Beruflich Dokumente

Kultur Dokumente

Sociology Family Paper

Hochgeladen von

api-241782132Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sociology Family Paper

Hochgeladen von

api-241782132Copyright:

Verfügbare Formate

Running Head: The Impact of Social Policies and Family

The Impact of Social Policies and Family SOC 210-11H Heather Harris November 6, 2012

The Impact of Social Policies and Family The traditional family has changed in its structure and definition, so too has the social policies in the state and federal government. In the past thirty year the family that was once mainly comprised of a heterosexual married couple and defined as the man as the primary breadwinner and the wife the primary caregiver of the children. In todays society that is no longer the picture. Families are comprised of a number of different relationships and varied arrangements. In 2011 there are 34.3 million families with children and 58.1 million where both parents are working (U.S. Department of Labor, 2012). The cost of childcare is continuously rising. The cost of childcare in New York for an infant is approximately $10,400 a year. That

number put New York as one of the top ten least affordable childcare states in the country (Child Care Aware of America, 2012). In the US there is still a driving force to keep mothers in the work force, and little support to aid families in providing care for their children. Issues such as parental leave and the support to families provided by employers remains important factors in the success for families in providing childcare. In a recent report published there is are more than one hundred and seventy eight countries which offer paid leave for new mothers, and fifty nations that offer parental leave however the United States is an exemption to this list. Attempts have been made to enact paid family leave have failed in opposition of employer cost. In 1993 the United States created the Family Medical Leave Act that provided individuals up to twelve weeks of unpaid leave for the care of a new child or sick family member. It is estimated that only ten percent of private sector employees are eligible for this program. The problems associated with the program include exclusion to individuals who work for employers with less than 50 employees and individuals who are unable to afford unpaid leave. California and New Jersey are the only two states that have adopted paid leave programs which are financed through employee payroll deductions.

The Impact of Social Policies and Family There is a recent proposal to the Obama administration with a proposed budget of twenty three million dollars to aide additional states in adopting paid leave programs. Californias program is financed through a one percent deduction in wages which equates to an average of four hundred and eighty eight dollars a week. In California the percentage of men who have taken leave has

increased from 2004 to twenty six percent (Crary, 2011). Another benefit that was created to aid families in New York was the Temporary Disability Insurance Program. This program covers individuals temporarily with partial salary while the employee is recovering from a non-work related injury or illness or pregnancy (NYS Insurance Fund, 2012). Tax credits and exemptions are available for families with children. These credits include money paid to aide in tuition and childcare expenses. The Child Tax Credit is a federal benefit to families to help offset the cost of childcare. This program was created in 1997 and covers individuals with incomes ranging from three thousand dollars to a maximum of one hundred ten thousand dollars for families. New York State has also adopted a state child care credit which allows residents to obtain credit for childcare in addition to federal credits (Tax Credit for Working Families, 2012). The Earned Income Credit is another tax credit which is available at both the federal and state level for individuals filing taxes. The credit is available for lowmoderate income individuals. This program was originated in 1975 by Congress in an effort to offset the costs of social security taxes and incentive to work. The maximum benefit for families filing joint for federal returns is five thousand seven hundred and fifty one dollars for three or more children and a maximum income of forty three thousand nine hundred ninety eight dollars (IRS, 2012). For New York State Residents the credit is subject to the same federal guidelines but is equal to thirty percent of the federal allowed credit minus any household credits that may apply (NYS Tax & Finance, 2012). Another program that was developed to aid families that are

The Impact of Social Policies and Family

struggling financially is called Temporary Assistance for Needy Families (TANF). This program provided additional aid to states who were suffering from an increase in demand for services related to hardship and declining economy. The goal of this program was to improve families ability for self independence through job training, marriage, and education (US Department of Health & Human Services, 2010). The Federal government provides assistance to states through a program entitled the Child Care and Block Development Grant. This grant is allocated to states to aid low income families in providing childcare for children. This program does not require childcare to be provided by a licensed facility which leaves child welfare at risk. There are approximately thirty percent of children under this program currently receiving care through unlicensed providers (Child Care Aware of America, 2012). Tax credits as noted above also aid families in providing assistance in child care costs. Italy and Germany have adopted many policies that support the working family by providing longer paid leave to families and emphasis on care provided by the family. Other countries such as France have placed an emphasis on aiding families through providing additional support through subsidized childcare (Henneck, 2003). I feel that support for programs initiated in States similar to California and New Jersey for paid leave would provide much needed assistance to families in providing childcare. Despite the added cost to employers in staffing the overall effect was positive and reflected in higher productivity, profitability and overall staff morale (Crary, 2011). The struggle faced by employees within these states is a fear of job security in an unstable economy. Other struggles that families face are those who do not qualify for childcare tax credits for reasons such as inadequate earnings to file taxes and those who do not file.

