Beruflich Dokumente

Kultur Dokumente

Asahi Glass Case - BEST

Hochgeladen von

Cat0%(1)0% fanden dieses Dokument nützlich (1 Abstimmung)

2K Ansichten23 SeitenAsahi case study

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAsahi case study

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0%(1)0% fanden dieses Dokument nützlich (1 Abstimmung)

2K Ansichten23 SeitenAsahi Glass Case - BEST

Hochgeladen von

CatAsahi case study

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 23

Nova School of Business and Economics

Spring Semester 2012

Applied Corporate Finance

Asahi Glass Case: Implementing EVA

Professor: Jos Neves Adelino

Graders: Carla Peixoto and Andr Fernando

Group 12:

Filipa Gomes #440

Guilherme Ribeiro Pereira #474

Marta Cachola #437

Nuno Vasconcellos e S #494

Teresa Cortez #395

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 2

Executive Summary

Asahi Glass Company (AGC) is a Japanese-based multinational manufacturer of flat

glass, chemicals, electronics and displays and other materials. In 1998, Mrs. Shinya Ishizu

was appointed the CEO of this global company, ranked as the sixth largest among all the

Japanese companies. As soon as he occupied the chair, Mrs. Ishizu started implementing

some drastic changes in the companys structure and corporate governance with the purpose

of making AGC an international and globalized entity.

The Japanese market and culture is a particular one, which makes the implementation

of changes really hard and complex. As far as corporate governance is concerned, the

Japanese culture revealed that the bank with the strongest relationship, also known as the

main bank, had an active role in the company, closely monitoring and intervening in case of

financial distress. With the deregulation of the capital markets and the crisis in the early 90s,

these systems gradually disappeared giving more relevance to credit rating agencies and less

to banks. Subsequently, the focus of corporate governance shifted towards

internationalization and opened the circle to outsiders, which was exactly the case of AGC.

By combining Ishizus goals and the shift in the Japanese corporate governance culture, AGC

saw a makeover in its business strategy with the creation of in-house companies, a reform

in its corporate governance structure and an introduction of a new management performance

measure system.

The new compensation scheme was based on Economic Value Added (EVA) that

evaluates employees, at large, accordingly to their value creation contribution to the overall

company. More broadly, EVA represents the portion of free cash flows after a capital charge

is deducted. An EVA-based performance measurement system can become very complex,

since the computation of its components (NOPAT, capital employed and cost of capital)

requires adjustments. The difficulties in measuring EVAs components at market values,

associated with the inconsistent accounting standards represent the main challenges when

implementing EVA. At AGC, the EVA system presented an extra handicap since the

incentives scheme was designed based on an EVA calculated with a single Cost of Capital

and Tax Rate for the whole firm. These types of compensation mechanisms should have a

slice and dice approach that consists in evaluating managers according to their regions and

business units ability of creating value.

After aligning all the companys strategic reposition with the EVA-based

compensation system, AGC would consist in an interesting and appealing investment. The

new management performance measurement plan would properly reduce agency problems,

limit the companys risk exposure, prevent managers short-run goals, and efficiently allocate

resources within the company. Bottom line, employees would more easily perceive the value

that they are creating and, at the same time, maximizing shareholders value would become

their forthcoming goal.

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 3

Index

Executive Summary............2

Problem Statement..............................................................................................4

Corporate Governance Systems in Japan & Main-bank Relationships..................................4

Corporate Governance Systems in Japan........................................................................4

Main-bank Relationships............................................................................................4

Organizational and Cultural Changes.....6

The Changes and inherent boosters........6

The obstacles...7

Economical Value Added (EVA)...............................................................................................8

EVAs Components....9

EVA versus NPV....9

EVAs Uses....9

Advantages of EVA Performance Measurement Systems....10

Challenges when Implementing EVA..11

The EVA Systems in Asahi Glass....11

How did AGC implement EVA systems?........11

Measuring EVA at AGC...............................................................................................11

AGCs Challenges when Implementing EVA Systems....14

Recommendations AGC: Buy or not to buy?........................16

Appendixes...17

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 4

Problem Statement

Asahi Glass Companys founder Toshiya Iwasaki frequently used the moto Never

take the easy way out, but confront difficulties to describe the corporate culture he had built.

Almost a century later, President and CEO Shinya Ishizu saw himself forced to cope with it as

he was confronted with the need to modify the companys structure and culture, in order to

adapt it to the ever-changing globalized world. Several reforms needed to be implemented,

comprising corporate governance procedures (e.g. non-executive employees appointed to

executive positions), global business units organization and the implementation of a new

management system for resource allocation and performance measurement based on

Economic Value Added (EVA). Still, a quite significant resistance from senior management

and some employees was felt, as they did not understand the potential benefits it would bring.

Ishizu had to ensure their support in order to pursue the aim of making AGC a relevant global

competitor.

Corporate Governance Systems in Japan & Main-bank Relationships

Corporate Governance Systems in Japan

Japanese corporate governance is highly characterized by its conservative tradition

and long-term focused relationships, commonly know as insider type system as illustrated

by Appendix 1. Besides the maximization of shareholder value, Japanese companies are

focused mainly on all stakeholders involved Appendix 2 and this is highly reflected in the

corporate governance models.

As we can see in Appendix 3, the number of outside directors on the board of

directors was considerably lower in Japan, making the focus of decisions on insider

stakeholders rather than external shareholders Appendix 4. Nevertheless, the main bank

relationship evidences that a major portion of the Japanese corporate governance system was

in the hands of the creditors instead of the shareholders. Deriving from the traditionally

conservative Japanese culture, these relationships would generate rather long term

continuance of firms and seniority of its stakeholders. Short term profit was not a main

driver in this setup, thus management and employees were likely to become more stable. This

is well illustrated in Appendix 5 where the contrast between Japan and courtiers like UK and

USA is very significant, being job security more important than dividends for Japanese

companies. This system was, in fact, historically linked with lifelong employment system and

seniority promotion. There were, however, some drawbacks to this governances nature,

namely due to its closeness concerning the share of information and lack of transparency in

management.

