Beruflich Dokumente

Kultur Dokumente

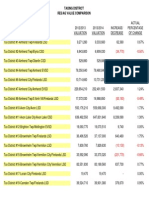

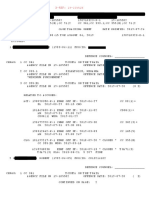

Lorain County School Districts Delinquent Amount Owed As of 09-23-14

Hochgeladen von

LorainCountyPrintingOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lorain County School Districts Delinquent Amount Owed As of 09-23-14

Hochgeladen von

LorainCountyPrintingCopyright:

Verfügbare Formate

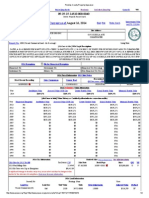

Page 3 of 12

Tax Year: 2013

Lorain County

09/25/2014 10:55:18 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

20080 - AMHERST EVSD

04 - AMHERST TWP/AMHERST EVSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$10,044.07

$1,080.43

$8,963.64

054 - 1993 PERMANENT IMPROVEMENT-GENERAL

$2,340.70

$253.83

$2,086.87

066 - 2000 BOND ($26,310,000)

$7,610.26

$818.62

$6,791.64

$14,969.46

$1,610.23

$13,359.23

220 - 1976 CURRENT EXPENSE/RECREATIONAL

$76.61

$8.37

$68.24

221 - 1976 CURRENT EXPENSE/RECREATIONAL

$68.96

$7.54

$61.42

276 - 1976 CURRENT EXPENSE

$9,997.32

$1,092.94

$8,904.38

282 - 1982 CURRENT EXPENSE

$4,844.65

$520.41

$4,324.24

285 - 1985 CURRENT EXPENSE

$4,682.96

$509.17

$4,173.79

290 - 1990 CURRENT EXPENSE

$3,550.63

$388.22

$3,162.41

292 - 1992 CURRENT EXPENSE

$4,533.34

$491.72

$4,041.62

295 - 1995 CURRENT EXPENSE

$6,441.92

$697.39

$5,744.53

518 - 2012 CURRENT EXPENSE

$9,463.43

$1,017.97

$8,445.46

$78,624.31

$8,496.84

$70,127.47

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$55,603.51

$10,456.10

$45,147.41

054 - 1993 PERMANENT IMPROVEMENT-GENERAL

$13,451.04

$2,463.21

$10,987.83

066 - 2000 BOND ($26,310,000)

$42,129.75

$7,922.42

$34,207.33

068 - 2013 EMERGENCY ($4,024,956)

$82,869.74

$15,583.50

$67,286.24

220 - 1976 CURRENT EXPENSE/RECREATIONAL

$456.36

$81.48

$374.88

221 - 1976 CURRENT EXPENSE/RECREATIONAL

$410.78

$73.34

$337.44

276 - 1976 CURRENT EXPENSE

$59,563.22

$10,634.12

$48,929.10

282 - 1982 CURRENT EXPENSE

$26,648.78

$5,034.19

$21,614.59

285 - 1985 CURRENT EXPENSE

$27,230.85

$4,945.26

$22,285.59

290 - 1990 CURRENT EXPENSE

$21,166.26

$3,777.43

$17,388.83

292 - 1992 CURRENT EXPENSE

$26,075.88

$4,771.94

$21,303.94

295 - 1995 CURRENT EXPENSE

$36,731.77

$6,763.65

$29,968.12

518 - 2012 CURRENT EXPENSE

$52,391.27

$9,851.74

$42,539.53

Totals for: 07 - AMHERST CITY/AMHERST EVSD $444,729.21

$82,358.38

$362,370.83

068 - 2013 EMERGENCY ($4,024,956)

Totals for: 04 - AMHERST TWP/AMHERST EVSD

Tax District:

Tax District:

07 - AMHERST CITY/AMHERST EVSD

43 - LORAIN CITY/AMHERST EVSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$22,112.61

$4,899.57

$17,213.04

054 - 1993 PERMANENT IMPROVEMENT-GENERAL

$5,227.02

$1,149.11

$4,077.91

066 - 2000 BOND ($26,310,000)

$16,754.35

$3,712.30

$13,042.05

068 - 2013 EMERGENCY ($4,024,956)

