Beruflich Dokumente

Kultur Dokumente

Chapter 1 - Test Bank

Hochgeladen von

api-253108236Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 1 - Test Bank

Hochgeladen von

api-253108236Copyright:

Verfügbare Formate

Chapter 1 The Government and Not-For-Profit Environment

TRUE/FALSE (CHAPTER 1 1. 2. . ". #. $. '. ). -. The main objective of a typical governmental or not-for-profit entity is to earn a profit. A governments budget may be backed by the force of law. !overnmental entities have no need for an accounting system. A governments internal managers rely on general purpose financial statements for a considerable amount of information about their government. !overnments and not-for-profits may never engage in business-type activities. %enders use the financial statements of governments and not-for profits just as they would those of businesses& that is& to help assess the borrowers credit-worthiness. (inancial statements& no matter how prepared& do not directly affect the economic worth of an entity. The (inancial Accounting *tandards Advisory +oards standards do not apply to the federal ,epartment of Treasury. !overnments may be subject to the same pressures that led to accounting scandals like .nron.

1/. The !overnmental Accounting *tandards +oard establishes generally accepted accounting principles for all state and local government entities& as well as all not-for-profit entities.

!ranof Test +ank 0hapter 1

1age 1

!ULT"PLE CH#"CE (CHAPTER 1 1. A primary characteristic that distinguishes governmental entities from business entities is a2 The need to generate revenues e3ual to or in e4cess of e4penditures5e4penses. b2 The importance of the budget in the governing process. c2 The need to provide goods or services. d2 The correlation between revenues generated and demand for goods or services. A primary characteristic that distinguishes not-for-profit entities from business entities is a2 The need to generate revenues e3ual to or in e4cess of e4penditures5e4penses. b2 The importance of the budget in the governing process. c2 The need to provide goods or services. d2 The correlation between revenues generated and demand for goods or services. 6hich of the following characteristics distinguishes a governmental or not-for-profit entity from a business entity7 a2 There is always a direct link between revenues generated and e4penditures5e4penses incurred. b2 0apital assets are used to produce revenues and save costs. c2 8evenues are always indicative of demand for goods and services. d2 The mission of the entity will determine the goods or services provided. The most significant financial document provided by a governmental entity is the a2 The balance sheet. b2 The operating statement. c2 The operating budget. d2 The cash flow statement. 6hich of the following statements is true7 a2 !overnments may engage in activities similar to activities engaged in by for-profit entities. b2 There are a limited number of different types of governments. c2 All governmental entities engage in the same activities. d2 9anagers may have a long-term focus and thereby sacrifice the short-term li3uidity of the entity.

2.

".

#.

$. 6hich of the following activities is :;T an activity in which a governmental entity might engage7 a2 *elling electric power. b2 ;perating a golf course. c2 ;perating a bookstore. d2 All of the above are activities that might be carried out by a government. '. <n which of the following activities is a not-for-profit entity least likely to engage7 a2 1roviding educational services. b2 1roviding health-care services. c2 1roviding for terrorism defense. d2 8etail sales of cookies.

!ranof Test +ank 0hapter 1

1age 2

).

6hich of the following can be affected by !AA17 a2 %egal ability to issue bonds. b2 Ability to balance the budget. c2 Amount reported as employee pension plan contributions. d2 0laims and judgments settled.

-. 6hich of the following characteristics is uni3ue to a governmental entity7 a2 The ability to have activities financed with ta4-e4empt debt. b2 The power to impose fees. c2 The ability to issue ta4-e4empt debt. d2 The ability to have activities financed by (ederal grants. 1/. To obtain a comprehensive understanding of a governments fiscal health& a financial analyst should obtain an understanding of which of the following7 a2 All of the resources owned by the governmental entity. b2 All of the resources which may be summoned by a governmental entity. c2 ,emographic data about the residents served by the governmental entity. d2 All of the above. 11. 6hich of the following is common to both governments and not-for-profit entities but distinguishes these entities from for-profit entities7 a2 The budget is a legal& financial document. b2 8evenues are usually indicative of demand for goods or services. c2 There is direct matching of revenues and e4penses. d2 There are no defined ownership interests. 12. 6hich of the following is :;T a purpose of e4ternal financial reporting by governments7 .4ternal financial reports should allow users to a2 Assess financial condition. b2 0ompare actual results with the budget. c2 Assess the ability of elected officials to effectively manage people. d2 .valuate efficiency and effectiveness. 1 . 6hich of the following is :;T a reason why users need governmental and not-for-profit e4ternal financial statements7 a2 To determine the ability of the entity to meet its obligations. b2 To determine the ability of the entity to continue to provide services. c2 To predict future fiscal solvency. d2 To evaluate the overall profitability of the entity. 1". =sers of government financial statements should be interested in information about compliance with laws and regulations for which of the following reasons7 a2 To determine if the entity has complied with bond covenants. b2 To determine if the entity has complied with ta4ing limitations. c2 To determine if the entity has complied with donor restrictions on the use of funds. d2 To determine all of the above.