Main-bank Relationships

In Japan during the 60s and 70s, banks were the main financial providers for

companies in general; capital markets were still undeveloped and too regulated. Among the

banks providing the financing there would be one that maintained the strongest relationship

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 5

with the company, thus, being called as the main bank. Generally, the main bank had

several roles besides being the core financial provider; it would monitor the companys

financial performance and it would also intervene if necessary when there were signs of

financial distress.

The relationship with the main bank would often be reinforced through a cross-

shareholding agreement, which is indeed the case of AGC. In this relationship both parties

hold small minority interest stakes in each other and generate special agreement on decision

voting and selling their shares. AGC was part of the Mitsubishi Group and its main bank

was, not surprisingly, the Bank of Tokyo-Mitsubishi, which owned 3.8% of AGC (seven

largest shareholder), and AGC owned 0.9% of the Financial Group. According to AGCs

CFO this ownership relation was extremely important as he said: the main bank used to act

as the stable shareholder, which understood AGCs business and supported our management.

In this way it was generally accepted that the bank would actively participate in the corporate

governance of the firm and would selectively intervene when needed. There were cases when

senior bank executives were invited as executive or non-executive board members,

reinforcing the influence of the main bank, for instance, in the companys strategic

decisions.

Nevertheless, having the major lender as a participant in the decision-making process,

it can obviously arise some problems regarding conflict of interests. It is in the main interest

of the bank that AGCs business is as safe as possible and this could bias their decision when

considering the risks of projects. This risk is partially absorbed by having the bank as a

shareholder, but since the ownership stake can be proportionally lower than the value of loans

provided, this shareholder position might be negligible in comparison with the lender

position.

However, when Japan suffered the severe economic downturn in the early 90s, these

cross-shareholding agreements and tight relationships suffered a major hit. Banks were selling

their equity holdings in order to compensate for the losses. At the same time, with the

deregulation of capital markets and its take-off, companies initiated their flow search with the

open markets and started a divesture process of cross-holding shares. Since these shares yield

returns as close to 1%, investors were not interested in having the company tied with such

low-yielding assets. Here we can see a change in the corporate governance style, as the main

bank relationship and cross-holding agreements collapse, the focused starts slowly shifting

from inside out.

With the higher resort to capital markets, a new necessary cost emerges: credit ratings.

In comparison with the main bank relationship, the latter has several advantages in these

terms. Having the main bank monitoring responsibilities and stakes in the company as a

shareholder and lender gives some kind of flexibility and better credit terms than the funds

being provided by an outside party that evaluates the company with an external perception.

There were significant agency costs savings in the previous relationship with banks that were

subsequently aggravated with the new credit rating systems that resulted from being listed.

Both the credit rating entities and rated companies were inexperienced with ratings in the

Japanese market, resulting in higher costs during the whole rating process. Being dependent

on the capital markets might bring extra volatility to the business since external factors can

deteriorate lending conditions in the markets, reducing the flexibility once provided by main

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 6

banks. In the previous system, since banks were treated as insiders they were better

equipped to evaluate the credit worthiness of the company.

Organizational and Cultural Changes

Shinya Ishizu was a visionary, who realized the importance of launching Asahi Glass

to a different competing dimension. From the moment he was appointed CEO in 1998, he

started modifying the companys structure and culture, aiming to make it internationally

relevant, facing market globalization. Several restructures had to be made in order to improve

operational performance, coordination at all levels, quick decision making and accounting

standardization.

The Changes and inherent boosters

AGC had a tri-polar organization, enclosing three main regions: Japan/Asia, Europe

and U.S. Due to concerns regarding financial risk, senior management decided to provide

managing autonomy to each regional operation, within these three areas. Nevertheless,

customers (e.g. automobile and electronic) were increasingly becoming global and requested

a single, consistent service worldwide (e.g. price for supplies). Thus, a global assessment of

the company was needed. In order to efficiently manage and optimize the value for each

business, as we may detain from the cases exhibit 7a, in 1998 the company decided that

subsidiaries performance assessment was to be made as a part of AGC group. Furthermore, a

Shrink to Grow strategy was implemented in order to deal with weak domestic performance

and Asian economic crisis. This strategy consisted on allocating resources to the several

business units on a selective and focused manner.

A year later, the company decided to implement an EVA-based measurement system,

with the purpose of assessing each business units performance. Managers and executives

bonuses were connected to these measures, thus creating the proper incentives for them to

seek a value added approach.

Following EVAs introduction, AGC chose to extend the changes and included the

resource allocation process in the companys three-year mid-term planning cycle. The criteria

chosen for the resource allocation were the suitability of each SBUs investment and FCF

projections with the companys strategy, along with the value input to the total value of the

firm.

In 2002, a new initiative entitled Look Beyond was announced. The purpose was to

enhance shared value and to improve the three-year planning cycles, by providing long-term

direction. To fulfill these aims, three major restructures had to be made: creation of in-

house companies, corporate governance reform and definition of group corporate and

business operating functions.

The first step was the creation of four in-house companies, which resulted from the

split of AGC into smaller units, globally: the Flat Glass Company, the Automotive Glass

Company, the Display Company and the Chemicals Company. SBU and subsidiary SBU

supplemented them, as displayed in the cases exhibit 7b. Previously, AGCs operations were

geographically organized. With this restructure, they became organized per product lines,

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 7

fostering international coordination and enabling AGC to supply important global customers.

Besides, two non-Japanese executives were chosen to manage the first two of these

companies, forcing many employees to learn English. The goals were to foster independency,

delegating authority, enabling quick decision making to allow the board to focus on strategic

matters. Ishizu incited employees to closely communicate despite the country differences,

sharing knowledge and experiences with one another.

