Beruflich Dokumente

Kultur Dokumente

Q1 2013 Bulletin From Muscat Securities Market

Hochgeladen von

MENAanalystOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Q1 2013 Bulletin From Muscat Securities Market

Hochgeladen von

MENAanalystCopyright:

Verfügbare Formate

Overview of First Quarter ( Q1 ) 2013

2013

! )

-C

:

General Index Activity:

At the end of Q1 2013, MSM 30 Index closed at a level of 5,989.68 points compared

5,989.68

to 5,690.07 points recorded in the corresponding period of the previous year, with

30

"% %5.27 ! ! & '

an increase of 5.27%. The highest close level for the index (MSM ) during Q1 of 2013

2012

6,174.34 $

(" !

was 6,174.34 points as on 26 Mar 2013. On other hand, the lowest close level was

. 2013 ""1 (" !

5,763.77 points as on 01 Jan 2013 .

2013

2013

"# $%

)*

)+

5,763.77 - ' . ' )* /

:

1 " 10.52 !' 1 " 12.19 2013

5 0 " 31.66

as against R. 10.52 billion ( US$ 27.31 billion ) as in Q1 2012, recording an increase

0"

by 15.92% .

The Turnover of Q1 2013 reached R. 515.94 million (US$ 1,340.10 million) compared

( $"

$%

26

"# $% "2

" 34!

6 ) %15.92 ! !& ' +&

), $7

- ' .'

.( !

- ' . ' $ " 5 0 " 27.31 ! $ "

5 0 " 1,340.10 ) 1

2012

to R. 268.53 million (US$ 697.49 million) for the same period of the previous year,

,

2013 .

0 ,

Trading Activity:

The Market Capitalization of Q1 2013 reached R. 12.19 billion ( US$ 31.66 billion ),

"# $%

5,690.07 !

" 515.94

)* ( $ "

"

"234! "%

5 0 " 697.49 ) 1

" 268.53 !

. %92.13 8 '

and it increased by 92.13% .

The total number of Securities Traded of Q1 of 2013 reached 2,182.62 million

" 901.26 !

compared to 901.26 million shares traded during Q1 of 2012, increased by

2013

142.17% .

)* "

! &

),

. %142.17 8 '

" 2,182.62

!!

0

- ' . ' )* "

:$

Activities Sector-wise:

In term of total number of shares traded, Financial Sector was the most active

sector during Q1 of 2013, it reached 1,501.47 million shares which represents

68.79% of the total number of Securities traded, and R. 288.38 million of Turnover.

&# & 0$

9" 3

34! "% .

"

" 321.21

Followed by, Industrial Sector with number of shares of 321.21 million shares and

total Turnover of R. 99.11 million. At the end, Services Sector recorded 247.78

00 $ ,+

0

9"

.1

.1

27.66% . The value of shares bought by Non-Omani investors, during Q1 reached R.

"

""

116.49 million comprising 22.58% of the total value. The value of shares sold by Non-

"3"

"2 $ ,+

Omani investors during the same period reached R. 106.58 million comprising

$% ""

" =

$%$!,

; 5!

" 106.58 - ' . ' )* #

""

reached R. 12.61 million as aggregate Buy.

;);

" "%

.%27.66

" 116.49

""

.

2013

" 247.78

# "234! "% #

! 34!0%

"!

"4 $

"2

"234! #

"4

)*

.' #

;5 $

34!0% >

:$

%22.58 : "

" 12.61 @! 2013

" 1,501.47

" 288.38 8

" 116.03

20.66% of the total value.

In addition, the net institutional investment of Non-Omani in the market for Q1 2013

;"

" 99.11 8

Non-Omani Investment & Institutional Investment:

Regarding to Foreign Investment in the market, Non-Omani Investment has reached

2013

< 8 2/"" 1

9" 3 0* 8 2&;;

million shares and total turnover of R. 116.03 million.

%68.79 !

!

" 3 "!

"2$ ,+

;5

" "%

?

)* #

"234! .

%20.66 /!

; 5 $%< A B ! "0,

.>

<

1

$ ,+ 30

1,200,000,000

6,050

1,000,000,000

6,000

5,950

800,000,000

5,900

600,000,000

5,850

400,000,000

"

5,800

200,000,000

0

Turnover (Rial) E 1D

Volume

0 "

MSM 30 Index FG

"2

00

Published by Information Center - Muscat Securities Market

5,750

Jan

""

114,685,492.67

512,624,195

5,799.79

Feb " !%

187,876,011.68

712,720,593

5,975.58

5,700

Mar .

213,375,681.73

957,278,892

5,989.68

FG

00 E1D

"2

MSM 30 Index & Total Trading Activity for the First 3 Months of 2013

MSM 30 Index for the first 3 months of 2013

March

." *

2013

>!

2013

February

." *

" !%

2013

>!

;); - ' 30

January

." *

" "

2013

>;);

";

>;);

";

>;);

";

Thursday

Wednesday

Tuesday

Monday

Sunday

Thursday

Wednesday

Tuesday

Monday

Sunday

Thursday

Wednesday

Tuesday

Monday

Sunday

07 Mar 13

5,993.36

06 Mar 13

5,999.57

05 Mar 13

5,997.44

04 Mar 13

6,001.05

03 Mar 13

5,985.33

07 Feb 13

5,852.57

06 Feb 13

5,842.86

05 Feb 13

5,836.61

04 Feb 13

5,812.61

03 Feb 13

5,784.88

03 Jan 13

5,781.85

02 Jan 13

5,765.94

01 Jan 13

5,763.77

14 Mar 13

6,103.83

13 Mar 13

6,077.24

12 Mar 13

6,061.82

11 Mar 13

6,013.10

10 Mar 13

6,001.23

14 Feb 13

5,898.27

13 Feb 13

5,883.76

12 Feb 13

5,869.03

11 Feb 13

5,855.98

10 Feb 13

5,862.34

10 Jan 13

5,818.51

09 Jan 13

5,800.91

08 Jan 13

5,778.83

07 Jan 13

5,770.32

06 Jan 13

5,781.85

21 Mar 13

6,129.83

20 Mar 13

6,132.92

19 Mar 13

6,131.27

18 Mar 13

6,152.82

17 Mar 13

6,153.25

21 Feb 13

5,979.91

20 Feb 13

5,956.13

19 Feb 13

5,911.75

18 Feb 13

5,896.89

17 Feb 13

5,896.60

17 Jan 13

5,806.49

16 Jan 13

5,807.00

15 Jan 13

5,836.79

14 Jan 13

5,851.32

13 Jan 13

5,844.02

28 Mar 13

6,051.37

27 Mar 13

6,073.36

26 Mar 13

6,174.34

25 Mar 13

6,169.54

24 Mar 13

6,168.92

28 Feb 13

5,975.58

27 Feb 13

5,983.09

26 Feb 13

5,959.67

25 Feb 13

5,933.02

24 Feb 13

5,964.51

-I,+

Holiday

23 Jan 13

5,819.63

22 Jan 13

5,837.16

21 Jan 13

5,829.32

20 Jan 13

5,810.61

31 Jan 13

5,799.79

30 Jan 13

5,800.52

29 Jan 13

5,836.40

28 Jan 13

5,814.08

27 Jan 13

5,819.79

" "

31 Mar 13

5,989.68

>!

"

"

"

"

.

"

30

"

"

"

" !%

$ %

"

"

&

" "

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

$ %

" !%

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

* Note: the numbers from 1 to 23 describe No. of Traded Days.

"

"

" 00 H7

23

"

+1

2 : C)

The Turnover (Rial '000') for the first 3 months of 2013

March

." *

2013

>!

2013

February

." *

" !%

2013

>!

