Beruflich Dokumente

Kultur Dokumente

Chapter 7 Bonds and Their Valuation

Hochgeladen von

farbwnOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 7 Bonds and Their Valuation

Hochgeladen von

farbwnCopyright:

Verfügbare Formate

Chapter 7

Bonds and Their Valuation

SOLUTIONS TO END-OF-CHAPTER PROBLEMS

7-1 With your financial calculator, enter the following:

N = 10; I = YTM = 9%; PMT = 0.08 × 1,000 = 80; FV = 1000; PV = VB = ?

PV = $935.82.

7-2 With your financial calculator, enter the following to find YTM:

N = 10 × 2 = 20; PV = -1100; PMT = 0.08/2 × 1,000 = 40; FV = 1000; I = YTM

= ?

YTM = 3.31% × 2 = 6.62%.

With your financial calculator, enter the following to find YTC:

N = 5 × 2 = 10; PV = -1100; PMT = 0.08/2 × 1,000 = 40; FV = 1050; I = YTC = ?

YTC = 3.24% × 2 = 6.49%.

7-3 The problem asks you to find the price of a bond, given the following

facts: N = 16; I = 8.5/2 = 4.25; PMT = 45; FV = 1000.

With a financial calculator, solve for PV = $1,028.60.

7-4 VB = $985; M = $1,000; Int = 0.07 × $1,000 = $70.

a. Current yield = Annual interest/Current price of bond

= $70/$985.00

= 7.11%.

b. N = 10; PV = -985; PMT = 70; FV = 1000; YTM = ?

Solve for I = YTM = 7.2157% ≈ 7.22%.

c. N = 7; I = 7.2157; PMT = 70; FV = 1000; PV = ?

Solve for VB = PV = $988.46.

7-5 a. 1. 5%: Bond L: Input N = 15, I = 5, PMT = 100, FV = 1000, PV = ?,

PV = $1,518.98.

Bond S: Change N = 1, PV = ? PV = $1,047.62.

2. 8%: Bond L: From Bond S inputs, change N = 15 and I = 8, PV = ?,

PV = $1,171.19.

Bond S: Change N = 1, PV = ? PV = $1,018.52.

Answers and Solutions: 7 - 1

3. 12%: Bond L: From Bond S inputs, change N = 15 and I = 12, PV

= ?, PV = $863.78.

Bond S: Change N = 1, PV = ? PV = $982.14.

b. Think about a bond that matures in one month. Its present value is

influenced primarily by the maturity value, which will be received

in only one month. Even if interest rates double, the price of the

bond will still be close to $1,000. A 1-year bond’s value would

fluctuate more than the one-month bond’s value because of the

difference in the timing of receipts. However, its value would

still be fairly close to $1,000 even if interest rates doubled. A

long-term bond paying semiannual coupons, on the other hand, will be

dominated by distant receipts, receipts that are multiplied by 1/(1

+ kd/2)t, and if kd increases, these multipliers will decrease

significantly. Another way to view this problem is from an

opportunity point of view. A 1-month bond can be reinvested at the

new rate very quickly, and hence the opportunity to invest at this

new rate is not lost; however, the long-term bond locks in subnormal

returns for a long period of time.

N

I NT M

7-6 a. VB = ∑ (1 + k )

t= 1 d

t

+

(1 + kd)N

M = $1,000. I = 0.09($1,000) = $90.

1. VB = $829: Input N = 4, PV = -829, PMT = 90, FV = 1000, I = ? I =

14.99%.

2. VB = $1,104: Change PV = -1104, I = ? I = 6.00%.

b. Yes. At a price of $829, the yield to maturity, 15 percent, is

greater than your required rate of return of 12 percent. If your

required rate of return were 12 percent, you should be willing to

buy the bond at any price below $908.88.

7-7 The rate of return is approximately 15.03 percent, found with a

calculator using the following inputs:

N = 6; PV = -1000; PMT = 140; FV = 1090; I = ? Solve for I = 15.03%.

7-8 a. Using a financial calculator, input the following:

N = 20, PV = -1100, PMT = 60, FV = 1000, and solve for I = 5.1849%.

However, this is a periodic rate. The nominal annual rate =

5.1849%(2) = 10.3699% ≈ 10.37%.

b. The current yield = $120/$1,100 = 10.91%.

c. YTM = Current Yield + Capital Gains (Loss) Yield

Answers and Solutions: 7 - 2

10.37% = 10.91% + Capital Loss Yield

-0.54% = Capital Loss Yield.

d. Using a financial calculator, input the following:

N = 8, PV =

, PMT = 60, FV = 1060, and solve for I = 5.0748%.