The Impact of Social Policies and Family The United States faces many struggles in family life. Single family homes can face the

burden of most of these demands in providing for their families. The poorest families are eligible for welfare however these families are faced with the social stigmas of resentment and labeling that are associated with not working. The majority of the poor are uneducated and unable to obtain higher paying positions that could move them out of poverty status. By focusing support on programs that have been trialed in other states such as the temporary assistance program in California and New Jersey states would be better equipped to handle the needs of those in need of assistance in caring for their families.

The Impact of Social Policies and Family References

Child Care Aware of America. (2012, August). Parents and the high cost of child care: 2012 update. Retrieved from http://www.naccrra.org/sites/default/files/default_site_pages/2012/2012_price_report_on e_pager_aug10_2.pdf

Crary, D. (2011, February 11). Children. Retrieved from http://www.msnbc.msn.com/id/41721787/ns/health-childrens_health/t/us-decadesbehind-other-countries-parental-leave-report-says/ Henneck, R. (2003, May). Family policy in the us, japan, germany, italy and france: Parental leave, child benefits/family allowances, child care, marriage/cohabitation, and divorce . Retrieved from http://www.contemporaryfamilies.org/work-family/fampolicy.html IRS. (2012). Eitc home page--its easier than ever to find out if you qualify for eitc. Retrieved from http://www.irs.gov/Individuals/EITC-Home-Page--Its-easier-than-ever-to-find-outif-you-qualify-for-EITC NYS Insurance Fund. (2012). About disability benefits. Retrieved from http://ww3.nysif.com/DisabilityBenefits/AboutDisabilityBenefits

New York State Department of Tax and Finance, (2012). Earned income credit new york state. Retrieved from website: http://www.tax.ny.gov/pit/credits/earned_income_credit.htm

Tax Credit for Working Families. (2012). Child tax credit. Retrieved from http://www.taxcreditsforworkingfamilies.org/child-tax-credit/

The Impact of Social Policies and Family U.S. Department of Health and Human Services, (2010). Tanf emergency contingency fund. Retrieved from website: http://www.hhs.gov/recovery/reports/plans/pdf20100610/ACF TANF Emergency Fund June 2010.pdf

U.S Department of Labor, Bureau of Labor Statistics. (2012). Employment characteristics of families summary. Retrieved from website: http://www.bls.gov/news.release/famee.nr0.htm

Das könnte Ihnen auch gefallen

- SchizophreniaDokument13 SeitenSchizophreniaapi-241782132Noch keine Bewertungen

- Scholarly ProjectDokument11 SeitenScholarly Projectapi-241782132Noch keine Bewertungen

- Asthma and Children Living in PovertyDokument10 SeitenAsthma and Children Living in Povertyapi-241782132Noch keine Bewertungen

- RecDokument2 SeitenRecapi-241782132Noch keine Bewertungen

- 5 Year AwardDokument1 Seite5 Year Awardapi-241782132Noch keine Bewertungen

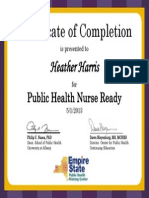

- Certificate HarrisDokument1 SeiteCertificate Harrisapi-241782132Noch keine Bewertungen

- Nys LicenseDokument1 SeiteNys Licenseapi-241782132Noch keine Bewertungen

- EvaluationDokument7 SeitenEvaluationapi-241782132Noch keine Bewertungen

- Healthcare Provider: HeartDokument1 SeiteHealthcare Provider: Heartapi-241782132Noch keine Bewertungen

- Rotating Asset AccountingDokument4 SeitenRotating Asset Accountingapi-241782132100% (1)

- Harris ResumeDokument4 SeitenHarris Resumeapi-241782132Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Gallstone, Choledocholithiasis, Ascending CholangistisDokument12 SeitenGallstone, Choledocholithiasis, Ascending CholangistisNurulasyikin MAA100% (1)

- Contentdamdiagnosticsusenproductsaaccu Chek Inform IitoolkitOS0130802 Accu Chek Inform IIDokument264 SeitenContentdamdiagnosticsusenproductsaaccu Chek Inform IitoolkitOS0130802 Accu Chek Inform IIRose LeanoNoch keine Bewertungen