$32,956.02

$7,302.15

$25,653.87

220 - 1976 CURRENT EXPENSE/RECREATIONAL

$173.48

$37.84

$135.64

221 - 1976 CURRENT EXPENSE/RECREATIONAL

$156.16

$34.06

$122.10

276 - 1976 CURRENT EXPENSE

$22,641.44

$4,939.25

$17,702.19

282 - 1982 CURRENT EXPENSE

$10,640.15

$2,360.70

$8,279.45

285 - 1985 CURRENT EXPENSE

$10,505.42

$2,303.73

$8,201.69

290 - 1990 CURRENT EXPENSE

$8,043.07

$1,754.40

$6,288.67

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 4 of 12

Tax Year: 2013

Lorain County

09/25/2014 10:55:18 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

20080 - AMHERST EVSD

43 - LORAIN CITY/AMHERST EVSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

292 - 1992 CURRENT EXPENSE

$10,127.09

$2,225.89

$7,901.20

295 - 1995 CURRENT EXPENSE

$14,342.43

$3,158.25

$11,184.18

518 - 2012 CURRENT EXPENSE

$20,834.57

$4,616.32

$16,218.25

$174,513.81

$38,493.57

$136,020.24

$697,867.33

$129,348.79

$568,518.54

Totals for: 43 - LORAIN CITY/AMHERST EVSD

Totals for: 20080 - AMHERST EVSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

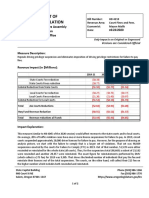

Page 2 of 5

Tax Year: 2013

Lorain County

09/25/2014 10:57:31 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

20230 - AVON LAKE CSD

11 - AVON LAKE CITY/AVON LAKE CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$102,250.93

$19,545.79

$82,705.14

077 - 1994 BOND ($2,000,000)

$3,165.09

$605.05

$2,560.04

078 - 1999 BOND ($41,800,000)

$85,695.66

$16,381.18

$69,314.48

079 - 2009 EMERGENCY ($3,400,000)

$105,659.17

$20,197.32

$85,461.85

081 - 2011 EMERGENCY ($4,500,000)

$144,368.31

$27,596.78

$116,771.53

276 - 1976 CURRENT EXPENSE

$228,693.80

$46,281.25

$182,412.55

278 - 1978 CURRENT EXPENSE

$73,201.99

$14,899.24

$58,302.75

292 - 1992 CURRENT EXPENSE

$88,493.38

$17,595.38

$70,898.00

296 - 1996 CURRENT EXPENSE

$75,584.44

$14,769.32

$60,815.12

392 - 1992 CURRENT EXPENSE

$105,131.39

$20,903.58

$84,227.81

441 - 2009 BOND ($13,000,000)

$27,997.39

$5,351.85

$22,645.54

442 - 2009 BOND ($5,500,000)

$15,824.83

$3,025.01

$12,799.82

486 - 1991 PERMANENT IMPROVEMENT

$24,581.14

$5,025.19

$19,555.95

$209,858.05

$40,115.51

$169,742.54

Totals for: 11 - AVON LAKE CITY/AVON LAKE C$1,290,505.57

$252,292.45

$1,038,213.12

$252,292.45

$1,038,213.12

528 - 2013 EMERGENCY ($6,500,000)

Totals for: 20230 - AVON LAKE CSD

Copyright (C) 1997-2014 DEVNET Incorporated

$1,290,505.57

SCHUSTER

Page 2 of 5

Tax Year: 2013

Lorain County

09/25/2014 10:56:44 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

20220 - AVON LSD

10 - AVON CITY/AVON LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$114,987.31

$11,555.11

$103,432.20

069 - 2003 BOND ($14,950,000)

$33,901.48

$3,406.75

$30,494.73

070 - 2011 EMERGENCY ($1,800,000)

$49,563.59

$4,980.67

$44,582.92

071 - 1999 BOND ($8,000,000)

$13,481.21

$1,354.75

$12,126.46

072 - 2010 EMERGENCY ($914,700)

$24,980.08

$2,510.27

$22,469.81

073 - 2006 BOND ($19,800,000)

$20,816.30

$2,091.83

$18,724.47

074 - 1995 BOND/HIGH SCHOOL ($12,950,000)