On a corporate governance scope, it was observable a reduction of the Board of

Directors from 20 members to 7, of which two were independent members and four executive

officers. The aim was to separate execution and oversight of management. AGC was a

pioneer in this topic in Japan, since companies usually did not appoint external directors or, at

best, had just one sitting on the Board. Furthermore, this reform along with the in-house

companies creation allowed the narrowed board to cope with few important strategic issues.

In 2003, with the purpose of reducing succession issues, AGC established a four-

person nominating committee. Their role was to control the executive succession process.

Due to the presence of the two independent directors, presidents were no longer responsible

for choosing their successors.

In order to be able to manage all the previously mentioned changes, AGC created

group corporate functions and business operating functions (in-house companies and

SBUs). The formers were entailed of supervising each of the latters, offering a common

management platform and strategically allocating resources according to the value creation

demonstrated by each business unit. As in-house companies and SBUs were charged with

business operating function, they became more autonomous, having the chance to maximize

value.

One other consequence of the new structure was centralization of financial functions.

Financing, tax management and insurance tasks changed from being settled within each

region, to be consolidated, thus allowing for a significant cost reduction. Of these, tax

management was the most promising and a European tax manager was appointed the role of

global tax coordinator. Additionally, each in-house companys EBIT and operating assets,

and EVA, became its own responsibility. Senior management inducements were dependent

upon these performance measures.

Finally, AGC decided to extent the globalization to human resources management,

training senior and middle managers, most of which foreign, to lead the company in the

future. The aim was to decrease the percentage of Japanese employees from 30 to 6, within in

10 years.

The obstacles

The success of this restructure does not come without withdraws. There is a long road

to go between the carefully planned intentions of the process and the final outcome. Ishizus

first impression was that the company was quite comfortable with its lasting success and

expansion, benefiting from the oligopoly in which it stood and unable to realize the inevitable

change it hade to make to keep up the pace of global markets. Resistance and cultural change,

along with conflict of interests and accounting inconsistencies resume the main issues to deal

with.

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 8

First of all, lays the problem of resistance. Although younger and oversees staff easily

embraced changes, senior management had a difficult time doing so and expressed resistance.

Even though the creation of in-house companies enhanced several improvements, it

also brought up the issue of geographic and cultural distance. The language barrier, along

with company size, and business dimension, created communication problems which

compromised the restructure process. Having foreign directors and co-workers was a

challenge for Japanese employees, who usually did not speak other language besides their

mother tongue. Moreover, managers worried about important investment decisions that were

left up to in-house companies, whose presidents may lack insights regarding AGCs

financial position and compromise the companys overall creditworthiness. More in-debt and

frequent communication was required. In addition, Japanese employees were feeling

disregarded, as the company tried to increase the number of foreign employees.

Conflict of interests with minority shareholders and local partners was another

problem that arose with Ishizus transformations. As they tended to seek their interests by

focusing on individual profit of each local company, they disregarded the company as a

whole. For this reason, AGC decided to buy out the interest they held, which is not a viable

long-term solution. Furthermore, in-house companies president hold the power of decision

on the capital structure and credit risk divisions, whereas, Ishizu was to answer for those

issues to the external market. Besides, being in-house companies responsible for their

EBIT, operating assets and EVA, led presidents bonuses to be determined taking into

account the annual operating profits, despite top management being evaluated for both short-

and long-term performance. Thus, deviation of interests could lead the companys capital

structure and compromise its credit ratings. Despite the mitigation efforts of restricting the

decision through the AGC group medium-term planning conference, the issue remained latent

and some claimed that the group corporate should be responsible for both asset allocation and

capital structure decisions. AGCs accounting system had not been standardized yet at the

time, which created inconsistency in decision-making and performance evaluation.

Consequently, resource allocation and attribution of incentives were not properly made.

Being the mentioned changes as important as they are, a first step should be taken

towards the change of corporate culture and the achievement of senior management support,

so that the other transformations may happen in a smoother way.

Economic Value Added (EVA)

Economic Value Added (EVA) is equivalent to the residual income that measures the

firms ability to generate profits in excess of the cost of capital employed to generate those

profits. The EVA can be also seen as the spread between the return on and cost of capital

multiplied by the capital employed. While a positive EVA means that the company has

generated excess profits required to remunerate investors for the capital that they have been

provided; a negative EVA reveals that the company has been devouring sources without

proving return to investors for their capital employed in the firm. These interpretations can be

better understood by looking at the following formula:

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 9

EVAs Components

NOPAT: It stands for Net Operating Profits After-Taxes and it is a taxed version of the

EBIT. The costs incurred and the tax shields generated with debt are not reflected in the

NOPAT since it will be reflected on the after-tax cost of debt in the discount rate.

Cost of Capital: It is commonly represented by the weighted average cost of capital

(WACC), and it reflects the composite return expected by the firms investors. It includes

both the debt and the equity investors expectations, taking into account the CAPM and

market values.

Capital Employed: There are two methods to compute a companys capital employed: the

financing and the operating approaches. The first focus on the right side of the Balance Sheet

and defines the invested capital as the sum of shareholders equity and all interest bearing

debt. The second method, on the opposite, departures from the left side of the balance Sheet

and then make some adjustments. This means that it takes into account all the companys

assets and then deducts the short-term non-interest bearing debt.

EVA versus NPV

Using either the EVA or the NPV analysis when taking investing decisions, is

equivalent. Both methodologies provide the same result: invest in projects that yield a return

higher than the companys cost of capital. This result can be derived mathematically and

intuitively seen by looking at Appendix 6 and, hence, one can notice that the NPV of a

certain project is clearly equivalent to the PV of EVA of that same project. But when

considering compensation incentives and budgeting purposes, the story may differ. It is can

be easier for workers to perceive their function in a company by looking at the EVA than

through the NPV analysis. EVA is much more intuitive than the NPV, since it reveals the

value that is being created whether NPV shows how much a company is worth at some point

in time. People perceive easier flows than stocks. Bottom line, in order to maximize

shareholder wealth, companies should maximize the PV of future EVA.