However, this is a periodic rate. The nominal annual rate =

5.0748%(2) = 10.1495% ≈ 10.15%.

7-9 The problem asks you to solve for the YTM, given the following facts:

N = 5, PMT = 80, and FV = 1000. In order to solve for I we need PV.

However, you are also given that the current yield is equal to 8.21%.

Given this information, we can find PV.

Current yield = Annual interest/Current price

0.0821 = $80/PV

PV = $80/0.0821 = $974.42.

Now, solve for the YTM with a financial calculator:

N = 5, PV = -974.42, PMT = 80, and FV = 1000. Solve for I = YTM =

8.65%.

7-10 The problem asks you to solve for the current yield, given the

following facts: N = 14, I = 10.5883/2 = 5.29415, PV = -1020, and FV =

1000. In order to solve for the current yield we need to find PMT.

With a financial calculator, we find PMT = $55.00. However, because

the bond is a semiannual coupon bond this amount needs to be multiplied

by 2 to obtain the annual interest payment: $55.00(2) = $110.00.

Finally, find the current yield as follows:

Current yield = Annual interest/Current price = $110/$1,020 = 10.78%.

7-11 The bond is selling at a large premium, which means that its coupon

rate is much higher than the going rate of interest. Therefore, the

bond is likely to be called--it is more likely to be called than to

remain outstanding until it matures. Thus, it will probably provide a

return equal to the YTC rather than the YTM. So, there is no point in

calculating the YTM--just calculate the YTC. Enter these values:

N = 10, PV = -1353.54, PMT = 70, FV = 1050, and then solve for I.

The periodic rate is 3.2366 percent, so the nominal YTC is 2 × 3.2366%

= 6.4733% ≈ 6.47%. This would be close to the going rate, and it is

about what the firm would have to pay on new bonds.

7-12 a. To find the YTM:

Answers and Solutions: 7 - 3

N = 10, PV = -1175, PMT = 110, FV = 1000

I = YTM = 8.35%.

b. To find the YTC, if called in Year 5:

N = 5, PV = -1175, PMT = 110, FV = 1090

I = YTC = 8.13%.

c. The bonds are selling at a premium which indicates that interest rates

have fallen since the bonds were originally issued. Assuming that

interest rates do not change from the present level, investors would

expect to earn the yield to call. (Note that the YTC is less than the

YTM.)

d. Similarly from above, YTC can be found, if called in each subsequent

year.

If called in Year 6:

N = 6, PV = -1175, PMT = 110, FV = 1080

I = YTM = 8.27%.

If called in Year 7:

N = 7, PV = -1175, PMT = 110, FV = 1070

I = YTM = 8.37%.

If called in Year 8:

N = 8, PV = -1175, PMT = 110, FV = 1060

I = YTM = 8.46%.

If called in Year 9:

N = 9, PV = -1175, PMT = 110, FV = 1050

I = YTM = 8.53%.

According to these calculations, the latest investors might expect a

call of the bonds is in Year 6. This is the last year that the

expected YTC will be less than the expected YTM. At this time, the

firm still finds an advantage to calling the bonds, rather than

seeing them to maturity.

7-13 First, we must find the amount of money we can expect to sell this bond

for in 5 years. This is found using the fact that in five years, there

will be 15 years remaining until the bond matures and that the expected

YTM for this bond at that time will be 8.5%.

N = 15, I = 8.5, PMT = 90, FV = 1000

PV = -$1,041.52. VB = $1,041.52.

This is the value of the bond in 5 years. Therefore, we can solve for

the maximum price we would be willing to pay for this bond today,

subject to our required rate of return of 10%.

N = 5, I = 10, PMT = 90, FV = 1041.52

PV = -$987.87. VB = $987.87.

We are willing to pay up to $987.87 for this bond today.

Answers and Solutions: 7 - 4

7-14 Before you can solve for the price, we must find the appropriate

semiannual rate at which to evaluate this bond.

EAR = (1 + NOM/2)2 - 1

0.0816 = (1 + NOM/2)2 - 1

NOM = 0.08.

Semiannual interest rate = 0.08/2 = 0.04 = 4%.

