Beruflich Dokumente

Kultur Dokumente

CIT Vs Kulandagan

Hochgeladen von

Rupal Maheshwari0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

23 Ansichten1 SeiteThe Supreme Court of India heard appeals regarding whether income earned in Malaysia by an Indian firm owning property there could be taxed in India, and whether capital gains on the sale of that foreign property were taxable in India. The Income Tax Officer had assessed both the Malaysian business income and capital gains for taxation in India. However, the Commissioner of Income Tax (Appeals) and the Tribunal held that under the India-Malaysia tax treaty, the business income could not be taxed in India since the firm had no permanent establishment in India, and that capital gains on property in another country were not taxable in India. The matter was referred to the High Court.

Originalbeschreibung:

Originaltitel

CIT vs Kulandagan

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe Supreme Court of India heard appeals regarding whether income earned in Malaysia by an Indian firm owning property there could be taxed in India, and whether capital gains on the sale of that foreign property were taxable in India. The Income Tax Officer had assessed both the Malaysian business income and capital gains for taxation in India. However, the Commissioner of Income Tax (Appeals) and the Tribunal held that under the India-Malaysia tax treaty, the business income could not be taxed in India since the firm had no permanent establishment in India, and that capital gains on property in another country were not taxable in India. The matter was referred to the High Court.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

23 Ansichten1 SeiteCIT Vs Kulandagan

Hochgeladen von

Rupal MaheshwariThe Supreme Court of India heard appeals regarding whether income earned in Malaysia by an Indian firm owning property there could be taxed in India, and whether capital gains on the sale of that foreign property were taxable in India. The Income Tax Officer had assessed both the Malaysian business income and capital gains for taxation in India. However, the Commissioner of Income Tax (Appeals) and the Tribunal held that under the India-Malaysia tax treaty, the business income could not be taxed in India since the firm had no permanent establishment in India, and that capital gains on property in another country were not taxable in India. The matter was referred to the High Court.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Commissioner Of Income Tax vs P.V.A.L. Kulandagan Chettiar ...

on 26 May, 2004

Page 1 of 17

Supreme Court of India

Indian Kanoon - http://indiankanoon.org/doc/1725672/

Mobile View

Supreme Court of India

Commissioner Of Income Tax vs P.V.A.L. Kulandagan Chettiar ... May, 2004

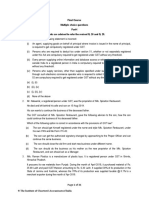

Equivalent citations: (2004) 189 CTR SC 193, 2004 267 ITR 654 SC Author: S R Babu Bench: S R Babu, G Mathur JUDGMENT S. Rajendra Babu, C.J. 1. These appeals involve following two questions for our consideration although several other questions were considered by the High Court :(a) Whether the Malaysian income cannot be subjected to tax in India in the basis of the agreement of avoidance of double taxation entered into between Government of India and Government of Malaysia ? (b) Whether the capital gains should be taxable only in the country in which the assets are situated? 2. The facts leading to these appeals are that the respondent is a firm owning immovable properties at Ipoh, Malaysia; that during the course of the assessment year the assessee income of Rs. 88,424/- from rubber estates; that the respondent sold property, the short term capital gains of which came to Rs. 18,113/-; that the Income Tax Officer assessed that both the incomes are assessable in India and brought the same to tax; that the respondent filed an appeal before the Commissioner of Income Tax (Appeals) who held that under Article 7(1) of the Avoidance of Double Taxation of Income and Prevention of Fiscal Evasion of Tax unless the respondent has a permanent establishment of the business in India such business income in Malaysia cannot be included in the total income of the assessee and, therefore, no part of the capital gains arising to the respondent in the foreign country could be taxed in India. 3. This order was carried in appeal to the Tribunal. The Tribunal, after examining various contentions raised before it, confirmed the order of the Commissioner of Income Tax (Appeals) and held that (i) since the respondent has no permanent establishment for business in India, the business income in Malaysia cannot be included in his income in India, and (ii) the property is situated in Malaysia, capital gains cannot be taxed in India. Thereafter, the matter was carried by way of a reference to the High Court.

http://indiankanoon.org/doc/1725672/?type=print

8/21/2012

Das könnte Ihnen auch gefallen

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisVon EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNoch keine Bewertungen

- From (Abhay Raj Singh Chauhan (Abhay18290@gmail - Com) ) - ID (656) - Vada - TaxDokument18 SeitenFrom (Abhay Raj Singh Chauhan (Abhay18290@gmail - Com) ) - ID (656) - Vada - TaxAnugya JhaNoch keine Bewertungen

- 2022 139 Taxmann Com 145 Mumbai Trib 2022 195 ITD 652 Mumbai Trib 06 06 2022Dokument13 Seiten2022 139 Taxmann Com 145 Mumbai Trib 2022 195 ITD 652 Mumbai Trib 06 06 2022ABCNoch keine Bewertungen

- Corporate Tax PlanningDokument5 SeitenCorporate Tax PlanningAravind Swamy NathanNoch keine Bewertungen

