Beruflich Dokumente

Kultur Dokumente

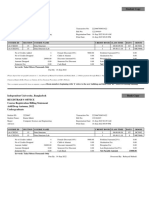

Auditing in Bangladesh

Hochgeladen von

aspire5572wxmiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Auditing in Bangladesh

Hochgeladen von

aspire5572wxmiCopyright:

Verfügbare Formate

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

INTRODUCTION

In today’s society the exercise of an auditor’s to the economic and ethical

leadership sets the bounding standard or in other words equips an auditor

in such a way that recognizes him as a reliable body. With the growing

conscious recognition of the importance of financial data in the ordering of

everyday business and economic life, the need of basic economic facts is

providing a constantly enlarging opportunity for the accounting

profession. The auditors' reports have an especial capacity to fulfill the

need for reliable and authoritative financial material not only because of

the reputation or prestige of the certified statements, but also because of

the significance generally attached by the business man to the functions

of the auditor and his reports. These functions, and the scope of these

reports, have in the past been definitely related to the character of and

changes in business activity.

Audits and reviews are basically procedures performed on the financial

statements of a company, for the purpose of determining whether the

financial statements include any material misstatements. Misstatements

are essentially wrong numbers due to numerical errors, fraud, or errors in

interpreting the accounting rules. Misstatements are material if they are

large enough to make a difference to a user of the financial statements,

such as a bank or investor. And the person who involved in auditing is

known as auditor. It also provides the techniques necessary to examine

the internal control system of a company and perform operational or

compliance audits by internal or external auditors.

The early conceptions of the functions of the auditor were such as to

confine him to the duties of a mere checker and verifier of debits and

credits. As business became more complex in its interrelationships there

has been a compensating broadening demand for the acceptance of new

and formerly unrecognized responsibilities by the auditor. This has

INTRODUCTION TO AUDITING | ACT 341

PAGE | 1

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

progressed so far that the highest type of auditor is looked upon today as

a financial expert. The premises upon which most audits are predicated,

however, are still largely those of the checker-verifier. Recent economic

trends have accentuated the new conceptions and demands upon the

auditor. The control of business enterprises within and among themselves

has emphasized the importance of the budgetary and managerial aspects

of the accountants' reports in enabling business units to coordinate their

internal and external activities in the scheme of the economic plan.

Thus the word “audit” is derived from the Latin word ‘audire” which

means “to hear”. In olden times, whenever the owners of a business

suspected fraud, they appointed certain persons to check the accounts.

Such persons sent for the accountants and “heard” whatever they had to

say connection with the accounts. It was an Italian, Luca Paciaio, who first

published his treatise on double entry system of book-keeping for the first

time in 1494. He mentioned and described the duties and responsibilities

of an auditor, since then; there have been lot of changes in the scope and

definition of audit and the duties and responsibilities of an auditor.

Spicer and Pegler , have defined Audit as “such as examination of the

books, accounts and vouchers of a business, as will enable the auditor to

satisfy himself that the balance sheet is properly drawn up, so as to give a

true and fair view of the state of the affairs of the business, and whether

the profit and Loss account gives a true and fair view of profit or loss for

the financial period, according to the best of his information and the

explanations given to him and as shown by the books and if not, in what

respect he is not satisfied.”

F.R.M. De Paula, an English authority on auditing literature, describes

auditing as “ the examination of a balance sheet and Profit and Loss

account prepared by others, together with the books, accounts, and

vouchers relating thereto in such a manner that manner that auditor may

be able to satisfy himself and honestly report that, in his opinion, such

balance sheet properly drawn up so as to exhibit a true and correct view

INTRODUCTION TO AUDITING | ACT 341

PAGE | 2

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

of the state of affairs to the particular concern according to the

information and explanations given to him, and as shown by the books”.

He further continues that an “audit of a balance sheet involves the

verification of the profit and loss account, as the balance of that account

must be included in some form or other in the former”.

HISTORY OF AUDITING

The complicated evolution of auditing has been changing throughout the

historical changes. Thus the practice of auditing have always had a

dramatic shift of change to cope with the needs of everyday business

environment. Auditing has been around since the beginning of human

civilization, focusing mainly, at first, on finding fraud. As the United States

grew, the business world grew, and auditing began to play more

important roles. In the late 1800’s and early 1900’s, people began to

invest money into large corporations. The Stock Market crash of 1929 and

various scandals made auditors realize that their roles in society were

very important. Scandals and stock market crashes made auditors aware

of deficiencies in auditing, and the auditing community was always quick

to fix those deficiencies. The auditors’ job became more difficult as the

accounting principles changed, and became easier with the use of internal

controls. These controls introduced the need for testing; not an in-depth

detailed audit. Auditing jobs would have to change to meet the changing

business world. The invention of computers impacted the auditors’ world

by making their job at times easier and at times making their job more

difficult.

The practice of auditing has been in the human society since its

beginning. Auditing was used mostly for the detection of fraud and was

INTRODUCTION TO AUDITING | ACT 341

PAGE | 3

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

done through extensive detailed examination from ancient times until the

late nineteenth century. Fraud was a great concern during the early

history of auditing, because internal controls were not used or not used

effectively until the twentieth century. To protect the public, the British

Companies Act of 1844 provided for mandatory audits. Soon afterward, in

1853, organizations of chartered accountants were formed in Scotland.

The same industrial revolution was occurring across the Atlantic in the

United States. By the late nineteenth century, British auditors were being

sent to audit American companies. Thus it was the British who built the

infrastructure for professional auditing in the United States.

The late nineteenth century was a turning point in auditing history, when

laws like the English Companies Act of 1862 were enacted. “The English

Companies Act of 1862 was a general acceptance of the need for an

independent review of accounts for both large and small enterprises (Lee,

1988).” This Act of 1862 showed that there was a great demand for

specialized-trained professionals to perform these reviews reliably and

independently.

The Late 1800’s to Early 1900’s

During this era a lot of items were omitted from the records were

overlooked by the auditors, and the result was an auditing profession that

was viewed by outsiders as more clerical than professional. Auditing of

the late nineteenth century involved a complete review of transactions

and the preparation of the corrected accounts and financial statements.

This was obviously an inefficient and expensive way to perform an audit.

England and the United States saw the need to make an audit more

efficient and less expensive. Around 1895, the technique of sampling

emerged. The audits of the late 1800s and early 1900s were largely

devoted to the accuracy of bookkeeping detail. In most cases, all vouchers

were examined and all footings verified. Hence, items omitted from the

records were overlooked by the auditors, and the result was an auditing

INTRODUCTION TO AUDITING | ACT 341

PAGE | 4

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

profession that was viewed by outsiders as more clerical than

professional.

