Beruflich Dokumente

Kultur Dokumente

Partnership Law in Zimbabwe

Hochgeladen von

Vincent MutambirwaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Partnership Law in Zimbabwe

Hochgeladen von

Vincent MutambirwaCopyright:

Verfügbare Formate

Financial Training Company

2007

Corporate and Business Law- F4 (Zimbabwe)

Casebook

Creation of a partnership

A partnership is a contractual association involving a minimum of two persons and not exceeding twenty in number in which the persons concerned agree to contribute money, labour or skill to a common project and to carry on business with the object of making a profit for their joint benefit. In our law no formalities are required for the creation of a partnership and although writing or registration is not necessary the partners may agree to writing as a requirement for the validity of their contract (condition precedent). In Jourbert v Tarry and Co (1915) the essentials of a partnership were stated as follows: (a) contribution (whether goods, money or labour) (b) objective must be the making of profit (c) for the joint benefit of the parties (d) the partnership agreement must be lawful and it is essential that the parties must intend to create a partnership. It is quite clear from the facts of this case that Mr Shumba has breached the partnership agreement in a significant number of ways. Some of the obligations of a partnership which Shumba has breached are as follows:

1. Sharing of Management Every partner is entitled to participate in the management of the partnership business and may not be excluded therefrom. In addition a partner may not transact any partnership business without the consent of all his co-partners.

Muller v Pienaar (1968)

Financial Training Company

2. A partner may not use partnership property contrary to the terms of the agreement. It has been stated that one partner cannot use the property of the partnership so as to exclude the other partner entirely from the control of the partnership property. Munro v Ekerold (1949) A partner may not sell, donate or alienate partnership property without the consent of his co-partners. Furthermore a partner who has forcibly or fraudulently been dispossessed by a co-partner of partnership assets may obtain a mandament van spolie (spoliation order) restoring him to possession. Shapiro v Roth (1962) 3. Duty of Good Faith Partners stand in a fiduciary relation to one another and are obliged to observe uberrimae fides, the highest degree of good faith. Not only must a partner avoid a conflict of interest situation but also he must refrain from securing for himself a secret benefit or profit at the expense of the partnership. 4. Access to Books In the absence of an express agreement to the contrary, every partner has a right without permission of his co-partners to inspect, examine and make extracts from all the books of the firm. This right may be exercised at all reasonable times. A partner is entitled to insist that all partnership records be kept at the principal place of business of the partnership at least in situations where constant reference is essential to the day to day conduct of the business. 5. Duty to account and to share profits A partner is obliged to account for and deliver to the partnership whatever he has obtained as a partner on behalf of the partnership or within the scope of the partnership business or in continuance of partnership transactions. Each partner must allow his co-partner the latters share of the profits. In De Jager v Olifants Tin B Syndicate (1912) A syndicate formed to prospect for tin directed a member X to prospect a farm on its behalf. He discovered tin on a neighbouring farm to the right of which he then claimed he was solely entitled. He was held bound to account to the syndicate since he had acquired the rights in the course of operations conducted on behalf of the partnership.

Page 2

Financial Training Company

Partnerships vs Companies

A partnership is different from a company in the following respects: A partnership cannot consist of more than twenty people unless the members belong to a designated calling or profession in terms of Section 6 of the Companies Act [Chapter 24:03]. A company on the other hand may have an unlimited number and the number is limited to fifty in the case of a private company. A company is required by law to have at least two directors, other than alternate directors, at least one of them shall be ordinarily resident in Zimbabwe. In terms of s.169(1) of the Companies Act [Chapter 24:03]. No such requirements pertaining to directors exists for a partnership. A company may only commence its business after incorporation in terms of the Companies Act. Due to the feature of its incorporation such a business association is said to have a corporate personality or legal personality or juristic personality per Dadoo Ltd v Krugersdorp Municipal Council 1920 A.D. 530, Salomom v

Salomon and Co Ltd 1897

A.C. 22. This sharply contrasts with a partnership which may commence its business before incorporation, see Tourbert v Tarry. A partnership is not required by law to hold regular meetings whereas a company is required by law to hold meetings such as the Annual General Meetings in terms of s.125 of the Companies Act [Chapter 24:03]. A partner cannot transfer his shares without the consent of the other partners whereas company shares are freely transferable save for private companies, which are bound to limit the transferability of their shares. The total amount of capital and each partners contribution can be altered by agreement whereas the capital of a company is governed by the memorandum and Companies Act. A partnership has no perpetual existence. The insolvency or death of a partner dissolves the partnership unless provision is made to the contrary in the partnership document, whereas the

Page 3

Financial Training Company

death or insolvency of a member does not dissolve a company. Each partner is liable for the debts of a partnership. Their liability is joint and several whereas the liability of a member of a company is limited to the amount unpaid on his shares, see

Chingadia Brothers v Shingadia, Olivans v Dejurger.

