Beruflich Dokumente

Kultur Dokumente

Computation AY2012 13

Hochgeladen von

Asif ShaikhCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Computation AY2012 13

Hochgeladen von

Asif ShaikhCopyright:

Verfügbare Formate

Name Of Assessee

PAN

Father's Name

Residential Address

:

:

:

:

Status

Ward No

Sex

Email Address

Residential Status

Name Of Bank

Micr Code

Address

Account No.

Return

:

:

:

:

:

:

:

:

:

:

Sangita Bikaschandra Mohanty

AHEPM3173D

Kishore Chandra Mohanty

Shop No 1, Dosti Lris, Dosti Acres, Antop Hill, Wadala (e), Mumbai,

Maharashtra-400037

INDIVIDUAL

Assessment Year

: 2012 - 2013

Financial Year

: 2011 - 2012

Female

Date Of Birth

: 23/06/1969

rahulkjain.co@gmail.com

Resident

Union Bank Of India

400026139

Wadala East (Wle)

583501010050248

Revised (Original Filing Return Date : 29/09/2012 & No. : 504664781290912)

COMPUTATION OF TOTAL INCOME

Profits And Gains From Business And Profession

585541

Profit Before Tax As Per Profit And Loss Account

Add :

Depreciation Disallowed

Prior Period Items

Disallowed U/s 37

Disallowed U/s 40

Disallowed U/s 43B

566680

553459

14321

5000

50000

4170

Less :

Allowed U/s 43B

Allowed Depreciation

54630

553459

Income From Other Sources

Other Income

Interest Bank Sb Account

Total

626950

1193630

-608089

585541

116717

96000

20717

116717

Gross Total Income

702258

Less Deductions Under Chapter-VIA

80C Deduction

Total Deductions

Total Income

Total Income Rounded Off U/s 288A

34818

34818

667440

667440

COMPUTATION OF TAX ON TOTAL INCOME

Tax On Rs. 190000

Nil

Tax On Rs. 310000 (500000-190000) @ 10%

31000

Tax On Rs. 167440 (667440-500000) @ 20%

33488

Tax On Rs. 667440

Add: Education Cess @ 2%

Add: Secondary And Higher Education Cess @ 1%

Less Tax Deducted At Source

Commission Or Brokerage

Contractors And Sub-contractors

84546

720

64488

64488

1290

65778

645

66423

Other Interest

1676

Refundable

Tax Rounded Off U/s 288B

86942

-20519

(20519)

(20520)

Detail Of Deduction U/s 80C

Lic

34818

Total

34818

Details of Tax Deducted at Source on Income other than Salary

Sl.

No.

Tax Deduction

Unique TDS

Account Number Certificate No.

(TAN) of the

Deductor

Name and address of the Deductor

Amount

paid /credited

Date of

Payment

/Credit

Total tax

deducted

Amount

claimed for this

year

194A : Other Interest

1.

MUMU05653E

UNION BANK OF INDIA

Total

16757 29/09/2011

16757

1676

1676

1676

1676

194C : Contractors and sub-contractors

1.

2.

3.

4.

5.

6.

7.

8.

9.

MUMG08556C

MUMG08556C

MUMG08556C

MUMG08556C

MUMG08556C

MUMG08556C

MUMG08556C

MUMG08556C

MUMG08556C

GODFREY PHILLIPS INDIA LTD.

GODFREY PHILLIPS INDIA LTD.

GODFREY PHILLIPS INDIA LTD.

GODFREY PHILLIPS INDIA LTD.

GODFREY PHILLIPS INDIA LTD.

GODFREY PHILLIPS INDIA LTD.

GODFREY PHILLIPS INDIA LTD.

GODFREY PHILLIPS INDIA LTD.

GODFREY PHILLIPS INDIA LTD.