EVAs Uses

EVA is commonly used as a management control system for performance

measurement and incentive compensation. Managers focused on earnings might take

misleading decisions since accounting earnings only deduct the costs incurred with debt and,

therefore, managers tend to invest in projects that yield only above the after-tax cost of debt.

With the EVA approach, one can notice that the company is able to create value if the

projects yield above the overall cost of capital. By explicitly separating the cost of equity of

the capital employed, EVA raises the bar and, therefore, promotes a more efficient allocation

of capital. Furthermore, we will analyze that the main decision when computing EVA is what

cost of capital should we use to evaluate each manager dependently on his country and

business unit.

Another possible measure that we could use, alternatively to the cost of capital, is the

return on net assets (RONA). Since RONA reflects the amount of capital used to generate

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 10

operating profits, it does not incorporate the return required by investors to provide such

capital. It can be easily seen by the following algebraic expression:

If managers incentives were design based on RONA, there are two types of sub-

optimal behaviours that could prevail: 1) For instance, assuming a cost of capital lower than

the RONA, managers will tend to engage in investments that yield a return between the cost

of capital and the RONA. This provides a positive NPV but it would under generate profits

for the company. 2) Another scenario is when the cost of capital is higher than the RONA. In

this case, if managers are evaluated based on improvements in the companys RONA, they

will tend to accept projects with a return higher than the RONA but lower than the cost of

capital, thus resulting in a negative NPV. In summary, more profitable companies may

underinvest and less profitable companies may overinvest. EVA-based systems such the one

used by Asahi Glass prevent these type of situations.

There are five ways by which companies, specifically managers, can improve EVA,

assuming a ceteris paribus analysis: 1) increase returns on existing capital through

maximizing operating profits or better asset utilization; 2) invest in new projects with a

positive spread (expected returns greater than the cost of capital); 3) divest projects with a

poor performance; 4) optimize the capital structure to reduce the cost of capital, thus

increasing the spread margin; 5) ultimately, extend the period over which the spread is

expected to be remain positive competitive advantage period.

Advantages of EVA Performance Measurement Systems

As far as managerial compensation is concern, companies often rely on packages

based on EVA. By doing it, companies should ensure that the implementation of an EVA-

based performance measurement system properly aligns managers and owners incentives,

limits the risk exposure, and, more importantly, that incentives managers in fact.

The main advantages of EVA compensation plans are: the avoidance of managers

common short-run goals; the direct link with shareholders value, reducing agency problems;

the unrestricting bonus level, meaning that there is no cap or floor on the bonus amount; and,

finally, the limited, at some point, accounting distortions.

Even though EVA systems may become complex, they can be adequately applicable

for the majority of the companies, even if they are established in less liquid or volatile

markets, and multidivisional firms. For instance, in international multidivisional companies,

as Asahi Glass, it is possible to compute different EVAs for each country branch and for each

division, in order to accurately evaluate those country and division employees. Having an

overall EVA, in this situation, can create some misleading and unwanted incentives.

A major benefit that these types of compensation systems can bring is the easiness at

which employees are able to perceive the value that they generating for the company. EVA

enables employees to realize how much value are they bringing to the table. An alternative

incentive scheme could be an equity-based one which links employees bonus with the

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 11

companys stock price. The issue with these types of mechanisms is that employees do not

objectively perceive how can they improve the stock price, and thus have a large bonus.

Finally, if companies have the resources and ability to implement complex systems,

the larger the breakdown in the bonus plan into financial value drivers (such as, asset

turnover, profit margin, etc), the more effective and realized the incentives become. This also

represents a lot more of implementation risk, since the firm would need a strong cost

accounting department that would define overhead allocation rates, set internal transfer prices

and align the performance metric with scope of decision.

Challenges when Implementing EVA

When implementing such a complex system as an EVA system, companies may be

confronted with several handicaps. Prior to the implementation, there is the difficulty of

calculating EVA that arises. Since EVA departures from accounting captions and then is

subject to some adjustments, the companys accounting standards should be in place. For

instance, AGCs business units across the world had different accounting standards that

represented an obstacle to the implementation of EVA.

Another issue regarding the EVAs computation is the fact that accounting figures are

reported at their historical cost, and EVA relies on market values. Since most times the

market value of assets in place are difficult to determine, as an alternative companies use

book values. Therefore, by using book values the EVAs reached do not reflect properly

investors opportunity cost and expectations. Miscalculations, such this one, might lead to

value destruction. Additional, in order to totally reflect investors market return opportunities,

EVA should also reflect any growth expectations. A proper way of address it is by

establishing incentives based on EVA improvements.

The EVA Systems in Asahi Glass

How did AGC implement EVA systems?

Asahi implemented EVA in 1999, as a reference for performance evaluation, and

resource allocation. It was calculated according to the formula previously mentioned, where

group taxes were assumed to be 38% and the WACC for the group to be 8%. With this, Asahi

created a hurdle rate of 8% of return for their investments and decided to base the

managers incentives in creating opportunities that achieved higher returns than this.

Measuring EVA at AGC

At Asahi, EVA is used by taking into account a given cost of capital and tax rate as

the companys without considering the segmentation by both regional areas and In-house

companies that the AGC Group encompasses. Furthermore, we will identify this as a

drawback of EVA systems implementation at AGC. Moreover, in the referred in-house

companies there was a further division between products, for example, in the glass business

segment there are three different products: flat glass, automotive glass and other such as

techno glass.

