 Part 39/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 9 Part 3Dokument27 Seiten2012-156 Doc 9 Part 39/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 12 Part 2Dokument28 Seiten2012-156 Doc 12 Part 29/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 9 Part 6Dokument17 Seiten2012-156 Doc 9 Part 69/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 10 Part 2Dokument24 Seiten2012-156 Doc 10 Part 29/11 Document ArchiveNoch keine Bewertungen

- 2012-156 Doc 9 Part 5Dokument21 Seiten2012-156 Doc 9 Part 59/11 Document ArchiveNoch keine Bewertungen

- CFPB Your Money Your Goals Choosing Paid ToolDokument6 SeitenCFPB Your Money Your Goals Choosing Paid ToolJocelyn CyrNoch keine Bewertungen

- Iec 60287-3-2Dokument77 SeitenIec 60287-3-2zwerr100% (2)

- The Magnificent-Equity ValuationDokument70 SeitenThe Magnificent-Equity ValuationMohit TewaryNoch keine Bewertungen

- 3-Investment Information and Securities TransactionDokument59 Seiten3-Investment Information and Securities TransactionAqil RidzwanNoch keine Bewertungen

- Create PHP CRUD App DatabaseDokument6 SeitenCreate PHP CRUD App DatabasearyaNoch keine Bewertungen

- H.C.G. Paper 1 History & Civics examDokument5 SeitenH.C.G. Paper 1 History & Civics examGreatAkbar1100% (1)

- Heartbalm Statutes and Deceit Actions PDFDokument29 SeitenHeartbalm Statutes and Deceit Actions PDFJoahanna AcharonNoch keine Bewertungen

- John Andrews Criminal ComplaintDokument7 SeitenJohn Andrews Criminal ComplaintFOX 11 NewsNoch keine Bewertungen

- Thread - o - Ring - Fittings (TD Williamson) PDFDokument4 SeitenThread - o - Ring - Fittings (TD Williamson) PDFRahul RaghukumarNoch keine Bewertungen

- Kashmir Highway sports club membership formDokument2 SeitenKashmir Highway sports club membership formSarah HafeezNoch keine Bewertungen

- Order Dated - 18-08-2020Dokument5 SeitenOrder Dated - 18-08-2020Gaurav LavaniaNoch keine Bewertungen

- Hydrochloric Acid MSDS: 1. Product and Company IdentificationDokument7 SeitenHydrochloric Acid MSDS: 1. Product and Company IdentificationdeaNoch keine Bewertungen

- Au Dit TinhDokument75 SeitenAu Dit TinhTRINH DUC DIEPNoch keine Bewertungen

- Quotation for 15KW solar system installationDokument3 SeitenQuotation for 15KW solar system installationfatima naveedNoch keine Bewertungen

- Bmu AssignmnetDokument18 SeitenBmu AssignmnetMaizaRidzuanNoch keine Bewertungen

- Carey Alcohol in The AtlanticDokument217 SeitenCarey Alcohol in The AtlanticJosé Luis Cervantes CortésNoch keine Bewertungen

- DENR V DENR Region 12 EmployeesDokument2 SeitenDENR V DENR Region 12 EmployeesKara RichardsonNoch keine Bewertungen

- UKLSR Volume 2 Issue 1 Article 3 PDFDokument34 SeitenUKLSR Volume 2 Issue 1 Article 3 PDFIbrahim SalahudinNoch keine Bewertungen

- ADokument109 SeitenALefa Doctormann RalethohlaneNoch keine Bewertungen

- Cambridge IGCSE: 0450/22 Business StudiesDokument12 SeitenCambridge IGCSE: 0450/22 Business StudiesTshegofatso SaliNoch keine Bewertungen

- Cod 2023Dokument1 SeiteCod 2023honhon maeNoch keine Bewertungen

- The Elite and EugenicsDokument16 SeitenThe Elite and EugenicsTheDetailerNoch keine Bewertungen

- Eriodic Ransaction Eport: Hon. Judy Chu MemberDokument9 SeitenEriodic Ransaction Eport: Hon. Judy Chu MemberZerohedgeNoch keine Bewertungen

- List of Cases For SUCCESSIONDokument5 SeitenList of Cases For SUCCESSIONpetercariazoNoch keine Bewertungen

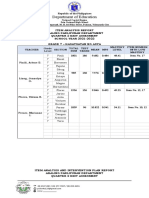

- Item Analysis Repost Sy2022Dokument4 SeitenItem Analysis Repost Sy2022mjeduriaNoch keine Bewertungen

- Model articles of association for limited companies - GOV.UKDokument7 SeitenModel articles of association for limited companies - GOV.UK45pfzfsx7bNoch keine Bewertungen

- Lea2 Comparative Models in Policing Syllabus Ok Converted 1Dokument6 SeitenLea2 Comparative Models in Policing Syllabus Ok Converted 1Red Buttrerfly RC100% (2)

- Property LawDokument10 SeitenProperty LawVaalu MuthuNoch keine Bewertungen

- Electricity Act 2003 key reformsDokument21 SeitenElectricity Act 2003 key reformsSupervisor CCCNoch keine Bewertungen

- SAP Business One and The Prolification of TechnologyDokument23 SeitenSAP Business One and The Prolification of TechnologyDeepak NandikantiNoch keine Bewertungen