Beruflich Dokumente

Kultur Dokumente

Garrison 13th Edition Chapter 9

Hochgeladen von

Ali HaiderCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Garrison 13th Edition Chapter 9

Hochgeladen von

Ali HaiderCopyright:

Verfügbare Formate

Chapter 9

Profit Planning

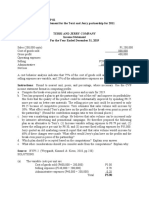

Exercise 9-1 (20 minutes)

April

1.

May

June

Total

February sales:

$ 23,00

$230,000 10%..... $ 23,000

0

March sales:

$260,000 70%,

10%........................ 182,000 $ 26,000

208,000

April sales: $300,000

20%, 70%, 10%...

60,000 210,000 $ 30,000 300,000

May sales: $500,000

20%, 70%...........

100,000 350,000 450,000

June sales: $200,000

40,00

20%....................

40,000

0

$265,00

$420,00 $1,021,00

Total cash collections

0 $336,000

0

0

Observe that even though sales peak in May, cash collections

peak in June. This occurs because the bulk of the companys

customers pay in the month following sale. The lag in

collections that this creates is even more pronounced in some

companies. Indeed, it is not unusual for a company to have the

least cash available in the months when sales are greatest.

2. Accounts receivable at June 30:

From May sales: $500,000 10%................. $ 50,000

From June sales: $200,000 (70% + 10%)... 160,000

$210,00

Total accounts receivable at June 30.............

0

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

Solutions Manual, Chapter 9

Exercise 9-2 (10 minutes)

Budgeted sales in units.......

Add desired ending

inventory*........................

Total needs..........................

Less beginning inventory....

Required production............

Quarte

April

May

June

r

215,00

50,000 75,000 90,000

0

7,500

9,000

8,000

8,000

223,00

57,500 84,000 98,000

0

5,000 7,500 9,000 5,000

218,00

52,500 76,500 89,000

0

*10% of the following months sales in units.

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

2

Managerial Accounting, 13th Edition

Exercise 9-3 (15 minutes)

Year 2

Year 3

First

Second Third

Fourth

First

Required production in bottles.............. 60,000 90,000 150,000 100,000 70,000

Number of grams per bottle..................

3

3

3

3

3

Total production needsgrams............. 180,000 270,000 450,000 300,000 210,000

First

Second

Year 2

Third

Fourth

Production needsgrams (above)......... 180,000 270,000 450,000 300,000

Add desired ending inventorygrams...

54,000 90,000 60,000 42,000

Total needsgrams............................... 234,000 360,000 510,000 342,000

Less beginning inventorygrams.........

36,000 54,000 90,000 60,000

Raw materials to be purchasedgrams 198,000 306,000 420,000 282,000

Cost of raw materials to be purchased

at 150 roubles per kilogram................

29,700 45,900 63,000 42,300

Year

1,200,00

0

42,000

1,242,00

0

36,000

1,206,00

0

180,90

0

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

Solutions Manual, Chapter 9

Exercise 9-4 (20 minutes)

1. Assuming that the direct labor workforce is adjusted each quarter, the direct labor

budget is:

Units to be produced................................

Direct labor time per unit (hours).............

Total direct labor-hours needed...............

Direct labor cost per hour.........................

Total direct labor cost..............................

1st

2nd

3rd

4th

Quarter Quarter Quarter Quarter

Year

8,000

6,500

7,000

7,500 29,000

0.35 0.35 0.35 0.35 0.35

2,800

2,275

2,450

2,625 10,150

$12.00 $12.00 $12.00 $12.00 $12.00

$ 33,60

$ 29,40 $ 31,50 $121,80

0 $ 27,300

0

0

0

2. Assuming that the direct labor workforce is not adjusted each quarter and that overtime

wages are paid, the direct labor budget is:

Units to be produced...............................

Direct labor time per unit (hours)............

Total direct labor-hours needed..............

Regular hours paid..................................

Overtime hours paid................................

1st

2nd

3rd

4th

Quarter Quarter Quarter Quarter

8,000

6,500

7,000

7,500

0.35 0.35 0.35 0.35

2,800

2,275

2,450

2,625

2,600

2,600

2,600

2,600

200

0

0

25

Year

Wages for regular hours (@ $12.00 per

$124,80

hour)..................................................... $31,200 $31,200 $31,200 $31,200

0

Overtime wages (@ 1.5 $12.00 per

hour).....................................................

3,600

0

0

450

4,050

Total direct labor cost............................. $34,800 $31,200 $31,200 $31,650 $128,85

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

4

Managerial Accounting, 13th Edition

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

Solutions Manual, Chapter 9

Exercise 9-5 (15 minutes)

1.

