Beruflich Dokumente

Kultur Dokumente

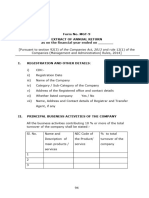

Minimum Wages Act Form 3

Hochgeladen von

Satyam mishraOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Minimum Wages Act Form 3

Hochgeladen von

Satyam mishraCopyright:

Verfügbare Formate

Minimum Wages (Central) Rules

FORM III

Annual Return

Rule 21(4-A)

Return for the year ending the 31st December

1 (a) Name of the establishment and postal address

(b) Name and residential address of the Owner/Contractor

(c) Name and residential address of the Managing Agent/Director/Partner in charge of the

day-to-day affairs of the establishment owned by a company, body corporate or

Association

2. Number of days worked during the year.

*3. Number of mandays worked during the year.

†4. Average daily number of persons employed during the year:

(i) Adults (ii) Children

5. Total wages paid in cash

‡6. Total cash value of the wages paid in kind

7. Deductions:

Number of cases Total amount

Rs. P

(a) Fines

(b) Deductions for damage or loss

(c) Deductions for breach of contract

Disbursement from fines:

Purpose Amount

Rs. P.

(a) (c)

(b) (d)

8. Balance of fine fund in hand at the end of the year

Dated

Signature

Designation

* This is the aggregate number of attendance during the year.

† The average daily number of persons employed during the year is obtained by dividing the aggregate number of attendances during

the year by the number of working days.

‡ Cash value of the wages paid in kind should be obtained by taking the difference between the cost price paid by the employer and the

actual price paid by the employees for supplies of essential commodities given at concessional rates.

Das könnte Ihnen auch gefallen

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Von EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Noch keine Bewertungen

- AC216 Unit 3 Assignment 5 - Revise Amortization MorganDokument1 SeiteAC216 Unit 3 Assignment 5 - Revise Amortization MorganEliana MorganNoch keine Bewertungen

- 0064 - Form L - Annual Return of Indian Trade Union ActDokument4 Seiten0064 - Form L - Annual Return of Indian Trade Union ActSreedharanPN67% (9)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Cape Law: Text and Cases: Contract Law, Tort Law and Real PropertyVon EverandCape Law: Text and Cases: Contract Law, Tort Law and Real PropertyNoch keine Bewertungen

- Sample Exam Questions For Law Enforcement AdministrationDokument20 SeitenSample Exam Questions For Law Enforcement AdministrationSatyam mishra100% (14)

- Form IR8A YA 2018Dokument2 SeitenForm IR8A YA 2018Sandeep KumarNoch keine Bewertungen

- Manpower Planning SheetDokument1 SeiteManpower Planning SheetSatyam mishra75% (4)

- Manpower Planning SheetDokument1 SeiteManpower Planning SheetSatyam mishra75% (4)

- Experience & Relieving Letter FormatDokument4 SeitenExperience & Relieving Letter FormatNisha_Yadav_627780% (25)

- Form III Annual ReturnsDokument2 SeitenForm III Annual ReturnsBalakrishna HNoch keine Bewertungen

- FORM III Annual ReturnDokument2 SeitenFORM III Annual ReturnHR kpl100% (1)

- Form Iv - PowDokument3 SeitenForm Iv - PowShiva kant0% (1)

- The Payment of Wages Act, 1936 Form Iv Annual Returns Wages and Deductions From WagesDokument5 SeitenThe Payment of Wages Act, 1936 Form Iv Annual Returns Wages and Deductions From WagesSUDHIR KUMARNoch keine Bewertungen

- FORMIIIDokument1 SeiteFORMIIIJOYNARAYAN CHAKRABORTYNoch keine Bewertungen

- Annual Return Form IV, Payment of Wages ActDokument1 SeiteAnnual Return Form IV, Payment of Wages Actjustinranjit0% (1)

- Declaration of Income & AssetsDokument3 SeitenDeclaration of Income & AssetsAdnan Tahir100% (1)

- Declaration of Income and AssetsDokument5 SeitenDeclaration of Income and AssetsAziz Khan LodhiNoch keine Bewertungen

- Annual Return Form - III of M.W. ActDokument2 SeitenAnnual Return Form - III of M.W. ActShiva kantNoch keine Bewertungen

- Data For AARDokument3 SeitenData For AARJonson PalmaresNoch keine Bewertungen

- US Internal Revenue Service: f1120fsc - 1995Dokument6 SeitenUS Internal Revenue Service: f1120fsc - 1995IRSNoch keine Bewertungen

- Ae211 Intact2 FinalexamDokument6 SeitenAe211 Intact2 FinalexammercyvienhoNoch keine Bewertungen

