Beruflich Dokumente

Kultur Dokumente

Case 1 Quizz

Hochgeladen von

Carlos Rafael Angeles GuzmanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Case 1 Quizz

Hochgeladen von

Carlos Rafael Angeles GuzmanCopyright:

Verfügbare Formate

Carlos Rafael Angeles Guzman A01098165

Case 1: Quizz

1. What is the possible meaning of the changes in stock price for Berkshire

Hathaway and Scottish Power plc on the day of the acquisition announcement?

Specifically, what does the $2.55 billion gain in Berkshires market value of

equity imply about the intrinsic value of PacifiCorp?

Berkshire was more diversified after the acquisition and the stock price increase.

The intrinsic value of Pacific Corp was good.

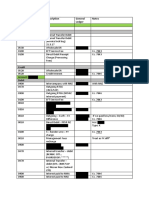

2. Based on the multiples for comparable regulated utilities, what is the range of

possible values for PacifiCorp? What questions might you have about this

range?

The implied value of PacifiCorp is giving bad results for range of revenue as

compared to EBIT, EBITDA and Net income. Its expected to be good results:

Revenue > EBITDA > EBIT > NI

3. Assess the bid for PacifiCorp. How does it compare with the firms intrinsic value

perform a simple discounted cash-flow (DCF) analysis.

4. How well has Berkshire Hathaway performed? How well has it performed in the

aggregate? What about its investment in MidAmerican Energy Holdings?

Berkshire Hathaway has consistently outperformed the market since its

inception in 1965. In 1977, the firms year end closing share price was $107; on

May 24, 2005 the closing price on its Class A shares reached $85,500.

5. What is your assessment of Berkshires investments in Buffetts Big Four:

American Express, Coca-Cola, Gillette, and Wells Fargo?

They invested in successful firms. The total cost to Berkshires investment in the

Big 4 was $3.832 Billion, but the market value of their investment was $24.681

Billion. This means that Berkshires current gain on their investment in the big 4

is $20.849 Billion.

6. From Warren Buffetts perspective, what is the intrinsic value? Why is it

accorded such importance? How is it estimated? What are the alternatives to

intrinsic value? Why does Buffett reject them?

The discounted value of the cash that can be taken out of a business during its

remaining life. Intrinsic value is per-share progress. Buffett assessed intrinsic

value as the present value of future expected performance.

7. Critically assess Buffetts investment philosophy. Identify points where you

agree and disagree with him.

The invest strategies of Buffets seems easier than others investors that make

very complex financial analysis but most investors focus on financial statements

and net profit, but dont take into consideration intangible assets such as

management experience and patents. Buffet considers the intrinsic value of the

investment and analyses intangible aspects as well as financial aspects.

8. Should Berkshire Hathaways shareholders endorse the acquisition of

PacifiCorp?

PacifiCorps intrinsic value is comparable to the industry, Berkshire is not adding

much more risk to their portfolio and its provide a stable long term investment

for the future.

Das könnte Ihnen auch gefallen

- Warren E Buffet CaseDokument14 SeitenWarren E Buffet CaseAyu Eka Putri100% (1)

- Caso 1Dokument7 SeitenCaso 1Carlos Rafael Angeles GuzmanNoch keine Bewertungen

- Caso 1 - Warren E Buffett 2005Dokument11 SeitenCaso 1 - Warren E Buffett 2005Al Aquino40% (5)

- Warren Buffett Presentation v3Dokument25 SeitenWarren Buffett Presentation v3Sisi Ye50% (2)

- Warren E BuffetDokument13 SeitenWarren E BuffetAyu Eka Putri67% (3)

- Week 1 GroupDokument2 SeitenWeek 1 GroupConner Becker100% (1)

- Green Shoe Option in India An AnalysisDokument12 SeitenGreen Shoe Option in India An Analysisnidhi23880% (1)

- AmulDokument48 SeitenAmulAmit Yadav0% (1)

- Green Shoe OptionDokument19 SeitenGreen Shoe OptionPROFas100% (1)

- Transparent Value PresentationDokument13 SeitenTransparent Value PresentationashwiniharitwalNoch keine Bewertungen