Solving for price:

N = 20, I = 4, PMT = 45, FV = 1000

PV = -$1,067.95. VB = $1,067.95.

7-15 a. The current yield is defined as the annual coupon payment divided by

the current price.

CY = $80/$901.40 = 8.875%.

b. Solving for YTM:

N = 9, PV = -901.40, PMT = 80, FV = 1000

I = YTM = 9.6911%.

c. Expected capital gains yield can be found as the difference between

YTM and the current yield.

CGY = YTM - CY = 9.691% - 8.875% = 0.816%.

Alternatively, you can solve for the capital gains yield by first

finding the expected price next year.

N = 8, I = 9.6911, PMT = 80, FV = 1000

PV = -$908.76. VB = $908.76.

Hence, the capital gains yield is the percent price appreciation

over the next year.

CGY = (P1 - P0)/P0 = ($908.76 - $901.40)/$901.40 = 0.816%.

7-16 Using the TIE ratio, we can solve for the firm's current operating

income.

TIE = EBIT/Int Exp

3.2 = EBIT/$10,500,000

EBIT = $33,600,000.

Using the same methodology, you can solve for the maximum interest

expense the firm can bear without violating its covenant.

2.5 = $33,600,000/Int Exp

Max Int Exp = $13,440,000.

Therefore, the firm can raise debt to the point that its interest

expense increases by $2.94 million ($13.44 − $10.50). The firm can

Answers and Solutions: 7 - 5

raise $25 million at 8%, which would increase the cost of debt by $25 ×

0.08 = $2 million. Additional debt will be issued at 10%, and the

amount of debt to be raised can be found, since we know that only an

additional $0.94 million in interest expense can be incurred.

Additional Int Exp = Additional Debt × Cost of debt

$0.94 million = Additional Debt × 0.10

Additional Debt = $9.40 million.

Hence, the firm may raise up to $34.4 million in additional debt

without violating its bond covenants.

7-17 First, we must find the price Baili paid for this bond.

N = 10, I = 9.79, PMT = 110, FV = 1000

PV = -$1,075.02. VB = $1,075.02.

Then to find the one-period return, we must find the sum of the change

in price and the coupon received divided by the starting price.

Ending price - Beginningprice + Coupon received

One-period return =

Beginningprice

One-period return = ($1,060.49 - $1,075.02 + $110)/$1,075.02

One-period return = 8.88%.

7-18 The answer depends on when one works the problem. We used The Wall

Street Journal, February 3, 2003:

a. AT&T’s 8.625%, 2031 bonds had an 8.6 percent current yield. The

bonds sold at a premium, 100.75% of par, so the coupon interest rate

would have to be set lower than 8.625% for the bonds to sell at par.

If we assume the bonds aren’t callable, we can do a rough

calculation of their YTM. Using a financial calculator, we input the

following values:

0.08 625

N = 29 × 2 = 58, PV = 1.0075 × -1,000 = -1007.50, PMT =

2

× 1,000 = 86.25/2 = 43.125, FV = 1000, and then solve for YTM = kd =

4.2773% × 2 = 8.5546%.

Thus, AT&T would have to set a rate of 8.55 percent on new long-term

bonds.

b. The return on AT&T’s bonds is the current yield of 8.6 percent, less

a small capital loss in 2031. The total return is about 8.55

percent.

7-19 a. Yield to maturity (YTM):

With a financial calculator, input N = 28, PV = -1165.75, PMT = 95, FV

= 1000, I = ? I = kd = YTM = 8.00%.

Answers and Solutions: 7 - 6

Yield to call (YTC):

With a calculator, input N = 3, PV = -1165.75, PMT = 95, FV = 1090,

I = ? I = kd = YTC = 6.11%.

b. Knowledgeable investors would expect the return to be closer to 6.1

percent than to 8 percent. If interest rates remain substantially

lower than 9.5 percent, the company can be expected to call the issue

at the call date and to refund it with an issue having a coupon rate

lower than 9.5 percent.

c. If the bond had sold at a discount, this would imply that current

interest rates are above the coupon rate. Therefore, the company would

not call the bonds, so the YTM would be more relevant than the YTC.

