Beruflich Dokumente

Kultur Dokumente

Valuation Template 2013

Hochgeladen von

capri69Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Valuation Template 2013

Hochgeladen von

capri69Copyright:

Verfügbare Formate

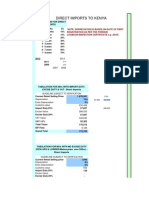

DIRECT IMPORTS TO KENYA

DEPRECIATION FOR DIRECT IMPORTS

0 - 6 months Over 6 months 1 - 2 years 2 - 3 years 3 - 4 years 4 - 5 years 5 - 6 years 6 - 7 years 7 - 8 years 5% 10% 15% 20% 30% 40% 50% 60% 70%

TABULATION FOR MVs WITH IMPORT DUTY, EXCISE DUTY & VAT - Direct Imports

GUIDELINE SUBJECT TO VERIFICATION

Current Retail Selling Price Depreciation Extra Depreciation Customs value Import Duty 25% Excise Value Excise Duty 20% VAT Value VAT 16 % Total Taxes IDF Fees Grand Total CIF

2,820,000 70% 0% 388,966 97,241 486,207 97,241 583,448 93,352 287,834 8,752 296,586 500,000 796,586

97,241

Dep counter Current Year YOM 2006 2013 7 NO of Yrs

TOTAL 588,310

TABULATION FOR MVs WITH NO EXCISE DUTY (PICK-UPS & LORRIES) - Direct Imports GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 552 Import Duty 25% 138 Excise Value Excise Duty 20% VAT Value 690

VAT 16% Total Taxes IDF Fees Grand Total

110 248 12 261

TABULATION FOR MVs WITH NO EXCISE DUTY & VAT (PRIME MOVERS) - Direct Imports GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 727 Import Duty 10% 73 Excise Value Excise Duty 20% VAT Value VAT 16% Total Taxes 73 IDF Fees 16 Grand Total 89

TABULATION FOR MVs WITH NO EXCISE DUTY (TRAILERS) - Direct Imports GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 690 Import Duty 10% 69 Excise Value Excise Duty 20% VAT Value 759 VAT 16% 121

IDF Fees 16

Total Taxes

206

TABULATION FOR Motor Cycles (<250cc) Previously Registered GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 640 Import Duty 25% 160 Excise Value Excise Duty 20% VAT Value VAT 16% -

IDF fees Total Taxes

14 174

TABULATION FOR MVs WITH NO EXCISE DUTY & VAT (BUS 29+ SEATER) - Direct Imports GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price Depreciation Extra Depreciation Customs value Import Duty 25% Excise Value Excise Duty 20% VAT Value VAT 16% IDF Fees Total Taxes 1,000 0% 0% 640 160 14 174

TABULATION FOR MACHINERIES WITH VAT ONLY (E.g BULLDOZERS) -Direct Imports GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price Depreciation Extra Depreciation Customs value Import Duty 25% Excise Value Excise Duty 20% VAT Value VAT 16% IDF Fees Total Taxes

1,000 0% 0% 690 110 16 126

PREVIOUSLY REGISTERED IN KENYA

Depreciation for previously Registered Motor Vehicle

0- .5 years .5 - 1 years

5% 20%

35% 50% 60% 70% 75% 80% 83% 86% 89% 90% 91% 92% 93% 94% 95%

1 - 2 years 2 - 3 years 3 - 4 years 4 - 5 years 5 - 6 years 6 - 7 years 7 - 8 years 8 - 9 years 9 - 10 years 10 - 11years 11 - 12 years 12 - 13 years 13 - 14 years 14 - 15 years over 15 years

TABULATION FOR MVs WITH IMPORT DUTY, EXCISE DUTY & VAT - Previously Registered in Kenya GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling Price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 460 Import Duty 25% 115 Excise Value 575 Excise Duty 20% VAT Value VAT 16 % Total Taxes 115 690 110 340

