Beruflich Dokumente

Kultur Dokumente

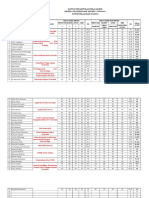

The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013

Hochgeladen von

srichardequipOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013

Hochgeladen von

srichardequipCopyright:

Verfügbare Formate

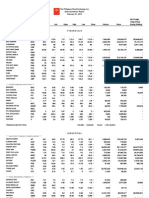

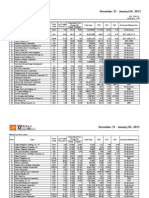

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 18 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

FINANCIALS

**** BANKS ****

ASIATRUST

BANK PH ISLANDS

ASIA

BPI

105.6

106

104.5

106.5

104

106

776,930

82,228,414

10,337,129

BDO UNIBANK

BDO

85.45

85.5

89.8

91

84.8

85.5

8,273,040

719,731,305

(316,149,972.5)

CHINABANK

CHIB

62

62.5

65

65

62.5

62.5

227,220

14,551,229

620,571

CITYSTATE BANK

CSB

EW

33

18

33.25

34.7

34.75

32.6

33

2,487,500

83,575,675

14,184,265

METROBANK

EIBA

EIBB

MBT

116.8

116.9

117.5

120.9

116.4

116.9

5,842,350

686,955,485

869,692

PB BANK

PBB

34.55

34.6

35.75

36.35

34.5

34.6

1,740,500

61,019,470

(672,565)

PBCOM

PBC

PNB

97.6

98.1

99

99.5

97.5

98.1

474,150

46,514,659.5

(8,920,223.5)

70

122

65.6

125

66

125.8

69

126

69

125.8

65.1

126

66

110

13,840

RCBC

PTC

PSB

RCB

444,200

29,561,741

6,661,763.5

SECURITY BANK

SECB

181.5

181.6

185.8

185.8

180

181.5

362,400

65,840,068

18,420,541

UNION BANK

UBP

121

121.1

123.5

123.5

119.5

121

142,490

17,205,109

5,181,586

EAST WEST BANK

EXPORT BANK

EXPORT BANK B

PHIL NATL BANK

PHILTRUST

PSBANK

**** OTHER FINANCIAL INSTITUTION ****

BANKARD

BKD

1.02

1.05

1.17

1.19

1.01

1.02

3,847,000

4,119,260

(102,480)

BDO LEASING

COL FINANCIAL

BLFI

COL

1.96

19.6

2.03

19.86

19.9

19.9

19.5

19.86

297,200

5,864,288

159,200

FILIPINO FUND

FFI

12.9

13.36

13.02

13.02

13

13

12,000

156,200

FIRST ABACUS

FAF

I

MFC

MAKE

0.81

2.73

545

27.8

0.88

2.88

555

27.85

2.8

550

27.85

2.9

550

27.85

2.8

545

27.85

2.9

545

27.85

61,000

920

9,900

174,240

505,950

275,715

MED

NRCP

1.95

1.97

1.95

1.95

1.95

1.95

NTL REINSURANCE

100,000

195,000

PHIL STOCK EXCH

PSE

465.8

466

474

474

466

466

54,840

25,664,592

(298,506)

SUN LIFE

SLF

1,051

1,098

1,050

1,050

1,050

1,050

415

435,750

VANTAGE

2.56

2.62

IREMIT

MANULIFE

MAYBANK ATR KE

MEDCO HLDG

FINANCIALS SECTOR TOTAL

VOLUME :

25,154,165

VALUE :

1,844,587,990.5

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ABOITIZ POWER

AP

36.7

36.75

36.85

37

36.5

36.75

2,843,800

104,471,980

(49,907,255)

ALSONS CONS

CALAPAN VENTURE

ACR

H2O

1.32

4.35

1.33

4.48

1.38

4.2

1.38

4.36

1.32

4.2

1.33

4.35

306,000

60,000

407,930

258,180

ENERGY DEVT

EDC

6.27

6.28

6.65

6.65

6.28

6.28

42,631,300

272,481,633

(6,789,940)

FIRST GEN

FGEN

23.15

23.2

23.8

23.9

23.1

23.2

2,329,600

54,633,185

10,736,360

FIRST PHIL HLDG

FPH

107.9

108

108.5

109.5

107.5

107.9

208,490

22,521,581

4,465,071

MANILA WATER

MWC

37.05

37.1

37

37.15

36.9

37.1

2,028,700

75,223,955

(16,550,540)

MERALCO

MER

314.8

315

325

328

312

314.8

416,580

133,321,722

(11,724,180)

PETRON

PCOR

13.86

13.9

14.3

14.3

13.84

13.9

17,029,400

237,877,792

(73,215,304)

PHOENIX

PNX

9.4

9.45

9.55

9.6

9.3

9.4

2,741,300

25,795,090

(12,990,601)

SALCON POWER

SPC

4.72

4.95

4.72

4.72

4.72

4.72

22,000

103,840

TRANS ASIA

TA

2.25

2.27

2.42

2.42

2.24

2.25

30,918,000

70,534,030

1,663,800

VIVANT

VVT

9.01

9.7

9.01

9.01

9.01

9.01

300

2,703

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

ANI

7.14

7.14

6.99

7.14

95,100

667,101

ALLIANCE SELECT

FOOD

1.96

1.98

2.1

2.1

1.95

1.96

6,509,000

13,125,880

292,800

BOGO MEDELLIN

BMM

CAT

50.6

13.52

55

15.9

55

13.54

55

13.54

53

13.52

53

13.52

2,500

500

134,525

6,764

CBC

DNL

6.58

6.6

6.96

6.96

6.4

6.6

13,439,600

89,022,472

(23,367,571)