In the late 1890’s, therefore the main objectives of auditing were the

detection/prevention of fraud and the detection/prevention of errors.

Auditing in the United States began to branch from the heavy influences

of Britain in the 1900’s. The main objectives of auditing in the United

States were to obtain accurate financial conditions and earnings of an

enterprise and secondly to detect fraud and errors. Auditors in the early

1900’s were primarily used to submit a certified balance sheet to banks to

obtain credit. Bankers were no longer loaning money based on good

character, but now focused on the definite knowledge of the financial

affairs of the borrowers. Large life insurance companies also began using

independent public accountants to certify published statements since the

Hughes investigation of 1905.

The improvement of accounting practices and standards were the main

concerns of the accounting community in the early 1900’s. Any deviation

from the Interstate Commerce Act was forbidden and punishable. The

business world also began to feel the need for improvement of accounting

principles when the businessmen’s pocketbooks were being squeezed

during the World War I era. Income taxes before World War I were at such

a low rate that they had no or little effect on the accounting practices of

the business world. In 1917 and 1918, the U.S. Government significantly

increased income taxes and a new tax was enacted that was a heavy

graduated excess profits tax. These taxes made the business world see

the need for improvement of accounting principles and the need for

accountants to mitigate the increase in taxes. Public accountants were

now commonly called on for financial advice and tax planning guidance.

This led to periodical auditing of the companies’ accounts.

Between the 1920’s and the 1930’s

When auditors and business managers learned about internal controls,

they were able to evaluate an entity’s controls. Through this evaluation,

INTRODUCTION TO AUDITING | ACT 341

PAGE | 5

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

they can do less detailed testing if the controls are strong, strong controls

will save time and money. After the Stock Market Crash of 1929, the

government saw the need for more standards and audits. They were

needed to keep businesses and publicly traded securities to stay uniform

and truthful with respect to their financial condition.

In 1930’s, the Securities and Exchange Commission had rigorous control

of public utility holding companies and this would result in a very

important accounting provision. The Public Utility Act of 1935 specified the

prevention of the payment of dividends out of capital or unearned surplus

without the approval of the Commission. This was a very significant

movement that made the distinction of earned and unearned surplus in

statutory law, which was previously only mentioned, in accounting

practice and few corporate laws.

The responsibility to of fraud detection was a question that was

unanswered for many years until the McKesson & Robbins scandal case of

1939, which put this question in the spotlight. Before 1940, the uniform

agreement as to the audit responsibility for the detection of fraud did not

exist. By 1940, with heavy influence of the McKesson & Robbins scandal

case, the responsibility for fraud detection now began to shift to

management. Auditors’ main concern was to determine the fairness of the

reported financial statements. By this time, a uniform agreement was

made that testing was the auditors’ technique, and detailed examination

was only done when deemed necessary. Of course, the strength of the

internal controls was the deciding factor on how much testing should be

done.

The 1950’s continued to reduce the importance of fraud detection on

auditors. The belief that fraud detection was the responsibility of the

management of the company was generally held. If auditors found any

irregularities as they performed their audit, it was their obligation to bring

this to the attention of the management. Ironically, many audit techniques

of the period were specifically designed to assist in the detection of fraud.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 6

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

Emphasis of the audit was placed on the determination of the truthfulness

of the financial statements. The late 1950’s and 1960’s brought more

reform and brought up the concept of reasonable assurance of financial

statements. Also, materiality of misstatements was brought to attention of

the accounting profession. The auditor was required to perform tests in

line with G.A.A.S. to detect material misstatements that would influence

the confidence of investors in a company. The general concept to start an

audit with an examination of the companies’ internal controls and the

extent of testing required was decided from the test results. The

computer had a great impact on how businesses and accounting would be

performed from the 1960’s to the present.

Technology changing the world of auditing

The evolution of computers changed auditing forever. The first electronic

computers were analog devices that began in the 1920’s and developed

through World War II. These computers were used to perform complex

mathematical computations such as integration. The 1940’s brought the

development of digital computers that used binary logic. With binary logic,

it was now possible to express exact numerical values instead of using

approximate analog quantities to approximate numerical values.

In 1958, the Institute of Chartered Accountants issued a statement

entitled Accounting by Electronic Methods. This statement referred to

E.P.D. as he method of analyzing, marshaling, recording and reporting

business information by means of equipment, the central feature of which

is an electronic digital computer. Bookkeeping for accountant has been

time consuming and in the 1950’s accountants have looked around for

new ways of processing this data. Punch card machines was the first

move but they were not fast enough for their needs, the digital computer

was the next choice for providing a faster and more detailed cost analysis.

Accountants didn’t change their ways overnight; changing over from

manual system to computers took many years.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 7

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

Auditing in general was changed forever, as data once on paper was now

on magnetic tape reels and later floppy disks. The detection of fraud was

more difficult to discover when data could be easily erased or changed.

Auditing changed with the times as it always had. The discovery for new

internal controls was needed, as these controls were important to make

an audit successful and efficient. A computer system within a business

with strong internal controls made an audit easier and resulted in more

dependable financial statements. The computer of the 1970’s could

handle large amounts of data and process the information in a very short

time. Computers made accounting jobs in general easier, with the

computer handling the bookkeeping work. This freed up time so

accountants could focus on more important jobs.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 8

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

THE AUDITOR

An auditor in general engages in the evaluation of an organization,

system, process, project or product. Auditors’ tasks are performed to

ascertain the validity and reliability of information; also to provide an

assessment of a system's internal control. The goal of an auditor is to

express an opinion on the person/organization/system in question, under

evaluation based on work done on a test basis. Due to practical

constraints, an audit seeks to provide only reasonable assurance that the

statements are free from material error. Hence, statistical sampling is

often adopted in audits. In the case of financial audits, a set of financial

statements are said to be true and fair when they are free of material

misstatements - a concept influenced by both quantitative and qualitative

factors.

Traditionally, audits were mainly associated with gaining information

about financial systems and the financial records of a company or a

business. However, recent auditing has begun to include other information

about the system, such as information about environmental performance.

As a result, there are now professions conducting environmental audits.

An auditor also engages in an independent assessment of the fairness by

which a company's financial statements are presented by its

management. It is performed by competent, independent and objective

person(s) known as auditors or accountants, who then issue an auditor's

report based on the results of the audit. However an auditor may be a

watchdog but not a bloodhound.

The task of an auditor is to determine the quality of financial &

operational/administrative control by examining and evaluating the

records, system and procedure, operations and activities of an

INTRODUCTION TO AUDITING | ACT 341

PAGE | 9

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

organization. Financial and operational control can be easily determined

by analytical reviews, intra and inter firm comparison and comparison of

current information with anticipated results. Profit as a percentage of

sales, expenses as a percentage of sales, working capital ratio, return on

investment and important guidelines to measure a concern’s

performance. Through interpretation of significant ratios an auditor can

find firm’s strength and weaknesses and where to emphasize to detect

fraud and error.