$16,454.75

$1,653.54

$14,801.21

276 - 1976 CURRENT EXPENSE

$277,705.00

$29,249.54

$248,455.46

278 - 1978 CURRENT EXPENSE

$14,887.27

$1,544.91

$13,342.36

485 - 2004 PERMANENT IMPROVEMENT

$17,568.94

$2,079.04

$15,489.90

$122,520.44

$12,312.10

$110,208.34

515 - 2012 BOND ($32,000,000)

$20,618.53

$2,071.97

$18,546.56

519 - 2012 EMERGENCY ($2,500,000)

$68,001.22

$6,833.47

$61,167.75

$795,486.12

$81,643.95

$713,842.17

$795,486.12

$81,643.95

$713,842.17

494 - 2010 EMERGENCY ($4,450,975)

Totals for: 10 - AVON CITY/AVON LSD

Totals for: 20220 - AVON LSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 2 of 8

Tax Year: 2013

Lorain County

09/25/2014 10:58:05 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

20490 - BLACK RIVER LSD

39 - HUNTINGTON TWP/BLACK RIVER LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$5,414.83

$1,507.40

$3,907.43

082 - 1994 BOND ($7,800,000)

$2,406.57

$669.95

$1,736.62

276 - 1976 CURRENT EXPENSE

$16,891.75

$4,701.53

$12,190.22

280 - 1980 CURRENT EXPENSE

$3,056.00

$855.80

$2,200.20

290 - 1990 CURRENT EXPENSE

529 - 2013 EMERGENCY ($1,600,000)

Totals for: 39 - HUNTINGTON TWP/BLACK RIVE

Totals for: 20490 - BLACK RIVER LSD

Copyright (C) 1997-2014 DEVNET Incorporated

$5,925.34

$1,626.63

$4,298.71

$12,784.90

$3,559.10

$9,225.80

$46,479.39

$12,920.41

$33,558.98

$46,479.39

$12,920.41

$33,558.98

SCHUSTER

Page 2 of 7

Tax Year: 2013

Lorain County

09/25/2014 10:58:59 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

21050 - CLEARVIEW LSD

45 - LORAIN CITY/CLEARVIEW LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$41,793.86

$2,156.72

$39,637.14

085 - 2011 EMERGENCY ($352,690)

$27,718.42

$1,430.36

$26,288.06

086 - 1999 BOND ($3,260,000)

$20,310.30

$1,048.08

$19,262.22

$5,555.98

$286.70

$5,269.28

087 - 2000 BOND ($980,000)

088 - 2000 BOND ($1,432,000)

$8,148.84

$420.51

$7,728.33

089 - 2012 EMERGENCY ($546,856)

$43,830.87

$2,261.81

$41,569.06

276 - 1976 CURRENT EXPENSE

$74,782.32

$3,977.41

$70,804.91

278 - 1978 CURRENT EXPENSE

$2,312.52

$120.38

$2,192.14

292 - 1992 CURRENT EXPENSE

$18,489.75

$963.91

$17,525.84

451 - 2001 CLASSROOM FACILITIES

$3,016.56

$157.21

$2,859.35

495 - 2010 PERMANENT IMPROVEMENT

$6,087.16

$316.02

$5,771.14

$21,051.10

$1,086.30

$19,964.80

$273,097.68

$14,225.41

$258,872.27

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$55,185.84

$6,908.17

$48,277.67

085 - 2011 EMERGENCY ($352,690)

$36,600.18

$4,581.62

$32,018.56

086 - 1999 BOND ($3,260,000)

$26,818.28

$3,357.11

$23,461.17

$7,336.26

$918.35

$6,417.91

$10,759.99

$1,346.93

$9,413.06

$57,875.53

$7,244.87

$50,630.66

$102,019.95

$12,759.40

$89,260.55

520 - 2012 EMERGENCY ($261,855)

Totals for: 45 - LORAIN CITY/CLEARVIEW LSD

Tax District:

61 - SHEFFIELD TWP/CLEARVIEW LSD

087 - 2000 BOND ($980,000)

088 - 2000 BOND ($1,432,000)

089 - 2012 EMERGENCY ($546,856)