;); - ' (1 J )

January

." *

"2

" "

2013

>;);

";

>;);

";

>;);

";

Thursday

Wednesday

Tuesday

Monday

Sunday

Thursday

Wednesday

Tuesday

Monday

Sunday

Thursday

Wednesday

Tuesday

Monday

Sunday

07 Mar 13

5,912.52

06 Mar 13

9,822.72

05 Mar 13

10,317.50

04 Mar 13

9,360.68

03 Mar 13

10,788.57

07 Feb 13

7,315.51

06 Feb 13

6,597.87

05 Feb 13

5,174.96

04 Feb 13

5,394.47

03 Feb 13

6,913.68

03 Jan 13

6,321.42

02 Jan 13

5,270.52

01 Jan 13

6,178.36

14 Mar 13

12,303.61

13 Mar 13

9,712.65

12 Mar 13

10,908.51

11 Mar 13

8,948.27

10 Mar 13

7,756.67

14 Feb 13

13,993.03

13 Feb 13

7,192.51

12 Feb 13

6,233.29

11 Feb 13

6,332.38

10 Feb 13

5,473.35

10 Jan 13

8,214.62

09 Jan 13

6,026.85

08 Jan 13

5,543.65

07 Jan 13

4,497.61

06 Jan 13

4,595.82

21 Mar 13

9,204.60

20 Mar 13

9,682.56

19 Mar 13

8,814.40

18 Mar 13

8,271.49

17 Mar 13

9,745.30

21 Feb 13

10,520.99

20 Feb 13

14,106.06

19 Feb 13

8,436.55

18 Feb 13

8,254.87

17 Feb 13

4,620.28

17 Jan 13

6,496.78

16 Jan 13

3,728.23

15 Jan 13

4,300.14

14 Jan 13

5,921.44

13 Jan 13

3,198.19

28 Mar 13

7,663.88

27 Mar 13

12,922.47

26 Mar 13

11,132.05

25 Mar 13

10,372.85

24 Mar 13

22,023.57

28 Feb 13

33,348.53

27 Feb 13

8,715.75

26 Feb 13

12,383.87

25 Feb 13

10,068.80

24 Feb 13

6,799.25

-I,+

Holiday

23 Jan 13

5,024.82

22 Jan 13

4,652.89

21 Jan 13

5,378.63

20 Jan 13

5,017.05

31 Jan 13

6,476.20

30 Jan 13

6,220.00

29 Jan 13

5,713.54

28 Jan 13

3,950.59

27 Jan 13

1,958.16

31 Mar 13

7,710.80

>!

"

Jan 2013

Feb 2013

"

Mar 2013 "

0

'

"

(1J )

"2

'

"

"

"

"

&

" "

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

$ %

" !%

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

& Note: the numbers from 1 to 23 describe No. of Traded Days.

" 00 H7

"

"

"

23

+1

2 : C)

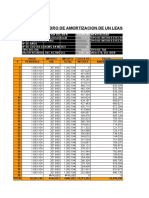

( 2013 - 2012 )

Summary of Statistics Data of Q1 ( 2012 - 2013 )

(1

" ) "2

"

3 '< 00

Market Capitalization ( Rial Million )

No. of Trades

"2

0 3 "L< +M *

Vale of Securities Traded

"

00

No. of Securities Traded

Period

"4 !

2013

2012

13.86%

11,889.71

10,442.76

13.62%

12,168.44

15.92%

15.92%

Var %

"4 !

2013

2012

21.71%

32,013

26,302

10,709.76

36.63%

36,648

12,189.69

10,515.68

21.44%

12,189.69

10,515.68

26.09%

Var %

"4 !

"4 !

2013

2012

68.35%

114,685,493

68,124,027

26,822

109.86%

187,876,012

43,801

36,067

92.43%

112,462

89,191

92.13%

2012

112.84%

512,624,195

240,853,082

January " "

89,524,264

221.56%

712,720,593

221,646,868

February " !%

213,375,682

110,885,843

118.18%

957,278,892

438,764,074

March .

515,937,186

268,534,135

142.17%

2,182,623,680

901,264,024

Q1

Var %

Var %

. "2

Note: All figures do not inculude OTC transactions except the Market Capitalization .

3 0*

<

Services Index

Industrial Index

"

K *

2013

2012

18.71%

2,963.09

2,496.11

14.42%

3,116.09

19.35%

3,150.72

Var %

E1

" D "2

"4 !

2013

2012

32.57%

7,691.32

5,801.84

2,723.39

29.38%

8,189.27

2,639.81

28.48%

8,155.30

Var %

MSM 30 Index

"

E1

) *+ ,#

" D

2013

2012

7.06%

6,763.81

6,317.59

6,329.84

8.39%

7,050.81

6,347.56

9.47%

7,271.57

Var %

"2 $ ,+

" ,: C )

30

Financial Index

"4 !

5 2

Period

"4 !

- '

2013

" D

"4 !

- '

2013

2012

4.29%

5,799.79

5,561.39

January " "

6,504.93

2.36%

5,975.58

5,837.66

February " !%

6,642.69

5.27%

5,989.68

5,690.07

* - # .

Var %

"

/

00 $ ,+

March .

FG

* 0

5,989.68

12,189.69

"

"

"

"

"

"

"

10,515.68

2,182.62

515.94

#

"

"

268.53

901.26

"

"

Var %

"4

15.9%

"

"

"

"

"

"

Var %

"4

92.1%

(

(

!

!

Var %

"4

142.2%

5,690.07

#

(

(

!

!

Var %

"4

5.3%

( O"

Trading Activity of Q1 in 2012 & 2013 ( Sector-wise )

$ ,N

30

00

3 '<

No. of

Trades

0 "2

(1)

Value of

Sec. (Rial)

3 0* 8 2

Bonds

Total

00

"

No. of

Sec. Traded

00

3 '<

No. of

Trades

0 "2

(1)

Value of

Bonds (Rial)

00

3 '<

No. of

Bonds Traded

No. of

Trades

0 "2

(1)

Value of

Shares (Rial)

2012 $

< 8 2

Services Sector

00

0 30

2 ) 2013

Industrial Sector

00

0

No. of

Shares Traded

00

3 '<

0 "2

(1)

Financial Sector

00

0

00

3 '<

0 "2

(1)

Period

00

0

-'

No. of

Trades

Value of

Shares (Rial)

No. of

Shares Traded

No. of

Trades

Value of

Shares (Rial)

No. of

Shares Traded

2012

26,302

68,124,027

240,853,082

11

52,755

47,303

6,574

19,768,918

36,620,498

7,478

13,049,707

48,502,802

12,239

35,252,647

155,682,479

January " "

26,822

89,524,264

221,646,868

48

1,488,030

1,369,352

9,446

37,447,169

58,375,023

6,550

21,625,184

59,034,939

10,778

28,963,880

102,867,554

February " !%

36,067

110,885,843

438,764,074

54

1,456,356

1,269,182

8,279

38,473,312

84,220,238

8,449

23,061,580

75,285,062

19,285

47,894,595

277,989,592

March .

89,191

268,534,135

901,264,024

113

2,997,141

2,685,837

24,299

95,689,400

179,215,759

22,477

57,736,471

182,822,803

42,302

112,111,122

536,539,625

Q1

2013

32,013

114,685,493

512,624,195

42

29,249

162,923

5,472

25,180,207

58,543,604

6,074

19,265,474

57,675,916

20,425

70,210,563

396,241,752

January " "

36,648

187,876,012

712,720,593

32

523,535

4,585,135

7,606

42,718,971

96,014,052

9,285

38,143,141

115,420,010

19,725

106,490,365

496,701,396

February " !%

43,801

213,375,682

957,278,892

37

11,866,561

107,423,995

7,922

48,129,615

93,217,546

10,364

41,701,232

148,114,083

25,478

111,678,274

608,523,268

112,462

515,937,186

2,182,623,680

111

12,419,345

112,172,053

21,000

116,028,793

247,775,202

25,723

99,109,846

321,210,009

65,628

288,379,202

1,501,466,416

89,191

268,534,135

901,264,024

113

2,997,141

2,685,837

24,299

95,689,400

179,215,759

22,477

57,736,471

182,822,803

42,302

112,111,122

536,539,625

!

2012

Q1 of 2012

112,462

515,937,186

2,182,623,680

111

12,419,345

112,172,053

21,000

116,028,793

247,775,202

25,723

99,109,846

321,210,009

65,628

288,379,202

1,501,466,416

!

2013

Q1 of 2013

314.37%

4076.43%

-14%

26%

92.13%

142.17%

Note: The figures do not inculude OTC .

-2%

21.26%

38.26%

14%

71.66%

75.69%

55%

157.23%

March .

Q1

Var % "4

179.84%

K *

5 2

" ,: C )

2013

Value of Buy & Sell by Groups for Q1 of

"!

Value of Sell

Nationalties

& Groups

8 ,

! 3

"2

, :

>

Value of Buy

0%

"! >

8 ,

"2

"2

3" ,

3

,

0%

Total

Institutions

Individuals

Total

Institutions

Individuals

OMANIS

409,352,630

79.34%

223,822,475

43.38%

185,530,155

35.96%

399,447,133

77.42%

225,881,331

43.78%

173,565,802

33.64%

GCC

63,129,834

12.24%

55,394,154

10.74%

7,735,680

1.50%

39,972,698

7.75%

33,681,379

6.53%

6,291,319

1.22%

ARABS

11,885,738

2.30%

186,224

0.04%

11,699,513

2.27%

11,533,156

2.24%

33,177

0.01%

11,499,980

2.23%

FOREIGN

31,568,984

6.12%

21,697,553

4.21%

9,871,431

1.91%

64,984,199

12.60%

56,172,436

10.89%

8,811,763

1.71%

: ,

Grand Total

515,937,186

100%

301,100,407

58.36%

214,836,779

41.64%

515,937,186

100%

315,768,323

61.20%

200,168,863

38.80%

$ ,N

"!