LT GROUP

GSMI

JFC

LFM

LTG

16

121.9

49

14.9

16.5

122

50

14.92

16.7

122

15

16.7

123.5

15.04

16.5

122

14.84

16.5

122

14.9

3,500

403,420

2,486,300

57,950

49,434,775

37,230,014

3,027,256

5,244,312

PANCAKE

PCKH

7.85

8.29

8.3

8.3

8.3

8.3

100

830

PEPSI COLA

PIP

6.18

6.19

6.23

6.3

6.19

6.19

5,107,400

31,867,940

3,228,408

PUREFOODS

PF

270

275

294.8

295

270

275

108,080

30,328,064

(2,980,544)

RFM CORP

RFM

4.56

4.67

4.72

4.72

4.52

4.52

220,000

1,018,550

(120,340)

ROXAS AND CO

RCI

ROX

2.26

3

2.44

3.24

3.25

3.25

108,000

336,950

SAN MIGUEL CORP

SMB

SMC

118.9

119.6

119

119.6

118

119.6

1,025,200

121,893,680

42,573,913

SWIFT FOODS

SFI

0.134

0.135

0.135

0.135

0.135

0.135

270,000

36,450

CNTRL AZUCARERA

COSMOS

DNL INDUS

GINEBRA

JOLLIBEE

LIBERTY FLOUR

ROXAS HLDG

SAN MIGUEL BREW

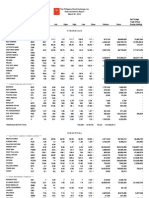

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 18 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

UNIV ROBINA

URC

102.5

102.7

103.8

103.8

102.5

102.7

4,384,360

451,568,007

183,177,860

VICTORIAS

VMC

VITA

1.45

0.89

1.47

0.9

1.5

0.94

1.5

0.97

1.45

0.9

1.47

0.9

536,000

3,223,000

783,120

2,963,910

(48,500)

VITARICH

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

20.8

21

22.35

22.35

20.85

20.9

30,700

654,170

4,300

CONCRETE A

CA

CAB

EEI

50

15

12.6

65

12.62

12.84

12.84

12.5

12.6

1,108,300

13,927,506

1,580,430

3,800

48,792

CONCRETE B

EEI CORP

FED CHEMICALS

HOLCIM

FED

HLCM

8

12.84

9.5

12.98

12.84

12.84

12.84

12.84

LAFARGE REP

LRI

10.48

10.68

10.68

10.68

10.42

10.68

291,800

3,072,314

(177,054)

MARIWASA

MMI

6.03

6.15

6.99

6.03

3,032,700

19,929,970

57,312

MEGAWIDE

MWIDE

17.6

17.7

17.7

17.7

17.6

17.6

2,507,300

44,378,510

(0)

PHINMA

TKC STEEL

PHN

PNC

CMT

SRDC

T

0.41

1.63

1.65

13.42

1.64

13.42

1.66

13.42

1.63

13.42

1.66

20,500

98,000

275,110

160,270

(13,420)

-

VULCAN INDL

VUL

1.54

1.55

1.56

1.57

1.53

1.54

1,410,000

2,179,990

CIP

COAT

73

2.78

95

2.9

2.9

2.9

2.9

2.9

508,000

1,473,200

LMG CHEMICALS

EURO

LMG

1.73

2.18

1.9

2.28

1.75

2.3

1.75

2.37

1.75

2.22

1.75

2.28

20,000

282,000

35,000

637,910

4,650

MABUHAY VINYL

MVC

1.8

1.97

1.69

1.8

1.67

1.8

37,000

64,120

MANCHESTER A

MIH

14.84

15

14.2

14.28

80,100

1,155,626

MANCHESTER B

MIHB

MAH

MAHB

PPC

PNCC

SEACEM

SUPERCITY

**** CHEMICALS ****

CHEMPHIL

CHEMREZ

EUROMED

METROALLIANCE A

METROALLIANCE B

PRYCE CORP

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CIRTEK HLDG

CHIPS

22.95

23

24.2

24.2

22.95

23

91,900

2,118,215

GREENERGY

INTEGRATED MICR

GREEN

IMI

0.018

3.99

0.019

4

0.019

3.99

0.019

4

0.019

3.98

0.019

3.99

77,400,000

54,000

1,470,600

215,360

IONICS

ION

0.64

0.65

0.68

0.68

0.64

0.64

1,329,000

863,980

(325,000)

PANASONIC

PMPC

ALPHALAND

ALPHA

18

21.8

22.15

22.15

19

21.8

21,400

420,660

(211,800)

FILSYN A

SPLASH CORP

FYN

FYNB

PCP

SPH

1.73

1.78

1.76

1.77

1.72

1.72

53,000

92,810

STENIEL

STN

**** OTHER INDUSTRIALS ****

FILSYN B

PICOP RES

INDUSTRIALS SECTOR TOTAL

VOLUME :

228,812,095

VALUE :

2,008,011,328.5

HOLDING FIRMS

**** HOLDING FIRMS ****

ABACUS CONS

ABA

0.65

0.66

0.68

0.68

0.66

0.66

4,772,000

3,166,620

ABOITIZ EQUITY

AEV

56.7

57

57.3

57.3

56.7

56.7

490,170

27,867,941

1,642,295

ALCORN GOLD

APM

0.159

0.16

0.165

0.166

0.159

0.159

529,290,000

85,593,500

(231,380)

ALLIANCE GLOBAL

AGI

21.65

21.75

22.2

22.2

21.4

21.75

14,371,400

312,810,430

(25,368,305)

ANGLO PHIL HLDG

APO

2.31

2.32

2.33

2.33

2.31

2.31

170,000

393,200

ANSCOR

ANS

6.9

6.93

6.91

6.96

6.9

6.9

235,900

1,628,025

(51,754)

