Beruflich Dokumente

Kultur Dokumente

Business Scenarios For NIC v1.2

Hochgeladen von

Chandrima Das0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

23 Ansichten7 SeitenOriginaltitel

Business Scenarios for NIC v1.2

Copyright

© © All Rights Reserved

Verfügbare Formate

XLS, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

23 Ansichten7 SeitenBusiness Scenarios For NIC v1.2

Hochgeladen von

Chandrima DasCopyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

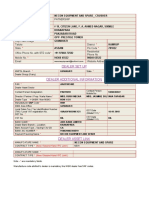

Cessn. Pct Cession Cap Cessn. Pct Cession Cap Cessn. Pct Cession Cap Cessn.

Pct Cession Cap (PML)

Obl. QS 10% 5,000,000 10% 26 mln 10% 10%

Retention 87.50% 43,750,000 77.50% 202 mln 85.00% 995 mln 1,000m

Market Cession 0 - 2,100m

Surplus 1 2.50% 1,250,000 12.50% 33 mln 5.00% 59 mln 2,000m

Scenario 1 Scenario 1.1

New Policy Extra Endorsement

Sum Insured 30.00mln Risk Category Small Endt SI 20.0mln Risk Category Small

Premium 30.0 K B3 C3 Endt Prem 20.0 K B3 C3

Eff. Dt 1-Apr-08 B4 C4 Endt. Eff. Dt 1-May-08 B4 C4

Exp. Dt 31-Mar-09 B5 C5 Endt. Exp. Dt 31-Mar-09 B5 C5

# of days 365 B6 C6 # of days 335 B6 C6

Total SI 30.00mln Total SI 50.0mln

Total Prem 30.0 K Daily Prem 82.19 Total Prem 50.0 K New Daily Prem 141.89

PML % 100% PML % 100%

SI Cession Cession

Premium

Share % Total SI share Total Premium

Ceded

Endt. SI

share

Endt. Prem

share

Share % Total SI share

Obl. QS 3.00mln 3,000 10.00% 3.000 mln 3,000 Obl. QS 2.000 mln 2,000 10.00% 5.000 mln

Retention 26.25mln 26,250 87.50% 26.250 mln 26,250 Retention 17.500 mln 17,500 87.50% 43.750 mln

Inter Co Cession 0.00mln - 0.00% .000 mln - Inter Co Cession .000 mln - 0.00% .000 mln

Surplus 1 0.75mln 750 2.50% .750 mln 750 Surplus 1 .500 mln 500 2.50% 1.250 mln

Total Fac - - 0.00% .000 mln - Total Fac .000 mln - 0.00% .000 mln

Fac A - - 0.00% .000 mln - Fac A .000 mln - 0.00% .000 mln

Fac B - - 0.00% .000 mln - Fac B .000 mln - 0.00% .000 mln

Notes Notes

Fire Medium

SI >50m and PML<260m

(2)

Fire Small

SI <50m

(1)

Fire Listed Risks 1

PML260m to 1170m

(3)

Fire Listed Risks 2

PML>1170m

(4)

Cession made on the basis of Risk Category Cession made on the basis of Risk Category

Page 1 of 7

Scenario 2 Scenario 2.1

New Policy Extra Endorsement

Sum Insured 2,300.00mln Risk Category Listed Risk 1 Endt SI 50.00mln Risk Category Listed Risk 2

Premium 20,000.0 K H3 I3 Endt Prem 20.0 K J3 K3

Eff. Dt 1-Apr-08 H4 I4 Endt. Eff. Dt 15-Apr-08 J4 K4

Exp. Dt 31-Mar-09 H5 I5 Endt. Exp. Dt 31-Mar-09 J5 K5

# of days 365 H6 I6 # of days 351 J6 K6

Total SI 2,300.00mln Total SI 2,350.00mln

Total Prem 20,000.0 K Daily Prem 54,794.52 Total Prem 20,020.0 K New Daily Prem 54,851.50