It is not possible for an auditor to check every single thing. In such a

situation, the auditor has to evaluate the internal control system

introduced by the organization. By doing this, an auditor also become

aware of the operational control in force in an organization. For example,

if an auditor finds that the wages as a percentage of sales is far higher in

this year than last year, then he will decide to apply more substantive

tests in this regard.

Internal auditor conclude whether the resource utilization of the enterprise

is effective & efficient or not by reviewing whether the accounting records

have been properly maintained, the assets adequately safeguarded and

the procedure lay down by the management properly compiled with.

Auditors have to conduct an appraisal of the various organizational

functions and provide advice and recommendation on the activities and

operation reviewed by him.

The auditors are straightforward, honest, independent and sincere in his

approach to this professional work. Professional ethics ensure right action

on the part of the members of the profession. That is why everybody

relies on auditor’s determination on the reliability of the financial and

operational control of an enterprise.

The auditor needs to follow a certain guidelines and standards. Standard

is the means of judging the level of professional competence and the

degree of consistency attained by auditors in the performance of their

duties/functions. For this purpose, we are to study and understand

INTRODUCTION TO AUDITING | ACT 341

PAGE | 10

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

professional pronouncements on auditing which indicating the collective

view of the profession on: -

Principles and techniques of auditing and

The application of such principles and techniques to various auditing

situations.

Professional bodies of accountants of various countries have issued

pronouncements on accepted auditing practices for the guidance of their

members. Most of these pronouncements discuss various auditing

practices primarily required for the purpose of expressing an expert

opinion on financial statements. The pronouncements issued by

professional bodies attempt to codify the auditing practices expected to

be observed by the auditor when he seeks to express an opinion on

financial statement. These however, do not interfere with the auditor’s

individual judgment in selecting the procedure to be followed and in

determining the extent to which he should apply such procedures.

The analytical review steps for forming his overall conclusions about the

consistency of financial information as a whole with his knowledge of the

entity’s business and relevant economic conditions is also performed by

the auditor. For example an auditor can compare significant ratios for the

entity with those of other entities in the same industry or with the industry

average. This review may assist an auditor in identifying an unusual and

unexpected balance, which was not previously identified. Though the

procedures of analytical review have been highly commendable in the

arena of professional audit, the extent of its reliance much depend on the

substantive information that might be available from the entity, nature of

assertion the auditor might exert on the business logically and the

predictability of relationships among items of financial information (so

that any deviation there from can be taken as being indicative of potential

miss statements) and the strength of the evaluation of the internal

control. If the auditor really faces any such circumstance where the

application of analytical review may not be expected to desired results as

INTRODUCTION TO AUDITING | ACT 341

PAGE | 11

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

expected of a good audit report, there is no barrier for the auditor for an

extensive check, as he may think proper and adequate. The system of

analytical review adopted generally in combinations of other method have

in major cases yielded the desired results enabling the auditor to present

a good audit report; exhibiting a proper statement of financial information

of the entity under audit.

The auditor’s concept of internal control is fundamentally identical to the

concept of control or management control of the management theorists. It

is one of the activities or functions of management, but it is notable in its

complete dependence upon the other functions of management. This has

led some management thinkers to suggest that it should not be regarded

as a distinct function in its own right, just as others have suggested that

coordination should not be regarded as a separate function.

As we know, there can be no control unless there is a plan to be

controlled. A successful organization, which established individual

responsibilities, is likewise an essential component of control. Staffing

must also be appropriate for control to be effective. All it means is that

when the auditor reviews an enterprise’s arrangements for internal

control, the evaluation is of the management process, embracing all the

functions of management viz: planning, organizing, staffing, directing and

leading controlling and finally coordinating.

In practice an internal auditor may be restricted by the terms of reference

to conducting reviews only in certain sections of the enterprise. They may

be asked to audit only up to a certain level. Usually it is impossible for

internal audit effectively above the organizational level of the director of

internal audit. They may audit only certain operations, such as accounting

and financial.

Even if internal audit has a restricted scope but within the areas where it

does have a mandate it should be concerned with all the functions of

management (planning, organizing, staffing, directing, controlling, and

coordinating). The only exception to this is where internal audit if

INTRODUCTION TO AUDITING | ACT 341

PAGE | 12

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

restricted to checking for distributed compliance with laid down

procedures and has no role in connecting upon which procedures are the

right ones: sterile mode of internal auditing if fortunately seldom seen

now a days. So it appears that internal audit is concerned to review all the

arrangements that have been made to manage the enterprise, being

limited only by any boundary that management themselves have

prescribed defining the scope of their internal auditing department. But

within these boundaries internal audit is concerned to review all the

functions of management. Anyway the financial auditor has no limitation

like that of the internal auditor and hence, he can go for in depth auditing

as per acceptable audit practices.

The term ‘investigation’ in auditing means a systematic and in depth

examination or enquiry to establish a fact or to evaluate a specific

situation. Professional accountants are often called upon to investigate

the accounts or related records of an undertaking. Such assignments

differ substantially from a normal audit tasks. Audit aims at collection on

the financial statements or other data under examination. An

investigation, on the other hand, requires a special in depth scrutiny of

the particular records or transaction’s with the object of substantiating a

fact or happening or assessing a particular situation.

In the backdrop of the basic differences between nature and objectives of

an audit and those of an investigation, the approach to an investigation is

different from that followed in an audit. An investigation calls for a more

thorough examination of the selected areas than what is required in an

audit of the entire financial aspect of the entity under audit. This is

because the scope and objective of an audit are broad and general while

those of investigation are narrow and specific. The investigators are

concerned with a particular task in a given area but the audit cannot be

completed without examination and scrutiny of the whole area of the

entity. It will this appear that an investigation looks for substantive and in

some cases, even conclusive evidence for establishing a fact, say a

specific complain in installing a machinery, whereas, an auditor may rely

INTRODUCTION TO AUDITING | ACT 341

PAGE | 13

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

on a persuasive evidence for his circumstantial audit report. An

investigator does not accept a fact as correct until it is substantiated.

Unlike an auditor, an investigator cannot presume that in the absence of

suspicious circumstances, a figure or a stated fact is necessarily correct.

