Beruflich Dokumente

Kultur Dokumente

Industry Conditions Report

Hochgeladen von

Aaditya JainCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Industry Conditions Report

Hochgeladen von

Aaditya JainCopyright:

Verfügbare Formate

Capstone Industry Conditions Report For C58560

Your instructor can customize the simulation scenario. The information below is specific to your industry. The sensors your company manufactures are incorporated into the products your customers sell. Your customers fall into five groups which are called market segments. A market segment is a group of customers who have similar needs. The segments are named for the customer's primary requirements and are called: Traditional Low End High End Customers within each market segment employ different standards as they evaluate sensors. They consider four buying criteria: Price Age MTBF (Mean Time Before Failure) Positioning Performance Size

1 Positioning

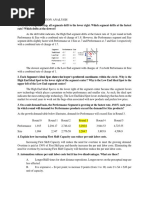

Perceptual Map Each market segment has different positioning preferences. This is illustrated by the sets of dashed and solid circles in the graphic below. Over time, these preferences will shift (see Section 2.1.5 in the Team Member Guide for more information). Perceptual Map Form: Segment circles and ideal spots for Round 0 are shown below (see Section 3.1 in the Team Member Guide for more information about segment circles and ideal spots).

1 of 8

Capstone Industry Conditions Report For C58560

Drift Rates Each year, the segments drift the length of the hypotenuse of the triangle formed by customers' desire for smaller and faster products.

Table 1 Segment Circle Drift Rates: Every year, customers demand increased performance (Pfmn) and decreased size. Note that the drift rates vary for each segment.

Pfmn Traditional Low End High End Performance Size +0.7 +0.5 +0.9 +1.0 +0.7

Size -0.7 -0.5 -0.9 -0.7 -1.0

Segment Centers

Table 2: Segment Centers at the End of Each Round: As shown in the Perceptual Map Form above, size is on the vertical axis and performance (Pfmn) is on the horizontal axis.

Traditional Round 0 1 2 3 4 5 6 7 8 Pfmn Size 4.3 5.0 5.7 6.4 7.1 7.8 8.5 9.2 9.9 15.1 14.4 13.7 13.0 12.3 11.6 10.9 10.2 9.5

Low End Pfmn Size 1.8 2.3 2.8 3.3 3.8 4.3 4.8 5.3 5.8 17.6 17.1 16.6 16.1 15.6 15.1 14.6 14.1 13.6

High End Pfmn Size 6.8 7.7 8.6 9.5 12.6 11.7 10.8 9.9

Performance Pfmn 7.3 8.3 9.3 10.3 11.3 12.3 13.3 14.3 15.3 Size 17.1 16.4 15.7 15.0 14.3 13.6 12.9 12.2 11.5

Size Pfmn Size 2.3 3.0 3.7 4.4 5.1 5.8 6.5 7.2 7.9 12.1 11.1 10.1 9.1 8.1 7.1 6.1 5.1 4.1

10.4 9.0 11.3 8.1 12.2 7.2 13.1 6.3 14.0 5.4

The information in Table 2 reflects the segment centers at the end of the round. Therefore, the Round 0 positions can be seen as the Round 1 starting positions, Round 2 positions can be seen as the Round 3 starting position, etc. Each month during the simulation year, the segment drifts 1/12th of the distance from the starting position to the ending position.

2 of 8

Capstone Industry Conditions Report For C58560

Ideal Spots

Table 3 Ideal Spot Offsets: Customers prefer products located this distance from the center of the segment circle. Pfmn Traditional Low End High End Performance Size 0.0 -0.8 +1.4 +1.4 +1.0 Size 0.0 +0.8 -1.4 -1.0 -1.4

The information in Table 3 shows the Ideal Spot "offsets" or distances from the segment center. The ideal spot is that point where, all other things being equal, demand is highest. It is different from the segment center. Why are some ideal spots ahead of the segment centers? The segments are moving. From a customers perspective, if they buy a product at the ideal spot, it will still be a cutting edge product when it wears out.

2 Segment Sizes and Growth Rates

Traditional and Low End sell more units than the high technology segments, High End, Performance and Size. Page 10 of the Capstone Courier, the Market Segment Report, displays total industry sales. Each market segment grows at a different rate. Table 4 lists the beginning segment growth rates for your industry. The growth rates might change from year to year. Check the Segment Analysis reports in the Capstone Courier each round for the upcoming year's growth rates.