ASIA AMLGMATED

AAA

4.47

4.51

4.47

4.51

4.46

4.51

19,000

85,510

ATN HLDG A

ATN

ATNB

AC

0.95

0.96

550

1

1

550.5

560

560

548

550

1,064,360

586,255,120

5,057,195

BH

DMC

432

51.35

645

51.5

52.85

52.85

51.35

51.5

3,147,720

162,473,559.5

(140,133,549)

FC

FDC

5.5

5.6

5.75

5.75

5.5

5.5

413,600

2,325,852

(57,020)

2.51

2.75

0.217

733

2.9

3.95

0.238

735

3

769

3

769

2.9

730

2.9

733

93,000

247,880

271,700

183,373,305

(31,860,035)

ATN HLDG B

AYALA CORP

BHI HLDG

DMCI HLDG

FIL ESTATE CORP

FILINVEST DEV

FJ PRINCE A

GT CAPITAL

FJP

FJPB

FPI

GTCAP

HOUSE OF INV

HI

JG SUMMIT

JGS

JOLLIVILLE HLDG

FJ PRINCE B

FORUM PACIFIC

7.91

7.84

8.1

7.84

2,863,900

22,908,216

12,351,170

40.05

40.15

41

41

39.95

40.05

5,236,500

210,563,195

(25,328,810)

LODESTAR

JOH

KPH

KPHB

LIHC

5.74

4.95

4.85

0.88

6.65

5.05

5.59

0.9

0.91

0.91

0.89

0.89

121,000

107,710

LOPEZ HLDG

LPZ

7.27

7.31

7.4

7.4

7.27

7.31

4,094,600

29,953,957

(11,979,494)

KEPPEL HLDG A

KEPPEL HLDG B

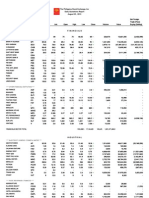

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 18 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

MABUHAY HLDG

MHC

0.55

0.59

0.59

0.59

0.55

0.59

648,000

365,900

MARCVENTURES

MARC

1.72

1.77

1.73

1.8

1.73

1.77

1,105,000

1,923,350

METRO PAC INV

MPI

5.29

5.3

5.45

5.45

5.26

5.29

26,964,900

143,110,623

65,220,347

MINERALES IND

MIC

6.45

6.69

6.7

6.74

6.5

6.69

39,000

258,810

MJC INVESTMENTS

PACIFICA

MJIC

PA

5.72

0.046

5.98

0.05

0.046

0.05

0.046

0.05

500,000

23,400

PRIME MEDIA

PRIM

1.83

1.84

1.81

1.9

1.81

1.83

512,000

945,530

PRIME ORION

POPI

REG

SPM

0.67

2.66

2.02

0.68

2.7

2.16

0.69

2.7

2.05

0.69

2.7

2.05

0.67

2.7

2.02

0.68

2.7

2.02

9,749,000

300,000

154,000

6,535,770

810,000

314,000

567,520

-

SM INVESTMENTS

SINO

SM

0.31

1,030

0.315

1,033

0.31

1,073

0.315

1,100

0.31

1,025

0.315

1,033

2,070,000

396,760

646,850

417,402,490

(324,450)

(92,274,285)

SOLID GROUP

SGI

2.06

2.08

2.11

2.11

2.05

2.06

1,265,000

2,623,820

(41,200)

SOUTH CHINA

SOC

1.11

1.19

1.13

1.13

1.12

1.12

180,000

201,800

SYNERGY GRID

SGP

370

450

370

370

370

370

140

51,800

UNIOIL HLDG

UNI

0.26

0.27

0.26

0.27

0.26

0.27

320,000

84,800

WELLEX INDUS

WIN

0.26

0.27

0.265

0.28

0.26

0.27

1,790,000

469,600

106,600

ZEUS HLDG

ZHI

0.465

0.47

0.49

0.49

0.46

0.465

1,600,000

743,400

REPUBLIC GLASS

SEAFRONT RES

SINOPHIL

HOLDING FIRMS SECTOR TOTAL

VOLUME :

614,225,090

VALUE :

2,206,425,213.5

PROPERTY

**** PROPERTY ****

A BROWN

BRN

2.81

2.83

2.85

2.93

2.83

2.83

50,000

141,860

ANCHOR LAND

ARANETA PROP

ALHI

ARA

17.6

1.54

20

1.67

20

1.78

20

1.82

20

1.53

20

1.6

1,100

3,462,000

22,000

5,772,440

20,000

-

ARTHALAND CORP

ALCO

0.208

0.21

0.214

0.214

0.207

0.207

350,000

73,070

AYALA LAND

ALI

29.55

29.6

30.45

30.6

29.4

29.55

19,647,400

582,333,465

(59,655,085)

BELLE CORP

BEL

5.41

5.5

5.9

5.9

5.39

5.41

9,663,000

54,035,665

1,458,701

CEBU HLDG

CHI

4.62

4.65

4.74

4.74

4.65

4.65

5,692,000

26,475,940

(94,000)

CEBU PROP A

CPV

CPVB

CPG

4.7

4.81

2

5.1

5.1

2.01

2.1

2.1

1.99

2.01

57,212,000

115,253,640

(1,727,200)

LAND

CDC

CEI

2.31

1.12

0.067

2.44

1.14

0.069

1.12

0.068

1.12

0.068

1.12

0.068

1.12

0.068

50,000

1,000,000

56,000

68,000

EMPIRE EAST

CYBR

ELI

0.75

1.02

0.76

1.03

0.76

1.09

0.76

1.09

0.76

1.03

0.76

1.03

4,099,000

36,193,000

3,115,240

38,113,110

(912,000)

(4,690,930)

EVER GOTESCO

EVER

FILINVEST LAND

FLI

GLOBAL ESTATE

GOTESCO LAND A

CEBU PROP B

CENTURY PROP

CITY AND LAND

CITYLAND DEVT

CROWN EQUITIES

CYBER BAY

GOTESCO LAND B

HIGHLANDS PRIME

IRC PROP

KEPPEL PROP

MARSTEEL A

MARSTEEL B

MEGAWORLD

MRC ALLIED

0.3

0.31

0.31

0.31

0.3

0.3

7,700,000

2,322,800

(310,000)

