Beruflich Dokumente

Kultur Dokumente

ch16 Key

Hochgeladen von

rocksarthaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ch16 Key

Hochgeladen von

rocksarthaCopyright:

Verfügbare Formate

ch16 Key

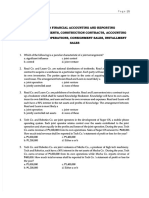

1. Contributed services to professional associations generally are recognized as revenues by the associations. FALSE Larsen - 016 Chapter... #1 2. The accounting period in which pledged revenues are recognized is dependent on donor specifications. TRUE Larsen - 016 Chapter... #2 3. Fund-raising costs expected to benefit future accounting periods are deferred by nonprofit organizations. FALSE Larsen - 016 Chapter... #3 4. Collections are a type of nonexhaustible plant assets of nonprofit organizations. FALSE Larsen - 016 Chapter... #4 5. The modified accrual basis of accounting used by some funds of a governmental entity is appropriate for some funds of a nonprofit organization. FALSE Larsen - 016 Chapter... #5 6. The Designated Fund Balance ledger account of a nonprofit organization's unrestricted fund is similar to a retained earnings appropriation account of a business corporation. TRUE Larsen - 016 Chapter... #6 7. A life income fund of a nonprofit organization resembles a sinking fund for the retirement of debt of a business enterprise. FALSE Larsen - 016 Chapter... #7 8. A quasi-endowment fund may be expended by a nonprofit organization after either the passage of a period of time or the occurrence of an event specified by the donor of the endowment principal. FALSE Larsen - 016 Chapter... #8 9. The provision for doubtful loans of a university's student loan fund is debited to the Doubtful Loans Expense ledger account. FALSE Larsen - 016 Chapter... #9 10. Assets of the unrestricted fund of a nonprofit organization may be transferred to a restricted fund by the organization's board of directors. FALSE Larsen - 016 Chapter... #10 11. Fund accounting is inappropriate for a nonprofit hospital. FALSE Larsen - 016 Chapter... #11 12. Contributed material is recognized as revenues by a nonprofit organization's unrestricted fund. TRUE Larsen - 016 Chapter... #12 13. If a university waives tuition charges for children of its faculty and staff, no revenues are recognized. FALSE Larsen - 016 Chapter... #13 14. Depreciation expense is recognized by nonprofit organizations. TRUE Larsen - 016 Chapter... #14

15. Assets of a nonprofit organization's restricted funds are derived from the operations of the organization. FALSE Larsen - 016 Chapter... #15 16. The principal of term endowment funds may be expended by a nonprofit organization after the passage of a period of time or the occurrence of an event. TRUE Larsen - 016 Chapter... #16 17. Payments to the beneficiary of a nonprofit organization's life income fund are fixed in amount. FALSE Larsen - 016 Chapter... #17 18. The issuance of a statement of activities is appropriate for nonprofit organizations. TRUE Larsen - 016 Chapter... #18 19. A gift to a nonprofit hospital that is not restricted by the donor is credited in the hospital's general fund to: A. Fund Balance B. Deferred Revenues C. Contributions Revenues D. Nonoperating Revenues Larsen - 016 Chapter... #19 20. Which of the following funds of a nonprofit organization makes periodic payments of a fixed amount at equal intervals. A. Annuity fund B. Agency fund C. Endowment fund D. Restricted fund Larsen - 016 Chapter... #20 21. An annuity fund of a nonprofit organization is most similar to the organization's: A. Endowment fund B. Restricted fund C. Agency fund D. Life income fund Larsen - 016 Chapter... #21 22. The current fair value of contributed material is recognized in a nonprofit organization's unrestricted fund with a debit to Inventories and a credit to: A. Undesignated Fund Balance B. Payable to Restricted Fund C. Designated Fund BalanceMerchandise D. Contributions Revenues E. Some other ledger account Larsen - 016 Chapter... #22 23. Are tuition remissions for which there is no intention of collection from the student recognized by a nonprofit university as:

A. Item A C. Item C

B. Item B D. Item D

Larsen - 016 Chapter... #23

24. Which of the following is not a source of resources of a nonprofit organization's restricted fund? A. Operations of the nonprofit organization B. Contributions of individuals or governmental entities C. Gains on disposals of investments D. Revenues from endowments

