Beruflich Dokumente

Kultur Dokumente

Audit Ipcc Important

Hochgeladen von

Surya TejaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Audit Ipcc Important

Hochgeladen von

Surya TejaCopyright:

Verfügbare Formate

AUDITING IMPORTANT QUESTIONS NOVEMBER 2013 1. NATURE OF AUDITING a. Audit Vs Investigation b. Window dressing c. Teeming & Lading d.

Advantages and Limitations of an audit 2. BASIC CONCEPTS: a. Independence b. Evidence c. True & Fair 3. PREPARATION FOR AN AUDIT: a. Audit programme b. Working Papers c. Sampling or Test checks 4. INTERNAL CONTROL SYSTEM: a. Objectives of Internal Control b. Examination in depth c. Internal Audit Vs Statutory Audit d. Internal check 5. AUDIT IN CIS ENVIRONMENT: a. Internal Controls in CIS b. Manual system of accounting Vs Computer accounting system c. Approaches in CIS Audit 6. VOUCHING: a. Vouching Vs Verification b. Sale of junk materials c. Sale of investments d. Refund of insurance premium e. Interest and dividend receipts PAYMENTS f. Service tax g. Postage h. Directors remuneration i. Freight j. Cut off arrangements 7. VERIFICATION: a. Depreciation b. Capital Reserve Vs Reserve Capital c. Goodwill d. Investment in capital of a firm e. Cash in transit f. Goods sent on consignment g. Contingent liability h. Bills payable i. Loans 8. COMPANY AUDIT I : a. First auditor b. Central Government c. Casual Vacancy d. Ceiling on no. of audit e. Rights of auditor f. CARO g. Sec.227(1A) h. Signing of Report

i. Reports j. Directors responsibility statement 9. COMPANY AUDIT II: a. Buy back of shares b. Sweat equity shares c. Dividend d. Forfeiture of shares 10. SPECIAL AUDIT: a. Incomplete records b. Hotels c. Hire purchase companies d. School or college 11. GOVERNMENT AUDIT: a. C & AG duties b. Expenditure audit c. Propriety audit d. EEE audit 12. SAS : a. SA 210 Agreeing the terms of engagement b. SA 200 Overall objectives c. SA 250 Laws & Regulations d. SA 299 Joint auditors e. SA 402 Service Organisation f. SA 510 Opening balances g. SA 540 Audit of accounting estimates h. SA 550 Related Parties i. SA 570 Going concern. j. SA 620 Expert

Das könnte Ihnen auch gefallen

- Ch05 - Audit Risk and MaterialityDokument18 SeitenCh05 - Audit Risk and MaterialitySamit Tandukar100% (1)

- Corporate Finance Workbook: A Practical ApproachVon EverandCorporate Finance Workbook: A Practical ApproachNoch keine Bewertungen

- CPA Review Notes 2019 - Audit (AUD)Von EverandCPA Review Notes 2019 - Audit (AUD)Bewertung: 3.5 von 5 Sternen3.5/5 (10)

- Q1 - Q4 - Prelim Exam ACC5111 - Auditing and Assurance PrinciplesDokument81 SeitenQ1 - Q4 - Prelim Exam ACC5111 - Auditing and Assurance Principlesartemis100% (1)

- AT Q1 Pre-Week - MAY 2019Dokument17 SeitenAT Q1 Pre-Week - MAY 2019Aj Pacaldo100% (3)

- ISO 8583 Technical SpecificationDokument117 SeitenISO 8583 Technical Specificationluis alberto MosqueraNoch keine Bewertungen

- May 09 Final Pre-Board (At)Dokument13 SeitenMay 09 Final Pre-Board (At)Ashley Levy San PedroNoch keine Bewertungen

- Reviewer in AuditngDokument32 SeitenReviewer in AuditngHazel MoradaNoch keine Bewertungen

- Ch13 - Substantive Audit Testing Financing and Investing CycleDokument18 SeitenCh13 - Substantive Audit Testing Financing and Investing CycleAbas Norfarina100% (2)