1.85

1.87

1.96

1.96

1.84

1.85

15,006,000

28,121,430

(4,228,250)

GERI

2.1

2.11

2.11

2.11

2.05

2.1

13,769,000

28,742,180

20,352,140

GO

GOB

HP

IRC

2.02

1.2

2.2

1.24

2.02

1.32

2.02

1.32

2.02

1.2

2.02

1.2

1,000

1,935,000

2,020

2,431,550

KEP

MC

MCB

MEG

3

3.58

3.5

3.62

3.77

3.78

3.55

3.58

89,747,000

327,426,680

(75,487,080)

0.114

0.57

0.53

18.1

2.9

0.117

0.58

0.54

25

3.1

0.116

0.56

0.52

3.2

0.118

0.58

0.53

3.2

0.115

0.56

0.52

3.2

0.115

0.58

0.53

3.2

2,980,000

905,000

1,670,000

13,000

344,540

511,300

880,060

41,600

PRIMEX CORP

MRC

PHES

RLT

TFC

PMT

PRMX

ROBINSONS LAND

RLC

24.5

24.85

25

25

24.2

24.5

2,522,300

61,489,820

7,505,465

ROCKWELL

ROCK

2.8

2.82

3.12

3.12

2.78

2.8

19,493,000

56,025,360

11,082,500

SAN MIGUEL PROP

SM DEVT

SMP

SHNG

SMDC

3.34

7.89

3.4

7.9

3.4

8.05

3.4

8.22

3.4

7.88

3.4

7.89

445,000

4,245,100

1,513,000

33,993,342

1,373,610

SM PRIME HLDG

SMPH

18.72

18.78

19

19.12

18.58

18.78

11,313,400

211,904,626

26,711,708

STA LUCIA LAND

SLI

0.88

0.91

1.08

1.08

0.85

0.88

21,298,000

19,761,610

(251,890)

STARMALLS

STR

SUN

3.88

0.59

4.04

0.6

4.06

0.6

4.06

0.6

4.06

0.58

4.06

0.59

2,000

422,000

8,120

248,420

UW

VLL

5.31

5.32

5.35

5.38

5.29

5.32

26,559,700

141,747,439

(15,821,795)

PHIL ESTATES

PHIL REALTY

PHIL TOBACCO

PRIMETOWN PROP

SHANG PROP

SUNTRUST HOME

UNIWIDE HLDG

VISTA LAND

PROPERTY SECTOR TOTAL

VOLUME :

358,070,000

VALUE :

1,744,600,737

SERVICES

**** MEDIA ****

ABS CBN

ABS

37.8

37.95

38.5

38.5

37.75

37.8

56,000

2,123,505

GMA NETWORK

GMA7

9.76

9.93

9.65

9.93

9.6

9.93

252,700

2,500,185

MANILA BULLETIN

MB

0.81

0.85

0.85

0.85

0.81

0.81

248,000

202,370

MLA BRDCASTING

MBC

3.6

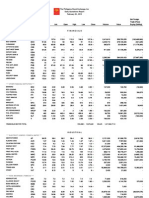

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 18 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

**** TELCOMMUNICATION ****

GLOBE TELECOM

GLO

1,180

1,189

1,188

1,189

1,180

1,189

38,365

45,537,450

18,542,000

LIBERTY TELECOM

PLDT

LIB

TEL

2.29

2,782

2.4

2,790

2,840

2,840

2,778

2,790

169,515

475,320,230

(67,921,060)

PTT CORP

PTT

**** INFORMATION TECHNOLOGY ****

DFNN INC

DFNN

4.27

4.3

4.3

4.55

4.3

4.3

80,000

345,270

IMPERIAL A

IP CONVERGE

IMP

IMPB

CLOUD

5.1

4.23

5.99

63

4.25

5.1

4.21

5.1

4.3

5.1

4.19

5.1

4.23

400

532,000

2,040

2,242,780

IPVG CORP

IP

0.62

0.63

0.65

0.66

0.63

0.63

806,000

524,570

ISLAND INFO

IS

0.05

0.052

0.052

0.052

0.05

0.05

2,710,000

139,820

ISM COMM

ISM

2.09

2.15

2.12

2.12

2.09

2.09

310,000

651,980

NEXTSTAGE

PHILWEB

NXT

WEB

14.18

14.48

14.58

14.58

14.18

14.5

340,000

4,916,738

(333,980)

TOUCH SOLUTIONS

TSI

17

17.2

20

20

17

17

439,900

7,958,730

52,500

TRANSPACIFIC BR

TBGI

YEHEY

1.95

1.29

2.19

1.35

1.29

1.3

1.29

1.3

26,000

33,640

IMPERIAL B

YEHEY CORP

**** TRANSPORTATION SERVICES ****

2GO GROUP

2GO

1.68

1.7

1.7

1.7

1.7

1.7

6,000

10,200

ASIAN TERMINALS

ATI

CEB

13.12

66.8

13.9

67

67.5

67.5

66

67

384,440

25,668,036.5

9,211,166

MACROASIA

ICT

LSC

MAC

86.5

1.45

2.45

87

1.63

2.5

87

2.45

87

2.45

85.5

2.45

87

2.45

882,450

7,000

76,166,891.5

17,150

19,420,770.5

-

PAL HLDG

PAL

CEBU AIR

INTL CONTAINER

LORENZO SHIPPNG

**** HOTEL & LEISURE ****

ACESITE HOTEL

ACE

1.26

1.3

1.28

1.31

1.26

1.3

134,000

170,700

BOULEVARD HLDG

BHI

0.127

0.128

0.126

0.13

0.126

0.128

16,380,000

2,105,680

(139,520)