"2

" " ," *

>

.5 7

" " ," *

4 ++

"

"

# 3

:

2 25

"

"

# 3

""

1 2"

"

# 3

:

,

$1 6 4 "

"

# 3

:

,

$1 6 4 "

"

# 3

Value of Buy & Sell by Groups for First 3 Months of

"!

Value of Sell

8 ,

"2

0%

"2

" " ," *

4 ++

"

"

# 3

:

2 25

"

"

# 3

""

1 2"

"

# 3

""

2013

#

>

Value of Buy

8 ,

9); 3

, :

"! >

"2

"2

0%

3" ,

- '

Notionalty

Period

Total

Institutions

Individuals

Total

Institutions

Individuals

94,903,545

82.75%

50,934,400

44.41%

43,969,145

38.34%

84,228,726

73.44%

46,580,522

40.62%

37,648,204

32.83%

OMANIS

19,781,948

17.25%

12,836,710

11.19%

6,945,238

6.06%

30,456,767

26.56%

23,777,515

20.73%

6,679,252

5.82%

NON - OMANIS

114,685,493

100%

63,771,110

55.61%

50,914,382

44.39%

114,685,493

100%

70,358,037

61.35%

44,327,456

38.65%

136,543,833

72.68%

77,426,982

41.21%

59,116,850

31.47%

154,020,735

81.98%

94,789,432

50.45%

59,231,303

31.53%

OMANIS

51,332,179

27.32%

42,966,701

22.87%

8,365,478

4.45%

33,855,277

18.02%

25,072,122

13.35%

8,783,155

4.67%

NON - OMANIS

187,876,012

100%

120,393,683

64.08%

67,482,329

35.92%

187,876,012

100%

119,861,554

63.80%

68,014,457

36.20%

177,905,252

83.38%

95,461,092

44.74%

82,444,160

38.64%

161,197,672

75.55%

84,511,377

39.61%

76,686,295

35.94%

OMANIS

35,470,429

16.62%

21,474,521

10.06%

13,995,908

6.56%

52,178,009

24.45%

41,037,354

19.23%

11,140,656

5.22%

NON - OMANIS

213,375,682

100%

116,935,614

54.80%

96,440,068

45.20%

213,375,682

100%

125,548,731

58.84%

87,826,950

41.16%

""

""

"

" "

January

$ ,N

Total

""

""

"

" !%

February

$ ,N

Total

""

""

"

$ ,N

Total

.

March

( &"

2 ) 2013

2012

( ""

" ) $!,

; 5

FOREIGN INVESTMENT ( NON-OMANI ) for 2012 & Q1 of 2013 ( Sector-wise )

2012

3 0*

"4

General

8 ,

Change %

Total

<

Services

Industria

Financial

-'

: ,

""," *

: ,

""," *

: ,

""," *

: ,

""," *

Foreigners

GCC

Foreigners

GCC

Foreigners

GCC

Foreigners

GCC

Period

-0.30%

23.69%

7.18%

16.51%

7.86%

20.50%

10.67%

10.05%

6.02%

17.02%

Jan " "

-0.49%

23.57%

7.15%

16.42%

7.92%

20.60%

10.68%

9.95%

5.95%

16.88%

Feb " !

%

1.96%

24.04%

7.35%

16.69%

7.92%

20.65%

10.59%

9.95%

6.33%

17.26%

Mar .

-1.90%

23.58%

7.26%

16.32%

7.63%

19.87%

10.69%

10.00%

6.28%

16.86%

Apr " !

-0.43%

23.48%

7.21%

16.27%

7.58%

19.91%

10.71%

9.95%

6.21%

16.77%

May "

12.00%

26.30%

11.98%

14.32%

7.50%

19.83%

10.72%

10.01%

13.32%

13.86%

Jun " "

0.76%

26.50%

11.96%

14.54%

7.50%

21.02%

10.76%

10.01%

13.29%

13.88%

Jul " "

1.49%

26.89%

12.18%

14.72%

7.43%

20.81%

10.81%

10.01%

13.57%

14.19%

Aug .

-0.15%

26.85%

12.20%

14.66%

7.50%

20.83%

10.84%

10.10%

13.57%

14.08%

Sep ! !

-4.92%

25.53%

11.59%

13.94%

7.46%

20.85%

0.30%

66.53%

12.62%

13.11%

Oct !

10.33%

28.17%

12.43%

15.74%

7.48%

20.81%

10.90%

10.18%

13.79%

15.63%

Nov !%

-0.15%

28.13%

12.36%

15.76%

7.39%

20.85%

65.01%

0.06%

13.72%

15.67%

Dec ! "0

2013

3 0*

"4

General

8 ,

Change %

Total

<

Services

Industria

Financial

-'

: ,

""," *

: ,

""," *

: ,

""," *

: ,

""," *

Foreigners

GCC

Foreigners

GCC

Foreigners

GCC

Foreigners

GCC

Period

0.25%

28.20%

12.43%

15.77%

7.52%

20.85%

11.00%

10.04%

13.77%

15.69%

Jan " "

-0.33%

28.11%

12.42%

15.68%

7.57%

20.92%

11.05%

10.00%

13.73%

15.56%

Feb " !

%

-1.58%

27.66%

12.41%

15.25%

7.73%

20.73%

11.25%

10.13%

13.63%

14.97%

Mar .

2013

!

2012

$!,5 ; 5

Foreign Investment for Year 2012 & Q1 of 2013

#

#

#

3

3

3

#

3

#

3

#

#

#

!

$ %

2,

2 8

0: ,

1 /*

4 ++ ""," *

9 /

$ %

#

#

3

#

3

#

2013 ( .

Securities Traded ( January - March ) 2013

- " ")

#

" C

Regular Market

Company Name

00

0 "

No. of

Days Traded

!

#

0

0

% Share

Turnover

)N

Close

Price

Low

Price

High

Price

U %N

00

3 '<

Opening

Price

No. Of

Trades

"2

0

Value of

Shares Traded

00

0 #

No. Of

Shares Traded

Financial

AHLI BANK

62

2.57%

0.168

0.168

0.189

0.180

1,662

5,840,648

32,433,395

AL ANWAR HOLDING

63

79.09%

0.208

0.134

0.213

0.134

5,605

16,018,007

94,908,585

AL OMANIYA FINANCIAL SER.

20

1.12%

0.360

0.315

0.370

0.316

65

819,277

2,379,983

AL SHARQIA INVESTMENT HOLDING

56

49.66%

0.149

0.101

0.160

0.107

2,050

4,975,266

39,726,851

BANK DHOFAR

59

1.27%

0.383

0.357

0.416

0.357

1,182

5,947,668

15,396,208

'C = !

BANK MUSCAT

63

4.82%

0.615

0.572

0.647

0.576

9,006

60,598,418

98,174,683

=!

BANK SOHAR

63

16.35%

0.194

0.167

0.198

0.176

4,723

32,710,475

179,852,715

DHOFAR INSURANCE

24

9.84%

0.230

0.177

0.245

0.177

103

4,497,749

19,676,696

DHOFAR INT.DEV.AND INV. HOLD

56

7.72%

0.449

0.375

0.507

0.375

1,251

6,646,582

15,443,456

GLOBAL FINANCIAL INVESTMENT

63

27.74%

0.105

0.092

0.114

0.092

3,518

8,704,261

83,207,288

GULF INVESTMENT SER.

63

352.79%

0.136

0.094

0.139

0.094

6,186

23,529,953

207,595,794

GULF INV. SER. PREF SHARES

0.21%

0.099

0.084

0.099

0.090

19,151

195,604

HSBC BANK OMAN

63

1.39%

0.180

0.168

0.207

0.207

1,573

5,277,443

27,756,202

MUSCAT FINANCE

15

0.06%

0.164

0.164

0.175

0.172

33

22,904

132,239

NATIONAL BANK OF OMAN

62

5.42%

0.283

0.279

0.308

0.285

2,549

17,673,871

60,082,966

OMAN AND EMIRATES INV. OM

63

133.23%

0.115

0.103

0.121

0.104

3,228

9,122,303

81,190,017

OMAN UNITED INSURANCE

56

25.13%

0.249

0.196

0.268

0.196

1,793

5,716,130

25,125,174

$? = !

7!

"

3 0* "

7!

; R "2

< =!