Answers and Solutions: 7 - 7

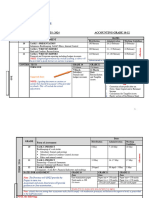

7-20 Percentage

Price at 8% Price at 7% change

10-year, 10% annual coupon $1,134.20 $1,210.71 6.75%

10-year zero 463.19 508.35 9.75

5-year zero 680.58 712.99 4.76

30-year zero 99.38 131.37 32.19

$100 perpetuity 1,250.00 1,428.57 14.29

7-21 a. t Price of Bond C Price of Bond Z

0 $1,012.79 $ 693.04

1 1,010.02 759.57

2 1,006.98 832.49

3 1,003.65 912.41

4 1,000.00 1,000.00

b.

Bo

1,10

7-8

Das könnte Ihnen auch gefallen

- Solutions Chapter 7Dokument7 SeitenSolutions Chapter 7Judy Anne SalucopNoch keine Bewertungen

- Chapter 6-Liquidity of Short-Term Assets Related Debt-Paying AbilityDokument35 SeitenChapter 6-Liquidity of Short-Term Assets Related Debt-Paying AbilityNazim Shahzad50% (2)

- Interest Rate Parity PresentationDokument31 SeitenInterest Rate Parity Presentationviki12334Noch keine Bewertungen

- Tutorial 8 AnswerDokument3 SeitenTutorial 8 AnswerHaidahNoch keine Bewertungen

- Chapter 6 Solutions Interest Rates and Bond ValuationDokument7 SeitenChapter 6 Solutions Interest Rates and Bond ValuationTuvden Ts100% (1)

- E. Patrick Assignment 2.2Dokument4 SeitenE. Patrick Assignment 2.2Alex100% (3)

- Capital Structure Theory - MM ApproachDokument2 SeitenCapital Structure Theory - MM ApproachSigei Leonard100% (1)

- Tugas GSLC Corp Finance Session 17 & 18Dokument8 SeitenTugas GSLC Corp Finance Session 17 & 18Javier Noel Claudio100% (1)

- Additional Funds Needed MasDokument22 SeitenAdditional Funds Needed MasWilmer Mateo Bernardo100% (1)

- Chapter 13 SolutionsDokument8 SeitenChapter 13 Solutionsflyerfan3767% (3)

- Role of Financial Management in OrganizationDokument8 SeitenRole of Financial Management in OrganizationTasbeha SalehjeeNoch keine Bewertungen

- Solutions To Problems: LG 1 BasicDokument13 SeitenSolutions To Problems: LG 1 BasicMuwadat Hussain67% (3)

- Solutions. Chapter. 9Dokument6 SeitenSolutions. Chapter. 9asih359Noch keine Bewertungen

- FIN 534 Homework Chapter 6Dokument3 SeitenFIN 534 Homework Chapter 6Jenna KiragisNoch keine Bewertungen

- Chapter 7 Test BankDokument93 SeitenChapter 7 Test BankM.Talha100% (1)

- Ch09 PPT Capital Budgeting TechniquesDokument36 SeitenCh09 PPT Capital Budgeting Techniquesmuhammadosama100% (2)

- Chap 11 SolutionsDokument6 SeitenChap 11 SolutionsMiftahudin Miftahudin100% (2)

- Cash Flow Estimation and Risk AnalysisDokument2 SeitenCash Flow Estimation and Risk AnalysisKristel Sumabat100% (1)

- Chapter-6 GITMAN SOLMANDokument24 SeitenChapter-6 GITMAN SOLMANJudy Ann Margate Victoria67% (6)

- BFIN525 - Chapter 9 ProblemsDokument6 SeitenBFIN525 - Chapter 9 Problemsmohamad yazbeckNoch keine Bewertungen

- Bond Valuation PDFDokument49 SeitenBond Valuation PDFAnonymous fzhh0qKNoch keine Bewertungen

- Activity Based Costing Boosts Building Firm's CompetitivenessDokument20 SeitenActivity Based Costing Boosts Building Firm's CompetitivenessMazni HanisahNoch keine Bewertungen

- Time Value of MoneTIME VALUE OF MONEY SOLVEDy SolvedDokument4 SeitenTime Value of MoneTIME VALUE OF MONEY SOLVEDy SolvedFaiz Ahmed0% (1)

- Capital Budgeting ProblemsDokument9 SeitenCapital Budgeting ProblemsSugandhaShaikh0% (1)

- Chapter 21Dokument4 SeitenChapter 21Rahila RafiqNoch keine Bewertungen

- Chap11 SolutionDokument29 SeitenChap11 SolutionJustine Mark Soberano100% (1)

- Capital Investment Decision AnalysisDokument36 SeitenCapital Investment Decision Analysisgerald calignerNoch keine Bewertungen

