Beruflich Dokumente

Kultur Dokumente

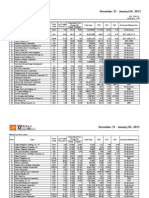

The Philippine Stock Exchange, Inc Daily Quotations Report February 14, 2013

Hochgeladen von

srichardequipOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Philippine Stock Exchange, Inc Daily Quotations Report February 14, 2013

Hochgeladen von

srichardequipCopyright:

Verfügbare Formate

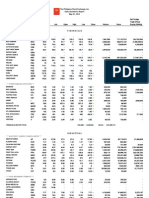

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 14 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

FINANCIALS

**** BANKS ****

ASIATRUST

ASIA

BDO

84.9

85.5

85.65

85.75

84.2

85.5

1,281,570

109,114,918

(23,320,401)

BPI

CHIB

107

63.85

107.1

64

107

63.75

107.7

64.75

106.6

63.75

107

64

1,164,320

322,470

124,485,549

20,730,841.5

35,270,884

(93,910)

CSB

EW

15

30.5

25

30.55

30.65

30.75

30.5

30.55

919,500

28,103,395

(21,480,880)

METROBANK

EIBA

EIBB

MBT

111.9

112

113

113.8

111.5

111.9

2,059,470

231,035,875

21,339,288

PBCOM

PBC

73

78.3

73

73

72.95

73

20,000

1,459,999.5

PHIL. NATL BANK

PNB

97.05

97.15

97.3

99

96.6

97.15

743,170

72,142,782

(3,039,913)

PHILTRUST

PSBANK

PTC

PSB

65.5

116.8

116.9

114

116.9

114

116.9

10,250

1,169,210

RCBC

RCB

64.3

64.4

63.4

64.5

63.4

64.4

235,030

14,977,449

938,469

SECURITY BANK

SECB

172.2

173

174.5

177.5

172

172.2

665,880

116,859,151

18,524,161

UNION BANK

UBP

122.8

123.3

123

123.2

122.5

122.8

590,230

72,435,148

(5,679,968)

BDO UNIBANK

BPI

CHINABANK

CITYSTATE BANK

EW

EXPORT BANK

EXPORT BANK B

**** OTHER FINANCIAL INSTITUTION ****

BANKARD

BKD

1.02

1.01

1.02

1.01

1,167,000

1,186,180

BDO LEASING

COL FINANCIAL

BLFI

COL

1.98

18.64

2.02

18.88

2.02

18.9

2.02

18.98

2.02

18.64

2.02

18.88

8,000

123,800

16,160

2,341,942

FILIPINO FUND

FFI

11.38

11.94

11.4

11.8

11.38

11.38

2,300

26,614

(11,400)

FIRST ABACUS

FAF

0.82

0.83

0.81

0.82

0.8

0.82

231,000

184,950

IREMIT

PHILNARE

I

MFC

MAKE

MED

NRCP

2.82

25.05

1.96

2.9

25.5

1.98

1.98

1.99

1.96

1.98

246,000

485,090

PSE

PSE

462.8

463.8

464

464

461.2

463.8

6,830

3,157,300

120,020

SUN LIFE

SLF

1,122

1,127

1,120

1,122

1,120

1,122

165

185,090

VANTAGE

2.54

2.55

2.56

2.56

2.54

2.54

438,000

1,116,720

VOLUME :

10,234,985

MANULIFE

MAYBANK ATR KE

MEDCO HLDG

FINANCIALS SECTOR TOTAL

VALUE :

801,214,364

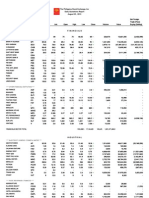

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ABOITIZ POWER

AP

37.8

37.9

37.95

38

37.8

37.9

1,630,700

61,834,955

(10,584,000)

ALSONS CONS

ACR

1.39

1.4

1.44

1.44

1.38

1.39

1,986,000

2,760,280

55,600

CALAPAN VENTURE

H2O

4.06

4.35

4.02

4.02

4.02

4.02

1,000

4,020

ENERGY DEVT.

EDC

7.45

7.47

7.45

7.5

7.35

7.47

7,689,300

57,318,256

(4,065,981)

FIRST GEN

FIRST PHIL HLDG

FGEN

FPH

26.65

109.3

26.7

109.9

26.75

109.4

27

110

26.3

107.5

26.7

109.9

868,100

903,780

23,099,355

98,595,304

(3,284,785)

32,049,386

MANILA WATER

MWC

34.3

34.35

34.6

34.85

34.35

34.35

5,876,500

202,894,835

(10,190,755)

MERALCO A

MER

301.6

304

300.2

306

298.8

301.6

423,670

127,721,356

21,899,330

PETRON

PCOR

12.86

12.9

12.72

12.98

12.66

12.9

11,430,400

146,993,808

(697,176)

PHOENIX

PNX

10.8

10.9

11

11

10.8

10.8

340,500

3,684,242

172,976

SALCON POWER

SPC

TA

VVT

4.62

1.8

9.15

4.8

1.82

9.2

1.8

9.1

1.84

9.15

1.79

9.1

1.8

9.15

18,037,000

6,300

32,580,730

57,410

(8,944,530)

(9,150)

