Beruflich Dokumente

Kultur Dokumente

Post Office Small Savings Ready Reckoner

Hochgeladen von

abhinav0115Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Post Office Small Savings Ready Reckoner

Hochgeladen von

abhinav0115Copyright:

Verfügbare Formate

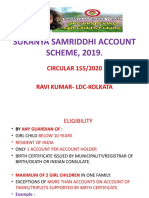

POST OFFICE SAVINGS SCHEMES - A READY RECKONER S. No. Investment type Eligibility restriction?

Period Rate of Interest as Payout frequency Minimum Investment for financial year 2014-15 8.5% compounded Maturity Rs. 100 half yearly Maximum investment limit No max limit Tax deduction on investment? (Yes/No) Yes - under Section 80C Taxability- Interest Taxability- Maturity Amount Allowed? Pre-mature withdrawal Penalty? Allowed? Loan Interest rate? Other features

National Savings Certificate (NSC) VIII issue

NIL

5 years

Interest accrued is taxable each year and you can also claim rebate u/s 80C

No

Can be withdrawn after 3 years subject to the rules

No penalty, however, withdrawal is at reduced rates No penalty, however, withdrawal is at reduced rates No

No

NA

A/C can be opened by an individual, minor or on behalf of a minor.

National Savings NIL Certificate (NSC) - IX issue Public Provident Only Individuals can Fund (PPF) invest (not HUF)

10 years

8.8% compounded Maturity half yearly 8.7% (monthly interest credited yearly) 8.4% p.a. (compounding not applicable) Maturity

Rs. 100

No max limit

Yes - under Section 80C

Monthly Income Scheme

NIL

15 years (effective 16 years)+ extension of 5 years block 5 years

Monthly

Rs. 5 but there should Rs. 1,00,000 per year per Yes - under Section 80C be a deposit minimum person of Rs. 500 in a financial year Single A/c- Rs. 4.5 lacs/ No joint A/c- Rs. 9 lacs

Accrued interest each year is No taxable and also allowed u/s 80C Exempt No

Can be withdrawn after 3 years subject to the rules Yes, from 7th financial year from the year of a/c opening

No

NA

A/C can be opened by an individual, minor or on behalf of a minor. 2% read our complete post on Public Provident fund here: http://sohamfp.com/public-provident-fund/

Loans are allowed from 3rd 5th financial year

Taxable

No

Yes (after expiry of 1 year)

1-3 years: 2%, More than 3 years= 1%

No

NA

Joint account allowed Nomination allowed Transferable account from 1 post office to another post office Conversion of single to joint and vice versa allowed One transaction of deposit or withdrawl necessary in 3 years A/c can be opened in name of minor Minor of 10 years and above can open and operate an a/c Any number of a/c can be opened in one post office subject to maximum investment limit by adding balance in all accounts. Interest can be obtained through auto credit into savings account through PDCs or ECS Joint account allowed Nomination allowed Transferable account from 1 PO to another Conversion of single to joint and vice versa allowed. One transaction of deposit or withdrawl necessary in 3 years. A/c can be opened in name of minor. Minor of 10 years and above can open and operate an a/c. After 4 continious defaults in deposit, the a/c will become discontinue and can be revived within 2 months. If not revived, no further deposit can be made in account. Rebate on advance deposit of at least 6 installments. Any number of a/c can be opened in one post office.

Recurring Deposit

NIL

5 years - can be extended every year (upto max. 5 years)

8.40% p.a. (compounded quarterly)

Maturity

Rs. 10 per month or any No Limit amount in multiples of Rs 5

No

Taxable

No

Yes (one withdrawal after 1 NIL year - upto 50% of balance as on that date)

No

NA

Time Deposit

NIL

1/2/3/5 years

1 year- 8.40%; 2 year- 8.40%; 3 year- 8.40%; 5 year- 8.50% (compounded quarterly)

Annually

Rs 200 and in multiples No Limit thereof.

