Beruflich Dokumente

Kultur Dokumente

Deloitte Telecommunications Data Analytics July2012

Hochgeladen von

afzallodhi7360 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

18 Ansichten8 Seitentelecom financial data

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldentelecom financial data

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

18 Ansichten8 SeitenDeloitte Telecommunications Data Analytics July2012

Hochgeladen von

afzallodhi736telecom financial data

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

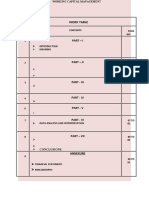

Sie sind auf Seite 1von 8

Telecommunications

and Data Analytics

Improving nancial performance by turning

challenges into opportunities

2

The telecommunications industry has experienced

rapid changes over the past decade as a result of

technological advancements, regulatory inuences

and increased competition.

Companies have responded to these changes with

strategic acquisitions, multiple and complex pricing

plans, and product bundling. They have also sought

to offer differentiated products such as IPTV and

cloud computing. These changes in the market

present new challenges which could undermine

earnings and impact key industry performance

measures including EBITDA and Average Revenue

Per User (ARPU).

The telecommunications industry regularly uses

data analytics in elds such as customer analysis

and network optimisation. For nancial analyses such

as identifying risks, which could negatively impact

an entitys nancial performance, communications

service providers have traditionally used statistical

sampling techniques that cover only short time

periods and a limited subset of data.

To better understand and respond to these risks,

Chief Financial Ofcers (CFOs) can now use more

sophisticated data analytic methods to supplement

the audit advisory services they receive. In particular,

a cost-effective opportunity exists to analyse large

volumes of data over an extended period, providing

more insight and greater agility to respond.

In this article, we discuss ve areas in which data

analytics can be used to address the opportunities

and risks faced by communications service providers:

ARPU leakage, network development, protability

of stores and franchises, phone inventory and

cash outows.

CFOs can now use more

sophisticated data analytic

methods to identify revenue

opportunities and address risks

that negatively impact their

companys margin

Data analytics and improving nancial results

The following ve cases show that the combination of deep industry insights and data analytics offer

CFOs the unique ability to effectively address industry specic nancial risks and create opportunities

by analysing data over an extended period of time.

Time

Telecommunications and Data Analytics 3

CFOs can make the adjustments

they need to get ARPU back on

the path to growth

Telecommunications companies invest heavily

in capturing and analysing ARPU. In recent years,

the number of variables which contribute to ARPU

has increased alongside the complexity of product

offerings, bundling and billing arrangements.

As a result, CFOs may struggle to understand

why ARPU is changing and what they can

do to arrest downward trends.

Outperforming competitors requires a granular,

in-depth understanding of the factors that drive

changes in ARPU data analytics make this possible

at levels not previously achievable. Analytics can also

identify outliers that provide meaningful clues to

the sources of underages or overages. Armed with

this information, CFOs can make strategic pricing

decisions to get ARPU back on the path to growth.

Deloitte recently helped a leading Australian

telecommunications provider understand the

reasons behind changes in ARPU by analysing

how customers moved between certain price

plans. This exercise signicantly helped the

carrier optimise its strategic price setting.

1 ARPU leakage

identifying outliers

Price plan

A

R

P

U

Figure 1: ARPU analytics

4

2 Network development

project accounting and capital

expenditure tracking

As communications service providers invest

signicant time, effort and capital into optimising

and expanding their networks, tracking and

accounting for these projects is essential for CFOs

and internal auditors. CFOs need to decide which

aspects of network building exercises are booked

as expenses and which can be capitalised as

assets. Conducting data analytics on capital works

in progress can identify projects with unusual

characteristics that present increased risks

of capital loss.

By analysing variables such as actuals versus

budget, timing of spend, and cost composition

across all capital projects week to week and month

to month CFOs can create a risk prole for each

project. They can then pinpoint those projects which

need additional management attention to minimise

downside nancial exposure.

CFOs can pinpoint those projects

which need additional management

attention to minimise downside

fnancial exposure

Figure 2: Network development detailed project risk prole

Risk Score

P

r

o

j

e

c

t

t

u

r

n

o

v

e

r

(

Y

T

D

)

Projects that fall within the accepted turnover/risk ratio

Projects with increased risk that warrant further investigation

Telecommunications and Data Analytics 5

3 Proftability of stores

and franchisees

Many customers buy telecommunication services,

phones and related devices through company-owned

or franchised retail stores. Data analytics gives CFOs

the opportunity to measure the performance of each

store using more granular metrics than protability

alone. This extends to unobvious correlations not

historically visible.

