Beruflich Dokumente

Kultur Dokumente

Advanced Financial Management. - Leverages - Presentation Final.

Hochgeladen von

Ankit SinghOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Advanced Financial Management. - Leverages - Presentation Final.

Hochgeladen von

Ankit SinghCopyright:

Verfügbare Formate

Q1. A FIRM HAS SALES OF RS. 10,00,000 , VARIABLE COST IS 70% , TOTAL COST IS RS.

9,00,000 AND 10% DEBT OF RS. 5,00,000. IF TAX = 40% CALCULATE : (A) (B) (C) (D) Sol :OPERATING LEVERAGE. FINANCIAL LEVERAGE. COMBINED LEVERAGE. IF THE FIRM WANTS TO DOUBLE ITS EBIT, HOW MUCH OF A RAISE IN SALES WOULD BE NEEDED ON A % BASIS ? INCOME STATEMENT PARTICULARS SALES LESS : VARIABLE COST ( 70% OF 10,00,000 ) CONTRIBUTION LESS : FIXED COST ( TOTAL COST VARIABLE COST i.e 9,00,000 - 7,00,000 ) EBIT LESS : INTEREST ( 10% OF 5,00,000 ) NPBT LESS : TAX @ 40% NPAT AMOUNT RS. 10,00,000 7,00,000

3,00,000 2,00,000

1,00,000 50,000 50,000 20,000 30,000

(A) OPERATING LEVERAGE :

CONTRIBUTION EBIT

= 3,00,000 1,00,000 = 3 Times (B) FINANCIAL LEVERAGE : EBIT NPBT = 1,00,000 50,000 = 2 Times (C) COMBINED LEVERAGE : CONTRIBUTION NPBT = 3,00,000 50,000 = 6 Times

(D) CALCULATION OF % CHANGE IN SALES CONTRIBUTION EBIT 3 = = % CHANGE IN EBIT % CHANGE IN SALES 100 % CHANGE IN SALES

% CHANGE IN SALES

100 3

33.33%

NEW SALES = ( 100 + 33.33% ) x = 133.33% X

RS. 10,00,000.

RS . 10,00,000.

= RS. 13,33,3000

Q2. CALCULATE OPERATING , FINANCIAL AND COMBINED LEVERGRS. 01. OUTPUT = 15,000 UNITS 02. TOTAL OPERATING COST = 3,65,000 03. VARIABLE COST PER UNIT = 30% OF SELLING PRICE 04. 10% BORROWED CAPITAL = RS. 8,00,000 05. SELLING PRICE PER UNIT = RS. 50 06. TAX = 40% Sol :INCOME STATEMENT PARTICULARS SALES ( 15,000 X RS. 50 PER UNIT ) LESS : VARIABLE COST ( 30% OF Rs. 50 = 15 X 15,000 ) CONTRIBUTION LESS : FIXED COST ( TOTAL COST VARIABLE COST i.e 3,65,000 - 2,25,000 ) EBIT LESS : INTEREST ( 10% OF 8,00,000 ) NPBT LESS : TAX @ 40% NPAT AMOUNT RS. 7,50,000 2,25,000

5,25,000 1,40,000

3,85,000 80,000 3,05,000 1,22,000 1,83,000

(A) OPERATING LEVERAGE :

CONTRIBUTION EBIT

= 5,25,000 3,85,000 = 1.36 Times (B) FINANCIAL LEVERAGE : EBIT NPBT = 3,85,000 3,05,000 = 1.26 Times (C) COMBINED LEVERAGE : CONTRIBUTION NPBT = 5,25,000 3,05,000 = 1.72 Times

Q3. A FIRMS SALES = RS. 75,00,000 , VARIABLE COSTS = RS. 42,00,000 , & FIXED COST = RS. 6,00,000. IT HAS 9% DEBT = RS. 45,00,000 & ITS EQUITY WAS RS. 55,00,000 & TAX = 35%. 01. DEGREE OF OPERATING LEVERAGE. 02. DEGREE OF FINANCIAL LEVERAGE. 03. COMBINED LEVERAGE 04. NEW EBIT IF SALES = RS. 50,00,000. Sol :INCOME STATEMENT PARTICULARS SALES LESS : VARIABLE COST CONTRIBUTION LESS : FIXED COST AMOUNT RS. 75,00,000 42,00,000 33,00,000 6,00,000