- MCQ IdtDokument30 SeitenMCQ IdtkartikNoch keine Bewertungen

- Memorial For Petitioner PDFDokument28 SeitenMemorial For Petitioner PDFdevil_3565Noch keine Bewertungen

- Direct-Tax Insights: Important Judgements and UpdatesDokument2 SeitenDirect-Tax Insights: Important Judgements and UpdatesAnkit KumarNoch keine Bewertungen

- Theory Questions For PracticeDokument2 SeitenTheory Questions For Practice04 Sourabh BaraleNoch keine Bewertungen

- PromptDokument10 SeitenPromptRichik DadhichNoch keine Bewertungen

- Analysis of Vodafone Tax CaseDokument9 SeitenAnalysis of Vodafone Tax Caserjt163100% (1)

- Vodafone Case Analysis: Internal Assignment-2Dokument7 SeitenVodafone Case Analysis: Internal Assignment-2KK SinghNoch keine Bewertungen

- Ashish Kumar AFB 2011-13003Dokument26 SeitenAshish Kumar AFB 2011-13003Kumar BishalNoch keine Bewertungen

- WWW Taxguru inDokument11 SeitenWWW Taxguru inSakshi TripathiNoch keine Bewertungen

- 012-Practice Questions - Income TaxDokument106 Seiten012-Practice Questions - Income Taxalizaidkhan29% (7)

- Tax Implications On Cross Border Mergers and Acquisitions-Indian PerspectiveDokument3 SeitenTax Implications On Cross Border Mergers and Acquisitions-Indian Perspectivesiddharth pandeyNoch keine Bewertungen

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDokument8 SeitenThe Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDipen AdhikariNoch keine Bewertungen

- A Study of Corporate Tax in IndiaDokument27 SeitenA Study of Corporate Tax in IndiaKHUSHBOO GOYAL - DMNoch keine Bewertungen

- The Vodafone - Hutchison Case and Its Implications: Shantanu SurpureDokument10 SeitenThe Vodafone - Hutchison Case and Its Implications: Shantanu Surpuredeath_wishNoch keine Bewertungen

- 08-5 Investment Law, Mids 2023Dokument3 Seiten08-5 Investment Law, Mids 2023swarnim DwivediNoch keine Bewertungen

- Hand Out Vodafone International Holdings BDokument11 SeitenHand Out Vodafone International Holdings Bprernachopra88Noch keine Bewertungen

- Tax Law Cases Sem-1Dokument43 SeitenTax Law Cases Sem-1rashmi narayanNoch keine Bewertungen

- Salary Received by A Non-Resident in India Is Taxable in India On Receipt BasisDokument4 SeitenSalary Received by A Non-Resident in India Is Taxable in India On Receipt BasisBommanaVamsidharreddyNoch keine Bewertungen

- Involved Stakeholders (Parties)Dokument3 SeitenInvolved Stakeholders (Parties)shrutNoch keine Bewertungen

- 04 - Vodafone Case AnalysisDokument17 Seiten04 - Vodafone Case AnalysisSakthi NathanNoch keine Bewertungen

- Mock Test Cma June 20 Set 2 PDFDokument7 SeitenMock Test Cma June 20 Set 2 PDFamit jangraNoch keine Bewertungen

- Double Tax Avoidance AgreementDokument20 SeitenDouble Tax Avoidance AgreementSuchismita PatiNoch keine Bewertungen

- Vodafone Case FinalDokument5 SeitenVodafone Case FinalNishit SaraiyaNoch keine Bewertungen

- Moot Problem FinalDokument8 SeitenMoot Problem FinalAbdullah KhanNoch keine Bewertungen

- Vodafone Tax Case: Arindam Daschowdhury (PGDM 100109) Deepak B.S. (PGDM 100110)Dokument16 SeitenVodafone Tax Case: Arindam Daschowdhury (PGDM 100109) Deepak B.S. (PGDM 100110)vishala4Noch keine Bewertungen

- Investment in India The Vodafone EffectDokument4 SeitenInvestment in India The Vodafone Effectaruba ansariNoch keine Bewertungen

- Tax Management: Impact of Vodafone Tax Case On Mergers and Acquisition in IndiaDokument4 SeitenTax Management: Impact of Vodafone Tax Case On Mergers and Acquisition in IndiaShalma PintoNoch keine Bewertungen

- Tax Alert - Delivering Clarity: 10 June 2020Dokument6 SeitenTax Alert - Delivering Clarity: 10 June 2020UTKARSHNoch keine Bewertungen

- Vodafone Tax Case: Analysis of Key IssuesDokument10 SeitenVodafone Tax Case: Analysis of Key IssuesShishir SinghNoch keine Bewertungen

- Tax RevDokument4 SeitenTax RevCanapi AmerahNoch keine Bewertungen

- Tax CIA Bryna 2011346Dokument14 SeitenTax CIA Bryna 2011346BRYNA BHAVESH 2011346Noch keine Bewertungen

