Beruflich Dokumente

Kultur Dokumente

Team D 4-14-12 52 Cvs Financial Analysis

Hochgeladen von

api-239990812Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Team D 4-14-12 52 Cvs Financial Analysis

Hochgeladen von

api-239990812Copyright:

Verfügbare Formate

Running head: CVS CAREMARK FINANCIAL ANALYSIS

CVS Caremark Financial Analysis Team D: Catherine Alvarez, Rochelle Betton-Ford, Lee Ann Gober, Brittany Lane, and Stevia Simpson-Ross Siena Heights University LDR640 Financial Systems Management Professor: Lihua Dishman May 23, 2012

CVS CAREMARK FINANCIAL ANALYSIS Abstract

CVS Caremark has been in business for over 20 years. It is one of the leading pharmacy stores in the nation. The goal of this financial analysis is to show some of CVS Caremark financial data that will provide a look into why this company has been a strong and top competitor in the drug store industry. Information has been gathered from CVS Caremarks 2009 through 2011 balance sheets, income statements, and statement of cash flows. An analysis of 12 CVS Caremarks financial ratios has been chosen. A trend analysis and an analytical report of CVS Caremarks financial ratios have also been included in this report to give a brief overview of CVS financial status and their increased rate of success. Additionally, a Peer Group Analysis, using the same 12 ratios as CVS Caremark will be used as a comparison with pharmacy competitors Walgreens and Rite Aid. Moreover, a Diagnostic Report will be given as an assessment of what CVS Caremark could or perhaps should do differently via recommendations for CVS Caremark to remain a viable and profitable corporation. Lastly, our conclusion which is based on CVS Caremarks financial status is a summary of the direction which could be beneficial to the company and its shareholders.

CVS CAREMARK FINANCIAL ANALYSIS Table of Contents Page Number Abstract Introduction Financial Ratio Calculation and Analysis Financial Ratio and Trend Analysis Peer Group Analysis Diagnostic Report Recommendation and Conclusion Appendices Consolidated Statement of Income Consolidated Balance Sheets Consolidated Statements of Cash Flows References 17 18 20 22 2 4 6 7 10 12 15

CVS CAREMARK FINANCIAL ANALYSIS CVS Caremark Financial Analysis There may be a time in a persons life when they become sick. Hopefully the times will be few and far in between. However, when that time comes a visit to the doctors office may be needed. After receiving a diagnosis from the doctor in some cases a prescription for medication

will be written. The goal of the prescription is to get the necessary medication to make the person feel well again; that is when a good pharmacy is needed. A consumers trust in his or her pharmacy is significant. CVS/Pharmacy, the retail division of CVS Caremark Corporation is Americas leading retail pharmacy with more than 7,300 CVS Caremark stores and access to a network of more than 65,000 pharmacies (CVS Caremark: Facts). CVS Caremark is a market leader in mail order pharmacy, specialty pharmacy, and retail clinics. CVS is also a leader in servicing providers of Medicare Part D Prescription Drug Plans. CVS Caremark offers a signature Pharmacy Advisor Program as well as an innovative Generic Step Therapy and a Genetic Benefit Management Program which promotes cost effective, healthier behaviors and improved health care outcomes. CVS stores have come a long way since its beginning in 1963. The store was founded in Lowell, Massachusetts by brothers Stanley and Sidney Goldstein and partner Ralph Hoagland. This original location started by selling health and beauty products. The acronym CVS stands for Consumer Value Stores (CVS Caremark: History). CVS growth in sales has been a major factor for the company to acquire many drug stores such as: Mack Drugs, Arbor Drugs, People Drugs, Revco Drugs, Clinton Drugs and Discounts Stores, and Eckerd drug stores. By 1974 CVS achieved sales of 100 million and by the 1985 sales reached one billion. In 1996, CVS Corporation became a standalone company trading on the New York Stock Exchange under the

CVS CAREMARK FINANCIAL ANALYSIS ticker CVS. In 2007 CVS Corporation and Caremark Rx, Inc. completed their transformative merger, creating CVS Caremark as we know it today (CVS Caremark: History). Today, CVS Caremark has achieved sales of more than $107 billion in annual revenue.

