Beruflich Dokumente

Kultur Dokumente

Exercise Chapter 3: Adjusting The Accounts

Hochgeladen von

Seany SukmawatiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exercise Chapter 3: Adjusting The Accounts

Hochgeladen von

Seany SukmawatiCopyright:

Verfügbare Formate

Tugas 3 - SIAK Seany Sukmawati - 1106154034

E3-3 Concordia Industries collected $105,000 from customers in 2014. Of the amount

collected, $28,000 was from revenue accrued from services performed in 2013. In addition,

Concordia recognized $44,000 of revenue in 2014, which will not be collected until 2015.

Concordia Industries also paid $72,000 for expenses in 2014. Of the amount paid,

$30,000 was for expenses incurred on account in 2013. In addition, Concordia incurred

$37,000 of expenses in 2014, which will not be paid until 2015.

I nstructions

(a) Compute 2014 cash-basis net income.

(b) Compute 2014 accrual-basis net income.

(a) 2014 cash-basic net income

Revenues = $105,000

Expenses = $72,000

Net income = 105,000 72,000 = $33,000

(b) 2014 accrual-basic net income

Revenues = $105,000 - $28,000 + $44,000 = $121,000

Expenses = $72,000 - $30,000 + $37,000 = $ 79,000

Net income = 121,000 79,000 = $42,000

Tugas 3 - SIAK Seany Sukmawati - 1106154034

P3-3A Costello Advertising Agency Inc. was founded by Pat Costello in January of 2013.

Presented below are both the adjusted and unadjusted trial balances as of December 31, 2014.

I nstructions

(a) Journalize the annual adjusting entries that were made.

(b) Prepare an income statement and a retained earnings statement for the year ending

December 31, 2014, and a statement of finansial position at December 31.

(c) Answer the following questions.

(1) If the note has been outstanding 6 months, what is the annual interest rate on that

note?

(2) If the company paid $14,500 in salaries in 2014, what was the balance in Salaries

and Wages Payable on December 31, 2013?

Tugas 3 - SIAK Seany Sukmawati - 1106154034

(a) Journal

Date Account Title Ref Debit Credit

2014 Adjusting Entries

Des. 31 Supplies Expense 3,600

Supplies 3,600

(To record supplies used)

Des. 31 Insurance Expense 850

Prepaid Expense 850

(To record insurance expired)

Des. 31 Depreciation Expense 5,000

Accumulated Depreciation---Equipment 5,000

(To record monthly depreciation)

Des. 31 Unearned Service Revenue 1,600

Service Revenue 1,600

(To record revenue for services performed)

Des. 31 Accounts Receivable 3,500

Service Revenue 3,500

(To record revenue for services performed)

Des. 31 Interest Expense 150

Interest Payable 150

(To record interest on notes payable)

Des. 31 Salaries and Wages Expense 1,300

Salaries dan Wages Payable 1,300

(To record accrued salaries and wages)

(b)

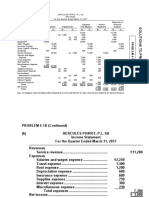

COSTELLO ADVERTISING AGENCY

Income Statement

For the Year Ended December 31, 2014

Revenues

Service Revenue $63,700

Expenses

Salaries and Wages Expense $11,300

Insurance Expense 850

Interest Expense 500

Depreciation Expense 5,000

Supplies Expense 3,600

Rent Expense 4,000

Total expenses 25,250

Net income $38,450

COSTELLO ADVERTISING AGENCY

Statement of Retained Earnings

For the Year Ended December 31, 2014

Retained Earnings, Jan 1 $5,500

Add: Net income 38,450

Less: Dividens 12,000

Retained Earnings, Dec 31 $31,950

Tugas 3 - SIAK Seany Sukmawati - 1106154034

COSTELLO ADVERTISING AGENCY

Statement of Financial Position

December 31, 2014

Assets

Cash

$11,000

Accounts Receivable

23,500

Art Supplies

5,000

Prepaid Insurance

2,500

Equipment $60,000

Accumulated Depreciation Equip 33,000 27,000

Total Assets $69,000

Liabilities and Stockholders' Equity

Liabilities

Accounts Payable $5,000

Interest Payable 150

Notes Payable 5,000

Unearned Advertising Revenue 5,600

Salaries and Wages Payable 1,300

Total Liabilities $17,050

Stockholders' Equity

Share Capital---Ordinary $20,000

Retained Earnings 31,950 51,950

Total liabilities and stockholders' equity $69,000

(c) Answer the following questions.