GRAND PLAZA

GPH

WPI

30

0.39

44.95

0.4

0.405

0.405

0.39

0.4

830,000

326,500

CEU

FEU

IPO

10.1

1,170

10.2

10.98

1,205

11.5

10.9

10.9

10.5

10.5

27,000

287,500

BLOOMBERRY

BCOR

BLOOM

24.9

13.66

25.6

13.68

24.8

14.22

24.9

14.58

24.8

13.3

24.9

13.66

4,400

18,371,800

109,400

254,912,956

20,598,946

IP EGAME

EG

0.022

0.023

0.024

0.024

0.022

0.023

427,500,000

9,794,100

11,500

LEISURE AND RES

LR

8.14

8.15

8.4

8.41

8.14

8.15

779,700

6,419,815

692,750

MANILA JOCKEY

MJC

2.45

2.5

2.53

2.55

2.45

2.45

400,000

997,170

PACIFIC ONLINE

LOTO

14.7

14.9

15.2

15.2

14.7

14.7

135,300

2,003,962

PHIL RACING

PRC

9.95

10

10.34

10.34

9.95

9.95

14,000

143,950

20,270

PRMIERE HORIZON

PHA

0.325

0.335

0.33

0.33

0.325

0.325

2,220,000

727,000

CALATA CORP

CAL

3.29

3.33

3.34

3.4

3.3

3.33

268,000

890,200

PHIL SEVEN CORP

SEVN

PGOLD

91

38.9

91.6

39

91

39.9

92

39.9

91

38.7

91

39

141,980

3,484,800

13,060,180

135,768,305

13,060,180

39,426,285

APC GROUP

APC

0.78

0.79

0.81

0.81

0.78

0.78

24,344,000

19,284,010

EASYCALL

ICTV INC

ECP

PORT

ICTV

2.85

10

0.4

2.9

19

0.405

0.405

0.405

0.405

0.405

200,000

81,000

81,000

PAXYS

PAX

2.7

2.75

2.75

2.81

2.7

2.7

301,000

824,760

(82,500)

PHILCOMSAT

PHC

STI

0.97

0.99

0.97

0.97

0.99

97,997,000

95,483,690

(66,951,260)

WATERFRONT

**** EDUCATION ****

CENTRO ESCOLAR

FAR EASTERN U

IPEOPLE

**** CASINOS & GAMING ****

BERJAYA

**** RETAIL ****

PUREGOLD

**** OTHER SERVICES ****

GLOBALPORT

STI HLDG

SERVICES SECTOR TOTAL

VOLUME :

601,497,050

VALUE :

1,211,289,009

MINING & OIL

**** MINING ****

ABRA MINING

APEX MINING A

APEX MINING B

ATLAS MINING

ATOK

BENGUET A

BENGUET B

AR

APX

APXB

AT

AB

BC

BCB

0.0047

4.28

0.005

4.5

0.0048

4.5

0.005

4.5

0.0047

4.5

0.005

4.5

123,000,000

1,000

585,200

4,500

4.3

-

4.82

-

22.9

22.9

21.6

22

3,094,800

68,827,920

(14,985,650)

18.5

18.1

17.6

20.5

18.3

18.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 18 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Net Foreign

Trade (Peso)

Buying (Selling)

Value

CENTURY PEAK

CPM

0.93

0.96

0.92

0.97

0.92

0.96

50,840,000

46,790,700

(0)

COAL ASIA HLDG

COAL

0.98

0.99

1.01

0.99

0.99

6,827,000

6,798,560

(2,018,430)

DIZON MINES

DIZ

11.3

11.6

11.6

11.8

11.3

11.6

10,800

124,460

GEOGRACE

GEO

0.51

0.52

0.54

0.54

0.51

0.52

1,415,000

728,720

LEPANTO A

LC

1.08

1.09

1.11

1.11

1.07

1.09

13,860,000

15,058,130

LEPANTO B

LCB

1.13

1.16

1.17

1.17

1.13

1.16

6,788,000

7,859,930

(4,775,430)

MANILA MINING A

MA

0.057

0.058

0.058

0.059

0.058

0.058

144,360,000

8,374,480

MANILA MINING B

MAB

0.057

0.058

0.06

0.06

0.058

0.058

242,410,000

14,296,600

NICKEL ASIA

NIKL

24.05

24.3

25.45

25.45

23.8

24.3

1,995,400

48,382,430

(9,267,910)

NIHAO

NI

3.46

3.47

3.58

3.58

3.37

3.5

2,205,000

7,661,220

(198,780)

OMICO CORP

OM

0.56

0.57

0.57

0.57

0.56

0.56

204,000

114,260

ORNTL PENINSULA

ORE

3.3

3.38

3.5

3.5

3.29

3.3

1,351,000

4,480,180

(164,500)

PHILEX

PX

17.4

17.46

17.84

17.84

17.4

17.46

2,018,000

35,408,622

(3,513,492)

SEMIRARA MINING

SCC

232

233

237

237

231

233

261,220

60,766,342

7,585,960

UNITED PARAGON

UPM

0.016

0.017

0.016

0.017

0.016

0.017

105,000,000

1,686,000

BASIC PETROLEUM

BSC

0.275

0.28

0.28

0.28

0.275

0.275

3,250,000

909,850

(8,400)

ORIENTAL A

PETROENERGY

OPM

OPMB

PERC

0.02

0.021

6.95

0.021

0.022

7

0.02

0.021

6.95

0.02

0.021

7.03

0.02

0.021

6.95

0.02

0.021

6.95

200,600,000

47,000,000

30,000

4,012,000

987,000

209,348

(25,200)

-

PHILODRILL

OV

0.041

0.042

0.042

0.042

0.041

0.041

260,100,000

10,694,700

(1,054,200)