" Q

; 5

"

'C

"

" 0 'C

; R " 0

; N 3 0* "," *

-

-I

; ) "," *

$ $!. T = !

"

$

=!

-3

" Q -0

"

OMINVEST

63

6.59%

0.404

0.363

0.409

0.388

2,795

7,095,315

18,331,992

3 "'

ONIC. HOLDING

63

51.99%

0.320

0.289

0.340

0.290

2,330

28,022,160

90,155,065

7! =

TAAGEER FINANCE

60

6.41%

0.152

0.151

0.196

0.151

1,676

2,733,282

15,190,473

"

TRANSGULF IND. INV. HOLDING

63

196.54%

0.126

0.084

0.132

0.084

4,388

14,178,267

131,433,247

UNITED FINANCE

60

7.45%

0.150

0.148

0.192

0.150

1,299

3,504,548

20,481,871

57,019

263,653,679

1,258,870,504

Total

/7!

",Q

; R S" * !

"

-0

8 ,

<

Industrial

AL ANWAR CERAMIC TILES

62

9.00%

0.388

0.385

0.467

AL HASSAN ENGINEERING

62

57.87%

0.178

0.150

AL JAZEERA STEEL PRODUCTS

54

10.03%

0.296

0.293

ASAFFA FOODS

38

1.75%

0.752

DHOFAR CATTLE FEED

62

20.36%

0.296

0.413

1,836

8,860,211

21,149,911

0.185

0.150

0.322

0.305

2,447

7,474,474

43,524,873

873

3,855,838

12,532,583

0.530

0.825

0.550

157

1,317,207

2,029,413

"B P >'<

0.228

0.320

0.240

1,440

4,135,867

15,679,078

'C J)

="

"

)!

" 0#

"0"0 3 ,

-"I,

GALFAR ENGINEERING AND CON.

63

16.15%

0.342

0.338

0.380

0.363

3,946

13,540,470

37,311,765

35

GULF INT. CHEMICALS

58

92.77%

0.165

0.162

0.192

0.170

1,947

3,607,067

19,482,072

3"

NAT. ALUMINIUM PRODUCTS

59

180.82%

0.301

0.192

0.304

0.199

3,698

14,460,678

60,704,385

"

3,

OMAN CABLES INDUSTRY

56

6.82%

1.436

1.120

1.540

1.120

1,029

8,500,289

6,116,319

"

3)!

OMAN CEMENT

61

3.01%

0.636

0.630

0.677

0.650

1,202

6,454,632

9,971,276

OMAN CHLORINE

22

8.66%

0.650

0.549

0.650

0.549

79

3,321,185

5,346,782

"

OMAN FISHERIES

63

20.25%

0.114

0.102

0.124

0.102

1,563

2,798,882

25,316,401

"

OMAN FLOUR MILLS

51

1.86%

0.546

0.475

0.551

0.480

435

1,494,081

2,933,376

OMAN REFRESHMENT

17

0.38%

2.200

2.200

2.460

2.250

67

447,358

190,036

RAYSUT CEMENT

57

2.53%

1.480

1.420

1.565

1.425

826

7,436,717

5,057,208

SALALAH MILLS

39

3.80%

1.261

1.000

1.310

1.022

206

2,205,054

1,831,326

VOLTAMP ENERGY

63

24.42%

0.408

0.351

0.417

0.375

2,169

5,586,211

14,775,031

23,920

95,496,221

283,951,835

Total

0#

"

',

" 0 S" *

/"

<

3

"

3!

3

P3 "

/)<

2

8 ,

3 0*

Services

ACWA POWER BARKA

41

2.19%

0.539

0.400

0.550

0.419

378

1,601,230

3,507,143

> ! !

AL JAZEERA SERVICES

59

34.61%

0.426

0.378

0.488

0.388

2,380

9,196,443

21,184,894

3 0* -"I,

Al MAHA PETROLEUM PRODUCTS MAR

40

2.34%

20.670

18.400

20.700

18.449

148

3,251,363

161,394

MAJAN COLLEGE

14

0.33%

0.351

0.299

0.352

0.300

32

32,447

100,156

MUSCAT GASES

0.46%

0.850

0.840

0.870

0.859

15

117,050

136,819

NATIONAL GAS

10

0.72%

0.447

0.415

0.545

0.535

40

115,586

215,572

NAWRAS

63

5.97%

0.523

0.455

0.565

0.461

3,888

19,743,447

38,859,087

OMAN HOLDING INTERNATIONAL

27

5.18%

0.305

0.299

0.330

0.300

78

1,709,667

5,692,886

OMAN INVESTMENT AND FINANCE

63

82.24%

0.267

0.208

0.284

0.208

6,515

29,046,930

115,138,961

OMAN NATIONAL ENGINE. INVT.

21

0.33%

0.350

0.340

0.429

0.375

66

105,375

265,546

OMAN OIL MARKETING

20

0.35%

2.119

2.000

2.150

2.140

84

460,387

217,299

OMAN TELECOMMUNICATION

2,621

20,468,897

14,081,604

63

1.88%

1.413

1.380

1.501

1.470

PORT SER. CORPORATION

59

18.91%

0.479

0.478

0.565

0.522

1,377

9,915,706

17,973,545

RENAISSANCE SERVICES

60

9.85%

0.526

0.473

0.544

0.503

2,265

13,992,706

27,778,168

SHELL OMAN MARKETING

48

1.06%

2.227

2.212

2.400

2.393

280

2,350,003

1,008,875

SMN POWER HOLDING

27

2.33%

5.401

4.449

5.500

4.500

128

2,198,870

465,182

SOHAR POWER

46

2.50%

2.411

1.600

2.598

1.626

521

1,253,970

552,323

UNITED POWER

36

4.67%

1.161

1.050

1.441

1.060

138

223,669

162,984

Total

20,954

115,783,745

247,502,438

Market Total

101,893

474,933,645

1,790,324,777

" ' 3,

No. of Companies Traded : 56 :

"

#

,

"

3 I4

"

I4

.

/7!

"

"

"

; R

0# "

"

"

"

'

35< R "

>

3 0*

3 0* 7#

"

"

7!

<

/2

-0

8 ,

8 ,

0 3

00

2013 ( .

Securities Traded ( January - March ) 2013

- " ")

#

"I

Parallel Market

Company Name

00

0 "

No. of

Days Traded

!

#

0

0

% Share

Turnover

)N

Close

Price

Low

Price

High

Price

U %N

00

3 '<

Opening

Price

No. Of

Trades

"2

0

Value of

Shares Traded

00

0 #

No. Of

Shares Traded

Financial

AL BATINAH DEV. INV. HOLDING

50

39.03%

0.073

0.045

0.079

0.053

714

729,024

11,707,667

ALIZZ ISLAMIC BANK

62

3.58%

0.106

0.105

0.115

0.110

1,218

3,932,205

35,813,508

$ ) N I =!

BANK NIZWA

63

9.43%

0.110

0.100

0.117

0.105

4,566

15,640,239

141,484,713

I =!

FINANCIAL SERVICES

55

49.79%

0.079

0.056

0.089

0.070

1,551

2,526,998

32,365,875

MUSCAT NATIONAL HOLDING

0.40%

1.726

1.700

1.759

1.700

34,057

19,770

NATIONAL FINANCE

19

0.51%

0.153

0.130

0.155

0.134

120

177,008

1,274,308

NATIONAL SECURITIES

0.94%

0.056

0.055

0.067

0.061

47

13,270

234,149

OMAN ORIX LEASING

35

1.74%

0.149

0.135

0.160

0.136

127

568,940

3,788,016

THE FINANCIAL CORPORATION

11

0.09%

0.101

0.100

0.124

0.112

29

6,815

63,538

8,380

23,628,556

226,751,544

Total

; N

"

"

/7!

3 0*

"

"

"

"

P "

",Q . "

$

8 ,

<

Industrial

COMPUTER STATIONERY IND.

0.00%

0.325

0.320

0.325

0.320

105

328

CONSTRUCTION MATERIALS

IND.

61

39.54%

0.060

0.053

0.068

0.055

1,387

2,054,002

33,607,608

DHOFAR FISHERIES IND.

0.00%

1.279

1.278

1.279

1.278

72

56

GULF MUSHROOM PRODUCTS

14

3.38%

0.472

0.472

0.520

0.518

27

392,952

764,690

MAJAN GLASS

0.45%

0.340

0.340

0.497

0.497

35

76,905

191,072

MUSCAT THREAD MILLS

0.09%

0.178

0.178

0.225

0.184

2,340

10,889

NATIONAL DETERGENT

0.01%

0.899

0.810

0.899

0.810

729

900

"

NAT. PHARMACEUTICAL IND.