Yuvwell Corporation

Manufacturing Overhead Budget

Budgeted direct labor-hours........................

Variable overhead rate................................

Variable manufacturing overhead................

Fixed manufacturing overhead....................

Total manufacturing overhead.....................

Less depreciation.........................................

Cash disbursements for manufacturing

overhead...................................................

1st

2nd

3rd

4th

Quarte Quarte Quarte Quarte

r

r

r

r

Year

8,000 8,200 8,500 7,800 32,500

$3.25 $3.25 $3.25 $3.25 $3.25

$26,00 $26,65 $27,62 $25,35 $105,62

0

0

5

0

5

192,00

48,000 48,000 48,000 48,000

0

74,000 74,650 75,625 73,350 297,625

64,00

16,000 16,000 16,000 16,000

0

$58,00 $58,65 $59,62 $57,35 $233,62

0

0

5

0

5

Total budgeted manufacturing overhead for the

2.

year (a).................................................................

Total budgeted direct labor-hours for the year (b). .

Manufacturing overhead rate for the year (a) (b)

$297,625

32,500

$

9.16

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

6

Managerial Accounting, 13th Edition

Exercise 9-6 (15 minutes)

Weller Company

Selling and Administrative Expense Budget

1st

2nd

Quarter Quarter

Budgeted unit sales.................................... 15,000 16,000

Variable selling and administrative

expense per unit.......................................

$2.50

$2.50

$ 37,50

$

Variable expense.........................................

0 40,000

Fixed selling and administrative expenses:

Advertising...............................................

8,000

8,000

Executive salaries..................................... 35,000 35,000

Insurance..................................................

5,000

Property taxes..........................................

8,000

20,00

20,00

Depreciation.............................................

0

0

68,00

71,00

Total fixed expense.....................................

0

0

Total selling and administrative expenses... 105,500 111,000

20,00

20,00

Less depreciation........................................

0

0

Cash disbursements for selling and

$ 85,50 $ 91,00

administrative expenses...........................

0

0

3rd

4th

Quarter Quarter

Year

14,000 13,000 58,000

$2.50

$2.50 $2.50

$

$ $145,00

35,000 32,500

0

8,000

35,000

5,000

20,00

0

68,00

0

103,000

20,00

0

$ 83,00

0

8,000 32,000

35,000 140,000

10,000

8,000

20,00

0 80,000

63,00

0 270,000

95,500 415,000

20,00

0 80,000

$ 75,50 $335,00

0

0

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

Solutions Manual, Chapter 9

Exercise 9-7 (15 minutes)

Garden Depot

Cash Budget

Cash balance,

beginning..............

Total cash receipts. .

Total cash available.

Less total cash

disbursements.......

Excess (deficiency)

of cash available

over

disbursements.......

Financing:

Borrowings (at

beginnings of

quarters)*...........

Repayments (at

ends of quarters)

Interest.................

1st

Quarte

r

$ 20,00

0

180,00

0

200,00

0

260,00

0

2nd

Quarte

r

$ 10,00

0

330,00

0

340,00

0

230,00

0

(60,000 110,00

)

0

3rd

4th

Quarter Quarter

Year

$ 35,80 $ 25,80 $ 20,00

0

0

0

210,00

950,00

0 230,000

0

245,800 255,800 970,000

220,00

950,00

0 240,000

0

25,80

0

70,000

70,00

Total financing.........

0

Cash balance,

$ 10,00

ending...................

0

15,800

20,00

0

70,000

(70,000)

(70,000)

(4,200

(4,200

)

)

(74,200

(4,200

)

)

$ 35,80 $ 25,80

$ 15,80

0

0 $ 15,800

0

* Since the deficiency of cash available over disbursements is

$60,000, the company must borrow $70,000 to maintain the

desired ending cash balance of $10,000.

$70,000 3% 2 = $4,200.

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

8

Managerial Accounting, 13th Edition

Exercise 9-8 (10 minutes)

Gig Harbor Boating

Budgeted Income Statement

Sales (460 units $1,950 per unit)...............

Cost of goods sold (460 units $1,575 per

unit)............................................................

Gross margin.................................................

Selling and administrative expenses*...........

Net operating income....................................

Interest expense...........................................

Net income....................................................

$897,00

0

724,500

172,500

139,500

33,000

14,000

$ 19,000

* (460 units $75 per unit) + $105,000 = $139,500.

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

Solutions Manual, Chapter 9

Exercise 9-9 (15 minutes)

Mecca Copy

Budgeted Balance Sheet

Assets

Current assets:

Cash*............................................