CVS Caremark is still maintaining the vision, mission, and values of its founders with a purpose of helping people in their path to better health by reinventing pharmacy (CVS Caremark 10-K, 2011). Their annual income statement, balance sheet, and cash flow report provides to its shareholders the required year-end figures. Conducting a financial analysis of CVS Caremark using the companys Financial Statements for years 2010 and 2011 respectively will provide detailed insight into the financial health of the company. A financial analysis is the selection, evaluation, and interpretation of financial data, along with other pertinent information, to assist in investment and financial decision making. A financial analysis can prove useful to the CVS Caremark Board of Directors, managers, payers, lenders, and others who make judgment regarding the financial health of an organization. It can also prove useful to those who evaluate issues such as employee performance, the efficiency of operations, credit policies, and externally evaluate potential investments and the credit worthiness of borrowers (Drake, P. 2012, p. 1). One widely accepted method of assessing financial statements is by conducting ratio analysis. Most healthcare systems and healthcare organizations routinely evaluate their financial condition by calculating various ratios and comparing the values to those for previous periods, looking for differences that could indicate a meaningful change in the companys financial condition. The five groups of ratios are: Liquidity, Profitability, Asset Management, Solvency and Market Value. Liquidity ratios provide the information regarding a companys ability to meet its

CVS CAREMARK FINANCIAL ANALYSIS short-term and immediate obligations. Profitability ratios provide information on the amount of income from each dollar of sales (p. 2). Asset Management Ratios relate information on a companys ability to manage its resources efficiently. Solvency measures the size of a companys after-tax income; excluding non-cash depreciation expenses, as compared to the firm's total debt obligations. It provides a measurement of how likely a company will be to continue meeting its debt obligations. Market Value Ratios evaluate the economic status of your

company in the wider marketplace (p. 3). Many companies compare their ratio values to those of similar competitors looking for differences that could indicate weakness and or opportunities for improvement in their industry. For the purpose of Team Ds Learning Team Project, we have looked at the following figures for calculation: Liquidity Ratios: Current Ratios and Quick Ratios; Solvency Ratios: Debt- Ratio, Debt-to-Equity Ratio, Times-Interest-Earned Ratio; Asset Management Ratios: Inventory Turnover Ratio and Total Assets Turnover Ratio; Profitability Ratios: Return on Sales, Return on Total Assets, and Return on Total Equity; Market Value Ratios: Earning Per Share and Price/Earnings Ratios. Based upon our ratio findings, CVS Caremark is continuing to maintain profitability in this troubled economic market. Financial Ratio Calculations and Analysis In Table 1 below you will find twelve (12) ratio calculations for CVS Caremark for fiscal year 2011. The calculations of ratios cover the following five financial categories: Liquidity, Asset Management, Solvency, Profitability, and Market Value. Table 1 Financial Ratios Liquidity Current Ratios Quick Ratios Calculations Formula/Calculation Steps/Final Results Current assets/Current liabilities: 18,594/11,956 = 1.56 Cash +Accounts receivable/Current liabilities =

CVS CAREMARK FINANCIAL ANALYSIS Calculations Formula/Calculation Steps/Final Results Quick Ratio: 1413 + 6047 = 7460/11956 = 0.62

Financial Ratios Asset Management Inventory Turnover Ratio

Total Assets Turnover Ratio Solvency Debt Ratios Debt to Equity Ratios

Cost of goods sold/Ending inventories = beginning inventory (2010) 10,695 + inventory (2011) 10,046 = 20,741/2 =10,371 (2011) = ending inventory (COGS) 107,100/10,371 = 10.33 = Inventory Turnover Ratio (December 2010 ending inventory is the beginning inventory for 2011) Net sales/Total assets = Total Assets Turnover Ratio: 107,100/6,4543 = 1.66 Total liabilities/Total assets = Debt Ratio: 11,956/ 64543 = 0.19 Long term debt + short term debt Divide stockholders total equity = Total debt/Total stockholder equity = Debt to Equity Ratio: 9208 + 750 = 9958/38,051 = 0.26 EBIT/Total interest = Time-Interest-Earned Ratio: 6330/584 = 10.84 EBIT/Sales = Return on Sales: 6330/107100 = 0.06 EBIT/Total Net assets: 6330/64543 = 0.10 Net income after taxes/ Equity = Return on Total Equity: 34610/38051 = 0.91 x10 = 9.10 Earnings after tax/Number of shares outstanding = Earnings Per Share: 3457/1298 = 2.66 Share price/Earnings per Share = P/Earnings Ratio 40.78/2.66 = 15.33