- Paper No. 1: The Income Tax Appellate Tribunal Residential Training Programme Maharashtra Judicial Academy, MumbaiDokument24 SeitenPaper No. 1: The Income Tax Appellate Tribunal Residential Training Programme Maharashtra Judicial Academy, MumbaimarxianbybirthNoch keine Bewertungen

- Finance Bill 2012 - Major Issues and ChallengesDokument8 SeitenFinance Bill 2012 - Major Issues and ChallengesNehaNoch keine Bewertungen

- LANDMARK Tax Judgement in FAVOUR of Indian Seafarers Dec 2016Dokument6 SeitenLANDMARK Tax Judgement in FAVOUR of Indian Seafarers Dec 2016सचिनरावतNoch keine Bewertungen

- Final Course Multiple Choice Questions Part-I Students Are Advised To Refer The Revised Q. 26 and Q. 29Dokument31 SeitenFinal Course Multiple Choice Questions Part-I Students Are Advised To Refer The Revised Q. 26 and Q. 29Sanket Mhetre100% (1)

- Justice Aswinlal. O.M & Justice Athullya SDokument10 SeitenJustice Aswinlal. O.M & Justice Athullya SAmal M SNoch keine Bewertungen

- Test 1 QP Sir FRK CAME PREDokument3 SeitenTest 1 QP Sir FRK CAME PREUmair GOLDNoch keine Bewertungen

- TaxationDokument7 SeitenTaxationstk2796Noch keine Bewertungen

- International Taxation in India - Recent Developments & Outlook (Part - Ii)Dokument6 SeitenInternational Taxation in India - Recent Developments & Outlook (Part - Ii)ManishJainNoch keine Bewertungen

- Assistant Director of Income Tax-I, New Delhi Appellant: Signature Not VerifiedDokument63 SeitenAssistant Director of Income Tax-I, New Delhi Appellant: Signature Not Verifiedyezdi bhagwagarNoch keine Bewertungen

- Bengal Tiger Line Pte Ltd. Vs DCIT ITAT ChennaiDokument40 SeitenBengal Tiger Line Pte Ltd. Vs DCIT ITAT ChennaiArulnidhi Ramanathan SeshanNoch keine Bewertungen

- Retrospective Tax by Financial Bill 2012: Iilm Institute For Higher Eduction, GurgaonDokument8 SeitenRetrospective Tax by Financial Bill 2012: Iilm Institute For Higher Eduction, Gurgaonshantanu_malviya_1Noch keine Bewertungen

- © The Institute of Chartered Accountants of IndiaDokument9 Seiten© The Institute of Chartered Accountants of IndiaSuresh TamangNoch keine Bewertungen

- Slaughter and May: Vodafone's Supreme Court Victory in IndiaDokument3 SeitenSlaughter and May: Vodafone's Supreme Court Victory in IndiaKundan PrasadNoch keine Bewertungen

- TS 24 ITAT 2013 (Mum) P T McKinsey IndonesiaDokument5 SeitenTS 24 ITAT 2013 (Mum) P T McKinsey IndonesiaNeeta Punjabi BhatiaNoch keine Bewertungen

- Delhi ITAT BAR Reporter - January 2021Dokument43 SeitenDelhi ITAT BAR Reporter - January 2021Trisha MajumdarNoch keine Bewertungen

- Double Taxation Relief: Tax SupplementDokument5 SeitenDouble Taxation Relief: Tax SupplementlalitbhatiNoch keine Bewertungen

- Income Tax Appellate Tribunal - Mumbai: Suresh Industries P.LTD, Mumbai Vs Assessee On 13 September, 2012Dokument5 SeitenIncome Tax Appellate Tribunal - Mumbai: Suresh Industries P.LTD, Mumbai Vs Assessee On 13 September, 2012Puneet kumarNoch keine Bewertungen

- Requirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Dokument5 SeitenRequirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Srikrishna DharNoch keine Bewertungen

- Facts of Vodafone's Case (Case Study)Dokument3 SeitenFacts of Vodafone's Case (Case Study)Nanasaheb MarkadNoch keine Bewertungen

- Test Paper - 3 CA FinalDokument3 SeitenTest Paper - 3 CA FinalyeidaindschemeNoch keine Bewertungen

- Tax IncidenceDokument25 SeitenTax IncidenceSaiprasad D DoddaiahNoch keine Bewertungen

- Practice Questions - Income Tax PDFDokument114 SeitenPractice Questions - Income Tax PDFEmran100% (4)

- Deputy Commissioner of IDokument8 SeitenDeputy Commissioner of IKavitha T SNoch keine Bewertungen

- Federal Tax Ombudsman Secretariat: Complaint No.24/ISD/ST (08) /242/2012Dokument4 SeitenFederal Tax Ombudsman Secretariat: Complaint No.24/ISD/ST (08) /242/2012Muhammad Afzaal HussainNoch keine Bewertungen

- Vodafone SummaryDokument4 SeitenVodafone SummaryAbhinav AggarwalNoch keine Bewertungen