(1) If the note has been outstanding 6 months, what is the annual interest rate on

that note?

$150 * 2 = 300 annual interest on a principal balance of $5,000 = 6% simple interest

per year.

(2) If the company paid $14,500 in salaries in 2014, what was the balance in

Salaries and Wages Payable on December 31, 2013?

$1,300 + $14,500 - $11,300 = $4,500 balance on December 31, 2013.

Tugas 3 - SIAK Seany Sukmawati - 1106154034

E4-6 Selected worksheet data for Freeman Company are presented below.

Account Titles Trial Balance Adjusted Tral Balance

Dr. Cr. Dr. Cr.

Accounts Receivable

? 34,000

Prepaid Insurance

26,000 18,000

Supplies

7,000 ?

Accumulated Depreciation---Equipment

12,000 ?

Salaries and Wages Payable

? 5,000

Service Revenue

88,000 95,000

Insurance Expense

?

Depreciation Expense

10,000

Supplies Expense

4,700

Salaries and Wages Expense

? 49,000

I nstructions

(a) Fill in the missing amounts.

(b) Prepare the adjusting entries that were made.

(a)

Account Titles Trial Balance Adjusted Tral Balance

Dr. Cr. Dr. Cr.

Accounts Receivable

23,000 34,000

Prepaid Insurance

26,000 18,000

Supplies

7,000 2,300

Accumulated Depreciation---Equipment

12,000 22,000

Salaries and Wages Payable

0 5,000

Service Revenue

88,000 95,000

Insurance Expense

4,000

Depreciation Expense

10,000

Supplies Expense

4,700

Salaries and Wages Expense

44,000 49,000

Totals

$100,000 $100,000 $122,000 $122,000

(b)

Date Account Title Ref Debit Credit

Supplies Expense 4,300

Supplies 4,300

(To record supplies used)

Insurance Expense 4,000

Prepaid Expense 4,000

(To record insurance expired)

Depreciation Expense 10,000

Accumulated Depreciation---Equipment 10,000

(To record monthly depreciation)

Accounts Receivable 11,000

Service Revenue 11,000

(To record revenue for services performed)

Salaries and Wages Expense 5,000

Salaries dan Wages Payable 5,000

(To record accrued salaries and wages)

(1)

(2)

(3)

(4)

(5)

(6)

Tugas 3 - SIAK Seany Sukmawati - 1106154034

P4-5B Tom Brennan opened Brennan's Cleaning Service on July 1, 2014. During July the

following transactions were completed.

July 1 Stockholders invested $20,000 cash in the business in exchange for ordinary shares.

1 Purchased used truck for $12,000, paying $4,000 cash and the balance on account.

3 Purchased cleaning supplies for $2,100 on account.

5 Paid $1,800 cash on one-year insurance policy effective July 1.

12 Billed customers $5,900 for cleaning services.

18 Paid $1,500 cash on amount owed on truck and $1,400 on amount owed on

cleaning supplies.

20 Paid $4,500 cash for employee salaries.

21 Collected $4,400 cash from customers billed on July 12.

25 Billed customers $8,000 for cleaning services.

31 Paid $350 for the monthly gasoline bill for the truck.

31 Declared and paid a $1,200 cash dividend.

The chart of accounts for Brennan's Cleaning Service contains the following accounts: No.

101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No. 130 Prepaid Insurance, No.

157 Equipment, No. 158 Accumulated Depreciation---Equipment, No. 201 Accounts Payable,

No. 212 Salaries and Wages Payable, No. 311 Share Capital---Ordinary, No. 320 Retained

Earnings, No. 332 Dividends, No. 350 Income Summary, No. 400 Service Revenue, No. 633

Gasoline Expense, No. 631 Supplies Expense, No. 711 Depreciation Expense, No. 722

Insurance Expense, and No. 726 Salaries and Wages Expense.

I nstructions

(a) Journalize and post the July transactions. Use page J1 for the journal and the three-

column form of account.

(b) Prepare a trial balance at July 31 on a worksheet.

(c) Enter the following adjustments on the worksheet and complete the worksheet.

(1) Services provided but unbilled and uncollected at July 31 were $3,300.

(2) Depreciation on equipment for the month was $500.

(3) One-twelfth of the insurance expired.