Larsen - 016 Chapter... #24

25. One-half of the tuition of classes taken by spouses of Colby College faculty members is remitted (waived) by Colby. In the journal entry for tuition for a four-unit course for a professor's spouse, with tuition at $210 a unit, Tuition Revenues is credited for: A. $0 (credit Remission Revenue) B. $420 C. $840 D. Some other amount Larsen - 016 Chapter... #25 26. The type of endowment fund for which the principal may be expended after the occurrence of an event specified by the donor of the principal is: A. A pure endowment fund B. A quasi-endowment fund C. An expendable endowment fund D. None of the foregoing Larsen - 016 Chapter... #26 27. Any restrictions on gifts, grants, or bequests received by nonprofit organizations are imposed by: A. State laws B. Governing boards C. Donors D. "Nonprofit Organizations" Larsen - 016 Chapter... #27 28. Are unpaid amounts of conditional pledges that may be revoked by a nonprofit organization recognized as expense when:

A. Item A C. Item C

B. Item B D. Item D

Larsen - 016 Chapter... #28

29. The difference between a nonprofit organization's annuity funds and life income funds is: A. The nature of the Fund Balance ledger account B. The fixed versus variable amount of payments to recipients C. The status of each fund in the organization's investment pool D. Some other difference

Larsen - 016 Chapter... #29

30. One characteristic of nonprofit organizations that is comparable with characteristics of governmental entities is: A. Stewardship of resources B. Governance by board of directors C. Measurement of cost expirations D. None of the foregoing Larsen - 016 Chapter... #30 31. A nonprofit organization's restricted fund typically is established in Rationale to: A. A resolution of the organization's board of trustees B. A mandate of a governmental agency C. Provisions of a contribution to the organization D. Some other transaction or event

Larsen - 016 Chapter... #31

32. Prepare journal entries (omit explanations) for the following transactions or events of the General Fund and Anna Waters Restricted Fund of Modem Hospital (a nonprofit organization) during January, 2006.

Larsen - 016 Chapter... #32

33. On July 1, 2006, the Unrestricted Fund, Restricted Fund, and Endowment Fund of Urban Health Organization, a nonprofit organization, pooled their investments, as follows:

During the month of July, 2006, the Urban Health Organization investment pool, managed by the Unrestricted Fund, received interest and dividends revenue totaling $64,000. Prepare journal entries dated July 31, 2006, in the three funds of Urban Health Organization to record receipt of the interest and dividends revenue. Omit explanations, but identify the fund in which each journal entry is recorded.

Larsen - 016 Chapter... #33

34. The Student Loan Fund of Dorris College had the following transactions and events during the month of September, 2006. (1) Disbursed new loans totaling $400,000. (2) Received payments of $120,000 on loans receivable, including $4,000 interest. (3) Wrote off uncollectible loans totaling $30,000. (4) Estimated a required increase of $40,000 in the Allowance for Doubtful Loans ledger account balance on September 30, 2006. (5) Computed accrued interest of $8,000 on loans receivable on September 30, 2006. Prepare journal entries for the Dorris College Student Loan Fund to record the foregoing transactions and events. Omit explanations.

Larsen - 016 Chapter... #34

35. Martha Randall, audit manager of the CPA firm Alan West & Company, is conducting a staff training program on accounting and auditing of nonprofit organizations. During the program, staff assistant Milton Rogers questions the feasibility of the Financial Accounting Standards Board's establishing accounting standards for all nonprofit organizations. "Given the wide variety of nonprofit organizations, from cemetery organizations to zoological societies," says Rogers, "it seems unfeasible to believe that one set of standards would fit all such organizations." What should be Martha Randall's (or another training program participant's) Rationale to Milton Rogers? Explain. Milton Rogers's point is a valid one because there are some significant differences among the various types of nonprofit organizations. Foremost among these differences is the self-sufficiency of such nonprofit organizations as labor unions, private foundations, and professional associations, which do not rely significantly on contributions revenue, compared with the many other types of nonprofit organizations that must obtain such revenue. However, the common characteristics of nonprofit organizations, chiefly service to society and no profit motivation, make it desirable that there not be wide variations among the accounting standards used by the organizations. The Financial Accounting Standards Board's requirement that nonprofit organizations disclose in the statement of financial position and statement of activities data concerning unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets should accommodate the different types of nonprofit organizations.

