Beruflich Dokumente

Kultur Dokumente

CH 08

Hochgeladen von

Abdalelah FrarjehOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CH 08

Hochgeladen von

Abdalelah FrarjehCopyright:

Verfügbare Formate

Copyright 2012 John Wiley & Sons, Inc.

. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-1

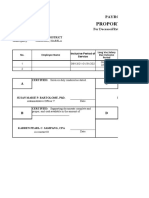

CHAPTER 8

Valuation of Inventories: A Cost-Basis Approach

ASSIGNMENT CLASSIFICATION TABLE (BY TOPIC)

Topics

Questions

Brief

Exercises Exercises Problems

Concepts

for Analysis

1. Inventory accounts;

determining quantities,

costs, and items to be

included in inventory;

the inventory equation;

balance sheet disclosure.

1, 2, 3, 4,

5, 6, 8, 9

1, 3 1, 2, 3,

4, 5, 6

1, 2, 3 1, 2, 3, 5

2. Perpetual vs. periodic. 2 9, 13,

17, 20

4, 5, 6

3. Recording of discounts. 10, 11 7, 8 3 4

4. Inventory errors. 7 4 5, 10,

11, 12

2

5. Flow assumptions. 12, 13, 16,

18, 20

5, 6, 7 9, 13, 14,

15, 16, 17,

18, 19, 20,

21, 22

1, 4, 5,

6, 7

5, 6, 7, 8, 11

6. Inventory accounting

changes.

18 7 6, 7, 10

7. Dollar-value LIFO

methods.

14, 15, 17,

18, 19

8, 9 22, 23, 24,

25, 26

1, 8, 9,

10, 11

8, 9

8-2 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

ASSIGNMENT CLASSIFICATION TABLE (BY LEARNING OBJECTIVE)

Learning Objectives

Brief

Exercises Exercises Problems

1. Identify major classifications of inventory. 1

2. Distinguish between perpetual and periodic

inventory systems.

2 4, 9, 13,

17, 20

4, 5, 6

3. Identify the effects of inventory errors

on the financial statements.

4 5, 10, 11, 12 2

4. Understand the items to include as inventory cost. 3 1, 2, 3, 4,

5, 6, 7, 8

1, 2, 3

5. Describe and compare the cost flow assumptions

used to account for inventories.

5, 6, 7 9, 13, 14, 15,

16, 17, 18,

19, 20, 22

1, 4, 5, 6, 7

6. Explain the significance and use of a LIFO reserve. 21

7. Understand the effect of LIFO liquidations.

8. Explain the dollar-value LIFO method. 8, 9 22, 23, 24,

25, 26

1, 8, 9,

10, 11

9. Identify the major advantages and disadvantages

of LIFO.

10. Understand why companies select given inventory

methods.

Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-3

ASSIGNMENT CHARACTERISTICS TABLE

Item Description

Level of

Difficulty

Time

(minutes)

E8-1 Inventoriable costs. Moderate 1520

E8-2 Inventoriable costs. Moderate 1015

E8-3 Inventoriable costs. Simple 1015

E8-4 Inventoriable costsperpetual. Simple 1015

E8-5 Inventoriable costserror adjustments. Moderate 1520

E8-6 Determining merchandise amountsperiodic. Simple 1020

E8-7 Purchases recorded net. Simple 1015

E8-8 Purchases recorded, gross method. Simple 2025

E8-9 Periodic versus perpetual entries. Moderate 1015

E8-10 Inventory errors, periodic. Simple 1015

E8-11 Inventory errors. Simple 1015

E8-12 Inventory errors. Moderate 1520

E8-13 FIFO and LIFOperiodic and perpetual. Moderate 1520

E8-14 FIFO, LIFO and average cost determination. Moderate 2025

E8-15 FIFO, LIFO, average cost inventory. Moderate 1520

E8-16 Compute FIFO, LIFO, average costperiodic. Moderate 1520

E8-17 FIFO and LIFOperiodic and perpetual. Simple 1015

E8-18 FIFO and LIFO; income statement presentation. Simple 1520

E8-19 FIFO and LIFO effects. Moderate 1520

E8-20 FIFO and LIFOperiodic. Simple 1015

E8-21 LIFO effect. Moderate 1015

E8-22 Alternate inventory methodscomprehensive. Moderate 2530

E8-23 Dollar-value LIFO. Simple 510

E8-24 Dollar-value LIFO. Simple 1520

E8-25 Dollar-value LIFO. Moderate 2025

E8-26 Dollar-value LIFO. Moderate 1520

P8-1 Various inventory issues. Moderate 3040

P8-2 Inventory adjustments. Moderate 2535

P8-3 Purchases recorded gross and net. Simple 2025

P8-4 Compute FIFO, LIFO, and average cost. Complex 4055

P8-5 Compute FIFO, LIFO, and average cost. Complex 4055

P8-6 Compute FIFO, LIFO, and average costperiodic

and perpetual.