!ranof Test +ank 0hapter 1

1age

1#. 6hich of the following is :;T generally considered a main user of government and not-forprofit entity e4ternal financial statements7 a2 <nvestors and creditors. b2 Ta4payers. c2 ,onors. d2 <nternal managers. 1$. 6hich of the following is a probable use a donor would make of the e4ternal financial statements of a not-for-profit entity7 a2 To determine the proportion of entity resources directed to programs as opposed to fundraising. b2 To determine the creditworthiness of the entity for investment purposes. c2 To determine the salaries paid to all employees of the entity. d2 To determine the budget of the entity. 1'. A regulatory agency would use the e4ternal financial statements of a local government for which of the following purposes7 a2 To assure that the entity is spending and receiving resources in accordance with laws& regulations or policies. b2 To determine how resources should be allocated. c2 To e4ercise general oversight responsibility. d2 To do all of the above. 1). 6hich of the following constituency groups would be most likely to evaluate government financial statements to determine likely areas in which to achieve cost-savings7 a2 0reditors. b2 =nion officials representing the governments employees. c2 (ederal agencies that provide purpose-restricted grants. d2 *tudents of governmental accounting. 1-. 6hich of the following objectives is considered to be the cornerstone of financial reporting by a governmental entity7 a2 Accountability. b2 +udgetary compliance. c2 <nterperiod e3uity. d2 *ervice efforts and accomplishments. 2/. 6hich of the following is an objective of financial reporting by governmental entities as established by !A*+7 a2 (inancial reporting should assist users in assessing the management skills of top management. b2 (inancial reporting should assist users in determining if current-period revenues were sufficient to pay for current-period services. c2 (inancial reporting should assist users in evaluating the cash management operations of the governmental entity for the year. d2 (inancial reporting should assist users in assessing whether the government provided appropriate services to its constituents in the current year.

!ranof Test +ank 0hapter 1

1age "

21. 6hich of the following is an objective of financial reporting for not-for-profit entities as established by (A*+7 (inancial reporting should provide information that is useful to present and potential resource providers and other users in> a2 Assessing the types of services provided and the need for those services. b2 Assessing the services provided and the entitys ability to earn a profit. c2 9aking rational decisions about the allocation of resources to those organi?ations. d2 Assessing how managers have managed personnel. 22. As used by !A*+& interperiod e3uity refers to which of the following7 (inancial reporting should> a2 ,emonstrate compliance with finance-related contractual re3uirements. b2 1rovide information to determine whether current-year revenues were sufficient to pay for current-year services. c2 ,emonstrate whether resources were obtained and used in accordance with the entitys legally adopted budget. d2 1rovide information to assist users in assessing the governments economy& efficiency& and effectiveness. 2 . !iven a specific set of data& the basis of accounting selected by or imposed on a governmental entity will least affect which of the following7 a2 ,etermining whether or not the governmental entity has a balanced budget. b2 ,etermining whether or not the governmental entity has the ability to issue debt. c2 ,etermining whether or not certain economic events occurred. d2 ,etermining the annual payments to a government-sponsored pension plan. 2". The basis of accounting selected by or imposed on a governmental entity can influence which of the following7 a2 A decision to contract-out a specific service rather than provide that service itself. b2 The amount of salary increases proposed by union negotiators. c2 The amount that is available to spend on a donor-specified project or service. d2 All of the above. 2#. The !overnmental Accounting *tandards +oard is the primary standard-setting body for> a2 All governments. b2 All state and local governments. c2 All governments and all not-for-profit entities. d2 All state and local governments and all not-for-profit entities. 2$. =nder certain circumstances a governmental entity might use standards established by which of the following standard-setting bodies7 a2 !A*+. b2 (A*+. c2 A<01A. d2 All of the above.

!ranof Test +ank 0hapter 1

1age #

2'. The primary standard-setting body for accounting and financial reporting by a statesupported college or university is> a2 !A*+. b2 (A*+. c2 A<01A. d2 All of the above. 2). <n descending order& the hierarchy of !AA1 applicable to a church-owned college may be> a2 (A*+ *tatements and <nterpretations& (A*+ Technical +ulletins& A<01A <ndustry Audit !uides& (A*+ <mplementation !uides& other accounting literature@including !A*+ *tandards. b2 (A*+ *tatements and <nterpretations& (A*+ Technical +ulletins& (A*+ <mplementation !uides& A<01A 1ractice +ulletins Aif cleared by (A*+2. c2 !A*+ *tatements and <nterpretations& A<01A <ndustry Audit !uides& !A*+ <mplementation !uides& other accounting literature@including (A*+ *tandards. d2 !A*+ *tatements and <nterpretations& !A*+ Technical +ulletins& A<01A <ndustry Audit !uides& A<01A 1ractice +ulletins Aif cleared by !A*+2& !A*+ <mplementation !uides& other accounting literature@including (A*+ standards. 2-. 6hich of the following entities was a principal in creating the (A*A+7 a2 =.*. 0ongress. b2 ;ffice of 9anagement and +udget. c2 !overnmental Accounting *tandards +oard. d2 *ecurities and .4change 0ommission. /. The purpose of the (A*A+ is to> a2 .stablish accounting standards for not-for-profit entities. b2 .stablish accounting standards for federal entities. c2 .stablish accounting standards for all governmental entities. d2 .stablish accounting standards for non-federal governmental entities.