PNOC A

PEC

PECB

PXP

29.6

29.95

30.25

30.6

29.6

29.95

129,600

3,880,070

134,740

**** OIL ****

ORIENTAL B

PNOC B

PX PETROLEUM

MINING AND OIL SECTOR TOTAL

VOLUME :

1,216,750,820

VALUE :

348,641,222

PREFERRED

ABC PREF

ABC

PBCP

ACPA

ACPR

DMCP

FGENF

FGENG

520.5

101.6

109.4

521

107.5

110.7

520.5

110.6

521

110.7

520.5

110.6

521

110.7

260

720

135,430

79,679

PCOR PREF

FPHP

PPREF

101

108.6

101.3

109

108.4

109

108.4

109

51,020

5,561,168

PF PREF

PFP

1,038

1,041

1,037

1,040

1,037

1,038

12,295

12,786,295

SFI PREF

SFIP

SMCP1

SMC2A

SMC2B

1.22

74.9

75.05

1.45

74.95

76.25

74.95

75.05

75

76.3

74.85

75.05

74.95

76.25

892,580

4,450

66,901,103

334,367.5

(3,569,000)

-

ABS HLDG PDR

SMC2C

BCP

ABSP

76.05

12.4

40.5

78

41

76

41.25

76

41.25

76

40.6

76

41

14,000

542,300

1,064,000

22,234,195

9,213,355

GMA HLDG PDR

GMAP

9.85

9.9

9.75

9.95

9.7

9.9

133,000

1,302,350

291,750

GLO PREF A

GLOPA

TLHH

PBC PREF

AC PREF A

AC PREF B

DMC PREF

FGEN PREF F

FGEN PREF G

FPH PREF

SMC PREF 1

SMC PREF 2A

SMC PREF 2B

SMC PREF 2C

BC PREF A

TEL PREF HH

PREFERRED TOTAL

VOLUME :

1,650,625

VALUE :

110,398,587.5

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC.

IRC WARRANT

MEG WARRANT

IRW

MEGW1

0.05

2.55

2.77

2.67

2.67

2.59

2.61

583,000

1,521,910

MEG WARRANT 2

MEGW2

2.09

2.85

2.5

2.5

2.5

2.5

41,000

102,500

PLDT USD

DTEL

WARRANTS, PHIL. DEPOSIT RECEIPT, ETC. TOTAL

VOLUME :

624,000

VALUE :

1,624,410

SMALL AND MEDIUM ENTERPRISES

IRIPPLE

MAKATI FINANCE

RPL

MFIN

9.2

2.51

10.48

4.65

SMALL AND MEDIUM ENTERPRISES TOTAL

TOTAL REGULAR

VOLUME :

VOLUME :

3,044,509,220

VALUE :

VALUE :

9,363,555,500.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 18 , 2013

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

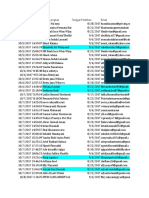

NO. OF ADVANCES:

34

NO. OF DECLINES:

136

NO. OF UNCHANGED:

37

NO. OF TRADED ISSUES: 207

NO. OF TRADES:

37976

BLOCK SALES

SECURITY

PRICE

MBT

115.8685

MBT

115.8714

TEL

2,838.2375

ICT

87

JFC

122.6

URC

102.4074

URC

103.9

PGOLD

40

BLOOM

14

ODDLOT VOLUME:

ODDLOT VALUE:

:

:

VOLUME

245,130

183,360

10,000

626,185

172,870

288,030

768,219

1,340,300

6,127,400

VALUE

28,402,845.405

21,246,179.904

28,382,376

54,478,095

21,193,862

29,496,403.422

79,817,954.1

53,612,000

85,783,600

217,935

170,813.34

MAIN BOARD CROSS VOLUME: :

MAIN BOARD CROSS VALUE:

:

262,349,570

2,547,936,716.96

NON-SECTORAL VOLUME:

0

NON-SECTORAL VALUE:

0

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining and Oil

PSEi

All Shares

SME

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,752.4

9,994.34

5,958.82

2,739.81

1,940.29

21,324.16

6,666.8

4,173.03

1,775.75

10,026.19

5,959.39

2,739.81

1,940.29

21,324.16

6,690.28

4,182.07

1,727.77

9,849.43

5,745.25

2,636.01

1,898.52

20,815.89

6,514.89

4,082.94

1,733.11

9,854.26

5,766.03

2,647.75

1,909.44

20,964.7

6,536.18

4,094.62

-0.66

-1.55

-2.81

-2.88

-1.47

-1.91

-1.78

-1.8

-11.58

-155.25

-166.71

-78.39

-28.49

-409.24

-118.42

-74.88

25,582,795

230,047,465

614,226,251

358,082,638

609,604,319

1,216,945,181

1,894,248,150.11

2,138,563,501.5

2,206,448,601.79

1,744,646,997.87

1,433,573,592.35

348,658,786.05

GRAND TOTAL

FOREIGN BUYING

FOREIGN SELLING

3,054,488,649 Php 9,766,139,629.671

Php 4,716,687,171.08

Php 5,281,552,998.52

Companies Under Suspension by the Exchange as of 03/18/2013

ACPR

- AC PREF B

ASIA

- ASIATRUST

CBC

- COSMOS

CMT

- SEACEM

EIBA

- EXPORT BANK

EIBB

- EXPORT BANK B

FC

- FIL ESTATE CORP

FYN

- FILSYN A

FYNB

- FILSYN B

GO

- GOTESCO LAND A

GOB

- GOTESCO LAND B

MAH

- METROALLIANCE A

MAHB

- METROALLIANCE B

MC

- MARSTEEL A

MCB

- MARSTEEL B

NXT

- NEXTSTAGE

PAL

- PAL HLDG

PBC

- PBCOM

PBCP

- PBC PREF

PEC

- PNOC A

PECB

- PNOC B

PHC

- PHILCOMSAT

PNC

- PNCC

SMB

- SAN MIGUEL BREW

SMP

- SAN MIGUEL PROP

MED

- MEDCO HLDG

PCP

- PICOP RES

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 18 , 2013

Name

PMT

PPC

PTT

STN

UW

ABC

TLHH

SMCP1

Symbol

-

Bid

PRIMETOWN PROP

PRYCE CORP

PTT CORP

STENIEL

UNIWIDE HLDG

ABC PREF

TEL PREF HH

- SMC PREF 1

* Sectoral totals includes main transactions

** Total Regular includes main transactions

*** Grand total includes main,oddlot and block sale transactions

Ask

Open

High

Low

Close

Volume

Value

Net Foreign

Trade (Peso)