- Kinds of Blood. Differences Between Men and WomenDokument11 SeitenKinds of Blood. Differences Between Men and WomenTiagoSantosNoch keine Bewertungen

- VITA 1511 VITA 1511E Prothetikleitfaden BA en V01 Screen enDokument150 SeitenVITA 1511 VITA 1511E Prothetikleitfaden BA en V01 Screen enAstri Ggamjong Xiao LuNoch keine Bewertungen

- The Varsity 39Dokument254 SeitenThe Varsity 39cosmin_bloju8997Noch keine Bewertungen

- Lecture 1 Introduction To Industrial HygieneDokument40 SeitenLecture 1 Introduction To Industrial Hygienesiti zubaidahNoch keine Bewertungen

- MRCP 2 PACES Exam Cases From 2011Dokument6 SeitenMRCP 2 PACES Exam Cases From 2011Kolitha KapuduwageNoch keine Bewertungen

- Maslow TheoryDokument10 SeitenMaslow Theoryraza20100% (1)

- Part-IDokument507 SeitenPart-INaan SivananthamNoch keine Bewertungen

- Receiving and Storage PDFDokument12 SeitenReceiving and Storage PDFshyamkattiNoch keine Bewertungen

- Preparing A Family For Childbirth and ParentingDokument5 SeitenPreparing A Family For Childbirth and ParentingBern NerquitNoch keine Bewertungen

- TermoregulasiDokument22 SeitenTermoregulasiAkhmad FatharoniNoch keine Bewertungen

- Formularium 2018 ADokument213 SeitenFormularium 2018 Asupril anshariNoch keine Bewertungen

- 5 Problems (FSPR)Dokument6 Seiten5 Problems (FSPR)NMDNMSSDNoch keine Bewertungen

- Career Breaks in Lothian and Borders Police Service in EdinburghDokument2 SeitenCareer Breaks in Lothian and Borders Police Service in EdinburghTanaya0% (1)

- NursingDokument18 SeitenNursingKairmela PeriaNoch keine Bewertungen

- Analysis of Variation of Water Quality in Kelani River, Sri LankaDokument6 SeitenAnalysis of Variation of Water Quality in Kelani River, Sri LankaIJEAB JournalNoch keine Bewertungen

- Vince Gironda 8x8 RoutineDokument10 SeitenVince Gironda 8x8 RoutineCLAVDIVS0% (2)

- EOHSP 09 Operational Control ProcedureDokument3 SeitenEOHSP 09 Operational Control ProcedureAli ImamNoch keine Bewertungen

- H. Pylori IgA ELISA Package InsertDokument2 SeitenH. Pylori IgA ELISA Package Inserttalha saleemNoch keine Bewertungen

- Material Safety Data Sheet: 1 Identification of SubstanceDokument5 SeitenMaterial Safety Data Sheet: 1 Identification of SubstanceRey AgustinNoch keine Bewertungen

- Sample FNCP For InfectionDokument3 SeitenSample FNCP For InfectionAnonymous gHwJrRnmNoch keine Bewertungen

- Lesson 8 - Extent of Factors Affecting Health in KirkleesDokument8 SeitenLesson 8 - Extent of Factors Affecting Health in KirkleeswapupbongosNoch keine Bewertungen

- Greenwood Village Vaping Ordinance ProposalDokument2 SeitenGreenwood Village Vaping Ordinance ProposalMichael_Lee_RobertsNoch keine Bewertungen

- Experimental and Clinical Reconstructive Microsurgery 1st Ed. 2003 EditionDokument559 SeitenExperimental and Clinical Reconstructive Microsurgery 1st Ed. 2003 EditionLuka DamjanovicNoch keine Bewertungen

- RA7610Dokument3 SeitenRA7610Andrew GallardoNoch keine Bewertungen

- TCVN 6560-1999 Air Quality For Incinerator (En)Dokument2 SeitenTCVN 6560-1999 Air Quality For Incinerator (En)Pn ThanhNoch keine Bewertungen

- Draft HHP Informed Consent FormDokument7 SeitenDraft HHP Informed Consent Formapi-589951233Noch keine Bewertungen

- Wu 2008Dokument8 SeitenWu 2008SergioNoch keine Bewertungen

- Junal 1Dokument6 SeitenJunal 1indadzi arsyNoch keine Bewertungen