Yes - only 5yr TD scheme qualifies for a tax deduction u/s 80C

Taxable

No

After 6 months

Money paid out will be at the rate of interest as reduced by 2%

Yes

Joint account allowed Nomination allowed Transferable account from 1 PO to another Conversion of single to joint and vice versa allowed. A/c can be opened in name of minor. Minor of 10 years and above can open and operate an a/c. Any number of a/c can be opened in one post office. 2,3 & 5 year a/c can be closed after 1 year at discount. A/c can also be closed after six months but before one year with interest @post office savings account.

Savings Bank account

NIL

Running a/c

4% p.a. For Single Running a/c / Joint accounts

Rs 20

Single A/c- Rs. 1 lac/ Joint A/c- Rs. 2 lacs

No

Exempt upto Rs. 3500 for No single account and Rs. 7000 for joint account

Not applicable - as it is a running account

NA

NA

NA

Joint account allowed, Nomination allowed, A/c can be transfered from one PO to another Conversion of single to joint and vice versa allowed. One transaction of deposit or withdrawl necessary in 3 years. A/c can be opened in name of minor. Minor of 10 years and above can open and operate an a/c. One a/c can be opened in one post office. Joint a/c can be opend with spouse only and first depositor will be the investor. Transferable a/c from one post office to another. The a/c is closed if the person dies without nominating spouse as nominee. If spouse is nominee, she can continue account even being at age below 60 years. Any number of a/c can be opened in one post office subject to maximum investment limit by adding balance in all a/c's. Interest can be obtained through auto credit into savings account through PDCs or ECS. TDS will be deducted if interest is > Rs. 10K p.a.

Senior Citizen Savings Scheme (SCSS)

Individual must have completed 60 years/ 55 years in case of retirement NRIs and HUF cannot invest

5 years (one time extension allowed for 3 years)

9.2% p.a.

Quarterly

Rs. 1000

Rs. 15 lacs

Yes, under Section 80C of Income Tax Act

Taxable

No

Yes (after expiry of 1 year)

Between 1-2 years - 1.5% After 2 years - 1%

Das könnte Ihnen auch gefallen

- Thrift Savings Plan Investor's Handbook for Federal EmployeesVon EverandThrift Savings Plan Investor's Handbook for Federal EmployeesNoch keine Bewertungen

- SB and Jan Suraksha SchemesDokument54 SeitenSB and Jan Suraksha SchemesSreemon P VNoch keine Bewertungen

- Post Office Monthly Income SchemeDokument7 SeitenPost Office Monthly Income SchemeLaxman RathodNoch keine Bewertungen

- Post Office SchemesDokument27 SeitenPost Office SchemesvarshapadiharNoch keine Bewertungen

- Scheme Interest Payable, Rates, Periodicity Etc. Investment Limits and Denominations Salient Features Including Tax RebateDokument4 SeitenScheme Interest Payable, Rates, Periodicity Etc. Investment Limits and Denominations Salient Features Including Tax RebatesumitakumariNoch keine Bewertungen

- Post Office Saving Schemes in IndiaDokument10 SeitenPost Office Saving Schemes in IndiaRagavendra RagsNoch keine Bewertungen

- SchemeDokument3 SeitenSchemeavinash1109Noch keine Bewertungen

- Small Saving SchemeDokument30 SeitenSmall Saving SchemePallaviNoch keine Bewertungen

- Sources of FinanceDokument24 SeitenSources of FinanceAnkit Sinai TalaulikarNoch keine Bewertungen

- Post Office Savings SchemesDokument8 SeitenPost Office Savings SchemesKailashnath GantiNoch keine Bewertungen

- Public Provident Fund SchemeDokument3 SeitenPublic Provident Fund SchemeAshish PatilNoch keine Bewertungen

- Small Savings SchemesDokument10 SeitenSmall Savings SchemesankitNoch keine Bewertungen

- PPF & Sukanya SamriddhiDokument7 SeitenPPF & Sukanya Samriddhicarry minatteeNoch keine Bewertungen

- Postal InsuranceDokument21 SeitenPostal InsuranceMaha RasiNoch keine Bewertungen