276 - 1976 CURRENT EXPENSE

278 - 1978 CURRENT EXPENSE

$3,082.60

$385.78

$2,696.82

292 - 1992 CURRENT EXPENSE

$24,684.90

$3,089.12

$21,595.78

$4,025.95

$503.82

$3,522.13

451 - 2001 CLASSROOM FACILITIES

495 - 2010 PERMANENT IMPROVEMENT

$8,090.28

$1,012.56

$7,077.72

$27,796.43

$3,479.56

$24,316.87

Totals for: 61 - SHEFFIELD TWP/CLEARVIEW L $364,276.19

$45,587.29

$318,688.90

$59,812.70

$577,561.17

520 - 2012 EMERGENCY ($261,855)

Totals for: 21050 - CLEARVIEW LSD

Copyright (C) 1997-2014 DEVNET Incorporated

$637,373.87

SCHUSTER

Page 2 of 6

Tax Year: 2013

Lorain County

09/25/2014 11:01:27 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

21150 - COLUMBIA LSD

25 - COLUMBIA TWP/COLUMBIA LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$44,513.93

$11,936.28

$32,577.65

091 - 2013 EMERGENCY ($647,000)

$29,850.34

$8,004.27

$21,846.07

092 - 2010 EMERGENCY ($625,000)

$28,890.38

$7,746.86

$21,143.52

094 - 2013 EMERGENCY (950,000)

$43,815.74

$11,749.05

$32,066.69

276 - 1976 CURRENT EXPENSE

$122,303.92

$32,645.84

$89,658.08

280 - 1980 CURRENT EXPENSE

$21,013.08

$5,610.49

$15,402.59

496 - 2010 PERMANENT IMPROVEMENT

$17,456.36

$4,680.86

$12,775.50

505 - 2011 BOND ($6,000,000)

$16,059.97

$4,306.43

$11,753.54

530 - 2013 CURRENT EXPENSE

$48,005.13

$12,872.42

$35,132.71

$371,908.85

$99,552.50

$272,356.35

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$7,959.44

$490.93

$7,468.51

091 - 2013 EMERGENCY ($647,000)

$5,337.46

$329.20

$5,008.26

092 - 2010 EMERGENCY ($625,000)

$5,165.81

$318.62

$4,847.19

094 - 2013 EMERGENCY (950,000)

$7,834.58

$483.22

$7,351.36

276 - 1976 CURRENT EXPENSE

$21,119.54

$1,341.55

$19,777.99

280 - 1980 CURRENT EXPENSE

$3,636.56

$230.58

$3,405.98

496 - 2010 PERMANENT IMPROVEMENT

$3,121.32

$192.51

$2,928.81

505 - 2011 BOND ($6,000,000)

$2,871.66

$177.12

$2,694.54

530 - 2013 CURRENT EXPENSE

$8,583.67

$529.41

$8,054.26

$65,630.04

$4,093.14

$61,536.90

$437,538.89

$103,645.64

$333,893.25

Totals for: 25 - COLUMBIA TWP/COLUMBIA LS

Tax District:

29 - EATON TWP/COLUMBIA LSD

Totals for: 29 - EATON TWP/COLUMBIA LSD

Totals for: 21150 - COLUMBIA LSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 3 of 12

Tax Year: 2013

Lorain County

09/25/2014 11:02:59 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

21670 - ELYRIA CSD

23 - CARLISLE TWP/ELYRIA CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$528.42

$252.79

$275.63

080 - 2007 PERMANENT IMPROVEMENT-GENERAL

$62.91

$30.10

$32.81

097 - 2007 BOND ($45,000,000)

$464.25

$222.10

$242.15

276 - 1976 CURRENT EXPENSE

$999.57

$478.20

$521.37

282 - 1982 CURRENT EXPENSE

$422.35

$202.05

$220.30

292 - 1992 CURRENT EXPENSE

$476.40

$227.91

$248.49

299 - 1999 CURRENT EXPENSE

$525.88

$251.58

$274.30

497 - 2010 EMERGENCY ($4,435,000)

$717.14

$343.08

$374.06

502 - 2010 EMERGENCY ($8,252,548)

$1,226.68

$586.84

$639.84

$5,423.60

$2,594.65

$2,828.95

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$20,297.19

$2,601.29

$17,695.90

$2,416.41

$309.69

$2,106.72

097 - 2007 BOND ($45,000,000)