Each partner is an agent of the partnership whereas a member of a company is not its agent. A partnership can do anything that the parties agree to do whereas the activities of a company are confined to its memorandum of association.

Co-ownership and partnership

There is an ill-defined line between co-ownership and partnership. This is so even if the signatories to the agreement describe themselves as co-owners, R v

Bowen and Others 1967 RLR 96. However, partners may be co-owners but the converse does

not apply in the absence of evidence clearly establishing this, Oblowitz v Oblowitz (1953) 4 S.A. 426. The principal differences which have emerged from case law, Oblowitzs case (above),

Runciman v Schultz 1923 TPD 45 and also Sauerman & Another v Schultz (1950) 4 S.A. 455,

between partnership and co-ownership can be summarised as follows: (i) co-ownership does not necessarily involve community of profit and loss, while partnership does. (ii) one co-owner can, without the consent of the others, alienate his interest in the property jointly owned, whereas a partner cannot. (iii) one co-owner is not as such the agent of the others, whereas a partner is. (iv) co-ownership need not exist for the sake of gain or profit, whereas that element is fundamental to the legal conception of a partnership. (v) one co-owner may use the property (within certain limits) for his own purpose, and without reference to, or the consent of, the other co-owners, whereas a partner may, unless specifically authorised, use partnership property only for the purpose of the partnership.

Partnership unlimited liability

A partnership is defined as a legal relationship arising from a contract between two or more persons in terms of which they agree to carry on an enterprise with the object of making a profit to be divided among them. Each agrees to contribute property and/or labour for the purposes of that enterprise.

Page 4

Financial Training Company

It is important at this point to note the legal nature or status of a partnership. A partnership is not a legal entity having an existence separate from the individual person constituting it. During the existence of the partnership, partners are joint co-creditors and joint co-debtors of the rights and obligations of the partnership Shingadia Brothers v Shingadia. A partnership is a contract and as such all essentials of a contract must be present. The essentials of the special contract of partnership were stated in the frequently cited case of

Joubert v Tarry and Co (1915) which states as follows:

now what constitutes a partnership between persons is not always an easy matter to determine the definitions differ to some extent we are safe if we adopt the essentials which have been laid down in Pothier on Partnership These essentials are fourfold. First that, each of the parties brings something into the partnership, or binds himself to bring something into it, whether it may be money, or his labour or skill. The second is that, the business should be carried on for the benefit of the partners. The third is that the object should be to make profit. Finally, the contract between the parties should be a legitimate contract.

It is clear from the facts that the fourfold test stated in Joubert (supra) is fulfilled. The object of the partnership is to make profit through the garage enterprise. Fadzai contributed capital, while Farai works full time at the garage (labour and skill). Therefore all the essentials for the existence of a valid contract between the parties are present and as such the partnership is valid. This is emphasised in the case of Oblowitz v Oblowitz (1953). The term partnership is used in two senses. It may refer either to the contract between the parties or to the relationship brought about by the contract. The essential feature, however, is the contract, for the rights and obligations of the partners flow from the terms, express or implied, of their agreement Ex parte Butner Brothers (1930). In the carrying out of the partnership objectives parties should scrupulously comply with the terms and conditions of their agreement. It should also be borne in mind that to a large extent the principles of agency apply in a partnership. For the benefit of the partnership, partners should comply with the terms of the partnership agreement. In the case of Divine Gates & Co v African Clothing Factory (1930) the court emphasised that parties are very often styled agents of each other. Whether they are actually agents or not they certainly have the power of agents and the broad principles of the law applicable to agents apply to an extent to partners. However, although partners may have the powers of agents, they are much more than agents. The character sustained by a partner is much more complex than merely that of agent Not only is the partner an agent, but sustains the double character of agent and principal in one and the same transaction. See also

Potchefstroom Daines and Industries Co Pvt Ltd v Standard Fresh Milk Supply Co (1913).

As has been mentioned earlier on, a partnership is not a legal entity. Any liability of one partner attaches to the other partner as well. The fact that Farai has pledged the partnership account in

Page 5

Financial Training Company

the amount of $200 million without the consent of Fadzai does not exempt Fadzai from liability. A partner is an agent of the other partners. The result of this relationship is that partners must display the highest degree of good faith in their dealings with one another. The principle of

uberrammae fides (utmost good faith) applies to partnerships among other contractual

relationships such as agency and suretyship. Not only are partners enjoined by the law to avoid a situation of conflict of interest but partners must avoid making a secret profit or deriving a secret benefit (be it monetary or otherwise) at the expense of the partnership business. The common interest of the partners in the carrying on of partnership business leads to the general rule that each partner is the agent of the other. However, there is implied authority of a partner to act as agent for other partners and bind them in the scope of the partnership business.