TRANS-ASIA

VIVANT

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ANI

7.6

7.63

7.62

7.62

7.6

7.61

27,400

208,325

ALLIANCE SELECT

FOOD

BMM

CBC

DNL

1.98

50.35

6.18

1.99

61

6.19

1.99

6

2

6.21

1.95

5.97

1.99

6.18

2,157,000

11,047,100

4,280,000

67,565,454

19,600

(6,251,578)

GSMI

JFC

16.98

110.8

17

111.5

17

112

17

112

17

110.8

17

110.8

16,200

1,048,620

275,400

116,280,279

102,000

(49,560,954)

LT GROUP

LFM

LTG

42.5

15.4

56

15.46

49

15.2

49

15.46

49

15.16

49

15.46

700

5,347,400

34,300

82,143,142

11,144,410

PANCAKE

PCKH

7.75

8.25

8.25

7.5

7.5

800

6,150

PEPSI-COLA

PIP

6.3

6.4

6.45

6.46

6.3

6.4

9,942,900

63,603,332

(27,302,905)

PUREFOODS A

PF

309

314.6

303

303

105,360

32,334,952

2,515,308

RFM CORP

RFM

4.81

4.84

4.9

4.92

4.78

4.81

1,909,000

9,203,940

(341,850)

ROXAS AND CO.

RCI

ROX

2.25

3.2

2.37

3.3

3.3

3.3

3.3

3.3

65,000

214,500

SAN MIGUEL CORP.

SMB

SMC

122.5

122.7

119.6

122.5

119.5

122.5

2,211,100

266,805,438

79,871,551

SWIFT

SFI

0.146

0.149

0.146

0.146

0.146

0.146

1,070,000

156,220

TARLAC

CAT

13

15

13

13

13

13

3,000

39,000

UNIV ROBINA

URC

95.15

95.2

95.5

96

94.5

95.2

3,071,340

292,191,038

122,262,328

BOGO MEDELLIN

COSMOS

DNL INDUS

GINEBRA

JOLLIBEE

LIBERTY FLOUR

ROXAS HLDG.

SAN MIGUEL

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 14 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

VICTORIAS

VMC

1.46

1.48

1.47

1.48

1.46

1.48

2,052,000

3,024,230

(516,040)

VITARICH

VITA

0.96

0.98

0.98

0.98

0.98

0.98

214,000

209,720

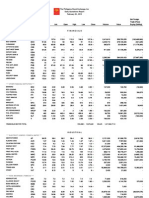

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

19.1

19.2

19.5

19.98

19.2

19.2

16,600

322,696

CONCRETE A

EEI CORP.

CA

CAB

EEI

50

15

12.84

65

12.86

12.84

12.9

12.8

12.84

1,799,300

23,108,864

(1,408,472)

FED. CHEMICALS

FED

9.82

11.5

9.87

9.87

9.82

9.82

900

8,863

HOLCIM

13.3

11.7

5.52

13.5

11.8

5.55

13.3

11.52

5.7

13.5

11.8

5.7

13.3

11.52

5.52

13.5

11.8

5.55

13,500

465,400

179,950

5,405,072

(26,660)

1,051,446

MARIWASA

HLCM

LRI

MMI

41,200

231,890

MEGAWIDE

MWIDE

17.88

17.9

18

18

17.7

17.9

554,400

9,928,488

(158,250)

PHINMA

PHN

PNC

CMT

SRDC

T

VUL

12.8

1.2

1.68

1.64

13.34

1.7

1.65

13.38

1.7

1.63

13.4

1.7

1.67

12.8

1.7

1.63

13.34

1.7

1.65

5,600

200,000

1,094,000

73,948

340,000

1,810,820

(690,400)

MANCHESTER A

CIP

COAT

EURO

LMG

MVC

MIH

73

2.9

1.83

2.73

1.65

12.9

98

2.95

1.85

2.75

1.85

13

3.01

2.74

12.7

3.01

2.76

13.4

3.01

2.74

12.62

3.01

2.75

12.9

8,000

759,000

120,700

24,080

2,083,390

1,542,368

24,080

-

MANCHESTER B

MIHB

12.9

13

12.9

13.2

12.9

12.9

17,600

227,070

METROALLIANCE A

MAH

MAHB

PPC

25.7

0.019

4.1

0.67

26.5

0.02

4.18

0.69

26.6

0.02

4.08

0.69

26.6

0.02

4.1

0.69

25.5

0.019

4.08

0.66

26.5

0.02

4.1

0.68

34,800

70,000,000

84,000

1,409,000

906,120

1,337,000

344,300

949,420

9,500

-

CONCRETE B

LAFARGE_REP

PNCC

SEACEM

SUPERCITY

TKC STEEL

VULCAN IND`L

**** CHEMICALS ****

CHEMPHIL

CHEMREZ

EUROMED

LMG CHEMICALS

MABUHAY VINYL

METROALLIANCE B

PRYCE CORP

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CHIPS

IONICS

CHIPS

GREEN

IMI

ION

PANASONIC

PMPC

4.8

6.75

4.8

4.8

4.8

4.8

100

480

SPLASH CORP.