(4) An inventory count shows $600 of cleaning supplies on hand at July 31.

(5) Accrued but unpaid employee salaries were $2,200.

(d) Prepare the income statement and retained earnings statement for July and a classified

balance sheet at July 31.

Tugas 3 - SIAK Seany Sukmawati - 1106154034

(e) Journalize and post adjusting entries. Use page J2 for the journal.

(f) Journalize and post closing entries and complete the closing process. Use page J3 for the

journal.

(g) Prepare a post-closing trial balance at July 31.

(a)

General Journal

Date Account Titles and Explanation Ref. Debit Credit

July 1 Cash 101 20,000

Share Capital---Ordinary 311 20,000

(Issued shares for cash)

1 Equipment 157 12,000

Cash 101 4,000

Accounts Payable 201 8,000

(Purchased truck for cash with balance on

accounts)

3 Supplies 126 2,100

Account Payable 201 2,100

(Purchased cleaning supplies on account)

5 Prepaid insurance 130 1,800

Cash 101 1,800

(Paid one-year policy: effective date July 1)

12 Account Receivale 112 5,900

Service Revenue 101 5,900

(Billed customer for services provided)

18 Account Payable 201 1,500

Cash 101 1,500

(Paid cash on amount owed on truck)

18 Account Payable 201 1,400

Cash 101 1,400

(Paid cash on amount owed on cleaning

supplies)

20 Salaries and Wages Expense 726 4,500

Cash 101 4,500

(Paid salaries expense)

21 Cash 101 4,400

Account Receivable 112 4,400

(Receive cash for services provided billed on

July 12)

25 Account Receivale 112 8,000

Service Revenue 101 8,000

(Billed customer for services provided)

31 Gasoline Expense 633 350

Cash 101 350

(Paid for the monthly gasoline bill for the truck)

31 Dividends 332 1,200

Cash 101 1,200

(declared and paid a cash dividends)

J1

Tugas 3 - SIAK Seany Sukmawati - 1106154034

General Ledger

Cash

No. 101

Date Explanation Ref. Debit Credit Balance

July 1 J1 20,000 20,000

1 J1 4,000 16,000

5 J1 1,800 14,200

18 J1 1,500 12,700

18 J1 1,400 11,300

20 J1 4,500 6,800

21 J1 4,400 11,200

31 J1 350 10,850

31 J1 1,200 9,650

Account Receivable

No. 112

Date Explanation Ref. Debit Credit Balance

Jul.12 J1 5,900 5,900

21 J1 4,400 1,500

25 J1 8,000 9,500

Supplies

No. 126

Date Explanation Ref. Debit Credit Balance

July 3 J1 2,100 2,100

Prepaid Insurance

No. 130

Date Explanation Ref. Debit Credit Balance

July 5 J1 1,800 1,800

Equipment

No. 157

Date Explanation Ref. Debit Credit Balance

July 1 J1 12,000 12,000

Account Payable

No. 201

Date Explanation Ref. Debit Credit Balance

July 1 J1 8,000 8,000

3 2,100 10,100

18 1,500 8,600

18 1,400 7,200

Share Capital---Ordinary

No. 311

Date Explanation Ref. Debit Credit Balance

July 1 J1 20,000 20,000

Dividends

No. 332

Date Explanation Ref. Debit Credit Balance

Jul.31 J1 1,200 1,200

Service Revenue

No. 400

Date Explanation Ref. Debit Credit Balance

Jul.12 J1 5,900 5,900

25 8,000 13,900

Gasoline Expanse

No. 633

Date Explanation Ref. Debit Credit Balance

Jul.31 J1 350 350

Salaries and Wages Expanse

No. 726

Date Explanation Ref. Debit Credit Balance

July 3 J1 4,500 4,500

(b)

BRENNANS CLEANING SERVICE

Trial Balance

July 31, 2014

Debit Credit

Cash $ 9,650

Account Receivable 9,500

Supplies 2,100

Prepaid Insurance 1,800

Equipment 12,000

Accounts Payable $ 7,200

Share Capital--Ordinary 20,000

Dividends 1,200

Service Revenue 13,900

Gasoline Expense 350

Salaries and Wages Expense 4,500

$ 41,100

$ 41,100

Tugas 3 - SIAK Seany Sukmawati - 1106154034

(c)