- Ch.09 Solution Manual - Funadmentals of Financial ManagementDokument18 SeitenCh.09 Solution Manual - Funadmentals of Financial Managementsarahvillalon100% (2)

- Capital Budgeting: Decision Criteria: True-FalseDokument40 SeitenCapital Budgeting: Decision Criteria: True-Falsedavid80dcnNoch keine Bewertungen

- Chapter 21 Mergers and AcquisitionDokument13 SeitenChapter 21 Mergers and AcquisitionTuan Huynh50% (2)

- Chapter 13 Solutions MKDokument26 SeitenChapter 13 Solutions MKCindy Kirana17% (6)

- Other Topics in Capital Budgeting: Multiple Choice: ConceptualDokument33 SeitenOther Topics in Capital Budgeting: Multiple Choice: ConceptualAileen CempronNoch keine Bewertungen

- Business Valuation Questions and Answers-1Dokument80 SeitenBusiness Valuation Questions and Answers-1Ralkan Kanton67% (3)

- Assignment On: Managerial Economics Mid Term and AssignmentDokument14 SeitenAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNoch keine Bewertungen

- Chapter 10 Practice Problems WACC CalculationDokument5 SeitenChapter 10 Practice Problems WACC CalculationEvelyn RoldanNoch keine Bewertungen

- Capital Budgeting QuizDokument11 SeitenCapital Budgeting Quizbahilog86% (7)

- Chapter 6 SolutionsDokument7 SeitenChapter 6 Solutionshassan.murad83% (12)

- Bond ValuationDokument51 SeitenBond ValuationRudy Putro100% (1)

- Chap 5Dokument52 SeitenChap 5jacks ocNoch keine Bewertungen

- Financial Markets Week 2 3Dokument9 SeitenFinancial Markets Week 2 3Jericho DupayaNoch keine Bewertungen

- Risk and Return FundamentalsDokument41 SeitenRisk and Return FundamentalsMo Mindalano Mandangan100% (6)

- Ib Case Study q2Dokument1 SeiteIb Case Study q2Raisa Uronchondi0% (1)

- Chapter 18Dokument16 SeitenChapter 18Faisal AminNoch keine Bewertungen

- Solution Manual of Chapter 7 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerDokument55 SeitenSolution Manual of Chapter 7 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerCoco ZaideNoch keine Bewertungen

- Chapter 11 Quiz Connect CampDokument25 SeitenChapter 11 Quiz Connect CampaksNoch keine Bewertungen

- Bond ValuationDokument4 SeitenBond Valuationmanoranjan838241Noch keine Bewertungen

- Homework Solutions (Fundamental of Financial Management)Dokument3 SeitenHomework Solutions (Fundamental of Financial Management)angelvoice89Noch keine Bewertungen

- Ch09 Solations Brigham 10th EDokument12 SeitenCh09 Solations Brigham 10th ERafay HussainNoch keine Bewertungen

- Solution Manual For Fundamentals of Corporate Finance 7th Canadian Edition Richard A BrealeyDokument22 SeitenSolution Manual For Fundamentals of Corporate Finance 7th Canadian Edition Richard A BrealeyKarinaMasonprdbc100% (44)

- GF520 Unit2 Assignment CorrectionsDokument7 SeitenGF520 Unit2 Assignment CorrectionsPriscilla Morales86% (7)

- Yield To Maturity Answer KeyDokument2 SeitenYield To Maturity Answer KeyBrandon LumibaoNoch keine Bewertungen

- RWJ Chapter 4Dokument52 SeitenRWJ Chapter 4Parth ParthNoch keine Bewertungen

- Solutions Paper - TVMDokument4 SeitenSolutions Paper - TVMsanchita mukherjeeNoch keine Bewertungen

- CH 5 SNDokument17 SeitenCH 5 SNSam TnNoch keine Bewertungen

- 05 Lecture - The Time Value of Money PDFDokument26 Seiten05 Lecture - The Time Value of Money PDFjgutierrez_castro7724Noch keine Bewertungen

- Exam Name: CFA Level I Total Questions: 22 Assignment Name: JUN18L1QME/C02 (9dbafcb4) Pass Mark Rate: 65% Assignment Duration: 33 MinutesDokument9 SeitenExam Name: CFA Level I Total Questions: 22 Assignment Name: JUN18L1QME/C02 (9dbafcb4) Pass Mark Rate: 65% Assignment Duration: 33 MinutesjuanNoch keine Bewertungen