ALPHA

FYN

FYNB

PCP

SPH

1.73

1.74

1.74

1.74

1.73

1.73

193,000

334,280

STENIEL

STN

GREENERGY

INTEGRATED MICRO

**** OTHER INDUSTRIALS ****

ALPHALAND

FILSYN A

FILSYN B

PICOP RES

INDUSTRIALS SECTOR TOTAL

VOLUME :

169,038,420

VALUE :

1,954,375,178.5

HOLDING FIRMS

**** HOLDING FIRMS ****

ABACUS A

ABA

AEV

0.67

57.45

0.68

57.5

0.68

57.5

0.68

57.5

0.67

57.4

0.68

57.5

1,679,000

817,800

1,126,050

47,017,215

26,310,602

APM

AGI

0.15

20.2

0.151

20.25

0.152

20.65

0.152

20.65

0.147

19.96

0.151

20.2

1,564,130,000

30,459,100

232,588,400

615,087,828

514,000

116,706,776

ANSCOR

APO

ANS

2.38

6.2

2.41

6.27

2.4

6.05

2.41

6.3

2.38

6.03

2.41

6.2

2,422,000

349,400

5,802,580

2,132,614

23,800

-

ASIA AMALGAMATED

AAA

4.9

4.95

4.9

4.91

4.9

4.91

6,000

29,450

ATN HOLDINGS A

ATN

ATNB

AC

0.95

1

566

1

1.03

566.5

0.98

1.03

565

1.05

1.03

570

0.98

1.03

564

1.05

1.03

566.5

20,000

100,000

19,790

103,000

686,110

388,911,340

120,250,675

BH

DMC

224

53.05

645

53.15

54.8

55

52.8

53.05

5,745,430

305,321,999

15,493,325

FJP

FC

FDC

2.98

5.9

3

5.95

3

5.93

3

5.99

3

5.9

3

5.9

17,000

563,900

51,000

3,357,735

860,062

HOUSE OF INV

FJPB

FPI

GTCAP

HI

3.06

0.22

717

7.64

3.4

0.24

718

7.83

0.249

721

7.78

0.25

723

7.87

0.249

715

7.64

0.25

718

7.64

30,000

263,640

16,500

7,480

189,305,025

129,160

12,267,245

-

JG SUMMIT

JGS

39.3

39.4

39.4

39.8

39.2

39.4

428,300

16,885,275

827,830

JOLLIVILLE HLDG

JOH

6.13

7.02

6.13

6.13

6.13

6.13

400

2,452

KEPPEL HLDG A

KPH

5.5

4.12

4.22

4.12

4.22

9,300

38,776

KEPPEL HLDG B

LODESTAR

KPHB

LIHC

5

0.98

5.59

1

0.98

0.98

0.98

0.98

578,000

566,440

LOPEZ HLDGS.

LPZ

7.55

7.57

7.49

7.6

7.45

7.57

3,728,100

27,947,959

(3,589,914)

MABUHAY HLDG.

MHC

0.55

0.59

0.54

0.6

0.54

0.6

181,000

104,320

ABOITIZ

ALCORN GOLD

ALLIANCE GLOBAL

ANGLO-PHIL HLDG

ATN HOLDINGS B

AYALA CORP

BHI HLDG

DMCI HOLDINGS

F&J PRINCE A

FIL ESTATE CORP

FILINVEST DEV.

FJ PRINCE B

FORUM PACIFIC

GT CAPITAL

MARCVENTURES

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 14 , 2013

Name

Symbol

METRO PAC INV

MARC

MPI

MINERALES IND

MIC

MJC INVESTMENTS

MJIC

PA

PRIM

POPI

SEAFRONT RES.

REG

SPM

SINOPHIL

SINO

SM INVESTMENTS

SM

SOLID GROUP

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

1.97

5.21

1.98

5.23

1.97

5.31

1.97

5.31

1.96

5.2

1.97

5.21

259,000

25,759,800

509,400

134,690,071

(30,575,121)

6.6

6.65

6.75

6.85

6.55

6.65

258,000

1,724,755

6.02

0.048

0.68

6.19

0.049

0.69

6.02

0.05

0.69

6.02

0.05

0.69

6.02

0.049

0.68

6.02

0.049

0.68

900

6,000,000

1,544,000

5,418

294,100

1,052,420

49,000

-

2.5

2.22

2.72

2.28

2.34

2.34

2.22

2.22

79,000

176,060

0.325

0.34

0.325

0.34

0.325

0.34

590,000

192,800

995

997

1,000

1,003

994

997

251,040

250,419,817.5

(103,973,602.5)

WELLEX INDUS

SGI

SOC

SGP

UNI

WIN

2.3

1.16

366

0.27

0.285

2.32

1.19

489

0.285

0.295

2.32

0.27

0.29

2.34

0.27

0.3

2.3

0.27

0.285

2.32

0.27

0.285

297,000

20,000

950,000

684,480

5,400

275,300

ZEUS HOLDINGS

ZHI

0.56

0.57

0.58

0.58

0.57

0.57

1,364,000

780,680

PACIFICA

PRIME MEDIA

PRIME ORION

REPUBLIC GLASS

SOUTH CHINA

SYNERGY GRID

UNIOIL HLDG.