For example, management can review the controls

and processes at stores that signicantly outperform

or underperform relative to their peers and potential

catchment. CFOs can ensure they are comparing like

for like, by taking into account factors such as the

particular demographics for each store location

along with store size and operating attributes.

This can provide valuable insights for future

planning. In addition, CFOs can identify the stores

at greatest risk of poor nancial performance

and take appropriate action.

Catchment spend on communication devices

High performing stores

Stores with operational improvement opportunities

Underperforming stores to consider for closure and / or relocation

S

t

o

r

e

c

o

n

t

r

i

b

u

t

i

o

n

t

o

n

e

t

m

a

r

g

i

n

CFOs can identify stores at

greatest risk of poor fnancial

performance and take

appropriate action

Figure 3: Store performance

6

4 Phone inventory

minimizing holding costs

Mainly as a result of the introduction of the smart

phone, phone inventory has signicantly increased

in value and now represents a substantial cost to

operators. As a consequence, adequate monitoring

of phone inventory levels has become important

in order to minimize holding costs and prevent the

organisation from unnecessary losses relating to

impairment of outdated phone inventory.

Traditional inventory management systems provide

high level insight into the aforementioned, however,

typically allow only a retrospective view on the

inventory challenge. CFOs can use data analytics to

perform an in-depth analysis of its existing phone

inventory, analyse product margins at the lowest level

and predict phone inventory with an increased risk

of becoming obsolete. This will help improve stock

replenishment, optimise phone inventory levels

and reduce costs relating to holding inventory.

CFOs can improve stock

replenishment, optimize phone

inventory levels and reduce costs

relating to holding inventory

Average number of days to sell

Figure 4: Optimising inventory levels

I

n

v

e

n

t

o

r

y

v

a

l

u

e

Communication devices above optimal inventory levels

7

5 Cash outfows

Communications service providers typically

experience signicant cash outows when

purchasing fixed assets such as network

components and communication devices.

This warrants increased scrutiny of a

telcos payments processing and control.

CFOs can use data analytics to validate

existing supplier databases and identify any

invalid or unused suppliers. They can also

verify that purchase authorisations comply

with internal authorisation rules, including

instances of duplicate payments (which occur

more frequently than many realise). As a

result, CFOs can gain insights into breaches

of purchase authorisation procedures and

take steps to reduce unnecessary loss.

Deloitte helped a prominent Australian

telecommunications carrier conduct an

in-depth analysis of the effectiveness of its

payments function. Several ideas to improve

processes and controls were implemented.

Conclusion

Given the massive number of transactions processed by telecommunications companies; and the

costs and complexity involved in their operations, data analytics offers CFOs a valuable opportunity

for enhancing the frameworks and procedures they adopt to drive protability and minimise

unnecessary downside risk.

CFOs can gain insights into

breaches of purchase authorisation

procedures and take steps to

reduce unnecessary loss

About Deloitte Australia

Deloittes next-generation advisory services combine deep telecommunication industry expertise with leading-edge nancial data analytics.

Our advisory professionals can draw on the expertise of more than 100 data analytics experts across Australia. We can help CFOs accurately

pinpoint the challenges and risks they face, correctly interpret the results of data analytics exercises and maximise the benets that result.

Please contact us for more information about this topic or the role data analytics could play in your organisation.

Please visit www.deloitte.com/au/tmtinsights for more Deloitte thought leadership on issues and opportunities in the

Telecommunications sector.

Contact Us

Deloitte

225 George Street

Sydney, New South Wales

Australia

Tel: +61 2 9322 7000

Fax: +61 2 9322 7001

This publication contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the Deloitte Network) is, by means of this

publication, rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible

for any loss whatsoever sustained by any person who relies on this publication.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent

entity. Please see www.deloitte.com/au/about for a detailed description of the legal structure of Deloitte Touche Tohmatsu Limited and its member firms.

Deloitte provides audit, tax, consulting, and financial advisory services to public and private clients spanning multiple industries. With a globally connected network of member firms in more than 150

countries, Deloitte brings world-class capabilities and high-quality service to clients, delivering the insights they need to address their most complex business challenges. Deloittes approximately 182,000

professionals are committed to becoming the standard of excellence.