Times-Interest-Earned Ratio Profitability Return on Sales Return on Total Assets Return on Total Equity Market Value Earnings Per Share Price/Earnings Ratio

In summary, the breakdown of Table 1 ratios show that while CVS Caremark has

improved in some areas, the fluctuation of the economy can have extreme effects on any organization. But with good direction and effective decisions the numbers will and can meet the expectations that CVS Caremark predict when the reviews are done. CVS Caremark Financial Ratio and Trend Analysis Trend Analysis gives details that can be reviewed as to how well a company is doing overall. A look at financial ratios will also give details as to how the company is performing.

CVS CAREMARK FINANCIAL ANALYSIS Information can also be obtained from CVS Caremark Balance Sheet, Income Statement and

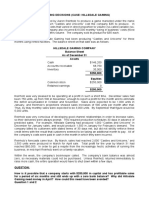

Cash Flow Statements. Table 1 below provides a CVS Caremark Trend Analysis which includes comparisons of 2009, 2010, and 2011 ratios. The area of concentration includes ratios for liquidity, assets management, solvency/leverage, profitability, and market value. Table 2 2009 1.43 0.53 9.55 1.60 0.24 0.31 11.44 0.07% 6.00% 10.33% 2.66 12.70

Financial Ratios Liquidity Current Ratios Quick Ratios Asset Management Inventory Turnover Ratio Total Assets Turnover Ratio Solvency Debt Ratios Debt to Equity Ratios Times-Interest-Earned Ratio Profitability Return on Sales Return on Total Assets Return on Total Equity Market Value Earnings Per Share Price/Earnings Ratio

2010 1.60 0.57 9.01 1.55 0.21 0.27 12.16 0.06% 5.51% 9.09% 2.50 13.20

2011 1.56 0.62 12.65 1.66 0.21 0.26 10.72 0.06% 5.36% 9.10% 17.20 16.66

Share price performance previous 3 years

CVS CAREMARK FINANCIAL ANALYSIS Liquidity Ratios This ratio includes current ratios and quick ratios. Table 1 shows that CVS Caremark

current ratios improved from 2009 to 2010 but then slightly deteriorated from 2010 to 2011. The quick ratio for CVS improved from 2009 to 2010 and from 2010 to 2011. The purpose for knowing these stats is to give a company an idea if they will be able to meet their short term debts. Asset Management Ratios This area of ratios include CVS Caremarks inventory turnover and total assets turnover. In other words this shows how CVS Caremark was able or not to turn assets including inventory into sales. CVS Caremark assets turnover and inventory turnover has both been up and down, in 2009 and 2010. But both of these ratios has shown growth in the 2011 trend analysis. Solvency Ratios This area of the ratio chart shows how CVS Caremark is using leverage to finance assets. In finance having an debt ratio and debt to equity ratios greater than 20% is an indication that a company is financially healthy. According to Table 1, CVS Caremark has shown that it is in good shape, which is great for the company. CVS Caremark has also shown a steady decrease for interest payout for this period as well. Profitability Ratios CVS Caremark has like other competitors in the pharmacy industry faces economic hits. CVS Caremark has a strong rating among analyst as a stock to buy (Schaeffer, 2012). Market Value Ratios CVS Caremark has shown that this company is not going to let its competitors take the lead in the retail drug store industry. Through continued acquisitions and strategic moves in this

CVS CAREMARK FINANCIAL ANALYSIS

10

industry the rating to buy will continue. (Yahoo News, 2012). Having the backing of well trusted analyst investors will continue to make profits as well as CVS Caremark. Peer Group Analysis The following table presents summary information for 2011 regarding the top competitors in the pharmacy industry which include CVS, Walgreens, and Rite Aid. Table 3 Financial Ratios Liquidity Ratios Current Ratios Quick Ratios Solvency Ratios Debt Ratios Debt to Equity Ratios Times-Interest-Earned Ratio Asset Management Ratios Inventory Turnover Ratio Total Assets Turnover Ratio Profitability Ratios Return on Sales Return on Total Assets Return on Total Equity Market Value Ratios Earnings Per Share Price-Earnings Ratio CVS Caremark 1.56 0.62 0.21 0.26 10.72 Walgreens 1.60 0.60 0.46 0.24 5.30 Rite Aid 1.80 0.40 1.27 0.40 0.20 Industry 1.70 0.70 N/A 0.40 8.10