Moderate 2535

P8-7 Financial statement effects of FIFO and LIFO. Moderate 3040

P8-8 Dollar-value LIFO. Moderate 3040

P8-9 Internal indexesdollar-value LIFO. Moderate 2535

P8-10 Internal indexesdollar-value LIFO. Complex 3035

P8-11 Dollar-value LIFO. Moderate 4050

8-4 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

ASSIGNMENT CHARACTERISTICS TABLE (Continued)

Item Description

Level of

Difficulty

Time

(minutes)

CA8-1 Inventoriable costs. Moderate 1520

CA8-2 Inventoriable costs. Moderate 1525

CA8-3 Inventoriable costs. Moderate 2535

CA8-4 Accounting treatment of purchase discounts. Simple 1525

CA8-5 General inventory issues. Moderate 2025

CA8-6 LIFO inventory advantages. Simple 1520

CA8-7 Average cost, FIFO, and LIFO. Simple 1520

CA8-8 LIFO application and advantages. Moderate 2530

CA8-9 Dollar-value LIFO issues. Moderate 2530

CA8-10 FIFO and LIFO. Moderate 3035

CA8-11 LIFO ChoicesEthical Issues. Moderate 2025

Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-5

LEARNING OBJECTIVES

1. Identify major classifications of inventory.

2. Distinguish between perpetual and periodic inventory systems.

3. Identify the effects of inventory errors on the financial statements.

4. Understand the items to include as inventory cost.

5. Describe and compare the cost flow assumptions used to account for inventories.

6. Explain the significance and use of a LIFO reserve.

7. Understand the effect of LIFO liquidations.

8. Explain the dollar-value LIFO method.

9. Identify the major advantages and disadvantages of LIFO.

10. Understand why companies select given inventory methods.

8-6 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

CHAPTER REVIEW

1. Careful attention is given to the inventory account by many business organizations because

it represents one of the most significant assets held by the enterprise. Inventories are of

particular importance to merchandising and manufacturing companies because they

represent the primary source of revenue for the organization. Inventories are also

significant because of their impact on both the balance sheet and the income statement.

Chapter 8 initiates the discussion of the basic issues involved in recording, classifying,

and valuing items classified as inventory.

Inventory Issues

2. (L.O. 1) Inventories are asset items held for sale in the ordinary course of business or

goods that will be used or consumed in the production of goods to be sold. Merchandise

inventory refers to the goods held for resale by a merchandising concern. The inventory

of a manufacturing firm is composed of three separate items: raw materials, work in

process, and finished goods.

3. (L.O. 2) Inventory records may be maintained on a perpetual or periodic inventory system

basis. A perpetual inventory system provides a means for generating up-to-date records

related to inventory quantities. Under this inventory system, data are available at any time

relative to the quantity of material or type of merchandise on hand. In a perpetual inventory

system, purchases and sales of goods are recorded directly in the Inventory account as

they occur. A Cost of Goods Sold account is used to accumulate the issuances from

inventory. The balance in the Inventory account at the end of the year should represent

the ending inventory amount.

4. When the inventory is accounted for on a periodic inventory system, the acquisition of

inventory is debited to a Purchases account. Cost of goods sold must be calculated when

a periodic inventory system is in use. The computation of cost of goods sold is made by

adding beginning inventory to net purchases and then subtracting ending inventory.

Ending inventory is determined by a physical count at the end of the year under a periodic

inventory system. Even in a perpetual inventory system, a physical inventory count at

year-end is normally taken due to the potential for loss, error, or shrinkage of inventory

during the year.

5. Inventory planning and control is of vital importance to the success of a merchandising

or manufacturing concern. If an excessive amount of inventory is accumulated, there is

the danger of loss owing to obsolescence. If the supply of inventory is inadequate, the

potential for lost sales exists. This dilemma makes inventory an asset to which manage-

ment must devote a great deal of attention.

6. Reconciliation between the recorded inventory amount and the actual amount of inventory

on hand is normally performed at least once a year. This is called a physical inventory

and involves counting all inventory items and comparing the amount counted with the

amount shown in the detailed inventory records. Any errors in the records are corrected

to agree with the physical count.

Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-7

7. The cost of goods sold during any accounting period is defined as all the goods

available for sale during the period less any unsold goods on hand at the end of the

period (ending inventory). The process of computing cost of goods sold is complicated

by the determination of (a) the physical goods to be included in inventory, (b) the costs to

be included in inventory, and (c) the cost flow assumption to be used.

Physical Goods to be Included in Inventory

8. Normally, goods are included in inventory when they are received from the supplier.

However, at the end of the period, proper accounting requires that all goods to which the

company has legal title be included in ending inventory. Goods in transit at the end of the

period, shipped f.o.b. shipping point, should be included in the buyers ending inventory.

If goods are shipped f.o.b. destination, they belong to the seller until actually received by

the buyer. Inventory out on consignment belongs to the consignors inventory.

9. In actual practice a few exceptions exist regarding the general rule that inventory is recorded

by the company that has legal title to the merchandise. These exceptions are known as

special sale agreements. Three of the more common special sale agreements are (a) sales

with buy back agreement, (b) sales with high rates of return, and (c) sales on installment.

Effect of Inventory Errors

10. (L.O. 3) Errors in recording inventory can affect the balance sheet, the income statement, or

both, because inventory is used in the preparation of both financial statements. For

example, the failure to include certain inventory items in a year-end physical inventory count

would result in the following items being overstated (O) or understated (U): ending inventory

(U); working capital (U); cost of goods sold (O); and net income (U). If merchandise was not

recorded as a purchase nor counted in the ending inventory, the result would be an under-

statement of inventory and accounts payable in the balance sheet and an understatement of

purchases and inventory in the income statement. Net income would be unaffected by this

omission as purchases and ending inventory would be misstated by the same amount.

Costs Included in Inventory

11. (L.O. 4) Inventories are recorded at cost when acquired. Cost in terms of inventory

acquisition includes all expenditures necessary in acquiring the goods and converting

them to a saleable condition. Product costs are those costs that attach to the inventory

and are recorded in the inventory account. These costs include freight charges on goods

purchased, other direct costs of acquisition, and labor and other production costs incurred

in processing the goods up to the time of sale. Period costs, such as selling expenses

and general and administrative expenses, are not considered inventoriable costs. The

reason these costs are not included as a part of the inventory valuation concerns the fact

that, in most instances, these costs are unrelated to the immediate production process.

12. The accounting profession allows for the capitalization of interest costs related to assets

constructed for internal use or assets produced as discrete projects (such as ships or real

estate projects) for sale or lease. In the case of inventories that are routinely manufac-

tured or produced in large quantities on a repetitive basis, interest costs should not be

capitalized.