!ranof Test +ank 0hapter 1

1age $

PR#$LE!S (CHAPTER 1 1. Thorn 0ounty adopted a cash budget for (B2//' as follows. The 0ity budget laws prohibit budgeting or operating at a deficit. ,uring the year the 0ounty collected or spent the following amounts. 6as the 0ounty in compliance with budget laws7 ,id the 0ounty accomplish the goal of interperiod e3uity7 .4plain your answers in detail. +udgeted 8eceipts from 1roperty ta4 collections (rom the 2//$ levy (rom the 2//' levy <n advance for 2//) 8eceipts from +onds <ssued +orrowed from +ank Adue in # years2 ,isbursements *alaries and 6ages ;perating .4penses 0ity Dall Anne4 purchased 1ayments on ,ebt-1rincipal 1ayments on <nterest 1ension 0ontribution C 1//&/// C1&///&/// C #/&/// C #//&/// C -/C C C C C C #//&/// 2//&/// #//&/// 1#/&/// #/&/// )/&/// 0ollected5*pent C -/C -//&/// C -/C #//&/// C '#&/// C C C C C C #//&/// 2'#&/// #//&/// 1#/&/// #/&/// -/-

.4planations provided by the 0ity for the differences between budget and actual are as follows. 1roperty ta4 collections are down because the major industry in the community closed and many citi?ens are currently unemployed. ;perating e4penses are up because the only bridge over a river bisecting the 0ity sustained damages by an uninsured motorist and had to be repaired immediately. The repair was not budgeted.

!ranof Test +ank 0hapter 1

1age '

2. *ave-the-+irds A*T+2& a not-for-profit entity dedicated to ac3uiring and preserving habitat for upland birds& prepares financial statements in accordance with generally accepted accounting principles. 0urrently& standards re3uire that a not-for-profit entity report virtually all contributions as revenue in the year received. ,uring the current year *T+ received a donation of several hundred acres of prime habitat for upland birds. *T+ will re3uire several hundred thousand dollars in additional donations in order to make the land completely suitable for the birds. +efore embarking on its fund-raising campaign *T+ prepares financial statements which are summari?ed as follows. *tatement of (inancial 1osition A+alance *heet2 0ash C )&/// *upplies C 2&/// .3uipment Anet of depreciation2 C #&/// %and C1&///&/// Total Assets C1&/1#&/// %iabilities :et Assets@=nrestricted :et Assets@8estricted Total %iabilities and :et Assets C 1&/// C 1"&/// C1&///&/// C1&/1#&///

*tatement of Activities A<ncome *tatement2 8evenues C1&/ /&/// .4penses> *alaries C /&/// 0hange in :et Assets C1&///&/// 6hat difficulties& if any& will *ave-the-+irds encounter in its new fund-raising drive7 Enowing that the donation of the land accounted for C1&///&/// of the revenue reported by *ave-the-+irds& do you think the financial statements present fairly the financial position and results of operations of this not-for-profit entity7

. Fohnson 0ity prepares its budget on the cash basis and prepares its e4ternal financial statements on the accrual basis. (rom the following data prepare statements of activity Aincome statements2 on both the cash basis and the accrual basis. 6hich statement best represents the results of operations of the 0ity7 6hich statement best demonstrates compliance with laws and regulations7 6hich statement would you rather see7 6hich conveys the best information to the citi?ens of Fohnson 0ity7 The 0ity levies ta4es in the current year of C1 million. ;f this amount C.- million is collected during the current year& C./# will be collected ne4t year& and C./" will be collected in the future. C./1 will never be collected. ,uring the current year the 0ity pays bills from prior periods C./$ million& bills of the current period C.) million& and defers payment until future periods on bills that were received for services consumed during the current period C.1 million.

!ranof Test +ank 0hapter 1

1age )

". 0ertain fiscal practices of governments promote interperiod e3uity while others do not. (or the situations listed below& indicate whether interperiod e3uity is promoted or undermined. 6hy7 a. <ssuing /-year serial bonds to finance the construction of capital assets with estimated / year lives. b. 1aying for the pensions of retired employees out of resources provided by current-period ta4payers. c. 0harging the cost of supplies as e4penditures in the year in which they were used rather than when they were purchased. d. <ssuing /-year bonds to finance a portion of the current period operating costs of a citys school system e. 0harging payments of wages and salaries made in the first week of a new year to the previous fiscal year& the year in which the wages and salaries were earned.

