Beruflich Dokumente

Kultur Dokumente

Financial Data For Bata Hydro

Hochgeladen von

Rahul SttudOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Data For Bata Hydro

Hochgeladen von

Rahul SttudCopyright:

Verfügbare Formate

Assignment II Caselet

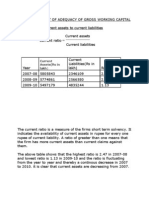

The table below gives the relevant data for Bata Hydro Electric company for the years 2002 to 2010. Using the data, figure out the weighted average cost of capital of the company using market value weights . Financial Data for Bata Hydro-Electric power company Book Value Market Value (Rs in Crores) (Rs in crores) Debentures (8 per cent due 2014-2017) 1.00 0.87 Debentures (11 per cent due 2021-2025) 2.23 1.76 Long-term loans(11 per cent) 2.77 2.77 Preference capital (7 per cent) 0.89 0.45 Net worth 8.87 2.90 Equity Data 2002 2003 2004 2005 2006 2007 2008 2009 2010 Earnings per Rs 17.4 16.1 13.1 17.7 16.4 21.8 20.3 20.3 29.0 share Dividend per Rs 13.0 13.0 5.0 13.0 13.0 13.0 13.0 13.0 15.0 share Bonus 1:12 Adjusted earnings* Rs 17.4 16.1 13.1 19.2 17.8 23.6 22.0 22.0 31.4 per share Adjusted dividend*per Rs 13.0 13.0 5.0 14.1 14.1 14.1 14.1 14.1 16.3 share # Market price 101.25

*Adjusted for the bonus declaration in the ratio of 1:12 in 2005 # Market price is the average of high and low in March 2010 8 % debentures, due 2014-2017: These debentures are repayable in 4 equal annual installments beginning 2014.The market value per Rs 100 face value of the debenture was Rs 87 as on 31st March 2010. 11% debentures, due 2021-2025 : These debentures are repayable in 5 annual installments beginning 2021.The market value per Rs 100 face value of these debentures was 79 on 31st March 2010. Market Price of Preference shares in March 2010 is Rs.50. Assume an effective tax rate of 57.75 %.

Das könnte Ihnen auch gefallen

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersVon EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNoch keine Bewertungen

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsVon EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNoch keine Bewertungen

- CH 7 Index Numbers2Dokument23 SeitenCH 7 Index Numbers2FJNoch keine Bewertungen

- Infosys LTD: FM Concept Ratio Analysys of " "Dokument22 SeitenInfosys LTD: FM Concept Ratio Analysys of " "Shiva ShettyNoch keine Bewertungen

- Estimates OF State Domestic Product, Odisha: (Both at Basic Prices and Market Prices)Dokument24 SeitenEstimates OF State Domestic Product, Odisha: (Both at Basic Prices and Market Prices)naina saxenaNoch keine Bewertungen

- Economics of RajasthanDokument19 SeitenEconomics of RajasthanSukriti tripathiNoch keine Bewertungen

- Index Number CompletedDokument20 SeitenIndex Number CompletedKayode AdebayoNoch keine Bewertungen

- Effect of Financial Ratio On Stock Price in TelecoDokument9 SeitenEffect of Financial Ratio On Stock Price in Telecotejaguggilam20Noch keine Bewertungen

- Question 1Dokument8 SeitenQuestion 1elvitaNoch keine Bewertungen

- Current Macroeconomic Situation: Real SectorDokument14 SeitenCurrent Macroeconomic Situation: Real SectorMonkey.D. LuffyNoch keine Bewertungen

- Havells Initiating Coverage 27 Apr 2011Dokument23 SeitenHavells Initiating Coverage 27 Apr 2011ananth999Noch keine Bewertungen

- Ap2.Macro Economic AggregatesDokument4 SeitenAp2.Macro Economic AggregatesChandu KumarNoch keine Bewertungen

- Summary of Economic Review 2020-21Dokument166 SeitenSummary of Economic Review 2020-21hemant.niotNoch keine Bewertungen

- Additonal Mathematics Project Work 2013 Selangor (Project 2)Dokument15 SeitenAdditonal Mathematics Project Work 2013 Selangor (Project 2)farhana_hana_982% (11)

- Financial Intermediation: ANK ReditDokument25 SeitenFinancial Intermediation: ANK ReditPraveen Reddy PenumalluNoch keine Bewertungen

- AFM PPT FinalDokument45 SeitenAFM PPT Final0nilNoch keine Bewertungen

- Financial & Other Graphs As 12.2.3 12.2.1Dokument16 SeitenFinancial & Other Graphs As 12.2.3 12.2.1wmathematicsNoch keine Bewertungen

- IDR Bond Market Update 13 September 2021 (Eng)Dokument5 SeitenIDR Bond Market Update 13 September 2021 (Eng)Manonsih VictoryaNoch keine Bewertungen