About Deloitte Australia

In Australia, the member firm is the Australian partnership of Deloitte Touche Tohmatsu. As one of Australias leading professional services firms, Deloitte Touche Tohmatsu and its affiliates provide audit,

tax, consulting, and financial advisory services through approximately 5,700 people across the country. Focused on the creation of value and growth, and known as an employer of choice for innovative

human resources programs, we are dedicated to helping our clients and our people excel. For more information, please visit Deloittes web site at www.deloitte.com.au.

Liability limited by a scheme approved under Professional Standards Legislation.

Member of Deloitte Touche Tohmatsu Limited

2012 Deloitte Touche Tohmatsu.

AM_Syd_03/12_046770

About the authors

Philip Takken is a Director in Deloittes Technology,

Media and Telecommunications practice in Sydney.

In the last fourteen years Philip has been providing

Assurance and Advisory services to major

incumbents as well as emerging telecommunication

companies in both the USA and Asia Pacic.

Tel: +61 2 9322 3957

Email: phtakken@deloitte.com.au.

Slav Tabachnik is a Director in Deloittes Data

Analytics practice in Sydney. Slav has more than

twelve years experience developing computer models

to assist customer management, compliance, revenue

and cost management activities using electronic data

sets. Slav has applied these skills across a number of

engagements in the telecommunications industry

in Germany, Canada and Australia.

Tel: +61 2 9322 7345

Email: stabachnik@deloitte.com.au.

Das könnte Ihnen auch gefallen

- Resume Template 7Dokument1 SeiteResume Template 7afzallodhi736Noch keine Bewertungen

- Internal Audit & E-Commerce Industry Speaker - CA Kartik RadiaDokument23 SeitenInternal Audit & E-Commerce Industry Speaker - CA Kartik Radiaafzallodhi736Noch keine Bewertungen

- NEO PI 3 BRC Sample ReportDokument8 SeitenNEO PI 3 BRC Sample Reportafzallodhi736Noch keine Bewertungen

- Jacob ScottDokument2 SeitenJacob Scottafzallodhi736100% (1)

- Validating The NEO Personality Inventory PDFDokument7 SeitenValidating The NEO Personality Inventory PDFafzallodhi736Noch keine Bewertungen

- Mps Feb 2014 - EnglishDokument58 SeitenMps Feb 2014 - Englishafzallodhi736Noch keine Bewertungen

- Tool+6 8 +Case+Study+-+M-PESA,+TanzaniaDokument18 SeitenTool+6 8 +Case+Study+-+M-PESA,+Tanzaniaafzallodhi736Noch keine Bewertungen

- 11 Years of Supreme CourtDokument32 Seiten11 Years of Supreme Courtafzallodhi736Noch keine Bewertungen

- Parks + Marangu Falls 2012Dokument3 SeitenParks + Marangu Falls 2012afzallodhi736Noch keine Bewertungen

- Telecommunications Data ModelDokument1 SeiteTelecommunications Data Modelafzallodhi736Noch keine Bewertungen

- List of Hospitals in MumbaiDokument6 SeitenList of Hospitals in Mumbaiafzallodhi736Noch keine Bewertungen

- Bresson BissonDokument13 SeitenBresson Bissonafzallodhi736Noch keine Bewertungen

- WithholdingTaxTable RatesDokument3 SeitenWithholdingTaxTable Ratesafzallodhi736Noch keine Bewertungen

- Segregration of DutiesDokument30 SeitenSegregration of Dutiesafzallodhi736Noch keine Bewertungen

- Best Practices For World-Class I/T GovernanceDokument28 SeitenBest Practices For World-Class I/T Governanceafzallodhi736Noch keine Bewertungen

- 5 Package Tour 16 12Dokument2 Seiten5 Package Tour 16 12afzallodhi736Noch keine Bewertungen

- Indian Application FormDokument6 SeitenIndian Application Formafzallodhi736Noch keine Bewertungen

- Unit Linked Insurance Polices (Ulips) : Frequently Asked Questions (Faqs)Dokument6 SeitenUnit Linked Insurance Polices (Ulips) : Frequently Asked Questions (Faqs)afzallodhi736Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- SEBI Grade A Model Test Paper 2Dokument32 SeitenSEBI Grade A Model Test Paper 2Snehashree SahooNoch keine Bewertungen

- SCM Activity Implementatio: Product Production System Fabric Supplier Retail CustomerDokument18 SeitenSCM Activity Implementatio: Product Production System Fabric Supplier Retail CustomerfekaduNoch keine Bewertungen