8-8 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

Purchase Discounts

13. When purchases are recorded net of discounts, failure to pay within the discount period

results in the treatment of lost discounts as a financial expense. If the gross method is

used, purchase discounts should be reported as a deduction from purchases on the

income statement. If the net method is used, purchase discounts lost should be con-

sidered a financial expense and reported in the other expense and loss section of the

income statement.

Cost Flow Assumptions

14. Determining the specific cost of inventory items that have been sold as well as those

remaining in ending inventory is sometimes a difficult process. This is due, in part, to the

fact that there is no requirement that the cost flow assumption adopted be consistent with

the physical flow of the goods through the inventory account. Thus, it is important when

accounting for inventory costs that a company make consistent use of a cost flow

assumption. The major objective in selecting a method should be to choose the one which

most clearly reflects periodic income.

15. (L.O. 5) Inventory cost flow assumptions include (a) specific identification, (b) average

cost, (c) first-in, first-out (FIFO), (d) last-in, first-out (LIFO), and (e) dollar-value LIFO. It

should be remembered that these assumptions relate to the flow of costs and not the

physical flow of inventory items into and out of the company.

16. Specific identification calls for identifying each item sold and each item in inventory.

The costs of the specific items sold are included in cost of goods sold, and the costs of

the specific items on hand are included in inventory. The average cost method prices

items in the inventory on the basis of the average cost of all similar goods available

during the period.

FIFO

17. Use of the FIFO inventory method assumes that the first goods purchased are the first

used or sold. In all cases where FIFO is used, the inventory and cost of goods sold would

be the same at the end of the month whether a perpetual or periodic system is used.

A major advantage of the FIFO method is that the ending inventory is stated in terms of

an approximate current cost figure. However, because FIFO tends to reflect current costs

on the balance sheet, a basic disadvantage of this method is that current costs are not

matched against current revenues on the income statement.

LIFO

18. Use of the LIFO inventory method assumes that the most recent inventory costs are the

first costs recorded for goods manufactured or sold. When inventory records are kept on

a periodic basis, the ending inventory would be priced by using the total units as a basis

of computation, disregarding the exact dates of purchases. The calculation of ending

inventory and cost of goods sold changes somewhat when the LIFO method is used in

connection with perpetual inventory records.

Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-9

LIFO Reserve

19. (L.O. 6) Many companies use LIFO for tax and external reporting purposes, but maintain

a FIFO, average cost, or standard cost system for internal reporting purposes. The

difference between the inventory method used for internal reporting purposes and LIFO is

referred to as the Allowance to Reduce Inventory to LIFO or the LIFO Reserve. The

change in the allowance balance from one period to the next must be made each year.

LIFO Liquidation

20. (L.O. 7) When the LIFO inventory method is used, many companies combine inventory

items into natural groups or pools. Each pool is assumed to be one unit for the purpose

of costing the inventory. Any increment above beginning inventory is normally identified

as a new inventory layer and priced at the average cost of goods purchased during the

year. When the inventory is decreased, the most recently added inventory layer is the first

layer eliminated (last-in, first-out). The specific-goods pooled LIFO approach reduces

record keeping and, accordingly, the cost of utilizing the LIFO inventory method.

Dollar-Value LIFO

21. (L.O. 8) Use of the specific-goods pooled approach can result in problems for companies

that often change the mix of their products, materials, and production methods. To

overcome these problems, the dollar-value LIFO method has been developed. The

important feature of the dollar-value LIFO method is that increases and decreases in a

pool are determined and measured in terms of total dollar value, not the physical quantity

of the goods as is done in the traditional LIFO pool approach.

22. In computing inventory under the dollar-value LIFO method, the ending inventory is first

priced at the most current cost. Current cost is then restated to prices prevailing when

LIFO was adopted. This is accomplished by using a price index. A new inventory layer is

formed when the ending inventory, stated in base-year costs, exceeds the base-year

costs of beginning inventory. Increases are priced at current cost. If the ending inventory,

stated at base-year costs, is less than beginning inventory, the decrease is subtracted

from the most recently added layer. A price index for the current year is computed by

dividing Ending Inventory for the Period at Current-Year Costs by Ending Inventory for

the Period at Base-Year Costs. The dollar-value method is a more practical way of valuing

a complex, multiple-item inventory than the traditional LIFO method.

Advantages and Disadvantages of LIFO

23. (L.O. 9) Proponents of the LIFO method advocate its use on the basis of its (a) proper

matching of recent costs with current revenue, (b) tax benefits, (c) improved cash flow,

and (d) future earnings hedge. Those opposed to the LIFO method claim that it (a) lowers

reported earnings, (b) reports outdated costs on the balance sheet, (c) is contrary to

normal physical flow, (d) creates involuntary liquidation problems, and (e) invites poor

buying habits.

8-10 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

Selection of Inventory Method

24. (L.O. 10) LIFO is generally preferable to FIFO when: (a) selling prices and revenues

have been increasing faster than costs, and (b) LIFO has been traditional, such as

department stores and industries where a fairly constant base stock is present. LIFO

would not be preferable when: (a) prices tend to lag behind costs, (b) specific identi-

fication is traditional, and (c) unit costs tend to decrease as production increases, thereby

nullyifying the tax benefit that LIFO might provide.

Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-11

LECTURE OUTLINE

This chapter can be covered in three to four class sessions. Students should have had

previous exposure to inventory accounting topics except for dollar-value LIFO and the modified

perpetual system (perpetual records kept in units only).

A. (L.O. 1) Inventory Classification.

1. Among the most significant assets of many enterprises, inventories are asset items held

for sale in the ordinary course of business or goods that will be used or consumed in

the production of goods to be sold.