PML % 50% PML SI 1,150.0m PML % 50% PML SI 1,175.0m

SI Cession Cession

Premium

Share % Total SI share Total Premium

Ceded

Endt. SI

share

Endt. Prem

share

Share % Total SI share

Obl. QS 0.0m 2,000,000 10.00% 230.0m 2000K Obl. QS 5.0m 2,000 10.00% 235.0m

Retention 1,955.0m 17,000,000 85.00% 1,955.0m 17000K Retention 45.0m 37,482 85.11% 2,000.0m

Inter Co Cession 0.0m - 0.00% 0.0m 0K Inter Co Cession 115.0m 942,162 4.89% 115.0m

Surplus 1 117.0m 1,000,000 5.00% 115.0m 1000K Surplus 1 -115.0m (961,644) 0.00% 0.0m

Total Fac 0.0m - 0.00% 0.0m 0K Total Fac 0.0m - 0.00% 0.0m

Fac A 0.0m - 0.00% 0.0m 0K Fac A 0.0m - 0.00% 0.0m

Fac B 0.0m - 0.00% 0.0m - Fac B 0.0m - 0.00% 0.0m

Notes Notes Cession made on the basis of Risk Category SI increase changes the risk category to Listed Risk 2 and Cession made on the basis

of Risk Category. PML % has been taken into account while determining the cession

capacity.

Page 2 of 7

Total

Premium

Ceded

5,000

43,750

-

1,250

-

-

-

Cession made on the basis of Risk Category

Page 3 of 7

Total

Premium

Ceded

2002K

17037K

942K

38K

0K

0K

0K

SI increase changes the risk category to Listed Risk 2 and Cession made on the basis

of Risk Category. PML % has been taken into account while determining the cession

capacity.

Page 4 of 7

Scenario 1.2 Scenario 1.3

Extra Endorsement Refund Endorsement

Endt SI 10.0mln Risk Category Medium Endt SI -15.0mln Risk Category Small

Endt Prem 10.0 K E3 F3 Endt Prem -5.0 K B3 C3

Endt. Eff. Dt 1-Jul-08 E4 F4 Endt. Eff. Dt 1-Oct-08 B4 C4

Endt. Exp. Dt 31-Mar-09 E5 F5 Endt. Exp. Dt 31-Mar-09 B5 C5

# of days 274 E6 F6 # of days 182 B6 C6

Total SI 60,000,000 Total SI #########

Total Prem 60.0 K New Daily Prem 178.390 Total Prem 55.0 K New Daily Prem #######

PML % 100% PML % 100%

Endt. SI share Endt. Prem

share

Share % Total SI

share

Total

Premium

Ceded

Endt. SI

share

Endt. Prem

share

Share % Total SI

share

Obl. QS 1,000,000 1,000 10.00% 6.000 mln 6,000 Obl. QS -1.500 mln (500) 10.00% 4.500 mln

Retention 2,750,000 3,862 77.50% 46.500 mln 47,612 Retention -7.125 mln (1,128) 87.50% #########

Inter Co Cession - - 0.00% .000 mln - Inter Co Cession .000 mln - 0.00% .000 mln

Surplus 1 6,250,000 5,138 12.50% 7.500 mln 6,388 Surplus 1 -6.375 mln (3,372) 2.50% 1.125 mln

Total Fac - - 0.00% .000 mln - Total Fac .000 mln - 0.00% .000 mln

Fac A - - 0.00% .000 mln - Fac A .000 mln - 0.00% .000 mln

Fac B - - 0.00% .000 mln - Fac B .000 mln - 0.00% .000 mln

Notes Notes Cession % altered based on change in Risk category Cession % altered based on change in Risk category