- Multi Commodity Exchange of IndiaDokument6 SeitenMulti Commodity Exchange of Indianit111Noch keine Bewertungen

- Maruti SuzukiDokument13 SeitenMaruti SuzukildhboyNoch keine Bewertungen

- ECON 2004 - Engineering Economy: Inflation and Foreign ExchangeDokument15 SeitenECON 2004 - Engineering Economy: Inflation and Foreign ExchangeMustafa Gökhan YavuzNoch keine Bewertungen

- Financial Statement Analysis OF Maruti Suzuki India LTD.: Submitted To: Submitted byDokument46 SeitenFinancial Statement Analysis OF Maruti Suzuki India LTD.: Submitted To: Submitted bySusil Kumar SaNoch keine Bewertungen

- Econ 304 HW 2Dokument8 SeitenEcon 304 HW 2Tedjo Ardyandaru ImardjokoNoch keine Bewertungen

- 2010 10 06 NJ MezrichDokument26 Seiten2010 10 06 NJ Mezrichxy053333Noch keine Bewertungen

- Daiwa Capital MarketDokument6 SeitenDaiwa Capital MarketRongye Daniel LaiNoch keine Bewertungen

- GDP Press Note 28nov2018Dokument30 SeitenGDP Press Note 28nov2018Bhairavi UvachaNoch keine Bewertungen

- Price IndicesDokument43 SeitenPrice IndicesrajanloombaNoch keine Bewertungen

- Planning Commission HandbookDokument274 SeitenPlanning Commission HandbookAshutosh SinghNoch keine Bewertungen

- 172-Article Text-1185-1-10-20190731Dokument15 Seiten172-Article Text-1185-1-10-20190731ariza syafnurNoch keine Bewertungen

- Combined Chapters 1 To 5 MBA Research ProjectDokument149 SeitenCombined Chapters 1 To 5 MBA Research ProjectManoj JainNoch keine Bewertungen

- Analysis of DLF (FINAL)Dokument31 SeitenAnalysis of DLF (FINAL)Sumit SharmaNoch keine Bewertungen

- Indonesia PDFDokument48 SeitenIndonesia PDFAmelia PutriNoch keine Bewertungen

- Prime Bank LTD: Dse: Primebank Bloomberg: PB:BDDokument13 SeitenPrime Bank LTD: Dse: Primebank Bloomberg: PB:BDSajidHuqAmitNoch keine Bewertungen

- Current Assets (Rs in Lakh)Dokument35 SeitenCurrent Assets (Rs in Lakh)Jagadeesh MuthikiNoch keine Bewertungen

- Wei 20140221newDokument14 SeitenWei 20140221newRandora LkNoch keine Bewertungen

- Interpretation of The CAMEL RatioDokument3 SeitenInterpretation of The CAMEL RatioAnuja AgrawalNoch keine Bewertungen

- 0000001635-Political Economy of Indian Development 1991-2017Dokument57 Seiten0000001635-Political Economy of Indian Development 1991-2017VigneshVardharajanNoch keine Bewertungen

- Bond ValuationsDokument37 SeitenBond ValuationsCharanjeet SinghNoch keine Bewertungen

- IndexDokument1 SeiteIndexarindam.ims.20074698Noch keine Bewertungen

- Valuation: Source: BSE: 500290 DCF 1st Stage: Next 10 Years Cash Flow ForecastDokument2 SeitenValuation: Source: BSE: 500290 DCF 1st Stage: Next 10 Years Cash Flow ForecastAman KhanNoch keine Bewertungen

- CBEB 2102 Financial Management Group Assignment Honeywell International IncDokument12 SeitenCBEB 2102 Financial Management Group Assignment Honeywell International IncSyifaa' NajibNoch keine Bewertungen

- Budget at A GlanceDokument455 SeitenBudget at A Glancesiddhsonu4uNoch keine Bewertungen

- The Construction Sector of Indonesia: 18th Asia Construct ConferenceDokument17 SeitenThe Construction Sector of Indonesia: 18th Asia Construct ConferenceTio IskandarNoch keine Bewertungen

- DRC - en Updated Q2 2011Dokument3 SeitenDRC - en Updated Q2 2011kinhtequocte41Noch keine Bewertungen

- Car Assemblers' - Value Seeker 01 October 07Dokument2 SeitenCar Assemblers' - Value Seeker 01 October 07wahab_54Noch keine Bewertungen

- Full & Final Report Fin 435Dokument26 SeitenFull & Final Report Fin 435Numayer Ahmed Chaudhuri100% (1)

- Analysis of Financial StatementsDokument54 SeitenAnalysis of Financial StatementsBabasab Patil (Karrisatte)Noch keine Bewertungen