!ranof Test +ank 0hapter 1

1age -

ESSA% (CHAPTER 1 1. <n the =nited *tates& educational services can be provided by federal governmental entities& by non-federal governmental entities& by not-for-profit entities& and by for-profit entities. Are the accounting and financial reporting standards the same for each of these entities7 *hould they be the same7 2. The !overnmental Accounting *tandards +oard A!A*+2 stated that an objective of financial reporting is to measure interperiod e3uity& that is@G(inancial reporting should provide information to determine whether current-year revenues were sufficient to pay for currentyear services.H 6hat is your understanding of interperiod e3uity7 6hat costs incurred in the current year should be paid for by the ta4payers of the current period7 6hat costs incurred in the current year should be paid for by future ta4payers7 . A not-for-profit entity raises funds to support specific programs& services& and activities. The recipients of the programs& services& and activities are fre3uently not the providers of the resources to deliver the programs& services& and activities. 6hat information would donors to these not-for-profit entities be interested in seeing7 6hat information would program beneficiaries be interested in seeing7 <dentify other users of the financial statements of a notfor-profit and the types of information in which they would be interested. ". 6hat is the significance@for financial reporting purposes@of the fact that neither not-forprofits nor governments have owners Astockholders27 #. 6hat are some of the definitional criteria that distinguish a governmental entity from a notfor-profit entity7 $. Dow does the (A*+ influence generally accepted accounting principles for state and local governments7

!ranof Test +ank 0hapter 1

1age 1/

ANS&ERS T# TRUE/FALSE 'UEST"#NS (CHAPTER 1 1. 2. . ". #. $. '. ). -. 1/. ( T ( T ( T T ( T (

ANS&ERS T# !ULT"PLE CH#"CE (CHAPTER 1 1. 2. . ". #. $. '. ). -. 1/. 11. 12. 1 . 1". 1#. 1$. 1'. 1). 1-. 2/. 21. 22. 2 . 2". 2#. 2$. 2'. 2). 2-. /. b b d c a d c c c d d c d d d a d b a b c b c d b d a a b b

!ranof Test +ank 0hapter 1

1age 11

ANS&ERS T# PR#$LE!S (CHAPTER 1 1. The 0ity adopted a cash budget that projected an operating surplus of C1'/&///I therefore& it was in compliance with the GbudgetingH portion of budget laws. <n addition& the 0ity GbalancedH its current period operations. Total inflows are C1&"'#&/// and total outflows are C1&"'#&///. The 0ity was seriously affected by the closure of the major employer in town. The 0ity compensated for the shortfall in property ta4 revenues by failing to make the pension contribution in the current period and by borrowing on a long-term note at the bank. Although one e4penditure category e4ceeded the budgeted amount Aoperating e4penses was C'#&/// more than budgeted2& another was short by C)/&/// Apension contributions2. The 0ity has probably complied with the budget laws that prohibit operating at a deficit Aif deficit is defined as a cash deficit2. <t has probably not complied with the budget laws if the laws state that current revenues Anot including borrowing2 must be e3ual to or e4ceed current period costs. <nterperiod e3uity is another issue. +y failing to make the re3uired contribution the 0ity has passed on to future ta4payers costs that were associated with operations of the current period. Also& by borrowing at the bank the 0ity has incurred obligations that must be borne by future ta4payers. *ave-the-+irds will be launching a major fund-raising drive with a financial statement that shows C1&/ /&/// in donations and only C /&/// in e4penses. <t may be difficult to e4plain to potential donors why the entity is conducting a fund-raising drive at the present time. The balance sheet should help *ave-the-+irds e4plain why they need the additional monies. Dowever& many people familiar with financial statements of for-profit entities may have difficulty understanding how an entity can generate a C1&///&/// Jprofit and still need to be soliciting funds. The e3uity section shows :et Assets of C1&///&///. <t may be difficult for readers to understand that this is not similar to 8etained .arnings in for-profit entities. The distinction between unrestricted and restricted may be meaningless to the average reader. KNote( *tudents may react as readers@why do they need another fund-raising drive now7 <f so& they have failed to grasp an important issue for many not-for-profit entities.L The financial statements of *ave-the-+irds present fairly the financial position and results of operations of the entity. The financial statements do not tell the whole story. <t will be necessary for *ave-the-+irds to e4plain why they need the funds.

2.

!ranof Test +ank 0hapter 1

1age 12

. Fohnson 0ity financial statements would be as follows> Cash Basis C.- million A./$2 million A.)2 million C./" million 1roperty ta4 receipts 1roperty ta4 revenues 1rior period e4penses Accrued e4penses 0urrent e4penses G:et <ncomeH Accrual Basis C.-- million A.12 million A.)2 million C./- million

The cash basis financial statement would best demonstrate compliance with the budget but the non-cash basis financial statement would best convey results of operations. As a citi?en& < would like to see both because legal compliance is important to me but so are results of operations. <t may take both statements to fully inform the public about operations. K Note( At this point students have not been e4posed to Mmodified accrualM accounting so they will not struggle with revenue recognition issues imbedded in this problem.L ". a. b. c. 1romotes interperiod e3uity. +ecause the bonds are re3uired to be repaid over the life of the capital assets& the cost of those assets is allocated to the periods over which ta4payers benefit from the use of the assets. =ndermines interperiod e3uity. The employee benefits costs@pension benefits@are paid by an entirely different generation of ta4payers@long after the employees earned the benefits by providing services. 1romotes interperiod e3uity. Although not particularly material& supplies do not benefit ta4payers until they are used to provide services. 8eporting these as e4penditures when purchased reports the cost in a different period from when the benefit is provided. =ndermines interperiod e3uity. =sing debt to finance operating costs spreads the cost of providing services provided in a single period over the entire term of the long-term debt. <nterest costs on the debt amplify the problem. 1romotes interperiod e3uity. Again& while possibly immaterial& reporting the cost of providing services@in the form of wages and salaries@in the period in which services were provided promotes interperiod e3uity.

d. e.