- Auditing Theory MCQs Arens, Elder and BeasleyDokument23 SeitenAuditing Theory MCQs Arens, Elder and BeasleyLeigh PilapilNoch keine Bewertungen

- Auditing Theory SalosagcolDokument4 SeitenAuditing Theory SalosagcolYuki CrossNoch keine Bewertungen

- Provident Fund: How Should Provident Fund Trust Deed and Rules Consist ofDokument3 SeitenProvident Fund: How Should Provident Fund Trust Deed and Rules Consist ofAzhar Rana100% (1)

- May 2019 First PBDokument6 SeitenMay 2019 First PBRandy PaderesNoch keine Bewertungen

- Effective Project Management: Guidance and Checklists for Engineering and ConstructionVon EverandEffective Project Management: Guidance and Checklists for Engineering and ConstructionNoch keine Bewertungen

- Aud Module 1-5Dokument23 SeitenAud Module 1-5yaanvinaNoch keine Bewertungen

- AUDIT - 1ST Preboard (SET A)Dokument13 SeitenAUDIT - 1ST Preboard (SET A)KriztleKateMontealtoGelogo0% (1)

- ch13 - Substantive Audit Testing - Financing and Investing CycleDokument19 Seitench13 - Substantive Audit Testing - Financing and Investing CycleJoshua WacanganNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNoch keine Bewertungen

- AT - Diagnostic Examfor PrintingDokument8 SeitenAT - Diagnostic Examfor PrintingMichaela PortarcosNoch keine Bewertungen

- Audit TheoryDokument18 SeitenAudit TheoryGerlieNoch keine Bewertungen

- Vendors (Service Providers)Dokument292 SeitenVendors (Service Providers)Nawair IshfaqNoch keine Bewertungen

- Audit Mcqs Ricchiute Test BankDokument30 SeitenAudit Mcqs Ricchiute Test BankjpbluejnNoch keine Bewertungen

- Feu - MakatiDokument15 SeitenFeu - MakatiRica RegorisNoch keine Bewertungen

- Holiday Inn Manila v. NLRCDokument2 SeitenHoliday Inn Manila v. NLRCMekiNoch keine Bewertungen

- M SandDokument15 SeitenM Sandsanthu256100% (1)

- 24090953Dokument8 Seiten24090953Michael Brian TorresNoch keine Bewertungen

- AUDITING - MCQsDokument7 SeitenAUDITING - MCQsChandler BingNoch keine Bewertungen

- QC, Pea, Ap 1Dokument3 SeitenQC, Pea, Ap 1ALLYSON BURAGANoch keine Bewertungen

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Final Examination Auditing and Assurance PrincipleDokument16 SeitenColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Final Examination Auditing and Assurance PrincipleFeelingerang MAYoraNoch keine Bewertungen

- N C O B A A: Ational Ollege F Usiness ND RTSDokument9 SeitenN C O B A A: Ational Ollege F Usiness ND RTSNico evansNoch keine Bewertungen

- Audit PlanningDokument12 SeitenAudit Planninginto the unknownNoch keine Bewertungen

- Navkar Institute DATE:3-3-19 CODE:NI-6027 Batch:Inter Rev May 19 GR Ii & Both MARKS:100 Ca Intermediate Audit and Assurance syllabus:FULL Q-1. MCQ: 1Dokument12 SeitenNavkar Institute DATE:3-3-19 CODE:NI-6027 Batch:Inter Rev May 19 GR Ii & Both MARKS:100 Ca Intermediate Audit and Assurance syllabus:FULL Q-1. MCQ: 1Sravani BysaniNoch keine Bewertungen

- Acctg 14 QuizDokument10 SeitenAcctg 14 QuizCHRISTINE GALANGNoch keine Bewertungen

- Audit Risk and MaterialityDokument5 SeitenAudit Risk and Materialitycharmsonin12Noch keine Bewertungen

- AUDIT MCQs RICCHIUTE TEST BANKDokument29 SeitenAUDIT MCQs RICCHIUTE TEST BANKLeigh PilapilNoch keine Bewertungen

- Audit Risk and MaterialityDokument28 SeitenAudit Risk and MaterialityMarian Grace DelapuzNoch keine Bewertungen