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 12

First of all, we computed the EVA for the fiscal years of 2000, 2001 and 2002 having

into consideration the operating profit and the capital employed gathered from the

consolidated financial statements of AGC Group. In order to get the capital employed, we

summed the interest-bearing debt, given by the short-term bank loans, commercial paper,

current maturities of bonds and the total long-term liabilities, and the total shareholders

equity. As for the tax rate and the weighted average cost of capital (WACC), the values

considered were the ones referred in the cases Exhibit 10 for the AGC Group (Taxes=38%

and WACC=8%). As previously mentioned, EVA was calculated as follows:

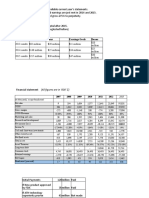

The results of the consolidated AGC Groups EVA for the 3 years are shown in the

table below:

Table 1 EVA of the Consolidated AGC Group

In order to make an assessment of the EVA of 2000, 2001 and 2002 achieved before,

we decided to take a more segmented approach by going from product to business unit and

then to the AGC Group as whole.

For the glass business segment, we started by creating a weight structure based on the

values of sales of the various products per year based on the cases Exhibit 4. Given that for

the fiscal year of 2000, the values were not available the average of the other 2 years was

taken as a proxy. Having this done, we computed a weighted average of each products

WACC and tax rate in order to reach a WACC and a tax rate of the division for each year as

presented in the following table:

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 13

Table 2 - WACC and Tax Rate of the Glass Division

The tax rates and the WACCs taken were the Flat Glass Co., the Automotive Co. and,

for the other products, we took ATG (Asahi Techno Glass). These values are given in the

cases Exhibit 10b and are considered as an average of the Flat Glass Asia, America and

Europe and Automotive Asia, America and Europe, respectively. It is reasonable to consider

this value as constant across time but it is an error of the Asahi management in the EVA

implementation that we had to take.

For the electronics and displays business segment, the same approach was taken but

this time with just 2 products: display and electronics materials. The tax rates and the

WACCs considered, which are again taken out of the Exhibit 10b from the captions Display

Co. and Electronic, respectively. The results are shown in the subsequent table:

Table 3 WACC and Tax Rate of the Display and Electronics Division

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 14

After this step, we had the operating profit for each of the business segments (glass,

electronics and displays, chemicals and other) taken from the Exhibit 4 of the case. To get the

tax rates and the WACC of each business segments we took the values achieved in the Tables

2 and 3 for the glass and electronic and displays divisions, for the chemicals we took the

caption with the same name in the Exhibit 10 and for the other division we took a simple

average of the remaining captions (building material, ceramics, Asahi fiber and Ise chemical).

Having the operating profit and the tax rate of each business segment, we easily obtained the

NOPAT as it is presented in the previous expression. In order to obtain the capital employed

by division, the values could only be obtained by distributing the capital employed of the

consolidated firm according to weights. The most adequate proxy for the capital employed

amongst the captions available in the Exhibit 4 is the assets value since conceptually the

capital employed is higher when the assets are higher too. Therefore, we computed the

weights according to the assets value, used the results obtained to multiply by the cost of

capital of each of the divisions and got to the Economic Profit per division following the EVA

expression previously referred. The table with all the computations described is available in

the Appendix 7.

After getting the values for each division, it is possible to aggregate them by summing

the EVAs of each division per year and the results obtained are shown below as well as the

results of the EVA consolidated.

Table 4 EVA of the Consolidated and the Sum of the EVAs with Capital Employed weighted by Assets

The values obtained through the consolidated approach and through the segmented

approach seem to be quite similar and this might lead us to conclude that segmenting the

calculations does not bring much value to the EVA obtained. To make sure of this idea we

computed the values of the tax rate and WACC by aggregating the divisional results and then

compare to the 28% and 8% given in the case, respectively. To get the tax rate aggregated we

multiplied the tax rate of each division by its weight based on operating profits and then

summed them all up and achieved values of 38.13% in 2000 and 38.10% in 2001 and 2002,

which are a bit higher than the 38% assumed in the case. For the WACC, the procedure was

the same but using weights based on assets and the results obtained were 7.93% in 2000 and

2001 and 7.92% in 2002, which is slightly lower than the 8% cost of capital stated in the case.

AGCs Challenges when Implementing EVA Systems

There are several assumptions behind EVA, which needed to be taken into account

when performing the computation. It is possible to calculate it for the operations in a given

country, for a specific business area, or even for a specific business area in a given country,

and all these different calculations imply different assumptions. That is, if you want to

calculate EVA for Asahi Glass flat glass operations in Japan, you would have to calculate the

respective NOPAT, capital employed and WACC.

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 15

By reading the present case, one may acknowledge that Asahi Glass quite simplifies

the process of calculating EVA. That is, if they want to know what is their EVA in Japan they

look at the data mentioned above (without making any adjustments) and simply calculate it.

Thus, they would get the Japanese NOPAT and the capital employed, multiply the latter by

the groups WACC and then reach the EVA.

This would be fine, if they did not employ capital in a country and then sold some of

the products generated by that capital in a different one, or if different countries (and

businesses) did not have different WACCs. In a nutshell, if you employ capital in Japan to

produce a flat glass, sell it in Korea, for instance, and do not adjust the inputs, employed

capital in Japan would go up as well as the Korean NOPAT, which would reduce the Japanese

EVA and increase the Korean one.

With this, we intend to show how EVA can lead to wrong conclusions, and even may

give the wrong incentives if used to calculate a managers performance and bonus. When a

company does not use EVA carefully, which is the case of Asahi, it could lead them to accept

a project which could destroy value (with an expected return lower than the WACC) or it

could lead them to beneficiate a manager for an achieving, which merit was not his.

Summarizing what we have covered so far about the way Asahi uses EVA, we believe

that they are not paying full attention to what EVA means, and they do not really know what

are the inputs that EVA requires to give a plausible measure of performance. As a whole, we

believe that EVA can be very useful to assess the performance of a specific business area (as

it is relatively easy to calculate all the inputs needed for that) or even to evaluate the

performance of a given country (although non producing countries could be penalized as they

cannot control the capital employed to produce what they are selling). Basically, Asahi should

have different WACCs for different locations and business units, and it should adjust the

capital employed, according to the sales of each country.

