Beruflich Dokumente

Kultur Dokumente

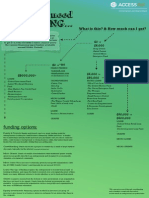

Loans That Change Lives: How Does It Work?

Hochgeladen von

vparthibban37Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Loans That Change Lives: How Does It Work?

Hochgeladen von

vparthibban37Copyright:

Verfügbare Formate

loans that change lives

www.kiva.org

K

$25 $375 loaned so far still needed

iva.org is a non-prot that is revolutionizing the ght against global poverty by enabling people to connect with and make personal loansof as little as $25to low-income entrepreneurs in the developing world. Most of the poor in developing countries are self-employed entrepreneurs and a small loan to purchase business-related items such as sewing machines or livestock can empower them to earn their way out of poverty.

HOW DOES IT WORK?

Kiva brings together lenders and worthy enterprises on the web.

From Kenya to Ecuador, micronance institutions (MFI) around the world go to Kiva.org and post photos and proles of low income entrepreneurs in need of money for their businesses.

$25

LEND NOW

Loans made easy and personal.

Innovation of the Week: Kiva.org uses smart design to make a little cash go a long way. Revolutionizing how donors and lenders in the US are connecting with small entrepreneurs in developing countries. If youve got 25 bucks, a PC and a PayPal account, youve now got the wherewithal to be an international nancier. Kiva simply democratizes access to a worldwide micronance movement that has been empowering the working poor for two decades. At Kiva.org, a schoolteacher in Kansas can partner with an expert seamstress in countries like Kenya, Mexico and Ecuador to jump-start a tailor shop. . Lenders go to Kiva.org and browse through proles of low-income entrepreneursa dairy farmer in Kenya, a man who wants to open a shoe shop in Honduras, or a tailor in Bulgaria. Lenders can then loan as little as $25 to the entrepreneur of their choice via PayPal, a globally recognized online payment service.

When a loan is funded by individual lenders, Kiva pools the money and transfers it to a Micronance partner who handles distribution and collection of loan payments.

Journal updates keep the lenders informed about the progress of the entrepreneur they sponsored. Loan repayments made by the entrepreneur over the course of about 6-18 months are sent back to Kiva by the MFI partner.

Once loans are repaid, Kiva users can choose to withdraw their principal or re-loan to another entrepreneur. (80%+ of Kiva lenders choose to re-loan!

an entrepreneur and make a small loan (as little as $25) within months. Withdraw your money or lend again! your entrepreneurs small business grow via email updates

SELECT

GET RePAID

KIVA TRANSFERS

funds abroad to a microfinance partner who

administers the loan

WATCH

Kiva Shows You Where Your Money Goes

Unlike donations which usually go into general funds, Kiva loans show you exactly WHO your money goes to, WHAT they are doing with it, and HOW you are making a difference. Best part? Its a loan, not a donation. We invite you to make a small loan and make a big difference!

Kiva is a regisitered 501(3)(c) non-prot based out of San Francisco, CA

Das könnte Ihnen auch gefallen

- Zero Debt: The Ultimate Guide to Financial Freedom, 3rd EditionVon EverandZero Debt: The Ultimate Guide to Financial Freedom, 3rd EditionBewertung: 5 von 5 Sternen5/5 (1)

- CCC C CCCCCC CCCCC CCCCCCCC C CCCC CCCCCCC CC CCCCDokument9 SeitenCCC C CCCCCC CCCCC CCCCCCCC C CCCC CCCCCCC CC CCCCJagpreet MalhotraNoch keine Bewertungen

- No Debt Zone: Your 9 Step Guide To a Debt Free LifeVon EverandNo Debt Zone: Your 9 Step Guide To a Debt Free LifeBewertung: 5 von 5 Sternen5/5 (1)

- Kiva - MarketingDokument5 SeitenKiva - MarketingAmanda CortezNoch keine Bewertungen

- Copia de KIVA 1 ProjectDokument1 SeiteCopia de KIVA 1 ProjectMarrehernandezNoch keine Bewertungen

- Microfinancing: Joanna Buickians Narine MirzakhanyanDokument27 SeitenMicrofinancing: Joanna Buickians Narine Mirzakhanyanikjot5430Noch keine Bewertungen