Accounts receivable......................

Supplies inventory........................

Total current assets........................

Plant and equipment:

Equipment....................................

Accumulated depreciation............

Plant and equipment, net................

Total assets.....................................

Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable.........................

Stockholders' equity:

Common stock..............................

Retained earnings#......................

Total stockholders' equity...............

Total liabilities and stockholders'

equity...........................................

$12,200

8,100

3,200

34,000

(16,000)

$23,500

18,000

$41,500

$ 1,800

$ 5,000

34,700

39,700

$41,500

* Plug figure.

Retained earnings, beginning

# balance.......................................

Add net income.............................

Deduct dividends..........................

Retained earnings, ending

balance.......................................

$28,000

11,500

39,500

4,800

$34,700

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

10

Managerial Accounting, 13th Edition

Exercise 9-10 (20 minutes)

Cash balance, beginning.......................

Add collections from customers............

Total cash available...............................

Less disbursements:

Purchase of inventory.........................

Selling and administrative expenses...

Equipment purchases.........................

Dividends............................................

Total disbursements..............................

Excess (deficiency) of cash available

over disbursements............................

Financing:

Borrowings..........................................

Repayments (including interest).........

Total financing.......................................

Cash balance, ending............................

Quarter (000 omitted)

1

2

3

4

$6 *

$5

$5

$5

65

70

96 *

92

71 *

75

101

97

35 *

28

8*

2*

73

45

30

8

2

85

(2)*

(10)

7

0

7

$5

*

*

*

*

*

15 *

0

15

$5

48

30 *

10 *

2*

90

35 *

25

10

2*

72

11 *

25

0

(6)

(6)

$5

Year

$6

323 *

329

163

113 *

36 *

8

320

9

0

22

(17)* (23)

(17)

(1)

$8

$8

*Given.

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

Solutions Manual, Chapter 9

11

Exercise 9-11 (30 minutes)

1.

Gaeber Industries

Production Budget

Budgeted unit sales...........

Add desired ending

inventory........................

Total units needed.............

Less beginning inventory. .

Required production..........

1st

Quarter

8,000

1,400

2nd

Quarter

7,000

1,200

3rd

Quarter

6,000

1,400

4th

Quarter

7,000

1,700

Year

28,000

1,700

9,400

1,600

7,800

8,200

1,400

6,800

7,400

1,200

6,200

8,700

1,400

7,300

29,700

1,600

28,100

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

12

Managerial Accounting, 13th Edition

Exercise 9-11 (continued)

2.

Gaeber Industries

Direct Materials Budget

Required production.....................

Raw materials per unit.................

Production needs..........................

Add desired ending inventory.......

Total needs..................................

Less beginning inventory.............

Raw materials to be purchased....

Cost of raw materials to be

purchased at $4.00 per pound...

1st

Quarter

7,800

2

15,600

2,720

18,320

3,120

15,200

2nd

Quarter

6,800

2

13,600

2,480

16,080

2,720

13,360

3rd

Quarter

6,200

2

12,400

2,920

15,320

2,480

12,840

4th

Quarter

7,300

2

14,600

3,140

17,740

2,920

14,820

$60,800

$53,440

$51,360

$59,280 $224,880

Year

28,100

2

56,200

3,140

59,340

3,120

56,220

Schedule of Expected Cash Disbursements for Materials

Accounts payable, beginning

balance......................................

1st Quarter purchases..................

2nd Quarter purchases.................

3rd Quarter purchases.................

4th Quarter purchases.................

Total cash disbursements for

materials....................................

$14,820

45,600

$60,420

$15,200

40,080

$55,280

$13,360

38,520

$51,880

$ 14,820

60,800

53,440

$12,840

51,360

44,460

44,460

$57,300 $224,880

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

Solutions Manual, Chapter 9

13

Exercise 9-12 (30 minutes)

1.

Jessi Corporation

Sales Budget

1st

2nd

3rd

4th

Quarter Quarter Quarter Quarter

Year

Budgeted unit sales...........

11,000

12,000

14,000

13,000

50,000

Selling price per unit......... $18.00 $18.00 $18.00 $18.00 $18.00

$198,00 $216,00 $252,00 $234,00 $900,00

Total sales.........................

0

0

0

0

0

Schedule of Expected Cash Collections

Accounts receivable,

beginning balance.......... $ 70,200

st

1 Quarter sales................ 128,700 $ 59,400

2nd Quarter sales...............

140,400 $ 64,800

rd

3 Quarter sales................

163,800 $ 75,600

th

4 Quarter sales................

152,100

$198,90 $199,80 $228,60 $227,70

Total cash collections........