- National Savings Monthly IncomeDokument3 SeitenNational Savings Monthly Incomejack sNoch keine Bewertungen

- Top 5 Small Saving Schemes by Government of India GK Notes As PDFDokument6 SeitenTop 5 Small Saving Schemes by Government of India GK Notes As PDFsachin vastrakarNoch keine Bewertungen

- Post Office SchemeDokument10 SeitenPost Office SchememehtadiveshNoch keine Bewertungen

- Post Office SchemesDokument10 SeitenPost Office SchemesmuntaquirNoch keine Bewertungen

- Financial Schemes IndiaDokument3 SeitenFinancial Schemes IndiainvkrishnanNoch keine Bewertungen

- Assignment of Security Analysis & Portfolio Management On Post Office DepositsDokument6 SeitenAssignment of Security Analysis & Portfolio Management On Post Office DepositsShubhamNoch keine Bewertungen

- Assignment of Security Analysis & Portfolio Management On Post Office DepositsDokument6 SeitenAssignment of Security Analysis & Portfolio Management On Post Office DepositsShubhamNoch keine Bewertungen

- Chapter 4 Investment ProductsDokument14 SeitenChapter 4 Investment ProductsMalar KodiNoch keine Bewertungen

- Sbi FDDokument2 SeitenSbi FDAngela Ramos0% (1)

- SAPMDokument45 SeitenSAPMswamyNoch keine Bewertungen

- Public Provident Fund (PPF) : Name of The SchemeDokument5 SeitenPublic Provident Fund (PPF) : Name of The SchemeSumit GuptaNoch keine Bewertungen

- What Is PPF Account and The Benefits of Investing in PPF?Dokument2 SeitenWhat Is PPF Account and The Benefits of Investing in PPF?Vikash SuranaNoch keine Bewertungen

- Postal Savings Schemes: Post Office Savings BankDokument14 SeitenPostal Savings Schemes: Post Office Savings Bankaditya chNoch keine Bewertungen

- Govt Schemes 3.1.23Dokument27 SeitenGovt Schemes 3.1.23Sumit Suman ChaudharyNoch keine Bewertungen

- PPFrules 14 PDFDokument3 SeitenPPFrules 14 PDFPratap Narayan SinghNoch keine Bewertungen

- Corp Tax Saver Plus: Terms & ConditionsDokument1 SeiteCorp Tax Saver Plus: Terms & ConditionsranajithdkNoch keine Bewertungen

- Po SchemesDokument3 SeitenPo SchemesSitaraMadhavanNoch keine Bewertungen

- What Is Sukanya Samriddhi YojanaDokument7 SeitenWhat Is Sukanya Samriddhi Yojanaaarja sethiNoch keine Bewertungen

- What Is The Differences Between GPF EPFDokument7 SeitenWhat Is The Differences Between GPF EPFsanthoshkumark20026997Noch keine Bewertungen

- Non-Marketable Financial Assets: Bank DepositsDokument8 SeitenNon-Marketable Financial Assets: Bank DepositsDhruv MishraNoch keine Bewertungen

- Inestment PlanDokument17 SeitenInestment PlanNikunj AgrawalNoch keine Bewertungen

- 15 Year Public Provident Fund AccountDokument1 Seite15 Year Public Provident Fund AccountAndRoid DeveLoPerNoch keine Bewertungen

- Presentation On Post Office: by Nitika DhyaniDokument21 SeitenPresentation On Post Office: by Nitika Dhyaniparag sonwaneNoch keine Bewertungen

- A Simple Guide To Fixed DepositDokument1 SeiteA Simple Guide To Fixed DepositchiragdedhiaNoch keine Bewertungen

- Public Provident Fund (PPF) Scheme 1968Dokument1 SeitePublic Provident Fund (PPF) Scheme 1968Karthic KeyanNoch keine Bewertungen

- Kisan Vikas PatraDokument16 SeitenKisan Vikas PatraAnonymous aAMqLLNoch keine Bewertungen

- Public Provident FundDokument10 SeitenPublic Provident FundJubin JainNoch keine Bewertungen