!ranof Test +ank 0hapter 1

1age 1

ANS&ERS T# ESSA% 'UEST"#NS (CHAPTER 1 1. Accounting standards for educational institutions differ by the nature of the ownership. 1ublic schools AE-122 are accounted for in the same way as state and local governments& as are public colleges and universities& theoretically. 1rivate schools& colleges& and universities are accounted for using not-for-profit standards established by (A*+. (or-profit educational institutions would use the (A*+ rules for other for-profit entities. +ecause these entities are all involved in delivering the same basic service@education@it would appear that they should have the same standards. Dowever& public schools are subject to the same openness as other government activities. The citi?ens should have a voice in determining what services are offered through the schools and how those services are delivered. The budget process is the opportunity for the public to be heard and the adopted budget is a plan of action to which citi?ens can& and should& hold officials accountable. (orprofit schools are organi?ed to generate profits and should measure net income using full accrual accounting. :ot-for-profit entities generate revenues from tuition and solicit contributions from the public& or a select group of the public. ,onors to not-for-profit entities may be interested in different information than ta4payers are interested in. KNote( *tudents will have differing opinions about the appropriateness of different accounting standards for educational institutions determined by ownership rather than by activity. The 3uestion is designed to solicit their thoughts.L 2. <nterperiod e3uity means that the citi?ens of one time period should pay the costs of the goods and services consumed during that time period. <nterperiod e3uity as an accounting concept means that the financial statements should measure the success of a governmental entity in accomplishing the goal of raising sufficient revenues to pay for the cost of services consumed during a period. Dowever& interperiod e3uity is a policy decision& not an accounting decision. To achieve interperiod e3uity& current-year ta4payers should cover the cost of current-year services. .veryone would agree that current period operating costs should be covered& including supplies and payroll costs. <n addition& a portion of the cost of capital assets or other improvements& which benefit more than one period& should be considered in the e3uation. (inally& certain costs may not be paid until well into the future but arise from current operations. The governments employees earn many of these in the current period& including accumulating vacation benefits& pension benefits& and other postemployment benefits. 0osts that should not be included in the current year measure of interperiod e3uity are costs that will benefit future periods@for e4ample& the portion of the historical cost of capital assets that will be allocated over future periods.

!ranof Test +ank 0hapter 1

1age 1"

. ,onors to not-for-profit A:(12 entities are probably interested in information about the costs incurred by the not-for-profit. ,onors would be interested in comparing the cost incurred in delivering services by one entity compared to the cost incurred by another entity for delivering the same type of service. The amount spent on programs compared to the amount spent on fund-raising and general and administrative costs would be of interest to donors. 9ajor donors should be very interested in the amounts spent on salaries to top :(1 officials because major donors are& in effect& paying those salaries. +eneficiaries would be interested in the costs of delivering the goods and services and the success of the :(1 in securing the funds necessary to continue to deliver those goods and services. 8egulatory agencies& such as the <8*& would be very interested in the financial information of :(1 entities to assess whether they should continue to be considered a :(1 entity. !overnments would be interested in the financial information of :(1 entities. 9any governments are considering outsourcing or privati?ing the delivery of goods and services. <f other entities can& indeed& perform those services more efficiently than government& perhaps the services should be privati?ed or outsourced. ". The obvious significance of the fact that neither not-for-profits nor governments have owners is that neither governments nor not-for-profits report owners e3uity. 9ore important however& is the fact that financial reports of governments cannot focus on owners. They must be prepared from the perspective of parties other than stockholders. !enerally this focus is on resource providers and the restrictions they place on the assets they contribute. <n addition& this distinction often means that there is less interest in the fair market values of assets and liabilities and other accounting measures that rely on fair values& such as pension e4pense. :o stockholders e4ist to consider the price5earnings ratios of these entities or a potential buyout5takeover. (inally& both the (A*+ and !A*+ have called for information on service efforts and accomplishments. These measures would be used to assess& among other things& how effectively and efficiently the entities provide services. This information& however& is not easily e4pressed in monetary measures and has not yet been included in financial statements. #. (irst& and foremost& a governmental entity usually has the power to assess ta4es. :ot-forprofit entities do not. <n addition& governments may issue ta4-e4empt debt and their governing bodies are either elected by ta4payers or appointed by another government. %ess common is the fact that a governmental entity can usually be unilaterally dissolved by another governmental entity Ausually the one that created it2 and its assets assumed without compensation. :one of these things are true about not-for-profit entities. $. The (A*+ influences generally accepted accounting principles of governments in two key ways. (irst& (A*+ pronouncements are included in the !A*+ GhierarchyH of !AA1. (A*+ pronouncements that the !A*+ has specifically made applicable to governments are included in the highest categoryI those that the !A*+ has not specifically adopted are included in the lowest category. *econd& the business-type activities of governments are re3uired Awith a few e4ceptions2 to follow the business accounting principles as set forth by the (A*+.