Table 4 Beginning Segment Growth Rates Traditional Low End High End Performance Size 9.9% 12.6% 16.9% 20.9% 19.0%

3 Buying Criteria By Segment

These are your products and the primary segments they sell into at the beginning of the simulation. These can change according to your decisions and as the simulation evolves.

Able Acre Adam Aft

Traditional Low End High End Performance

Agape Size

3 of 8

Capstone Industry Conditions Report For C58560

The buying criteria for each segment, in order of importance, are displayed below. Positioning and Age score information also display. Please see Chapter 3 of the Team Member Guide for explanations of Positioning, Age, Price and MTBF scores. 3.1 Traditional Segment Buying Criteria (Round 0) Traditional customers seek proven products at a modest price. Age, 2 years importance: 47% Price, $20.00-$30.00 importance: 23% Ideal Position, performance 4.3 size 15.1 importance: 21% MTBF, 14,000-19,000 importance: 9%

Industry Conditions Figure 3.1: Traditional Buying Criteria

Traditional customers give higher position scores to sensors located in the center of the segment circle.

Traditional customers give higher scores to sensors in the 2 year range.

4 of 8

Capstone Industry Conditions Report For C58560

3.2 Low End Segment Buying Criteria (Round 0) Low End customers seek low prices and well proven products. Price, $15.00-$25.00 importance: 53% Age, 7 years importance: 24% Ideal Position, performance 1.0 size 18.4 importance: 16% MTBF, 12,000-17,000 importance: 7%

Industry Conditions Figure 3.2 Low End Buying Criteria

Low End customers prefer inexpensive sensors with slower performance and larger size.

Low End customers give higher scores to sensors in the 7 year range.

5 of 8

Capstone Industry Conditions Report For C58560

3.3 High End Segment Buying Criteria (Round 0) High End customers seek cutting-edge technology in size/performance and new designs. Ideal Position, performance 8.2 size 11.2 importance: 43% Age, 0 years importance: 29% MTBF, 20,000-25,000 importance: 19% Price, $30.00-$40.00 importance: 9%

Industry Conditions Figure 3.3 High End Buying Criteria

High End customers demand cutting edge sensors with high performance and small size.

High End customers give higher scores to newer sensors.

6 of 8

Capstone Industry Conditions Report For C58560

3.4 Performance Segment Buying Criteria (Round 0) Performance customers seek high reliability and cutting edge performance technology. MTBF, 22,000-27,000 importance: 43% Ideal Position, performance 8.7 size 16.1 importance: 29% Price, $25.00-$35.00 importance: 19% Age, 1 year importance: 9%

Industry Conditions Figure 3.4 Performance Buying Criteria

Performance customers emphasize performance over size.

Performance customers want sensors in the 1 year range.

7 of 8

Capstone Industry Conditions Report For C58560

3.5 Size Segment Buying Criteria (Round 0) Size customers seek cutting edge size technology and younger designs. Ideal Position, performance 3.3 size 10.7 importance: 43% Age, 1.5 years importance: 29% MTBF, 16,000-21,000 importance: 19% Price, $25.00-$35.00 importance: 9%

Industry Conditions Figure 3.5 Size Buying Criteria

Size customers emphasize size over performance.

Size customers prefer sensors in the 1.5 year range.

4 Projected Interest Rates

Prime Interest Rate Round 1: 6.4%

8 of 8

Das könnte Ihnen auch gefallen

- Speed Changers, Drives & Gears, Type World Summary: Market Sector Values & Financials by CountryVon EverandSpeed Changers, Drives & Gears, Type World Summary: Market Sector Values & Financials by CountryNoch keine Bewertungen

- Value and Capital Management: A Handbook for the Finance and Risk Functions of Financial InstitutionsVon EverandValue and Capital Management: A Handbook for the Finance and Risk Functions of Financial InstitutionsBewertung: 5 von 5 Sternen5/5 (1)

- 1: Segment Locations and Drift Rates:: Perceptual MapDokument8 Seiten1: Segment Locations and Drift Rates:: Perceptual MapSagar SachdevaNoch keine Bewertungen

