Beruflich Dokumente

Kultur Dokumente

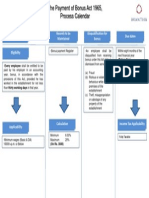

Act Requirement Records To Be Maintained Disqualification For Bonus Due Dates

Hochgeladen von

Bhattacharjee Shaibal0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten1 SeiteBonus act

Originaltitel

Bonus

Copyright

© © All Rights Reserved

Verfügbare Formate

PPT, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBonus act

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten1 SeiteAct Requirement Records To Be Maintained Disqualification For Bonus Due Dates

Hochgeladen von

Bhattacharjee ShaibalBonus act

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PPT, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

-Every employee shall be entitled to be

paid by his employer in an accounting

year, bonus, in accordance with the

provisions of this Act, provided he has

worked in the establishment for not less

than thirty working days in that year.

Act Requirement

The Payment of Bonus Act 1965,

Process Calendar

Records to be

Maintained

-Bonus payment Register

Disqualification for

bonus

Due dates

Eligibility

Calculation

Minimum 8.33%

Maximum 20%

(On Rs. 3500)

Within eight months of the

next financial year

(Before Nov).

Fully Taxable

Income Tax Applicability

-An employee shall be

disqualified from receiving

bonus under this Act, if he is

dismissed from service for-

(a) Fraud

(b) Riotous or violent

behaviour while on the

premises of the

establishment

(c) Theft, misappropriation

or sabotage of any

property of the

establishment

Applicability

-Minimum wages (Basic & DA)

10000/=p.m. or Below

Das könnte Ihnen auch gefallen

- Act Requirement Records To Be Maintained Disqualification For Bonus Due DatesDokument1 SeiteAct Requirement Records To Be Maintained Disqualification For Bonus Due Datesshaileshv88Noch keine Bewertungen

- The Payment of Bonus Act 1965Dokument1 SeiteThe Payment of Bonus Act 1965k.salem@pmd-house.comNoch keine Bewertungen

- Payment of Bonus Act, 1965 in Brief: TG TeamDokument5 SeitenPayment of Bonus Act, 1965 in Brief: TG TeamChinnaNoch keine Bewertungen

- Payment of Bonus Act 1965Dokument9 SeitenPayment of Bonus Act 1965Akhil NautiyalNoch keine Bewertungen

- The Payment of Bonus Act, 1965Dokument36 SeitenThe Payment of Bonus Act, 1965NiveditaSharmaNoch keine Bewertungen

- Payment of Bonus Act 1965Dokument21 SeitenPayment of Bonus Act 1965Praful Kambe100% (1)

- West Bengal Act - Labour - Bonus - ActDokument4 SeitenWest Bengal Act - Labour - Bonus - ActRankit AlbelaNoch keine Bewertungen

- Payment of Bonus Act1965Dokument5 SeitenPayment of Bonus Act1965kumar_2089Noch keine Bewertungen

- 21 Payment of Bonus Act, 1965 & Equal Remuneration Act, 1976Dokument7 Seiten21 Payment of Bonus Act, 1965 & Equal Remuneration Act, 1976DHEERAJ SAGARNoch keine Bewertungen

- Salient FeaturesDokument1 SeiteSalient FeaturessakethNoch keine Bewertungen

- Industrial Relations and Labour LawDokument28 SeitenIndustrial Relations and Labour LawbubaimaaNoch keine Bewertungen

- Bonus Act - 1965Dokument14 SeitenBonus Act - 1965Guhan SubramaniamNoch keine Bewertungen

- Unit 3 Payment of Bonus ActDokument17 SeitenUnit 3 Payment of Bonus ActDeborahNoch keine Bewertungen

- Payment of Bonus ActDokument1 SeitePayment of Bonus ActAarthi PadmanabhanNoch keine Bewertungen

- The Payment of Bonus Act, 1966Dokument25 SeitenThe Payment of Bonus Act, 1966Amitav Talukdar67% (3)

- FINALDokument14 SeitenFINALveenagirishNoch keine Bewertungen

- Payment of Bonus ActDokument2 SeitenPayment of Bonus ActBinithaNoch keine Bewertungen

- Salient Features of Payment of Bonus Act 1965 PDFDokument3 SeitenSalient Features of Payment of Bonus Act 1965 PDFMab Mughal0% (1)

- Payment of Bonus Act 1965Dokument39 SeitenPayment of Bonus Act 1965Manojkumar MohanasundramNoch keine Bewertungen

- Jigar Bonus ActDokument2 SeitenJigar Bonus ActJigar PatelNoch keine Bewertungen