- HRM Final Version AnDokument12 SeitenHRM Final Version AnAhmed NounouNoch keine Bewertungen

- BECG Group No.7 - INFOSYSDokument2 SeitenBECG Group No.7 - INFOSYSAmit BhalaniNoch keine Bewertungen

- Chapter 18 AnsDokument74 SeitenChapter 18 AnsLuisLoNoch keine Bewertungen

- Case Studies - Culture in Mergers and AcquisitionsDokument8 SeitenCase Studies - Culture in Mergers and AcquisitionsVeronica ȚărușNoch keine Bewertungen

- Nalysis of Aravind Eye Care SystemDokument3 SeitenNalysis of Aravind Eye Care SystemDipesh Walia0% (1)

- SVCM - Group 4 - Case 3Dokument2 SeitenSVCM - Group 4 - Case 3NehaTaneja0% (1)

- GMO Case FinalDokument22 SeitenGMO Case Finalmurary123Noch keine Bewertungen

- Group Tata CorusDokument29 SeitenGroup Tata CorusbarphaniNoch keine Bewertungen

- Section A - Group 2 - PRA 8Dokument5 SeitenSection A - Group 2 - PRA 8sakshi agarwalNoch keine Bewertungen

- Gap Analysis: LegendDokument7 SeitenGap Analysis: LegendAravind GovindarajuNoch keine Bewertungen

- Sealed Air Corp Case Write Up PDFDokument3 SeitenSealed Air Corp Case Write Up PDFRamjiNoch keine Bewertungen

- Williams 2002: - A Case On Financial DistressDokument18 SeitenWilliams 2002: - A Case On Financial DistressGmitNoch keine Bewertungen

- Krispy Kreme Doughnuts: "It Ain't Just The Doughnuts That Are Glazed!"Dokument9 SeitenKrispy Kreme Doughnuts: "It Ain't Just The Doughnuts That Are Glazed!"dmaia12Noch keine Bewertungen

- Summit Distributors Case Analysis: Lifo Vs Fifo: Bryant Clinton, Minjing Sun, Michael Crouse MBA 702-51 Professor SafdarDokument4 SeitenSummit Distributors Case Analysis: Lifo Vs Fifo: Bryant Clinton, Minjing Sun, Michael Crouse MBA 702-51 Professor SafdarKhushbooNoch keine Bewertungen

- Gainesboro Machine ToolsDokument2 SeitenGainesboro Machine ToolsedselNoch keine Bewertungen

- Intel Case StudyDokument6 SeitenIntel Case StudyhazryleNoch keine Bewertungen

- Project On Parag MilkDokument74 SeitenProject On Parag MilkraisNoch keine Bewertungen

- Innocents Abroad: Currencies and International Stock ReturnsDokument24 SeitenInnocents Abroad: Currencies and International Stock ReturnsGragnor PrideNoch keine Bewertungen

- Investors' Attitude Towards Investment Decisions in Equity MarketDokument3 SeitenInvestors' Attitude Towards Investment Decisions in Equity MarketEditor IJTSRDNoch keine Bewertungen

- Impairing The Microsoft - Nokia PairingDokument54 SeitenImpairing The Microsoft - Nokia Pairingjk kumarNoch keine Bewertungen

- DuPont AnalysisDokument3 SeitenDuPont AnalysisChirag JainNoch keine Bewertungen

- Warren Buffett Case AnswerDokument5 SeitenWarren Buffett Case Answeryunn lopNoch keine Bewertungen

- Swati Anand - FRMcaseDokument5 SeitenSwati Anand - FRMcaseBhavin MohiteNoch keine Bewertungen

- Analysis of PepsiCo's Acquisition of Quaker OaksDokument2 SeitenAnalysis of PepsiCo's Acquisition of Quaker Oaksaza_ma100% (2)

- Capital Budgeting Modify 1Dokument72 SeitenCapital Budgeting Modify 1bhaskarganeshNoch keine Bewertungen

- Buffett CaseDokument15 SeitenBuffett CaseElizabeth MillerNoch keine Bewertungen

- AkilAfzal ZR2001040 FinalDokument4 SeitenAkilAfzal ZR2001040 FinalAkil AfzalNoch keine Bewertungen

