Beruflich Dokumente

Kultur Dokumente

DR Said e Cherkaoui Bric Marketplaces

Hochgeladen von

api-2300196530 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

816 Ansichten29 SeitenOriginaltitel

dr said e cherkaoui bric marketplaces

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

816 Ansichten29 SeitenDR Said e Cherkaoui Bric Marketplaces

Hochgeladen von

api-230019653Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 29

Dr.

Said El Mansour Cherkaoui

http://www.glocentra.weebly.com

saidcherkaoui@outlook.com

2

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

2

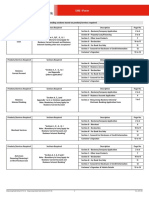

East Bay Center for International Trade

Development BRICs Seminar Series

by Said Cherkaoui, Ph.D.

Building New Global Market Order

with four BRIC Economies: Brazil, Russia, India and China

3 Go East Old Man?

4 Vu Dj A New World Order

5 - Attitudes Are Changing in BRIC Countries

6 - The World Economy Grows BRIC by BRIC

7 - While Economies are Growing Faster, China is

Speeding

8 - The Case for Local Asset Management

9 - The BRICs Impact on Global Markets: A

Transforming Event

10 - BRIC a Brac: BRICS Country in Vrac

11 - BRICs by Country: Brazil

12 - BRICs by Country: Russia

13 - BRICs by Country: India

14 - BRICs by Country: China

15 - BRICs or BREAK by Country

1 of 2 Table of Contents

3

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

3

East Bay Center for International Trade

Development BRICs Seminar Series

by Said Cherkaoui, Ph.D.

Building New Global Market Order **

with four BRIC countries: Brazil, Russia, India and China

16 - BRIC Steps

17 Goldman Sacks Report on the BRIC Economies

18 High Growth and Hyper Implications for the World Economy

19 Solid BRIC Economies and Broken Global Economy

20 BRICs Breaking Records in Economic and Financial Fields

21 BRICs and Industrial Commodity Market and Consumer Goods

22 Making the most of Cheaper BRIC Labor

23 - Find partners in the BRIC economies and to compete with their Talents

24 - BRIC Tips & Tactics

All the presentation and the extrapolation are made on current available studies and analysis and

do not pretend to be iron-clad analysis that will not be tempered by cyclical recession know by the

capitalist world. East Bay Center for International Trade Development, GLOCENTRA and Dr. Said

Cherkaoui do not bear any responsibility fo the Content or the use of the content of this analysis for

any purpose that can lead to a decision.

2 of 2 Table of Contents

4

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

4

Go East Young & Old Man?

BRIC countries will grow

most rapidly

Distribution of Worlds GDP (2004=100)

Source: Extrapolation of current growth rates from

World Bank, World Development Report

Developing countries will account

for nearly half of total growth in

global output over the next twenty

years.

Over two thirds of the growth in

developing countries will come from

just four countries: Brazil, Russia,

India and China

The BRICs countries have much

higher potential returns on

investment (but also higher risk)

than is likely to be available in the

UK

Is part of the solution to closing

the UK wealth gap greater direct

and portfolio investment in the BRIC

countries and/or in developing

countries generally?

All the extrapolation are made on current

available studies and analysis and do not pretend to

be iron-clad analysis that will not be tempered by

cyclical recession know by the capitalist world.

-

20

40

60

80

100

120

140

160

180

200

2004 2025

2004=100

29%

32%

23%

32%

5%

32%

9%

32%

35%

32%

32%

32%

20%

32%

5%

32%

18%

32%

25%

32%

5

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

5

Vu Dj A New Economic World Order

In less than 40 years, the BRICs economies could be larger than

the G6 in USD terms.

China could overtake the US as the worlds largest economy in a

little over 30 years.

Of the current G6, only the US and Japan may be among the six

largest economies in 2050.

New demand from the BRICs economies could rival the current

G6 within a decade and dwarf it by 2050.

Individuals in the BRICs are still likely to be poorer on average

than individuals in the G6 economies, except in Russia.