Total

8000

8000

8000

8000

8000

8000

8000

8000

8000

72000

27/04/2011

27/05/2011

28/06/2011

29/07/2011

30/08/2011

27/09/2011

27/10/2011

28/11/2011

30/12/2011

80

80

80

80

80

80

80

80

80

720

80

80

80

80

80

80

80

80

80

720

1120.87

102840.89

98931.83

16796

77233.07

14150

65847.47

80951.8

24753

82867.2

77996.7

82925.87

17443

77742

162.13

23703.3

845465.13

934222.13

30/04/2011

30/04/2011

31/05/2011

31/05/2011

31/05/2011

30/06/2011

30/06/2011

30/06/2011

31/07/2011

31/07/2011

31/07/2011

31/08/2011

31/08/2011

31/08/2011

30/09/2011

30/09/2011

112

10284

9893

1680

7723

1415

6585

8095

2475

8287

7800

8293

1744

7774

16

2370

84546

86942

112

10284

9893

1680

7723

1415

6585

8095

2475

8287

7800

8293

1744

7774

16

2370

84546

86942

194H : Commission or brokerage

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

MUMI07565F

Particulars

194j Professional Fees

Total

Particulars

Vat

Vat

Total

Sr. No.

1

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

IDEA CELLULAR LIMITED

Total

Grand Total

ALLOWED/DISALLOWED U/S 40

Assessmen Disallowed

Allowed

Balance

t Year

Amount (Rs.) Amount (Rs.) Amount (Rs.)

2012-13

50000

50000

50000

50000

ALLOWED/DISALLOWED U/S 43B

Assessmen Disallowed

Allowed

Balance

t Year

Amount (Rs.) Amount (Rs.) Amount (Rs.)

2011-12

54630

54630

2012-13

4170

4170

58800

54630

4170

DISALLOWED U/S 37

Particulars

Delay in filling of VAT Return

Total

Amount

5000.00

5000.00

Das könnte Ihnen auch gefallen

- Mum 02208Dokument3 SeitenMum 02208Asif ShaikhNoch keine Bewertungen

- Curriculum Vitae: Balkrushna S. TheradeDokument2 SeitenCurriculum Vitae: Balkrushna S. TheradeAsif ShaikhNoch keine Bewertungen

- Kabbadi PlayerDokument3 SeitenKabbadi PlayerAsif ShaikhNoch keine Bewertungen

- Indian Education Society Secondary 2017-18 Geography STD VI Project Guidelines Semester-1Dokument1 SeiteIndian Education Society Secondary 2017-18 Geography STD VI Project Guidelines Semester-1Asif ShaikhNoch keine Bewertungen

- Ayurvedic Plants Uses and BenefitsDokument3 SeitenAyurvedic Plants Uses and BenefitsAsif ShaikhNoch keine Bewertungen

- Annexure CDokument2 SeitenAnnexure CAsif ShaikhNoch keine Bewertungen

- Shibu GST REG01 Part A of The Registration ProcessDokument1 SeiteShibu GST REG01 Part A of The Registration ProcessAsif ShaikhNoch keine Bewertungen

- Grade VI Grade VII Grade VIII: Indian Education Society Semester 1 Syllabus 2017 - 2018 History & CivicsDokument1 SeiteGrade VI Grade VII Grade VIII: Indian Education Society Semester 1 Syllabus 2017 - 2018 History & CivicsAsif ShaikhNoch keine Bewertungen

- STD Vi First Term Portion Maths: PHYSICS-Ch. 4. Simple Machines - (Page No. 46 To 60)Dokument2 SeitenSTD Vi First Term Portion Maths: PHYSICS-Ch. 4. Simple Machines - (Page No. 46 To 60)Asif ShaikhNoch keine Bewertungen

- Declaration FormDokument1 SeiteDeclaration FormAsif ShaikhNoch keine Bewertungen

- Valentina Patel CIBOP Batch 52 Fresher.Dokument2 SeitenValentina Patel CIBOP Batch 52 Fresher.Asif ShaikhNoch keine Bewertungen