HOLDING FIRMS SECTOR TOTAL

VOLUME :

1,649,606,300

VALUE :

2,228,699,949.5

PROPERTY

**** PROPERTY ****

A. BROWN

BRN

2.82

2.85

2.9

2.9

2.83

2.83

253,000

721,080

ALCO

ANCHOR LAND

ALCO

ALHI

0.21

19.5

0.219

20.9

0.21

19.5

0.21

21

0.209

19.5

0.21

20

740,000

15,100

154,960

295,760

26,500

ARANETA PROP

ARA

1.42

1.43

1.36

1.44

1.35

1.42

4,865,000

6,821,650

830,180

AYALA LAND

ALI

30.85

30.9

30.85

31

30.45

30.9

3,187,700

98,165,585

1,114,505

BELLE CORP.

BEL

5.17

5.2

5.24

5.26

5.14

5.2

6,343,600

32,846,694

16,864,379

CEBU HLDG.

CHI

4.91

5.08

4.86

4.91

394,000

1,972,260

(100,000)

CEBU PROP A

CENTURY PROP

CPV

CPVB

CPG

5

4.81

2.05

5.1

5.1

2.06

2.07

2.1

2.03

2.06

6,495,000

13,368,890

4,734,010

CITY & LAND

LAND

2.36

2.55

2.49

2.6

2.49

2.5

35,000

87,650

CITYLAND DEVT.

CDC

1.13

1.15

1.14

1.15

1.13

1.13

1,045,000

1,181,390

(973,250)

CROWN EQUITIES

CEI

0.067

0.069

0.067

0.067

0.067

0.067

820,000

54,940

CYBER BAY

EMPIRE EAST

CYBR

ELI

0.79

1.02

0.8

1.03

0.79

1.04

0.8

1.06

0.79

1.02

0.79

1.02

837,000

11,412,000

663,230

11,874,880

491,030

EVER-GOTESCO

EVER

0.37

0.38

0.385

0.385

0.36

0.38

11,100,000

4,057,050

FILINVEST LAND

FLI

1.86

1.87

1.88

1.91

1.87

1.87

26,347,000

49,804,560

(11,991,650)

GLOBAL-ESTATE

GERI

GO

GOB

HP

IRC

KEP

MC

MCB

MEG

2.07

1.8

1.19

2.9

3.55

2.1

2.18

1.2

3

3.56

2.1

3

3.51

2.1

3

3.65

2.05

3

3.51

2.1

3

3.55

10,075,000

26,000

86,663,000

20,931,790

78,000

309,441,540

671,250

39,499,470

MRC

PHES

0.123

0.6

0.125

0.61

0.127

0.62

0.127

0.63

0.123

0.61

0.125

0.62

3,490,000

4,695,000

432,610

2,864,740

TFC

RLT

18.5

0.465

25

0.495

0.465

0.465

0.465

0.465

10,000

4,650

CEBU PROP B

GOTESCO LAND A

GOTESCO LAND B

HIGHLANDS PRIME

IRCPROPERTIES

KEPPEL PROP

MARSTEEL A

MARSTEEL B

MEGAWORLD

MRC ALLIED

PHIL ESTATES

PHIL. TOBACCO

PHILREALTY

PRIMETOWN PROP

PRIMEX CORP.

PMT

PRMX

2.71

3.1

2.71

2.71

2.7

2.7

10,000

27,050

ROBINSONS LAND

RLC

21.8

21.85

22.1

22.2

21.8

21.85

3,688,000

80,760,490

(14,885,915)

ROCKWELL

ROCK

3.1

3.12

3.1

3.15

3.09

3.11

783,000

2,440,800

(18,840)

SAN MIGUEL PROP

SHNG PROPERTIES

SMP

SHNG

3.13

3.16

3.13

3.16

3.13

3.16

93,000

293,340

SM DEVT

SMDC

7.37

7.4

7.04

7.42

7.04

7.37

16,290,200

117,809,136

15,006,395

SM PRIME HLDG.

SMPH

18.32

18.34

18.48

18.48

18.28

18.32

5,050,900

92,628,256

(14,795,892)

STA.LUCIA LAND

SLI

0.78

0.79

0.77

0.79

0.77

0.79

394,000

309,080

STARMALLS

STR

3.61

3.89

3.8

3.9

3.8

3.9

10,000

38,400

SUNTRUST HOME

SUN

UW

VLL

0.59

5.3

0.6

5.34

0.6

5.32

0.62

5.4

0.59

5.3

0.59

5.34

577,000

7,797,500

341,460

41,533,827

10,233,043

UNIWIDE HLDG

VISTA LAND

PROPERTY SECTOR TOTAL

VOLUME :

215,594,000

VALUE :

897,070,938

SERVICES

**** MEDIA ****

ABS-CBN

ABS

39.4

39.5

39.5

40.4

39.2

39.2

211,600

8,420,250

GMA NETWORK

MANILA BULLETIN

GMA7

MB

9.95

0.95

9.98

0.96

9.99

0.88

9.99

0.97

9.96

0.88

9.98

0.95

447,300

1,884,000

4,461,276

1,740,030

MLA BRDCASTING

MBC

3.5

4.95

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 14 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

**** TELCOMMUNICATION ****

GLOBE TELECOM

GLO

1,168

1,170

1,175

1,180

1,170

1,170

87,915

103,145,985

LIBERTY TELECOM

LIB

2.65

2.75

2.65

2.67

2.65

2.65

41,000

108,860

PLDT

TEL

2,858

2,860

2,878

2,878

2,856

2,860

76,760

220,070,390

14,528,570

PTT CORP

PTT

(3,169,065)