- Ublic Deposit Scheme: Application FormDokument2 SeitenUblic Deposit Scheme: Application Formsarvesh.bhartiNoch keine Bewertungen

- 7 Must Know Facts About Public Provident FundDokument2 Seiten7 Must Know Facts About Public Provident FundAmit VermaNoch keine Bewertungen

- Public Provident Fund (PPF)Dokument3 SeitenPublic Provident Fund (PPF)rupesh_kanabar1604100% (2)

- PPF Section 80cDokument8 SeitenPPF Section 80cPaymaster ServicesNoch keine Bewertungen

- Aggarwal SahibDokument3 SeitenAggarwal Sahibrohitsharma465Noch keine Bewertungen

- Your PPF InformationDokument3 SeitenYour PPF InformationJitender ManralNoch keine Bewertungen

- BankDokument36 SeitenBankSachin ManjhiNoch keine Bewertungen

- Small Savings and Fixed IncomesDokument12 SeitenSmall Savings and Fixed Incomeskk0675Noch keine Bewertungen

- Safe Investment: Post Office SchemesDokument2 SeitenSafe Investment: Post Office SchemesAparna DixitNoch keine Bewertungen

- Public Provident Fund Scheme 1968: Salient FeaturesDokument16 SeitenPublic Provident Fund Scheme 1968: Salient FeaturesjyottsnaNoch keine Bewertungen

- Indian Post OfficeDokument75 SeitenIndian Post OfficeEvanchalin mercyNoch keine Bewertungen

- Salient Features of Sukanya Samriddhi YojanaDokument3 SeitenSalient Features of Sukanya Samriddhi Yojanajha.sofcon5941Noch keine Bewertungen

- Senior Citizen Savings SchemeDokument1 SeiteSenior Citizen Savings SchemeSankar SilNoch keine Bewertungen

- Chapter 3Dokument25 SeitenChapter 3Amala JosephNoch keine Bewertungen

- Small Savings Scheme in IndiaDokument16 SeitenSmall Savings Scheme in IndiasomashekhareddyNoch keine Bewertungen

- Al Rajhi BankDokument4 SeitenAl Rajhi BankSimon LeeNoch keine Bewertungen

- All GBD SchemesDokument26 SeitenAll GBD SchemesElizabeth ThomasNoch keine Bewertungen

- 11 Ways To Plan Financial LifeDokument5 Seiten11 Ways To Plan Financial LifeClifford DmelloNoch keine Bewertungen

- CMA-How To Save Tax 2013-14Dokument37 SeitenCMA-How To Save Tax 2013-14sunilsunny317Noch keine Bewertungen

- Sample FHC ReportDokument24 SeitenSample FHC Reportabhinav0115Noch keine Bewertungen

- NSC Interest CalculatorDokument1 SeiteNSC Interest Calculatorabhinav0115100% (1)

- SB10 B ApplnforTfrofAccntDokument1 SeiteSB10 B ApplnforTfrofAccntRidhima_Dhingr_8846Noch keine Bewertungen

- Form-A - (PPF Opening) PDFDokument2 SeitenForm-A - (PPF Opening) PDFprithvirajd20Noch keine Bewertungen

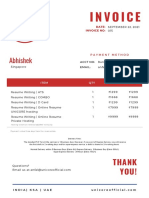

- Unicore InvoiceDokument1 SeiteUnicore InvoiceUNICORE No.1 Resume Writer in IndiaNoch keine Bewertungen

- Deposit Function PDFDokument75 SeitenDeposit Function PDFrojon pharmacyNoch keine Bewertungen

- Department of Education: Region IX, Zamboanga Peninsula Division of Zamboanga City Tolosa, Zamboanga CityDokument1 SeiteDepartment of Education: Region IX, Zamboanga Peninsula Division of Zamboanga City Tolosa, Zamboanga CityRay FaustinoNoch keine Bewertungen

- Unit 1-The Organisation of The Financial Industry PDFDokument25 SeitenUnit 1-The Organisation of The Financial Industry PDFNguyễn Văn NguyênNoch keine Bewertungen