0.00%

0.100

0.100

0.110

0.110

17

"L 0 3

OMAN CHROMITE

2.56%

3.899

3.600

3.900

3.648

16

299,010

76,697

OMAN FIBER OPTIC

0.01%

2.760

2.500

2.760

2.760

1,328

500

OMAN PACKAGING

25

6.41%

0.290

0.230

0.332

0.253

166

666,264

2,080,234

OMAN TEXTILE HOLDING

17

1.38%

0.280

0.280

0.304

0.300

53

24,014

82,944

SWEETS OF OMAN

11

1.00%

0.949

0.900

1.000

0.920

42

66,350

70,318

1,743

3,584,072

36,886,253

Total

"!

"

"

<

>!0

<

'C

<

' K 5 "," *

, K,I

"*

<

< 3 'C

"

<

"

"

" <! J " ) "

J" 4

"

7!

S"

3"

8 ,

3 0*

Services

AL KAMIL POWER COMPANY

0.08%

2.250

1.930

2.282

1.930

16,283

7,401

DHOFAR UNIVERSITY

0.91%

1.098

1.050

1.130

1.119

142,411

127,310

SALALAH BEACH RESORT

0.29%

1.355

1.350

1.355

1.350

24,316

18,008

SALALAH PORT SERVICES

15

0.05%

0.530

0.490

0.540

0.490

26

45,632

88,372

Total

45

228,641

241,091

Market Total

10,168

27,441,269

263,878,888

2

'C

)< $

V

,

,

3 0* )<

8 ,

No. of Companies Traded : 26 :

8 ,

0 3

00

2013 ( .

Securities Traded ( January - March ) 2013

- " ")

#

;;

Third Market

Company Name

00

0 "

No. of

Days Traded

!

#

0

0

% Share

Turnover

)N

Close

Price

Low

Price

High

Price

U %N

00

3 '<

Opening

Price

No. Of

Trades

"2

0

Value of

Shares Traded

00

0 #

No. Of

Shares Traded

Financial

BANK SOHAR RIGHTS ISSUE

15.84%

0.070

0.034

0.074

0.068

Total

229

1,096,967

15,844,368

229

1,096,967

15,844,368

8

-

" 7%

< =!

8 ,

<

Industrial

NATIONAL MINERAL WATER

13

1.31%

0.041

0.035

0.045

0.040

23

9,707

262,699

OMAN CERAMIC COMPANY

14

1.65%

0.529

0.501

0.599

0.550

20

16,604

31,143

OMAN FILTERS INDUSTRY

0.37%

0.040

0.020

0.040

0.040

2,626

74,380

OMAN FOODS INTERNATIONAL

0.06%

0.167

0.150

0.175

0.150

616

3,699

60

29,554

371,921

Total

"0

W"

"

JI*

< "

" 0 "LB4 "

8 ,

3 0*

Services

1

16,407

31,673

Total

16,407

31,673

Market Total

290

1,142,927

16,247,962

OMAN INT. MARKETING

6.33%

0.518

0.518

0.518

0.518

"

" 0 "

8 ,

8 ,

No. of Companies Traded : 5 :

30

Bonds Traded

Bond Name

0 3

00

0 "

!

0

0

0

)N

U %N

00

3 '<

"2

0 30

00

0 30

00

No. of

Days Traded

% Bond

Turnover

Close

Price

Low

Price

High

Price

Opening

Price

No. Of

Trades

Value of

Bonds Traded

No. Of

Bonds Traded

AL OMANIYA FIN.SER .BONDS 3

1.24%

0.100

0.090

0.100

0.090

13,456

135,249

3 "

3 0* "

30

AL OMANIYA FIN.SER .BONDS 4

0.51%

0.103

0.100

0.103

0.103

52,730

511,942

4 "

3 0* "

30

BANK MUSCAT BONDS 6.25

0.03%

1.010

1.010

1.010

1.010

10,100

10,000

BANK MUSCAT BONDSNONGUARANT 7

0.20%

1.020

1.020

1.020

1.020

51,000

50,000

BANK MUSCAT CONVERTABLE

BONDS7

31

0.23%

1.206

1.100

1.206

1.198

81

43,467

37,498

7 "

BANK MUSCAT SUBORDINATED

BONDS

0.01%

1.140

1.140

1.140

1.140

11,400

10,000

RENAISSANCE SERVICES

BONDS3.75

10

26.33%

0.102

0.100

0.111

0.105

20

12,237,192

111,417,364

111

12,419,345

112,172,053

Total

6.25

= !3 0

"

= !3 0

!2

= !3 0

8 " ;

= !3 0

3.75 3 0* 7# 3 0

8 ,

No. of Bonds Traded : 7 :

0 30

00

2012 ( 6

Financial Performance of Companies ( Yearly ) 2012

Name of Company

3 0,

(1)

Total

Asset (Rial)

(1) "" ?

Shareholders

Equity (Rial)

$%<

(1) H!

(31\12\2012)

)N

# 00

(1) -0<

"

(1) "

"

# 0L

5 (1) " %0 (6

)0

Net

Profit (Rial)

Close Price

(31\12\2012)

Subscribed

Shares (Rial)

Par

Value (Rial)

Book

Value (Rial)

J 7

# " !

Earnings P/S Price Earnings

(Annualised)

Ratio

+)N

" %0 "

Price to

Book value

)3

+0L

"" ?

Return on

Equity

>0

0L

<

Return on

Asset

Financial

1,099,229,714

167,513,449

21,742,692

0.177

120,370,491

0.100

0.14

0.02

9.80

1.27

12.98%

1.98%

3,992,000

3,231,000

-290,000

0.052

3,000,000

0.100

0.11

-0.01

-5.38

0.48

-8.98%

-7.26%

; N

210,248,217

58,010,531

5,656,445

0.315

20,208,777

0.100

0.29

0.03

11.25

1.10

9.75%

2.69%

"

3 0* "

AL SHARQIA INVESTMENT

HOLDING

20,355,364

16,378,810

285,818

0.108

8,000,000

0.100

0.20

0.00

30.23

0.53

1.75%

1.40%

7!

; R "2

AL SHUROOQ INV. SER. HOLIDNG

5,375,635

4,321,709

-514,424

1.150

5,000,000

1.000

0.86

-0.10

-11.18

1.33

-11.90%

-9.57%

BANK DHOFAR

2,143,830,000

261,504,000

37,745,000

0.357

110,011,647

0.100

0.24

0.03

10.41

1.50

14.43%

1.76%

'C = !

BANK MUSCAT

7,913,669,000

1,072,621,000

139,206,000

0.576

203,851,068

0.100

0.53

0.07

8.43

1.09

12.98%

1.76%

=!

BANK SOHAR

178,716,600

144,880,000

23,011,000

0.176

10,000,000

0.100

1.45

0.23

0.76

0.12

15.88%

12.88%

< =!

DHOFAR INSURANCE

115,518,240

33,539,797

5,850,996

0.177

20,000,000

0.100

0.17

0.03

6.05

1.06

17.44%

5.06%

DHOFAR INT.DEV.AND INV. HOLD

174,737,977

83,450,763

11,069,279

0.375

20,000,000

0.100

0.42

0.06

6.78

0.90

13.26%

6.33%

FINANCIAL SERVICES

6,238,234

3,349,734

-1,162,400

0.069

6,500,000

0.100

0.05

-0.02

-3.86

1.34

-34.70%

-18.63%

FINCORP AL-AMAL FUND

3,941,784

3,797,448

74,931

1.109

3,448,644

1.000

1.10

0.02

51.04

1.01

1.97%

1.90%

GLOBAL FINANCIAL INVESTMENT

40,016,855

37,074,063

1,854,839

0.091

30,000,000

0.100

0.12

0.01

14.72

0.74

5.00%

4.64%

GULF INVESTMENT SER.

24,669,843

16,763,812

1,293,342

0.094

15,023,400

0.100

0.11

0.01

10.92

0.84

7.72%

5.24%

2,412,816,000

294,137,000

5,796,000

0.208

200,031,279

0.100

0.15

0.003

71.78

1.41

1.97%

0.24%

$ $!. T = !

3,252,311

3,218,464

133,874

1.700

2,669,927

1.000

1.21

0.05

33.90

1.41

4.16%

4.12%

107,174,000

28,861,000

3,846,000

0.168

20,160,961

0.100

0.14

0.02

8.81

1.17

13.33%

3.59%

48,811,763

14,537,116

-273,637

1.759

5,000,000

1.000

2.91

-0.05

-32.14

0.61

-1.88%

-0.56%

/7!