- Bonus ActDokument5 SeitenBonus ActPriya SonuNoch keine Bewertungen

- Payment of Bonus ActDokument23 SeitenPayment of Bonus Actharbhajansingh143Noch keine Bewertungen

- Indus Relation 2Dokument12 SeitenIndus Relation 2rashmaNoch keine Bewertungen

- Salient Features of The Payment of Bonus ActDokument5 SeitenSalient Features of The Payment of Bonus ActbudhnabamNoch keine Bewertungen

- Payment of Bonus Act 1965Dokument3 SeitenPayment of Bonus Act 1965imadNoch keine Bewertungen

- Unit III - The Payment of Bonus Act, 1965 - Labour LawsDokument13 SeitenUnit III - The Payment of Bonus Act, 1965 - Labour Lawspatelia kevalNoch keine Bewertungen

- The Payment of Bonus Act 1965Dokument18 SeitenThe Payment of Bonus Act 1965SHivani GuptaNoch keine Bewertungen

- Labour Law AssignmentDokument13 SeitenLabour Law Assignmentshivam madhwaniNoch keine Bewertungen

- Introduction To GST Unit 1 8 Mark Questions.Dokument4 SeitenIntroduction To GST Unit 1 8 Mark Questions.manoharchary157Noch keine Bewertungen

- Payment of Bonus Act. 1965: XxviiDokument4 SeitenPayment of Bonus Act. 1965: XxviiAshwiniNoch keine Bewertungen

- Objective and Main Provision Of: Payment of Bonus ActDokument10 SeitenObjective and Main Provision Of: Payment of Bonus ActSanjay shuklaNoch keine Bewertungen

- Titel - 180806 - Luther - Employment - Law - in - MyanmarDokument158 SeitenTitel - 180806 - Luther - Employment - Law - in - MyanmarKhineNoch keine Bewertungen

- T P B A, 1965: HE Ayment of Onus CTDokument6 SeitenT P B A, 1965: HE Ayment of Onus CTaks.vishnuNoch keine Bewertungen

- Eligibility For Bonus: Thirty Working DaysDokument17 SeitenEligibility For Bonus: Thirty Working DaysAli AsgarNoch keine Bewertungen

- Bonus ActDokument6 SeitenBonus ActRamniwash SinghNoch keine Bewertungen

- Bonus Act 1Dokument28 SeitenBonus Act 1Narayana VeluNoch keine Bewertungen

- The Payment of Bonus ACT, 1965Dokument20 SeitenThe Payment of Bonus ACT, 1965anandi_meenaNoch keine Bewertungen

- The Payment of Bonus Act 1965Dokument23 SeitenThe Payment of Bonus Act 1965anitikaNoch keine Bewertungen

- Laws Relating To WagesDokument16 SeitenLaws Relating To Wagesnitin_chotuNoch keine Bewertungen

- The Payment of Bonus Act, 1965Dokument18 SeitenThe Payment of Bonus Act, 1965Vaishnavi DeshpandeNoch keine Bewertungen

- Payment of Bonus Act, 1965 SummaryDokument2 SeitenPayment of Bonus Act, 1965 SummaryNidhi MallapadiNoch keine Bewertungen

- The Payment of Bonus ActDokument10 SeitenThe Payment of Bonus Actshanky631Noch keine Bewertungen

- Labour Law Assignment - Payment of BonusDokument20 SeitenLabour Law Assignment - Payment of BonusMohammed Zahin O VNoch keine Bewertungen

- Bonus Act - 1965 - 1Dokument24 SeitenBonus Act - 1965 - 1nawabrp100% (1)

- Payment of Bonus Act 1965: Presented By: Ankit GuptaDokument45 SeitenPayment of Bonus Act 1965: Presented By: Ankit GuptaAnkit GuptaNoch keine Bewertungen

- Payment of Bonus Act, 1965Dokument31 SeitenPayment of Bonus Act, 1965Milani NarulaNoch keine Bewertungen

- Payment of Bonus Act 1965Dokument5 SeitenPayment of Bonus Act 1965haritha kunderuNoch keine Bewertungen

- 4.unit 5Dokument24 Seiten4.unit 5Nandini RajputNoch keine Bewertungen

- The Payment of Bonus Act 1965Dokument44 SeitenThe Payment of Bonus Act 1965Ihsan Ullah Himmat B-124Noch keine Bewertungen

- 42 Annex-6 Labour Laws 1 191Dokument12 Seiten42 Annex-6 Labour Laws 1 191bhogbhogaNoch keine Bewertungen