12.65 1.66 7.36% 5.36% 9.10% 17.20 16.66

6.90 2.70 9.90 17.80 33.82 -

5.40 3.30 0.05 -5.50% 28.20% 29.49 -1.81

7.20 2.00 0.48 5.10% 25.50% N/A 17.50

Liquidity Ratios The higher current ratio means that the company has a higher ability to pay back debt; Rite Aid has the highest current ratio at 1.80. Ideally, a company would not want to have liabilities higher than current assets because if all the debt had to be paid back in the short- run the company would not have the ability to do it. All three companies have quick ratios which are

CVS CAREMARK FINANCIAL ANALYSIS

11

lower than 1:1 which means that the quick assets do not have the ability to pay off its liabilities quickly. CVS does have the largest quick ratio with Walgreens closely following. A company does not want to have a quick ratio lower than 1:1 because if the company faces financial difficulty it will not have the ability to pay off current debt. The larger the liquidity ratio, the better the ability the company has to satisfy its short-term obligations. Solvency Ratios Debt ratio indicates what proportion of debt a company has relative to its assets. When the debt ratio is high, the company is in a financial crisis. Once a company reaches an extremely high debt ratio, the creditors may require repayment which could lead to bankruptcy. Typically, a debt ratio less than 1 or 100% means the company needs less debt to finance its assets. CVS has the lowest debt ratio of 21% which means CVS only rely on 21% of debt to finance assets. Rite Aid has a high debt ratio at 127% which means the company should try to lower that number. Asset Management Ratios CVS is well ahead of the pack, almost doubling their inventory turnover ratio. The other two companies are doing a fairly good job managing their inventories as shown in the ratios. Walgreens and Rite Aid have close ratios and are below the industry standards, this means these companies need to better manage their inventory and improve on eliminating their inventory. Profitability Ratios The return on assets ratio shows how profitable a companys assets are in generating revenue. Walgreens is better at operations with Return on Assets (ROA) around 10%, while CVS is around 5%, and Rite Aid is at -5%. CVS Caremark surpasses Walgreens and Rite Aid combined in Return on Sales. Return on Equity (ROE) is important for investors because it

CVS CAREMARK FINANCIAL ANALYSIS shows how profitable a company is for its shareholders. Rite Aid had the best ROE which was above the industry standard followed by Walgreens. Market Value Ratios Earnings per share are used to gauge a companys profitability per unit of shareholder

12

ownership. This is another area where CVS fell behind the other two companies. CVS Caremark has a high price earnings ratio at 16.66. Compared to industry average (-1.81) Rite Aid is extremely low. The higher the P/E ratio, the more money the investor is expecting for return. A P/E ratio of 0-10 indicates that either the stock is undervalued or the companys sales have declined. A P/E ratio of 10-17 means it is usually the fair value while a P/E of 17-25 means that the companys earnings have increased. Presently CVS Caremark is healthy and strong. This fact says it all: CVS Caremarks market capitalization surpasses Walgreens and Rite Aid. Market capitalization expresses the total dollar value of a public company. CVS is bigger and has a higher P/E. CVS is the industry leader with Walgreens following and Rite Aid at the bottom. Rite Aid has the the largest debt ratio of the three. Diagnostic Report CVS Caremark experienced strong financial results and accomplishments in 2011 and has set a solid foundation for future growth. Net revenues increased $11.3 billion in 2011 compared to 2010, and decreased $2.4 billion in 2010 compared to 2009. During 2011, net revenues in the Retail Pharmacy segment increased 3.9 % and net revenues in the Pharmacy Services segment increased 24.9% compared to the prior year. Gross profit increased $342 million in 2011, to $20.6 billion or 19.2 % of net revenues as compared to $20.2 billion in the prior year (CVS Caremark 10-K, 2011).