- Set 2Dokument6 SeitenSet 2Nicco OrtizNoch keine Bewertungen

- Exam 14 February 2020 Questions and AnswersDokument7 SeitenExam 14 February 2020 Questions and AnswersDan Andrei BongoNoch keine Bewertungen

- Audtbans 5Dokument7 SeitenAudtbans 5John DoesNoch keine Bewertungen

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryDokument18 SeitenColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryFeelingerang MAYoraNoch keine Bewertungen

- Exam 14 February 2020 Questions and AnswersDokument6 SeitenExam 14 February 2020 Questions and AnswersCielo DecilloNoch keine Bewertungen

- Prof. Falsado Online SeatworkDokument9 SeitenProf. Falsado Online SeatworkMarian Grace DelapuzNoch keine Bewertungen

- CH 13Dokument19 SeitenCH 13pesoload100Noch keine Bewertungen

- Management Accounting QuizzerDokument7 SeitenManagement Accounting QuizzerLorielyn Jundarino TimbolNoch keine Bewertungen

- Practice Final PB AuditingDokument14 SeitenPractice Final PB AuditingBenedict BoacNoch keine Bewertungen

- ASSET 2019 Mock Boards - AUDITDokument8 SeitenASSET 2019 Mock Boards - AUDITKenneth Christian WilburNoch keine Bewertungen

- Source: Auditing: A Risk Analysis Approach 5 Edition by Larry F. KonrathDokument19 SeitenSource: Auditing: A Risk Analysis Approach 5 Edition by Larry F. KonrathMelanie SamsonaNoch keine Bewertungen

- At 07 FS Audit Process Audit Planning 1Dokument4 SeitenAt 07 FS Audit Process Audit Planning 1Michael Oliver ApolongNoch keine Bewertungen

- FARDokument7 SeitenFARRosemarie MoinaNoch keine Bewertungen

- Auditing & Assurance Principles - Specialized Industries (Module 5, 8 & Banking)Dokument4 SeitenAuditing & Assurance Principles - Specialized Industries (Module 5, 8 & Banking)Joana Lyn BuqueronNoch keine Bewertungen

- Quiz On Audit Engagement and PlanningDokument7 SeitenQuiz On Audit Engagement and PlanningAdam SmithNoch keine Bewertungen

- Auditing Problems FPB With Answer KeysDokument9 SeitenAuditing Problems FPB With Answer KeysPj ManezNoch keine Bewertungen

- I - Multiple Choice Questions (45%) : Lebanese Association of Certified Public Accountants - AUDIT October Exam 2016Dokument11 SeitenI - Multiple Choice Questions (45%) : Lebanese Association of Certified Public Accountants - AUDIT October Exam 2016Kryzzel Anne JonNoch keine Bewertungen

- Auditing Exam Final For Extension AADokument12 SeitenAuditing Exam Final For Extension AAUnanimous ClientNoch keine Bewertungen

- 408test 1 Review QuestionsDokument5 Seiten408test 1 Review QuestionsAstrid VargasNoch keine Bewertungen

- Auditing Theory MCQsDokument21 SeitenAuditing Theory MCQsDawn Caldeira100% (1)

- A. B. C. D. A. B. C. D.: ANSWER: Review Prior-Year Audit Documentation and The Permanent File For The ClientDokument7 SeitenA. B. C. D. A. B. C. D.: ANSWER: Review Prior-Year Audit Documentation and The Permanent File For The ClientRenNoch keine Bewertungen

- Multiple-Choice QuestionsDokument20 SeitenMultiple-Choice QuestionsRafael GarciaNoch keine Bewertungen

- Quiz 11.26.22Dokument5 SeitenQuiz 11.26.22karen perrerasNoch keine Bewertungen

- AUDITING THEORY - Review MaterialsDokument5 SeitenAUDITING THEORY - Review MaterialsorehuelajdNoch keine Bewertungen

- Midterm Questions PDFDokument9 SeitenMidterm Questions PDFJhanvi SinghNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Ashok Leyland Desk ResearchDokument55 SeitenAshok Leyland Desk ResearchAbhishek TsNoch keine Bewertungen