2. For manufacturing companies the inventory amount may be broken down into raw

materials, work in process, and finished goods.

B. (L.O. 2) Inventory Cost Flow.

TEACHING TIP

Contrast the accounting procedures under the perpetual and periodic inventory systems by

using Illustration 8-1. This example is based on Illustration 8-4 in the textbook on page 438.

1. Perpetual inventory systemThe costs of purchases and sales are recorded directly

in the Inventory account (perpetual record kept in units and dollars).

2. Periodic inventory systemThe cost of purchases is recorded in a Purchases (nominal

or temporary) account. The balance in the Inventory account remains unchanged

during the period. No record is kept at the time of sale of the number or cost of the

units sold. At the end of the period, the quantity of goods on hand is determined by

physical count and the cost of ending inventory is recorded. Cost of goods sold is

determined by adding the beginning inventory to the purchases and deducting the

ending inventory.

3. Modified perpetual inventory systemThe cost of purchases is recorded directly in

the Inventory account. The cost of sales is not recorded at the time of sale, but

a record is kept of the number of units sold (perpetual record kept in units only).

C. (L.O. 2) Basic Issues in Inventory Valuation. These include the determination of the

(1) physical goods to be include in inventory, (2) the costs to include in inventory, and (3)

the cost flow assumption to adopt.

D. (L.O. 2) Goods to be Included in Inventory. Technically, purchases should be recorded when

legal title passes to the buyer. The following items require careful judgment:

1. Goods in Transit: If the goods are shipped f.o.b. shipping point, title passes to the

buyer when the seller delivers the goods to the common carrier. If the goods are shipped

f.o.b. destination, title passes when the buyer receives the goods.

8-12 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

2. Consigned Goods: Goods out on consignment remain the property of the consignor.

3. Special Sales Agreements in which the transfer of legal title may not be accompanied

by a transfer of the risks of ownership. (The concept of revenue realization can be

discussed in connection with these special arrangements.)

a. Sales with buyback agreement.

(1) In essence, the seller finances the cost of the inventory by transferring legal

title to a third party and receiving payment. The seller then agrees to buy

the inventory back at a specified price over a specified future period.

(2) These transactions are often described as parking transactions because

the seller simply parks the inventory on another firms balance sheet and uses

it as a financing device.

(3) In these arrangements, the inventory and related liability from the repurchase

agreement should remain on the sellers books. No sale should be recorded.

b. Sales with high rates of return.

(1) When the amount of returns can be reasonably estimated, the goods should be

considered sold.

(2) If returns are unpredictable, the goods should not be removed from the sellers

inventory accounts.

c. Installment sales. The goods should be excluded from the sellers inventory (i.e.,

considered sold) if the percentage of bad debts can be reasonably estimated.

4. (L.O. 3) Effect of inventory Errors.

a. The three most common types of inventory errors:

(1) Correct recording of purchases but incorrect computing and recording of ending

inventory count.

(2) Recording purchase transactions in the wrong accounting period. However,

ending inventory is computed and recorded correctly.

(3) Failure to include an item as a recorded purchase combined with failure to

include and record the item in the ending inventory count.

b. Corrections of inventory errors may involve two procedures:

(1) Preparation of correcting journal entries. Generally, a purchase is recorded

when the invoice arrives. If this does not coincide with passage of legal title by

the end of the accounting period, correcting entries may be required to prevent

cut-off errors. (See Exercises 8-4 and 8-5 in the textbook).

Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-13

(2) Computation of the correct amounts of inventory and related items including

purchases, cost of goods sold, net income, retained earnings, accounts payable,

working capital, and the current ratio.

(i) This is a good place to reinforce understanding of the basic inventory

equation:

Beginning Inventory + Purchases Ending Inventory = Cost of Goods Sold.

(ii) Point out the obvious, but useful, fact that the ending inventory of one

period is the beginning inventory of the next period.

c. Discuss the impact of inventory errors on the affected accounts.

TEACHING TIP

Illustration 8-2 demonstrates the effects of inventory errors on the income statement by

emphasizing the debit or credit balance of the affected items.

Illustration 8-3 summarizes the effects of inventory errors on the income statement and the

balance sheet.

E. (L.O. 4) Costs Included in Inventory.

1. Distinguish between product costs and period costs. Product costs are those costs

directly connected with bringing goods to the buyers place of business and converting

them to a saleable condition. Period costs such as selling and general and adminis-

trative expenses are not considered to be directly related to the acquisition or production

of goods.

2. Manufacturing Costs. Includes all costs which are traceable to the production of the

product. These costs are classified as direct materials, direct labor, and manufacturing

overhead.

3. Interest costs associated with getting inventories ready for sale are usually expensed

as incurred. However, SFAS No. 34 requires capitalization of interest cost related to

construction of discrete projects such as ships or real estate projects.

4. Purchase Discounts. Discuss the gross and net methods.

a. Gross method. Purchases and accounts payable are recorded at the gross amount.

Purchase discounts taken are credited to the Purchase Discounts account which

is reported in the income statement as a reduction of Purchases.

b. Net method (considered more appropriate than the gross method). Purchases and

accounts payable are recorded at the net amount. Purchase discounts not taken

are debited to the Purchase Discounts Lost account which is reported in the other

expense section of the income statement.

8-14 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

F. (L.O. 5) Choice of Cost Flow Assumption. This problem arises when numerous purchases

have been made at different prices and it is necessary to identify which goods remain on

hand and which have been sold.

TEACHING TIP

Illustration 8-4 provides a comparison of ending inventory computations under FIFO, LIFO,

and average cost under periodic and perpetual systems.

1. Specific Identification: Used where a small number of costly, distinctive items are sold.

It matches actual costs against actual revenue, but offers the opportunity to manipulate

income.