CVS CAREMARK FINANCIAL ANALYSIS During 2011, CVS Caremark Gross Profit increased $342 million, to $20.6 billion or

13

19.2% of net revenues as compared to $20.2 billion in 2010. Gross profit decreased $139 million in 2010, to $20.2 billion or 21% of net revenues, as compared to 2009 (CVS Caremark 10-K, 2011). The decline in gross profit as a percent of net revenues was driven by the increased weighting toward Pharmacy Services whose gross profit margin tends to be lower than that of the Retail Pharmacy segment. CVS gross profit as a percentage of revenues benefited from the increase in their total generic dispensing rate, which increased to 74% and 75% in 2011 and 2010 respectively, compared to the generic dispensing rate of 68% in 2009 (CVS Caremark 10-K, 2011). These increases can be attributed to the new generic drug introductions and the companys continued efforts to encourage plan members to use generic drugs when they are available. Retail Pharmacy increased by 2.5% offset by declines in the Pharmacy Services segment by 1.1%, compared to the prior year. CVS Caremark had a great year of accomplishment in 2011; the Company reported solid financial results. The retail business continued to post strong top- and bottom-line results, and our PBM enjoyed strong revenue growth. On November 1, 2011, the CVS Caremark completed the sale of its TheraCom, L.L.C. ("TheraCom") subsidiary to AmerisourceBergen Corporation for $250 million, subject to a working capital adjustment. TheraCom is a provider of commercialization support services to the biotech and pharmaceutical industry. The TheraCom business has historically been part of the Company's Pharmacy Services segment. The results of the TheraCom business are presented as discontinued operations and have been excluded from both continuing operations and segment results for all periods presented. The Company recognized a $53 million pre-tax gain and a $37

CVS CAREMARK FINANCIAL ANALYSIS million after tax loss on the sale of TheraCom. The after tax loss was caused by the income tax treatment of TheraCom's nondeductible goodwill (PR Newswire, 2012).

14

During the three months ended December 31, 2011, CVS Caremark opened 24 new retail drugstores and closed one. In addition, the company relocated five retail drugstores. As of December 31, 2011, the Company operated 7,404 locations, included in which were 7,327 retail drugstores, 30 onsite pharmacies, 31 retail specialty pharmacy stores, 12 specialty mail order pharmacies, and 4 mail order pharmacies in 44 states, the District of Columbia, and Puerto Rico (PR Newswire, 2012). Based upon the trend analysis for CVS ability to meet their short term debt, the current ratios improved from 2009 to 2010, but slightly deteriorated from 2010 to 2011. The Quick ratios improved from 2009, 2010 and 2011. The assets turnover and total asset turnover fluctuated in 2009 and 2010, while there was growth in 2011. The companys debt ratio and debt equity ratios is greater than 20% which indicates the company is financially healthy. This is further demonstrated by the companys strong profitability ratios. Comparing CVS Caremark with its competitors, CVS market capitalization and revenues exceed both Walgreens and Rite Aid. CVS also lead in the debt rate comparison with ratios of 0.21, 1.27, and 0.46 for CVS Caremark, Rite Aid and Walgreens respectively. Rite Aid has the highest debt ratio at 127%. While each of the three companies analyzed are doing relatively well managing their inventories CVS is achieving exceedingly well in this area.CVS surpasses the combined revenues of Walgreens and Rite Aid. The Peer Analysis shows that CVS is the industry leader in pharmacy followed by Walgreens and then Rite Aid. Recommendations CVS Caremark is still a very viable force in the retail drug store industry. This company

CVS CAREMARK FINANCIAL ANALYSIS

15

is taking steps to evaluate what is best for the company and its shareholders. Profits are expected to continue to grow under the current Board of Directors. Some recommendations for better results in 2012:

Anticipate benefits from prescription transfers from Walgreens. Continue profit making acquisitions (i.e., UAM Medicare Part-D business). Continue with developing and improving operating profits in both Pharmacy Services and Retail Pharmacy segments.

Research and expand key initiatives for CVS Caremark. Create new integrated offerings. Streamline where necessary. Conclusion CVS Caremark has a long profitable future ahead. They appear to be making real-time

adjustments as needed. Even in these difficult economic times, CVS Caremark has kept its integrity, keeping with the visions of its founders. President and Chief Executive Officer Larry Merlo has continued to make CVS Caremark and its subsidiaries a strong sought after stock.