- Advantages and Disadvantages of MicrofinanceDokument10 SeitenAdvantages and Disadvantages of MicrofinanceMohammadur Rahman50% (2)

- Kiva Micro Funds: Inside StoryDokument13 SeitenKiva Micro Funds: Inside StorySarthak MehtaNoch keine Bewertungen

- Advantages and Disadvantages of MicrofinanceDokument11 SeitenAdvantages and Disadvantages of MicrofinanceprashantNoch keine Bewertungen

- Sample - Student - Report KivaDokument9 SeitenSample - Student - Report Kivamoon dangerNoch keine Bewertungen

- 2021 Kiva Report PROOF - The Company LabDokument9 Seiten2021 Kiva Report PROOF - The Company LabChloeNoch keine Bewertungen

- About ASA PhilippinesDokument5 SeitenAbout ASA PhilippinesjolinaNoch keine Bewertungen

- Coalition To Back Black Business GrantDokument3 SeitenCoalition To Back Black Business GrantHafsa MadiNoch keine Bewertungen

- Social Shifters CompetetionDokument7 SeitenSocial Shifters CompetetionPaul PoetNoch keine Bewertungen

- For Immediate Release Contact: Company: Givelist Address: Santa Monica, California Contact Number: Email: WebsiteDokument2 SeitenFor Immediate Release Contact: Company: Givelist Address: Santa Monica, California Contact Number: Email: WebsiteShien Brojas OropesaNoch keine Bewertungen

- Hidden Money Checklist (PDF Doc)Dokument5 SeitenHidden Money Checklist (PDF Doc)Guruatt0% (1)

- Discover Bank ReviewDokument7 SeitenDiscover Bank ReviewyadavrajeNoch keine Bewertungen

- Frequently Asked Questions About MicrofinanceDokument3 SeitenFrequently Asked Questions About MicrofinanceJayakrishnan S KaniyaparambilNoch keine Bewertungen

- Kiva Case StudyDokument2 SeitenKiva Case StudyPia NietoNoch keine Bewertungen

- Credit Counseling For Responsible Retail BankingDokument12 SeitenCredit Counseling For Responsible Retail BankingSubhanan SahooNoch keine Bewertungen

- Fundingmap 1Dokument1 SeiteFundingmap 1api-266863151Noch keine Bewertungen

- About KivaDokument1 SeiteAbout KivaNISTYear5Noch keine Bewertungen

- grameen bank案例研究Dokument6 Seitengrameen bank案例研究cjbyd3tkNoch keine Bewertungen

- Organization Overview-1Dokument5 SeitenOrganization Overview-1api-276863157Noch keine Bewertungen

- Format of Bank Balance SheetDokument14 SeitenFormat of Bank Balance SheetAmi Tanu100% (1)

- Final Hard Coy Sks FinanceDokument32 SeitenFinal Hard Coy Sks FinanceVineeth MudaliyarNoch keine Bewertungen

- How To Become A Small Business Administration Micro Lender IntermediaryDokument2 SeitenHow To Become A Small Business Administration Micro Lender IntermediaryRodney SampsonNoch keine Bewertungen

- About Microfinance: I. OverviewDokument13 SeitenAbout Microfinance: I. OverviewAnkur SrivastavaNoch keine Bewertungen

- Banking BasicsDokument35 SeitenBanking Basicsparkerroach21Noch keine Bewertungen

- How To Build Wealth FastDokument9 SeitenHow To Build Wealth FastDrew LashuaNoch keine Bewertungen

- Instant Cash ProgramsDokument6 SeitenInstant Cash ProgramsginasandsNoch keine Bewertungen

- Microfinance Note 1Dokument12 SeitenMicrofinance Note 1Vandi GbetuwaNoch keine Bewertungen

- Module 10 FinancingDokument8 SeitenModule 10 FinancingDonna Cece MelgarNoch keine Bewertungen

- 35 Great Ways To Fund A Small BusinessDokument6 Seiten35 Great Ways To Fund A Small Businessruth capcha muñizNoch keine Bewertungen

- 2013 CrowdFundingDokument38 Seiten2013 CrowdFundingAxel LanuzaNoch keine Bewertungen