To improve the way EVA is used by Asahi we would recommend some changes,

which would lead to never choosing a project that could destroy value, and that would award

managers according to their performance correctly.

These recommendations encompass both the right choice of WACC and the correct

allocations of capital employed:

1) When calculating EVA for a specific business unit Asahi should use a WACC

according to location where the capital is employed. As an example, when assessing flat

glass performance, Asahi should use the WACC appropriate for this industry, according to

the countries where flat glass is produced (as per in the cases exhibit 10), it should use the

capital employed that is respective to the production of flat glass and the NOPAT that is

originated from flat glass sales.

2) When calculating EVA for a specific country, Asahi should correct the employed

capital, according to the capital that was employed to produce the NOPAT in that country.

For instance, if a country does not have production, then it should use the capital employed in

the other countries that was necessary to produce what that country is selling. This way, every

countrys EVA calculation would weight the capital employed, according to the percentage of

NOPAT for that industry. The drawback for these non-producing countries is that they could

not manage the employed capital, as it would be given from the producing country, as thus

they could only improve EVA through NOPAT. This method would, however, be perfect to

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 16

assess the EVA of a producing country, if we reduced the employed capital by not

considering the percentage that was not sold in that country. On top of this, again, the WACC

should be calculated considering the place where the products were produced, and the

different industries.

Another issue not yet discussed is the foreign exchange rates. From what we read,

Asahi does not have a system to prevent losses from unexpected changes in these rates. This

might have implications on our suggestion for the computation of the EVA. If we import

employed capital from a country to another, we need to make it in the same currency to

calculate the EVA. This way, changes in the exchange rates would change some EVAs, even

if the operations of Asahi did not change. We believe this risk could simply be mitigated if

Asahi hedged their foreign exchange exposure, with financial products.

Recommendations AGC: Buy or not to buy?

The global expansion of the Asahi Glass Corporate Group trough the Worlds main

regions has been quite successful having big companies as costumers in Europe, Asia and

America.

This expansion has led to employees dissatisfaction because of the change in the

recruitment policy from just Japanese workers to a more international approach and a goal of

reaching 30% of the employee base to be non-Japanese. This change in recruiting strategy

must be smoothened and properly presented by the management across the company, in order

to ease this transition.

The main issue that the management should handle is the implementation of EVA in a

more segmented approach per region and business division. Having different WACCs and

Tax rates per country and per In-house company would provide a chance for the management

to enhance their decision making process in whether to accept or reject projects as well as to

reward appropriately the employees. This framework of applying EVA could afford to create

ways of maximizing the value creation of the Asahi Glass Corporate Group by finding the

right strategies regarding production and selling locations as well as the right internal transfer

pricing. This decision should take into account the changes in the Accounting Standards that

are about to occur in some of the countries were the company is present.

All this effort in fulfilling this segmented EVA would have to be measured and

assessed in order to know the implementation costs and risks as well as the potential benefits

that it would create.

If all these changes in the EVA implementation were done, we would definitely buy

stock in Asahi as their strategic repositioning will allow them to maximize the full value

creation potential of each business unit and each region.

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 17

Appendixes

Appendix 1 Insider and Open types of Governance

Appendix 2 Constituents of Corporate Governance

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 18

Appendix 3 Composition of Board of Directors in different Companies

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 19

Appendix 4 Companies give priority to Stakeholders or Shareholders Interests?

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 20

Appendix 5 Executives Choices on Dividend Policy versus Job Stability

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 21

Appendix 6 Economical Value Added versus Net Present Value

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 22

Appendix 7 EVA of each Business Segment with Capital Employed calculated

recurring to weights by Assets

Applied Corporate Finance Asahi Glass Case

Group 12 Spring Semester 2012 23

Appendix 8 (Extra) EVA of each Business Segment with Capital Employed calculated

recurring to weights by Sales (not referred in the report)

Das könnte Ihnen auch gefallen

- Asahi Glass Case Prithviraj Chauhan PDFDokument3 SeitenAsahi Glass Case Prithviraj Chauhan PDFKaushik meridianNoch keine Bewertungen

- Disney: Sleeping Beauty BondsDokument3 SeitenDisney: Sleeping Beauty Bondschamp10100% (1)

- EcofDokument6 SeitenEcofAnish NarulaNoch keine Bewertungen

- Business Case: Monmouth IncDokument20 SeitenBusiness Case: Monmouth IncShamsuzzaman Sun100% (1)

- Section2 Group4Dokument4 SeitenSection2 Group4Siva MNoch keine Bewertungen

- Asahi Case SolutionDokument1 SeiteAsahi Case SolutionAmit BiswalNoch keine Bewertungen

- Case Asahi BreweriesDokument32 SeitenCase Asahi BreweriesJohar Menezes100% (1)

- Acova RadiateursDokument10 SeitenAcova RadiateursAnandNoch keine Bewertungen

- Asahi Glass Company - Diversification StrategyDokument17 SeitenAsahi Glass Company - Diversification StrategyHarris Desfianto67% (3)

- New York Times Paywall Group 7Dokument17 SeitenNew York Times Paywall Group 7Amisha LalNoch keine Bewertungen

- Solutions To Chapters 7 and 8 Problem SetsDokument21 SeitenSolutions To Chapters 7 and 8 Problem SetsMuhammad Hasnain100% (1)

- A) Stock Performance of Ahold and Tesco Between Jan-2008 and Dec-2011Dokument4 SeitenA) Stock Performance of Ahold and Tesco Between Jan-2008 and Dec-2011MANAV ROY100% (2)

- Group3 - OM Assignment (Kulicke and Soffa)Dokument9 SeitenGroup3 - OM Assignment (Kulicke and Soffa)Sonali RajoreNoch keine Bewertungen