6

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

6

Attitudes Are Changing in BRIC Countries

Old Attitude New Attitude

Capital flight Capital inflow

Invest outside of the country Better investment returns at home

Export oriented Consumption oriented

Family financial unit Individual unit

Children support parents Save for retirement

Socialist It is good to be rich

Rural Urban

Self doubt Confidence

Weak currency Strong currency

7

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

7

The World Economy Grows BRIC by BRIC

The BRIC (Brazil, Russia, India, China) countries will be 40% of the

world growth and 30% of the total global economy by 2025 *

The middle class in BRIC will be 800 million in 2010*

Greater than the combined population of USA, Europe and

Japan

BRICs nearly 3 times the population size of the OECD

The BRICs will produce 200 million new high-income people

The BRIC consumer will be a driving force of the world economy

Mutual funds are the ideal investment vehicle for this investor

group

Source: * Goldman Sachs BRIC study & World Bank, World Development

Indicators Database April 2005

8

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

8

While Economies are Growing Faster,

China is Speeding

0

5

10

15

20

25

30

35

40

0% 5% 10% 15% 20% 25% 30%

rate of change (%/year)

w

i

n

d

o

w

(

y

e

a

r

s

)

Most of the worlds economies

double every 35 years.

In the best of times, the developed world

takes 25 years to double.

Chinas economy doubles every 7 years.

Source: J im Brock Taken from presentation China: Risks and Opportunities for Global

Investors, Jing Ulrich 5/05

9

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

9

The Case for Local Asset Management

Most investors in the fastest growing economies invest locally

BRIC countries have restrictions on foreign investing

Even in developed countries about 75% of investments are local

Local financial institutions do not have mutual fund expertise

Local asset management provides opportunity for selling

additional products

The obvious: the locals know more about their markets

10

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

10

The BRICs Impact on Global Markets: A Transforming Event

A sequence of pressures: crude, cars then capital

The growth of a BRICs middle class could be a key market dynamic

The timing of impact varies across the BRICs

The next decade is likely to be the peak period for resource pressure

11

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

11

BRIC a Brac: BRICS Country in Vrac

BRAZIL:

One of the world's largest commodity exporters

Home to the largest iron ore supplies

Exports also include coffee and soya

RUSSIA:

Home to the largest supply of natural gas

Detained 15% of the world's crude oil reserves

Country debt awarded investment-grade rating in 2005

INDIA:

Highly skilled workforce

Key centre for international companies looking to outsource

Large infrastructure programs

CHINA:

Ranked 5th largest exporter of merchandise

Huge domestic consumption

Host of the 2008 Olympic Games

12

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

12

BRICs by Country: Brazil

Over the next 50 years, Brazils GDP growth rate averages 3.6%.

The size of Brazils economy overtakes Italy by 2025; France by 2031;

United Kingdom and Germany by 2036.

CRITICAL ISSUES:

Challenges: lack of openness, lower education levels, lower savings and

investment, higher public and foreign debt.

Lower convergence rate at first, then catch-up with China.

Foreign and public debt constraints; Infrastructure; Openness to trade.

Despite the considerable efforts to secure macroeconomic stability, the

Brazilian government have failed to convince foreign corporate decision-

makers.

13

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

13

BRICs by Country: Russia

By 2050, Russias GDP per capita is by far the highest of the BRICs.

Demographic dynamics drive GDP per capita path.

Russias economy overtakes Italy in 2018; France in 2024; United

Kingdom in 2027 and Germany in 2028.

Critical issues: What would be the Political and Economic life after

Putin; The Transition from Oil.

Dreaming or not with Russia

Oil and gas prices major positive factor

Only (too?) slow progress on structural and democratic reforms

Environment for Foreign Direct Investment far from perfect, instability

of security and corruption

Yields in local markets unattractive in comparison to several Western

EU economies

RUB should appreciate, but CBR has its own agenda

Despite Russia's abundant energy supplies, internal political

uncertainties seem to deter foreign direct investors.

14

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

14

BRICs by Country: India

Indias growth rate remains above 5% throughout the period.

Ernst & Young conducted on 2007 a survey of 809 managers from various

industries in Europe, America and Asia about their investment

preferences. India popularity appears to be increasing fast. While 11

percent of investors cited India among their top three preferences in 2004,

it has risen to 26 percent in 2007

Indias GDP outstrips that of Japan by 2032.

India could raise its income per capita in 2050 to 35 times current levels.

Still, Indias income per capita will be significantly lower than

any other BRICs countries.

Critical issues: Openness; Basic Education; Policy Coherence.

15

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

15

Sourcing out and in China & India

United States 125,150

EU-25 107,254

Hong Kong S.A.R. 100,870

Japan 73,510

South Korea 27,812

Others 17,800

Total exports 593,329

EU-25

17,128

United States

13,643

UAE

6,043

Hong Kong S.A.R.