2. Average Cost: Items in the ending inventory and items sold are priced at the average

cost of goods available during the period. Either weighted-average (periodic) or

moving-average (perpetual) procedures may be used.

3. First-In, First-Out: Assumes goods are used in the order purchased. While this method

presents ending inventory at approximately current cost, it does not match current

costs against current revenues.

a. Ending Inventory and cost of goods sold will be the same under both periodic and

perpetual inventory systems.

4. Last-In, First-Out: Assumes that the last goods purchased are used or sold first.

G. (L.O. 6) LIFO Reserve (or the Allowance to Reduce Inventory to LIFO). Used when a

company maintains a FIFO, average cost, or standard cost system for internal reporting

purposes and LIFO for tax and external reporting purposes. The change in the allowance

balance from one period to the next is the LIFO effect.

H. (L.O. 7) Effect of LIFO Liquidations.

1. LIFO Liquidations. A frequent occurrence when specific-goods LIFO is used. When

the inventory balance is reduced (liquidated), the cost of the old inventory layers is

included in cost of goods sold, resulting in higher net income.

2. Specific-goods pooled LIFO approach. Inventory items are combined in pools of

similar items. This approach may help prevent LIFO liquidations because decreases in

one quantity may be offset by increases in another quantity.

Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-15

I. (L.O. 8) Dollar-value LIFO. This differs from specific-goods pooled LIFO in that increases

and decreases in a pool are measured in terms of the total dollar value and not the physical

quantity of goods in the inventory pool.

1. Discuss the steps involved in the dollar-value LIFO approach.

TEACHING TIP

Illustration 8-5, which is based on the Enrico Company data in the textbook, shows a

straightforward for presenting the dollar-value LIFO computations.

a. Compute the quantity of ending inventory at current cost. (This approximates FIFO.)

b. Divide (a) by the current price index to obtain the ending inventory at base-year cost.

c. Split (b) into layers depending on the year the items were acquired.

d. Multiply each layer in (c) by the appropriate price index (price index in the year of

acquisition) to obtain the ending inventory at dollar-value LIFO cost.

TEACHING TIP

Under certain circumstances the dollar-value LIFO approach produces the same inventory

cost as the specific goods LIFO approach. This can be demonstrated by using the example

in Illustration 8-6.

2. Discuss the computation of a price index.

a. Many companies may be able to use published external price indices.

b. Some companies must compute internal price indices. The double-extension

method is discussed in the chapter. The price index for the current year is

computed as follows:

Ending Inventory for the Period at Current Cost

Ending Inventory for the Period at Base-Year Cost

J. (L.O. 9) Major Advantages and Disadvantages of LIFO.

1. Advantages of LIFO.

a. Matching. LIFO matches more recent costs against current revenues to provide a

better measure of current earnings.

b. Tax benefits/Improved cash flow. During times of rising prices, LIFO provides

a deferral of income taxes payable.

c. Future earnings hedge. With LIFO, future price declines will not substantially

affect a companys future reported earnings.

8-16 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

2. Disadvantages of LIFO.

a. Reduced earnings. During times of rising prices, reported earnings under LIFO

are less than they would be under FIFO. However, because the IRS has now

relaxed the LIFO conformity rule, companies are permitted to make supplementary

disclosure of non-LIFO income numbers in the financial statements.

b. Inventory understated. Under LIFO, the oldest costs (which are the lowest costs

if prices are rising) remain in inventory.

c. Physical flow. LIFO does not approximate the actual physical flow of items except

in unusual situations.

d. Involuntary liquidation. If layers of old costs are eliminated, distortions in re-

ported income can occur.

e. Poor buying habits. A company may adopt an uneconomic pattern of purchases

in order to avoid the liquidation problem or in order to manipulate net income.

K. (L.O. 10) Why companies select given inventory methods.

1. LIFO will be the preferred method if:

a. Selling prices and revenues have been increasing faster than costs, and

b. A company has a fairly constant base stock.

2. LIFO would not be the preferred method if:

a. Prices tend to lag behind costs.

b. Specific identification is traditional.

c. Unit costs tend to decrease as production increases, thereby nullifying the tax

benefit that LIFO might provide.

Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-17

ILLUSTRATION 8-1

INVENTORY RECORDING SYSTEMS

8-18 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

ILLUSTRATION 8-2

ADJUSTING AND CLOSING THE INVENTORY ACCOUNTS

Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-19

ILLUSTRATION 8-3

EFFECT OF INVENTORY ERRORS

8-20 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

ILLUSTRATION 8-4

COMPUTATION OF ENDING INVENTORY

Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only) 8-21

ILLUSTRATION 8-5

DOLLAR-VALUE LIFO

8-22 Copyright 2012 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 14/e Instructors Manual (For Instructor Use Only)

ILLUSTRATION 8-6

COMPARISON OF UNIT LIFO AND DOLLAR-VALUE LIFO

Das könnte Ihnen auch gefallen

- Solutions To CH 8 A ExercisesDokument32 SeitenSolutions To CH 8 A ExercisesJavier TsangNoch keine Bewertungen

- Unit V Study GuideDokument4 SeitenUnit V Study GuideVirginia TownzenNoch keine Bewertungen

- Learning Objectives: Valuation of Inventories: A Cost - Basis ApproachDokument7 SeitenLearning Objectives: Valuation of Inventories: A Cost - Basis ApproachSuraj NamdeoNoch keine Bewertungen

- MBAO-107 AssignmentDokument8 SeitenMBAO-107 AssignmentramtgemNoch keine Bewertungen

- CH 15Dokument28 SeitenCH 15refa260894Noch keine Bewertungen

- Inventory Management in LiberyDokument101 SeitenInventory Management in LiberySamuel DavisNoch keine Bewertungen