- Klarna Case StudyDokument2 SeitenKlarna Case Studyarkadii0% (1)

- Case Write Up - Asahi Glass - Group9Dokument5 SeitenCase Write Up - Asahi Glass - Group9Tina Gupta100% (1)

- Asahi Case Final FileDokument4 SeitenAsahi Case Final FileRUPIKA R GNoch keine Bewertungen

- Case Study: Exchange Rate Policy at The Monetary Authority of SingaporeDokument16 SeitenCase Study: Exchange Rate Policy at The Monetary Authority of SingaporeDexpistol33% (3)

- Metallgesellschafts Hedging Debacle - DRM Group 4Dokument2 SeitenMetallgesellschafts Hedging Debacle - DRM Group 4vineet kabra100% (1)

- Asahi Glass CompanyDokument14 SeitenAsahi Glass CompanyMohit Manaktala100% (2)

- Asahi Breweries, Case Study - Group 7Dokument15 SeitenAsahi Breweries, Case Study - Group 7Sajesh Thykoodan T V100% (1)

- Banyan HouseDokument8 SeitenBanyan HouseNimit ShahNoch keine Bewertungen

- Lockheed Tristar ProjectDokument1 SeiteLockheed Tristar ProjectDurgaprasad VelamalaNoch keine Bewertungen

- Case StudyDokument4 SeitenCase StudylifeisyoungNoch keine Bewertungen

- Cash Flow AnalysisDokument10 SeitenCash Flow AnalysisHenry KimNoch keine Bewertungen

- NYT - Paywall - For StudentsDokument69 SeitenNYT - Paywall - For StudentsSakshi Shah100% (1)

- OPM National Bicycle Company D1 Section 1Dokument19 SeitenOPM National Bicycle Company D1 Section 1Tony JosephNoch keine Bewertungen

- Barco Projection SystemDokument3 SeitenBarco Projection SystemJigyasu PritNoch keine Bewertungen

- CBRM Calpine Case - Group 4 SubmissionDokument4 SeitenCBRM Calpine Case - Group 4 SubmissionPranavNoch keine Bewertungen

- Flowers Nev It T GlendaleDokument58 SeitenFlowers Nev It T Glendaletriguy_2010Noch keine Bewertungen

- Case Study: Asahi Glass LimitedDokument11 SeitenCase Study: Asahi Glass LimitedRohan RoyNoch keine Bewertungen

- Asahi Glass 2009-10Dokument29 SeitenAsahi Glass 2009-10Divya SharmaNoch keine Bewertungen

- AsahiDokument2 SeitenAsahiSoumyasree Chakraborty100% (1)

- Asahi GlassDokument28 SeitenAsahi GlassAura Rachmawati100% (1)

- Transworld Xls460 Xls EngDokument6 SeitenTransworld Xls460 Xls EngAman Pawar0% (1)

- Asahi Glass OcrDokument29 SeitenAsahi Glass OcrHernâni Rodrigues VazNoch keine Bewertungen

- Maruti Suzuki Financial Ratios, Dupont AnalysisDokument12 SeitenMaruti Suzuki Financial Ratios, Dupont Analysismayankparkhi100% (1)

- Asahi Glass Group1Dokument8 SeitenAsahi Glass Group1Amit KumarNoch keine Bewertungen

- Asahi India Glass Project by DEV MASANDDokument145 SeitenAsahi India Glass Project by DEV MASANDdevmasand67% (3)

- Caso HuaweiDokument4 SeitenCaso HuaweiAle GarlandNoch keine Bewertungen

- Asahi India Glass Project by DEEPAK SINGH AaaDokument57 SeitenAsahi India Glass Project by DEEPAK SINGH AaaDeepak SinghNoch keine Bewertungen

- T8 RevivalDokument6 SeitenT8 RevivalSumit AggarwalNoch keine Bewertungen

- Britannia DCF CapmDokument12 SeitenBritannia DCF CapmRohit Kamble100% (1)

- Dell Working Capital CaseDokument2 SeitenDell Working Capital CaseIshan Rishabh Kansal100% (2)

- Atlantic Computers Examples For CaseDokument3 SeitenAtlantic Computers Examples For CaseHirsch AuflaufNoch keine Bewertungen

- WESCO Distribution IncDokument10 SeitenWESCO Distribution IncSugandha GuptaNoch keine Bewertungen

- Organizational Behaviour II: Assignment-Ii Section - C Group-5Dokument6 SeitenOrganizational Behaviour II: Assignment-Ii Section - C Group-5Arnab BhattacharyaNoch keine Bewertungen

- Beta Management Company SummaryDokument8 SeitenBeta Management Company Summarysabohi83% (6)

- Case AnalysisDokument3 SeitenCase AnalysisKotwal Mohit Kotwal100% (1)

- Financial Management - Case - Sealed AirDokument7 SeitenFinancial Management - Case - Sealed AirAryan AnandNoch keine Bewertungen

- Sealed Air CorporationDokument7 SeitenSealed Air CorporationMeenal MalhotraNoch keine Bewertungen

- Cottle-Taylor Expanding The Oral Care Group in India Group-6Dokument17 SeitenCottle-Taylor Expanding The Oral Care Group in India Group-6ayush singlaNoch keine Bewertungen

- Tata Motors Cost of CapitalDokument10 SeitenTata Motors Cost of CapitalMia KhalifaNoch keine Bewertungen

- Teuer Furniture Case AnalysisDokument3 SeitenTeuer Furniture Case AnalysisPankaj Kumar0% (1)

- EC2101 Practice Problems 8 SolutionDokument3 SeitenEC2101 Practice Problems 8 Solutiongravity_coreNoch keine Bewertungen

- Earn Pay-Outs: Sales Goals Bonus Earnings Goals BonusDokument5 SeitenEarn Pay-Outs: Sales Goals Bonus Earnings Goals BonusUjjwal BhardwajNoch keine Bewertungen