- Working Capital ManagementDokument80 SeitenWorking Capital ManagementVijeshNoch keine Bewertungen

- Stocks - Physical Verification Guidance NoteDokument2 SeitenStocks - Physical Verification Guidance NoteJoão Henrique Machado100% (1)

- Business Finance: Types, Formula, and Format For Budget PreparationDokument15 SeitenBusiness Finance: Types, Formula, and Format For Budget Preparationmarkjempalomaria100% (1)

- OYO Case Study SolutionDokument4 SeitenOYO Case Study SolutionVIKASH GARGNoch keine Bewertungen

- System Analysis and DesignDokument1.445 SeitenSystem Analysis and Designaone0087% (23)

- Projects Inventory Management Integration White Paper PDFDokument21 SeitenProjects Inventory Management Integration White Paper PDFYaseen Iqbal100% (1)

- OTB User Manual V6.11Dokument46 SeitenOTB User Manual V6.11r96r100% (1)

- Accounting For Inventory, Control Accounts and A Bank ReconciliationDokument13 SeitenAccounting For Inventory, Control Accounts and A Bank ReconciliationMonicah NyamburaNoch keine Bewertungen

- Auditing and Assurance Services 16th Edition Arens Solutions ManualDokument28 SeitenAuditing and Assurance Services 16th Edition Arens Solutions Manualgloriaelfleda9twuoe100% (20)

- Acctg 326 Exam 1 FlashcardsDokument5 SeitenAcctg 326 Exam 1 Flashcardsvgurrola14Noch keine Bewertungen

- UNIT III-Financial Aspects of Inventory StrategyDokument17 SeitenUNIT III-Financial Aspects of Inventory StrategyMonica Lorevella NegreNoch keine Bewertungen

- Oscm - No AnswerDokument89 SeitenOscm - No AnswerNGAN PHAM THI THANHNoch keine Bewertungen

- UNIT V PomDokument55 SeitenUNIT V PomVandhana PramodhanNoch keine Bewertungen

- Act512 - Assignment Chapter - 06Dokument9 SeitenAct512 - Assignment Chapter - 06Rafin MahmudNoch keine Bewertungen

- Table - 23-7: Schedule 1g: Ending Inventories Budget, First Quarter, 20XXDokument4 SeitenTable - 23-7: Schedule 1g: Ending Inventories Budget, First Quarter, 20XXeahpotNoch keine Bewertungen

- Assignemnt 2 MSDokument2 SeitenAssignemnt 2 MSIhsan IqbalNoch keine Bewertungen

- Inventory MGT TechniquesDokument21 SeitenInventory MGT TechniquesTambe Chalomine AgborNoch keine Bewertungen

- Invty MgtORDokument36 SeitenInvty MgtORkevin punzalan100% (1)

- Curriculum Vitae: Gopakumar. S Mobile:+971569983931 ObjectiveDokument3 SeitenCurriculum Vitae: Gopakumar. S Mobile:+971569983931 ObjectiveGopakumar SNoch keine Bewertungen

- Some Definitions of Materials Management:: Material Management: It's Definition, Objectives and Organization!Dokument5 SeitenSome Definitions of Materials Management:: Material Management: It's Definition, Objectives and Organization!akurati_sNoch keine Bewertungen

- Chapter 4 Financial Statement AnalysisDokument63 SeitenChapter 4 Financial Statement AnalysismindayeNoch keine Bewertungen

- Nishant - SAP PSDokument4 SeitenNishant - SAP PSniteshsh31Noch keine Bewertungen

- Soft Computing and The Bullwhip Effect : Christer Carlsson and Robert FullérDokument26 SeitenSoft Computing and The Bullwhip Effect : Christer Carlsson and Robert FullérKksksk IsjsjNoch keine Bewertungen

- 05 - Network Design in Supply ChainDokument21 Seiten05 - Network Design in Supply ChainAfnanNoch keine Bewertungen

- Quiz 1 Answers PDFDokument4 SeitenQuiz 1 Answers PDFMariamiNoch keine Bewertungen

- VI. Budgeting and Financial ForecastingDokument39 SeitenVI. Budgeting and Financial ForecastingJemNoch keine Bewertungen

- Calderon Inv. 2018Dokument2 SeitenCalderon Inv. 2018Joseph PamaongNoch keine Bewertungen

- Inventory and Risk Management-AbstractDokument2 SeitenInventory and Risk Management-AbstractSaritha ReddyNoch keine Bewertungen