- Bus ProposalDokument2 SeitenBus Proposalapi-546263679Noch keine Bewertungen

- Convenient Monsters: City FinanceDokument11 SeitenConvenient Monsters: City FinanceSarthak GargNoch keine Bewertungen

- Fundraiser For Your SynagogueDokument1 SeiteFundraiser For Your SynagogueaudinaNoch keine Bewertungen

- MICROFINANCEDokument16 SeitenMICROFINANCEGulshan JangidNoch keine Bewertungen

- Micro Credit PresentationDokument33 SeitenMicro Credit PresentationHassan AzizNoch keine Bewertungen

- Funding Guide For Small Business CoachesDokument13 SeitenFunding Guide For Small Business CoachesAmanda GantNoch keine Bewertungen

- Generation: Serving The StartupDokument3 SeitenGeneration: Serving The StartupsiteromNoch keine Bewertungen

- What Is The Difference Between A Startup and A Small Business?Dokument12 SeitenWhat Is The Difference Between A Startup and A Small Business?Chrz JNoch keine Bewertungen

- So Cent Assoc Tip Sheet 10Dokument3 SeitenSo Cent Assoc Tip Sheet 10Efor AlfaNoch keine Bewertungen

- Meaning Microfinance Is The Provision of Financial Services To Low-Income Clients or Solidarity LendingDokument11 SeitenMeaning Microfinance Is The Provision of Financial Services To Low-Income Clients or Solidarity LendingsonalnemaNoch keine Bewertungen

- 10 Ways To Finance Your BusinessDokument36 Seiten10 Ways To Finance Your Businessvidrascu100% (1)

- Lecture 15 - Microfinance and Poverty ReductionDokument16 SeitenLecture 15 - Microfinance and Poverty ReductionSamara ChaudhuryNoch keine Bewertungen

- Please Read: A Personal Appeal From Wikipedia Author LilarojaDokument23 SeitenPlease Read: A Personal Appeal From Wikipedia Author LilarojaavismlNoch keine Bewertungen

- Tugas BricolageDokument5 SeitenTugas BricolageIVAN . (00000031565)Noch keine Bewertungen

- White Paper - Regulation Crowdfunding 1 Year in ForceDokument17 SeitenWhite Paper - Regulation Crowdfunding 1 Year in ForceCrowdfundInsiderNoch keine Bewertungen

- Savings Products ToolkitDokument86 SeitenSavings Products ToolkitREAL SolutionsNoch keine Bewertungen

- Micro Finance Unit III & IVDokument13 SeitenMicro Finance Unit III & IVSarath KumarNoch keine Bewertungen

- Case Study KIVADokument4 SeitenCase Study KIVAKICTNoch keine Bewertungen

- Florida To KentuckyDokument53 SeitenFlorida To Kentuckyapi-247200426Noch keine Bewertungen

- The Scope of Micro Finance in Rural AreaDokument23 SeitenThe Scope of Micro Finance in Rural AreavirugargNoch keine Bewertungen

- The Grand Bank: Presented By: Paras ShahabDokument24 SeitenThe Grand Bank: Presented By: Paras ShahabParas ShahabNoch keine Bewertungen

- Assignment On: Strategic Management: ID-L0722RBRB1010Dokument10 SeitenAssignment On: Strategic Management: ID-L0722RBRB1010Sõúmëñ AdhikaryNoch keine Bewertungen

- VISADokument29 SeitenVISAShimaa Abou SreeNoch keine Bewertungen

- Grameen BankDokument76 SeitenGrameen BankashprabhaNoch keine Bewertungen

- Entrepreneurial Financing: Funding Your Startup: EDS 411 Dr. Maxwell OlokundunDokument22 SeitenEntrepreneurial Financing: Funding Your Startup: EDS 411 Dr. Maxwell OlokundunAkande AyodejiNoch keine Bewertungen

- Mutual Fund SIP - Best Mutual Fund SIP Portfolios To Invest in 2019 - The Economic TimesDokument3 SeitenMutual Fund SIP - Best Mutual Fund SIP Portfolios To Invest in 2019 - The Economic Timesvparthibban37Noch keine Bewertungen

- The Enneagram Personality Test - TruityDokument10 SeitenThe Enneagram Personality Test - Truityvparthibban37Noch keine Bewertungen