Blismal v Dardagen (1951).

Therefore, Fadzai and Farai have two options namely dissolving the partnership, or restructure the agreement and give Farai a salary on top of the profit he gets as a partner.

Partnerships and contracts

Generally speaking, a partner is in the full sense of the term an agent of his co-partners and to be rendered liable for a partnership obligation, a person must have been a member of the partnership at the time the obligation was contracted. The onus lies upon the third party to show that the contracting party had authority to bind the partnership and this authority may arise in a number of ways. Firstly it may arise by express provision in the partnership agreement. Secondly it may be implied from the partnership agreement or from the customary dealing of the partnership since each partner has authority to do all acts incidental to the proper conduct of the business

(Braker and Company v Deiner, (1934)). Thirdly, partners may be bound by their having held out, one of their number having authority. Fourthly, there may be ratification, express or implied of an authorized act. Whatever the authority of the partner who has contracted an obligation it is necessary to render his co-partners or the partnership liable, that the obligation should have been contracted in the name or on behalf of the partnership. (Lamb Brothers v Brenner and Co (1886)). In buying two tonnes of assorted rock from Germiston Quarries, Brian was ostensibly acting for and on behalf of Shingai Sculptors, the partnership at a time when he was the Chairman of the partnership. If notice was not brought by the partnership to the attention of Germiston Quarries that rock should only be purchased from

Page 6

Financial Training Company

Flintrock Quarry and that, if purchased from any other supplier (like Germiston Quarries) the prior consent of all members was necessary then the partnership can be estopped from denying the fact that Brian had authority to bind the partnership in his dealings with Germiston Quarries.

In Whiteside and Flanagan v Shakinowsky and Kaplan (1924) X gave a cheque in his partnerships name to the creditor. His partner, Y, disapproved, but neither informed the creditor of Xs want of authority nor instructed X to inform him. Y was held to have acquiesced in the transaction. Finally, for the partnership to be able to rescind the contract on the basis that the rock delivered by Germiston Quarries was only suitable for general sculpture work and not for the particular style of sculpture carried out at Shingai Sculptors they would have to prove that Brian had given Germiston Quarries exact specifications on the type of product the partnership required. Such knowledge on the part of the supplier will not be presumed. In the circumstances of the case the partnership faces formidable legal obstacles in its attempts to avoid the rock contract with Germiston Quarries.

Partnerships and third parties

The basic principle is that in a partnership each partner is the agent of the others. This was the position emphasized in Bain v Barclays Bank Ltd 1937. This is indeed the basis of a partners relationship with third parties. It must be understood, however, that the acts of a partner are binding not only on his fellow partners but also on himself.

The third party will only be able to establish liabilities on the partners if he can discharge the triple burden of proving that; (i) a partnership existed between all the par ties he seeks to hold liable. The facts reveal that there was a partnership; (ii) the partner on whose act he relies acted within the scope of his authority; and (iii) he acted in his capacity as a partner. There is no doubt, on the facts, that Tutu will be able to discharge the triple burden. This is so because the existence of a partnership may be proved by evidence, that one in fact exists, and it is immaterial that the third party may not have known of its existence at the time, Spark v

Palte Ltd 1956.

Partners are jointly and severally liable to third parties for the obligations of the partnership,

Page 7

Financial Training Company

Spark v Palte Ltd (supra), but while the partnership is still in existence Tutu is entitled to sue the

partnership as a whole and not the individual partners, Vulcan Trading Co (1958) (Pvt) Ltf v

Auyliffe & Others 1969.

However, if he sued the partnership and obtains judgment against the partnership, then he can execute against the partnership property. If that is insufficient, he may execute against the property of the individual partners, High Court Rules 1971 rule 342 and Magistrate Court (Civil) Rules 1980 Order 26 Rule 4.

Good faith

A partnership is a legal relationship between two or more persons (up to a maximum of 20), who carry on a lawful business or undertaking to which each contributes something with the object of making a profit and of sharing it between them.

A partnership is essentially a contract founded on the agreement of the parties. The agreement comprises the following essentials. (1) that each partner is to contribute something whether capital (such as money, property, materials or goodwill) or labour (such as work, industry or skill) (2) to a lawful business (3) which is to be carried on for their joint benefit (4) with the object of making a profit and sharing the same. The sharing of profit is such an essential feature of a partnership that an agreement that one of the partners is to have no share in the profit is void. (Bester v Van Niekerk (1960)) One of the fundamental obligations of a partner is that partners stand in a fiduciary relationship to one another and are obliged to observe uberrimae fides, the highest degree of good faith. A partner must not allow himself to be placed in a situation where his personal interests and the interests of the partnership conflict or may possibly conflict. Partners are accountable to the partnership for any profits, benefits or advantages that they obtain in the performance of their duties and may not appropriate to themselves assets, advantages and opportunities which belong to the partnership. This duty embraces any act prejudicial to the partnership or potentially so for example the opening of a competitive business.