- 12.5 - Practice Test SolutionsDokument15 Seiten12.5 - Practice Test SolutionsCamilo ToroNoch keine Bewertungen

- TVM CALCULATIONS AND CONCEPTSDokument8 SeitenTVM CALCULATIONS AND CONCEPTSHassleBustNoch keine Bewertungen

- Assignment 1 FinDokument23 SeitenAssignment 1 Finritesh0% (1)

- Expected Return Based On Its Current Market Price (P: Valuation of Shares & BondsDokument8 SeitenExpected Return Based On Its Current Market Price (P: Valuation of Shares & Bondsv_viswaprakash3814Noch keine Bewertungen

- This Is The Assignment For Financial.Dokument48 SeitenThis Is The Assignment For Financial.farbwnNoch keine Bewertungen

- Reading-Product Standardization or AdaptationDokument20 SeitenReading-Product Standardization or AdaptationfarbwnNoch keine Bewertungen

- Doce Findings of MarketingDokument8 SeitenDoce Findings of MarketingfarbwnNoch keine Bewertungen

- Other Info ColgateDokument1 SeiteOther Info ColgatefarbwnNoch keine Bewertungen

- Reading-Pricing For Global MarketsDokument14 SeitenReading-Pricing For Global MarketsfarbwnNoch keine Bewertungen

- Index of FilesDokument62 SeitenIndex of FilesPhani Pinnamaneni0% (1)

- Name of Organizations Coming For The Job Fair 2013Dokument1 SeiteName of Organizations Coming For The Job Fair 2013farbwnNoch keine Bewertungen

- Group 06 - Assignment # 2Dokument66 SeitenGroup 06 - Assignment # 2farbwnNoch keine Bewertungen

- Grading Criteria - Business Plan PresentationDokument3 SeitenGrading Criteria - Business Plan PresentationfarbwnNoch keine Bewertungen

- Lecture02 Portfolio TheoryDokument65 SeitenLecture02 Portfolio TheoryfarbwnNoch keine Bewertungen

- Sap Referrences This DocumentDokument1 SeiteSap Referrences This DocumentfarbwnNoch keine Bewertungen

- 0 Comments: Honda Atlas Cars: Gunning The Engine in 3QFY12Dokument3 Seiten0 Comments: Honda Atlas Cars: Gunning The Engine in 3QFY12farbwnNoch keine Bewertungen

- SAP MM Interview Questions Answers and ExplanationsDokument128 SeitenSAP MM Interview Questions Answers and ExplanationsAbhinav96% (28)

- Course OutlineDokument9 SeitenCourse OutlinefarbwnNoch keine Bewertungen

- Map Sapphire FinishingDokument1 SeiteMap Sapphire FinishingfarbwnNoch keine Bewertungen

- BMX Case Study For OperationsDokument7 SeitenBMX Case Study For Operationsfarbwn100% (1)

- OutlineDokument2 SeitenOutlinefarbwnNoch keine Bewertungen

- AzmaloDokument8 SeitenAzmalofarbwnNoch keine Bewertungen

- SBP Warns Banks Against Investing in Government SecuritiesDokument4 SeitenSBP Warns Banks Against Investing in Government SecuritiesfarbwnNoch keine Bewertungen

- Case WalmartDokument17 SeitenCase WalmartfarbwnNoch keine Bewertungen

- Pkgs (Final)Dokument15 SeitenPkgs (Final)farbwnNoch keine Bewertungen

- Wateen InternshipDokument1 SeiteWateen InternshipfarbwnNoch keine Bewertungen

- Boot LogDokument1 SeiteBoot LogfarbwnNoch keine Bewertungen

- Sociology AA CourseDokument1 SeiteSociology AA CoursefarbwnNoch keine Bewertungen

- Universa Hedge Fund ProspectusDokument72 SeitenUniversa Hedge Fund ProspectusJeff McGinn100% (1)

- Market EquilibriumDokument3 SeitenMarket EquilibriumAudrey NahuriraNoch keine Bewertungen

- JPE Fall 2013 Fordham PDFDokument12 SeitenJPE Fall 2013 Fordham PDFVijendranArumugamNoch keine Bewertungen

- Gold - Love N Fear TradesDokument62 SeitenGold - Love N Fear TradesgautamswamiNoch keine Bewertungen