- Investing Retirement Savings in Zero-Risk Products Is A Terrible Idea - The Economic TimesDokument2 SeitenInvesting Retirement Savings in Zero-Risk Products Is A Terrible Idea - The Economic Timesvparthibban37Noch keine Bewertungen

- FF0001 01 Free Business Model CanvasDokument3 SeitenFF0001 01 Free Business Model Canvasvparthibban37Noch keine Bewertungen

- Hot Transfer Printing MachineDokument2 SeitenHot Transfer Printing Machinevparthibban37Noch keine Bewertungen

- Ndfeb Neodymium Iron Boron-Standard Ndfeb Range Datasheet Rev1 PDFDokument4 SeitenNdfeb Neodymium Iron Boron-Standard Ndfeb Range Datasheet Rev1 PDFvparthibban37Noch keine Bewertungen

- Surat Solar City Master Plan PDFDokument117 SeitenSurat Solar City Master Plan PDFvparthibban37Noch keine Bewertungen

- TN Vellore Solar Site DescriptionDokument1 SeiteTN Vellore Solar Site Descriptionvparthibban37Noch keine Bewertungen

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurVon Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurBewertung: 4.5 von 5 Sternen4.5/5 (3)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsVon EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsBewertung: 5 von 5 Sternen5/5 (48)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryVon EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryBewertung: 4 von 5 Sternen4/5 (26)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (90)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureVon EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureBewertung: 4.5 von 5 Sternen4.5/5 (100)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizVon EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizBewertung: 4.5 von 5 Sternen4.5/5 (112)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelVon EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelBewertung: 5 von 5 Sternen5/5 (51)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthVon EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthBewertung: 4.5 von 5 Sternen4.5/5 (1027)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedVon EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedBewertung: 4.5 von 5 Sternen4.5/5 (38)

- Having It All: Achieving Your Life's Goals and DreamsVon EverandHaving It All: Achieving Your Life's Goals and DreamsBewertung: 4.5 von 5 Sternen4.5/5 (65)

- Entrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveVon EverandEntrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveBewertung: 4.5 von 5 Sternen4.5/5 (89)

- When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachVon EverandWhen the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachBewertung: 3.5 von 5 Sternen3.5/5 (6)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveVon EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNoch keine Bewertungen

- Every Tool's a Hammer: Life Is What You Make ItVon EverandEvery Tool's a Hammer: Life Is What You Make ItBewertung: 4.5 von 5 Sternen4.5/5 (249)

- Transformed: Moving to the Product Operating ModelVon EverandTransformed: Moving to the Product Operating ModelBewertung: 4 von 5 Sternen4/5 (1)

- Summary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberVon EverandSummary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberBewertung: 5 von 5 Sternen5/5 (39)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyVon EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyBewertung: 5 von 5 Sternen5/5 (22)

- Be Fearless: 5 Principles for a Life of Breakthroughs and PurposeVon EverandBe Fearless: 5 Principles for a Life of Breakthroughs and PurposeBewertung: 4 von 5 Sternen4/5 (49)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldVon Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldBewertung: 5 von 5 Sternen5/5 (20)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleVon EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleBewertung: 4.5 von 5 Sternen4.5/5 (48)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisVon EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderVon EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderBewertung: 4.5 von 5 Sternen4.5/5 (60)

- The Master Key System: 28 Parts, Questions and AnswersVon EverandThe Master Key System: 28 Parts, Questions and AnswersBewertung: 5 von 5 Sternen5/5 (62)

- Your Next Five Moves: Master the Art of Business StrategyVon EverandYour Next Five Moves: Master the Art of Business StrategyBewertung: 5 von 5 Sternen5/5 (802)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andVon EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andBewertung: 4.5 von 5 Sternen4.5/5 (709)

- The Kingdom Driven Entrepreneur's Guide: Doing Business God's WayVon EverandThe Kingdom Driven Entrepreneur's Guide: Doing Business God's WayBewertung: 5 von 5 Sternen5/5 (42)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessVon EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessBewertung: 4.5 von 5 Sternen4.5/5 (407)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessVon EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessBewertung: 4.5 von 5 Sternen4.5/5 (26)

- Summary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoVon EverandSummary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoBewertung: 4 von 5 Sternen4/5 (1)