- Statement of Cash Flows - Three Examples - Blank FormatDokument3 SeitenStatement of Cash Flows - Three Examples - Blank FormatAditya ShuklaNoch keine Bewertungen

- Restructuring in Japan eDokument28 SeitenRestructuring in Japan eNguyen Duy LongNoch keine Bewertungen

- The Study of Working Capital Management As A Financial Strategy (A Case Study of Nestle Nigeria PLC)Dokument9 SeitenThe Study of Working Capital Management As A Financial Strategy (A Case Study of Nestle Nigeria PLC)Jaidev SourotNoch keine Bewertungen

- The Study of Working Capital Management As A Financial Strategy (A Case Study of Nestle Nigeria PLC)Dokument9 SeitenThe Study of Working Capital Management As A Financial Strategy (A Case Study of Nestle Nigeria PLC)Jaidev SourotNoch keine Bewertungen

- Working CapitalDokument56 SeitenWorking CapitalharmitkNoch keine Bewertungen

- Working Capital Management of JK BankDokument98 SeitenWorking Capital Management of JK BankAkifaijaz100% (1)

- Asian Development Bank Institute: ADBI Working Paper SeriesDokument22 SeitenAsian Development Bank Institute: ADBI Working Paper Seriesghaziya hafizaNoch keine Bewertungen

- A1 Customer Information FormDokument2 SeitenA1 Customer Information FormJimmy TangonanNoch keine Bewertungen

- Namma Kalvi 12th Commerce Book Back 1 Mark Test Question Paper em 215254Dokument5 SeitenNamma Kalvi 12th Commerce Book Back 1 Mark Test Question Paper em 215254Aakaash C.K.100% (1)

- (03A) Cash Quiz ANSWER KEYDokument11 Seiten(03A) Cash Quiz ANSWER KEYGabriel Adrian ObungenNoch keine Bewertungen

- Q1.Explain The Concept of Franchising With An Example. List Out The Advantages and Disadvantages of FranchisingDokument11 SeitenQ1.Explain The Concept of Franchising With An Example. List Out The Advantages and Disadvantages of FranchisingNabil SayyedNoch keine Bewertungen

- hf5 MatrixDokument5 Seitenhf5 Matrixapi-322381844Noch keine Bewertungen

- Business Plan For Bakery: 18) Equipment (N) 19) Working CapitalDokument10 SeitenBusiness Plan For Bakery: 18) Equipment (N) 19) Working CapitalUmarSaboBabaDoguwaNoch keine Bewertungen

- Internet BankingDokument93 SeitenInternet BankingRajesh TyagiNoch keine Bewertungen

- Credit Appraisal ProcessDokument19 SeitenCredit Appraisal ProcessVaishnavi khot100% (1)

- Financial Institutions and Markets A ST MoumdzDokument10 SeitenFinancial Institutions and Markets A ST MoumdzNageshwar SinghNoch keine Bewertungen

- Account Statement For Account Number 4063008700000556: Branch DetailsDokument9 SeitenAccount Statement For Account Number 4063008700000556: Branch Detailsmanju maheshNoch keine Bewertungen

- Stapled Financing PDFDokument41 SeitenStapled Financing PDFFabian Montemiranda PajaroNoch keine Bewertungen

- Emerging Challenges Before Indian BanksDokument8 SeitenEmerging Challenges Before Indian Bankskumarravi07Noch keine Bewertungen

- Indonesia Salary Survey 2015Dokument6 SeitenIndonesia Salary Survey 2015July AnggrenyNoch keine Bewertungen

- Case Study 1234Dokument2 SeitenCase Study 1234Gemma RetesNoch keine Bewertungen

- Mobile Deposit TermsDokument6 SeitenMobile Deposit TermsHussein El BeqaiNoch keine Bewertungen

- Bpr-Examples From Indian Corporate WorldDokument29 SeitenBpr-Examples From Indian Corporate WorldDipraj KayasthaNoch keine Bewertungen

- Study On Customer Awareness About Icici Prudential Life InsuranceDokument67 SeitenStudy On Customer Awareness About Icici Prudential Life InsuranceAnil BatraNoch keine Bewertungen

- Bank of PunjabDokument72 SeitenBank of PunjabZia Shoukat100% (1)

- Reagen PapersDokument118 SeitenReagen PapersFilip DanielNoch keine Bewertungen

- Contemporary Financial Management 13th Edition by Moyer McGuigan Rao ISBN Test BankDokument19 SeitenContemporary Financial Management 13th Edition by Moyer McGuigan Rao ISBN Test Bankfrederick100% (25)

- Business Correspondent (BC) Model For Inclusive Growth: Performance Analysis of SKDRDPDokument8 SeitenBusiness Correspondent (BC) Model For Inclusive Growth: Performance Analysis of SKDRDPmdevi190499Noch keine Bewertungen

- Chapter 4 Share Capital and DebenturesDokument102 SeitenChapter 4 Share Capital and DebenturesAbhay SharmaNoch keine Bewertungen

- Investment Banking Origination & Advisory TrendsDokument29 SeitenInvestment Banking Origination & Advisory TrendsNabhan AhmadNoch keine Bewertungen

- Dissertation On Commercial BanksDokument4 SeitenDissertation On Commercial BanksNeedHelpWithPaperSingapore100% (1)

- Presentation of Properly Classified FSDokument9 SeitenPresentation of Properly Classified FSpapa1Noch keine Bewertungen

- Estate Planning Attorney ChecklistDokument21 SeitenEstate Planning Attorney Checklistadvikaditya2Noch keine Bewertungen

- Alice Blue Financial Service PVT LTD: Client Registration FormDokument26 SeitenAlice Blue Financial Service PVT LTD: Client Registration FormAzhar ShaikhNoch keine Bewertungen

- Management SystemDokument19 SeitenManagement SystemShahriarNoch keine Bewertungen