- Industry Conditions ReportDokument7 SeitenIndustry Conditions ReportPunit NemaNoch keine Bewertungen

- Capstone Industry Conditions Report For Industry C131190Dokument7 SeitenCapstone Industry Conditions Report For Industry C131190Cristian MiunsipNoch keine Bewertungen

- Conditions Report2Dokument6 SeitenConditions Report2alexfuentesroNoch keine Bewertungen

- Industry Conditions ReportDokument7 SeitenIndustry Conditions ReportHarshNoch keine Bewertungen

- DocxDokument2 SeitenDocxmohnish1006Noch keine Bewertungen

- Capstone CourierDokument7 SeitenCapstone CourierekanshjiNoch keine Bewertungen

- Capstone Situation AnalysisDokument5 SeitenCapstone Situation AnalysisHerbert Ascencio0% (1)

- Positioning MapsDokument5 SeitenPositioning MapsthuanvltkNoch keine Bewertungen

- TallerDokument102 SeitenTallerMarie RodriguezNoch keine Bewertungen

- B2B Bandits - Group 10Dokument6 SeitenB2B Bandits - Group 10ANSHUMAN DASNoch keine Bewertungen

- Capstone IntroductionDokument22 SeitenCapstone IntroductionSaurabh MehtaNoch keine Bewertungen

- Customers DescriptionDokument4 SeitenCustomers DescriptionMouna Tricha100% (1)

- Durr Environmental CaseDokument21 SeitenDurr Environmental CaseHayek Elie100% (5)

- Customer Intro PDFDokument4 SeitenCustomer Intro PDFJasdeep SinghNoch keine Bewertungen

- Condé Nast - Media Kit Print - Condé Nast Traveler - 2016-02-26Dokument17 SeitenCondé Nast - Media Kit Print - Condé Nast Traveler - 2016-02-26Carousel ConfessionsNoch keine Bewertungen

- Marketing Strategy For VoltasDokument37 SeitenMarketing Strategy For Voltasswatithorat50% (2)

- Market Segmentation and Analysis Tool UpdatedDokument11 SeitenMarket Segmentation and Analysis Tool UpdatedXico ShazzadNoch keine Bewertungen

- B2B Bandits - Group 10 PDFDokument10 SeitenB2B Bandits - Group 10 PDFANSHUMAN DASNoch keine Bewertungen

- Formulation of Manufacturing StrategyDokument30 SeitenFormulation of Manufacturing StrategywaqasalitunioNoch keine Bewertungen

- Capstone User Guide v4Dokument35 SeitenCapstone User Guide v4Vrinda MaskaraNoch keine Bewertungen

- London 2013 CasebookDokument91 SeitenLondon 2013 CasebookJinliang Zang100% (1)

- 1 Operational Flexibility PDFDokument37 Seiten1 Operational Flexibility PDFamir8100Noch keine Bewertungen

- Chapter 14 - Applied Problem SolutionsDokument10 SeitenChapter 14 - Applied Problem SolutionsZoha Kamal100% (1)

- Ent600 - Blueprint Guideline & Template - Updated Sept2018Dokument14 SeitenEnt600 - Blueprint Guideline & Template - Updated Sept2018Fnur FatihahNoch keine Bewertungen

- Technology Entrepreneurship (ENT600) : Blueprint (Ent600) : Guidelines & TemplateDokument14 SeitenTechnology Entrepreneurship (ENT600) : Blueprint (Ent600) : Guidelines & TemplateHasif HuzairNoch keine Bewertungen

- Marketing Presentation - PlanogramDokument28 SeitenMarketing Presentation - PlanogramAadhithya Chandrasekar100% (2)

- Atlantic ComputersDokument8 SeitenAtlantic ComputersSujeet Kumar Vikas100% (3)

- Team 4 - QFD - For MouseDokument23 SeitenTeam 4 - QFD - For MouseNigusu TilayeNoch keine Bewertungen

- Capsim Bus 497ADokument45 SeitenCapsim Bus 497Ajack stauberNoch keine Bewertungen

- Conumer Behaviour Towards Samsung AC in JalandharDokument30 SeitenConumer Behaviour Towards Samsung AC in JalandharShantana Bose100% (1)