"

2,537,818,000

304,452,000

40,662,000

0.285

110,802,500

0.100

0.27

0.04

7.77

1.04

13.36%

1.60%

132,174,382

33,762,266

4,113,025

0.134

25,054,469

0.100

0.13

0.02

8.16

0.99

12.18%

3.11%

AHLI BANK

AL BATINAH DEV. INV. HOLDING

AL OMANIYA FINANCIAL SER.

HSBC BANK OMAN

MAJAN CAPITAL FUND

MUSCAT FINANCE

MUSCAT NATIONAL HOLDING

NATIONAL BANK OF OMAN

NATIONAL FINANCE

$? = !

"

; N 3 0*

" Q

; 5

"

" 0 'C

"

3 0*

:

"

'C

"% 0<

; R " 0

; N 3 0* "," *

0<

"

"

=!

"

NATIONAL REAL ESTATE

DEVLOPMEN

11,782,950

9,460,724

-108,345

5.000

1,762,500

1.000

5.37

-0.06

-81.34

0.93

-1.15%

-0.92%

OMAN AND EMIRATES INV. OM

50,969,994

16,102,599

2,330,858

0.103

12,187,500

0.100

0.13

0.02

5.39

0.78

14.48%

4.57%

-3

OMAN ORIX LEASING

88,493,550

28,169,051

3,163,627

0.136

21,775,000

0.100

0.13

0.01

9.36

1.05

11.23%

3.57%

",Q . "

OMAN UNITED INSURANCE

84,677,597

21,991,222

2,642,972

0.195

10,000,000

0.100

0.22

0.03

7.38

0.89

12.02%

3.12%

" Q -0

1,406,743,000

200,990,000

22,711,000

0.386

30,000,000

0.100

0.67

0.08

5.10

0.58

11.30%

1.61%

3 "'

114,236,622

53,371,873

4,307,147

0.286

17,342,325

0.100

0.31

0.02

11.52

0.93

8.07%

3.77%

7! =

94,931,000

29,386,000

3,905,000

0.150

21,667,273

0.100

0.14

0.02

8.32

1.11

13.29%

4.11%

"

103,488,557

35,801,609

3,397,269

0.153

25,001,202

0.100

0.14

0.01

11.26

1.07

9.49%

3.28%

OMINVEST

ONIC. HOLDING

TAAGEER FINANCE

UNITED FINANCE

"

"

"

",Q

"

-0

<

Industrial

ABRASIVES MANUFACTURING

1,295,583

-933,472

-354,704

0.050

1,000,000

1.000

-0.93

-0.35

-0.14

-0.05

-38.00%

-27.38%

AL ANWAR CERAMIC TILES

36,766,413

32,305,070

6,497,242

0.414

20,442,628

0.100

0.16

0.03

13.03

2.62

20.11%

17.67%

AL HASSAN ENGINEERING

55,751,976

11,542,718

-3,758,994

0.153

7,520,800

0.100

0.15

-0.05

-3.06

1.00

-32.57%

-6.74%

AL JAZEERA STEEL PRODUCTS

80,958,647

34,775,796

3,418,137

0.307

12,489,796

0.100

0.28

0.03

11.22

1.10

9.83%

4.22%

AL-OULA COMPANY

1,884,954

100,808

331,448

0.530

5,100,000

1.000

0.02

0.06

8.16

26.81

328.79%

17.58%

AREEJ VEGETABLE OILS AND

DERIV

43,542,015

10,206,152

2,313,710

2.501

4,600,000

1.000

2.22

0.50

4.97

1.13

22.67%

5.31%

" ! 3 "I S"

ASAFFA FOODS

38,709,990

23,113,880

7,270,603

0.559

11,025,000

0.100

0.21

0.07

8.48

2.67

31.46%

18.78%

"B P >'<

COMPUTER STATIONERY IND.

4,737,052

1,888,827

77,478

0.325

1,000,000

0.100

0.19

0.01

41.95

1.72

4.10%

1.64%

CONSTRUCTION MATERIALS IND.

10,298,895

7,983,414

67,210

0.054

8,500,000

0.100

0.09

0.001

68.29

0.57

0.84%

0.65%

DHOFAR BEVERAGES FOOD

STUFF

6,295,789

4,469,025

170,296

0.260

200,000

0.100

2.23

0.09

3.05

0.12

3.81%

2.70%

DHOFAR CATTLE FEED

56,185,000

42,464,000

1,736,000

0.240

7,700,000

0.100

0.55

0.02

10.65

0.44

4.09%

3.09%

DHOFAR FISHERIES IND.

7,516,861

1,328,364

130,580

1.279

2,540,000

1.000

0.52

0.05

24.88

2.45

9.83%

1.74%

DHOFAR POULTRY

3,847,891

2,581,250

3,089,690

2.224

3,000,000

1.000

0.86

1.03

2.16

2.58

119.70%

80.30%

FLEXIBLE IND. PACKAGES

6,450,385

668,822

-1,802,698

0.125

2,120,804

0.100

0.03

-0.09

-1.47

3.96

-269.53%

-27.95%

456,549,000

91,858,000

9,206,000

0.364

33,000,000

0.100

0.28

0.03

13.05

1.31

10.02%

2.02%

GALFAR ENGINEERING AND CON.

0

="

"

)!

" 0#

"0"0 3 ,

"!

"LB4 0

-"I,

"

<

>!0

<

3!

'C

'C J)

"

<

'C

'C , 0

3 '4

35

0#

<

',

2012 ( 6

Financial Performance of Companies ( Yearly ) 2012

Name of Company

3 0,

(1)

Total

Asset (Rial)

(1) "" ?

Shareholders

Equity (Rial)

$%<

(1) H!

(31\12\2012)

)N

# 00

(1) -0<

"

(1) "

"

# 0L

5 (1) " %0 (6

)0

Net

Profit (Rial)

Close Price

(31\12\2012)

Subscribed

Shares (Rial)

Par

Value (Rial)

Book

Value (Rial)

J 7

# " !

Earnings P/S Price Earnings

(Annualised)

Ratio

+)N

" %0 "

Price to

Book value

)3

+0L

"" ?

Return on

Equity

>0

0L

<

Return on

Asset

<

Industrial

GULF INT. CHEMICALS

3,499,844

2,785,375

284,835

0.169

2,100,000

0.100

0.13

0.01

12.46

1.27

10.23%

8.14%

GULF MUSHROOM PRODUCTS

7,626,196

4,716,819

806,080

0.520

2,059,200

0.100

0.23

0.04

13.28

2.27

17.09%

10.57%

GULF PLASTIC INDUSTRIES

3,208,672

1,615,111

319,998

0.389

1,000,000

1.000

1.62

0.32

1.22

0.24

19.81%

9.97%

GULF STONES

6,626,709

4,326,306

243,908

0.082

363,000

0.100

1.19

0.07

1.22

0.07

5.64%

3.68%

MAJAN GLASS

16,936,697

12,996,566

918,489

0.498

3,820,300

0.100

0.34

0.02

20.71

1.46

7.07%

5.42%

MUSCAT THREAD MILLS

2,556,745

1,457,809

209,451

0.195

1,018,325

0.100

0.14

0.02

9.48

1.36

14.37%

8.19%

NAT. ALUMINIUM PRODUCTS

15,188,793

6,993,435

337,176

0.195

3,357,145

0.100

0.21

0.01

19.42

0.94

4.82%

2.22%

NATIONAL BISCUIT INDUSTRIES

7,506,542

2,712,285

520,464

3.749

1,000,000

1.000

2.71

0.52

7.20

1.38

19.19%

6.93%

3"

NATIONAL DETERGENT

22,507,671

12,669,244

679,207

0.899

1,701,250

0.100

0.74

0.04

22.52

1.21

5.36%

3.02%

"

NATIONAL MINERAL WATER

10,715,538

-442,258

-1,266,771

0.036

201,277

0.100

-0.22

-0.63

-0.06

-0.16

-286.43%

-11.82%

NAT. PHARMACEUTICAL IND.