- A Study On Customer Satisfaction Toward Maggi NoodlesDokument46 SeitenA Study On Customer Satisfaction Toward Maggi NoodlesChandan SrivastavaNoch keine Bewertungen

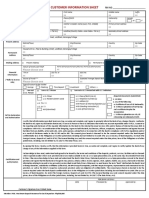

- CIS Deposit V 2.19 BPI - Fillable FormDokument2 SeitenCIS Deposit V 2.19 BPI - Fillable FormMichelle Iballa75% (4)

- 46th Inaugural Baba OwojoriDokument72 Seiten46th Inaugural Baba Owojorigarba shuaibuNoch keine Bewertungen

- CHAPTER - 5 Marketing in Small BusinessDokument25 SeitenCHAPTER - 5 Marketing in Small BusinesstemesgenNoch keine Bewertungen

- Starbucks MBUSDokument2 SeitenStarbucks MBUSxuan limNoch keine Bewertungen

- Facebook Inc. (FB) : 2 - AttractiveDokument6 SeitenFacebook Inc. (FB) : 2 - AttractiveCarlos TresemeNoch keine Bewertungen

- IndiaSales Feb CC SlabsDokument2 SeitenIndiaSales Feb CC Slabssocialmedia.manager.incNoch keine Bewertungen

- Business Analyst - Manmath Parida ResumeDokument1 SeiteBusiness Analyst - Manmath Parida ResumeManmathNoch keine Bewertungen

- Nayan Internship - Affiliation - Report MsiDokument22 SeitenNayan Internship - Affiliation - Report MsiToufiq NayanNoch keine Bewertungen

- Cosmeticsandtoiletries202004 DLDokument111 SeitenCosmeticsandtoiletries202004 DLLaura Daniela Silva AriasNoch keine Bewertungen

- A Project Report On Advertising Strategy of TATA MotorsDokument86 SeitenA Project Report On Advertising Strategy of TATA MotorsAbhishek KangeNoch keine Bewertungen

- Prasenjit MokhaleDokument3 SeitenPrasenjit MokhaleElango SundaramNoch keine Bewertungen

- Chapter 3Dokument43 SeitenChapter 3Vikram K MNoch keine Bewertungen

- Sampoorna Raksha Supreme (SRS) Brochure V3Dokument10 SeitenSampoorna Raksha Supreme (SRS) Brochure V3Praveen KumarNoch keine Bewertungen

- Annexure-173. M.A. EconomicsDokument95 SeitenAnnexure-173. M.A. Economicsnishita groverNoch keine Bewertungen

- Prob samplingDistOfMean2Dokument2 SeitenProb samplingDistOfMean2Sauban AhmedNoch keine Bewertungen

- High-Throughput Dewatering and Cake Washing: SeparationDokument12 SeitenHigh-Throughput Dewatering and Cake Washing: SeparationMichel M.Noch keine Bewertungen

- Forsage BUSD EngDokument32 SeitenForsage BUSD EngAmit AdhikariNoch keine Bewertungen

- Khata Book - List of Registered StudentsDokument8 SeitenKhata Book - List of Registered Studentsfitflex210Noch keine Bewertungen

- Chapter 10 Accounting Cycle of A Merchandising BusinessDokument40 SeitenChapter 10 Accounting Cycle of A Merchandising BusinessOmelkhair YahyaNoch keine Bewertungen

- Assignment 2Dokument9 SeitenAssignment 2DONALDNoch keine Bewertungen

- Sef 2023 PPMP WFPDokument34 SeitenSef 2023 PPMP WFPRYAN BUDUMONoch keine Bewertungen

- Los Ángeles Times BOLIVIADokument5 SeitenLos Ángeles Times BOLIVIAMarianita Guisselle Garcia SandovalNoch keine Bewertungen

- Foodstuff Trading Businesses in Dubai - HiDubaiDokument2 SeitenFoodstuff Trading Businesses in Dubai - HiDubaiN.M. EESWARANNoch keine Bewertungen