- Intermediate I Chapter 8Dokument45 SeitenIntermediate I Chapter 8Aarti JNoch keine Bewertungen

- Intermediate AccountingDokument68 SeitenIntermediate Accountingsyifa fatimatuzahraNoch keine Bewertungen

- Ch13 Wiley Plus Wk3Dokument58 SeitenCh13 Wiley Plus Wk3Prakash VaidhyanathanNoch keine Bewertungen

- Valuation of Inventories: A Cost-Basis Approach: Learning ObjectivesDokument59 SeitenValuation of Inventories: A Cost-Basis Approach: Learning ObjectivesSunny SunnyNoch keine Bewertungen

- Wey Fin 11e SM Ch06Dokument66 SeitenWey Fin 11e SM Ch06Muhammad Farhan AliNoch keine Bewertungen

- PorterSM05final FinAccDokument67 SeitenPorterSM05final FinAccGemini_0804100% (2)

- Kate Palarca g9 MinecraftDokument4 SeitenKate Palarca g9 MinecraftRoland RodriguezNoch keine Bewertungen

- Valuation of Inventories A Cost-Basis ApproachDokument46 SeitenValuation of Inventories A Cost-Basis ApproachIrwan JanuarNoch keine Bewertungen

- Material Management of Mahalaxmi Industries.Dokument14 SeitenMaterial Management of Mahalaxmi Industries.Groot AvengerNoch keine Bewertungen

- Principles of Accounting 11th Edition Needles Solutions ManualDokument15 SeitenPrinciples of Accounting 11th Edition Needles Solutions Manualbrainykabassoullw100% (17)

- Principles of Accounting 11Th Edition Needles Solutions Manual Full Chapter PDFDokument36 SeitenPrinciples of Accounting 11Th Edition Needles Solutions Manual Full Chapter PDFgestantasbesti.nevd100% (9)

- Inventory ManagementDokument17 SeitenInventory ManagementRyan RodriguesNoch keine Bewertungen

- CH 06 SMDokument94 SeitenCH 06 SMapi-234680678Noch keine Bewertungen

- Intermediate Accounting Ifrs 3Rd Edition Kieso Solutions Manual Full Chapter PDFDokument67 SeitenIntermediate Accounting Ifrs 3Rd Edition Kieso Solutions Manual Full Chapter PDFchanelleeymanvip100% (10)

- Intermediate Accounting Ifrs 3rd Edition Kieso Solutions ManualDokument38 SeitenIntermediate Accounting Ifrs 3rd Edition Kieso Solutions Manualrococosoggy74yw6m100% (17)

- Financial Statement Analysis: Assignment Classification TableDokument54 SeitenFinancial Statement Analysis: Assignment Classification TableJolie PhamNoch keine Bewertungen

- CH 08Dokument52 SeitenCH 08Cyrus Zack100% (5)

- Intermediate Accounting Ifrs 3rd Edition Kieso Solutions ManualDokument21 SeitenIntermediate Accounting Ifrs 3rd Edition Kieso Solutions ManualMichaelOrtizkgqdz94% (17)

- S.amutha A Study On Inventory Management in Izon Technologies Ramco Cement LimitedDokument30 SeitenS.amutha A Study On Inventory Management in Izon Technologies Ramco Cement LimitedeswariNoch keine Bewertungen

- Module 09Dokument53 SeitenModule 09samaanNoch keine Bewertungen

- Inventory Management Efficiency Analysis: A Case Study of An SME CompanyDokument7 SeitenInventory Management Efficiency Analysis: A Case Study of An SME Companybaya alexNoch keine Bewertungen

- Inventory ManagementDokument12 SeitenInventory ManagementnensimaeNoch keine Bewertungen

- Intermediate Accounting Ifrs 3rd Edition Kieso Solutions ManualDokument35 SeitenIntermediate Accounting Ifrs 3rd Edition Kieso Solutions Manualsportfulscenefulzb3nhNoch keine Bewertungen

- Chapter 8 Valuation of InventoriesDokument39 SeitenChapter 8 Valuation of InventoriesMichelle Joy Nuyad-Pantinople100% (1)

- Financial Reporting and Accounting Standards: Assignment Classification TableDokument20 SeitenFinancial Reporting and Accounting Standards: Assignment Classification TableChing Yin HoNoch keine Bewertungen

- CH 01Dokument20 SeitenCH 01Sinta Ayu HikmahNoch keine Bewertungen

- ACC101 Ch. 13Dokument60 SeitenACC101 Ch. 13hira_naz86Noch keine Bewertungen

- ch03 Part1Dokument6 Seitench03 Part1Sergio HoffmanNoch keine Bewertungen

- Course Out Line For Exit Exam CoursesDokument26 SeitenCourse Out Line For Exit Exam Coursesnatinaelbahiru74Noch keine Bewertungen

- Om Final WorkDokument24 SeitenOm Final WorkhuleNoch keine Bewertungen

- Inventory StrategyDokument27 SeitenInventory Strategyut123Noch keine Bewertungen

- Chapter 08 Solutions ManualDokument67 SeitenChapter 08 Solutions ManualRabiaAjmalNoch keine Bewertungen

- ACCT6065 Course SyllabusSpring2021132021Dokument5 SeitenACCT6065 Course SyllabusSpring2021132021Michael PironeNoch keine Bewertungen

- Accounting Principles Chapter 4 SolutionDokument124 SeitenAccounting Principles Chapter 4 SolutionHansAxel53% (34)

- Inventory Accounting: A Comprehensive GuideVon EverandInventory Accounting: A Comprehensive GuideBewertung: 5 von 5 Sternen5/5 (1)

- Transcript For Lecture Video 1Dokument5 SeitenTranscript For Lecture Video 1StaygoldNoch keine Bewertungen