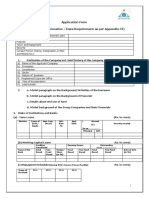

- Form 20B: (Refer Section 159 of The Companies Act, 1956)Dokument6 SeitenForm 20B: (Refer Section 159 of The Companies Act, 1956)Surendra DevadigaNoch keine Bewertungen

- US Internal Revenue Service: F5500ez - 1992Dokument1 SeiteUS Internal Revenue Service: F5500ez - 1992IRSNoch keine Bewertungen

- Payment of Bonus Act FormsDokument5 SeitenPayment of Bonus Act Formspratik06Noch keine Bewertungen

- Payment of Bonus Form A, B, C & DDokument4 SeitenPayment of Bonus Form A, B, C & Darun gupta0% (1)

- Indian Institute of Management, Nagpur: Special Need-Based Scholarship Form (SNBSF)Dokument4 SeitenIndian Institute of Management, Nagpur: Special Need-Based Scholarship Form (SNBSF)DHRUV SONAGARANoch keine Bewertungen

- US Internal Revenue Service: f5500sb - 1993Dokument3 SeitenUS Internal Revenue Service: f5500sb - 1993IRSNoch keine Bewertungen

- None - FORM IV - KA - PWDokument2 SeitenNone - FORM IV - KA - PWKishore KanthrajNoch keine Bewertungen

- US Internal Revenue Service: f5500sb - 1994Dokument3 SeitenUS Internal Revenue Service: f5500sb - 1994IRSNoch keine Bewertungen

- US Internal Revenue Service: F5500ez - 1993Dokument1 SeiteUS Internal Revenue Service: F5500ez - 1993IRSNoch keine Bewertungen

- 2020 Declaration of Assets ProformaDokument4 Seiten2020 Declaration of Assets ProformaMuhammad Anees YousafNoch keine Bewertungen

- Declaration of AssetsDokument4 SeitenDeclaration of AssetsHassan RanaNoch keine Bewertungen

- SPQP April 2024Dokument9 SeitenSPQP April 2024ggond6830Noch keine Bewertungen

- US Internal Revenue Service: f1120fsc - 1997Dokument6 SeitenUS Internal Revenue Service: f1120fsc - 1997IRSNoch keine Bewertungen

- Depreciation Rate Chart As Per Companies Act 2013 With Related LawDokument23 SeitenDepreciation Rate Chart As Per Companies Act 2013 With Related Lawfintech ConsultancyNoch keine Bewertungen

- NonDokument6 SeitenNonb jayaNoch keine Bewertungen

- Vote Book PSA522Dokument2 SeitenVote Book PSA522Muhammad HidayatullahNoch keine Bewertungen

- FundamentalsarihantDokument11 SeitenFundamentalsarihantSparsh SalujaNoch keine Bewertungen

- Iaii Midterm Exam Manual Set BDokument11 SeitenIaii Midterm Exam Manual Set BClara MacallingNoch keine Bewertungen

- US Internal Revenue Service: F5500ez - 1998Dokument1 SeiteUS Internal Revenue Service: F5500ez - 1998IRSNoch keine Bewertungen

- PhpobiilxDokument19 SeitenPhpobiilxShivansh JaiswalNoch keine Bewertungen

- 12th ACCOUNTS One MarksDokument3 Seiten12th ACCOUNTS One Markssujithrasuji773Noch keine Bewertungen

- LiabilityDokument8 SeitenLiabilityelainelxy2508Noch keine Bewertungen

- Annexure D: Report For The - (I/II/III/IV) Quarter Ended - Period Covered by The Report: - (3/6/9/12) MonthsDokument7 SeitenAnnexure D: Report For The - (I/II/III/IV) Quarter Ended - Period Covered by The Report: - (3/6/9/12) MonthsNarendra Ku MalikNoch keine Bewertungen

- US Internal Revenue Service: f1120fsc - 1994Dokument6 SeitenUS Internal Revenue Service: f1120fsc - 1994IRSNoch keine Bewertungen

- ADVANCED ACADEM9 BK AviDokument2 SeitenADVANCED ACADEM9 BK AviAdvanced AcademyNoch keine Bewertungen

- Declaration of Income and AssetsDokument8 SeitenDeclaration of Income and AssetsAsif AssiNoch keine Bewertungen

- Form - 25-Statutory - Report FINALDokument6 SeitenForm - 25-Statutory - Report FINALcandyboyfahadNoch keine Bewertungen

- +2-Accountancy-1-2-3-5-Mark Theory Material-Em-2023Dokument34 Seiten+2-Accountancy-1-2-3-5-Mark Theory Material-Em-2023saravanan.ma0611Noch keine Bewertungen