!ranof Test +ank 0hapter 1

1age 1#

Das könnte Ihnen auch gefallen

- Chapter 2 - Test BankDokument25 SeitenChapter 2 - Test Bankapi-253108236100% (5)

- Fund Accounting True/False and Multiple ChoiceDokument25 SeitenFund Accounting True/False and Multiple ChoiceAnonymous 1m13hVlta733% (3)

- GASB 34 Governmental Funds vs Government-Wide StatementsDokument22 SeitenGASB 34 Governmental Funds vs Government-Wide StatementsLisa Cooley100% (1)

- Gov Acc Quiz 1, BeltranDokument2 SeitenGov Acc Quiz 1, BeltranbruuhhhhNoch keine Bewertungen

- CHAPTER 3.pptx - ACC9 EditedDokument30 SeitenCHAPTER 3.pptx - ACC9 EditedAngelica CastilloNoch keine Bewertungen

- Gov Acc Post TestDokument15 SeitenGov Acc Post Test수지Noch keine Bewertungen

- Gov't Accounting Theories (GATDokument82 SeitenGov't Accounting Theories (GATorly100% (1)

- Module 2 Quiz AnswersDokument1 SeiteModule 2 Quiz AnswersVon Andrei MedinaNoch keine Bewertungen

- Government Accounting ManualDokument9 SeitenGovernment Accounting ManualGabriel PonceNoch keine Bewertungen

- Government Accounting Punzalan Solman Chap 2Dokument6 SeitenGovernment Accounting Punzalan Solman Chap 2Alarich Catayoc100% (1)

- QUIZ 3 - Government Accounting and Accounting For Non-Profit OrganizationsDokument4 SeitenQUIZ 3 - Government Accounting and Accounting For Non-Profit OrganizationsI am Jacob100% (1)

- Government Accounting & Non-Profit AccountingDokument11 SeitenGovernment Accounting & Non-Profit Accountingweddiemae villariza0% (2)

- Government Accounting Exam PhilippinesDokument3 SeitenGovernment Accounting Exam PhilippinesIrdo Kwan64% (11)

- Government entity service concession arrangementDokument7 SeitenGovernment entity service concession arrangementAyesha RGNoch keine Bewertungen

- Audit Risk Model and MaterialityDokument14 SeitenAudit Risk Model and Materialityedrick LouiseNoch keine Bewertungen

- VHWODokument6 SeitenVHWOJodie Sagdullas100% (1)

- Existence or Occurrence Completeness Rights and Obligations Valuation or AllocationDokument3 SeitenExistence or Occurrence Completeness Rights and Obligations Valuation or AllocationReyes, Jessica R.Noch keine Bewertungen

- Chapter 4 Revenues and Other ReceiptsDokument10 SeitenChapter 4 Revenues and Other ReceiptsKyree VladeNoch keine Bewertungen

- Governmental and Non-profit Accounting Multiple Choice QuestionsDokument17 SeitenGovernmental and Non-profit Accounting Multiple Choice Questionsrio100% (3)

- Aa2e Hal Testbank Ch04Dokument26 SeitenAa2e Hal Testbank Ch04jayNoch keine Bewertungen

- Home Office Branch and Agency Accounting QuestionsDokument32 SeitenHome Office Branch and Agency Accounting QuestionsMichaela Quimson100% (1)

- CH10 - Sales Agency & Branch OperationDokument24 SeitenCH10 - Sales Agency & Branch Operationclarisa oktaviana100% (4)

- Consolidated FinancialsDokument6 SeitenConsolidated FinancialsNiña YastoNoch keine Bewertungen

- Chapter 4 - Reveneus and Other ReceiptsDokument18 SeitenChapter 4 - Reveneus and Other Receiptsweddiemae villariza100% (8)

- Government Accounting Standards and PrinciplesDokument9 SeitenGovernment Accounting Standards and PrinciplesDena Heart OrenioNoch keine Bewertungen

- Cis Psa 401Dokument74 SeitenCis Psa 401Angela PaduaNoch keine Bewertungen

- This Study Resource Was: UNIT 14.1 TO 14.3Dokument9 SeitenThis Study Resource Was: UNIT 14.1 TO 14.3macmac29Noch keine Bewertungen

- Conversion Cycle NotesDokument7 SeitenConversion Cycle NotesJoana TrinidadNoch keine Bewertungen

- SDDokument19 SeitenSDNitinNoch keine Bewertungen

- PLP Government Accounting Final ExamDokument4 SeitenPLP Government Accounting Final ExamApril ManjaresNoch keine Bewertungen