Larsen - 016 Chapter... #35

Das könnte Ihnen auch gefallen

- HSBC in A Nut ShellDokument190 SeitenHSBC in A Nut Shelllanpham19842003Noch keine Bewertungen

- TAB Procedures From An Engineering FirmDokument18 SeitenTAB Procedures From An Engineering Firmtestuser180Noch keine Bewertungen

- Quiz 2 AbcDokument15 SeitenQuiz 2 AbcMa. Lou Erika BALITENoch keine Bewertungen

- Final 2 2Dokument3 SeitenFinal 2 2RonieOlarteNoch keine Bewertungen

- Module #6Dokument20 SeitenModule #6Joy RadaNoch keine Bewertungen

- ACC117-CON09 Module 3 ExamDokument16 SeitenACC117-CON09 Module 3 ExamMarlon LadesmaNoch keine Bewertungen

- MS03 09 Capital Budgeting Part 2 EncryptedDokument6 SeitenMS03 09 Capital Budgeting Part 2 EncryptedKate Crystel reyesNoch keine Bewertungen

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTDokument21 SeitenStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynNoch keine Bewertungen

- Chapter 3 Liquidation ValueDokument11 SeitenChapter 3 Liquidation ValueJIL Masapang Victoria ChapterNoch keine Bewertungen

- Philippine Deposit Insurance Corporation (PDIC) LawDokument11 SeitenPhilippine Deposit Insurance Corporation (PDIC) LawElmer JuanNoch keine Bewertungen

- Calculation For Liquidation Value at Closure Date Is Somewhat Like The Book Value CalculationDokument3 SeitenCalculation For Liquidation Value at Closure Date Is Somewhat Like The Book Value CalculationALYZA ANGELA ORNEDONoch keine Bewertungen

- Accounting For Special Transactions:: Corporate LiquidationDokument28 SeitenAccounting For Special Transactions:: Corporate LiquidationKim EllaNoch keine Bewertungen

- Audit of ReceivablesDokument20 SeitenAudit of ReceivablesDethzaida AsebuqueNoch keine Bewertungen

- Property, Plant and Equipment Problems 5-1 (Uy Company)Dokument14 SeitenProperty, Plant and Equipment Problems 5-1 (Uy Company)NaSheeng100% (1)

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDokument5 SeitenColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNoch keine Bewertungen

- Second PB Acctg 203BDokument12 SeitenSecond PB Acctg 203BBella AyabNoch keine Bewertungen

- PINTO - Razmen R. (MASECO MT EXAM)Dokument4 SeitenPINTO - Razmen R. (MASECO MT EXAM)Razmen Ramirez PintoNoch keine Bewertungen

- Audit Liability 12 Chapter 7Dokument1 SeiteAudit Liability 12 Chapter 7Ma Teresa B. CerezoNoch keine Bewertungen

- Assets Book Value Estimated Realizable ValuesDokument3 SeitenAssets Book Value Estimated Realizable ValuesEllyza SerranoNoch keine Bewertungen

- What Makes The Banking Industry A Specialized IndustryDokument3 SeitenWhat Makes The Banking Industry A Specialized IndustrylalagunajoyNoch keine Bewertungen

- Chapter 14, Modern Advanced Accounting-Review Q & ExrDokument18 SeitenChapter 14, Modern Advanced Accounting-Review Q & Exrrlg4814100% (4)

- Auditing 2&3 Theories Reviewer CompilationDokument9 SeitenAuditing 2&3 Theories Reviewer CompilationPaupauNoch keine Bewertungen

- QUizzer 4 - Overall With AnswerDokument20 SeitenQUizzer 4 - Overall With AnswerJan Elaine CalderonNoch keine Bewertungen

- PNC Midterm Exam Valuation Ver 2Dokument55 SeitenPNC Midterm Exam Valuation Ver 2Maybelle BernalNoch keine Bewertungen

- Week 4 - Lesson 4 Cash and Cash EquivalentsDokument21 SeitenWeek 4 - Lesson 4 Cash and Cash EquivalentsRose RaboNoch keine Bewertungen

- AC 3101 Discussion ProblemDokument1 SeiteAC 3101 Discussion ProblemYohann Leonard HuanNoch keine Bewertungen

- Cases (Cabrera)Dokument5 SeitenCases (Cabrera)Queenie100% (1)

- Grace Corporation Confirmation of Bank Balances DECEMBER 31, 20X1Dokument2 SeitenGrace Corporation Confirmation of Bank Balances DECEMBER 31, 20X1Joshua ComerosNoch keine Bewertungen

- Piecemeal RealizationDokument6 SeitenPiecemeal RealizationSethwilsonNoch keine Bewertungen