EBIT LESS : INTEREST ( 9% OF 45,00,000 ) NPBT LESS : TAX @ 35% NPAT

27,00,000 4,05,000 22,95,000 8,03,250 14,91,750

(A) OPERATING LEVERAGE :

CONTRIBUTION EBIT

= 33,00,000 27,00,000 = 1.22 Times (B) FINANCIAL LEVERAGE : EBIT NPBT = 27,00,000 22,95,000 = 1.17 Times (C) COMBINED LEVERAGE : CONTRIBUTION NPBT = 33,00,000 22,95,000 = 1.43 Times

(D) NEW EBIT IF SALES = RS. 50,00,000 CONTRIBUTION EBIT 1.22 = = % CHANGE IN EBIT % CHANGE IN SALES % CHANGE IN EBIT 50,00,000 - 75,00,000 75,00,000

% CHANGE IN EBIT

( 25 X 1.22 ) X 100

40.66%

NEW EBIT = ( 100 40.66% ) x = 59.34% X

RS. 27,00,000.

RS . 27,00,000.

= RS. 16,02,180

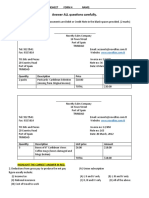

Q4. CURRENT BALANCE SHEET OF ABC LTD LIABILITIES EQUITY @ 10 10% DEBT RETAINED EARNINGS CURRENT LIABILITIES TOTAL AMOUNT RS 8,00,000 6,00,000 3,50,000 1,50,000 19,00,000

ASSETS FIXED ASSETS CURRENT ASSETS TOTAL

AMOUNT RS 10,00,000 9,00,000 19,00,000

CURRENT INCOME STATEMENT OF ABC LTD PARTICULARS AMOUNT RS. SALES OPERATING EXPENSES ( INCLUDING DEPRECIATION RS. 60,000) EBIT LESS : INTEREST 3,40,000 1,20,000 2,20,000 60,000

EBT LESS : TAXES NET INCOME

1,60,000 56,000 1,04,000

(A) DETERMINE ALL LEVERGES. (B) ASSUMING TOTAL ASSETS TO BE THE SAME WHAT WILL BE THE EPS IF SALES CHANGE BY 20%. Sol :INCOME STATEMENT PARTICULARS SALES LESS : VARIABLE COST ( 1,20,000 60,000 ) CONTRIBUTION LESS : FIXED COST ( LESS DEPRECIATION 60,000 ) EBIT LESS : INTEREST ( 10% OF 6,00,000 ) NPBT LESS : TAX @ 34% AMOUNT RS. 3,40,000 60,000

2,80,000 60,000

2,20,000 60,000 1,60,000 56,000

NPAT NO. OF EQUITY SHARES EPS

1,04,000 80,000 1.3 Times

(A) OPERATING LEVERAGE :

CONTRIBUTION EBIT

= 2,80,000 2,20,000 = 1.27 Times (B) FINANCIAL LEVERAGE : EBIT NPBT = 2,20,000 1,60,000 = 1.37 Times (C) COMBINED LEVERAGE : CONTRIBUTION NPBT = 2,80,000 1,60,000 = (D) 1.75 Times

CALCULATION OF EPS

CONTRIBUTION NPAT

% CHANGE IN EPS % CHANGE IN SALES

2,80,000 1,04,000

% CHANGE IN EPS 20

% CHANGE IN EPS

= 20 X 2.69 = 53.8%

IF SALES INCREASES BY 20% NEW EPS = 100% + 53.8% = 153.8% X 1.3 = 2.0644 Times

IF SALES DECREASES BY 20% NEW EPS = 100% - 53.8% = 46.2% X 1.3 = 0.5356 Times

Q5. CURRENT BALANCE SHEET OF ABC LTD

LIABILITIES EQUITY @ 10 10% DEBT RETAINED EARNINGS CURRENT LIABILITIES TOTAL

AMOUNT RS 60,000 80,000 20,000 40,000 2,00,000

ASSETS FIXED ASSETS CURRENT ASSETS TOTAL ASSET TURNOVER = 3 FIXED COST = RS. 1,00,000 VARIABLE COST = 40% TAXES = 35% (A) ALL LEVERGES.