$17,832.85

$2,285.46

$15,547.39

276 - 1976 CURRENT EXPENSE

$43,320.60

$5,804.23

$37,516.37

282 - 1982 CURRENT EXPENSE

$16,890.02

$2,198.77

$14,691.25

292 - 1992 CURRENT EXPENSE

$19,505.56

$2,561.62

$16,943.94

299 - 1999 CURRENT EXPENSE

$20,786.17

$2,693.98

$18,092.19

497 - 2010 EMERGENCY ($4,435,000)

$27,546.62

$3,530.37

$24,016.25

502 - 2010 EMERGENCY ($8,252,548)

$47,119.05

$6,038.77

$41,080.28

$215,714.47

$28,024.18

$187,690.29

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$320,731.73

$41,509.86

$279,221.87

Totals for: 23 - CARLISLE TWP/ELYRIA CSD

Tax District:

31 - ELYRIA TWP/ELYRIA CSD

080 - 2007 PERMANENT IMPROVEMENT-GENERAL

Totals for: 31 - ELYRIA TWP/ELYRIA CSD

Tax District:

33 - ELYRIA CITY/ELYRIA CSD

080 - 2007 PERMANENT IMPROVEMENT-GENERAL

$38,183.37

$4,941.79

$33,241.58

097 - 2007 BOND ($45,000,000)

$281,790.51

$36,469.99

$245,320.52

276 - 1976 CURRENT EXPENSE

$715,893.69

$91,763.43

$624,130.26

282 - 1982 CURRENT EXPENSE

$271,136.39

$34,970.73

$236,165.66

292 - 1992 CURRENT EXPENSE

$315,901.12

$40,666.88

$275,234.24

299 - 1999 CURRENT EXPENSE

$332,190.27

$42,886.99

$289,303.28

497 - 2010 EMERGENCY ($4,435,000)

$435,285.33

$56,335.66

$378,949.67

502 - 2010 EMERGENCY ($8,252,548)

$744,564.30

$96,363.27

$648,201.03

$3,455,676.71

$445,908.60

$3,009,768.11

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$1,986.70

$87.89

$1,898.81

$236.51

$10.46

$226.05

Totals for: 33 - ELYRIA CITY/ELYRIA CSD

Tax District:

68 - LORAIN CITY/ELYRIA CSD

080 - 2007 PERMANENT IMPROVEMENT-GENERAL

097 - 2007 BOND ($45,000,000)

$1,745.48

$77.21

$1,668.27

276 - 1976 CURRENT EXPENSE

$5,680.97

$251.30

$5,429.67

282 - 1982 CURRENT EXPENSE

$1,848.23

$81.76

$1,766.47

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 4 of 12

Tax Year: 2013

Lorain County

09/25/2014 11:02:59 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

21670 - ELYRIA CSD

68 - LORAIN CITY/ELYRIA CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

292 - 1992 CURRENT EXPENSE

$2,262.07

$100.06

$2,162.01

299 - 1999 CURRENT EXPENSE

$2,206.05

$97.58

$2,108.47

497 - 2010 EMERGENCY ($4,435,000)

$2,696.25

$119.27

$2,576.98

502 - 2010 EMERGENCY ($8,252,548)

$4,612.01

$204.01

$4,408.00

$23,274.27

$1,029.54

$22,244.73

$3,700,089.05

$477,556.97

$3,222,532.08

Totals for: 68 - LORAIN CITY/ELYRIA CSD

Totals for: 21670 - ELYRIA CSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 5 of 24

Tax Year: 2013

Lorain County

09/25/2014 11:04:46 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

21870 - FIRELANDS LSD

01 - AMHERST TWP/FIRELANDS LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$1,437.29

$179.07

$1,258.22

033 - PERMANENT IMPROVEMENT

$874.87

$109.01

$765.86

099 - 2011 EMERGENCY ($820,000)

$1,818.47

$226.57

$1,591.90

276 - 1976 CURRENT EXPENSE

$8,459.47

$1,060.70

$7,398.77

281 - 1981 CURRENT EXPENSE

$1,897.85

$234.38

$1,663.47

287 - 1987 CURRENT EXPENSE

$1,907.08

$236.26

$1,670.82

508 - 2011 EMERGENCY ($1,500,000)