Buying (Selling)

Das könnte Ihnen auch gefallen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013srichardequipNoch keine Bewertungen

- PSE Daily Quotations Report for March 12, 2013Dokument7 SeitenPSE Daily Quotations Report for March 12, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 30, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 29, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 29, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 02, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 24, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2013srichardequipNoch keine Bewertungen

- DAILY QUOTATIONSDokument7 SeitenDAILY QUOTATIONSsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipNoch keine Bewertungen

- PSE Daily Report Philippine Stock Exchange Daily Quotations Report for February 19, 2013Dokument7 SeitenPSE Daily Report Philippine Stock Exchange Daily Quotations Report for February 19, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 11, 2013srichardequipNoch keine Bewertungen

- Philippine Stock Exchange Daily Quotations Report for May 06, 2013Dokument7 SeitenPhilippine Stock Exchange Daily Quotations Report for May 06, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 25, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 15, 2013srichardequipNoch keine Bewertungen

- Philippine Stock Exchange Daily Report SummaryDokument7 SeitenPhilippine Stock Exchange Daily Report SummarysrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 17, 2013srichardequipNoch keine Bewertungen

- Philippine Stock Exchange Daily Report for March 08, 2013Dokument7 SeitenPhilippine Stock Exchange Daily Report for March 08, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013srichardequipNoch keine Bewertungen

- Philippine Stock Exchange Daily Report Provides Financial Sector Stock Prices and Trading DataDokument7 SeitenPhilippine Stock Exchange Daily Report Provides Financial Sector Stock Prices and Trading DatasrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 31, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 31, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipNoch keine Bewertungen

- DAILY QUOTATIONSDokument7 SeitenDAILY QUOTATIONSsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 01, 2013srichardequipNoch keine Bewertungen

- Philippine Stock Exchange Daily Report for March 04, 2013Dokument7 SeitenPhilippine Stock Exchange Daily Report for March 04, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Ryan Samuel C. CervasNoch keine Bewertungen

- Stockquotes 08162013Dokument7 SeitenStockquotes 08162013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013srichardequipNoch keine Bewertungen

- PSE Daily ReportDokument8 SeitenPSE Daily ReportsrichardequipNoch keine Bewertungen

- PSE REPORTDokument7 SeitenPSE REPORTsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report December 13, 2012Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report December 13, 2012srichardequipNoch keine Bewertungen

- PSE-DAILYDokument9 SeitenPSE-DAILYMelissa BaileyNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 23, 2013srichardequipNoch keine Bewertungen

- Philippine Stock Exchange Daily Report Provides Financial Sector and Stock PerformanceDokument7 SeitenPhilippine Stock Exchange Daily Report Provides Financial Sector and Stock PerformancesrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 28, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 28, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report May 07, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report December 14, 2012srichardequipNoch keine Bewertungen

- PSE Daily Quotations Report May 20, 2013Dokument7 SeitenPSE Daily Quotations Report May 20, 2013srichardequipNoch keine Bewertungen

- PSE Daily ReportDokument7 SeitenPSE Daily ReportsrichardequipNoch keine Bewertungen

- Stockquotes 08012013Dokument7 SeitenStockquotes 08012013srichardequipNoch keine Bewertungen

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsVon EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNoch keine Bewertungen

- Global Macro Trading: Profiting in a New World EconomyVon EverandGlobal Macro Trading: Profiting in a New World EconomyBewertung: 4 von 5 Sternen4/5 (5)

- Treasury Markets and OperationsVon EverandTreasury Markets and OperationsNoch keine Bewertungen

- Kase on Technical Analysis Workbook: Trading and ForecastingVon EverandKase on Technical Analysis Workbook: Trading and ForecastingNoch keine Bewertungen

- Improving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentVon EverandImproving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentBewertung: 5 von 5 Sternen5/5 (1)

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceVon EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceNoch keine Bewertungen

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesVon EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNoch keine Bewertungen

- Stockquotes 02112015 PDFDokument8 SeitenStockquotes 02112015 PDFsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNoch keine Bewertungen

- ECCODokument3 SeitenECCOsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNoch keine Bewertungen

- wk02 Jan2013mktwatchDokument3 Seitenwk02 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- Stockquotes 02042015 PDFDokument8 SeitenStockquotes 02042015 PDFsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNoch keine Bewertungen

- Stockquotes 02062015Dokument8 SeitenStockquotes 02062015srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Dokument8 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNoch keine Bewertungen

- October 2015: Sun Mon Tue Wed Thu Fri SatDokument1 SeiteOctober 2015: Sun Mon Tue Wed Thu Fri SatjNoch keine Bewertungen

- Stockquotes 02112015 PDFDokument8 SeitenStockquotes 02112015 PDFsrichardequipNoch keine Bewertungen

- wk01 Jan2013mktwatchDokument3 Seitenwk01 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- wk03 Jan2013mktwatchDokument3 Seitenwk03 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013srichardequipNoch keine Bewertungen