- Assignment 7 1Dokument1 SeiteAssignment 7 1Eilen Joyce BisnarNoch keine Bewertungen

- Chapter 11Dokument12 SeitenChapter 11Ya LunNoch keine Bewertungen

- Lobarbio, Fitz Clark T - FM1Dokument3 SeitenLobarbio, Fitz Clark T - FM1Fitz Clark LobarbioNoch keine Bewertungen

- AFAR Question PDFDokument16 SeitenAFAR Question PDFNhel AlvaroNoch keine Bewertungen

- CVP - SolutionsDokument8 SeitenCVP - SolutionsLaica MontefalcoNoch keine Bewertungen

- 500 MctheoriesDokument81 Seiten500 Mctheorieserickson hernanNoch keine Bewertungen

- Finman ReviewerDokument89 SeitenFinman Reviewersharon5lotino100% (1)

- Theories: Basic ConceptsDokument20 SeitenTheories: Basic ConceptsJude VeanNoch keine Bewertungen

- CH 17Dokument32 SeitenCH 17Aldrin CabangbangNoch keine Bewertungen

- Module 5&6Dokument29 SeitenModule 5&6Lee DokyeomNoch keine Bewertungen

- Unit V - Audit of Employee Benefits - Final - T31415 PDFDokument5 SeitenUnit V - Audit of Employee Benefits - Final - T31415 PDFSed ReyesNoch keine Bewertungen

- Home Office and Branch ReviewerDokument1 SeiteHome Office and Branch ReviewerSheena ClataNoch keine Bewertungen

- Chapter 28 AnsDokument9 SeitenChapter 28 AnsDave ManaloNoch keine Bewertungen

- This Study Resource Was: Cebu Cpar CenterDokument9 SeitenThis Study Resource Was: Cebu Cpar CenterGlizette SamaniegoNoch keine Bewertungen

- GovernanceDokument3 SeitenGovernanceAndrea Marie CalmaNoch keine Bewertungen

- Problem 3 5 6 Special TransactionDokument5 SeitenProblem 3 5 6 Special TransactionBabyann BallaNoch keine Bewertungen

- Lease ProblemsDokument15 SeitenLease ProblemsArvigne DorenNoch keine Bewertungen

- Investment ReviewerDokument2 SeitenInvestment ReviewerLilibeth SolisNoch keine Bewertungen

- Assignment: Assessment: Module 1: Banking and Other Financial InstitutionsDokument14 SeitenAssignment: Assessment: Module 1: Banking and Other Financial InstitutionsMiredoNoch keine Bewertungen

- Jamolod - Unit 1 - General Features of Financial StatementDokument8 SeitenJamolod - Unit 1 - General Features of Financial StatementJatha JamolodNoch keine Bewertungen

- Completion of Audit Quiz ANSWERDokument9 SeitenCompletion of Audit Quiz ANSWERJenn DajaoNoch keine Bewertungen

- Cash and Cash Equivalents - REVIEWERDokument15 SeitenCash and Cash Equivalents - REVIEWERLark Kent TagleNoch keine Bewertungen

- AISDokument11 SeitenAISJezeil DimasNoch keine Bewertungen

- The Purchasing/ Accounts Payable/ Cash Disbursement (P/AP/CD) ProcessDokument17 SeitenThe Purchasing/ Accounts Payable/ Cash Disbursement (P/AP/CD) ProcessJonah Mark Tabuldan DebomaNoch keine Bewertungen

- Auditing and Assurance Principles Pre TestDokument9 SeitenAuditing and Assurance Principles Pre TestKryzzel Anne JonNoch keine Bewertungen

- Chapter 2Dokument12 SeitenChapter 2Cassandra KarolinaNoch keine Bewertungen

- MODULE 2 CVP AnalysisDokument8 SeitenMODULE 2 CVP Analysissharielles /Noch keine Bewertungen

- Test Bank Management 8th Edition BatemanDokument40 SeitenTest Bank Management 8th Edition BatemanIris DescentNoch keine Bewertungen

- Cost of Capital: By: Judy Ann G. Silva, MBADokument21 SeitenCost of Capital: By: Judy Ann G. Silva, MBAAnastasha GreyNoch keine Bewertungen

- Intercompany DividendsDokument6 SeitenIntercompany DividendsClauie BarsNoch keine Bewertungen

- Larsen10 ch16Dokument58 SeitenLarsen10 ch16abmyonis100% (1)