Page 8

Financial Training Company

In the famous case of Robinson v Randfontein Estates (1921) the court made the following observation, where one man stands to another in a position of confidence, involving a duty to protect the interests of that other he is not allowed to make a secret profit at the others expense or place himself in a position where his interests conflict with his duty . Also in the case of Olifants Tin B Syndicate v De Jagel (1912) the court said, It is a general principle of our law that the contract of partnership is based on the utmost good faith, all the decided cases flow from that one great principle .

Partnership dissolution

A commercial partnership is a legal relationship between two or more persons, not exceeding twenty, who carry on a lawful business or undertaking to which each contributes something, with the object of making a profit and sharing it between them.

A partnership is formed where two or more persons make an agreement which comprises the following essentials: (1) that each is to contribute something, whether capital (such as money, property, materials or goodwill) or labour (such as work, industry or skills) (2) to a lawful business (3) which is to be carried on for their joint benefit (4) with the object of making a profit or sharing the same (5) the parties must have intended to create a partnership and if such intention is lacking the agreement cannot constitute a partnership.

However no formalities are prescribed by law for the creation of the partnership agreement which may thus be concluded in writing, orally or even tacitly by the conduct of the parties. Each partner is bound to perform his share of the duties as agreed upon or as implied by law. A partnership may be dissolved by agreement or by operation of law or by renunciation and the details pertaining to dissolution are as follows: 1. Agreement Where a partnership is being dissolved by agreement, all the partners must consent. There will be dissolution on the fulfillment of a condition expressly or impliedly agreed upon by all the partners at the time of the formation of the partnership or subsequently as dissolving the partnership . for example the completion of the partnership business. Thus a partnership to promote a prize fight may be dissolved when the fight has taken place:

Page 9

Financial Training Company

Dube v City Promotions (1964). A partnership will ordinarily be dissolved by the expiry of the

time agreed upon for its duration. There will also be dissolution where a partner retires in terms of the partnership or a subsequent agreement and if the remaining partners want to continue with the partnership, in law a new partnership is reconstituted.

2. Operation of Law A partnership is dissolved by operation of law on frustration of the partnership business or on the death of a partner or on the insolvency of the partnership or of a partner individually or where a partner by reason of the outbreak of war becomes an alien enemy or where a court order is made on the insanity of a partner. (a) Frustration A partnership is dissolved if its business purpose can no longer be achieved on account of supervening impossibility. For example, X and Y agree on a partnership for a certain period. The mine which the partnership is formed to work proves valueless and there is no reasonable likelihood of profit for the rest of the unexpired period.

Curtis v Beart (1909)

(b) Death of a partner Unless there is an agreement to the contrary, a partnership dissolves on the death of a partner. The executor of the deceased partner.s estate is entitled to the deceased.s share of the partnership assets and liable to the extent of the assets in his hands, for the deceased.s share of the partnership debts. The death of a partner will not however dissolve a partnership when the agreement clearly provides for its continuance for the benefit of the estate of the deceased and the deceased partner by his will has authorised such a continuation. (c) Insolvency A partnership is dissolved where a partner or the partnership is declared insolvent. (d) Partner becoming an alien enemy A partnership existing between persons domiciled in different countries is dissolved by a declaration of war and perhaps also a de facto state of war between those countries and the partnership is automatically dissolved. In Stern v De Wahl (1915) the court said that:

.a partnership with an alien partner comes to an end as soon as it is clear that one of the other partners takes on what the law considers to be an enemy character . . . .

3. Renunciation A partner may at any time effectively renounce and so dissolve the partnership and he may be

Page 10

Financial Training Company

liable in damages unless he renounces: (a) in certain cases by due notice of dissolution and (b) for lawful cause. Where a partnership is for an indefinite period it may be dissolved at will by a partner provided that the notice is given in terms of the agreement of partnership or if this is silent, must be reasonably given. Alternatively a partner may renounce the partnership on the following lawful grounds: (i) fulfilment of a condition allowing a partner to give notice of dissolution. In Holshausen v

Cumming (1909) the agreement provided that if either partner became addicted to drink the

other could dissolve the partnership on notice; (ii) breach of an essential term of the partnership, for example failure to contribute what one has agreed to contribute towards the partnership; (ii) conduct causing loss of confidence. A partner is entitled to renounce on the ground of circumstances, arising otherwise than through his own fault which cause him to lose confidence in his co-partner, for example carelessness in the conduct of a business by a managing partner.