0

0

0

0

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

14

Managerial Accounting, 13th Edition

$ 70,200

188,100

205,200

239,400

152,100

$855,00

0

Exercise 9-12 (continued)

2.

Jessi Corporation

Production Budget

Budgeted unit sales...........

Add desired ending

inventory........................

Total units needed.............

Less beginning inventory. .

Required production..........

1st

Quarter

11,000

2nd

Quarter

12,000

3rd

Quarter

14,000

4th

Quarter

13,000

Year

50,000

1,800

12,800

1,650

11,150

2,100

14,100

1,800

12,300

1,950

15,950

2,100

13,850

1,850

14,850

1,950

12,900

1,850

51,850

1,650

50,200

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

Solutions Manual, Chapter 9

15

Exercise 9-13 (30 minutes)

1.

Hareston Company

Direct Materials Budget

1st

2nd

3rd

4th

Quarter Quarter Quarter Quarter

7,000

8,000

6,000

5,000

2

2

2

2

14,000 16,000 12,000 10,000

1,600

1,200

1,000

1,500

15,600 17,200 13,000 11,500

1,400

1,600

1,200

1,000

14,200 15,600 11,800 10,500

Required production........................

Raw materials per unit....................

Production needs.............................

Add desired ending inventory..........

Total needs.....................................

Less beginning inventory................

Raw materials to be purchased.......

Cost of raw materials to be

purchased at $1.40 per pound...... $19,880 $21,840 $16,520 $14,700

Year

26,000

2

52,000

1,500

53,500

1,400

52,100

$72,940

Schedule of Expected Cash Disbursements for Materials

Accounts payable, beginning

balance......................................... $ 2,940

1st Quarter purchases..................... 15,904 $ 3,976

2nd Quarter purchases....................

17,472 $ 4,368

3rd Quarter purchases....................

13,216 $ 3,304

4th Quarter purchases....................

11,760

Total cash disbursements for

materials....................................... $18,844 $21,448 $17,584 $15,064

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

16

Managerial Accounting, 13th Edition

$ 2,940

19,880

21,840

16,520

11,760

$72,940

Exercise 9-13 (continued)

2.

Hareston Company

Direct Labor Budget

Units to be produced....................

Direct labor time per unit (hours).

Total direct labor-hours needed. . .

1st

Quarter

7,000

0.60

2nd

Quarter

8,000

0.60

3rd

Quarter

6,000

0.60

4th

Quarter

5,000

0.60

Year

26,000

0.60

4,200

4,800

3,600

3,000

15,600

Direct labor cost per hour............. $14.00 $14.00 $14.00 $14.00 $14.00

Total direct labor cost.................. $ 58,800 $ 67,200 $ 50,400 $ 42,000 $218,400

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

Solutions Manual, Chapter 9

17

Exercise 9-14 (30 minutes)

1.

Raredon Corporation

Direct Labor Budget

Units to be produced....................

Direct labor time per unit (hours).

Total direct labor-hours needed. . .

Direct labor cost per hour.............

Total direct labor cost..................

2.

1st

2nd

3rd

4th

Quarter

Quarter

Quarter

Quarter

Year

12,000

14,000

13,000

11,000

50,000

0.70

0.70

0.70

0.70

0.70

8,400

9,800

9,100

7,700

35,000

$10.50 $10.50 $10.50 $10.50 $10.50

$ 88,200 $102,900 $ 95,550 $ 80,850 $367,500

Raredon Corporation

Manufacturing Overhead Budget

Budgeted direct labor-hours.........

Variable overhead rate.................

Variable manufacturing overhead

Fixed manufacturing overhead.....

Total manufacturing overhead.....

Less depreciation.........................

Cash disbursements for

manufacturing overhead............

1st

Quarter

8,400

$1.50

$12,600

80,000

92,600

22,000

2nd

Quarter

9,800

$1.50

$14,700

80,000

94,700

22,000

3rd

Quarter

9,100

$1.50

$13,650

80,000

93,650

22,000

4th

Quarter

7,700

$1.50

$11,550

80,000

91,550

22,000

$70,600

$72,700

$71,650

$69,550 $284,500

The McGraw-Hill Companies, Inc., 2010. All rights reserved.