Das könnte Ihnen auch gefallen

- Dini Kusuma Wardani F0221073 Accounting Cycle For Service Company (Part III)Dokument29 SeitenDini Kusuma Wardani F0221073 Accounting Cycle For Service Company (Part III)Dini Kusuma100% (1)

- P3-5a, p3-2b William 6081901032 FDokument13 SeitenP3-5a, p3-2b William 6081901032 FWilliam Wihardja0% (1)

- Hercules Poirpt PDFDokument4 SeitenHercules Poirpt PDFsy yusuf75% (12)

- Tugas Accounting 2 PRINTDokument6 SeitenTugas Accounting 2 PRINTAnnaley WilstaniaNoch keine Bewertungen

- ACC 557 Week 2 Chapter 2 (E2-6, E2-9, E2-11, P2-2A) 100% ScoredDokument18 SeitenACC 557 Week 2 Chapter 2 (E2-6, E2-9, E2-11, P2-2A) 100% ScoredJoseph W. Rodgers100% (1)

- Rahma Yeni Rosada - F0120105 - EPDokument6 SeitenRahma Yeni Rosada - F0120105 - EPRahma RosadaNoch keine Bewertungen

- Weygand 8e ch2 SolutionDokument5 SeitenWeygand 8e ch2 SolutionSeany Sukmawati0% (1)

- Tugas P2-1A Dan P2-2A Peng - AkuntansiDokument5 SeitenTugas P2-1A Dan P2-2A Peng - AkuntansiAlche MistNoch keine Bewertungen

- Chapter 4 Homework (April 22)Dokument6 SeitenChapter 4 Homework (April 22)Sugim Winata EinsteinNoch keine Bewertungen

- P1-2B 6081901141Dokument3 SeitenP1-2B 6081901141Mentari Anggari67% (3)

- Tugas 4 Dasar AkuntansiDokument20 SeitenTugas 4 Dasar AkuntansiAji Surya Wijaya75% (4)

- P3-2B IFRS 2ndDokument5 SeitenP3-2B IFRS 2ndAfrishalPriyandhanaNoch keine Bewertungen

- Tugas 3 - Lat Adjusment - Sri KurniawatiDokument11 SeitenTugas 3 - Lat Adjusment - Sri KurniawatiSher KurniaNoch keine Bewertungen

- Tutorial Slides-Chap 5 - Accounting For Merchandising OperationsDokument17 SeitenTutorial Slides-Chap 5 - Accounting For Merchandising OperationsAli Zain Parhar100% (2)

- E3 5Dokument3 SeitenE3 5Lisa Hammerle Clark60% (5)

- Tugas 7 - ELRISKA TIFFANI - 142200111Dokument8 SeitenTugas 7 - ELRISKA TIFFANI - 142200111Elriska Tiffani50% (2)

- P5-1A Dan P5-2ADokument6 SeitenP5-1A Dan P5-2ASherly Meliana Geraldine100% (1)

- Tugas 3 - ELRISKA TIFFANI - 142200111Dokument3 SeitenTugas 3 - ELRISKA TIFFANI - 142200111Elriska Tiffani100% (1)

- Tugas 4 - AkuntansiDokument3 SeitenTugas 4 - AkuntansiYusuf HadiNoch keine Bewertungen

- Chapter 4 ExerciseDokument5 SeitenChapter 4 ExerciseSeany SukmawatiNoch keine Bewertungen

- Tugas 4 - ELRISKA TIFFANI - 142200111Dokument6 SeitenTugas 4 - ELRISKA TIFFANI - 142200111Elriska Tiffani75% (4)

- Jawaban Tugas 3 PDFDokument3 SeitenJawaban Tugas 3 PDFPanji Rossel71% (7)

- CH 04Dokument111 SeitenCH 04arif nugrahaNoch keine Bewertungen

- Brief Exercises BE2 - 1: No. Account (A) Debit Effect (B) Credit Effect (C) Normal BalanceDokument6 SeitenBrief Exercises BE2 - 1: No. Account (A) Debit Effect (B) Credit Effect (C) Normal BalanceRakibul Islam Khan83% (6)

- 2011 02 05 - 132842 - p5 7aDokument5 Seiten2011 02 05 - 132842 - p5 7aOlga Zaneta Euneke SitorusNoch keine Bewertungen

- Tugas Akuntan 3Dokument14 SeitenTugas Akuntan 3Michael Edision UrikpyNoch keine Bewertungen

- P5 2aDokument5 SeitenP5 2adelisa87% (15)