2013 2006 7

Dep counter Current Year YOM NO of Yrs

TABULATION FOR MVs WITH NO EXCISE DUTY (PICK-UPS & LORRIES) - Previously Registered in Kenya GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 552 Import Duty 25% 138 Excise Value Excise Duty 20% VAT Value 690

VAT 16% Total Taxes

110 248

TABULATION FOR MVs WITH NO EXCISE DUTY & VAT (PRIME MOVERS) - Previously Registered in Kenya GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 727 Import Duty 10% 73 Excise Value Excise Duty 20% VAT Value VAT 16% Total Taxes 73

TABULATION FOR MVs WITH NO EXCISE DUTY (TRAILERS) - Previously Registered in Kenya GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 627 Import Duty 10% 63 Excise Value Excise Duty 20% VAT Value 690 VAT 16% 110 Total Taxes 173

TABULATION FOR Motor Cycles (<250cc) Previously Registered in Kenya GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 640 Import Duty 25% 160 Excise Value Excise Duty 20% VAT Value VAT 16% -

Total Taxes

160

TABULATION FOR MVs WITH NO EXCISE DUTY & VAT (BUS 29+ SEATER) - Previously Registered in Kenya GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 640 Import Duty 25% 160 Excise Value Excise Duty 20% VAT Value VAT 16% Total Taxes 160

TABULATION FOR MACHINERIES WITH VAT ONLY (E.g BULLDOZERS) - Previously Registered in Kenya GUIDELINE SUBJECT TO VERIFICATION Current Retail Selling price 1,000 Depreciation 0% Extra Depreciation 0% Customs value 690 Import Duty 25% Excise Value Excise Duty 20% VAT Value VAT 16% 110 Total Taxes 110

CV

>>

510,000 CIF >> Ex-Rate >>

6,000 85

Local Taxes Profit Margin

Customs value Import Duty 25% Excise Value Excise Duty 20% VAT Value VAT 16 % Total Taxes IDF Fees Grand Total

510,000 127,500 637,500 127,500 765,000 122,400 377,400 11,475 388,875

127,500.00

CRSP

1,026,375.00

Das könnte Ihnen auch gefallen

- Motorcycle, Boat & Motor Vehicle Dealer Revenues World Summary: Market Values & Financials by CountryVon EverandMotorcycle, Boat & Motor Vehicle Dealer Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Valuation Template 2012Dokument19 SeitenValuation Template 2012Lemmy MulandiNoch keine Bewertungen

- VAT Presentation To The General PublicDokument27 SeitenVAT Presentation To The General PublicJoette PennNoch keine Bewertungen

- PRICE LIST AND CALCULATOR - Version 15Dokument106 SeitenPRICE LIST AND CALCULATOR - Version 15cmgimwaNoch keine Bewertungen

- Motor Vehicle Tax Calculator For ImportationDokument2 SeitenMotor Vehicle Tax Calculator For ImportationJulien ReddiNoch keine Bewertungen

- Final J&COTax Card 2015-16Dokument1 SeiteFinal J&COTax Card 2015-16Mansoor JanjuaNoch keine Bewertungen

- Malaysia GST PresentationDokument15 SeitenMalaysia GST PresentationJeffreyNoch keine Bewertungen

- Tax Reform Acceleration and InclusionDokument28 SeitenTax Reform Acceleration and InclusionWilliam Alexander Matsuhara AlegreNoch keine Bewertungen

- Tax Codes Gf7eDokument9 SeitenTax Codes Gf7eDragota MihaiNoch keine Bewertungen

- SARS Tax Tables: Download This Report and Save It On Your Desktop For Quick Tax Table Access 24/7Dokument6 SeitenSARS Tax Tables: Download This Report and Save It On Your Desktop For Quick Tax Table Access 24/7dannyboy738Noch keine Bewertungen

- Motor Vehicle Tax CalculatorDokument1 SeiteMotor Vehicle Tax CalculatorSidney MusondaNoch keine Bewertungen