AMOUNT RS. 1,50,000 50,000 2,00,000

Sol :-

INCOME STATEMENT PARTICULARS AMOUNT RS. 6,00,000 2,40,000

SALES { 3 = SALES/2,00,000 } LESS : VARIABLE COST ( 40% OF 6,00,000 ) CONTRIBUTION LESS : FIXED COST EBIT LESS : INTEREST ( 10% OF 80,000 ) NPBT LESS : TAX @ 35% NPAT NO. OF EQUITY SHARES EPS

3,60,000 1,00,000 2,60,000 8,000 2,52,000 88,200 1,63,800 6,000 27.3 Times

(A) OPERATING LEVERAGE :

CONTRIBUTION EBIT

= 3,60,000 2,60,000 = 1.38 Times

(B) FINANCIAL LEVERAGE : EBIT NPBT = 2,60,000 2,52,000 = 1.03 Times (C) COMBINED LEVERAGE : CONTRIBUTION NPBT = 3,60,000 2,52,000 = 1.42 Times

Q6. THE BALANCE SHEET OF T LTD ON 31.03.2008 IS AS UNDER (LACS) LIABILITIES EQUITY CAPITAL @ RS.10 10% DEBT RETAINED EARNINGS CURRENT LIABILITIES TOTAL ASSETS BUILDING MACHINERY STOCK DEBTORS CASH TOTAL AMOUNT RS 90 120 30 60 300 AMOUNT RS 150 75 50 20 5 300

THE TOTAL ASSETS TURNOVER IS 3 , FIXED COST IS 1/6TH OF SALES AND VARIABLES COSTS ARE 50% OF SALES. TAX = 35% CALCULATE (A) ALL LEVERAGES (B) THE MARKET PRICE OF THE SHARES IF THE P/E RATIO IS 2.5 TIMES

Sol :-

INCOME STATEMENT PARTICULARS AMOUNT RS. ( IN LAKHS) 900 450

SALES { 3 = SALES/ 300 } LESS : VARIABLE COST ( 50% OF 900 ) CONTRIBUTION LESS : FIXED COST ( 1/6TH OF 900 ) EBIT LESS : INTEREST ( 10% OF 120 ) NPBT LESS : TAX @ 35% NPAT NO. OF EQUITY SHARES EPS P/E MARKET PRICE

450 150

300 12 288 100.8 187.2 9 20.8 Times 2.5 Times 52

(A) OPERATING LEVERAGE :

CONTRIBUTION EBIT

= 450 300 = 1.5 Times (B) FINANCIAL LEVERAGE : EBIT NPBT = 300 288 = 1.04 Times (C) COMBINED LEVERAGE : CONTRIBUTION NPBT = 450 288 = 1.56 Times

CASE STUDY

A COMPANY HAS ASSESTS OF RS. 10,00,000 FINANCED WHOLLY BY EQUITY SHARE CAPITAL. THERE ARE 10,00,000 SHARES OUTSTANDING WITH A BOOK VALUE OF RS. 10 PER SHARE. LAST YEARS PROFIT BEFORE TAXES WAS RS. 2,50,000. THE TAX RATE IS 35 PER CENT. THE COMPANY IS THINKING OF AN EXPANSION PROGRAMME THAT WILL COST RS. 5,00,000 THE FINANCIAL MANAGER CONSIDERS THE THREE FINANCING PLANS : (I) SELLING 50,000 SHARES AT RS. 10 PER SHARE (II) BORROWING RS. 5,00,000 AT AN INTEREST RATE OF 14 PER CENT (III) SELLING RS. 5,00,000 OF PREFERENCE SHARES WITH A DIVIDEND RATE OF 14 PER CENT. THE PROFIT BEFORE INTEREST AND TAX ARE ESTIMATED TO BE RS. 3,75,000 AFTER EXPANSION. CALCULATE : (I) (II) (III) THE AFTER-TAX RATE OF RETURN ON ASSET, THE EARNINGS PER SHARE THE RATE OF RETURN ON SHAREHOLDERS EQUITY FOR EACH OF THE THREE FINANCING ALTERNATIVES. ALSO SUGGEST WHICH ALTERNATIVE SHOULS BE ACCEPTED BY THE FIRM.