- Erp-System: Marketing Analysis Module: International Conference On Computer Systems and Technologies - Compsystech'2004Dokument6 SeitenErp-System: Marketing Analysis Module: International Conference On Computer Systems and Technologies - Compsystech'2004Pallavi PuriNoch keine Bewertungen

- MC68HC11PA8 MC68HC711PA8 MC68HC11PB8 MC68HC711PB8: Technical DataDokument238 SeitenMC68HC11PA8 MC68HC711PA8 MC68HC11PB8 MC68HC711PB8: Technical DataCarlos Vicente LemesNoch keine Bewertungen

- Base of Capstone StrategyDokument2 SeitenBase of Capstone StrategySagar SabnisNoch keine Bewertungen

- Ent600 - Blueprint Guideline & TemplateDokument14 SeitenEnt600 - Blueprint Guideline & TemplateAdib ZafriNoch keine Bewertungen

- Categorisation and Category AnalysisDokument9 SeitenCategorisation and Category AnalysisjonchkNoch keine Bewertungen

- Jaipuria Institute of Management, Lucknow: PGDM/FS/RMDokument2 SeitenJaipuria Institute of Management, Lucknow: PGDM/FS/RMKritika ChauhanNoch keine Bewertungen

- 2014 SmaDokument7 Seiten2014 SmaLai Kuan ChanNoch keine Bewertungen

- Week1 Homework Solutions 13thedDokument6 SeitenWeek1 Homework Solutions 13thedKaramat KhanNoch keine Bewertungen

- Perceptual Mapping: Mdpref: MBA 651 - Measurement and AnalysisDokument32 SeitenPerceptual Mapping: Mdpref: MBA 651 - Measurement and AnalysisNAVEEN.A.S0% (1)

- Chanakya InitialHandoutMPX13Dokument13 SeitenChanakya InitialHandoutMPX13abcNoch keine Bewertungen

- b5 Life Cycle (Q&A 2018Dokument11 Seitenb5 Life Cycle (Q&A 2018Issa Adiema100% (1)

- Operations Management ProjectDokument26 SeitenOperations Management ProjectBhoomika Shetty MNoch keine Bewertungen

- 2a Ent600 - Blueprint - 2018 Guidelines & TemplateDokument14 Seiten2a Ent600 - Blueprint - 2018 Guidelines & TemplateMat Azib MugeNoch keine Bewertungen

- Current ScenarioDokument9 SeitenCurrent ScenarioSaptarishi SenNoch keine Bewertungen

- 26 Economies and Diseconomies of ScaleDokument5 Seiten26 Economies and Diseconomies of ScaleAvikshita JoarderNoch keine Bewertungen

- ABB Electric SegmentationDokument6 SeitenABB Electric Segmentationcerky697293% (14)

- Service LetterDokument8 SeitenService LetteralexNoch keine Bewertungen

- PTOS Key Metrics For More Accurate OutputDokument9 SeitenPTOS Key Metrics For More Accurate OutputlisahunNoch keine Bewertungen

- Production WheelDokument11 SeitenProduction WheelDavid L Jacobs0% (1)

- Assignment 2 OcsmDokument5 SeitenAssignment 2 OcsmvishnuNoch keine Bewertungen

- BLUEPRINTDokument4 SeitenBLUEPRINTIntan Syamelia MusaNoch keine Bewertungen

- Luring SME CustomersDokument4 SeitenLuring SME CustomersAnonymous K2oiMJxjSFNoch keine Bewertungen

- Abhra Bhattacharyya Kumar Gaurav Narendra Singh Rana Vishal Deep Sharma Vinay Kumar Singh Vivek KantDokument23 SeitenAbhra Bhattacharyya Kumar Gaurav Narendra Singh Rana Vishal Deep Sharma Vinay Kumar Singh Vivek KantNavya AgarwalNoch keine Bewertungen

- Configuration Management for Senior Managers: Essential Product Configuration and Lifecycle Management for ManufacturingVon EverandConfiguration Management for Senior Managers: Essential Product Configuration and Lifecycle Management for ManufacturingNoch keine Bewertungen

- "Swiggy Strike": Case StudyDokument7 Seiten"Swiggy Strike": Case StudyRavi JindalNoch keine Bewertungen