- Orvana Minerals Report Stonecap SecuritiesDokument22 SeitenOrvana Minerals Report Stonecap SecuritiesOld School ValueNoch keine Bewertungen

- Take Home Quiz: This Study Resource WasDokument4 SeitenTake Home Quiz: This Study Resource Wasகப்பல்ஹசன்நபி0% (1)

- NSB Project Report PDFDokument233 SeitenNSB Project Report PDFfriendbce100% (1)

- A Study On Leveraged Buyout's in IndiaDokument60 SeitenA Study On Leveraged Buyout's in Indiavinodab150% (2)

- Tata Motors ValuationDokument38 SeitenTata Motors ValuationAkshat JainNoch keine Bewertungen

- Koito Case UploadDokument11 SeitenKoito Case UploadJurjen van der WerfNoch keine Bewertungen

- Kraft Heinz Investor PresentationDokument34 SeitenKraft Heinz Investor PresentationCanadianValue100% (1)

- Answer Costs of Al Shaheer Corporation Going PublicDokument3 SeitenAnswer Costs of Al Shaheer Corporation Going PublicSyed Saqlain Raza JafriNoch keine Bewertungen

- Koito Case Questions 2,3,4Dokument2 SeitenKoito Case Questions 2,3,4Simo RajyNoch keine Bewertungen

- ACC Cement Research Report and Equity ValuationDokument12 SeitenACC Cement Research Report and Equity ValuationSougata RoyNoch keine Bewertungen

- Beta Case Study (Nirbhay Chauhan)Dokument10 SeitenBeta Case Study (Nirbhay Chauhan)Nirbhay ChauhanNoch keine Bewertungen

- Assignment Solution Finance 29-9-16Dokument16 SeitenAssignment Solution Finance 29-9-16Mudassir AliNoch keine Bewertungen

- Marriott CaseDokument1 SeiteMarriott CasejenniferNoch keine Bewertungen

- Case QuestionsDokument5 SeitenCase Questionschoijin9870% (1)

- Jaga: Managing Creativity and Open Innovation: Neelu, Parthib, Saurabh, Shikhar, Yash SagarDokument22 SeitenJaga: Managing Creativity and Open Innovation: Neelu, Parthib, Saurabh, Shikhar, Yash SagarSAURABH YADAVNoch keine Bewertungen

- OverviewDokument18 SeitenOverviewGaurav SinghNoch keine Bewertungen

- Case Study DotcomDokument35 SeitenCase Study DotcomAman AnandNoch keine Bewertungen

- Product Availability in SCMDokument25 SeitenProduct Availability in SCMNiranjan ThirNoch keine Bewertungen

- Diversification of Horlicks BrandDokument12 SeitenDiversification of Horlicks Branddeepak_hariNoch keine Bewertungen

- Berkshire HathawayDokument4 SeitenBerkshire HathawayHasna Nurul Fitri100% (1)

- Capital Market Analysis - Warren BuffettDokument10 SeitenCapital Market Analysis - Warren BuffettAnthony KwoNoch keine Bewertungen

- Warren BuffetDokument15 SeitenWarren BuffetRom Aure100% (4)

- Summary of Letters To Shareholders Berkshathway - 2003Dokument5 SeitenSummary of Letters To Shareholders Berkshathway - 2003sakshijaiswal1104Noch keine Bewertungen

- Quiz - iCPA PDFDokument14 SeitenQuiz - iCPA PDFCharlotte Canabang AmmadangNoch keine Bewertungen

- Public Prosecutor V Phua Keng TongDokument2 SeitenPublic Prosecutor V Phua Keng TongPhilip TanNoch keine Bewertungen

- YONO SBI - Final QuestionnaireDokument3 SeitenYONO SBI - Final QuestionnaireMusic & Art0% (2)

- Balancing Cash HoldingsDokument14 SeitenBalancing Cash HoldingsMelese AberaNoch keine Bewertungen

- Calamba T-37-ND 042823Dokument23 SeitenCalamba T-37-ND 042823Pajoe DrizNoch keine Bewertungen

- Mod 1 Answers - Valuations and ConceptsDokument3 SeitenMod 1 Answers - Valuations and Conceptsvenice cambryNoch keine Bewertungen