- ch04 PDFDokument100 Seitench04 PDFChang Chan ChongNoch keine Bewertungen

- Dmp3e Ch07 Solutions 01.28.10 FinalDokument26 SeitenDmp3e Ch07 Solutions 01.28.10 Finalmichaelkwok1Noch keine Bewertungen

- Wiley - Chapter 8: Valuation of Inventories: A Cost-Basis ApproachDokument23 SeitenWiley - Chapter 8: Valuation of Inventories: A Cost-Basis ApproachIvan Bliminse100% (1)

- ch001 - Kieso WeygandtDokument26 Seitench001 - Kieso WeygandtceilhynNoch keine Bewertungen

- Inventory Management: Anoop P. SDokument45 SeitenInventory Management: Anoop P. Sgowthamam0809Noch keine Bewertungen

- Dmp3e Ch05 Solutions 02.28.10 FinalDokument37 SeitenDmp3e Ch05 Solutions 02.28.10 Finalmichaelkwok1Noch keine Bewertungen

- Essentials of Financial Statement Analysis: Revsine/Collins/Johnson/Mittelstaedt: Chapter 5Dokument16 SeitenEssentials of Financial Statement Analysis: Revsine/Collins/Johnson/Mittelstaedt: Chapter 51220helen2000Noch keine Bewertungen

- Chapter 14 Managerial AccountingDokument55 SeitenChapter 14 Managerial Accountingcaliqueen910% (4)

- Chap 017 AccDokument47 SeitenChap 017 Acckaren_park1Noch keine Bewertungen

- Throughput Accounting: A Guide to Constraint ManagementVon EverandThroughput Accounting: A Guide to Constraint ManagementNoch keine Bewertungen

- Guide to Management Accounting Inventory turnover for managersVon EverandGuide to Management Accounting Inventory turnover for managersNoch keine Bewertungen

- Guide to Management Accounting Inventory turnover for managers: Theory & Practice: How to utilize management indicators to assist decision-makingVon EverandGuide to Management Accounting Inventory turnover for managers: Theory & Practice: How to utilize management indicators to assist decision-makingNoch keine Bewertungen

- Surviving the Spare Parts Crisis: Maintenance Storeroom and Inventory ControlVon EverandSurviving the Spare Parts Crisis: Maintenance Storeroom and Inventory ControlNoch keine Bewertungen

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementVon EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNoch keine Bewertungen

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerVon EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNoch keine Bewertungen

- استراتيجية المحاضرة الثالثةDokument32 Seitenاستراتيجية المحاضرة الثالثةAbdalelah FrarjehNoch keine Bewertungen

- Financial Statement Analysis: Prepared By: Abdulelah FararjehDokument25 SeitenFinancial Statement Analysis: Prepared By: Abdulelah FararjehAbdalelah Frarjeh100% (1)

- Capital Budgeting Cash Flows: Learning GoalsDokument39 SeitenCapital Budgeting Cash Flows: Learning GoalsChristian John Linalcoso AranteNoch keine Bewertungen

- نظم111111Dokument5 Seitenنظم111111Abdalelah FrarjehNoch keine Bewertungen

- What Is The Difference Between NormativeDokument2 SeitenWhat Is The Difference Between NormativeAbdalelah FrarjehNoch keine Bewertungen

- R Financial Accounting Theory and Analysis Text and Cases 11th EditionDokument21 SeitenR Financial Accounting Theory and Analysis Text and Cases 11th EditionAbdalelah FrarjehNoch keine Bewertungen

- Big DataDokument40 SeitenBig Dataalwida100% (1)

- Ch2 The Conceptual Framework Project TesDokument15 SeitenCh2 The Conceptual Framework Project TesAbdalelah FrarjehNoch keine Bewertungen

- DTGHRTHGRTHCVB FGHB FHGBRT FGHBRTGRTHR B RFTHBRTG FTHBRTDokument1 SeiteDTGHRTHGRTHCVB FGHB FHGBRT FGHBRTGRTHR B RFTHBRTG FTHBRTAbdalelah FrarjehNoch keine Bewertungen

- Marketing Chapter 3 P PTDokument33 SeitenMarketing Chapter 3 P PTAbdalelah FrarjehNoch keine Bewertungen

- Marketing Chapter 3 P PTDokument33 SeitenMarketing Chapter 3 P PTAbdalelah FrarjehNoch keine Bewertungen

- Big Data Application in Business and AccountingDokument16 SeitenBig Data Application in Business and AccountingAbdalelah FrarjehNoch keine Bewertungen

- Arens Chapter15Dokument43 SeitenArens Chapter15Abdalelah FrarjehNoch keine Bewertungen

- Chapter 4 - Test BankDokument28 SeitenChapter 4 - Test BankJoseph Gaspard85% (13)

- CH 10Dokument4 SeitenCH 10Abdalelah FrarjehNoch keine Bewertungen

- Dilutive Securities and Earnings Per Share: Convertible BondsDokument29 SeitenDilutive Securities and Earnings Per Share: Convertible BondsAbdalelah FrarjehNoch keine Bewertungen

- Legal Liability Considerations For AuditorsDokument44 SeitenLegal Liability Considerations For AuditorsAbdalelah FrarjehNoch keine Bewertungen

- Chap 009Dokument51 SeitenChap 009Abdalelah FrarjehNoch keine Bewertungen

- Chapter 1 - Auditing and Assurance ServicesDokument27 SeitenChapter 1 - Auditing and Assurance ServicesSa Sa XiaoNoch keine Bewertungen

- Solutions CH 14Dokument63 SeitenSolutions CH 14Abdalelah FrarjehNoch keine Bewertungen

- 16-Sampling Designs and ProceduresDokument27 Seiten16-Sampling Designs and ProceduresAbdalelah FrarjehNoch keine Bewertungen