$3,318.25

$413.42

$2,904.83

$19,713.28

$2,459.41

$17,253.87

Totals for: 01 - AMHERST TWP/FIRELANDS LSD

Tax District:

08 - AMHERST TWP/S AMH VILL/FIRELANDS LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$622.18

$157.07

$465.11

033 - PERMANENT IMPROVEMENT

$378.73

$95.61

$283.12

099 - 2011 EMERGENCY ($820,000)

$787.20

$198.74

$588.46

276 - 1976 CURRENT EXPENSE

$3,690.49

$931.46

$2,759.03

281 - 1981 CURRENT EXPENSE

$812.79

$205.27

$607.52

287 - 1987 CURRENT EXPENSE

$819.88

$207.03

$612.85

$1,436.45

$362.64

$1,073.81

$8,547.72

$2,157.82

$6,389.90

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$4,381.30

$953.50

$3,427.80

033 - PERMANENT IMPROVEMENT

$2,666.92

$580.39

$2,086.53

508 - 2011 EMERGENCY ($1,500,000)

Totals for: 08 - AMHERST TWP/S AMH VILL/FIR

Tax District:

13 - BROWNHELM TWP/FIRELANDS LSD

099 - 2011 EMERGENCY ($820,000)

$5,543.35

$1,206.37

$4,336.98

276 - 1976 CURRENT EXPENSE

$26,218.90

$5,706.22

$20,512.68

281 - 1981 CURRENT EXPENSE

$5,652.47

$1,230.02

$4,422.45

287 - 1987 CURRENT EXPENSE

508 - 2011 EMERGENCY ($1,500,000)

Totals for: 13 - BROWNHELM TWP/FIRELANDS

Tax District:

$5,727.33

$1,246.35

$4,480.98

$10,115.22

$2,201.33

$7,913.89

$60,305.49

$13,124.18

$47,181.31

15 - BROWNHELM TWP/VERMILION CTY/FIRELANDS LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$5,952.36

$721.05

$5,231.31

033 - PERMANENT IMPROVEMENT

$3,623.22

$438.90

$3,184.32

099 - 2011 EMERGENCY ($820,000)

$7,531.08

$912.28

$6,618.80

276 - 1976 CURRENT EXPENSE

$35,622.43

$4,315.15

$31,307.28

281 - 1981 CURRENT EXPENSE

$7,678.71

$930.16

$6,748.55

287 - 1987 CURRENT EXPENSE

508 - 2011 EMERGENCY ($1,500,000)

Totals for: 15 - BROWNHELM TWP/VERMILION

Copyright (C) 1997-2014 DEVNET Incorporated

$7,780.63

$942.51

$6,838.12

$13,742.32

$1,664.69

$12,077.63

$81,930.75

$9,924.74

$72,006.01

SCHUSTER

Page 6 of 24

Tax Year: 2013

Lorain County

09/25/2014 11:04:46 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

21870 - FIRELANDS LSD

19 - CAMDEN TWP/FIRELANDS LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$3,922.78

$462.75

$3,460.03

033 - PERMANENT IMPROVEMENT

$2,387.82

$281.68

$2,106.14

099 - 2011 EMERGENCY ($820,000)

$4,963.21

$585.49

$4,377.72

276 - 1976 CURRENT EXPENSE

$23,476.29

$2,769.40

$20,706.89

281 - 1981 CURRENT EXPENSE

$5,060.51

$596.97

$4,463.54

287 - 1987 CURRENT EXPENSE

$5,127.68

$604.89

$4,522.79

508 - 2011 EMERGENCY ($1,500,000)

$9,056.62

$1,068.37

$7,988.25

$53,994.91

$6,369.55

$47,625.36

Totals for: 19 - CAMDEN TWP/FIRELANDS LSD

Tax District:

20 - CAMDEN TWP/KIPTON VILL/FIRELANDS LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$842.07

$164.26

$677.81

$412.60

033 - PERMANENT IMPROVEMENT

$512.58

$99.98

099 - 2011 EMERGENCY ($820,000)

$1,065.42

$207.82

$857.60

276 - 1976 CURRENT EXPENSE

$5,039.48

$982.98

$4,056.50

281 - 1981 CURRENT EXPENSE

$1,086.30

$211.89

$874.41

287 - 1987 CURRENT EXPENSE

$1,100.72

$214.70

$886.02

508 - 2011 EMERGENCY ($1,500,000)