As an investigator to investigate the alleged misappropriation of closing

stock or of finished stock of the company under investigation, a

professional accountant is engaged. His objective would be to gather

substantive evidence in support of the quantitative and monetary figures

of the opening stick, production, sales and dispatches and the stock

register. For these, he would check all the related records thoroughly,

looking into every item carefully. If he uses here the statistical sampling

techniques like random sampling, he would do so merely to narrow down

his inquiry. Rather, he would scrutinizes and crosscheck the various

transactions till he is able to check precisely what he is looking for. In a

financial audit assignment on the other hand, the auditor i.e. a

professional accountant would select a representative sample from the

transactions, examine it in depth and if nothing arouses his suspicious, he

would rely on the examination and report that the accounts and the

statements represent a true and a fair view of the affairs of the

undertaking. To use the oft repeated metaphor, an auditor is a watchdog

and not a bloodhound. But the investigator shall stretch his nose for the

faintest of scents of frauds, material misstatements, material omissions

from the record and the like.

Due to the very purpose and nature of investigators, an investigator, even

though he is a professional accountant is not bound unlike an auditor, by

accounting conventions, IGAs, ISAs (International Guidelines on Auditing,

International Standard on Auditing) policies and disclosure requirements.

The exact nature and procedures to be followed in conducting an

investigation depend entirely upon the circumstances of the case, the

nature of appointment, requirement of the investigation results, etc. but

the fundamental achievements to be obtained through investigation

entirely depends on the knowledge, Intelligence Quest (IQ), honesty,

INTRODUCTION TO AUDITING | ACT 341

PAGE | 14

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

integrity and the foresightedness of the professional accountant being

appointed as such as an investigator.

Now it is clear that the importance of audit of the financial data is so vast

that it is much more important in an organization in order to run it

efficiently, effectively and in an orderly manner.

Types of Auditors Involved in the Current Day’s

Auditing

There are two types of auditors who are basically involved with present

day’s auditing practices:

• Internal Auditor - Internal auditors are employees of a company

hired to assess and evaluate its system of internal control. To

maintain independence, they present their reports directly to the

Board of Directors or to Top Management. They provide functional

operation to the concern. Internal Auditors are employees of the

company so that they can easily find out the frauds.

• External Auditor – External auditors are independent staff assigned

by an auditing firm to assess and evaluate financial statements of

their clients or to perform other agreed upon evaluations. Most

external auditors are employed by accounting firms for annual

engagements. They are called upon from the outside of the

company.

Common types of Audit in Practice

1) Single Audit

The Single Audit, is a rigorous, organization-wide audit or examination

of an entity that expends $500,000 or more of Federal funds received

for its operations. Usually performed annually, the Single Audit’s

objective is to provide assurance to the US federal government as to the

management and use of such funds by different recipients, such as

INTRODUCTION TO AUDITING | ACT 341

PAGE | 15

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

States, cities, universities, and non-profit organizations, among others. The audit is

typically performed by an independent certified public accountant (CPA) and

encompasses both financial and compliance components. The Single

Audits must be submitted to the Federal Audit Clearinghouse along with a

data collection form.

2) Clinical Audit

It is the process formally introduced in 1993 into the United Kingdom's

National Health Service (NHS), and is defined as "a quality improvement process

that seeks to improve patient care and outcomes through

systematic review of care against explicit criteria and the

implementation of change".

The key component of clinical audit is that performance is reviewed

(or audited) to ensure that what should be done is being done, and if

not it provides a framework to enable improvements to be made.

3) Computer Security Audit

A computer security audit is a manual or systematic measurable

technical assessment of a system or application. Manual

assessments include interviewing staff, performing security

vulnerability scans, reviewing application and operating system

access controls, and analyzing physical access to the systems.

Automated assessments, or CAAT's, include system generated audit

reports or using software to monitor and report changes to files and

settings on a system. Systems can include personal computers,

servers, mainframes, network routers, switches. Applications can

include Web Services, Microsoft Project Central, Oracle Database.

4) Conformity Assessment Audit

INTRODUCTION TO AUDITING | ACT 341

PAGE | 16

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

It is any activity to determine, directly or indirectly, that a process,

product, or service meets relevant standards and fulfills relevant

requirements. Conformity assessment activities may include:

Testing

Surveillance

Inspection

Auditing

Certification

Registration

Accreditation

5) Environmental Audit

Environmental audits are intended to quantify environmental

performance and environmental position. In this way they perform

an analogous function to financial audits. An environmental audit

report ideally contains a statement of environmental performance

and environmental position, and may also aim to define what needs

to be done to sustain or improve on indicators of such performance

and position.

Environmental Auditors can get certified through written exam and

acceptance of the Environmental Auditor Association code of ethics.

Depending on the nature of the audit, there are several different

designations to choose from. CECAB administers these designations.

6) Financial Audit

A financial audit, or more accurately, an audit of financial

statements, is the examination by an independent third party of the

financial statements of a company or any other legal entity (including

governments), resulting in the publication of an independent opinion on

whether or not those financial statements are relevant, accurate,

complete, and fairly presented.

Financial audits are typically performed by firms of practicing

accountants due to the specialist financial reporting knowledge they

INTRODUCTION TO AUDITING | ACT 341

PAGE | 17

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

require. The financial audit is one of many assurance or attestation

functions provided by accounting and auditing firms, whereby the firm

provides an independent opinion on published information.

Many organizations separately employ or hire internal auditors, who do

not attest to financial reports but focus mainly on the internal

controls of the organization. External auditors may choose to place limited

reliance on the work of internal auditors.

7) Internal Audit

Internal auditing is a profession and activity involved in advising

organizations regarding how to better achieve their objectives.

Internal auditing involves the utilization of a systematic

methodology for analyzing business processes or organizational

problems and recommending solutions. Professionals called internal

auditors are employed by organizations to perform the internal

auditing activity. The scope of internal auditing within an

organization is broad and may involve internal control topics such as the

efficacy of operations, the reliability of financial reporting, deterring

and investigating fraud, safeguarding assets, and compliance with

laws and regulations. Internal auditing frequently involves

measuring compliance with the entity's policies and procedures.

However, internal auditors are not responsible for the execution of

company activities; they advise management and the Board of

Directors (or similar oversight body) regarding how to better

execute their responsibilities. As a result of their broad scope of

involvement, internal auditors may have a variety of higher

educational and professional backgrounds. Publicly-traded United

States corporations typically have an internal auditing department,

led by a Chief Audit Executive ("CAE") who generally reports to the

Audit Committee of the Board of Directors, with administrative reporting to the

Chief Executive Officer. The profession is unregulated, though there are a

INTRODUCTION TO AUDITING | ACT 341

PAGE | 18

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

number of international standard setting bodies, an example of

which is the Institute of Internal Auditors .

8) Performance Audit

Performance audit refers to an examination of a program, function,

operation or the management systems and procedures of a

governmental or non-profit entity to assess whether the entity is

achieving economy, efficiency and effectiveness in the employment

of available resources. The examination is objective and systematic,

generally using structured and professionally adopted

methodologies.