Page 5 of 7

Scenario 2.2

Endorsement - Change in PML %

Endt SI 0.0mln Risk Category Listed Risk 1

Endt Prem .0 K H3 I3

Endt. Eff. Dt 1-Jul-08 H4 I4

Endt. Exp. Dt 31-Mar-09 H5 I5

# of days 274 H6 I6

Total SI 2350.0mln

Total Prem 20020.0 K New Daily Prem #########

PML % 40% PML SI 940.0m

Endt. SI share Endt. Prem

share

Share % Total SI

share

Total

Premium

Ceded

Obl. QS 0.0m - 10.00% 235.0m 2002K

Retention -2.5m (15,989) 85.00% 1,997.5m 17021K

Inter Co Cession -115.0m (735,477) 0.00% 0.0m 207K

Surplus 1 117.5m 751,466 5.00% 117.5m 790K

Total Fac 0.0m - 0.00% 0.0m 0K

Fac A 0.0m - 0.00% 0.0m 0K

Fac B 0.0m - 0.00% 0.0m 0K

Notes PML change results in change of risk category to Listed Risk 1 and Cession

made on the basis of Risk Category. PML % has been taken into account while

determining the cession capacity.

Page 6 of 7

Total

Premium

Ceded

5,500

46,484

-

3,016

-

-

-

Cession % altered based on change in Risk category

Page 7 of 7

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Frfi (&TR ('R: FTFTQRR (Dokument1 SeiteFrfi (&TR ('R: FTFTQRR (Chandrima DasNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Just in Time GeometryDokument386 SeitenJust in Time Geometrysudarsakkat100% (3)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Tables PDFDokument34 SeitenTables PDFChandrima DasNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- IndiaDokument41 SeitenIndiaChandrima DasNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Definition of Lossoccurrence ClauseDokument1 SeiteDefinition of Lossoccurrence ClauseChandrima DasNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Aviation Hull Insurance Study Material - Docx - N WadhawanDokument41 SeitenAviation Hull Insurance Study Material - Docx - N WadhawanChandrima DasNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Health Insurance - Updated Jan 2014 ..Ksn.Dokument35 SeitenHealth Insurance - Updated Jan 2014 ..Ksn.Chandrima DasNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Reis Main Functional ReportsDokument15 SeitenReis Main Functional ReportsChandrima DasNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Reinsurance ExplainedDokument55 SeitenReinsurance ExplainedChandrima DasNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- MRCE Data Dictionary v1.0Dokument4 SeitenMRCE Data Dictionary v1.0Chandrima DasNoch keine Bewertungen

- Diagnostic ToolDokument21 SeitenDiagnostic ToolChandrima DasNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Creative Writing 101Dokument6 SeitenCreative Writing 101Shreenivasan K AnanthanNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- CS 2007Dokument16 SeitenCS 2007kammaraNoch keine Bewertungen

- Project Management - CPM/PERT: SR Lecturer School of Mechanical & Building SciencesDokument55 SeitenProject Management - CPM/PERT: SR Lecturer School of Mechanical & Building SciencesbhargavrapartiNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Advanced Concepts of DfPower StudioDokument34 SeitenAdvanced Concepts of DfPower StudioChandrima DasNoch keine Bewertungen

- Combine FilesDokument1 SeiteCombine FilesChandrima DasNoch keine Bewertungen

- Khalid Mughal-Guide To Java Cert Java Zone 2005Dokument32 SeitenKhalid Mughal-Guide To Java Cert Java Zone 2005Gyanendra SinghNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- ENTU NI 28 JuneDokument4 SeitenENTU NI 28 JuneZm KholhringNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Procedure For Import of Gold Carried by Passenger Travelling by AirDokument3 SeitenProcedure For Import of Gold Carried by Passenger Travelling by AirYulia PuspitasariNoch keine Bewertungen

- Financial System in PakistanDokument13 SeitenFinancial System in PakistanMuhammad IrfanNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- PILMICO-MAURI FOODS CORP V CIRDokument18 SeitenPILMICO-MAURI FOODS CORP V CIRhowieboiNoch keine Bewertungen

- TTX Human Trafficking With ANSWERS For DavaoDokument7 SeitenTTX Human Trafficking With ANSWERS For DavaoVee DammeNoch keine Bewertungen

- The Criminal Procedure (Identification) Act, 2022 A Constitutional CritiqueDokument28 SeitenThe Criminal Procedure (Identification) Act, 2022 A Constitutional CritiqueArunNoch keine Bewertungen