**** INFORMATION TECHNOLOGY ****

DIVERSIFIED

DFNN

4.94

4.99

4.8

5.04

4.8

4.99

113,000

556,010

IMPERIAL A

IMP

5.15

5.99

5.2

5.2

5.15

5.15

2,300

11,870

IMPERIAL B

IMPB

CLOUD

3.92

44.8

4.06

3.91

4.06

3.91

4.06

9,000

35,940

0.66

0.051

2.18

14.16

0.67

0.054

2.25

14.24

0.67

2.19

14.22

0.68

2.19

14.24

0.67

2.18

14.16

0.67

2.19

14.24

180,000

51,000

841,300

120,720

111,680

11,969,690

(13,400)

(43,800)

1,900,072

IP CONVERGE

IPVG CORP.

PHILWEB

IP

IS

ISM

NXT

WEB

TOUCH SOLUTIONS

TSI

13.8

13.82

13.7

14.98

13.62

13.8

724,200

10,387,246

(1,620)

TRANSPACIFIC BR

TBGI

2.15

2.2

YEHEY

YEHEY

1.38

1.39

1.37

1.49

1.37

1.38

49,000

67,390

17,000

288,900

31,240

4,543,030

2,006,118

ISLAND INFO

ISM COMM.

NEXTSTAGE

**** TRANSPORTATION SERVICES ****

2GO GROUP

ASIAN TERMINALS

2GO

ATI

1.8

15.62

1.85

15.8

1.89

15.62

1.89

15.8

1.8

15.5

1.8

15.8

CEBU AIR, INC.

CEB

66.55

66.8

67.45

67.45

66.5

66.55

143,230

9,590,201.5

527,254.5

INTL CONTAINER

ICT

79.2

80.3

80

80.3

79

80.3

1,261,690

100,533,522

(11,414,810.5)

LORENZOSHIPPING

LSC

MAC

PAL

1.41

2.6

-

1.6

2.78

-

1.55

-

1.6

-

1.55

-

1.6

-

10,000

-

15,700

-

(1,550)

-

MACROASIA

PAL HOLDINGS

**** HOTEL & LEISURE ****

ACESITE HOTEL

ACE

1.33

1.38

1.4

1.4

1.33

1.33

17,000

22,770

BOULEVARD HLDG.

BHI

0.131

0.132

0.129

0.132

0.129

0.131

17,170,000

2,242,640

GRAND PLAZA

GPH

WPI

26.05

0.43

45

0.435

0.465

0.465

0.435

0.435

430,000

191,000

(108,250)

FAR EASTERN U

CEU

FEU

11.5

1,100

11.94

1,170

1,090

1,170

1,090

1,170

18,040

19,665,850

IPEOPLE

IPO

10

10.5

9.55

10

9.55

10

14,000

135,635

WATERFRONT

**** EDUCATION ****

CENTRO ESCOLAR

**** CASINOS & GAMING ****

BERJAYA

BCOR

BLOOMBERRY

LEISURE

BLOOM

EG

LR

MANILA JOCKEY

MJC

PACIFIC ONLINE

PHIL. RACING

LOTO

PRC

PREMIEREHORIZON

PHA

IP E-GAME

25.1

25.9

25.9

25.9

25

25.9

358,000

8,979,640

14

0.024

8.88

14.02

0.025

8.92

14.02

0.025

9.03

14.1

0.026

9.03

14

0.024

8.84

14.02

0.025

8.92

4,127,200

197,000,000

386,900

57,874,306

4,889,900

3,438,006

3,604,314

(12,500)

154,772

2.7

2.74

2.75

2.75

2.7

2.7

159,000

434,700

13.98

10.42

14

10.5

14

10.56

14

10.56

14

10.42

14

10.42

41,600

17,600

582,400

184,292

4,168

0.34

0.345

0.34

0.34

0.335

0.335

580,000

197,050

620,500

**** RETAIL ****

7-11

SEVN

93

100

99

100

99

100

21,770

2,160,460

CALATA CORP.

CAL

3.77

3.81

3.8

3.85

3.76

3.77

570,000

2,155,180

PUREGOLD

PGOLD

37.1

37.15

36.4

37.65

36

37.1

7,501,300

276,684,330

31,541,395

ICTVI

APC

ECP

PORT

ICTV

0.84

2.9

0.42

0.85

3

20

0.44

0.84

0.42

0.85

0.42

0.84

0.42

0.84

0.42

1,648,000

100,000

1,384,370

42,000

42,000

PAXYS

PAX

2.7

2.72

2.72

2.73

2.7

2.71

407,000

1,102,130

PHILCOMSAT

PHC

STI

1.03

1.04

1.05

1.05

1.03

1.03

7,924,000

8,169,330

**** OTHER SERVICES ****

APC GROUP

EASYCALL

GLOBALPORTS

STI_HOLDINGS

SERVICES SECTOR TOTAL

VOLUME :

249,401,205

VALUE :