18

Managerial Accounting, 13th Edition

Year

35,000

$1.50

$ 52,500

320,000

372,500

88,000

Das könnte Ihnen auch gefallen

- Comprehensive Budgeting Example: © The Mcgraw-Hill Companies, Inc., 2006. All Rights ReservedDokument14 SeitenComprehensive Budgeting Example: © The Mcgraw-Hill Companies, Inc., 2006. All Rights Reservedzelalem kebedeNoch keine Bewertungen

- Managerial Accounting - Chapter 05Dokument11 SeitenManagerial Accounting - Chapter 05jingsuke88% (8)

- Hansen and Mowen Managerial Accounting CH 14Dokument26 SeitenHansen and Mowen Managerial Accounting CH 14Feby RahmawatiNoch keine Bewertungen

- Acct 260 Chapter 10Dokument27 SeitenAcct 260 Chapter 10John Guy100% (1)

- 340 - Resource - 10 (F) Learning CurveDokument19 Seiten340 - Resource - 10 (F) Learning Curvebaby0310100% (2)

- Cornerstones of Cost Accounting Chapter 4 Answers Cornerstones of Cost Accounting Chapter 4 AnswersDokument3 SeitenCornerstones of Cost Accounting Chapter 4 Answers Cornerstones of Cost Accounting Chapter 4 Answersnotperfectisgood0% (1)

- 12-2 Cost AccountingDokument3 Seiten12-2 Cost AccountingRichKing100% (1)

- Acct 260 Chapter 12Dokument20 SeitenAcct 260 Chapter 12John Guy100% (1)

- HWChap 011Dokument52 SeitenHWChap 011hellooceanNoch keine Bewertungen

- Managerial Analysis: CVP 01 Break-EvenDokument4 SeitenManagerial Analysis: CVP 01 Break-EvenGrace SimonNoch keine Bewertungen

- Capital Budgeting Project AnalysisDokument25 SeitenCapital Budgeting Project AnalysisMarielle Tamayo100% (1)

- CVP AnalysisDokument5 SeitenCVP AnalysisAnne BacolodNoch keine Bewertungen

- Financial Management Week 1 HomeworkDokument6 SeitenFinancial Management Week 1 HomeworkF4ARNoch keine Bewertungen

- Standard Costing Managerial Control ToolDokument20 SeitenStandard Costing Managerial Control ToolEnrique Miguel Gonzalez Collado100% (1)

- Atkinson Test BankDokument32 SeitenAtkinson Test BankRyan James B. AbanNoch keine Bewertungen

- 2.lesson 3 (Cost Behavior - Solution)Dokument5 Seiten2.lesson 3 (Cost Behavior - Solution)Aamir DossaniNoch keine Bewertungen

- Cma August 2013 SolutionDokument66 SeitenCma August 2013 Solutionফকির তাজুল ইসলামNoch keine Bewertungen

- Capital Market TheoryDokument27 SeitenCapital Market TheoryJade100% (1)

- Test Bank Horngren Chapter 16Dokument20 SeitenTest Bank Horngren Chapter 16Sheila Marie Nacino Mabborang0% (1)

- CH 21Dokument44 SeitenCH 21nonfiction0650% (2)

- Unit 12 Responsibility Accounting and Performance MeasuresDokument16 SeitenUnit 12 Responsibility Accounting and Performance Measuresestihdaf استهدافNoch keine Bewertungen

- Responsibility AccountingDokument2 SeitenResponsibility Accountingakshayaec100% (1)

- Chap 018Dokument43 SeitenChap 018josephselo100% (1)

- Solutions Chapter 7Dokument39 SeitenSolutions Chapter 7Brenda Wijaya100% (2)

- An Electronic Presentation by Douglas Cloud: Pepperdine UniversityDokument43 SeitenAn Electronic Presentation by Douglas Cloud: Pepperdine UniversityGito Novhandra100% (4)

- Ifrs 5 Acca AnswersDokument2 SeitenIfrs 5 Acca AnswersMonirul Islam MoniirrNoch keine Bewertungen

- Chapter 5 - Cost EstimationDokument36 SeitenChapter 5 - Cost Estimationalleyezonmii0% (2)

- Chapter 16 PDFDokument43 SeitenChapter 16 PDFAdaad As0% (1)

- Humble Company Has Provided The Following Budget Information For TheDokument2 SeitenHumble Company Has Provided The Following Budget Information For TheAmit PandeyNoch keine Bewertungen

- Management Accounting - HCA16ge - Ch21Dokument63 SeitenManagement Accounting - HCA16ge - Ch21Corliss Ko100% (1)

- Management Accounting Chapter 9Dokument57 SeitenManagement Accounting Chapter 9Shaili SharmaNoch keine Bewertungen

- Hilton Chapter 14 Adobe Connect LiveDokument18 SeitenHilton Chapter 14 Adobe Connect LiveGirlie Regilme BalingbingNoch keine Bewertungen