3,864

PRC China

3,500

Others

2,508

Total exports

75,595

China's Exports 2004

(in million US$)

India's Exports 2004

(in million US$)

Source: WTO

In late 2006, Tata Consultancy Services won a landmark deal

worth $100 million from Bank of China, the first major IT

contract bagged by an Indian company with a Chinese firm.

16

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

16

India IT in China

IT in China, Jan. 2008

17

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

17

BRICs by Country: China

Chinas GDP growth rate falls to 5% in 2020 from its 8.1% growth rate

projected for 2007.

By the mid-2040s, growth slows to around 3.5%.

Even so, China becomes the worlds largest economy by 2041.

High investment rates, tapers off though projection period.

Chinas per capita income could be roughly what the developed economies

are now (about US$30,000 per capita).

Per OECD China is already bigger than 2 of G7 Canada and Italy

By 2010 China will be 4

th

largest economy after US, Japan and Germany- If

China were cut off from foreign trade and investment its growth would be just

1-2% p.a. less. *

Critical issues: Financial System Reform; Political Transition

* Source: Professor Lucas, University of Chicago Sunday Times 25thSeptember 2005

18

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

18

China Top Choice for Investors:

Ernst & Young

Source: WTO

Adjust font size:

Between February and March 2007, the survey asked 809

managers from various industries in European, American and

Asian firms about their investment preferences.

Almost half - 48 percent - of international investors cited China

as one of their top three preferred business locations in 2007,

up from 41 percent in the 2006 survey.

They said they were drawn to China for its low labor costs, more

competitive rates and higher productivity. The country's

infrastructure, quality of research and development, workforce

education and political stability were cited as major advantages.

China still lags behind in quality of workforce - only 4 percent of

those surveyed said it is the most attractive country in terms of

labor skills and only 4 percent consider China as the most

attractive economy in terms of R&D availability and quality, as

opposed to 43 percent for Europe and 27 percent for North

America. (China Daily July 5, 2007)

19

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

19

BRICs or BREAK by Country

Can Brazil cope with resource authoritarianism in Latin America?

Can Russia revive its non-commodity industries and develop more stable

political system not undermined by personality politics and cronyism?

Can India diversify from regional imbalances, poverty, Anglophone services

and bureaucratic and central state planning?

Can China make the transition from central politics, environment hurdles,

internal poverty and from state mercantilism to consumer markets?

What is the future of oil and commodity prices?

United States and Europe will need to collaborate in trade through bilateral

agreement to build a counterbalance market to the impact of the BRICS and

the Asian East European trade and financial expansion and arrangements.

The Dollar and Euro will be challenged as currencies for international

transactions and investments.

How can the United States of America or the European Union compete?

20

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

20

BRIC Step & Muscle Building

The best contacts and resources to help you get it done.

Start with the report that launched it all, Goldman Sachs, the global investment bank, got

the BRIC discussion going by suggesting that those four economies in development

would add up to do more than the entire "developed" world combined by 2050. Yet few

U.S. and European companies are seriously into any of them -- yet.

Archives and Studies at the Goldman Sachs:

http://www.goldmansachs.com/our-thinking/archive/index.html

The bank has thoughtfully boiled the relevant points down into a

http://www.goldmansachs.com/our-thinking/outlook/jan-hatzius-economic-outlook-us-

mid-yr-2014.html

and it issued a follow-up report in early 2005

http://www.goldmansachs.com/

http://www2.goldmansachs.com/hkchina/insight/research/pdf/BRICs_3_12-1-05.pdf .

One way to track which companies are driving the BRIC economies is to read up on the

investment funds which claim to offer a way to put money into the far-flung geography.

Some key investment vehicles include, of course:

https://assetmanagement.gs.com/content/gsam/worldwide.html

Allianz Global Investors http://www.bricstars.co.uk/literature/index.html#10_general

21

Attempt by emerging economies to challenge the US-based global lending institutions

China is starting a separate bilateral institution in Asia which is a rival to the Asian Development Bank, which is

considered to be over influenced by the US and its allies.

The Research Center of Shanghai's Fudan University says China has a strong advantage in terms of economic and

political stability compared to India and Russia.

China is the worlds second largest economy, with the largest trade and investment volumes, the research report

added.

On top of that, Chinas total bank-scale ranks among the highest in world, demonstrating its strong ability to resist

risks, the Fudan University report concluded.