959,071,936.5

MINING & OIL

**** MINING ****

ABRA MINING

AR

0.0052

0.0053

0.0052

0.0052

0.0052

0.0052

101,000,000

525,200

APEX MINING A

APEX MINING B

APX

APXB

4.48

4.46

4.6

4.71

4.49

4.49

4.46

4.46

197,000

878,810

ATLAS MINING

AT

22.6

22.7

22.7

22.8

22.4

22.65

455,000

10,270,605

865,400

ATOK

AB

BC

21.8

18.8

23

19

BENGUET A

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 14 , 2013

Name

Symbol

BENGUET B

Bid

Ask

18.9

1.01

1.12

High

Low

Close

18.4

1.01

1.05

18.5

1.01

1.13

18.4

1.01

1.03

18.5

1.01

1.11

Volume

Value

COAL ASIA

BCB

CPM

COAL

DIZON MINES

DIZ

14.26

14.3

15

15.2

14.26

14.26

827,400

12,183,958

(457,042)

GEOGRACE

GEO

0.55

0.56

0.57

0.57

0.55

0.55

1,254,000

690,430

LEPANTO A

LC

1.18

1.19

1.2

1.21

1.18

1.19

21,775,000

26,040,790

LEPANTO B

MANILA MINING A

LCB

MA

1.27

0.064

1.29

0.065

1.29

0.065

1.31

0.065

1.27

0.064

1.29

0.065

8,342,000

68,090,000

10,785,150

4,411,430

1,904,040

-

MANILA MINING B

MAB

0.068

0.07

0.069

0.07

0.068

0.07

39,930,000

2,762,690

NICKELASIA

NIKL

21.15

21.2

22

22.15

21

21.15

2,632,000

55,874,205

(3,478,500)

NIHAO

NI

3.93

3.94

3.9

3.97

3.86

3.94

3,335,000

13,050,970

43,340

OMICO CORP.

ORIENTAL P

OM

ORE

0.56

3.69

0.59

3.7

0.56

3.78

0.56

3.78

0.56

3.67

0.56

3.7

210,000

812,000

117,600

3,002,920

(22,380)

PHILEX

PX

18.58

18.6

18.8

19.06

18.4

18.6

4,888,400

91,261,176

(469,750)

SEMIRARA MINING

SCC

237.2

237.6

255

255

220

237.2

2,561,310

606,333,572

(62,776,046)

UNITED PARAGON

UPM

0.018

0.019

0.019

0.019

0.018

0.019

28,200,000

519,800

BASIC PETROLEUM

BSC

0.285

0.29

0.3

0.305

0.285

0.29

14,880,000

4,351,800

8,850

ORIENTAL A

PETROENERGY

OPM

OPMB

PERC

0.022

0.023

6.78

0.023

0.024

6.9

0.023

0.023

6.98

0.023

0.024

6.98

0.022

0.023

6.95

0.023

0.024

6.95

72,300,000

3,700,000

200

1,616,600

85,200

1,393

PHILEXPETROLEUM

PXP

32.3

32.35

33.8

33.8

32.35

32.35

382,300

12,544,540

(2,326,360)

PHILODRILL A

OV

0.045

0.046

0.045

0.046

0.045

0.045

73,500,000

3,315,700

77,700

PNOC A

PEC

PECB

CENTURY PEAK

18.5

0.99

1.11

Open

Net Foreign

Trade (Peso)

Buying (Selling)

1,600

100,000

47,951,000

29,500

101,000

52,476,890

(22,100)

(554,190)

**** OIL ****

ORIENTAL B

PNOC B

MINING AND OIL SECTOR TOTAL

VOLUME :

497,324,210

VALUE :

913,231,929

PREFERRED

ABC PREF

12.5

524

529

529

529

524

524

2,580

1,353,360

(1,048,220)

FIRST PHIL HOLD

DMCP

FGENF

FGENG

FPHP

102

107

100.8

107.5

109

101.3

100.8

100.8

100.8

100.8

500

50,400

PETRON PREF

PPREF

110.7

111

110.7

110.7

66,070

7,319,791

SMC PREF 1

SMCPREFS2C

SMCP1

SMC2A

SMC2B

SMC2C

74.95

75.2

76.55

75

75.25

76.7

75

75.25

76.5

75

75.25

76.6

74.95

75.2

76.5

75

75.25

76.55

2,059,080

596,700

15,650

154,430,900

44,901,575

1,197,492.5

(105,358,500)

-

SMPFC PREFS

PFP

1,039

1,040

1,039

1,040

1,150

1,195,950

SWIFT PREF

ABS-CBN PDR

SFIP

BCP

ABSP

1.3

11.92

41.3

1.47

41.5

41.6

44

41.5

41.5

1,481,700

62,615,225

6,132,015

GMA HOLDINGS

GMAP

10

10.06

10.04

10.12

10

10

2,988,900

29,999,692

(1,227,252)

GLO PREF A

GLOPA

TLHH

2,052,000

5,065,190

(145,800)

PBC PREF

AC PREF B

AYALA PREF. A

DMC PREF

FGEN PREF F

FIRST GEN G

SMCPREFS2A

SMCPREFS2B

BC PREF A

TEL PREF HH

ABC

PBCP

ACPR

ACPA

PREFERRED TOTAL

VOLUME :

7,212,330

VALUE :

303,064,385.5

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC.