- Information Accounting SystemsDokument20 SeitenInformation Accounting SystemsRen Dizon Bauto Binarao100% (2)

- ACC BUS COMB ADV ACCT 2 - MILLANDokument14 SeitenACC BUS COMB ADV ACCT 2 - MILLANPrecilla IrosidoNoch keine Bewertungen

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDokument5 SeitenBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Chapter 03 The Government Accounting ProcessDokument20 SeitenChapter 03 The Government Accounting ProcessRygiem Dela CruzNoch keine Bewertungen

- Governmental and Nonprofit Accounting Test BankDokument6 SeitenGovernmental and Nonprofit Accounting Test Banksamuel debebe100% (2)

- AFAR3 QuestionnairesDokument5 SeitenAFAR3 QuestionnairesTyrelle Dela CruzNoch keine Bewertungen

- Accounting For LTCCDokument5 SeitenAccounting For LTCCRoland CatubigNoch keine Bewertungen

- AGNPO Prelims ReviewerDokument84 SeitenAGNPO Prelims ReviewerKurt Morin CantorNoch keine Bewertungen

- Ch09 - Auditing Revenue CycleDokument29 SeitenCh09 - Auditing Revenue CyclerclagunaNoch keine Bewertungen

- Homework 2 AuditingDokument5 SeitenHomework 2 AuditingLeah Mae NolascoNoch keine Bewertungen

- Agricultural Accounting ConceptsDokument13 SeitenAgricultural Accounting Conceptsweddiemae villarizaNoch keine Bewertungen

- Bachelor of Science in Accountancy: GRC 2001: Introduction To Corporate GovernanceDokument2 SeitenBachelor of Science in Accountancy: GRC 2001: Introduction To Corporate GovernanceJherryMigLazaroSevilla100% (9)

- Auditing Theory MULTIPLE CHOICE. Read Carefully The Questions Below and Choose The Best Statement Among The ChoicesDokument12 SeitenAuditing Theory MULTIPLE CHOICE. Read Carefully The Questions Below and Choose The Best Statement Among The ChoiceschimchimcoliNoch keine Bewertungen

- Chapter 6 - Financial AssetsDokument20 SeitenChapter 6 - Financial Assetsjerome orillosaNoch keine Bewertungen

- ACC 410 Exam 2 Spring 2011KEYDokument8 SeitenACC 410 Exam 2 Spring 2011KEYusa4meNoch keine Bewertungen

- AP.2906 InvestmentsDokument6 SeitenAP.2906 InvestmentsmoNoch keine Bewertungen

- Chapter 1 - Test Bank Auditing UICDokument15 SeitenChapter 1 - Test Bank Auditing UICLana Bustami100% (4)

- Auditing Theories and Problems Quiz WEEK 2Dokument16 SeitenAuditing Theories and Problems Quiz WEEK 2Van MateoNoch keine Bewertungen

- T10 - Government AccountingDokument9 SeitenT10 - Government AccountingTheProdigal Son44% (9)

- Aactg16a Final Exam - Canceran, Michelle M.Dokument5 SeitenAactg16a Final Exam - Canceran, Michelle M.Michelle Manalo Canceran100% (1)

- Use The Following Information For The Next Three Questions:: Activity 3.2Dokument2 SeitenUse The Following Information For The Next Three Questions:: Activity 3.2Tine Vasiana DuermeNoch keine Bewertungen

- Prepare General Purpose Financial StatementsDokument4 SeitenPrepare General Purpose Financial StatementsVon Andrei Medina100% (1)

- Government Accounting: Accounting For Non-Profit OrganizationsDokument22 SeitenGovernment Accounting: Accounting For Non-Profit OrganizationsHazel Kaye Espelita67% (3)

- Chapter 1 The Government and Not-For-Profit Environment TBDokument12 SeitenChapter 1 The Government and Not-For-Profit Environment TBGG0% (1)

- Government and Not-For-Profit Chapter 1 True/FalseDokument15 SeitenGovernment and Not-For-Profit Chapter 1 True/FalseNatasha GraciaNoch keine Bewertungen

- Government and Not For Profit Accounting Concepts and Practices 7th Edition Granof Test BankDokument16 SeitenGovernment and Not For Profit Accounting Concepts and Practices 7th Edition Granof Test BankJessicaHardysrbxd100% (7)

- Test Bank For Government and Not For Profit Accounting Concepts and Practices 5th Edition GranofDokument15 SeitenTest Bank For Government and Not For Profit Accounting Concepts and Practices 5th Edition GranofChristine TiceNoch keine Bewertungen

- Test Bank For Government and Not For Profit Accounting 8th by GranofDokument20 SeitenTest Bank For Government and Not For Profit Accounting 8th by GranofHorace Renfroe100% (40)

- Government and Not For Profit Accounting Concepts and Practices 6th Edition Granof Test BankDokument15 SeitenGovernment and Not For Profit Accounting Concepts and Practices 6th Edition Granof Test Bankjessica100% (20)