- Generic ATM Interface User Guide PDFDokument90 SeitenGeneric ATM Interface User Guide PDFBIDC Email100% (1)

- Admit Card For MCQ Test, Written Exam & Viva Voce: Bangladesh BankDokument1 SeiteAdmit Card For MCQ Test, Written Exam & Viva Voce: Bangladesh Bankrupesh chakmaNoch keine Bewertungen

- Sbi New Atm Card Form PDFDokument2 SeitenSbi New Atm Card Form PDFLalrinpuii Joute0% (1)

- Cash Management of Icici BankDokument19 SeitenCash Management of Icici BankBassam QureshiNoch keine Bewertungen

- Banking Awareness-Live - Credit Rating AgenciesDokument2 SeitenBanking Awareness-Live - Credit Rating AgenciesyugandharNoch keine Bewertungen

- T24 Induction Business - TellerDokument62 SeitenT24 Induction Business - TellerCHARLES TUMWESIGYE100% (1)

- Investagrams ReportDokument6 SeitenInvestagrams ReportKaren Jella EscobinNoch keine Bewertungen

- Engineering Economy Course Student 2Dokument21 SeitenEngineering Economy Course Student 2Ashraf BestawyNoch keine Bewertungen

- Audit of Cash PDFDokument2 SeitenAudit of Cash PDFCharlize Natalie ReodicaNoch keine Bewertungen

- Important Schemes - Department of Financial Services - Ministry of Finance - Government of IndiaDokument4 SeitenImportant Schemes - Department of Financial Services - Ministry of Finance - Government of IndiaritulNoch keine Bewertungen

- Acct Statement XX8988 01102021Dokument1 SeiteAcct Statement XX8988 01102021punit GroverNoch keine Bewertungen

- Share Transfer FileDokument56 SeitenShare Transfer FileSARIKA MEHROTRANoch keine Bewertungen

- BFM - International Banking QuestionsDokument5 SeitenBFM - International Banking Questionsaathira. m.dasNoch keine Bewertungen

- 11th Commerce Centum MaterialDokument4 Seiten11th Commerce Centum MaterialMylai Artz KumarrNoch keine Bewertungen

- Impact of Cashless Economy On Common Man in India: Pappu B. Metri & Doddayallappa JindappaDokument3 SeitenImpact of Cashless Economy On Common Man in India: Pappu B. Metri & Doddayallappa Jindappajasleen kaurNoch keine Bewertungen

- Econ QB QB - Ch20 (ENG)Dokument59 SeitenEcon QB QB - Ch20 (ENG)William MaNoch keine Bewertungen

- Summary Account Payable Statement: JiopayDokument1 SeiteSummary Account Payable Statement: JiopayhazihappyNoch keine Bewertungen

- Chapter 10: Money and Banking OpenerDokument55 SeitenChapter 10: Money and Banking OpenerDwi NurjanahNoch keine Bewertungen

- Research ProposalDokument49 SeitenResearch ProposalAmanuel HawiNoch keine Bewertungen

- 161226070012Dokument17 Seiten161226070012Optimuz Optimuz100% (1)

- Letter of CreditDokument6 SeitenLetter of CreditbhumishahNoch keine Bewertungen

- STPM MATHEMATICS M Coursework/Kerja Kursus (Semester 1)Dokument11 SeitenSTPM MATHEMATICS M Coursework/Kerja Kursus (Semester 1)jq75% (4)

- RBI ROI FormatDokument11 SeitenRBI ROI FormatDevender RajuNoch keine Bewertungen

- Banking State Policies: The New Central Bank ActDokument14 SeitenBanking State Policies: The New Central Bank ActTan Mark AndrewNoch keine Bewertungen

- Final PNB BankDokument70 SeitenFinal PNB BankMitesh SonegaraNoch keine Bewertungen

- General Standing Instruction Order Payment PDFDokument3 SeitenGeneral Standing Instruction Order Payment PDFmiriam chewNoch keine Bewertungen