- Procedure Manual - IMS: Locomotive Workshop, Northern Railway, LucknowDokument3 SeitenProcedure Manual - IMS: Locomotive Workshop, Northern Railway, LucknowMarjorie Dulay Dumol67% (3)

- Internal Orders / Requisitions - Oracle Order ManagementDokument14 SeitenInternal Orders / Requisitions - Oracle Order ManagementtsurendarNoch keine Bewertungen

- 1 Dealer AddressDokument1 Seite1 Dealer AddressguneshwwarNoch keine Bewertungen

- AMCTender DocumentDokument135 SeitenAMCTender DocumentsdattaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Consent To TreatmentDokument37 SeitenConsent To TreatmentinriantoNoch keine Bewertungen

- Full Download Test Bank For Effective Police Supervision 8th Edition Larry S Miller Harry W More Michael C Braswell 2 PDF Full ChapterDokument36 SeitenFull Download Test Bank For Effective Police Supervision 8th Edition Larry S Miller Harry W More Michael C Braswell 2 PDF Full Chapteralterityfane.mah96z100% (12)

- Philippine Laws On WomenDokument56 SeitenPhilippine Laws On WomenElle BanigoosNoch keine Bewertungen

- Assignment Strategic Management 1 - Page 69 Text BookDokument2 SeitenAssignment Strategic Management 1 - Page 69 Text BookRei VikaNoch keine Bewertungen

- Turriff& District Community Council Incorporating Turriff Town Pride GroupDokument7 SeitenTurriff& District Community Council Incorporating Turriff Town Pride GroupMy TurriffNoch keine Bewertungen

- Fraud Detection and Deterrence in Workers' CompensationDokument46 SeitenFraud Detection and Deterrence in Workers' CompensationTanya ChaudharyNoch keine Bewertungen

- Beta Theta Pi InformationDokument1 SeiteBeta Theta Pi Informationzzduble1Noch keine Bewertungen

- SW Agreement-Edited No AddressDokument6 SeitenSW Agreement-Edited No AddressAyu AdamNoch keine Bewertungen

- Global Network: Brazil The PhilippinesDokument1 SeiteGlobal Network: Brazil The Philippinesmayuresh1101Noch keine Bewertungen

- Revenue Regulations No. 7-2012 (Sections 3 To 9 Only)Dokument43 SeitenRevenue Regulations No. 7-2012 (Sections 3 To 9 Only)Charmaine GraceNoch keine Bewertungen

- Cypherpunk's ManifestoDokument3 SeitenCypherpunk's ManifestoevanLeNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- City of Manila Vs Chinese CommunityDokument1 SeiteCity of Manila Vs Chinese CommunityEarl LarroderNoch keine Bewertungen

- ReservationsDokument30 SeitenReservationsplasmadragNoch keine Bewertungen

- Legal Ethics and Practical Exercises DigestDokument10 SeitenLegal Ethics and Practical Exercises Digestalma vitorilloNoch keine Bewertungen

- Short Term Financial Management 3rd Edition Maness Test BankDokument5 SeitenShort Term Financial Management 3rd Edition Maness Test Bankjuanlucerofdqegwntai100% (16)

- Financial Onion LinksDokument8 SeitenFinancial Onion LinksFelix Alaxandar100% (4)

- Pranali Rane Appointment Letter - PranaliDokument7 SeitenPranali Rane Appointment Letter - PranaliinboxvijuNoch keine Bewertungen

- Menasco HSE Training-Role of HSE ProfessionalDokument10 SeitenMenasco HSE Training-Role of HSE ProfessionalHardesinah Habdulwaheed HoluwasegunNoch keine Bewertungen

- CA CHP555 Manual 2 2003 ch1-13Dokument236 SeitenCA CHP555 Manual 2 2003 ch1-13Lucas OjedaNoch keine Bewertungen

- Jamii Cover: Type of PlansDokument2 SeitenJamii Cover: Type of PlansERICK ODIPONoch keine Bewertungen