- Decision ScienceDokument6 SeitenDecision Sciencejwalasuryavanshi1999Noch keine Bewertungen

- Uttar Pradesh Revene Sector 3 2013 Chap 2Dokument26 SeitenUttar Pradesh Revene Sector 3 2013 Chap 2rajendra lalNoch keine Bewertungen

- Eco304.1 - Group ProjectDokument36 SeitenEco304.1 - Group ProjectSamin Soria Samad 2013668620Noch keine Bewertungen

- How We Side-Step Bubbles in Double IncomeDokument11 SeitenHow We Side-Step Bubbles in Double IncomePIYUSH GOPALNoch keine Bewertungen

- Cost of Debt: Table 1: CRISIL Rating To Default Spread Mapping Default-Study-Fy2020 PDFDokument4 SeitenCost of Debt: Table 1: CRISIL Rating To Default Spread Mapping Default-Study-Fy2020 PDFAtul AnandNoch keine Bewertungen

- Analysis Fin StatementDokument46 SeitenAnalysis Fin Statementranho jaelaniNoch keine Bewertungen

- Data Analysis & InterpretationDokument47 SeitenData Analysis & InterpretationsangfroidashNoch keine Bewertungen

- 14 Chapter 7Dokument57 Seiten14 Chapter 7teddygroupsNoch keine Bewertungen

- Dashboard: Speedometer Data TrackDokument28 SeitenDashboard: Speedometer Data TrackSandesh TrivediNoch keine Bewertungen

- Table 2.6: Bank Group-Wise Selected Ratios of Scheduled Commercial Banks: 2011 and 2012Dokument3 SeitenTable 2.6: Bank Group-Wise Selected Ratios of Scheduled Commercial Banks: 2011 and 2012adtyshkhrNoch keine Bewertungen

- Dipawali ReportDokument16 SeitenDipawali ReportKeval ShahNoch keine Bewertungen

- DSEpp - Market and PriceDokument21 SeitenDSEpp - Market and Pricepeter wongNoch keine Bewertungen

- Compendium of Supply and Use Tables for Selected Economies in Asia and the PacificVon EverandCompendium of Supply and Use Tables for Selected Economies in Asia and the PacificNoch keine Bewertungen

- Highlights From Budget 2012Dokument2 SeitenHighlights From Budget 2012Rahul SttudNoch keine Bewertungen

- Supply Chain Management at GCMMF: Submitted By, Deepa Raghu I MBA (2011-13) (14.02.12)Dokument3 SeitenSupply Chain Management at GCMMF: Submitted By, Deepa Raghu I MBA (2011-13) (14.02.12)Rahul SttudNoch keine Bewertungen

- Stratergic Management Case Study On StarbucksDokument30 SeitenStratergic Management Case Study On StarbucksRahul Sttud50% (2)

- Consumer Behaviour: Amrita Vishwa Vidyapeetham Amrita School of BusinessDokument4 SeitenConsumer Behaviour: Amrita Vishwa Vidyapeetham Amrita School of BusinessRahul SttudNoch keine Bewertungen

- Concor TeaDokument35 SeitenConcor TeaRahul SttudNoch keine Bewertungen

- AFM AssignmentDokument12 SeitenAFM AssignmentRahul SttudNoch keine Bewertungen

- Nike IncDokument16 SeitenNike IncRahul SttudNoch keine Bewertungen

- Deflation Spiral Group 3Dokument16 SeitenDeflation Spiral Group 3Rahul SttudNoch keine Bewertungen

- Questionnaire: How Long You Work For This OrganisationDokument4 SeitenQuestionnaire: How Long You Work For This OrganisationRahul SttudNoch keine Bewertungen

- Submitted By: Arun Sen Arjun Anakha Keerthi Ashok Hima Lavanya Suraj T FebinDokument21 SeitenSubmitted By: Arun Sen Arjun Anakha Keerthi Ashok Hima Lavanya Suraj T FebinRahul SttudNoch keine Bewertungen

- MR Final PPT IntelDokument21 SeitenMR Final PPT IntelRahul SttudNoch keine Bewertungen

- Case Study On India Cements Limited & CSKDokument24 SeitenCase Study On India Cements Limited & CSKRahul SttudNoch keine Bewertungen

- Case Study-Analysis of Cigarette Ads: Group No-4Dokument16 SeitenCase Study-Analysis of Cigarette Ads: Group No-4Rahul SttudNoch keine Bewertungen

- Business-To-Business: EtymologyDokument2 SeitenBusiness-To-Business: EtymologyRahul SttudNoch keine Bewertungen

- Cyber Warfare: Presented ByDokument14 SeitenCyber Warfare: Presented ByRahul Sttud100% (1)

- Coca Cola Group 2Dokument28 SeitenCoca Cola Group 2Rahul SttudNoch keine Bewertungen