In most countries, performance audits of governmental activities are

carried out by the external audit bodies at federal or state level.

Many of these audit bodies have established guides for conducting

performance audits which explain how performance audits are

planned, conducted and its results reported.

INTOSAI, the international association of Supreme Audit Institutions,

has published generally accepted principles of performance auditing

in its implementation guidelines. In the United States, the standard

for government performance audits is the Generally Accepted

Government Auditing Standards (GAGAS), often referred to as the

"yellow book", maintained by the federal Government Accountability Office

(GAO). Similarly, the European Court of Auditors (ECA) has developed a

"performance audit manual" for its audits of the sound financial

management of the European Commission and the programs funded

through the EU budget.

Performance audits may also be conducted by Internal Auditors who

are employees of the entity being audited. However, some national

governments require agencies, departments and branches to

periodically retain outside auditors to conduct them.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 19

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

In the USA, all auditors who follow GAGAS standards are required to

maintain independence, supervision, continuing professional

education, and conduct the audit using a specific process designed

to increase the quality of the audit and reduce the politicization of

audit work. Although there are separate professional credentials and

certifications for Financial Auditors, the persons that conduct

Performance Audits in the USA are often Certified Public Accountants,

Certified Internal Auditors, or have a broad background in public

policy, business or public administration.

The scope of performance audits may include the detection of fraud,

waste and abuse, although often these are not included in the

scope. Prior to engaging in a performance audit, the auditor must

have a scope and plan defined which will be used to guide the audit

process. Performance auditing differs from performance

measurement, the latter being the responsibility of management of

the entity. In addition, performance measurement may include a

broad variety of activities that do not meet the rigor of an

independent external assessment.

THE PREVAILING AUDITING PRACTICES

Today, auditors utilize sampling techniques to test certain transactions

during the performance of an audit or review, since it would be nearly

impossible and too expensive to test every single transaction. The

sampling may be aimed at the largest items or the items on the financial

statements that pose the most risk of misstatement. If material errors in

the financial statements are discovered, the auditors will direct

management to correct them.

Auditing has been the backbone of the complicated business world and

has always changed with the times. As the business world grew strong,

auditors’ roles grew more important. The auditors’ job became more

difficult as the accounting principles changed. It also became easier with

INTRODUCTION TO AUDITING | ACT 341

PAGE | 20

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

the use of internal controls, which introduced the need for testing, not a

complete audit. Scandals and stock market crashes made auditors aware

of deficiencies in auditing, and the auditing community was always quick

to fix those deficiencies. Computers played an important role of changing

the way audits were performed and also brought along some difficulties.

So how does fraud fit into the idea of material misstatements?

Misstatements can be caused by either error or fraud. Auditors have some

responsibility for the detection of both errors and frauds that are material,

but this responsibility is not absolute. Auditors give "reasonable"

assurance that material misstatements have been uncovered, but not

total assurance. Errors are much more likely to be discovered during an

audit than are fraud. Fraud schemes are crafted to purposely exploit the

accounting system and controls, and therefore it is more difficult for an

auditor to find them. Since auditors are not all-knowing beings, the

assurance that the financial statements are correct can only be

"reasonable" assurance and not total assurance.

Traditionally audits were mainly associated with gaining information about

financial systems and the financial records of a company or a business.

However, recently auditing has begun to include other information about

the system, such as information about environmental performance. As a

result there are now professions that conduct environmental audits. In financial

accounting, an audit is an independent assessment of the fairness by which a

company's financial statements are presented by its management. It is

performed by competent, independent and objective person or persons,

known as auditors or accountants, who then issue an auditor's report on the

results of the audit.

Such systems must adhere to generally accepted standards set by

governing bodies that regulate businesses. It simply provides assurance

for third parties or external users that such statements present 'fairly' a

company's financial condition and results of operations.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 21

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

Auditing Rules

It’s important to understand the guidance given to auditors on the topic of

fraud. Accountants performing audits in the United States follow Generally

Accepted Auditing Standards (GAAS) in their performance of audits.

Additional guidance is provided in the Statements on Standards for

Auditing and Review Services (SSARS) and Statements on Auditing

Standards (SAS). These sets of authoritative guidance outline the

responsibilities that auditors have for finding fraud while performing

audits and reviews.

SAS number 99, "Consideration of Fraud in a Financial Statement Audit,"

became effective in late 2003. This statement directs auditors to use

professional skepticism and to consider that a fraud could have occurred

and could materially affect the financial statements. The auditors must

consider and identify the risk of fraud, and must continuously evaluate

evidence throughout the audit to determine whether or not there are any

fraud indicators.

The American Institute of Certified Public Accountants (AICPA) recently

issued SSARS number 12, "Omnibus Statement on Standards for

Accounting and Review Services." This applies to reviews, rather than

audits. Reviews provide less assurance on the financial statements, as the

review procedures are typically less thorough and less detailed than audit

procedures. This statement dictates that during a review, the auditor is

not required to assess the risk of fraud or develop plans specifically to

identify fraud.

The guidance for auditors is continuously evolving as the accounting

profession acknowledges that fraud is becoming a bigger issue for clients.

All of this alphabet soup can be boiled down to the fact that it is

management's responsibility, not the auditor's, to prevent and detect

fraud. The auditors must consider fraud throughout their procedures, but

they do not have an absolute responsibility for the detection of fraud.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 22

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

The Auditing Standards

When we talk about standards it means of judging the level of

professional competence and the degree of consistency attained in the

performance of their duties/functions. For this purpose, we are to study

and understand professional pronouncements on auditing which indicate

the collective view of the profession on (a) principles and techniques of

auditing and (b) the application of such principles and techniques to

various auditing situations.

Various Professional bodies in various countries have issued

pronouncements on accepted auditing practice for the guidance of their

members. Most of these pronouncements discuss various auditing

practices primarily required for the purpose of expressing an expert

opinion on financial statements.

The pronouncements issued by professional bodies attempt to codify the

auditing practices expected to be observed by the auditor when he seeks

to express an opinion on financial statements. These however, do not

interfere with the auditor’s individual judgment in selecting the procedure

to be followed and in determining to the extent to which he should apply

such procedures.

In case a deviation is necessary in a particular situation that should be

reported in the audit report. Compliance of standard audit practices is

expected in normal circumstances. In many countries, the auditors are

specifically required to state in their audit report whether the audit was

carried out in accordance with the generally accepted auditing standards.