- II PUC ACC REVISED POQs FOR 2022-23Dokument3 SeitenII PUC ACC REVISED POQs FOR 2022-23Shree Lakshmi vNoch keine Bewertungen

- Partnership Imp QDokument5 SeitenPartnership Imp Qa4603488Noch keine Bewertungen

- RKG Fundamentals Partnership Test 60 MarksDokument6 SeitenRKG Fundamentals Partnership Test 60 MarksSaumya SharmaNoch keine Bewertungen

- PartnershipDokument5 SeitenPartnershipjohnNoch keine Bewertungen

- Form No. MGT-9 Extract of Annual Return As On The Financial Year Ended OnDokument11 SeitenForm No. MGT-9 Extract of Annual Return As On The Financial Year Ended OnSUJATANoch keine Bewertungen

- Bat Libo I PurohitDokument5 SeitenBat Libo I PurohitNic AurthurNoch keine Bewertungen

- CPT - December - 2010 - Session 1 1: Master MindsDokument6 SeitenCPT - December - 2010 - Session 1 1: Master MindsViseshSatyannNoch keine Bewertungen

- MGT 9Dokument24 SeitenMGT 9Kusuma R N Kusuma R NNoch keine Bewertungen

- Advanced Accounting - Iii Semester: Unit:1 - Partnership Accounts-I Multiple ChoiceDokument15 SeitenAdvanced Accounting - Iii Semester: Unit:1 - Partnership Accounts-I Multiple ChoicepallaviNoch keine Bewertungen

- PFF12Dokument2 SeitenPFF12humanresources.qualimarkNoch keine Bewertungen

- US Internal Revenue Service: f1120fsc - 2001Dokument6 SeitenUS Internal Revenue Service: f1120fsc - 2001IRSNoch keine Bewertungen

- Loan Application FormDokument9 SeitenLoan Application FormrohitNoch keine Bewertungen

- Law Career Services Presents:: Resume & Cover Letter Writing WorkshopDokument42 SeitenLaw Career Services Presents:: Resume & Cover Letter Writing WorkshopSatyam mishraNoch keine Bewertungen

- Employment El Civics Soft SkillsDokument6 SeitenEmployment El Civics Soft SkillsSatyam mishraNoch keine Bewertungen

- Emotional IntelligenceDokument36 SeitenEmotional Intelligenceiva_17Noch keine Bewertungen

- Attrition CalculationDokument18 SeitenAttrition Calculationkapoor@manish100% (1)

- Certificate of AppreciationDokument1 SeiteCertificate of AppreciationSatyam mishraNoch keine Bewertungen

- Contract Labour ActDokument18 SeitenContract Labour ActSatyam mishraNoch keine Bewertungen

- Introduction To Industrial RelationDokument16 SeitenIntroduction To Industrial RelationSatyam mishra100% (3)

- Communication SkillsDokument16 SeitenCommunication SkillsShah MohitNoch keine Bewertungen

- Personality Types Perceptions Matrix DISCDokument2 SeitenPersonality Types Perceptions Matrix DISCSatyam mishra100% (1)

- Human Resource Ethics - Power Point PresentationDokument21 SeitenHuman Resource Ethics - Power Point PresentationSatyam mishra100% (1)

- Indian Fundamental RightsDokument6 SeitenIndian Fundamental Rightssent.navy100% (12)

- Leader TypesDokument25 SeitenLeader Typesdaywalker100% (2)

- Objectives: at The Completion of This Module, Participants Will Be Able ToDokument22 SeitenObjectives: at The Completion of This Module, Participants Will Be Able ToSatyam mishra100% (2)

- To Our ReadersDokument113 SeitenTo Our ReadersSatyam mishra50% (2)

- Right To PropertyDokument24 SeitenRight To PropertySungusia HaroldNoch keine Bewertungen

- Form D, Annual Return Under Payement of Bonus ActDokument2 SeitenForm D, Annual Return Under Payement of Bonus ActSatyam mishraNoch keine Bewertungen

- Champak Aug (First) 09Dokument84 SeitenChampak Aug (First) 09indianebooks100% (2)

- Induction Training 182Dokument1 SeiteInduction Training 182Satyam mishraNoch keine Bewertungen

- Kdas Right To PropertyDokument2 SeitenKdas Right To PropertySatyam mishraNoch keine Bewertungen

- Directors' BriefingDokument4 SeitenDirectors' BriefingSatyam mishraNoch keine Bewertungen

- Performance Appraisal HandbookDokument67 SeitenPerformance Appraisal HandbookRohan Rajkumar ChavanNoch keine Bewertungen

- HR GlossaryDokument75 SeitenHR Glossarydenesfiona100% (15)