- Test Bank For Government and Not For Profit Accounting Concepts and Practices 6Th Edition Granof 1118155971 9781118155974 Full Chapter PDFDokument46 SeitenTest Bank For Government and Not For Profit Accounting Concepts and Practices 6Th Edition Granof 1118155971 9781118155974 Full Chapter PDFmajor.young254100% (11)

- CIR vs RUEDA Estate Tax Exemption for Spanish NationalDokument1 SeiteCIR vs RUEDA Estate Tax Exemption for Spanish NationalAdriel MagpileNoch keine Bewertungen

- Due Process In India And Fighting Domestic Violence CasesDokument34 SeitenDue Process In India And Fighting Domestic Violence CasesSumit Narang0% (1)

- A Study On The Role and Importance of Treasury Management SystemDokument6 SeitenA Study On The Role and Importance of Treasury Management SystemPAVAN KumarNoch keine Bewertungen

- Waxman Letter To Office of National Drug Control PolicyDokument6 SeitenWaxman Letter To Office of National Drug Control PolicyestannardNoch keine Bewertungen

- Universal Principles of Biomedical EthicsDokument16 SeitenUniversal Principles of Biomedical EthicsMEOW41100% (3)

- Uloom Ul HadithDokument14 SeitenUloom Ul Hadithasma abbas100% (1)

- Labor Cases Just Cause Loss of Confidence PDFDokument177 SeitenLabor Cases Just Cause Loss of Confidence PDFRj MendozaNoch keine Bewertungen

- Jei and Tabligh Jamaat Fundamentalisms-Observed PDFDokument54 SeitenJei and Tabligh Jamaat Fundamentalisms-Observed PDFAnonymous EFcqzrdNoch keine Bewertungen

- Bridal ContractDokument5 SeitenBridal ContractStacey MarieNoch keine Bewertungen

- ResultGCUGAT 2018II - 19 08 2018Dokument95 SeitenResultGCUGAT 2018II - 19 08 2018Aman KhokharNoch keine Bewertungen

- Ibn Mujahid and Seven Established Reading of The Quran PDFDokument19 SeitenIbn Mujahid and Seven Established Reading of The Quran PDFMoNoch keine Bewertungen

- Resolution SEBC ReservationDokument3 SeitenResolution SEBC ReservationNishikant TeteNoch keine Bewertungen

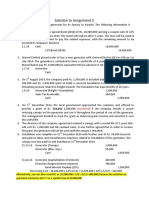

- Assignment 2 SolutionDokument4 SeitenAssignment 2 SolutionSobhia Kamal100% (1)

- FM ReportDokument2 SeitenFM Reportcaiden dumpNoch keine Bewertungen

- 2011 Veterans' Hall of Fame Award RecipientsDokument46 Seiten2011 Veterans' Hall of Fame Award RecipientsNew York SenateNoch keine Bewertungen

- Impact of Ownership Pattern On Independence of MediaDokument3 SeitenImpact of Ownership Pattern On Independence of MediaVishek MadanNoch keine Bewertungen

- QNet FAQDokument2 SeitenQNet FAQDeepak GoelNoch keine Bewertungen

- 2019 Graduation MessagesDokument4 Seiten2019 Graduation MessagesKevin ProvendidoNoch keine Bewertungen

- Sundanese Wedding CeremonyDokument2 SeitenSundanese Wedding Ceremonykarenina21Noch keine Bewertungen

- Succession 092418Dokument37 SeitenSuccession 092418Hyuga NejiNoch keine Bewertungen

- Golden Tax - CloudDokument75 SeitenGolden Tax - Cloudvarachartered283Noch keine Bewertungen

- Latur District JUdge-1 - 37-2015Dokument32 SeitenLatur District JUdge-1 - 37-2015mahendra KambleNoch keine Bewertungen

- Ibañez v. People: GR No. 190798. January 27, 2016Dokument2 SeitenIbañez v. People: GR No. 190798. January 27, 2016Tootsie GuzmaNoch keine Bewertungen

- s3 UserguideDokument1.167 Seitens3 UserguideBetmanNoch keine Bewertungen

- MC No. 005.22Dokument5 SeitenMC No. 005.22raymund pabilarioNoch keine Bewertungen

- Introduction:-: Mission & VisionDokument10 SeitenIntroduction:-: Mission & Visionzalaks100% (5)

- How to Charge Invoices on ERPDokument9 SeitenHow to Charge Invoices on ERPClarissa DelgadoNoch keine Bewertungen

- Q. Write A Short Note On Redressal Agencies in Consumer Protection Act?Dokument4 SeitenQ. Write A Short Note On Redressal Agencies in Consumer Protection Act?Siddharth SharmaNoch keine Bewertungen

- Cis-Corporation-Petro T&C Intl Pte LTD - Uob Singapore Oct2018Dokument7 SeitenCis-Corporation-Petro T&C Intl Pte LTD - Uob Singapore Oct2018WinengkuNoch keine Bewertungen

- Trinity College - Academic Calendar - 2009-2010Dokument3 SeitenTrinity College - Academic Calendar - 2009-2010roman_danNoch keine Bewertungen