- HWChap 012Dokument42 SeitenHWChap 012hellooceanNoch keine Bewertungen

- Accounting Chapter 10 Solutions GuideDokument56 SeitenAccounting Chapter 10 Solutions GuidemeaningbehindclosedNoch keine Bewertungen

- PROBLEM in RELEVANT COSTING 2 OCT 11 2019Dokument3 SeitenPROBLEM in RELEVANT COSTING 2 OCT 11 2019Ellyza SerranoNoch keine Bewertungen

- Chapter 2 SolutionsDokument31 SeitenChapter 2 SolutionsMuthia KhairaniNoch keine Bewertungen

- Dec. Analysis ExerciseDokument2 SeitenDec. Analysis ExerciseAzman Zalman0% (1)

- CH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDokument10 SeitenCH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionssamahNoch keine Bewertungen

- BKM PPT Ch24 10eDokument43 SeitenBKM PPT Ch24 10eSaurabh Chauhan100% (1)

- Understand Cost Concepts, Behavior and FlowDokument36 SeitenUnderstand Cost Concepts, Behavior and FlowYunita LalaNoch keine Bewertungen

- Unit Three Flexible Budget and StandardsDokument17 SeitenUnit Three Flexible Budget and StandardsShimelis TesemaNoch keine Bewertungen

- Cost Management A Strategic Emphasis Solutions Manual 5th EditionDokument4 SeitenCost Management A Strategic Emphasis Solutions Manual 5th EditionGraha MahasiswaNoch keine Bewertungen

- Chap 004Dokument30 SeitenChap 004Tariq Kanhar100% (1)

- Cost Accounting Hilton 14Dokument13 SeitenCost Accounting Hilton 14Vin TenNoch keine Bewertungen

- Activity Based Costing Boosts Building Firm's CompetitivenessDokument20 SeitenActivity Based Costing Boosts Building Firm's CompetitivenessMazni HanisahNoch keine Bewertungen

- Chap 008Dokument44 SeitenChap 008palak32100% (6)

- Ten Axioms, Principles in FinanceDokument14 SeitenTen Axioms, Principles in FinancePierreNoch keine Bewertungen

- CH 3 - Problems (Solutions) - From PacketDokument3 SeitenCH 3 - Problems (Solutions) - From PacketShun100% (1)

- Hilton CH 14 Select SolutionsDokument10 SeitenHilton CH 14 Select SolutionsHabib EjazNoch keine Bewertungen

- Assignment On: Managerial Economics Mid Term and AssignmentDokument14 SeitenAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNoch keine Bewertungen

- Chap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaDokument4 SeitenChap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaClaudine DuhapaNoch keine Bewertungen

- Sa Sept10 Ias16Dokument7 SeitenSa Sept10 Ias16Muiz QureshiNoch keine Bewertungen

- MARATHA MANDIR’S BABASAHEB GAWDE INSTITUTE OF MANAGEMENT STUDIES Profit PlanningDokument6 SeitenMARATHA MANDIR’S BABASAHEB GAWDE INSTITUTE OF MANAGEMENT STUDIES Profit PlanningPranav WaghmareNoch keine Bewertungen

- Donato's analysis of special order and ethical conflictDokument12 SeitenDonato's analysis of special order and ethical conflictT Yoges Thiru MoorthyNoch keine Bewertungen

- 1 ++Marginal+CostingDokument71 Seiten1 ++Marginal+CostingB GANAPATHYNoch keine Bewertungen

- Early in 2010 Inez Marcus The Chief Financial Officer ForDokument2 SeitenEarly in 2010 Inez Marcus The Chief Financial Officer ForAmit PandeyNoch keine Bewertungen

- Chapter 2 SolutionsDokument31 SeitenChapter 2 Solutionsws100% (2)

- Corporate Financial Analysis with Microsoft ExcelVon EverandCorporate Financial Analysis with Microsoft ExcelBewertung: 5 von 5 Sternen5/5 (1)

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityVon EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNoch keine Bewertungen

- Acc 325 Ch. 8 AnswersDokument10 SeitenAcc 325 Ch. 8 AnswersMohammad WaleedNoch keine Bewertungen

- M.Com Program Analysis of Financial Statements Exam PrepDokument5 SeitenM.Com Program Analysis of Financial Statements Exam PrepAli HaiderNoch keine Bewertungen

- Accounting McqsDokument2 SeitenAccounting McqsAli HaiderNoch keine Bewertungen

- Principles of Management Key ConceptsDokument1 SeitePrinciples of Management Key ConceptsAli HaiderNoch keine Bewertungen

- 17 Big Advantages and Disadvantages of Foreign Direct InvestmentDokument4 Seiten17 Big Advantages and Disadvantages of Foreign Direct InvestmentAli HaiderNoch keine Bewertungen