$1,944.12

$379.21

$1,564.91

$11,590.69

$2,260.84

$9,329.85

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$4,249.98

$608.61

$3,641.37

033 - PERMANENT IMPROVEMENT

$2,586.97

$370.46

$2,216.51

Totals for: 20 - CAMDEN TWP/KIPTON VILL/FIR

Tax District:

37 - HENRIETTA TWP/FIRELANDS LSD

099 - 2011 EMERGENCY ($820,000)

$5,377.17

$770.04

$4,607.13

276 - 1976 CURRENT EXPENSE

$25,375.15

$3,614.27

$21,760.88

281 - 1981 CURRENT EXPENSE

$5,500.81

$793.76

$4,707.05

287 - 1987 CURRENT EXPENSE

$5,567.17

$801.15

$4,766.02

508 - 2011 EMERGENCY ($1,500,000)

$9,812.00

$1,405.12

$8,406.88

$58,469.25

$8,363.41

$50,105.84

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$395.13

$136.75

$258.38

033 - PERMANENT IMPROVEMENT

$240.51

$83.25

$157.26

Totals for: 37 - HENRIETTA TWP/FIRELANDS LS

Tax District:

57 - NEW RUSSIA TWP/FIRELANDS LSD

099 - 2011 EMERGENCY ($820,000)

$499.91

$173.05

$326.86

276 - 1976 CURRENT EXPENSE

$2,364.63

$818.51

$1,546.12

281 - 1981 CURRENT EXPENSE

$509.71

$176.43

$333.28

287 - 1987 CURRENT EXPENSE

$516.49

$178.78

$337.71

508 - 2011 EMERGENCY ($1,500,000)

$912.22

$315.77

$596.45

$5,438.60

$1,882.54

$3,556.06

Totals for: 57 - NEW RUSSIA TWP/FIRELANDS

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 7 of 24

Tax Year: 2013

Lorain County

09/25/2014 11:04:46 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

21870 - FIRELANDS LSD

59 - NEW RUSSIA TWP/SO. AMHERST VILL/FIRELANDS LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$287.58

$28.95

$258.63

033 - PERMANENT IMPROVEMENT

$175.05

$17.63

$157.42

099 - 2011 EMERGENCY ($820,000)

$363.85

$36.64

$327.21

276 - 1976 CURRENT EXPENSE

$1,721.02

$173.29

$1,547.73

281 - 1981 CURRENT EXPENSE

$370.98

$37.35

$333.63

287 - 1987 CURRENT EXPENSE

$375.90

$37.85

$338.05

508 - 2011 EMERGENCY ($1,500,000)

$663.94

$66.85

$597.09

$3,958.32

$398.56

$3,559.76

$303,949.01

$46,941.05

$257,007.96

Totals for: 59 - NEW RUSSIA TWP/SO. AMHERS

Totals for: 21870 - FIRELANDS LSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 4 of 16

Tax Year: 2013

Lorain County

09/25/2014 11:06:22 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

22670 - KEYSTONE LSD

21 - CARLISLE TWP/KEYSTONE LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$7,120.83

$1,398.62

$5,722.21

103 - 2003 BOND ($17,500,000)

$4,284.79

$841.60

$3,443.19

276 - 1976 CURRENT EXPENSE

$17,880.71

$3,507.20

$14,373.51

277 - 1977 CURRENT EXPENSE

$2,511.02

$493.16

$2,017.86

291 - 1991 CURRENT EXPENSE

$7,477.11

$1,470.46

$6,006.65

$834.05

$164.30

$669.75

487 - 1994 PERMANENT IMPROVEMENT-ONGOING

488 - 1985 PERMANENT IMPROVEMENT

$732.56

$144.42

$588.14

$3,837.81

$753.80

$3,084.01

$44,678.88

$8,773.56

$35,905.32

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$19,048.67

$2,454.58

$16,594.09

103 - 2003 BOND ($17,500,000)

$11,462.08

$1,476.98

$9,985.10

276 - 1976 CURRENT EXPENSE

$47,885.86

$6,221.00

$41,664.86

498 - 2010 BOND ($11,500,000)