- Philippine Stock Exchange Daily Report Provides Financial Sector and Stock PerformanceDokument7 SeitenPhilippine Stock Exchange Daily Report Provides Financial Sector and Stock PerformancesrichardequipNoch keine Bewertungen

- PSE Daily ReportDokument7 SeitenPSE Daily ReportsrichardequipNoch keine Bewertungen

- PSE REPORTDokument7 SeitenPSE REPORTsrichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013srichardequipNoch keine Bewertungen

- Table 1 Marriage 2011Dokument1 SeiteTable 1 Marriage 2011srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipNoch keine Bewertungen

- Stockquotes 04022013Dokument7 SeitenStockquotes 04022013srichardequipNoch keine Bewertungen

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Dokument7 SeitenThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNoch keine Bewertungen

- January-February 2013: 17. Metropolitan Bank & Trust Co. (MBT)Dokument2 SeitenJanuary-February 2013: 17. Metropolitan Bank & Trust Co. (MBT)Nadine SantiagoNoch keine Bewertungen

- Template Pendaftaran Bpu TK BaruDokument36 SeitenTemplate Pendaftaran Bpu TK BaruRaznan RaedyNoch keine Bewertungen

- CASES ObliconDokument4 SeitenCASES ObliconYlourah SarmientoNoch keine Bewertungen

- Nilai Prakerin Dari DudiDokument16 SeitenNilai Prakerin Dari Dudieci daudNoch keine Bewertungen

- Form Rekening & ID Tentor (Jogja)Dokument14 SeitenForm Rekening & ID Tentor (Jogja)Cut Ummu FathimahNoch keine Bewertungen

- AllHome Corp. top holdersDokument6 SeitenAllHome Corp. top holdersCrhis SimthNoch keine Bewertungen

- Histori TransaksiDokument6 SeitenHistori TransaksiSalwa NtsNoch keine Bewertungen

- Master SuplyerDokument178 SeitenMaster Suplyerstevie baraNoch keine Bewertungen

- Membership Translate Yuanta FINALDokument49 SeitenMembership Translate Yuanta FINALAmita Shindu KusumaNoch keine Bewertungen

- Gapki Conference 2014 - List of ParticipantDokument36 SeitenGapki Conference 2014 - List of ParticipantadiNoch keine Bewertungen

- Lead Time RajalDokument46 SeitenLead Time RajalSri AriatiNoch keine Bewertungen

- Balanced FundsDokument1 SeiteBalanced FundsYannah HidalgoNoch keine Bewertungen

- STRUKTUR CRISIS MANAGEMENT TEAM PT. BANK MANDIRI (PERSERO) Tbk. KK MalukDokument1 SeiteSTRUKTUR CRISIS MANAGEMENT TEAM PT. BANK MANDIRI (PERSERO) Tbk. KK MalukFadhlan FrOstNoch keine Bewertungen

- Cimb 6189 - Soa Jun'22Dokument22 SeitenCimb 6189 - Soa Jun'22gee Girl0% (1)

- BanksDokument16 SeitenBanksjofer63Noch keine Bewertungen

- Draft SKBDN PT - Nubuwah Utama TuntasDokument5 SeitenDraft SKBDN PT - Nubuwah Utama Tuntaspt alam lintas indonesia jakarta100% (1)

- Mutasi Transaksi - Payroll8199 - 2710202111724Dokument9 SeitenMutasi Transaksi - Payroll8199 - 2710202111724Eko ApriantoNoch keine Bewertungen

- DAFTAR ANGGOTA KERUKUNAN KELUARGA BESAR ISTRI PEGAWAI PT. BANK NEGARA INDONESIADokument13 SeitenDAFTAR ANGGOTA KERUKUNAN KELUARGA BESAR ISTRI PEGAWAI PT. BANK NEGARA INDONESIARatuNoch keine Bewertungen

- Instapay ParticipantsDokument2 SeitenInstapay ParticipantsDan S BNoch keine Bewertungen

- Functions and Operations of The Bangko Sentral NG Pilipinas (PPT Version)Dokument41 SeitenFunctions and Operations of The Bangko Sentral NG Pilipinas (PPT Version)kim byunooNoch keine Bewertungen

- PT. BANK RAKYAT INDONESIA (PERSERO), TBK. statement snapshotDokument2 SeitenPT. BANK RAKYAT INDONESIA (PERSERO), TBK. statement snapshotahsan danishNoch keine Bewertungen

- 1-14022022 AkuaDokument14 Seiten1-14022022 AkuaWisnu Hadi IndarmawanNoch keine Bewertungen

- SAHAM Rekap Index - 1Dokument8 SeitenSAHAM Rekap Index - 1Muhammad ZamröniNoch keine Bewertungen

- Macr Incentive FC Rec Mei 2012 - 1Dokument3.649 SeitenMacr Incentive FC Rec Mei 2012 - 1Greget SekaliNoch keine Bewertungen

- Singapore Bank and Branch Codes - AchcodeDokument20 SeitenSingapore Bank and Branch Codes - Achcodedinesh_s_17Noch keine Bewertungen

- Philippine Stock Exchange Financials IndexDokument3 SeitenPhilippine Stock Exchange Financials IndexGen GaveriaNoch keine Bewertungen

- Top 10 largest commercial banks in the Philippines by assetsDokument21 SeitenTop 10 largest commercial banks in the Philippines by assetsRalph Evander IdulNoch keine Bewertungen

- Club Point RewardsDokument24 SeitenClub Point RewardsUjjueNoch keine Bewertungen

- Unioniank: Unionbank Plal.A Meralco An!Nue Onyx Sapphire Roads, Onigas CenlerDokument7 SeitenUnioniank: Unionbank Plal.A Meralco An!Nue Onyx Sapphire Roads, Onigas CenlerEdgar LayNoch keine Bewertungen

- Edit NamaDokument3 SeitenEdit NamaTracy Kirei PNoch keine Bewertungen