SOL :PARTICULARS PLAN - I EQUITY EBIT LESS: INTEREST EBT LESS: TAX @ 35% NPAT LESS: PREFERENCE DIV. RETAINED EARNINGS NO. OF EQUITY SHARES EPS 3,75,000 3,75,000 ( 1,31,250 ) 2,43,750 2,43,750 1,50,000 1.63 PLAN - II DEBT 3,75,000 ( 70,000 ) 3,05,000 ( 1,06,750 ) 1,98,250 1,98,250 1,00,000 1.98 PLAN - III PREF. SHARES 3,75,000 3,75,000 ( 1,31,250 ) 2,43,750 ( 70,000 ) 1,73,750 1,00,000 1.74

COMMENT : AS THE EPS IN PLAN II IS HIGHEST THAN OTHER PLANS , ITS PREFERABLE TO GO WITH PLAN-II i.e BORROWING RS. 5,00,000 AT AN INTEREST RATE OF 14 PER CENT

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Salary SlipDokument1 SeiteSalary SlipAnkit SinghNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Green MarketingDokument12 SeitenGreen MarketingsundaragiriNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- New Doc 2017-02-11Dokument1 SeiteNew Doc 2017-02-11Ankit SinghNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- 07 Service EncounterDokument23 Seiten07 Service EncounterAnkit SinghNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- ASHISH Mutual Fund Project ReportDokument41 SeitenASHISH Mutual Fund Project ReportVasudev SurendranNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Total Quality Management (Solutions)Dokument9 SeitenTotal Quality Management (Solutions)Ankit SinghNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Wipo Smes Kul 06 WWW 68913Dokument55 SeitenWipo Smes Kul 06 WWW 68913Ankit SinghNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Ipr 1Dokument20 SeitenIpr 1jyothimoncNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Services Marketing2821Dokument189 SeitenServices Marketing2821Ankit SinghNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Greenmarketing 110914052014 Phpapp02Dokument28 SeitenGreenmarketing 110914052014 Phpapp02Ankit SinghNoch keine Bewertungen

- Finalppt Ip 120705063938 Phpapp02Dokument39 SeitenFinalppt Ip 120705063938 Phpapp02Ankit SinghNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- EntrprnrshpDokument17 SeitenEntrprnrshpAnkit SinghNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Activity Based Costing.Dokument31 SeitenActivity Based Costing.Ankit SinghNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Financial Management in Sick UnitsDokument22 SeitenFinancial Management in Sick UnitsAnkit SinghNoch keine Bewertungen

- PMS Disclosure DocumentDokument33 SeitenPMS Disclosure DocumentAnkit SinghNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- CV Sanjeev Singh 1309 BDokument2 SeitenCV Sanjeev Singh 1309 BAnkit SinghNoch keine Bewertungen

- ICICI Bank-Investor Presentation08Dokument25 SeitenICICI Bank-Investor Presentation08Ankit SinghNoch keine Bewertungen

- Common Written Examination (Cwe) For Recruitment of Pos/Mts in Participating Organizations - Cwe Po/Mt-IiiDokument4 SeitenCommon Written Examination (Cwe) For Recruitment of Pos/Mts in Participating Organizations - Cwe Po/Mt-IiiAnkit SinghNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- AOL - TimeWarnerDokument31 SeitenAOL - TimeWarnerAnkit Singh100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- SIP FinalDokument47 SeitenSIP FinalAnkit SinghNoch keine Bewertungen

- Fin AsgntDokument5 SeitenFin AsgntAnkit SinghNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Laptop IndustryDokument31 SeitenThe Laptop IndustryOm PrakashNoch keine Bewertungen

- Conceptual SellingDokument8 SeitenConceptual SellingAnkit Singh100% (1)

- Fin AsgntDokument5 SeitenFin AsgntAnkit SinghNoch keine Bewertungen

- Capital StructureDokument8 SeitenCapital StructurePritesh SatraNoch keine Bewertungen

- Entreprenurial Leadership: Presented By: Ankit Singh. Karthik Sarma. Dhananjai Torkade. Heena Mirza. Viren PunjabiDokument11 SeitenEntreprenurial Leadership: Presented By: Ankit Singh. Karthik Sarma. Dhananjai Torkade. Heena Mirza. Viren PunjabiAnkit SinghNoch keine Bewertungen

- Letter For Mba Summer TrainingDokument1 SeiteLetter For Mba Summer Trainingsona's0% (1)

- Human Resource PlanningDokument20 SeitenHuman Resource PlanningAnkit SinghNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- JPF AR 2012 NewDokument74 SeitenJPF AR 2012 NewAnkit SinghNoch keine Bewertungen