CVS CAREMARK FINANCIAL ANALYSIS

16

Appendices

CVS CAREMARK FINANCIAL ANALYSIS Financial Statements of CVS Caremark Consolidated Statements of Income In millions, except per share amounts Net revenues Cost of revenues Gross profit Operating expenses Operating profit Interest expense, net Income before income tax provision Income tax provision Income from continuing operations Income (loss) from discontinued operations, net of tax Net income Net loss attributable to noncontrolling interest Net income attributable to CVS Caremark Basic earnings per common share: Income from continuing operations attributable to CVS Caremark Loss from discontinued operations attributable to CVS Caremark Net income attributable to CVS Caremark Weighted average common shares outstanding Diluted earnings per common share: Income from continuing operations attributable to CVS Caremark Loss from discontinued operations attributable to CVS Caremark Net income attributable to CVS Caremark Weighted average common shares outstanding Dividends declared per common share $ $

17

December 31, 2011 2010 107,100 $ 95,778 86,539 75,559 20,561 14,231 6,330 584 5,746 2,258 3,488 (31 ) 3,457 4 3,461 $ 20,219 14,082 6,137 536 5,601 2,179 3,422 2 3,424 3 3,427

2.61 (0.02 )

2.51

2.59 1,338

2.51 1,367

2.59 (0.02 )

2.49

2.57 1,347 0.500

2.49 1,377

0.350

CVS CAREMARK FINANCIAL ANALYSIS Consolidated Balance Sheets

18

In millions, except per share amounts Assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Deferred income taxes Other current assets Total current assets Property and equipment, net Goodwill Intangible assets, net Other assets Total assets Liabilities: Accounts payable Claims and discounts payable Accrued expenses Short-term debt Current portion of long-term debt Total current liabilities Long-term debt Deferred income taxes Other long-term liabilities Commitments and contingencies (Note 13) Redeemable noncontrolling interest Shareholders equity: Preferred stock, par value $0.01: 0.1 shares authorized; none issued or outstanding Common stock, par value $0.01: 3,200 shares authorized; 1,640 shares issued and 1,298 shares outstanding at December 31, 2011 and 1,624 shares issued and 1,363 shares outstanding at December 31, 2010 Treasury stock, at cost: 340 shares at December 31, 2011 and 259 shares at December 31, 2010 Shares held in trust: 2 shares at December 31, 2011 and 2010 Capital surplus Retained earnings Accumulated other comprehensive loss

December 31, 2011 2010 $ 1,413 5 6,047 10,046 503 580 18,594 8,467 26,458 9,869 1,155 $ 64,543 $ 1,427 4 4,925 10,695 511 144 17,706 8,322 25,669 9,784 688 $ 62,169

$ 4,370 3,487 3,293 750 56 11,956 9,208 3,853 1,445 30

$ 4,026 2,569 3,070 300 1,105 11,070 8,652 3,655 1,058 34

16 (11,953 (56 28,126 22,090 (172

16 ) (9,030 ) (56 27,610 19,303 ) (143 ) )

CVS CAREMARK FINANCIAL ANALYSIS Total shareholders equity Total liabilities and shareholders equity 38,051 $ 64,543

19 37,700 $ 62,169

CVS CAREMARK FINANCIAL ANALYSIS Consolidated Statements of Cash Flows December 31, 2011 2010 $ 97,688 (75,148 (13,635 4 (647 (2,406 5,856 $ 94,503 ) (73,143 ) (13,778 4 ) (583 ) (2,224 4,779

20

In millions Cash flows from operating activities: Cash receipts from customers Cash paid for inventory and prescriptions dispensed by retail network pharmacies Cash paid to other suppliers and employees Interest received Interest paid Income taxes paid Net cash provided by operating activities Cash flows from investing activities: Purchases of property and equipment Proceeds from sale-leaseback transactions Proceeds from sale of property and equipment Acquisitions (net of cash acquired) and other investments Purchase of available-for-sale investments Sale or maturity of available-for-sale investments Proceeds from sale of subsidiary Net cash used in investing activities Cash flows from financing activities: Increase (decrease) in short-term debt Proceeds from issuance of long-term debt Repayments of long-term debt Dividends paid Derivative settlements Proceeds from exercise of stock options Excess tax benefits from stock-based compensation Repurchase of common stock Other Net cash used in financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the year Reconciliation of net income to net cash provided by operating