- Understand Bills of Exchange in 40 CharactersDokument2 SeitenUnderstand Bills of Exchange in 40 CharactersAli HaiderNoch keine Bewertungen

- Fundamentals of MarketingDokument12 SeitenFundamentals of MarketingAli HaiderNoch keine Bewertungen

- Advance AccountingDokument5 SeitenAdvance AccountingAli HaiderNoch keine Bewertungen

- 12 Consignment Account 2Dokument2 Seiten12 Consignment Account 2Faizan ChNoch keine Bewertungen

- B.ed EnglishDokument12 SeitenB.ed EnglishAli HaiderNoch keine Bewertungen

- Busniess Strategy McqsDokument8 SeitenBusniess Strategy McqsAli HaiderNoch keine Bewertungen

- Pakistan Economic Survey 2014-15: Economic Adviser's Wing, Finance Division, Government of Pakistan, IslamabadDokument18 SeitenPakistan Economic Survey 2014-15: Economic Adviser's Wing, Finance Division, Government of Pakistan, IslamabadAhmed Ali KhanNoch keine Bewertungen

- Economics Notes from Prof. Usman Aziz of Govt College of Commerce AttockDokument23 SeitenEconomics Notes from Prof. Usman Aziz of Govt College of Commerce AttockAli HaiderNoch keine Bewertungen

- Accounting Conventions: Monetary MeasurementDokument5 SeitenAccounting Conventions: Monetary MeasurementAli HaiderNoch keine Bewertungen

- Activity Based CostingDokument1 SeiteActivity Based CostingAli HaiderNoch keine Bewertungen

- Punjab College Science and Commerce Gojra Admission TestDokument2 SeitenPunjab College Science and Commerce Gojra Admission TestAli HaiderNoch keine Bewertungen

- Unesco - Eolss Sample Chapters: Dynamic ProgrammingDokument8 SeitenUnesco - Eolss Sample Chapters: Dynamic ProgrammingAli HaiderNoch keine Bewertungen

- Tax ManagementDokument14 SeitenTax ManagementAli HaiderNoch keine Bewertungen

- Assignment No.3 Total Marks 20 Managerial Accountingdue Date: 31-08-2015Dokument3 SeitenAssignment No.3 Total Marks 20 Managerial Accountingdue Date: 31-08-2015Ali HaiderNoch keine Bewertungen

- Optimization Techniques and New Management ToolsDokument6 SeitenOptimization Techniques and New Management ToolsAli HaiderNoch keine Bewertungen

- M.com Growth Over 3 YearsDokument11 SeitenM.com Growth Over 3 YearsAli HaiderNoch keine Bewertungen

- MbaDokument7 SeitenMbaAli HaiderNoch keine Bewertungen

- Cost AccountingDokument2 SeitenCost AccountingAli HaiderNoch keine Bewertungen

- EconomicsDokument6 SeitenEconomicsAli HaiderNoch keine Bewertungen

- Microeconomics: MonopolyDokument27 SeitenMicroeconomics: MonopolyAli HaiderNoch keine Bewertungen

- 9 Ways To Fail Your InterviewDokument6 Seiten9 Ways To Fail Your InterviewAli HaiderNoch keine Bewertungen

- Steps To Install and Use Dosbox For 64-Bit OSDokument6 SeitenSteps To Install and Use Dosbox For 64-Bit OSAli HaiderNoch keine Bewertungen

- Accounting Conventions: Monetary MeasurementDokument5 SeitenAccounting Conventions: Monetary MeasurementAli HaiderNoch keine Bewertungen

- Meadtrem Slip SheetDokument1 SeiteMeadtrem Slip SheetAli HaiderNoch keine Bewertungen

- Session TrackingDokument38 SeitenSession TrackingAlpesh PatelNoch keine Bewertungen

- Non Verbal Communication 1Dokument3 SeitenNon Verbal Communication 1Ali HaiderNoch keine Bewertungen

- Bir - Train Tot - Transfer TaxesDokument14 SeitenBir - Train Tot - Transfer TaxesGlo GanzonNoch keine Bewertungen

- BDA Advises Quasar Medical On Sale of Majority Stake To LongreachDokument3 SeitenBDA Advises Quasar Medical On Sale of Majority Stake To LongreachPR.comNoch keine Bewertungen

- BRS and Accounting For Dividends On Ordinary Share Capital PDFDokument16 SeitenBRS and Accounting For Dividends On Ordinary Share Capital PDFAmit ShahNoch keine Bewertungen