Page 11

Das könnte Ihnen auch gefallen

- Littlejohn V Norwich Union Fire Insurance SocietyDokument9 SeitenLittlejohn V Norwich Union Fire Insurance SocietymakhanyaNoch keine Bewertungen

- Money Laundering in Zambia - Chitengi Sipho JustineDokument47 SeitenMoney Laundering in Zambia - Chitengi Sipho JustineCHITENGI SIPHO JUSTINE, PhD Candidate- Law & Policy100% (5)

- Federal Inland Revenue Service and Taxation Reforms in Democratic NigeriaVon EverandFederal Inland Revenue Service and Taxation Reforms in Democratic NigeriaIfueko Omoigui OkauruNoch keine Bewertungen

- ZIM - Company Law ModuleDokument61 SeitenZIM - Company Law ModuleAlbert Ziwome100% (14)

- Company Law Module - Zimbabwe Institute of Management (ZIM)Dokument61 SeitenCompany Law Module - Zimbabwe Institute of Management (ZIM)Tawanda Tatenda Herbert100% (3)

- Law of PartnershipsDokument37 SeitenLaw of PartnershipsAurelie Beatrice Mourguin50% (2)

- Legal Practitioners Practice Rules (SI 51 of 2002)Dokument39 SeitenLegal Practitioners Practice Rules (SI 51 of 2002)Nalishuwa100% (4)

- Group 6 Banking Law AssignmentDokument22 SeitenGroup 6 Banking Law Assignmentmoses machiraNoch keine Bewertungen

- Business Law D6Dokument234 SeitenBusiness Law D6Dixie Cheelo50% (2)

- A Sourcebook of Income Tax Law in TanzaniaDokument228 SeitenA Sourcebook of Income Tax Law in TanzaniaMaster KihimbwaNoch keine Bewertungen

- ZIMCODEDokument130 SeitenZIMCODETakudzwa Mashiri100% (1)

- How To Register A Company in TanzaniaDokument7 SeitenHow To Register A Company in TanzaniaPaschal MazikuNoch keine Bewertungen

- The Duty of Disclosure PDFDokument8 SeitenThe Duty of Disclosure PDFVusi Bhebhe83% (6)

- L7 Business & Company Law Q&ADokument12 SeitenL7 Business & Company Law Q&AChiso Phiri100% (8)

- Constitutional Law Notes MadhukuDokument13 SeitenConstitutional Law Notes MadhukuEmmanuel Nhachi100% (15)

- Class Notes - Company LawDokument59 SeitenClass Notes - Company LawMoses Bwalya MweeneNoch keine Bewertungen

- Law in Zimbabwe DefinedDokument1 SeiteLaw in Zimbabwe DefinedWadzanai Mutero100% (2)

- 5 Duties of The Employer: Common LawDokument36 Seiten5 Duties of The Employer: Common LawMethembe Mbambo100% (2)

- Example Commercial Law Problem QuestionDokument10 SeitenExample Commercial Law Problem QuestionEmmavent VenanceNoch keine Bewertungen

- AGENCY by MwapeDokument7 SeitenAGENCY by MwapeLeonard TembohNoch keine Bewertungen

- Delict Second SemesterDokument100 SeitenDelict Second SemesterfirdousNoch keine Bewertungen

- The Law and Practice of Conveyancing in Zimbabwe (2005)Dokument182 SeitenThe Law and Practice of Conveyancing in Zimbabwe (2005)Panashe100% (1)

- Family Law in Zambia - Chapter 10 - AdoptionDokument8 SeitenFamily Law in Zambia - Chapter 10 - AdoptionZoe The PoetNoch keine Bewertungen

- Practical Aspects of Commercial Law - All LecturesDokument344 SeitenPractical Aspects of Commercial Law - All LecturesRonnie Mchatta100% (1)

- MRL3701 Assignment 2 Semester 2024 AnswersDokument5 SeitenMRL3701 Assignment 2 Semester 2024 AnswersChiko100% (4)

- Set Up Your Non Profit in Uganda With A Company Limited by Guarantee StructureDokument3 SeitenSet Up Your Non Profit in Uganda With A Company Limited by Guarantee Structurewasswa isaac jeff0% (1)

- Banking Law CasesDokument6 SeitenBanking Law CasesCaesar Julius0% (1)

- Guide To Tanzania Taxation SystemDokument3 SeitenGuide To Tanzania Taxation Systemhima100% (1)

- Conveyancing Lectures - All NotesDokument62 SeitenConveyancing Lectures - All Noteszaiba officialNoch keine Bewertungen

- Deceased EstatesDokument415 SeitenDeceased EstatesFelicia Masoka67% (3)

- Company Law Tutor 1Dokument4 SeitenCompany Law Tutor 1Karen Christine M. Atong0% (1)

- Corporate and Business Law ZimDokument8 SeitenCorporate and Business Law ZimPrince MubaiwaNoch keine Bewertungen