14,337,919

5,896,601

524,369

0.100

5,000,000

0.100

0.12

0.01

9.54

0.85

8.89%

3.66%

OMAN CABLES INDUSTRY

146,813,054

61,744,923

11,907,715

1.125

897,000

0.100

6.88

1.33

0.85

0.16

19.29%

8.11%

OMAN CEMENT

185,059,514

158,003,720

17,511,406

0.645

33,087,271

0.100

0.48

0.05

12.19

1.35

11.08%

9.46%

OMAN CERAMIC COMPANY

5,168,794

865,009

154,968

0.501

1,892,196

1.000

0.46

0.08

6.12

1.10

17.92%

3.00%

OMAN CHLORINE

20,530,311

17,600,809

3,127,015

0.549

6,177,203

0.100

0.28

0.05

10.85

1.93

17.77%

15.23%

OMAN CHROMITE

4,728,021

4,307,793

200,708

3.650

3,000,000

1.000

1.44

0.07

54.56

2.54

4.66%

4.25%

OMAN FIBER OPTIC

20,066,368

7,783,730

-1,559,688

2.760

4,744,057

1.000

1.64

-0.33

-8.40

1.68

-20.04%

-7.77%

OMAN FILTERS INDUSTRY

1,160,229

-172,670

-347,269

0.020

2,000,000

0.100

-0.01

-0.02

-1.15

-2.32

-201.12%

-29.93%

3"

"

" 0 S" *

' K 5 "," *

" " )! 3

< S" *

S" *

, K,I

"*

"

<

3,

/"

< "

< 3 'C

"

"0

"

W"

"L 0 3

"

<

"

3)!

<

JI*

"

"

" <! J " ) "

< "

OMAN FOODS INTERNATIONAL

3,762,284

1,121,054

-225,413

0.150

6,200,721

1.000

0.18

-0.04

-4.13

0.83

-20.11%

-5.99%

" 0 "LB4 "

OMANI EURO FOODS INDUSTRIES

5,002,000

909,000

-329,000

1.000

2,000,000

1.000

0.45

-0.16

-6.08

2.20

-36.19%

-6.58%

"! 5 "

OMAN PACKAGING

11,770,561

5,774,007

1,449,125

0.230

3,243,586

0.100

0.18

0.04

5.15

1.29

25.10%

12.31%

J" 4

OMAN REFRESHMENT

36,659,402

24,137,632

10,015,737

2.250

5,000,000

0.100

0.48

0.20

11.23

4.66

41.49%

27.32%

3!

OMAN TEXTILE HOLDING

9,580,155

8,511,120

-575,726

0.300

6,000,000

1.000

1.42

-0.10

-3.13

0.21

-6.76%

-6.01%

PACKAGING CO. LTD

6,608,763

2,048,669

-652,048

0.370

3,000,000

1.000

0.68

-0.22

-1.70

0.54

-31.83%

-9.87%

-0 0

195,292,881

117,111,140

24,533,815

1.440

20,000,000

0.100

0.59

0.12

11.74

2.46

20.95%

12.56%

SALALAH MILLS

59,812,063

20,512,084

5,332,695

1.022

4,816,306

0.100

0.43

0.11

9.23

2.40

26.00%

8.92%

SWEETS OF OMAN

6,805,687

3,031,516

910,251

0.902

700,000

0.100

0.43

0.13

6.94

2.08

30.03%

13.37%

VOLTAMP ENERGY

25,410,796

15,213,490

1,307,218

0.368

6,050,000

0.100

0.25

0.02

17.03

1.46

8.59%

5.14%

RAYSUT CEMENT

"

7!

S"

J" 4

P3 "

/)<

3"

3 0*

Services

ACWA POWER BARKA

135,399,511

39,633,477

7,261,219

0.427

16,000,000

0.100

0.25

0.05

9.41

1.72

18.32%

5.36%

AL BATINAH HOTELS

3,659,995

3,659,995

129,092

1.298

2,310,000

1.000

1.58

0.06

23.23

0.82

3.53%

3.53%

! 0%

AL BURAIMI HOTEL

4,078,726

2,933,635

35,937

0.880

3,572,832

1.000

0.82

0.01

87.49

1.07

1.22%

0.88%

$ " ! 0%

AL JAZEERA SERVICES

29,299,419

22,669,385

4,890,321

0.386

11,171,717

0.100

0.20

0.04

8.82

1.90

21.57%

16.69%

AL KAMIL POWER COMPANY

42,652,000

20,370,000

2,884,000

1.980

9,625,000

1.000

2.12

0.30

6.61

0.94

14.16%

6.76%

Al MAHA PETROLEUM PRODUCTS

MAR

72,257,825

40,593,757

10,029,382

18.464

6,900,000

1.000

5.88

1.45

12.70

3.14

24.71%

13.88%

DHOFAR TOURISM

54,926,355

45,932,404

-2,388,389

1.000

13,700,000

1.000

3.35

-0.17

-5.74

0.30

-5.20%

-4.35%

"

'C

GULF HOTELS (OMAN)

32,938,000

27,792,000

2,429,000

11.000

3,428,000

1.000

8.11

0.71

15.52

1.36

8.74%

7.37%

S" *

0%

HOTELS MANAGEMENT CO. INT.

16,867,141

12,017,234

2,509,133

1.250

3,000,000

1.000

4.01

0.84

1.49

0.31

20.88%

14.88%

INTERIOR HOTELS

16,090,612

7,017,771

626,869

0.129

5,001,750

0.100

0.14

0.01

10.29

0.92

8.93%

3.90%

> ! !

3 0* -"I,

" ' 3,

"

0 ' - 0N "

" *0 0 %

2012 ( 6

Financial Performance of Companies ( Yearly ) 2012

Name of Company

3 0,

(1)

Total

Asset (Rial)

(1) "" ?

Shareholders

Equity (Rial)

$%<

(1) H!

(31\12\2012)

)N

# 00

(1) -0<

"

(1) "

"

# 0L

5 (1) " %0 (6

)0

Net

Profit (Rial)

Close Price

(31\12\2012)

Subscribed

Shares (Rial)

Par

Value (Rial)

Book

Value (Rial)

J 7

# " !

Earnings P/S Price Earnings

(Annualised)

Ratio

+)N

" %0 "

Price to

Book value

)3

+0L

"" ?

Return on

Equity

>0

0L

<

Return on

Asset

3 0*

Services

9,288,450

7,492,959

1,393,694

0.859

3,000,000

0.100

0.25

0.05

18.49

3.44

18.60%

15.00%

605,320

464,102

-56,817

2.050

500,000

1.000

0.93

-0.11

-18.04

2.21

-12.24%

-9.39%

%"7 $

66,355,148

8,764,142

140,147

0.545

2,500,000

0.100

0.35

0.01

97.22

1.55

1.60%

0.21%

"

309,041,000

180,049,000

36,976,000

0.461

65,094,423

0.100

0.28

0.06

8.12

1.67

20.54%

11.96%

OMAN HOTELS AND TOURISM

33,702,644

27,720,950

2,083,488

2.205

5,500,000

1.000

5.04

0.38

5.82

0.44

7.52%

6.18%

OMAN MEDICAL PROJECTS

19,640,595

11,297,405

-124,693

0.100

8,324,578

0.100

0.14

-0.001

-66.76

0.74

-1.10%

-0.63%

OMAN NATIONAL ENGINE. INVT.

59,952,467

19,878,537

2,236,551

0.375

7,000,200

0.100

0.28

0.03

11.74

1.32

11.25%

3.73%

OMAN OIL MARKETING

75,365,232

39,156,664

9,023,552

2.142

6,450,000

0.100

0.61

0.14

15.31

3.53

23.04%

11.97%

729,437,000

502,334,000

113,047,000

1.471

75,000,000

0.100

0.67

0.15

9.76

2.20

22.50%

15.50%

PORT SER. CORPORATION

47,759,295

35,362,539

5,659,155

0.518

9,504,000

0.100

0.37

0.06

8.70

1.39

16.00%

11.85%

RENAISSANCE SERVICES

648,195,000

166,198,000

3,058,000

0.508

28,209,445

0.100

0.59

0.01

46.86

0.86

1.84%

0.47%

SALALAH BEACH RESORT

9,998,865

8,979,022

775,364

1.350

6,250,000

1.000

1.44

0.12

10.88

0.94

8.64%

7.75%

SALALAH PORT SERVICES

123,239,000

44,357,000

7,083,000

0.500

17,983,740

0.100

0.25

0.04

12.70

2.03

15.97%

5.75%

SHELL OMAN MARKETING

84,475,000

30,522,000

12,289,000

2.393

10,000,000

0.100

0.31

0.12

19.47

7.84

40.26%

14.55%

SMN POWER HOLDING

281,800,000

32,749,000

6,562,000

4.500

19,963,560

1.000

1.64

0.33

13.69

2.74

20.04%

2.33%

SOHAR POWER

182,790,000

6,342,000

2,940,000

1.626

27,800,000

1.000

0.23

0.11

15.38

7.13

46.36%

1.61%

UNITED POWER

23,912,000

13,572,000

584,000

1.050

8,717,265

1.000

1.56

0.07

15.67

0.67

4.30%

2.44%

MUSCAT GASES

NAT. HOSPITALITY INSTITUTE

NATIONAL GAS

NAWRAS

OMAN TELECOMMUNICATION

3 I4

0#

I4

"

"!