IRCPROPERTIES W

MEG-WARRANTS

IRW

MEGW2

MEGW1

PLDT-USD

DTEL

MEG WARRANT 2

0.05

2.39

2.45

2.46

2.47

2.45

2.49

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC. TOTAL

2.43

2.47

VOLUME :

2,052,000

VALUE :

5,065,190

SMALL AND MEDIUM ENTERPRISES

IRIPPLE

RPL

9.2

9.4

9.7

9.7

9.3

9.3

600

5,620

(4,650)

MAKATI FINANCE

MFIN

2.5

2.75

2.5

2.5

2.5

2.5

1,000

2,500

SMALL AND MEDIUM ENTERPRISES TOTAL

TOTAL REGULAR

VOLUME :

VOLUME :

1,600

2,791,200,720

VALUE :

VALUE :

8,120

7,753,672,415.5

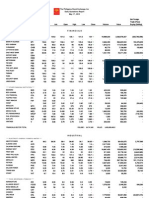

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 14 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

NO. OF ADVANCES:

72

NO. OF DECLINES:

84

NO. OF UNCHANGED:

56

NO. OF TRADED ISSUES: 212

NO. OF TRADES:

30333

BLOCK SALES

SECURITY

BPI

SECB

ICT

AC

ALI

BCOR

PRICE

104.7113

174

79.3317

563.9669

30.5513

25

ODDLOT VOLUME:

ODDLOT VALUE:

:

:

VOLUME

208,310

198,000

472,550

43,750

1,000,000

1,000,000

VALUE

21,812,410.903

34,452,000

37,488,194.835

24,673,551.875

30,551,300

25,000,000

298,619

167,744.27

MAIN BOARD CROSS VOLUME: :

MAIN BOARD CROSS VALUE:

:

736,644,432

2,014,648,823.46

NON-SECTORAL VOLUME:

0

NON-SECTORAL VALUE:

0

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining and Oil

PSEi

All Shares

SME

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,720.54

9,807.66

5,721.72

2,649.68

1,923.61

22,724.95

6,528.42

4,094.63

1,728.19

9,886.71

5,730.92

2,659.01

1,923.94

22,784.46

6,542.51

4,103.86

1,712.19

9,807.66

5,687.13

2,633.26

1,914.07

22,134.27

6,497.54

4,080.5

1,715.48

9,883.77

5,695.71

2,650.79

1,917.96

22,234.42

6,513.41

4,091.38

-0.17

0.81

-0.61

0.04

-0.29

-1.64

-0.22

-0.07

-2.88

79.07

-34.95

1.11

-5.65

-370.03

-14.58

-2.8

10,642,734

169,043,023

1,649,657,621

216,636,656

251,000,126

497,440,189

857,492,276.65

1,954,425,887.13

2,253,383,488.12

927,674,933.1

1,021,581,165.93

913,251,746.45

1,600

8,120

GRAND TOTAL

FOREIGN BUYING

FOREIGN SELLING

2,794,421,949 Php 7,927,817,617.383

Php 3,532,072,601.48

Php 3,379,183,799.84

Companies Under Suspension by the Exchange as of 02/14/2013

ACPR

ALPHA

ASIA

CBC

CMT

EIBA

EIBB

FC

FYN

FYNB

GO

GOB

MAH

MAHB

MC

MCB

NXT

PAL

PEC

PECB

PHC

PNC

PRIM

SMB

SMP

MED

PCP

PMT

PPC

PTT

- AC PREF B

- ALPHALAND

- ASIATRUST

- COSMOS

- SEACEM

- EXPORT BANK

- EXPORT BANK B

- FIL ESTATE CORP

- FILSYN A

- FILSYN B

- GOTESCO LAND A

- GOTESCO LAND B

- METROALLIANCE A

- METROALLIANCE B

- MARSTEEL A

- MARSTEEL B

- NEXTSTAGE

- PAL HOLDINGS

- PNOC A

- PNOC B

- PHILCOMSAT

- PNCC

- PRIME MEDIA

- SAN MIGUEL

- SAN MIGUEL PROP

- MEDCO HLDG

- PICOP RES

- PRIMETOWN PROP

- PRYCE CORP

- PTT CORP

The Philippine Stock Exchange, Inc

Daily Quotations Report

February 14 , 2013

Name

Symbol

Bid

STN

- STENIEL

UW

- UNIWIDE HLDG

ABC

- ABC PREF

TLHH

- TEL PREF HH

SMCP1

- SMC PREF 1

* Sectoral totals includes main transactions

** Total Regular includes main transactions

*** Grand total includes main,oddlot and block sale transactions

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

Das könnte Ihnen auch gefallen

- Sample Service Cleaning Business PlanDokument13 SeitenSample Service Cleaning Business Plandxc12670100% (3)

- Chapter 10Dokument32 SeitenChapter 10Josua Mondol80% (5)

- FTI Consulting ReportDokument98 SeitenFTI Consulting ReportJohn E. Mudd100% (1)

- NPCIDokument15 SeitenNPCIMmNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 31, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 12, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 28, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 28, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 29, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 29, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Ryan Samuel C. CervasNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 22, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 22, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 25, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 28, 2013srichardequipNoch keine Bewertungen

- Stockquotes 08232013Dokument7 SeitenStockquotes 08232013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013srichardequipNoch keine Bewertungen

- Stockquotes 08162013Dokument7 SeitenStockquotes 08162013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 06, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013srichardequipNoch keine Bewertungen