The institute of chartered accountants order, 1972 specifically provides

that a chartered accountant in practice shall be deemed to be guilty of

professional misconduct if he fails to invite attention to any material

departure from the generally accepted procedure of audit applicable to

the circumstances. It is thus apparent that in normal circumstances, an

auditor in Bangladesh has to follow the generally accepted procedure of

audit such as-international Auditing guidelines.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 23

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

The development of a coordinated worldwide accountancy profession,

accountancy bodies of different countries established the international

federation of accountants (IFAC) in 1977. The international auditing

practices committee (IAPC) is a standing committee of the council of IFAC

and has been assigned specific reasonability and authority to issue

international guidelines on auditing and related fields. The guidelines

issued by IAPC shall. However, in no case override the local statutory

professional regulations.

The statement on standard auditing practices (SAPs) issued by the

institute of chartered Accountants of Bangladesh are generally based on

the corresponding international Auditing Guidelines. However, in

developing the SAPs, the institute also takes into consideration the

existing laws, customs, uses and business environments of Bangladesh.

The international accounting standards committee (IASC) developed by

professional bodies all over the world has been engaged in formulating

and publishing standard of financial accounting. Auditing and accounting

professions are therefore correlated, coordinated and interdependent

subjects.

The institute of chartered accountant of Bangladesh (ICAB) can be briefly

classified as-

a) statements on accounting and auditing, including statements of

auditing practices(SAPs)

b) Accounting standards

c) Guidance notes on matters relating to accounting, auditing,

taxation, company law, ethics and other related matters.

d) Opinion on specific queries

e) Research studies and other miscellaneous publications

The council of the institute of chartered Accountant of Bangladesh

regularly issues statements on basic principles governing an audit. A

member of the professional body is to generally follow these guidelines

INTRODUCTION TO AUDITING | ACT 341

PAGE | 24

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

while conducting an audit. The auditor should be straightforward, honest

and sincere in his approach to his professional work.

Last but not the least, the auditor should respect the confidentiality of

information acquired in the course of his work and should not disclose any

such information to a third unless there is a legal or professional duty to

disclose.

The Behavioral Aspect of Auditing

During the course of auditing there is no doubt that an important aspect

an auditor should very carefully take note of. The conflicting role inherent

in auditor’s position is principally a conflict of reporting on people to

whom an auditor apparently appears to be an adviser, guide and a

controller. The auditor should look it upon with multidimensional angles.

Generally, the auditor tries to play down formal authority although it is

known that imposed chances have a high risk of failure. Different people

of different branches of an organization will react in different ways on

being reported upon. But the auditor’s reaction will be absolutely

nonpartisan provided the report addresses issues rightly and within areas

of main values and problems. But the auditor is not received in a

negative, hostile way. There is an inherent dislike of control system which

evaluates people before they have chances of evaluating themselves.

The behavioral aspects of auditing have now become a need nowadays.

An auditor has the needs of performing his audit jobs and so does the

individual auditee for the purpose of a representative verification of the

financial state of affairs of the entity. When a need is not met, then there

is a dissatisfaction which is potentially damaging for the both. The auditor

should utilize their psychological balance in a way most suitable to his

techniques and programs. Relationship can be regarded as the other

component of the human behavior. There is a formal relationship, the

nature of which is dependent on the personal qualities of the persons

involved. There is no meaningful relationship without proper

INTRODUCTION TO AUDITING | ACT 341

PAGE | 25

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

communication. The auditor should be well aware of all these techniques

of effective communications for his success in profession.

Types of Behavioral Auditing Study

The study of heuristics and biases appears to have been of limited

relevance for behavioral auditing research for several reasons. First, the

results have failed to reveal any consistent effects attributable to

heuristics and biases. Second, only narrow ranges of auditing tasks have

been used in heuristics and biases research. Third, it's not clear that

heuristics and biases are connected to central issues in behavioral

auditing. As a psychologist looking at the field, there appear to have been

three types of behavioral auditing studies. These are as follows:

The Replication Study:

The methods and procedures are borrowed in total. The major

research question is: Will the original findings replicate with auditors

as subjects? For the most part, behavioral auditing studies of

heuristics and biases fall into this category. They offer little advance

in methodology, analysis, theory, etc., over the original Kahneman

and Tversky studies. One positive feature of replication studies is

that they have introduced many auditing investigators to behavioral

research. On the negative side, however, replication studies are

limited in two important ways. First, they investigate issues which

originate with non-auditors and may be of questionable relevance to

auditing. Second, replication studies ask auditing subjects to answer

questions which have little relationship to their professional skills

and knowledge.

The Adaptation Study:

Another type of auditing study looks at a research problem

originating from accounting and/or auditing concepts, but using

methods adapted from behavioral research approaches. The

procedures are borrowed, but the problems arise from accounting.

One example involves analysis of sunk cost effects (e.g., Arkes &

INTRODUCTION TO AUDITING | ACT 341

PAGE | 26

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

Blumer, 1985; Thaler, 1980). The topic is of direct concern in

accounting, but the methods and analyses reflect procedures used

in heuristics and biases research.

Adaptation studies are obviously an advance over replication

research, since the research problems originate from accounting.

However, behavioral methods may be insufficient to investigate

many complex auditing issues, e.g., the effects of a new auditing

policy. Instead, it may be necessary to combine behavioral and non-

behavioral methods in unique ways to investigate such issues.

The Problem-Driven Study:

The third type of project involves research designed uniquely

around the concerns of behavioral auditing. Such studies lead to

their own methods and procedures; in contrast, the first two types

of studies are largely spin-offs from behavioral research. Thus, the

methods and procedures flow from important auditing problems, not

the other way around. This type of research marks the dividing line

as far as a non-auditor is concerned – as a psychologist, I am no

longer qualified to comment on specific projects. I firmly believe,

however, that this is the direction that behavioral research in

auditing should head. In summary behavioral auditing research on

heuristics and biases falls primarily into the replication category;

such research can be viewed as a transition stage. Adaptation

studies may apply some of the methods from heuristics and biases

research to accounting problems; this is clearly an improvement

over replication research. Finally, problem-driven studies represent

the future of behavioral auditing research; it's not clear, however,

that heuristics and biases will play any role in that future.

The Management and Internal audit:

Internal auditing involves conducting a systematic examination of

the record, systems and procedures and operations of an

organization as a service to the management. Internal audit

INTRODUCTION TO AUDITING | ACT 341

PAGE | 27

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

department is an administrative unit of the management, whereas

statutory auditing is hired by the management or statutory

authorities for a counter auditor for external uses as per the

requirements of the law.

The traditional concept of internal auditing was thus primarily

concerned with questions like whether the assets of the

organization were safeguarded and properly accounted for, whether

the accounting or other records were reliable and whether the

organizational procedures and policies were complied with. With a

significant emphasis, on the detection of fraud and accuracy of

financial records, the internal auditor was perceived as a “status

Quo” oriented auditor of financial records.