- Companies Act - SI 62 - 1996Dokument35 SeitenCompanies Act - SI 62 - 1996CourageNoch keine Bewertungen

- Revised 2024 Accounting Assessment Dates - Grade 10-12Dokument3 SeitenRevised 2024 Accounting Assessment Dates - Grade 10-12maziwisalianNoch keine Bewertungen

- Accounting NotesDokument6 SeitenAccounting NotesHimanshu SinghNoch keine Bewertungen

- Cost of Capital QDokument2 SeitenCost of Capital QPrinkeshNoch keine Bewertungen

- Investment Management Analysis: Your Company NameDokument70 SeitenInvestment Management Analysis: Your Company NameJojoMagnoNoch keine Bewertungen

- IB, PE & VC Recommended ResourcesDokument1 SeiteIB, PE & VC Recommended ResourcesRoll 16 Ritik KumarNoch keine Bewertungen

- Do Read This Note, Prior To Starting The Finance & Banking Fundamentals Masterclass ProgramDokument14 SeitenDo Read This Note, Prior To Starting The Finance & Banking Fundamentals Masterclass ProgramShivani NaiduNoch keine Bewertungen

- EC202 Exam Question Paper S1 2023 (May 1st 2023)Dokument5 SeitenEC202 Exam Question Paper S1 2023 (May 1st 2023)R and R wweNoch keine Bewertungen

- Project On Sebi Act 1992Dokument26 SeitenProject On Sebi Act 1992Sameer Kumbhar100% (1)

- EXERCISE Cashflow of The CompanyDokument41 SeitenEXERCISE Cashflow of The CompanyDev lakhaniNoch keine Bewertungen

- 2019 100,000 2 200,000 Eps (2020) 410,00/230,000 Eps (2019) 350,000/200,000 2020 100,000 3/12 25,000 120,000 9/12 90,000 115,000 2 230,000Dokument5 Seiten2019 100,000 2 200,000 Eps (2020) 410,00/230,000 Eps (2019) 350,000/200,000 2020 100,000 3/12 25,000 120,000 9/12 90,000 115,000 2 230,000XienaNoch keine Bewertungen

- Expert Advice - Goodarz AgahiDokument1 SeiteExpert Advice - Goodarz AgahiStradlingNoch keine Bewertungen

- Multiple Choice PracticeDokument6 SeitenMultiple Choice PracticeBenedict KaruruNoch keine Bewertungen

- Chapter 4 - State Preference TheoryDokument19 SeitenChapter 4 - State Preference TheoryK60 Đỗ Khánh NgânNoch keine Bewertungen

- Chapter 2 Financial Statement and Cash Flow AnalysisDokument26 SeitenChapter 2 Financial Statement and Cash Flow AnalysisFarooqChaudharyNoch keine Bewertungen

- Jethro S. Cortado BSA 1B Property and EquipmentDokument9 SeitenJethro S. Cortado BSA 1B Property and EquipmentJi Eun VinceNoch keine Bewertungen

- IasDokument229 SeitenIasPeter Apollo Latosa100% (1)

- Case 2 Coleco Industries, IncDokument41 SeitenCase 2 Coleco Industries, IncTamanna Shaon88% (8)

- JJJDokument6 SeitenJJJDevesh0% (1)

- Financial Statement Analysis of Beximco Pharma LTD On 2009Dokument14 SeitenFinancial Statement Analysis of Beximco Pharma LTD On 2009Marshal RichardNoch keine Bewertungen

- Capital Structure Decision: An Overview: Kennedy Prince ModuguDokument14 SeitenCapital Structure Decision: An Overview: Kennedy Prince ModuguChaitanya PrasadNoch keine Bewertungen

- Marginal-Costing 7dmZZc0Dokument78 SeitenMarginal-Costing 7dmZZc0Hema LathaNoch keine Bewertungen

- Accounting Q&ADokument6 SeitenAccounting Q&AIftikharNoch keine Bewertungen

- Finance Dossier FinalDokument90 SeitenFinance Dossier FinalHarsh GandhiNoch keine Bewertungen

- MacabacusEssentialsDemoComplete 210413 104622Dokument21 SeitenMacabacusEssentialsDemoComplete 210413 104622Pratik PatwaNoch keine Bewertungen

- Secrets of A Forex Millionaire TraderDokument61 SeitenSecrets of A Forex Millionaire TraderEric PlottPalmTrees.Com75% (12)