- Management Functions Narciso Isidro Jr. Irwin/Mcgraw-Hill ©the Mcgraw-Hill Companies, Inc., 2000Dokument24 SeitenManagement Functions Narciso Isidro Jr. Irwin/Mcgraw-Hill ©the Mcgraw-Hill Companies, Inc., 2000Asif ShaikhNoch keine Bewertungen

- Shop Registration Confirmation ReceiptDokument1 SeiteShop Registration Confirmation ReceiptAsif ShaikhNoch keine Bewertungen

- Family LawDokument20 SeitenFamily LawAsif ShaikhNoch keine Bewertungen

- Abacus: Why Was The Abacus Used?Dokument2 SeitenAbacus: Why Was The Abacus Used?Asif ShaikhNoch keine Bewertungen

- Hemant ResumeDokument2 SeitenHemant ResumeAsif ShaikhNoch keine Bewertungen

- Joint Hindu FamilyDokument3 SeitenJoint Hindu FamilyAsif ShaikhNoch keine Bewertungen

- Experienced Data Entry Professional Seeking New OpportunitiesDokument2 SeitenExperienced Data Entry Professional Seeking New OpportunitiesAsif ShaikhNoch keine Bewertungen

- Chandra Ya AnDokument4 SeitenChandra Ya AnAsif ShaikhNoch keine Bewertungen

- Diversity of FishDokument3 SeitenDiversity of FishAsif ShaikhNoch keine Bewertungen

- Calling Data - MAHADokument22 SeitenCalling Data - MAHAAsif Shaikh75% (4)

- Sameer KambliDokument4 SeitenSameer KambliAsif ShaikhNoch keine Bewertungen

- ProteinDokument2 SeitenProteinAsif ShaikhNoch keine Bewertungen

- Maharashtra: GDP Per Capita Income Per Capita Agriculture Textiles PetroleumDokument4 SeitenMaharashtra: GDP Per Capita Income Per Capita Agriculture Textiles PetroleumAsif ShaikhNoch keine Bewertungen

- 3 New Weapons in The Defense SystemDokument3 Seiten3 New Weapons in The Defense SystemAsif ShaikhNoch keine Bewertungen

- Coe-Ajay Kumar VindDokument2 SeitenCoe-Ajay Kumar VindAsif ShaikhNoch keine Bewertungen

- PlumbingDokument14 SeitenPlumbingAsif ShaikhNoch keine Bewertungen

- Kaju KATLI 840/ KGDokument2 SeitenKaju KATLI 840/ KGAsif ShaikhNoch keine Bewertungen

- Name of Student: Esther Biju Thomas: Roll No: 21 Professor in Charge: Smina Manon - 2016-2017Dokument19 SeitenName of Student: Esther Biju Thomas: Roll No: 21 Professor in Charge: Smina Manon - 2016-2017Asif ShaikhNoch keine Bewertungen

- Good HabitsDokument2 SeitenGood HabitsAsif ShaikhNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Arbaminch University College of Business and Economics Department of Accounting and FinancDokument8 SeitenArbaminch University College of Business and Economics Department of Accounting and FinancbabuNoch keine Bewertungen

- Homework 6Dokument6 SeitenHomework 6LiamNoch keine Bewertungen

- Private Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Dokument6 SeitenPrivate Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Esteban Enrique Posan BalcazarNoch keine Bewertungen

- Rosillo:61-64: 61) Pratts v. CADokument2 SeitenRosillo:61-64: 61) Pratts v. CADiosa Mae SarillosaNoch keine Bewertungen

- Cash Flow Final PrintDokument61 SeitenCash Flow Final PrintGeddada DineshNoch keine Bewertungen

- Business Math - Discounts Rate Interest (Version 1)Dokument56 SeitenBusiness Math - Discounts Rate Interest (Version 1)grace paragasNoch keine Bewertungen

- Full Committee Hearing On Food Prices and Small BusinessesDokument105 SeitenFull Committee Hearing On Food Prices and Small BusinessesScribd Government DocsNoch keine Bewertungen