Each BRICS member is expected to put an equal share into establishing the startup capital of $50 billion. BRICS

officials also plan to set up a joint $100 billion emergency swap fund for financial crises available only if needed to

meet the banks obligations. To compare, the World Bank has capital of $223 billion, and most of it is callable.

Despite initially being a small rival the World Bank or the International Monetary Fund, it will serve as a reminder to

the US of the shift in the global economy towards the developing world.

This is a considerable group of countries from around the world that have come together to create something

without US or European involvement, this is significant, the Financial Times quotes Oliver Stuenkel, Assistant

Professor of International Relations at the Getulio Vargas Foundation in So Paulo.

Since 2010 the US Congress has received proposals to increase the influence of emerging nations in the

International Monetary Fund; however the program has not yet faced further development.

Congress is not ratifying [the changes] and that has caused a certain amount of disquiet and unease among the

BRICS countries, said Jose Graa Lima of Brazil's external affairs ministry.

This arrangement [the BRICS bank and reserve fund] is not a response to that [but] it is an indication that it is

possible among the BRICS to create mechanisms to realise certain objectives, Graa Lima added.

Source: Shanghai favourite to become BRICS bank HQ - Published time: July 03, 2014 13:20, http://on.rt.com/29529b

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

21

22

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

22

Goldman Sacks Report on the BRIC Economies

The Goldman Sachs global economics team released a follow-up report

to its initial BRIC study towards the middle of October 2004.

Goldman's view, is that China and India will be producers of value-

added goods like electronics, while Brazil and Russia will come to

dominate raw materials production. Getting involved is a huge BRIC

step, but there are ways to build the right BRIC move.

Just as the initial report focused on the growth potential of the so-called

four BRIC (Brazil, Russia, India, China) economies, the new report takes

the analysis one step forward focuses on the impact of these economies

on global commodities (using oil as a proxy), demand for consumer

goods (using automobile sales to make the point), and the impact on

global capital markets.

23

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

23

Hyper Growth for the New World Economic Order

The main conclusions of the Report are:

- Over the coming years the strong growth profile of the BRIC economies;

-Their increasing importance will push up trend global growth to over 4 per

cent, compared to the trend of the past 20 years of 3.7 per cent;

- An increase in the global trend growth rate of this magnitude has

enormous positive implications for the entire world;

- The BRIC economies' share of world growth could rise from 20 % in 2003

to more than 40 per cent in 2025;

- Their total weight in the world economy will also rise from approximately

10 per cent today to more than 20 per cent within 20 years.

While the main conclusions of the report are quite dramatic, one must keep

in mind that these results need first validated by the current growth that is

not yet matching the high rates projected in the initial report.

24

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

24

Solid BRIC Economies

and Broken Global Economy

According to the Goldman Sacks Report on the BRICs, the number of people with an income

over $3,000 (approximation of middle class) should double within three years in the

corresponding economies, and within a decade over 800 million people will have crossed this

earning level.

Within 20 years, there could be approximately 200 million people in the BRICs economies with

incomes above $15,000 (as a point of reference that is more than the population of Japan).

This optimistic look is paradoxical to the reality of these BRIC countries where programs

against poverty have not even reduced the gap among the lower classes in terms of earning.

Despite this, the Goldman Sacks advanced projections and analysis that never before has this

type of scale been observed in terms of gross addition of numbers to the ranks of the

consuming class. In terms of sheer numbers, it is equivalent to the addition of a new America

and Europe to the global consumer class.

25

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

25

China & India Breaking Records as BRICs

Economies

Goldman Sachs estimates that by 2025 the income/capita in the G-6 will

exceed $35,000, only about 24 million people in the BRIC economies will

have similar income levels. China and India will emerge as the world's

largest car markets over time. Within 20 years, China most probably will

have overtaken the US as the world's largest car market. India will also

displace the US about 10-15 years later.

Highlighting India's greater inefficiency in energy use, the data indicate that

within 15 years India's contribution to global oil demand growth will

overtake China's. India's share of actual global oil demand will also peak

near 17-18 per cent, similar to China's.

26

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

26

BRICs and Industrial Commodity Market

and Consumer Goods

The Report (source: Goldman Sachs) makes the point that the emergence of the

BRIC economies has already had an impact on global commodity markets,

namely the impact of China. The huge price run-up in most industrial

commodities is attributed to strong Chinese demand.