- Central Excise and Sales TaxDokument37 SeitenCentral Excise and Sales TaxBhambore AtulNoch keine Bewertungen

- 0 Tax Tables 2011Dokument3 Seiten0 Tax Tables 2011rprakash123Noch keine Bewertungen

- Azam CFDokument10 SeitenAzam CFsahala11Noch keine Bewertungen

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDokument37 SeitenALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolNoch keine Bewertungen

- Tax Card 2013-14Dokument1 SeiteTax Card 2013-14Mudassir Ijaz100% (4)

- Issues of Taxation in Pakistan and Its SolutionsDokument40 SeitenIssues of Taxation in Pakistan and Its Solutionsعمر محمود100% (3)

- NTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage CapitalDokument5 SeitenNTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage Capitalhati1Noch keine Bewertungen

- Tax Reform For Acceleration and Inclusion (TRAIN) LAW: FeaturesDokument5 SeitenTax Reform For Acceleration and Inclusion (TRAIN) LAW: FeaturesAnni PagkatipunanNoch keine Bewertungen

- Business Attire SuiteeDokument2 SeitenBusiness Attire SuiteeKovalan RNoch keine Bewertungen

- Module 4 Intro To Business TaxDokument6 SeitenModule 4 Intro To Business TaxLexer John LorenzoNoch keine Bewertungen

- ISCO Tax Card TY 2016 FinalDokument13 SeitenISCO Tax Card TY 2016 FinalAtteique AnwarNoch keine Bewertungen

- A Critical Review of The Tax Structure of BangladeshDokument4 SeitenA Critical Review of The Tax Structure of BangladeshSumaiya IslamNoch keine Bewertungen

- Day 1 - Training MaterialsDokument12 SeitenDay 1 - Training MaterialsFarjana AkterNoch keine Bewertungen

- Proc. TX DescriptionDokument61 SeitenProc. TX DescriptionnelsonNoch keine Bewertungen

- Bus Tax Notes 2Dokument44 SeitenBus Tax Notes 2Zhaneah Rhej SaradNoch keine Bewertungen

- How To Calculate Tanzania Revenue Authority Car Import TaxDokument3 SeitenHow To Calculate Tanzania Revenue Authority Car Import Taxanna0% (1)

- Goods and Services Tax (GST)Dokument12 SeitenGoods and Services Tax (GST)Shanmughadas KGNoch keine Bewertungen

- Rates of Vehicle TaxDokument4 SeitenRates of Vehicle TaxmacumuNoch keine Bewertungen

- Final PPT On GST IcaiDokument70 SeitenFinal PPT On GST IcaiAnonymous 7K3cd3967% (3)

- Union Budget 2014-15Dokument13 SeitenUnion Budget 2014-15Deepak BothraNoch keine Bewertungen

- Q 2 & 3 On Funds FlowDokument2 SeitenQ 2 & 3 On Funds FlowChetan SharmaNoch keine Bewertungen

- Value Added TaxDokument17 SeitenValue Added TaxkirigofortunateNoch keine Bewertungen

- GTS Vat Presentation 18 July 2017 PDFDokument46 SeitenGTS Vat Presentation 18 July 2017 PDFSaadia KhalidNoch keine Bewertungen

- Withholding Tax Bureau of Internal RevenueDokument10 SeitenWithholding Tax Bureau of Internal RevenueFunnyPearl Adal GajuneraNoch keine Bewertungen

- Custom Duty CalculetorDokument2 SeitenCustom Duty CalculetorVelayudham ThiyagarajanNoch keine Bewertungen

- Tax Base For VAT: Import StageDokument2 SeitenTax Base For VAT: Import StageS. M. Saz Lul HoqueNoch keine Bewertungen

- 2023 Budget Speech Pocket GuideDokument16 Seiten2023 Budget Speech Pocket GuideHumbulani VhuthuhaweNoch keine Bewertungen