- CH 10Dokument4 SeitenCH 10Abdalelah FrarjehNoch keine Bewertungen

- Business Research Methods: Basic Data Analysis: Descriptive StatisticsDokument31 SeitenBusiness Research Methods: Basic Data Analysis: Descriptive StatisticsAbdalelah FrarjehNoch keine Bewertungen

- Intermediate Accouting Testbank ch13Dokument23 SeitenIntermediate Accouting Testbank ch13cthunder_192% (12)

- CH 07Dokument61 SeitenCH 07Abdalelah FrarjehNoch keine Bewertungen

- Intermediate Accouting Testbank ch13Dokument23 SeitenIntermediate Accouting Testbank ch13cthunder_192% (12)

- CH 10Dokument52 SeitenCH 10Abdalelah FrarjehNoch keine Bewertungen

- Hello WoldDokument1 SeiteHello WoldAbdalelah FrarjehNoch keine Bewertungen

- Hello WoldDokument1 SeiteHello WoldAbdalelah FrarjehNoch keine Bewertungen

- 5.4-Case Study APA Paper 11-3 and 13-6 - SampleDokument10 Seiten5.4-Case Study APA Paper 11-3 and 13-6 - SampleSMWNoch keine Bewertungen

- CASHFLOW TemplateDokument6 SeitenCASHFLOW Templatemilabol100% (1)

- Sample Business PlanDokument17 SeitenSample Business PlanNikita Garg95% (60)

- Advanced Tally MCQ Original - WatermarkDokument90 SeitenAdvanced Tally MCQ Original - WatermarkVinod RathodNoch keine Bewertungen

- PartnershipDokument9 SeitenPartnershipGrace A. ManaloNoch keine Bewertungen

- Financial Accounting MasterDokument80 SeitenFinancial Accounting Mastertimbuc202Noch keine Bewertungen

- Jawaban Soal No. 1 Jurnal Koreksi A) Sebelum Penutupan BukuDokument13 SeitenJawaban Soal No. 1 Jurnal Koreksi A) Sebelum Penutupan BukuAbdurahman YafieNoch keine Bewertungen

- PVP PayrollDokument4 SeitenPVP Payrollkim berlyNoch keine Bewertungen

- Tugas 5Dokument17 SeitenTugas 5Syafiq RamadhanNoch keine Bewertungen

- Accounting (IAS) /series 4 2007 (Code3901)Dokument17 SeitenAccounting (IAS) /series 4 2007 (Code3901)Hein Linn Kyaw0% (1)

- CA IPCC Accounting Guideline Answers May 2015Dokument24 SeitenCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNoch keine Bewertungen

- Rapid Review Kieso v1Dokument12 SeitenRapid Review Kieso v1mehmood981460Noch keine Bewertungen

- Financial Statements of A CompanyDokument34 SeitenFinancial Statements of A CompanykingNoch keine Bewertungen

- CH 09Dokument35 SeitenCH 09ReneeNoch keine Bewertungen

- Sap Chart of AccountsDokument10 SeitenSap Chart of AccountsNaseer Sap100% (1)

- Chapter Seven: Basic Accounting Principles & Budgeting FundamentalsDokument35 SeitenChapter Seven: Basic Accounting Principles & Budgeting FundamentalsbelaynehNoch keine Bewertungen

- Chapter 1 Basic Concepts of Accounting: (A) Business Decision (B) Planning (C) Organizing (D) StrategyDokument604 SeitenChapter 1 Basic Concepts of Accounting: (A) Business Decision (B) Planning (C) Organizing (D) StrategyAkshada BidkarNoch keine Bewertungen

- Business Model and Financial Projection of Caneblast JuiceDokument16 SeitenBusiness Model and Financial Projection of Caneblast Juiceankita sharmaNoch keine Bewertungen

- Unit 3 Revision QuestionsDokument9 SeitenUnit 3 Revision QuestionsKhalifa Al HanaeeNoch keine Bewertungen

- Intermediate Accounting 3 Part 1 Cash Flows Objectives of Cash Flow StatementDokument15 SeitenIntermediate Accounting 3 Part 1 Cash Flows Objectives of Cash Flow StatementMJ Legaspi0% (1)

- Black NikeDokument154 SeitenBlack NikeJoshua LauraNoch keine Bewertungen

- Following Your Retirement As Senior Vice President of Finance ForDokument1 SeiteFollowing Your Retirement As Senior Vice President of Finance Fortrilocksp SinghNoch keine Bewertungen

- Cenizabusinessplan 2Dokument68 SeitenCenizabusinessplan 2Dexterr DivinooNoch keine Bewertungen

- Corporations NotesDokument112 SeitenCorporations NotesLaura CNoch keine Bewertungen

- Income Statement, Its Elements, Usefulness and LimitationsDokument5 SeitenIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNoch keine Bewertungen

- Profit & Loss (Standard) : Resa Harisma 195154024Dokument1 SeiteProfit & Loss (Standard) : Resa Harisma 195154024Bikin OrtubanggaNoch keine Bewertungen

- Etextbook 978 1305947771 Century 21 Accounting General Journal Copyright UpdateDokument61 SeitenEtextbook 978 1305947771 Century 21 Accounting General Journal Copyright Updatemaryann.atkins290100% (42)

- 1-Intro-Professional Practice BSR659Dokument7 Seiten1-Intro-Professional Practice BSR659Qila HusinNoch keine Bewertungen

- Level Up Bookstore Income Statement For The Year Ended 31 December 2019Dokument4 SeitenLevel Up Bookstore Income Statement For The Year Ended 31 December 2019John TeyNoch keine Bewertungen

- Mainstream Institute (Sap Finance & Controlling) : Course ContentDokument7 SeitenMainstream Institute (Sap Finance & Controlling) : Course ContentMD RehanNoch keine Bewertungen