- Ansoff MatrixDokument14 SeitenAnsoff MatrixHemant PatilNoch keine Bewertungen

- Lecture 5.2-General Cost Classifications (Problem 2)Dokument2 SeitenLecture 5.2-General Cost Classifications (Problem 2)Nazmul-Hassan Sumon75% (4)

- Consultants DirectoryDokument36 SeitenConsultants DirectoryPeter WahlburgNoch keine Bewertungen

- 31.economic Contributions of Indian Film IndustryDokument3 Seiten31.economic Contributions of Indian Film IndustrymercatuzNoch keine Bewertungen

- A Practical Guide To GST (Chapter 15 - Transition To GST)Dokument43 SeitenA Practical Guide To GST (Chapter 15 - Transition To GST)Sanjay DwivediNoch keine Bewertungen

- PitchBook PME Benchmarking MethodologyDokument10 SeitenPitchBook PME Benchmarking Methodologykartikkhanna1990Noch keine Bewertungen

- Purchases, Cash Basis P 2,850,000Dokument2 SeitenPurchases, Cash Basis P 2,850,000Dummy GoogleNoch keine Bewertungen

- Chapter 04Dokument8 SeitenChapter 04Mominul MominNoch keine Bewertungen

- Agricultural Project Planning Module-IIDokument96 SeitenAgricultural Project Planning Module-IIGetaneh SeifuNoch keine Bewertungen

- Chapter 6 Self Test Taxation Discussion Questions PDF FreeDokument9 SeitenChapter 6 Self Test Taxation Discussion Questions PDF FreeJanjan RiveraNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Vijay Tiwari AgreementDokument8 SeitenVijay Tiwari AgreementAdvocate Shishir SaxenaNoch keine Bewertungen

- Course OutlineDokument217 SeitenCourse OutlineAðnan YasinNoch keine Bewertungen

- Certification of Non-Coverage From The Areas For Priority Development (APD) PDFDokument3 SeitenCertification of Non-Coverage From The Areas For Priority Development (APD) PDFAnonymous isdp4VNoch keine Bewertungen

- Intacc Midterm Sw&QuizzesDokument68 SeitenIntacc Midterm Sw&QuizzesIris FenelleNoch keine Bewertungen

- Syndicate Bank ProjectDokument86 SeitenSyndicate Bank Projectmohammed saleem50% (4)

- Ta/Da Bill of Non-Official Member Invited To Attend The MeetingDokument3 SeitenTa/Da Bill of Non-Official Member Invited To Attend The MeetingVasoya ManojNoch keine Bewertungen

- fm4chapter03 기업가치평가Dokument45 Seitenfm4chapter03 기업가치평가quynhnhudang5Noch keine Bewertungen

- Cases From The 1st Page of Sales Syllabus - Atty. SaronaDokument102 SeitenCases From The 1st Page of Sales Syllabus - Atty. SaronaAmanda ButtkissNoch keine Bewertungen

- Bandy How To Build Trading SysDokument113 SeitenBandy How To Build Trading SysJack ParrNoch keine Bewertungen

- Case Studies On HR Best PracticesDokument50 SeitenCase Studies On HR Best PracticesAnkur SharmaNoch keine Bewertungen

- Research Method in Eco FinDokument4 SeitenResearch Method in Eco FinAnusha RajaNoch keine Bewertungen

- Personal Trading BehaviourDokument5 SeitenPersonal Trading Behaviourapi-3739065Noch keine Bewertungen

- Group 2: Topic 1Dokument29 SeitenGroup 2: Topic 1jsemlpzNoch keine Bewertungen

- Change Your Life PDF FreeDokument51 SeitenChange Your Life PDF FreeJochebed MukandaNoch keine Bewertungen

- SJCBA Prospectus 2010-12-04nov09Dokument17 SeitenSJCBA Prospectus 2010-12-04nov09tyrone21Noch keine Bewertungen

- Quiz 2Dokument9 SeitenQuiz 2yuvita prasadNoch keine Bewertungen

- Chapter 1. Introduction To Cost and ManagementDokument49 SeitenChapter 1. Introduction To Cost and ManagementHARYATI SETYORINI100% (1)

- Steps of Loan ProcessDokument16 SeitenSteps of Loan ProcessShraddha TiwariNoch keine Bewertungen

- Acc 411 Principles of AuditingDokument95 SeitenAcc 411 Principles of Auditingbenard kibet legotNoch keine Bewertungen

- Chapter 2Dokument8 SeitenChapter 2Pradeep RajNoch keine Bewertungen