- LL324 - Company Law Module (Revised) PDFDokument166 SeitenLL324 - Company Law Module (Revised) PDFTapiwa NamwilanalungweNoch keine Bewertungen

- Session 2 - Promotors, Pre-Incorporation ContractsDokument1 SeiteSession 2 - Promotors, Pre-Incorporation ContractsQinghui ChuaNoch keine Bewertungen

- Business Transactions in IslamDokument20 SeitenBusiness Transactions in Islammorrisxvii0% (1)

- Tax HillDokument235 SeitenTax HillTawanda Tatenda Herbert100% (1)

- Law ReportDokument5 SeitenLaw Reporttasmia01Noch keine Bewertungen

- Accounting For Lawyers Notes, 2022Dokument114 SeitenAccounting For Lawyers Notes, 2022Nelson burchard100% (1)

- Contract Law - MajaDokument151 SeitenContract Law - Majabongani100% (3)

- Zambia Labour Law 2019 PDFDokument6 SeitenZambia Labour Law 2019 PDFJoseph MfungweNoch keine Bewertungen

- Disposition of A Right of Occupancy in TanzaniaDokument5 SeitenDisposition of A Right of Occupancy in TanzaniaFikiri Liganga100% (1)

- What Is Subjective Approach Contract LawDokument3 SeitenWhat Is Subjective Approach Contract LawVaishnavi ChoudharyNoch keine Bewertungen

- Zambia Must Prosper Ii PDFDokument282 SeitenZambia Must Prosper Ii PDFBricious Mulimbi86% (7)

- Administrative Law EssayDokument6 SeitenAdministrative Law Essaykay-Noch keine Bewertungen

- Law of Succession PDFDokument319 SeitenLaw of Succession PDFBISEKO100% (2)

- Zegu Superior Courts NotesDokument162 SeitenZegu Superior Courts Notesnyasha chiramba100% (1)

- Estate Planning Guide South AfricaDokument44 SeitenEstate Planning Guide South AfricaBrian KufahakutizwiNoch keine Bewertungen

- University of Lusaka: School of Economics, Business & ManagementDokument92 SeitenUniversity of Lusaka: School of Economics, Business & ManagementDixie Cheelo100% (1)

- PVL2601 Notes EngDokument20 SeitenPVL2601 Notes EngSibahle Zuma100% (1)

- FAC1601 Exam Pack & Solutions by Study UnitDokument101 SeitenFAC1601 Exam Pack & Solutions by Study UnitandreqwNoch keine Bewertungen

- Company Law in GhanaDokument5 SeitenCompany Law in Ghananaa_amerley100% (1)

- Advanced Civil Procedure NotesDokument74 SeitenAdvanced Civil Procedure Noteswadzievj80% (5)

- Business Associations 1 Class NotesDokument30 SeitenBusiness Associations 1 Class NotessakatuyaNoch keine Bewertungen

- The Law of Evidence in South AfricaDokument154 SeitenThe Law of Evidence in South AfricaShalom Ndiku0% (1)

- General Principles of Commercial Law 5th EditionDokument230 SeitenGeneral Principles of Commercial Law 5th EditionMatt100% (11)

- Law of Persons Questions and AnswersDokument35 SeitenLaw of Persons Questions and AnswersAlexandrine Nalyeende100% (1)

- DELICT Lecture NotesDokument21 SeitenDELICT Lecture Notesngozi_vinel88% (8)

- 4 Bed House PlanDokument1 Seite4 Bed House PlanVincent MutambirwaNoch keine Bewertungen

- A.3site Plan 7385Dokument1 SeiteA.3site Plan 7385Vincent MutambirwaNoch keine Bewertungen

- Sample HD HouseDokument1 SeiteSample HD HouseVincent MutambirwaNoch keine Bewertungen

- Mbizo 19 Longsecs Longsec1Dokument1 SeiteMbizo 19 Longsecs Longsec1Vincent MutambirwaNoch keine Bewertungen

- Pad Footings Quantity Take Off: Footing DetailsDokument1 SeitePad Footings Quantity Take Off: Footing DetailsVincent MutambirwaNoch keine Bewertungen

- East Elevation 1:100 West Elevation 1:100: WD - 003 ND11FDokument1 SeiteEast Elevation 1:100 West Elevation 1:100: WD - 003 ND11FVincent MutambirwaNoch keine Bewertungen

- Danet 1Dokument1 SeiteDanet 1Vincent MutambirwaNoch keine Bewertungen

- Draft House PlanDokument1 SeiteDraft House PlanVincent Mutambirwa100% (1)

- Dynamic 20852 ModelDokument1 SeiteDynamic 20852 ModelVincent MutambirwaNoch keine Bewertungen