) ) ) )

(1,872 592 4 (1,441 (3 60 250 (2,410

) (2,005 507 34 ) (177 ) 1 ) (1,640

450 1,463 (2,122 (674 (19 431 21 (3,001 (9 (3,460 (14 1,427 $ 1,413

) ) )

) )

(15 991 (2,103 (479 (5 285 28 (1,500

) ) ) )

) (2,798 ) 341 1,086 $ 1,427

CVS CAREMARK FINANCIAL ANALYSIS activities: Net income Adjustments required to reconcile net income to net cash provided by operating activities: Depreciation and amortization Stock-based compensation Gain on sale of subsidiary Deferred income taxes and other noncash items Change in operating assets and liabilities, net of effects from acquisitions: Accounts receivable, net Inventories Other current assets Other assets Accounts payable Accrued expenses Other long-term liabilities Net cash provided by operating activities

21

$ 3,457

$ 3,424

1,568 135 (53 144

1,469 150 ) 30

(748 607 (420 (49 1,128 85 2 $ 5,856

) 532 (352 ) (4 ) (210 (40 (176 (44 $ 4,779

) ) ) ) ) )

CVS CAREMARK FINANCIAL ANALYSIS References

22

American Psychological Association. (2010). Publication manual of the American Psychological Association (6th ed., 2nd printing). Washington, DC: APA Press. CVS Caremark Corp. (CVS) Debt and Solvency. Retrieved from http://www.stock-analysison.net-NYSE/Company/CVS-Caremark-Corp/Ratios/Profitability CVS Caremark. (n.d.). CVS Caremark. Retrieved April 12, 2012 from: http://infocvscaremark. com/our-company/history CVS Caremark. (2012). CVS Caremark. Retrieved April 12, 2012, from: http:// inforcvscaremark.com/corporate-responsibility/aboutreport Drake, P. P. (2012). Financial ratio analysis. A reading prepared by Pamela Peterson Drake, 1-3. PR Newswire, United Business Media CVS Caremark Reports Fourth Quarter and Full Year Results. Retrieved May 1, 2012, from: http://www.prnewswire.com/news-releases/cvscaremark-reports-fourth-quarter-and-full-year-results-2012-guidance-raised-to-reflectanticipated-first-quarter-benefit-of-prescription-transfers-from-walgreens138919549.html Rite Aid. (n.d.). Rite Aid Corp Quote Page (RAD). Retrieved April 18, 2012, from Rite Aid: http://www.dailyfinance.com/tmf/proxy?url=http%3a%2f%2f%2fwww.motleyfool.idman ageds Yahoo Finance. (n.d.). Rite Aid Corporation Stock. Retrieved April 17, 2012, from Yahoo: http://finance.yahoo.com/qis?s=RAD+Income+Statement&annual

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Final Law PaperDokument11 SeitenFinal Law Paperapi-239990812Noch keine Bewertungen

- Case Exercises NsDokument7 SeitenCase Exercises Nsapi-239990812Noch keine Bewertungen

- Interview Paper Rough Draft Near Completeion 5 27Dokument15 SeitenInterview Paper Rough Draft Near Completeion 5 27api-239990812Noch keine Bewertungen

- Nobody Nowhere October 18Dokument8 SeitenNobody Nowhere October 18api-239990812Noch keine Bewertungen

- The Extraordinary Autobiography Brochure 10 31Dokument3 SeitenThe Extraordinary Autobiography Brochure 10 31api-239990812Noch keine Bewertungen

- Access To Dental Care For Mentally and Physically Challenge Populati OnDokument18 SeitenAccess To Dental Care For Mentally and Physically Challenge Populati Onapi-239990812Noch keine Bewertungen

- Im It Value DR Schoenbart WK 10Dokument5 SeitenIm It Value DR Schoenbart WK 10api-239990812Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- SER Plagiarism ReportDokument6 SeitenSER Plagiarism ReportmayankNoch keine Bewertungen

- Tugas Manajemen Keuangan Review Ratio PerusahaanDokument3 SeitenTugas Manajemen Keuangan Review Ratio PerusahaanShofiNoch keine Bewertungen

- Ia 2 Midterm ExamDokument13 SeitenIa 2 Midterm ExamIrene Grace Edralin AdenaNoch keine Bewertungen