- Sample Income Tax FormDokument8 SeitenSample Income Tax FormSadav ImtiazNoch keine Bewertungen

- Far 7 Flashcards - QuizletDokument31 SeitenFar 7 Flashcards - QuizletnikoladjonajNoch keine Bewertungen

- Final Financial Accounting (Pulkit)Dokument14 SeitenFinal Financial Accounting (Pulkit)nitish_goel91Noch keine Bewertungen

- R26 CFA Level 3Dokument12 SeitenR26 CFA Level 3Ashna0188Noch keine Bewertungen

- W. H. Elliott & Sons Co., Inc. v. Charles J. Gotthardt, 305 F.2d 544, 1st Cir. (1962)Dokument6 SeitenW. H. Elliott & Sons Co., Inc. v. Charles J. Gotthardt, 305 F.2d 544, 1st Cir. (1962)Scribd Government DocsNoch keine Bewertungen

- Saving Your Rookie Managers From Themselves: by Carol A. WalkerDokument8 SeitenSaving Your Rookie Managers From Themselves: by Carol A. WalkerOmar ChaudhryNoch keine Bewertungen

- International Mining January 2018Dokument80 SeitenInternational Mining January 2018GordNoch keine Bewertungen

- NIT PMA NagalandDokument15 SeitenNIT PMA NagalandBasantNoch keine Bewertungen

- Marketing Management NotesDokument57 SeitenMarketing Management NotesKanchana Krishna KaushikNoch keine Bewertungen

- PDFDokument17 SeitenPDFRAJAT DUBEYNoch keine Bewertungen

- Informatica Powercenter CourseDokument8 SeitenInformatica Powercenter CourseThameemNoch keine Bewertungen

- Heartland Bank Brand Guidelines - 3 October 2017Dokument22 SeitenHeartland Bank Brand Guidelines - 3 October 2017nainaNoch keine Bewertungen

- Nyept Code:-Pt122: 2. For Export of Data From Company To Company Tally UsesDokument11 SeitenNyept Code:-Pt122: 2. For Export of Data From Company To Company Tally UsesSumit PandyaNoch keine Bewertungen

- NoSQL Case ExamplesDokument6 SeitenNoSQL Case Examplesvishwasg123Noch keine Bewertungen

- Investment and Portfolio ManagementDokument16 SeitenInvestment and Portfolio ManagementmudeyNoch keine Bewertungen

- Accounting Group Assignment 1Dokument7 SeitenAccounting Group Assignment 1Muntasir AhmmedNoch keine Bewertungen

- Natalie ResumeDokument1 SeiteNatalie Resumeapi-430414382Noch keine Bewertungen

- IRS Depreciation Guide With Optional Rate TablesDokument118 SeitenIRS Depreciation Guide With Optional Rate TablesManthan ShahNoch keine Bewertungen

- totallyMAd - 18 January 2008Dokument2 SeitentotallyMAd - 18 January 2008NewsclipNoch keine Bewertungen

- Satılacak Rulman ListesiDokument21 SeitenSatılacak Rulman ListesiIbrahim sofiNoch keine Bewertungen

- Fyp ProjectDokument5 SeitenFyp ProjectUsman PashaNoch keine Bewertungen

- Mobike and Ofo: Dancing of TitansDokument4 SeitenMobike and Ofo: Dancing of TitansKHALKAR SWAPNILNoch keine Bewertungen

- Rosenflex BrochureDokument32 SeitenRosenflex Brochuresealion72Noch keine Bewertungen

- Indirect Verification PDFDokument1 SeiteIndirect Verification PDFSai FujiwaraNoch keine Bewertungen

- A Proposed Bpo Hub in Arca SouthDokument22 SeitenA Proposed Bpo Hub in Arca SouthKent Francisco0% (1)

- Induction MaterialDokument56 SeitenInduction Materialvirender rawatNoch keine Bewertungen

- HLS Process ImprovementDokument18 SeitenHLS Process ImprovementsivaNoch keine Bewertungen

- Japanese YenDokument12 SeitenJapanese YenPrajwal AlvaNoch keine Bewertungen

- Balaji Traders 1st April 2013 To 31 March 2014Dokument12 SeitenBalaji Traders 1st April 2013 To 31 March 2014Timothy BrownNoch keine Bewertungen