- Retaining WallDokument1 SeiteRetaining WallVincent MutambirwaNoch keine Bewertungen

- Colonel Albert: Civil War First, Then Shoe BusinessDokument9 SeitenColonel Albert: Civil War First, Then Shoe BusinessVincent MutambirwaNoch keine Bewertungen

- Viva Afrika Price List AUGUST 2017 RetailDokument29 SeitenViva Afrika Price List AUGUST 2017 RetailVincent Mutambirwa33% (3)

- Municipality of Kwekwe Stamp: Storeroom 1 Storeroom 3Dokument1 SeiteMunicipality of Kwekwe Stamp: Storeroom 1 Storeroom 3Vincent MutambirwaNoch keine Bewertungen

- Population of Zimbabwe 2012Dokument178 SeitenPopulation of Zimbabwe 2012Vincent MutambirwaNoch keine Bewertungen

- Proposed Residence in A High Density Area in ZimbabweDokument1 SeiteProposed Residence in A High Density Area in ZimbabweVincent Mutambirwa100% (1)

- MZweIE Application Information & Form 1 Completion Guide FVDokument1 SeiteMZweIE Application Information & Form 1 Completion Guide FVVincent Mutambirwa0% (1)

- Eureka Projects PVT LTD: Machine Hire Log Sheet Job Site Machine(s) Month Date Work Carried Out Initials OperatorDokument4 SeitenEureka Projects PVT LTD: Machine Hire Log Sheet Job Site Machine(s) Month Date Work Carried Out Initials OperatorVincent MutambirwaNoch keine Bewertungen

- Technical Manual WholeDokument93 SeitenTechnical Manual WholeVincent MutambirwaNoch keine Bewertungen

- Manual Autodesk Revit InglesDokument631 SeitenManual Autodesk Revit Ingleslrfi100% (5)

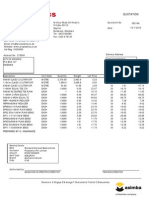

- Quotation: Description Unit Code Quantity Weight List Price Discount Net Price Net ValueDokument2 SeitenQuotation: Description Unit Code Quantity Weight List Price Discount Net Price Net ValueVincent MutambirwaNoch keine Bewertungen

- Contractors HandbookDokument43 SeitenContractors HandbookVincent Mutambirwa100% (1)

- The Legal Nature of A Company in ZimbabweDokument11 SeitenThe Legal Nature of A Company in ZimbabweVincent MutambirwaNoch keine Bewertungen

- 1E ECSA Candidate AppformDokument7 Seiten1E ECSA Candidate AppformVincent MutambirwaNoch keine Bewertungen

- How To Read Export CertificateDokument1 SeiteHow To Read Export CertificateVincent MutambirwaNoch keine Bewertungen

- Large Submersible Propeller PumpsDokument16 SeitenLarge Submersible Propeller PumpsVincent Mutambirwa100% (2)

- Bill of Quantities For HouseDokument15 SeitenBill of Quantities For HouseVincent Mutambirwa40% (5)

- Umale vs. Canoga Park Development CorporationDokument3 SeitenUmale vs. Canoga Park Development CorporationJoseph MacalintalNoch keine Bewertungen

- Seafarers' Employment AgreementsDokument11 SeitenSeafarers' Employment AgreementsRommel TottocNoch keine Bewertungen

- Historical Perspective of The Philippine Educational SystemDokument3 SeitenHistorical Perspective of The Philippine Educational SystemRoxane Rivera100% (1)

- Barangay Full Disclosure Monitoring Form NoDokument1 SeiteBarangay Full Disclosure Monitoring Form NoOmar Dizon100% (1)

- 1 Hannah-Isabela M. Barluado, RNDokument5 Seiten1 Hannah-Isabela M. Barluado, RNHannah-Isabela BarluadoNoch keine Bewertungen

- Gomez v. LipanaDokument2 SeitenGomez v. LipanaSor ElleNoch keine Bewertungen

- Final Exam Tax2 With AnswersDokument6 SeitenFinal Exam Tax2 With AnswersNikki Estores GonzalesNoch keine Bewertungen

- Form 13a. Request For Availability of Name. (Companies Regulations, 1966 - P.UDokument2 SeitenForm 13a. Request For Availability of Name. (Companies Regulations, 1966 - P.USenalNaldoNoch keine Bewertungen

- Davao Smoking LawDokument4 SeitenDavao Smoking LawJohn Remy HerbitoNoch keine Bewertungen

- Role of Lokpal and Lokyukta in India Redressal of PublicDokument14 SeitenRole of Lokpal and Lokyukta in India Redressal of Publictayyaba redaNoch keine Bewertungen

- Joseph Siegelman LawsuitDokument9 SeitenJoseph Siegelman LawsuitMike CasonNoch keine Bewertungen