- Stockquotes 08012013Dokument7 SeitenStockquotes 08012013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 31, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 31, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 04, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 29, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 29, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 22, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report December 11, 2012Dokument6 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report December 11, 2012srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNoch keine Bewertungen

- Stockquotes 02062015Dokument8 SeitenStockquotes 02062015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNoch keine Bewertungen

- Stockquotes 02112015 PDFDokument8 SeitenStockquotes 02112015 PDFsrichardequipNoch keine Bewertungen

- Stockquotes 02042015 PDFDokument8 SeitenStockquotes 02042015 PDFsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNoch keine Bewertungen

- ECCODokument3 SeitenECCOsrichardequipNoch keine Bewertungen

- wk02 Jan2013mktwatchDokument3 Seitenwk02 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- Stockquotes 02112015 PDFDokument8 SeitenStockquotes 02112015 PDFsrichardequipNoch keine Bewertungen

- wk03 Jan2013mktwatchDokument3 Seitenwk03 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- October 2015: Sun Mon Tue Wed Thu Fri SatDokument1 SeiteOctober 2015: Sun Mon Tue Wed Thu Fri SatjNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNoch keine Bewertungen

- wk01 Jan2013mktwatchDokument3 Seitenwk01 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 15, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2013srichardequipNoch keine Bewertungen

- Stockquotes 04022013Dokument7 SeitenStockquotes 04022013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 04, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipNoch keine Bewertungen

- Table 1 Marriage 2011Dokument1 SeiteTable 1 Marriage 2011srichardequipNoch keine Bewertungen

- Card Holder Dispute FormDokument1 SeiteCard Holder Dispute Formcool3420Noch keine Bewertungen

- Explanation TextDokument13 SeitenExplanation TextsahyudiNoch keine Bewertungen

- 0452 m15 Ms 12Dokument9 Seiten0452 m15 Ms 12IslamAltawanayNoch keine Bewertungen

- Member List Derivatives NYSE LiffeDokument15 SeitenMember List Derivatives NYSE LiffeNathan FergusonNoch keine Bewertungen

- Account Statement From 1 Jul 2021 To 31 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument6 SeitenAccount Statement From 1 Jul 2021 To 31 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAJNoch keine Bewertungen

- Specialized Marine DiplomaDokument3 SeitenSpecialized Marine DiplomaAnkur PatilNoch keine Bewertungen

- World-Class Banking For Indians Who Are Conquering The WorldDokument6 SeitenWorld-Class Banking For Indians Who Are Conquering The WorldRanvir RajNoch keine Bewertungen

- JMGS1 - Recollected Questions of Exam Held in Feb-2016Dokument4 SeitenJMGS1 - Recollected Questions of Exam Held in Feb-2016Anonymous Ey8uMU5nNoch keine Bewertungen

- Steps For EfpsDokument3 SeitenSteps For EfpsMarites Domingo - PaquibulanNoch keine Bewertungen

- Mortgage Loans in JapanDokument16 SeitenMortgage Loans in JapanBayarmagnay BaasansurenNoch keine Bewertungen

- Subcontract For ScaffoldingDokument23 SeitenSubcontract For ScaffoldingSarin100% (1)

- 5 3 NotesDokument7 Seiten5 3 Notesapi-301176378Noch keine Bewertungen

- RbiDokument3 SeitenRbiRaviteja ChodisettyNoch keine Bewertungen

- Cash and CequizDokument5 SeitenCash and CequizMaria Emarla Grace CanozaNoch keine Bewertungen

- Report On Recruitment of Life Advisors Bharti AXADokument84 SeitenReport On Recruitment of Life Advisors Bharti AXAmegha140190Noch keine Bewertungen

- Double Entry SystemDokument17 SeitenDouble Entry SystemDastaan Ali100% (1)

- Welcome To Park Controls UpdatedDokument6 SeitenWelcome To Park Controls UpdatedRitu DasNoch keine Bewertungen

- Premium Paid Acknowledgement PDFDokument1 SeitePremium Paid Acknowledgement PDFPragna NachikethaNoch keine Bewertungen

- Cma NivasDokument4 SeitenCma NivaskasyapNoch keine Bewertungen

- 1 Kyc PDFDokument70 Seiten1 Kyc PDFMallikaNoch keine Bewertungen

- Claims Against Fund Managers On The RiseDokument2 SeitenClaims Against Fund Managers On The RiseTheng RogerNoch keine Bewertungen

- Kel 6 - Creve Couer Pizza IncDokument3 SeitenKel 6 - Creve Couer Pizza IncTiara PradaniNoch keine Bewertungen

- UNICREDIT AG List of Correspondents For Commercial PaymentsDokument5 SeitenUNICREDIT AG List of Correspondents For Commercial PaymentsAnonymous XgX8kTNoch keine Bewertungen

- Tata MotorsDokument3 SeitenTata MotorsSiddharth YadiyapurNoch keine Bewertungen

- Indus Motor Company Limited List of Shareholders As of 30-06-2021Dokument440 SeitenIndus Motor Company Limited List of Shareholders As of 30-06-2021Hamza AsifNoch keine Bewertungen

- Renewal Notice: Policy No.P/141126/01/2019/003982Dokument1 SeiteRenewal Notice: Policy No.P/141126/01/2019/003982manoharNoch keine Bewertungen