- Assignment On:: Financial AnalysisDokument5 SeitenAssignment On:: Financial AnalysisMd. Mustafezur Rahaman BhuiyanNoch keine Bewertungen

- QUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestDokument3 SeitenQUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestLalaine Jhen Dela CruzNoch keine Bewertungen

- Project Financial AnalysisDokument79 SeitenProject Financial AnalysisAngel CastilloNoch keine Bewertungen

- VOLUME 4 BUSINESS VALUATION ISSUE 2: TRAPPED-IN CAPITAL GAINS REVISITEDDokument28 SeitenVOLUME 4 BUSINESS VALUATION ISSUE 2: TRAPPED-IN CAPITAL GAINS REVISITEDgioro_miNoch keine Bewertungen

- Forex Earthquake: by Raoul WayneDokument21 SeitenForex Earthquake: by Raoul WayneDavid100% (1)

- Table of Contents - Chapter 12: Accounts ReceivableDokument43 SeitenTable of Contents - Chapter 12: Accounts Receivabletgbyhn111Noch keine Bewertungen

- African Alliance Retail Card Web - 0Dokument2 SeitenAfrican Alliance Retail Card Web - 0Daud Farook IINoch keine Bewertungen

- Financial Management: Kota Fibres, LTD.: The Case PapersDokument8 SeitenFinancial Management: Kota Fibres, LTD.: The Case Papersmeishka100% (8)

- Intoduction To BankingDokument41 SeitenIntoduction To BankingAbhilash ShahNoch keine Bewertungen

- PT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYADokument3 SeitenPT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYARama fauziNoch keine Bewertungen

- Elliot Advisors 2020 Q1 LetterDokument10 SeitenElliot Advisors 2020 Q1 LetterEdwin UcheNoch keine Bewertungen

- 300 - PEI - Jun 2019 - DigiDokument24 Seiten300 - PEI - Jun 2019 - Digimick ryanNoch keine Bewertungen

- Analysis of Financial Performance Ratios for HP, IBM and DELL from 2008-2010Dokument35 SeitenAnalysis of Financial Performance Ratios for HP, IBM and DELL from 2008-2010Husban Ahmed Chowdhury100% (2)

- LIC plans major shakeup of Escorts boardDokument6 SeitenLIC plans major shakeup of Escorts boardqubrex1Noch keine Bewertungen

- Hotel FranchiseDokument10 SeitenHotel FranchiseTariku HailuNoch keine Bewertungen

- Reliance General Insurance Company LimitedDokument7 SeitenReliance General Insurance Company LimitedJash TodiNoch keine Bewertungen

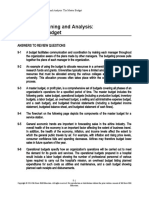

- Review QuestionsDokument2 SeitenReview QuestionsHads LunaNoch keine Bewertungen

- COMM 308 Course Outline - Summer 2 2021 - Section CADokument14 SeitenCOMM 308 Course Outline - Summer 2 2021 - Section CAOlivia ZakemNoch keine Bewertungen

- Richard W. Ellson: February 2016: Ellson Consulting, LLC: Raleigh, NCDokument4 SeitenRichard W. Ellson: February 2016: Ellson Consulting, LLC: Raleigh, NCNick HuronNoch keine Bewertungen

- Statement of Account: L018G SBI Long Term Equity Fund - Regular Plan - Growth NAV As On 22/04/2022: 219.8771Dokument4 SeitenStatement of Account: L018G SBI Long Term Equity Fund - Regular Plan - Growth NAV As On 22/04/2022: 219.8771Kirti Kant SrivastavaNoch keine Bewertungen

- Stamp Duty Rules ExplainedDokument3 SeitenStamp Duty Rules ExplainedSausan SaniaNoch keine Bewertungen

- Assessment of Effectiveness of Internal Control in Government MinistriesDokument11 SeitenAssessment of Effectiveness of Internal Control in Government MinistriesRonnie Balleras Pagal100% (1)

- Time Value of MoneyDokument35 SeitenTime Value of MoneysandhurstalabNoch keine Bewertungen

- Project Proposal: Ato Aniley WubieDokument26 SeitenProject Proposal: Ato Aniley Wubiedawit100% (2)

- Chapter 1 - IntroductionDokument37 SeitenChapter 1 - IntroductionTâm Lê Hồ HồngNoch keine Bewertungen

- Invoice 1524940931Dokument3 SeitenInvoice 1524940931Grand Malaka Ethical HotelNoch keine Bewertungen

- RBS Shareholder Fraud AllegationsDokument326 SeitenRBS Shareholder Fraud AllegationsFailure of Royal Bank of Scotland (RBS) Risk ManagementNoch keine Bewertungen