- Maldives Islamic Bank Appoints New CEO and Head of Office in Hulhumale AishathDokument1 SeiteMaldives Islamic Bank Appoints New CEO and Head of Office in Hulhumale AishathMH DataNoch keine Bewertungen

- Chapter 9 Solution Manual MacroDokument5 SeitenChapter 9 Solution Manual MacroMega Pop LockerNoch keine Bewertungen

- The General Banking Law of 2000 Section 35 To Section 66Dokument14 SeitenThe General Banking Law of 2000 Section 35 To Section 66Carina Amor ClaveriaNoch keine Bewertungen

- Practice Final Exam - FL2020.B52.FIN.448.02 & 03 - Advanced Financial ManagementDokument12 SeitenPractice Final Exam - FL2020.B52.FIN.448.02 & 03 - Advanced Financial ManagementMay ChenNoch keine Bewertungen

- INFO8000 Fall 2023 Individual Assignment-2Dokument2 SeitenINFO8000 Fall 2023 Individual Assignment-2kaurrrjass1125Noch keine Bewertungen

- Jul-21 Company Name Claim Buddy Numbers From Ir Base Year Below (In Consistent Units) This YearDokument32 SeitenJul-21 Company Name Claim Buddy Numbers From Ir Base Year Below (In Consistent Units) This YearProtyay ChakrabortyNoch keine Bewertungen

- Course Module 5 Mathematics of InvestmentDokument22 SeitenCourse Module 5 Mathematics of InvestmentAnne Maerick Jersey OteroNoch keine Bewertungen

- Chapter 7 - Clubbing of Income - NotesDokument17 SeitenChapter 7 - Clubbing of Income - NotesRahul TiwariNoch keine Bewertungen

- Sap Guide 2 0 1Dokument13 SeitenSap Guide 2 0 1api-359265393Noch keine Bewertungen

- GmailDokument4 SeitenGmailmoNoch keine Bewertungen

- X-Ray of Economic Implications of Corruption in Nigerian EconomyDokument20 SeitenX-Ray of Economic Implications of Corruption in Nigerian EconomyOdinakachi100% (1)

- Monetary PolicyDokument10 SeitenMonetary PolicyAshish MisraNoch keine Bewertungen

- Treasury Management AssignmentDokument11 SeitenTreasury Management AssignmentBulshaale Binu Bulshaale100% (1)

- Strategic ManagementDokument23 SeitenStrategic ManagementPhio Josh JarlegoNoch keine Bewertungen

- Literature Review Foriegn ExchangeDokument9 SeitenLiterature Review Foriegn Exchangeonline free projects0% (1)

- Project On Mutual Funds As An Investment AvenueDokument18 SeitenProject On Mutual Funds As An Investment AvenueRishi vardhiniNoch keine Bewertungen

- Classification of Riba: (A) Riba-un-Nasiyah or Riba-al-Jahiliya (B) Riba-al-Fadl or Riba-al-BaiDokument25 SeitenClassification of Riba: (A) Riba-un-Nasiyah or Riba-al-Jahiliya (B) Riba-al-Fadl or Riba-al-Baiatifkhan890572267% (3)

- Fii & Stock MKTDokument9 SeitenFii & Stock MKTKiran PawarNoch keine Bewertungen

- DisinvestmentDokument15 SeitenDisinvestmentjeevithajeevuNoch keine Bewertungen

- Bonds & Their Valuation: Charak RAYDokument43 SeitenBonds & Their Valuation: Charak RAYCHARAK RAYNoch keine Bewertungen

- GreeksDokument23 SeitenGreekscharandeep1985Noch keine Bewertungen

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument33 SeitenDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceawadhNoch keine Bewertungen

- Bruno - Gomes Statement 2021 07Dokument4 SeitenBruno - Gomes Statement 2021 07B gNoch keine Bewertungen

- AEC 103 - Intermediate Accounting: Assignment 3 Accounts Receivable and Estimation of Doubtful AccountDokument4 SeitenAEC 103 - Intermediate Accounting: Assignment 3 Accounts Receivable and Estimation of Doubtful Accountjames bryan angklaNoch keine Bewertungen