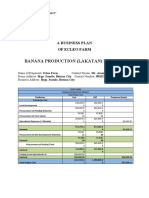

- Banana Production (Lakatan) Project: A Business Plan of Ecleo FarmDokument20 SeitenBanana Production (Lakatan) Project: A Business Plan of Ecleo Farmmarkgil1990Noch keine Bewertungen

- Assets Liobililies Owner's Equity: Balance SheetsDokument2 SeitenAssets Liobililies Owner's Equity: Balance SheetsVARGAS PALOMINO KIARA PAMELANoch keine Bewertungen

- OECD Economic Outlook - June 2023Dokument253 SeitenOECD Economic Outlook - June 2023Sanjaya AriyawansaNoch keine Bewertungen

- BBVA OpenMind Libro El Proximo Paso Vida Exponencial2Dokument59 SeitenBBVA OpenMind Libro El Proximo Paso Vida Exponencial2giovanniNoch keine Bewertungen

- Topic 4 AnnuityDokument22 SeitenTopic 4 AnnuityNanteni GanesanNoch keine Bewertungen

- Securities Market The BattlefieldDokument14 SeitenSecurities Market The BattlefieldJagrityTalwarNoch keine Bewertungen

- About Mutual Funds Lakshmi SharmaDokument83 SeitenAbout Mutual Funds Lakshmi SharmaYogendra DasNoch keine Bewertungen

- IRS Publication Form 8594Dokument2 SeitenIRS Publication Form 8594Francis Wolfgang UrbanNoch keine Bewertungen

- Drafting The International Contract For Sale of GoodsDokument14 SeitenDrafting The International Contract For Sale of Goodsfrancodemacedo100% (1)

- Portfolio Management (Assignment)Dokument4 SeitenPortfolio Management (Assignment)Isha AggarwalNoch keine Bewertungen

- Mindanao Savings & Loan Asso. vs Court of AppealsDokument11 SeitenMindanao Savings & Loan Asso. vs Court of AppealsdoraemoanNoch keine Bewertungen

- At 9004Dokument12 SeitenAt 9004SirNoch keine Bewertungen

- Mock-2, Sec-ADokument19 SeitenMock-2, Sec-AmmranaduNoch keine Bewertungen

- Job Costing vs Process Costing: Key DifferencesDokument2 SeitenJob Costing vs Process Costing: Key DifferencesJayceelyn OlavarioNoch keine Bewertungen

- About Ushar & Zakat 000000000000034 PDFDokument3 SeitenAbout Ushar & Zakat 000000000000034 PDFsyed Muhammad farrukh bukhariNoch keine Bewertungen

- 2 Forex Question CciDokument50 Seiten2 Forex Question CciRavneet KaurNoch keine Bewertungen

- Closing OperationsDokument88 SeitenClosing OperationsNavyaKmNoch keine Bewertungen

- Tissue Paper Converting Unit Rs. 36.22 Million Mar-2020Dokument29 SeitenTissue Paper Converting Unit Rs. 36.22 Million Mar-2020Rana Muhammad Ayyaz Rasul100% (1)

- CPT Mock QuestionDokument41 SeitenCPT Mock QuestionVijay Teja Reddy100% (1)

- Preventing MSME Fraud with Due DiligenceDokument16 SeitenPreventing MSME Fraud with Due Diligencesidh0987Noch keine Bewertungen

- 1 The Accounting Equation Accounting Cycle Steps 1 4Dokument6 Seiten1 The Accounting Equation Accounting Cycle Steps 1 4Jerric CristobalNoch keine Bewertungen

- PERSONAL PROPERTY SECURITY ACTDokument21 SeitenPERSONAL PROPERTY SECURITY ACTRikka Reyes100% (4)

- Banzon v. Cruz DIGESTDokument2 SeitenBanzon v. Cruz DIGESTjimmyfunk56100% (1)