- Chapter - I: Not - For - Profit - Organisation 1 Mark QuestionsDokument8 SeitenChapter - I: Not - For - Profit - Organisation 1 Mark QuestionsVishal DassaniNoch keine Bewertungen

- Course Specifications: Fire Investigation and Failure Analysis (E901313)Dokument2 SeitenCourse Specifications: Fire Investigation and Failure Analysis (E901313)danateoNoch keine Bewertungen

- Form Three Physics Handbook-1Dokument94 SeitenForm Three Physics Handbook-1Kisaka G100% (1)

- SME-Additional Matter As Per Latest Syllabus Implementation WorkshopDokument14 SeitenSME-Additional Matter As Per Latest Syllabus Implementation WorkshopAvijeet BanerjeeNoch keine Bewertungen

- Tradingview ShortcutsDokument2 SeitenTradingview Shortcutsrprasannaa2002Noch keine Bewertungen

- Cryo EnginesDokument6 SeitenCryo EnginesgdoninaNoch keine Bewertungen

- The Electricity Act - 2003Dokument84 SeitenThe Electricity Act - 2003Anshul PandeyNoch keine Bewertungen

- Engineering Management (Final Exam)Dokument2 SeitenEngineering Management (Final Exam)Efryl Ann de GuzmanNoch keine Bewertungen

- Material Safety Data Sheet (According To 91/155 EC)Dokument4 SeitenMaterial Safety Data Sheet (According To 91/155 EC)Jaymit PatelNoch keine Bewertungen

- Wendi C. Lassiter, Raleigh NC ResumeDokument2 SeitenWendi C. Lassiter, Raleigh NC ResumewendilassiterNoch keine Bewertungen

- Abu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationDokument27 SeitenAbu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationPaulWolfNoch keine Bewertungen

- Polytropic Process1Dokument4 SeitenPolytropic Process1Manash SinghaNoch keine Bewertungen

- Datasheet Qsfp28 PAMDokument43 SeitenDatasheet Qsfp28 PAMJonny TNoch keine Bewertungen

- Lactobacillus Acidophilus - Wikipedia, The Free EncyclopediaDokument5 SeitenLactobacillus Acidophilus - Wikipedia, The Free Encyclopediahlkjhlkjhlhkj100% (1)

- JAZEL Resume-2-1-2-1-3-1Dokument2 SeitenJAZEL Resume-2-1-2-1-3-1GirlieJoyGayoNoch keine Bewertungen

- Avalon LF GB CTP MachineDokument2 SeitenAvalon LF GB CTP Machinekojo0% (1)

- Review of Related LiteratureDokument4 SeitenReview of Related LiteratureCarlo Mikhail Santiago25% (4)

- Presentation Report On Customer Relationship Management On SubwayDokument16 SeitenPresentation Report On Customer Relationship Management On SubwayVikrant KumarNoch keine Bewertungen

- The Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and CountriesDokument13 SeitenThe Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and Countriesluisbmwm6Noch keine Bewertungen

- (X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Dokument9 Seiten(X-09485) XYLENE RECTIFIED Extra Pure (Mix Isomers)Bharath KumarNoch keine Bewertungen

- Schmidt Family Sales Flyer English HighDokument6 SeitenSchmidt Family Sales Flyer English HighmdeenkNoch keine Bewertungen

- Agricultural Economics 1916Dokument932 SeitenAgricultural Economics 1916OceanNoch keine Bewertungen

- Basic DfwmacDokument6 SeitenBasic DfwmacDinesh Kumar PNoch keine Bewertungen

- CodebreakerDokument3 SeitenCodebreakerwarrenNoch keine Bewertungen

- Ucm6510 Usermanual PDFDokument393 SeitenUcm6510 Usermanual PDFCristhian ArecoNoch keine Bewertungen

- Reference Template For Feasibility Study of PLTS (English)Dokument4 SeitenReference Template For Feasibility Study of PLTS (English)Herikson TambunanNoch keine Bewertungen

- MSDS - Tuff-Krete HD - Part DDokument6 SeitenMSDS - Tuff-Krete HD - Part DAl GuinitaranNoch keine Bewertungen

- Edita's Opertionalization StrategyDokument13 SeitenEdita's Opertionalization StrategyMaryNoch keine Bewertungen

- MMC Pipe Inspection RobotDokument2 SeitenMMC Pipe Inspection RobotSharad Agrawal0% (1)