The Operating Procedures are:

1. Prepare Annual Internal Audit Plan

2. Communicate Annual Internal Audit Plan

3. Conduct Internal Audit Planning and Notification

4. Perform Audit Fieldwork

5. Report Results

6. Wrap-up Audit

7. Review Final Report

8. Disseminate Report

9. Evaluate and Follow Up

1. Prepare an Annual Audit Plan:

In cooperation with the senior management, perform the

following:

• Conduct a preliminary risk assessment session utilizing

a facilitated group interview.

• Gather top management input on the preliminary risk

assessment.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 28

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

• Prepare a Draft Annual Audit Plan based upon the

results of the risk assessment process.

• Obtain the formal approval of the Audit & Governance

Committee of the Board of Trustees.

The need to conduct special requested projects from the Audit &

Governance Committee and senior management may also

require the deferral of planned audits.

2. Communicate Annual Internal Audit Plan

• Distribute the Annual Audit Plan to senior management.

• Keep senior management informed of any changes to the

Annual Audit Plan.

• Ensure that appropriate senior management is informed at

least a month prior to each planned audit.

• Note that special requested projects require different

procedures involving little or no notification to involved

management.

3. Conduct Internal Audit Planning and Notification

• Contact department management at least two weeks in

advance of scheduled audit date to discuss risk considerations

that led to the audit being on the annual plan, expected scope

of the audit, and current management concerns.

• Develop preliminary audit program outlining anticipated

scope, risk assessment, procedures and schedule.

• Schedule an Entrance Meeting with department management

and staff, and other stakeholders as appropriate, to go over

INTRODUCTION TO AUDITING | ACT 341

PAGE | 29

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

and finalize the audit program, obtain documents, schedule

interviews and communicate expected audit completion date.

4. Perform Audit Fieldwork

• Carry out fieldwork as indicated in the audit program.

• Obtain cooperation from the line management and

department staff as necessary to identify, obtain

documentation and conduct interviews, etc.

• Conduct fieldwork with minimal disruption to department

operations; for example, whenever possible, obtain

information from central sources rather than from

departmental staff or line management.

5. Report Results

• In general, share important and sensitive findings with

responsible managers immediately upon verification by the

auditor; short memo reports may be used in this process.

• Prepare a first draft final report and discuss it with responsible

managers immediately following the fieldwork.

6. Wrap-up Audit

• Schedule an Exit Meeting after responsible managers have

received the first draft report; this meeting will provide the

opportunity for responsible managers to discuss findings,

conclusions, and recommendations with the auditor.

• During or immediately after the Exit Meeting, ask responsible

managers to provide their responses to the auditor's findings

and recommendations, either in writing or in sufficient detail

for the auditors to capture them and reduce them to writing in

the final draft report.

7. Review Final Report

INTRODUCTION TO AUDITING | ACT 341

PAGE | 30

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

• Send final draft report to responsible managers and

discuss suggested changes. After processing changes, issue

the final report to the distribution indicated on the cover of

the final draft.

8. Disseminate Report

• Provide the full report to members of the Audit & Governance

Committee, the President, the CFO and the department

heads in the area being reported. Provide the Controller with

copies of any reports with financial system findings. Provide to

the Provost and Dean of each academic department when

appropriate.

9. Evaluate and Follow Up

• At the completion of each audit, the auditor will send an

evaluation survey form to the primary clients of the audit. This

form should be completed and returned to the Office of

Internal Audit, in order to ensure continuous improvement of

these procedures and the internal audit function.

Approximately six months following completion of each audit,

the auditor will conduct a follow-up review to verify the

completion of agreed-upon management actions and

ascertain the status of open recommendations. A follow-up

report will be generated annually for distribution to senior

management and members of the Audit & Governance

Committee.

Defining the Scope of Internal audit:

The scope of internal auditing encompasses the examination and

evaluation of the adequacy and effectiveness of the organization's

system of internal control; and the quality of performance in

INTRODUCTION TO AUDITING | ACT 341

PAGE | 31

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

carrying out assigned responsibilities. Examinations and

evaluations are composed of the following types of audits:

• Reliability and Integrity of Information

• Compliance with Policies, Plans, Procedures, Laws, and

Regulations

• Safeguarding of Assets

• Economical and Efficient Use of Resources

• Accomplishment of Established Objectives and Goals for

Operations or Programs

Dependability and Integrity of Information:

Internal auditors should review the reliability and integrity of

financial and operating information and the means used to identify

measure, classify, and report such information. Information systems

provide data for decision making, control, and compliance with

external requirements. Therefore, internal auditors should examine

information systems and, as appropriate, ascertain whether:

• Financial and operating records and reports contain accurate,

reliable, timely, complete, and useful information.

• Controls over record keeping and reporting are adequate and

effective.

Conformity with Policies, Plans, Procedures, Laws, and

Regulations:

Auditors especially internal auditors should review the systems

established to ensure compliance with those policies, plans,

procedures, laws, and regulations which could have a significant

impact on operations and reports, and should determine whether

the organization is in compliance. Management is responsible for

establishing the systems designed to ensure compliance with such

INTRODUCTION TO AUDITING | ACT 341

PAGE | 32

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

requirements as policies, plans, procedures, and applicable laws and

regulations. Internal auditors are responsible for determining

whether the systems are adequate and effective and whether the

activities audited are complying with the appropriate requirements.

1. Safeguarding of Assets:

Internal auditors should review the means of safeguarding assets

and, as appropriate, verify the existence of such assets. Internal

auditors should review the means used to safeguard assets from

various types of losses such as those resulting from theft, fire,

improper or illegal activities, and exposure to elements. Internal

auditors, when verifying the existence of assets, should use

appropriate audit procedures.

2. Economical and Efficient Use of Resources:

Internal auditors also should appraise the economy and efficiency

with which resources are employed. Management is responsible

for setting operating standards to measure an activity's

economical and efficient use of resources. Internal auditors are

responsible for determining whether:

Operating standards have been established for

measuring economy and efficiency.

Established operating standards are understood and are

being met.

Deviations from operating standards are identified,

analyzed, and communicated to those responsible for

corrective action.

Corrective action has been taken.

3. Audits related to the economical and efficient

use of resources should identify

such conditions as:

• Under-utilized facilities.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 33

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

• Nonproductive work.

• Procedures which are not cost justified.

• Overstaffing or understaffing.