The next stage will be the impact of the huge emerging middle class in the BRIC

economies on consumer goods demand, and finally longer term will be the

impact on financial markets.

The share of these economies in global capital markets is currently 3.5 %, and

depending on the extent of capital market development, they could account for

anything between 10 and 17 % of global equity markets by 2020.

Market capitalization in the BRIC economies is projected to increase by four

times or $4 trillion, approximating the size of the European within 15 years.

27

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

27

Making the Most of Cheaper BRIC Labor

It could be that your company's best way forward into BRIC-driven growth is

through labor capacity. Do you want to be pre-emptive and anticipate this

money shift or join the party later, when it becomes more accepted as

conventional wisdom? Every institution has to make up its own mind.

Join a major company investing in these regions, likely as a supplier or

contractor. Retailers like Wal-Mart will not ignore future foreign growth and will

need specific quality goods to sell. Heavy equipment makers like Caterpillar

will continue to do well in emerging heavy industries, as will personal care

companies like Proctor & Gamble. Or, browse companies in your sector at

Selectory.com.

This can vary dramatically by geography and sector, but certainly it has been

shown that India's technical elite is very good sources of cheap financial and

back-office labor. A much-talked about guide to sourcing in the BRIC region is

Mark Kobayashi-Hillary's Building a Future with BRICS

28

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

28

Find Partners in the BRIC Economies

and to Compete with their Talents

Peruse leads databases for a clearer sense of whether you belong in this arena.

The U.S. Commerce Department has a pay database of live trade leads calls

https://www.globus.org/

The Federation of International Trade Associations runs a leads database.

Some other active leads databases include

www.glocentra.weebly.com

http://www.tradezone.com/

Part of the big change for the developed world will be the flood of management and

technical talent. China alone is graduating tens of thousands of engineers a year.

A great overview of the challenges ahead can be found at the

http://news.bbc.co.uk/2/hi/europe/4260368.stm

= A good discussion of U.S.-China trade issues is here;

= U.S.-Brazil-business relations at the U.S. Department of State;

= India, a good starting point is this link: http://www.state.gov/p/sca/ci/in

= Russia is detailed by the

http://search.usa.gov/search?affiliate=usagov&query=russia

29

Contact Email: saidcherkaoui@outook.com Contact Phone: 510-859-8345

29

BRICs Top Tips & Neat Tactics

Part of the investment attractiveness of the BRIC countries is the enormous geographical

size of each, and the dreamed vision of huge demand and large new rich class of

consumers. While likely it will slow with the surge of stagflation in the developing world, the

rising cost of living, the dramatic and continuous increase of the oil price and the heated

world wide competition and war ragging drive to control its sources will all have an impact

on the growth of long-term export planning and development strategies implemented by

liberal economies.

Macro statistics should be treated with caution and stock markets do not necessarily reflect

economic production. The BRIC thesis is pretty much a theory -- but with some compelling

early evidence, such as India's rise as a talent pool and China's turn as the world's factory

floor. Keeping tabs on these big two is likely most of the game for now.

Further helpful advice for making the most of these BRICs Markets, contact us:

saidcherkaoui@outook.com

This presentation was designed and conducted in Seminars organized at the

East Bay Center for International Trade Development

Berkeley City College, Berkeley, California

Das könnte Ihnen auch gefallen

- Global Logistics International Trade DevelopmentDokument15 SeitenGlobal Logistics International Trade Developmentapi-230019653Noch keine Bewertungen

- International Marketing Planning DR Said El Mansour CherkaouiDokument40 SeitenInternational Marketing Planning DR Said El Mansour Cherkaouiapi-230019653Noch keine Bewertungen

- Saidcherkaoui Bric MarketplacesDokument27 SeitenSaidcherkaoui Bric Marketplacesapi-230019653Noch keine Bewertungen

- Management Practices in The Usa Japan and ChinaDokument8 SeitenManagement Practices in The Usa Japan and ChinaDina FatkulinaNoch keine Bewertungen

- Kwanzaausandthewell Beingoftheworld12 13 12Dokument2 SeitenKwanzaausandthewell Beingoftheworld12 13 12api-230019653Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Topic 7 - Forecasting Financial Statements (Updated)Dokument64 SeitenTopic 7 - Forecasting Financial Statements (Updated)Jasmine JacksonNoch keine Bewertungen