- James Stokes v. Malayan InsuranceDokument3 SeitenJames Stokes v. Malayan InsuranceEzra Dan Belarmino100% (1)

- Core Concept of Corporate Governance: Professor Niki Lukviarman (Governance Research Program-Andalas University)Dokument26 SeitenCore Concept of Corporate Governance: Professor Niki Lukviarman (Governance Research Program-Andalas University)Inney SildalatifaNoch keine Bewertungen

- Minsola V New City BuildersDokument7 SeitenMinsola V New City BuildersHv Estok100% (1)

- 143581-1967-Lua Kian v. Manila Railroad Co PDFDokument4 Seiten143581-1967-Lua Kian v. Manila Railroad Co PDFAmberChanNoch keine Bewertungen

- Alano V Planter's Development BankDokument1 SeiteAlano V Planter's Development BankKC NicolasNoch keine Bewertungen

- PD 223Dokument4 SeitenPD 223Catly CapistranoNoch keine Bewertungen

- CASE DIGEST Commercial LawDokument7 SeitenCASE DIGEST Commercial LawApril Dream Mendoza PugonNoch keine Bewertungen

- CIS - UnderstandingAadhaarAndItsNewChallenges - Report PDFDokument18 SeitenCIS - UnderstandingAadhaarAndItsNewChallenges - Report PDFmrinalNoch keine Bewertungen

- Quidet v. PeopleDokument1 SeiteQuidet v. PeopleMe Re100% (1)

- Rate The Lobbysists SurveyDokument1 SeiteRate The Lobbysists SurveySarah MirkNoch keine Bewertungen

- Pmap & EcopDokument27 SeitenPmap & EcopRoseNTolentinoNoch keine Bewertungen

- Bar Council of India Powers and FunctionsDokument11 SeitenBar Council of India Powers and FunctionsSonu Pandit100% (1)

- Ople V Torres Due ProcessDokument2 SeitenOple V Torres Due ProcessLester Nazarene OpleNoch keine Bewertungen

- NAFLU V OpleDokument3 SeitenNAFLU V OpleAnit EmersonNoch keine Bewertungen

- COMPLAINT SHEET BLANK - EditedDokument1 SeiteCOMPLAINT SHEET BLANK - EditedRyan Dela CruzNoch keine Bewertungen

- 210 Catubao vs. Sandiganbayan, G.R. No. 227371, October 02, 2019Dokument2 Seiten210 Catubao vs. Sandiganbayan, G.R. No. 227371, October 02, 2019Charles BayNoch keine Bewertungen

- Payroll Data EPFO April 2023Dokument29 SeitenPayroll Data EPFO April 2023bibhuti bhusan routNoch keine Bewertungen

- CIR V Lingayen GulfDokument3 SeitenCIR V Lingayen GulfTheodore BallesterosNoch keine Bewertungen

- People V Mabansag, GR L-46293Dokument14 SeitenPeople V Mabansag, GR L-46293Jae MontoyaNoch keine Bewertungen

- How to Win Your Case In Traffic Court Without a LawyerVon EverandHow to Win Your Case In Traffic Court Without a LawyerBewertung: 4 von 5 Sternen4/5 (5)

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseVon EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNoch keine Bewertungen

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersVon EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersBewertung: 5 von 5 Sternen5/5 (1)

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowVon EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowBewertung: 1 von 5 Sternen1/5 (1)

- The Certified Master Contract AdministratorVon EverandThe Certified Master Contract AdministratorBewertung: 5 von 5 Sternen5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsVon EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNoch keine Bewertungen

- The Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterVon EverandThe Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterNoch keine Bewertungen

- Law of Contract Made Simple for LaymenVon EverandLaw of Contract Made Simple for LaymenBewertung: 4.5 von 5 Sternen4.5/5 (9)

- Learn the Essentials of Business Law in 15 DaysVon EverandLearn the Essentials of Business Law in 15 DaysBewertung: 4 von 5 Sternen4/5 (13)

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreVon EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Profitable Photography in Digital Age: Strategies for SuccessVon EverandProfitable Photography in Digital Age: Strategies for SuccessNoch keine Bewertungen

- Technical Theater for Nontechnical People: Second EditionVon EverandTechnical Theater for Nontechnical People: Second EditionNoch keine Bewertungen

- Fundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignVon EverandFundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignBewertung: 3.5 von 5 Sternen3.5/5 (3)

- Contracts: The Essential Business Desk ReferenceVon EverandContracts: The Essential Business Desk ReferenceBewertung: 4 von 5 Sternen4/5 (15)

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityVon EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNoch keine Bewertungen

- Reality Television Contracts: How to Negotiate the Best DealVon EverandReality Television Contracts: How to Negotiate the Best DealNoch keine Bewertungen

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetVon EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNoch keine Bewertungen