4. Accomplishment of Established Objectives and Goals

for Operations or Programs

Management is responsible for establishing operating or

program objectives and goals, developing and implementing

control procedures, and accomplishing desired operating or

program results. Internal auditors should ascertain whether such

objectives and goals conform to those of the organization and

whether they are being met. The term "operations" refers to the

recurring activities of an organization directed toward producing

a product or rendering a service. Such activities may include,

but are not limited to, marketing, sales, production, purchasing,

human resources, finance and accounting, and governmental

assistance. An operation's results may be measured against

established objectives and goals which may include budgets,

time or production schedules, and/or operating plans. The term

"programs" refers to special purpose activities of an

organization. Such activities include but are not limited to the

raising of capital, sale of a facility, fund-raising campaigns, new

product or service introduction campaigns, capital expenditures,

and special purpose government grants. Special purpose

activities may be short-term or long-term, spanning several

years. When a program is completed, it generally ceases to

exist. Program results may be measured against established

program objectives and goals. Management is responsible for

establishing criteria to determine if objectives and goals have

been accomplished. Internal auditors should ascertain whether

criteria have been established. If so, internal auditors should use

such criteria for evaluation if they are considered adequate. If

management has not established criteria, or if the established

INTRODUCTION TO AUDITING | ACT 341

PAGE | 34

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

criteria, in the internal auditors' opinion, are less than adequate,

internal auditors should report such conditions to the

appropriate levels of management. Additionally, internal

auditors may recommend appropriate courses of action

depending on the circumstances. Internal auditors may

recommend alternative sources of criteria to management, such

as:

• Acceptable industry standards.

• Standards developed by professions or associations.

• Standards in law and government regulations.

With adequate criteria are not established by management,

internal auditors may still formulate criteria they believe to be

adequate in order to perform an audit, form an opinion, and

issue a report on the accomplishment of established objectives

and goals. The internal auditors' evaluation of the

accomplishment of established objectives and goals may be

carried out with respect to an entire operation or program or

only a portion of it. The objectives and goals established by

management for a proposed, new, or existing operation or

program are adequate and have been effectively articulated and

communicated.

The operation or program achieves its desired

level of interim or final results.

The factors which inhibit satisfactory performance

are identified, evaluated, and controlled in an

appropriate manner.

Management has considered alternatives for

directing an operation or program which may yield more

effective and efficient results.

An operation or program complements duplicates,

overlaps, or conflicts with other operations or programs.

Controls for measuring and reporting the

accomplishment of objectives and goals are established

and are adequate.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 35

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

An operation or program is in compliance with

policies, plans, procedures, laws, and regulations.

Internal auditors should communicate the audit results to the

appropriate levels of management. The report should state the

criteria established by management and employed by internal

auditors and disclose the nonexistence or inadequacy of any

needed criteria. Internal auditors can provide assistance to

managers who are developing objectives, goals, and systems by

determining whether the underlying assumptions are

appropriate; whether accurate, current, and relevant information

is being used; and whether suitable controls have been

incorporated into the operations or programs.

REGULATIONS PROFESSIONALISM AND

ETHICS OF AN AUDITOR

The professionalism of an auditor is of utmost significance in the light of

the powers he exercises while scrutinizing the financial state of affairs of

an entity. He can go for in-depth auditing in any case he deems fit. But at

the same time, none would like that he would be arrogant, unscrupulous

and unreasonable while conducting an audit. So has been there provided

regulatory restrictions as to what he should do and what not.

In 1973 the institute of chartered account order aims at regulating the

profession of financial auditors of Bangladesh. Similarly, chartered

accountants act, 1949 regulates the Indian professional accountants.

Similar, regulatory laws exist in all the industrially developed nations. All

persons passing certain specified qualifications or those having passed

the examinations and completed the training prescribed by the institute of

chartered Accountants, can become its members. There are two

categories of members of Bangladesh institute of chartered accountants

INTRODUCTION TO AUDITING | ACT 341

PAGE | 36

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

(ICAB) associates and fellows. A person becomes an associate member of

the institute as soon as his name is entered in the membership register.

These entities he /she to write ACA after his/her name. An associate in

continuous practice in Bangladesh for at least five years and any other

associate who has been a member of the institute, can be enrolled as a

fellow of the institute and is entitles to use the words FCA after his/her

name.

According to the ICAB order, 1973 clearly defines the ethical standard of a

member of the institutes. Any contravention of the prescribed ethical

standard will invoke the penal measures for such a breach as laid down in

the statue. There have been provided different penal measures for

different types of professional misconduct. Membership of the institute is

not mandatory but for doing practice as a professional accountant,

membership is obligatory. Someone getting into a substantive cadre job

may not be forced to become a member of the institute. All these are

about the institutional methods.

The IFAC considers the following to the fundamental principles by which

an accountant should be governed in the conduct of his professional

relation with others.

• Integrity: An accountant should be straightforward, honest

and sincere in his approach to his professional work.

• Objectivity: An accountant should be fair and should not

allow prejudice or bias to override his objectivity. While on

financial statements which come under his review, he should

maintain an impartial attitude.

• Independence: When in public practice, an accountant

should behold and appear to be free of any interest which

might be regarded, whatever be it actual effects, as being

incompatible with integrity and objectivity.

INTRODUCTION TO AUDITING | ACT 341

PAGE | 37

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

• Confidentiality: An accountant should respect the

confidentiality of information’s required in the course of his

work and should not disclose any such information to a third

party without a specific authority or unless there is a legal or

professional compulsion to disclose. The breach would charge

him for guilty of misfeasance.

• Technical standard: An accountant should carry out his

professional work in accordance with the technical and

professional standard relevant to that work.

• Professional competence: He should have duty to maintain

his level of competence through his professional career. He

should only undertake works which he or his firm can expect

to compete with professional competence and within

reasonable time. Last but not the least, an accountant should

conduct himself and refrain from any conduct which might

bring discredit to the profession.

In fine the practice of professional ethics is largely a matter of conscience

and the determination of the members to distinguish between what is

wrong and what is right. It thus involves a high civic sense.

FUNDAMENTALS OF INTERNAL CONTROL

The Committee of Sponsoring Organizations (COSO) of the National

Commission on Fraudulent Financial Reporting (also known as the Tread

way Commission), in 1992, published a document called Internal Control

Integrated Framework, which defined internal control as a process,

effected by an entity's board of directors, management and other

personnel, designed to provide reasonable assurance regarding the

achievement of objectives in three categories:

INTRODUCTION TO AUDITING | ACT 341

PAGE | 38

AUDITING: THE MOST RELIABLE ECONOMIC GUARD

1. Effectiveness and efficiency of operations.

2. Reliability of financial reporting.

3. Compliance with applicable laws and regulations.

Internal control can be judged as effective in each of these categories if

the board of directors and management have reasonable assurance that:

1. They understand the extent to which the entity’s operations

objectives are being achieved.

2. Published financial statements are being prepared reliably.

3. Applicable laws and regulations are being complied with.

The COSO Framework consists of five interrelated components as follows:

Control environment:

Sometimes referred to as the tone at the top of the organization,

meaning the integrity, ethical values, and competence of the