0'

"

"

0# "

"

"

"

'

35< R "

>

3 0*

3 0* 7#

)< $

3 0* )<

"

"

7!

/2

<

-0

! "031 $% "

Companies which their fiscal year do not end at 31st Dec

Name of Company

3 0,

(1)

Total

Asset (Rial)

(1) "" ?

Shareholders

Equity (Rial)

$%<

(1) H!

H! $%<

(1) 6

Net

Profit (Rial)

Annualized Net

Profit (Rial)

)N

Close Price

# 00

(1) -0<

"

(1) "

"

# 0L

5 (1) " %0 (6

)0

Subscribed

Shares (Rial)

Par

Value (Rial)

Book

Value (Rial)

J 7

# " !

Earnings P/S Price Earnings

Ratio

(Annualised)

+)N

" %0 "

Price to

Book value

$# 5$ 3

+0L

"" ?

Return on

Equity

0L

<

Return on

Asset

Financial

AL ANWAR HOLDING

41,083,000

22,344,000

1,148,000

1,530,667

0.132

12,000,000

0.100

0.19

0.01

10.35

0.71

6.85%

3.73%

NATIONAL SECURITIES

2,537,189

1,231,529

-290,460

-387,280

0.067

2,500,000

0.100

0.05

-0.02

-4.33

1.36

-31.45%

-15.26%

TRANSGULF IND. INV. HOLDING

11,715,915

8,274,001

2,334

3,112

0.083

6,687,500

0.100

0.12

0.00005

1783.62

0.67

0.04%

0.03%

THE FINANCIAL CORPORATION

8,016,981

7,213,310

-10,840

-14,453

0.124

7,002,996

0.100

0.10

-0.0002

-600.81

1.20

-0.20%

-0.18%

8

7!

"

P "

; R S" * !

/7!

$

<

Industrial

OMAN FISHERIES

23,769,605

15,607,576

-134,668

-179,557

0.102

12,500,000

0.100

0.12

-0.001

-71.01

0.82

-1.15%

-0.76%

OMAN AGRICULTURE DEV.

9,980,534

793,399

-438,570

-584,760

1.450

1,100,000

1.000

0.72

-0.53

-2.73

2.01

-73.70%

-5.86%

AL FAJAR AL ALAMIA

38,698,937

21,837,364

445,962

891,924

0.714

4,933,025

0.100

0.44

0.02

39.49

1.61

4.08%

2.30%

OMAN FLOUR MILLS

73,756,842

50,809,575

2,949,183

5,898,366

0.480

15,750,000

0.100

0.32

0.04

12.82

1.49

11.61%

8.00%

SOHAR POULTRY

7,822,017

2,243,267

552,632

1,105,264

0.206

3,000,000

1.000

0.75

0.37

0.56

0.28

49.27%

14.13%

"

"

I "

"

"

,'

"

, 0

<

3 0*

Services

OMAN HOLDING

INTERNATIONAL

127,232,632

52,109,289

758,740

1,011,653

0.300

11,000,000

0.100

0.47

0.01

32.62

0.63

1.94%

0.80%

OMAN INVESTMENT AND

FINANCE

72,824,325

23,250,192

1,755,905

2,341,207

0.207

14,000,400

0.100

0.17

0.02

12.38

1.25

10.07%

3.21%

OMAN INT. MARKETING

205,686

182,067

-8,438

-11,251

0.518

500,000

1.000

0.36

-0.02

-23.02

1.42

-6.18%

-5.47%

DHOFAR UNIVERSITY

50,205,581

12,723,911

869,609

3,478,436

1.130

14,000,000

1.000

0.91

0.25

4.55

1.24

27.34%

6.93%

'C

MAJAN COLLEGE

8,959,413

5,432,999

435,646

1,742,584

0.310

3,000,000

0.100

0.18

0.06

5.34

1.71

32.07%

19.45%

OMAN EDUCATION TRAINING

INV.

31,625,294

12,184,515

248,981

995,924

0.352

7,000,000

0.100

0.17

0.01

24.74

2.02

8.17%

3.15%

SAHARA HOSPITALITY

28,852,596

13,116,737

2,000,733

2,000,733

2.450

5,833,333

1.000

2.25

0.34

7.14

1.09

15.25%

6.93%

/7!

"

"

" "

"

"

; R

" 0 "

"

; R "

> <

%"7

2013

General Statistics 1989 - Q1 of 2013

$ " 0

3 '< 00

$ "

(1 J )

Trades Daily

Average

0

0

$ " 0

(J ) # 5 00

"

Turnover Daily

Average (R. '

000'

)

00

0 "

No. of Shares Traded

Daily Average ('

000'

)

No. of

Trading Days

! - 1989

00

3 '<

0 "2

(1 J )

No. of

Trades

Trunover

(Rial '

000'

)

No. of

Bonds ('

000'

)

3 "L< +

# 500

(J )

0

30 00

(J )

0

-'

Period

No. of Shares

Traded ("000)

23

62

40

153

3,459

9,509

--

6,037

1989

54

191

103

246

13,230

47,015

--

25,284

1990

57

239

103

246

13,940

59,004

--

25,396

1991

34

171

73

246

8,313

42,092

65

17,932

1992

30

341

141

245

7,246

83,469

819

34,418

1993

61

517

249

244

14,848

126,229

144

60,827

1994

106

440

225

248

26,203

1,091,612

57

55,743

1995

208

1,088

522

246

51,070

267,695

759

128,322

1996

657

6,567

1,668

246

161,597

1,615,402

105

410,261

1997

580

3,662

1,135

250

145,004

915,403

329

283,702

1998

513

1,033

575

245

125,609

253,012

795

140,813

1999

317

888

604

242

76,654

215,008

70

146,105

2000

2001

253

669

522

245

61,882

163,802

10,420

127,924

394

1,321

729

249

98,188

328,982

14,164

181,409

2002

761

2,381

1,266

249

189,415

592,822

14,164

315,219

2003

1,023

3,056

1,389

250

255,778

763,876

6,646

347,209

2004

1,550

5,539

2,017

254

393,697

1,406,879

3,092

512,221

2005

1,296

5,437

4,493

247

320,090

1,342,875

2,543

1,109,817

2006

2,301

10,736

13,799

248

570,768

2,662,497

1,433

3,422,159

2007

3,556

13,660

16,929

248

881,878

3,387,677

6,305

4,198,385

2008

4,268

9,287

24,665

246

1,049,899

2,284,628

23,882

6,067,649

2009

2,180

5,334

12,199

247

538,560

1,317,460

11,318

3,013,173

2010

1,462

4,031

9,619

246

359,596

991,566

14,101

2,366,218

2011

1,321

1,785

- * : ; .8

4,280

8,189

* /

1 +

17,346

32,864

< ; */

0 .* #

249

63

328,809

112,462

1,065,834

515,937

23,002

112,172

4,319,191

2,070,452

. /" "

2008

K *

2012

Q1 2013

0

5 2

: C)

2012

1,144

2,962

10,470

23

26,302

68,124

47

240,806

Jan

1,341

4,476

11,014

20

26,822

89,524

1,369

220,278

Feb

1,717

5,280

20,833

21

36,067

110,886

1,269

437,495

Mar "

1,394

4,196

14,040

64

89,191

268,534

2,686

898,578

Q1 # $ %&

2013

1,455

5,213

23,294

22

32,013

114,685

163

512,461

Jan

1,832

9,394

35,407

20

36,648

187,876

4,585

708,135

Feb

2,086

10,161

40,469

21

43,801

213,376

107,424

849,855

Mar "

1,785

8,189

32,864

63

112,462

515,937

112,172

2,070,452

1,394

4,196

14,040

64

89,191

268,534

2,686

898,578

Q1

2012

# $ %&

1,785

8,189

32,864

63

112,462

515,937

112,172

2,070,452

Q1

2013

# $ %&

28.09%

95.18%

134.07%

-1.56%

26.09%

92.13%

4076.43%

Q1 # $ %&

130.41%

Change % '(

"

"

"

"

"

"

"

1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

72

E1 J D

" $ "

72

8 =

EJ D # 5 00 $ "

Q1

2013

2013

Market Indices Performance 2013

>0

"," *

GCC Market Indices Performacne

"4

Benchmark

Var %

'

Var (Point)

2013/3/31 $%

Index in 31/3/2013

2012/3/31 $%

Index in 31/3/2012

Market

$!C !

ADX

18.50%

472.33

3,025.33

2,553.00

DFM

10.94%

180.37

1,829.24

1,648.87

KSE

9.03%

556.52

6,721.52

6,165.00

5,690.07

$!0

3"