- Definition of Vat: VAT Payable To SARS VAT Output - VAT InputDokument3 SeitenDefinition of Vat: VAT Payable To SARS VAT Output - VAT InputNOMFUNDO SENOSINoch keine Bewertungen

- Tax Rates For Tax Year 2020Dokument5 SeitenTax Rates For Tax Year 2020Ghulam MuhiuddinNoch keine Bewertungen

- Advantages of Producers of Hybrid CarsDokument1 SeiteAdvantages of Producers of Hybrid CarsJuan Paolo LoricaNoch keine Bewertungen

- GST Goods & Service TaxDokument36 SeitenGST Goods & Service Taxhahire100% (2)

- KSA VAT Compliance Data RequirementsDokument20 SeitenKSA VAT Compliance Data RequirementsKhaja ZakiuddinNoch keine Bewertungen

- Vat Advisor ExamDokument79 SeitenVat Advisor ExamMoin UddinNoch keine Bewertungen

- GST Ready Recokner PDFDokument265 SeitenGST Ready Recokner PDFkinnar2013Noch keine Bewertungen

- Tax Rates in NepalDokument4 SeitenTax Rates in NepalSai SandeepNoch keine Bewertungen

- Unec GM4Dokument63 SeitenUnec GM4Emiraslan MhrrovNoch keine Bewertungen

- 21 Useful Charts For Tax ComplianceDokument24 Seiten21 Useful Charts For Tax Compliancevrj1091Noch keine Bewertungen

- Vat 1Dokument77 SeitenVat 1Shajid HassanNoch keine Bewertungen

- Strategic Indirect Tax Planning To Reduce LiabilitiesDokument17 SeitenStrategic Indirect Tax Planning To Reduce LiabilitiesHafiz ChoudhuryNoch keine Bewertungen

- Outbound Charges (01.04.2012)Dokument27 SeitenOutbound Charges (01.04.2012)pravanthbabuNoch keine Bewertungen

- Value Added Tax (: Registration and Taxation Object For VAT, VAT Rates, and Offset Issues)Dokument19 SeitenValue Added Tax (: Registration and Taxation Object For VAT, VAT Rates, and Offset Issues)gunayNoch keine Bewertungen

- Topic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANDokument18 SeitenTopic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANJaved AnwarNoch keine Bewertungen

- AFS HinoPak MotorsDokument21 SeitenAFS HinoPak MotorsrolexNoch keine Bewertungen

- VAT Manual 1Dokument16 SeitenVAT Manual 1Pradeep JagirdarNoch keine Bewertungen

- TaxTables20062010Dokument2 SeitenTaxTables20062010Moazam FakeyNoch keine Bewertungen

- "Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1Dokument6 Seiten"Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1hina08855Noch keine Bewertungen

- Direct TaxDokument70 SeitenDirect TaxMohammed Nawaz ShariffNoch keine Bewertungen

- Fast-Track Tax Reform: Lessons from the MaldivesVon EverandFast-Track Tax Reform: Lessons from the MaldivesNoch keine Bewertungen

- Public: Alliances Transform AidDokument7 SeitenPublic: Alliances Transform AidVanesa JuarezNoch keine Bewertungen

- Inform Practice Note #30: ContentDokument8 SeitenInform Practice Note #30: ContentTSHEPO DIKOTLANoch keine Bewertungen

- Corporate Social ResponsibilityDokument8 SeitenCorporate Social ResponsibilityJustin Miguel IniegoNoch keine Bewertungen

- Societe Generale-Mind Matters-James Montier-Vanishing Value-Has The Market Rallied Too Far, Too Fast - 090520Dokument6 SeitenSociete Generale-Mind Matters-James Montier-Vanishing Value-Has The Market Rallied Too Far, Too Fast - 090520yhlung2009Noch keine Bewertungen

- Petron Terminal PaperDokument19 SeitenPetron Terminal PaperKamper DanNoch keine Bewertungen