- 4brief Ex 4Dokument5 Seiten4brief Ex 4Ervina CorneliaNoch keine Bewertungen

- YONAAADokument17 SeitenYONAAAMELLI MARIA RUMIMPUNU0% (1)

- P1-1a 6081901141Dokument2 SeitenP1-1a 6081901141Mentari AnggariNoch keine Bewertungen

- Fa2 TutorialDokument59 SeitenFa2 TutorialNam PhươngNoch keine Bewertungen

- P2 2BDokument6 SeitenP2 2BStella Tralalatrilili0% (2)

- Ch7 Ex WsDokument6 SeitenCh7 Ex WsFoong Chan PingNoch keine Bewertungen

- Akuntansi PengantarDokument7 SeitenAkuntansi PengantarRC50% (2)

- Pembahasan CH 3 4 5Dokument30 SeitenPembahasan CH 3 4 5bella0% (1)

- Accounting P4-1ADokument6 SeitenAccounting P4-1AAnother Jason100% (2)

- (SOLUTION) Chapter 3 - P3-5Dokument7 Seiten(SOLUTION) Chapter 3 - P3-5Nguyễn Quỳnh AnhNoch keine Bewertungen

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDokument6 SeitenNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNoch keine Bewertungen

- Question P8-1A: Cafu SADokument29 SeitenQuestion P8-1A: Cafu SAMashari Saputra100% (1)

- GENERAL JOURNAL Tugas Akuntansi 4Dokument9 SeitenGENERAL JOURNAL Tugas Akuntansi 4Sultan Fathulhaq100% (1)

- P4Dokument3 SeitenP4Trisyall TriyonoputraNoch keine Bewertungen

- Financial Accounting - Tugas 1Dokument6 SeitenFinancial Accounting - Tugas 1Alfiyan100% (1)

- Pengantar AkunDokument2 SeitenPengantar AkunNaurah Atika Dina100% (6)

- Bimbel PADokument31 SeitenBimbel PAHalle TeferiNoch keine Bewertungen

- Slowhand Services Journal Entries Date Particulars Ref. Debit CreditDokument5 SeitenSlowhand Services Journal Entries Date Particulars Ref. Debit CreditAL-AMIN AHMED MOBIN 1801015100% (1)

- PR P4-5a 29 November 2016Dokument8 SeitenPR P4-5a 29 November 2016Amiratul Ratna Putri50% (2)

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDokument7 SeitenE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Latihan Soal Kieso 2Dokument6 SeitenLatihan Soal Kieso 2Dimas Samuel100% (3)

- E2-7 Answer KeyDokument1 SeiteE2-7 Answer Keyusenix1100% (1)

- Tugas 14 SepDokument5 SeitenTugas 14 Sepmelvina siregar100% (1)

- P5-3a Pa1Dokument10 SeitenP5-3a Pa1Agnes Eviyany50% (6)

- P4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesDokument5 SeitenP4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesRisky Fernando67% (3)

- Regression Line of Overhead Costs On LaborDokument3 SeitenRegression Line of Overhead Costs On LaborElliot Richard100% (1)

- P4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesDokument7 SeitenP4-1A Prepare A Worksheet, Financial Statements, and Adjusting and Closing EntriesDidan EnricoNoch keine Bewertungen

- Quiz Review CH 5 6 7Dokument8 SeitenQuiz Review CH 5 6 7yanto ismailNoch keine Bewertungen

- CH 03Dokument4 SeitenCH 03vivien50% (2)

- 274-B-A-A-C (2683)Dokument10 Seiten274-B-A-A-C (2683)Ahmed Awais100% (2)

- CH 04Dokument4 SeitenCH 04vivien33% (3)

- ACC121 FinalExamDokument13 SeitenACC121 FinalExamTia1977Noch keine Bewertungen

- Teamwork For Ibl1201Dokument16 SeitenTeamwork For Ibl1201Thanh Phat Nguyen MyNoch keine Bewertungen

- Fee Structure NBADokument2 SeitenFee Structure NBAVenkiteshNoch keine Bewertungen

- PT Tigaraksa Satria TBK Dan Entitas Anaknya/and Its SubsidiariesDokument104 SeitenPT Tigaraksa Satria TBK Dan Entitas Anaknya/and Its SubsidiariesbanyuajiyudhaNoch keine Bewertungen