- GST 3Dokument18 SeitenGST 3Viraja GuruNoch keine Bewertungen

- Payment of Bonus Act 1965Dokument14 SeitenPayment of Bonus Act 1965Achin SharmaNoch keine Bewertungen

- 3.2.1 Procedure For Voluntary Winding Up: Step 7. Register For Sales TaxDokument3 Seiten3.2.1 Procedure For Voluntary Winding Up: Step 7. Register For Sales TaxAhsan LakhaniNoch keine Bewertungen

- RemunerationDokument18 SeitenRemunerationNoamanNoch keine Bewertungen

- Labour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Dokument5 SeitenLabour Laws Individual Assignment - Code On Wages Subject Code: MHR4CCHR05Seher BhatiaNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- Help Desk: Directorate of Commercial Taxes, West BengalDokument1 SeiteHelp Desk: Directorate of Commercial Taxes, West BengalBhattacharjee ShaibalNoch keine Bewertungen

- 03 - Prerequisites of Collective BargainingDokument8 Seiten03 - Prerequisites of Collective BargainingGayatri Dhawan100% (1)

- Tour Programme of A.S.M./S.E./S.O. Name: DT. Area Market 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31Dokument2 SeitenTour Programme of A.S.M./S.E./S.O. Name: DT. Area Market 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31Bhattacharjee ShaibalNoch keine Bewertungen

- The Trade Union Act, 1926Dokument55 SeitenThe Trade Union Act, 1926Vishal Singh JaswalNoch keine Bewertungen

- JD OperationDokument5 SeitenJD OperationBhattacharjee ShaibalNoch keine Bewertungen

- How To Change Logo From UI in Fusion HCMDokument6 SeitenHow To Change Logo From UI in Fusion HCMBhattacharjee ShaibalNoch keine Bewertungen

- Making First Contact/Entry: What Makes Up The Consulting Process?Dokument36 SeitenMaking First Contact/Entry: What Makes Up The Consulting Process?Bhattacharjee ShaibalNoch keine Bewertungen

- Resignation LetterDokument1 SeiteResignation LetterBhattacharjee ShaibalNoch keine Bewertungen

- CNFRM LTTR FormatDokument1 SeiteCNFRM LTTR FormatBhattacharjee ShaibalNoch keine Bewertungen

- Docs FRM New EmplysDokument1 SeiteDocs FRM New EmplysBhattacharjee ShaibalNoch keine Bewertungen

- PF E-Return ManualDokument24 SeitenPF E-Return Manualchirag bhojakNoch keine Bewertungen

- UserManual Ver1.4 Employers New PDFDokument41 SeitenUserManual Ver1.4 Employers New PDFAmitKumarNoch keine Bewertungen

- Form 2Dokument92 SeitenForm 2Bhattacharjee ShaibalNoch keine Bewertungen

- UnnatiDokument57 SeitenUnnatiBhattacharjee ShaibalNoch keine Bewertungen

- Compensation Management NotesDokument23 SeitenCompensation Management Noteschat2sowjiNoch keine Bewertungen

- The Payment of Gratuity Act 1972Dokument13 SeitenThe Payment of Gratuity Act 1972KijanjooNoch keine Bewertungen

- In Medical Terms Stress Is Described As,: "A Physical or Psychological Stimulus That Can Produce Mental Tension orDokument9 SeitenIn Medical Terms Stress Is Described As,: "A Physical or Psychological Stimulus That Can Produce Mental Tension orBhattacharjee ShaibalNoch keine Bewertungen

- Trading Account For The Year Ended DR CR: FormatDokument6 SeitenTrading Account For The Year Ended DR CR: FormatBhattacharjee ShaibalNoch keine Bewertungen

- By: Santanu Debnath & Shaibal BhattacharjeeDokument19 SeitenBy: Santanu Debnath & Shaibal BhattacharjeeBhattacharjee ShaibalNoch keine Bewertungen

- PerceptionDokument5 SeitenPerceptionBhattacharjee ShaibalNoch keine Bewertungen

- Adjustment EntriesDokument28 SeitenAdjustment EntriesBhattacharjee ShaibalNoch keine Bewertungen

- Debalina ProjectDokument74 SeitenDebalina ProjectBhattacharjee ShaibalNoch keine Bewertungen

- Management Development Program: By: Saheli Biswas & Shaibal BhattacharjeeDokument10 SeitenManagement Development Program: By: Saheli Biswas & Shaibal BhattacharjeeBhattacharjee ShaibalNoch keine Bewertungen

- NTC ReportDokument20 SeitenNTC ReportBhattacharjee ShaibalNoch keine Bewertungen