- RPT Sanction EPayment DetailsDokument4 SeitenRPT Sanction EPayment DetailsTYCS35 SIDDHESH PENDURKARNoch keine Bewertungen

- 1 UpdatesDokument37 Seiten1 UpdatesShaina BustosNoch keine Bewertungen

- PLDT VS NTCDokument4 SeitenPLDT VS NTCCMHNoch keine Bewertungen

- Nature and Scope of Financial ManagementDokument11 SeitenNature and Scope of Financial ManagementkorlaguntaNoch keine Bewertungen

- Financial Institution Assignment 3 - v1 SolutionsDokument5 SeitenFinancial Institution Assignment 3 - v1 SolutionsAtal OmarzaiNoch keine Bewertungen

- Quiz 3Dokument131 SeitenQuiz 3afeeraNoch keine Bewertungen

- Financial Management Midterm ExamDokument4 SeitenFinancial Management Midterm ExamJoody CatacutanNoch keine Bewertungen

- Bank Green Dot Account Balance Screenshot - Google SearchDokument1 SeiteBank Green Dot Account Balance Screenshot - Google SearchDa Bratt BrattNoch keine Bewertungen

- Dividends and Other PayoutsDokument29 SeitenDividends and Other PayoutsArif AlamgirNoch keine Bewertungen

- Ubs Sekuritas Indonesia Bilingual 31 Dec 2017 Released PDFDokument61 SeitenUbs Sekuritas Indonesia Bilingual 31 Dec 2017 Released PDFCharles EdwardNoch keine Bewertungen

- Under Variable Costing:: Question 1Dokument35 SeitenUnder Variable Costing:: Question 1Iris FenelleNoch keine Bewertungen

- LCCI Level 3 Certificate in Accounting ASE20104 ASE20104 Nov-2017Dokument20 SeitenLCCI Level 3 Certificate in Accounting ASE20104 ASE20104 Nov-2017Aung Zaw HtweNoch keine Bewertungen

- Chapter 10 - Financial Markets PDFDokument4 SeitenChapter 10 - Financial Markets PDFKelrina D'silvaNoch keine Bewertungen

- This Study Resource Was: Process Costing - AverageDokument7 SeitenThis Study Resource Was: Process Costing - AverageIllion IllionNoch keine Bewertungen

- PropertyGuru 2020 Financial StatementDokument115 SeitenPropertyGuru 2020 Financial StatementTerence LeeNoch keine Bewertungen

- Financial Analysis Term PaperDokument6 SeitenFinancial Analysis Term Paperaflsswofo100% (1)

- Chapter 9 Financial Forecasting For Strategic GrowthDokument18 SeitenChapter 9 Financial Forecasting For Strategic GrowthMa. Jhoan DailyNoch keine Bewertungen

- Fundamentals of Financial AccountingDokument40 SeitenFundamentals of Financial AccountingEYENNoch keine Bewertungen

- Bharti Airtel Ltd. (India) : SourceDokument6 SeitenBharti Airtel Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Jurnal Ananda Indra, Rustam Hidayat DLLDokument10 SeitenJurnal Ananda Indra, Rustam Hidayat DLLIlham Rajid RNoch keine Bewertungen

- Financial Reporting & AnalysisDokument11 SeitenFinancial Reporting & AnalysisSalman FarooqNoch keine Bewertungen

- AssssDokument10 SeitenAssssshimelisNoch keine Bewertungen

- CSTC College of Sciences Technology and Communication, IncDokument35 SeitenCSTC College of Sciences Technology and Communication, IncJohn Patrick MercurioNoch keine Bewertungen

- Hillsdale Gaming Case AnalysisDokument2 SeitenHillsdale Gaming Case AnalysisfraimeNoch keine Bewertungen

- Big, Quality Wins Will Build On Solid Base: Etherstack PLC (ESK)Dokument8 SeitenBig, Quality Wins Will Build On Solid Base: Etherstack PLC (ESK)Muhammad ImranNoch keine Bewertungen

- MN4001 Week 1 (Lecture)Dokument20 SeitenMN4001 Week 1 (Lecture)Gabriele KaubryteNoch keine Bewertungen

- MCD 2023 Annual ReportDokument73 SeitenMCD 2023 Annual ReportsherbicepsNoch keine Bewertungen