- The "Best Practices" When Using Fore! Trust Software After Enactment of The Secure ActDokument6 SeitenThe "Best Practices" When Using Fore! Trust Software After Enactment of The Secure ActENoch keine Bewertungen

- Guide To The Completion of The EMPLOYEE Income Tax FormDokument5 SeitenGuide To The Completion of The EMPLOYEE Income Tax FormMarz CuculNoch keine Bewertungen

- Steps in The Accounting Cycle of A Service Business (Preparing Adjusting Journal Entries)Dokument26 SeitenSteps in The Accounting Cycle of A Service Business (Preparing Adjusting Journal Entries)Zybel RosalesNoch keine Bewertungen

- Bernachtungsteuer Merkblatt Gast EnglishDokument3 SeitenBernachtungsteuer Merkblatt Gast EnglishWojciech KosmaNoch keine Bewertungen

- Cpa Reviewer in TaxationDokument34 SeitenCpa Reviewer in TaxationMika MolinaNoch keine Bewertungen

- Form 4A - GCT Returns PDFDokument2 SeitenForm 4A - GCT Returns PDFNicquainCTNoch keine Bewertungen

- Fringe Benefit Tax Dealings in PropertiesDokument13 SeitenFringe Benefit Tax Dealings in PropertiesBea Marie BernardoNoch keine Bewertungen

- Spamming FMTDokument14 SeitenSpamming FMTJames RudigerNoch keine Bewertungen

- Tax2 - Estate Donors VAT ReviewerDokument3 SeitenTax2 - Estate Donors VAT ReviewercardeguzmanNoch keine Bewertungen

- LBMachineryDokument3 SeitenLBMachineryJames Peter LobasNoch keine Bewertungen

- Earnings Deductions Amount Amount: For The Month of December 2019Dokument7 SeitenEarnings Deductions Amount Amount: For The Month of December 2019Chandramohan GNoch keine Bewertungen

- Indiana Property Tax Benefits: (This Form Must Be Printed On Gold or Yellow Paper)Dokument2 SeitenIndiana Property Tax Benefits: (This Form Must Be Printed On Gold or Yellow Paper)abramsdcNoch keine Bewertungen

- BIR Form No. 0901-D DividendsDokument2 SeitenBIR Form No. 0901-D DividendsKoji ZerofourNoch keine Bewertungen

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Dokument20 SeitenReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB Cloyd100% (1)

- Provisional: Provisional Income Tax CalculationDokument1 SeiteProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNoch keine Bewertungen

- Collection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Dokument1 SeiteCollection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)MohammadImranRazaNoch keine Bewertungen

- 7 Estate TaxDokument69 Seiten7 Estate TaxClaire diane CraveNoch keine Bewertungen

- UPL Ltd. (India) : SourceDokument6 SeitenUPL Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- SAP Practice Quetions (Only Answers)Dokument9 SeitenSAP Practice Quetions (Only Answers)Shahbaz IqbalNoch keine Bewertungen

- Comparative Analysis On The Taxation of Transfer of Shares Under Indonesia MY, PH, & VT Treaty - Angeline & ArfianDokument6 SeitenComparative Analysis On The Taxation of Transfer of Shares Under Indonesia MY, PH, & VT Treaty - Angeline & ArfianSolihin Makmur AlamNoch keine Bewertungen

- ITR-4 Notified Form AY 2021-22-0Dokument5 SeitenITR-4 Notified Form AY 2021-22-0Kuldeep JatNoch keine Bewertungen

- Qtech Software Private LimitedDokument1 SeiteQtech Software Private LimitedParveen SainiNoch keine Bewertungen

- NCR Cup 2 (Finals) TaxDokument63 SeitenNCR Cup 2 (Finals) TaxIvan DorosanNoch keine Bewertungen

- TablesDokument3 SeitenTablesJPNoch keine Bewertungen

- Actividad 7 1040 FormDokument2 SeitenActividad 7 1040 FormKevin ÁlvarezNoch keine Bewertungen

- On July 1 2006 Leon Cruz Established An Interior DecoratingDokument1 SeiteOn July 1 2006 Leon Cruz Established An Interior DecoratingM Bilal SaleemNoch keine Bewertungen

- North Mountain NurseryDokument4 SeitenNorth Mountain NurseryLevi BlueNoch keine Bewertungen

- Myob ElisDokument9 SeitenMyob ElisDesak ElisNoch keine Bewertungen