- Preference of Salaried Class On Various Investment Options Available To The 4Dokument20 SeitenPreference of Salaried Class On Various Investment Options Available To The 4Technology TipsNoch keine Bewertungen

- State Bank of India FinalDokument81 SeitenState Bank of India FinalShaikh Shakeeb100% (1)

- Marketing Plan Pull&BearDokument50 SeitenMarketing Plan Pull&Beartatiana_carr9081100% (17)

- Supply Chain ManagementDokument25 SeitenSupply Chain ManagementLino Gabriel100% (1)

- 42 42 Characteristics of Working CapitalDokument22 Seiten42 42 Characteristics of Working Capitalpradeepg8750% (2)

- Lesson 6 - ProductDokument7 SeitenLesson 6 - ProductShanley Del RosarioNoch keine Bewertungen

- Soap Industry AnalysisDokument6 SeitenSoap Industry AnalysisbkaaljdaelvNoch keine Bewertungen

- LVB Moratorium To End As Cabinet Okays Dbs Deal Unacademy Raises Fresh Funds at $2 BN Valuation Up1Dokument18 SeitenLVB Moratorium To End As Cabinet Okays Dbs Deal Unacademy Raises Fresh Funds at $2 BN Valuation Up1makiNoch keine Bewertungen

- Philippine PovertyDokument2 SeitenPhilippine PovertyHannah BarandaNoch keine Bewertungen

- Chap016 Managerial ControlDokument40 SeitenChap016 Managerial ControlHussain Ali Y AlqaroosNoch keine Bewertungen

- Technical Guide On Audit in Hotel Industry - AASBDokument108 SeitenTechnical Guide On Audit in Hotel Industry - AASBAbhishek86% (7)

- Unfair Trade PracticesDokument29 SeitenUnfair Trade PracticesVasudha FulzeleNoch keine Bewertungen

- How To Set Up A KPI Dashboard For Your Pre-Seed and Seed Stage Startup - Alex IskoldDokument12 SeitenHow To Set Up A KPI Dashboard For Your Pre-Seed and Seed Stage Startup - Alex IskoldLindsey SantosNoch keine Bewertungen

- 4a - Long Term Sources of FinanceDokument12 Seiten4a - Long Term Sources of FinanceSudha AgarwalNoch keine Bewertungen

- Make in India Advantages, Disadvantages and Impact On Indian EconomyDokument8 SeitenMake in India Advantages, Disadvantages and Impact On Indian EconomyAkanksha SinghNoch keine Bewertungen

- SBMA - Business Registration Application PDFDokument6 SeitenSBMA - Business Registration Application PDFfallingobjectNoch keine Bewertungen

- United Respublic of Tanzania Business Registrations and Licensing AgencyDokument2 SeitenUnited Respublic of Tanzania Business Registrations and Licensing AgencyGreen MakwareNoch keine Bewertungen

- CGQWDokument29 SeitenCGQWHemant SolankiNoch keine Bewertungen

- Supply Chain Management Is Adapted in Cruise Line International To Support The Business Strategy of The CompanyDokument13 SeitenSupply Chain Management Is Adapted in Cruise Line International To Support The Business Strategy of The CompanyKateNoch keine Bewertungen

- Four Sector ModelDokument2 SeitenFour Sector ModelVishal Patel100% (1)

- 04 Indeks Harga PenggunaDokument5 Seiten04 Indeks Harga PenggunaSRJ 112 SNEHA GOPAKUMARAN NAIRNoch keine Bewertungen

- Komal Traesury AssignmentDokument11 SeitenKomal Traesury AssignmentmanaskaushikNoch keine Bewertungen

- Basel 2 NormsDokument21 SeitenBasel 2 NormsamolreddiwarNoch keine Bewertungen

- The Importance of Supply Chain ManagementDokument27 SeitenThe Importance of Supply Chain ManagementPerla PascuaNoch keine Bewertungen

- TheoriesDokument25 SeitenTheoriesjuennaguecoNoch keine Bewertungen