- BPI Philippine High Dividend Equity Fund - November 2023 v2Dokument3 SeitenBPI Philippine High Dividend Equity Fund - November 2023 v2Gabrielle De VeraNoch keine Bewertungen

- California Apartment Association - Renting ManualDokument11 SeitenCalifornia Apartment Association - Renting Manualiam_narayananNoch keine Bewertungen

- BPI-OTC Payment of Fee - 1 PDFDokument2 SeitenBPI-OTC Payment of Fee - 1 PDFPhilip Ebersole100% (1)

- SYBAF Project Guidelines: 1) AuditingDokument6 SeitenSYBAF Project Guidelines: 1) AuditingBhavya RatadiaNoch keine Bewertungen

- Islamic Banking Situational Mcqs PDFDokument24 SeitenIslamic Banking Situational Mcqs PDFNajeeb Magsi100% (1)

- Working Capital and The Financing Decision: Discussion QuestionsDokument35 SeitenWorking Capital and The Financing Decision: Discussion QuestionsBlack UnicornNoch keine Bewertungen

- Research ReportDokument69 SeitenResearch ReportSuraj DubeyNoch keine Bewertungen

- Rosetta Stone Case StudyDokument3 SeitenRosetta Stone Case StudyEric100% (2)

- Clause 49 of Listing AgreementDokument18 SeitenClause 49 of Listing AgreementJatin AhujaNoch keine Bewertungen

- Notes in Tax On IndividualsDokument4 SeitenNotes in Tax On IndividualsPaula BatulanNoch keine Bewertungen

- Workshop 2 AccountingDokument6 SeitenWorkshop 2 AccountingJulieth CaviativaNoch keine Bewertungen

- Ch. 5 Financial AnalysisDokument34 SeitenCh. 5 Financial AnalysisfauziyahNoch keine Bewertungen

- ForexManagement Paresh Shah WileyIndiaDokument4 SeitenForexManagement Paresh Shah WileyIndiaArnoldNoch keine Bewertungen

- RUB MT 103/202: S.W.I.F.T. Payment Orders Filling-In Rules (Banks Non-Residents)Dokument12 SeitenRUB MT 103/202: S.W.I.F.T. Payment Orders Filling-In Rules (Banks Non-Residents)swift adminNoch keine Bewertungen

- Lecture 5Dokument1 SeiteLecture 5JohnNoch keine Bewertungen

- Percukaian (Taxation) 2022Dokument15 SeitenPercukaian (Taxation) 2022Faiz IskandarNoch keine Bewertungen

- HLB SME 1form (Original)Dokument14 SeitenHLB SME 1form (Original)Mandy ChanNoch keine Bewertungen

- Berkshire's Corporate Performance vs. The S&P 500Dokument23 SeitenBerkshire's Corporate Performance vs. The S&P 500FirstpostNoch keine Bewertungen

- Time Value of MoneyDokument22 SeitenTime Value of Moneyshubham abrolNoch keine Bewertungen

- Write A Note On Previous Year and Assessment YearDokument2 SeitenWrite A Note On Previous Year and Assessment YearBhaskar BhaskiNoch keine Bewertungen

- TENANCY AGREEMENT Pasar SegarDokument4 SeitenTENANCY AGREEMENT Pasar SegarFade ChannelNoch keine Bewertungen

- Annual Report 2017 PDFDokument216 SeitenAnnual Report 2017 PDFemmanuelNoch keine Bewertungen

- La Salle Charter School: Statement of Assets, Liabilities and Net Assets - Modified Cash BasisDokument5 SeitenLa Salle Charter School: Statement of Assets, Liabilities and Net Assets - Modified Cash BasisF. O.Noch keine Bewertungen

- Day1 10daysaccountingchallengeDokument16 SeitenDay1 10daysaccountingchallengeSeungyun ChoNoch keine Bewertungen

- CAF2-Intorduction To Economics and Finance - QuestionbankDokument188 SeitenCAF2-Intorduction To Economics and Finance - Questionbankrambo100% (1)

- Report of Checks Issued 2023Dokument1 SeiteReport of Checks Issued 2023Jahzeel RubioNoch keine Bewertungen

- Manufacturing Account Worked Example Question 8Dokument7 SeitenManufacturing Account Worked Example Question 8Roshan RamkhalawonNoch keine Bewertungen

- Junior Accountant RoleDokument1 SeiteJunior Accountant RoleRICARDO PROMOTIONNoch keine Bewertungen