Totals for: 21 - CARLISLE TWP/KEYSTONE LSD

Tax District:

40 - LAGRANGE TWP/KEYSTONE LSD

277 - 1977 CURRENT EXPENSE

$6,717.53

$866.00

$5,851.53

291 - 1991 CURRENT EXPENSE

$19,981.28

$2,555.59

$17,425.69

$2,225.87

$281.87

$1,944.00

487 - 1994 PERMANENT IMPROVEMENT-ONGOING

488 - 1985 PERMANENT IMPROVEMENT

$1,953.74

$246.23

$1,707.51

$10,266.37

$1,322.91

$8,943.46

Totals for: 40 - LAGRANGE TWP/KEYSTONE LS $119,541.40

$15,425.16

$104,116.24

498 - 2010 BOND ($11,500,000)

Tax District:

41 - LAGRANGE TWP/LAGRANGE VILL/KEYSTONE LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$21,027.75

$2,679.03

$18,348.72

103 - 2003 BOND ($17,500,000)

$12,652.99

$1,612.04

$11,040.95

276 - 1976 CURRENT EXPENSE

$49,908.76

$6,901.03

$43,007.73

277 - 1977 CURRENT EXPENSE

$7,392.44

$946.06

$6,446.38

291 - 1991 CURRENT EXPENSE

$23,177.31

$2,747.10

$20,430.21

487 - 1994 PERMANENT IMPROVEMENT-ONGOING

$2,746.59

$296.74

$2,449.85

488 - 1985 PERMANENT IMPROVEMENT

$2,479.44

$256.60

$2,222.84

$11,333.05

$1,443.87

$9,889.18

$130,718.33

$16,882.47

$113,835.86

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

498 - 2010 BOND ($11,500,000)

Totals for: 41 - LAGRANGE TWP/LAGRANGE V

Tax District:

46 - PENFIELD TWP/KEYSTONE LSD

$15,443.10

$2,843.88

$12,599.22

103 - 2003 BOND ($17,500,000)

$9,292.51

$1,711.24

$7,581.27

276 - 1976 CURRENT EXPENSE

$39,780.60

$7,325.72

$32,454.88

277 - 1977 CURRENT EXPENSE

$5,453.51

$1,004.28

$4,449.23

291 - 1991 CURRENT EXPENSE

$15,835.49

$2,916.15

$12,919.34

487 - 1994 PERMANENT IMPROVEMENT-ONGOING

$1,710.56

$315.01

$1,395.55

488 - 1985 PERMANENT IMPROVEMENT

$1,479.14

$272.39

$1,206.75

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 5 of 16

Tax Year: 2013

Lorain County

09/25/2014 11:06:22 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

22670 - KEYSTONE LSD

46 - PENFIELD TWP/KEYSTONE LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

$8,323.13

$1,532.73

$6,790.40

$97,318.04

$17,921.40

$79,396.64

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$3.75

$0.55

$3.20

103 - 2003 BOND ($17,500,000)

$2.25

$0.33

$1.92

276 - 1976 CURRENT EXPENSE

$9.65

$1.41

$8.24

277 - 1977 CURRENT EXPENSE

$1.32

$0.19

$1.13

291 - 1991 CURRENT EXPENSE

$3.84

$0.56

$3.28

487 - 1994 PERMANENT IMPROVEMENT-ONGOING

$0.41

$0.06

$0.35

488 - 1985 PERMANENT IMPROVEMENT

$0.36

$0.05

$0.31

498 - 2010 BOND ($11,500,000)

$2.02

$0.29

$1.73

$23.60

$3.44

$20.16

$392,280.25

$59,006.03

$333,274.22

498 - 2010 BOND ($11,500,000)

Totals for: 46 - PENFIELD TWP/KEYSTONE LSD

Tax District:

70 - ELYRIA CITY/KEYSTONE LSD

Totals for: 70 - ELYRIA CITY/KEYSTONE LSD

Totals for: 22670 - KEYSTONE LSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 2 of 5

Tax Year: 2013

Lorain County

09/25/2014 11:11:08 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

22970 - LORAIN CSD

42 - LORAIN CITY/LORAIN CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$419,980.28

$50,176.57

$369,803.71

105 - 2001 BOND ($41,094,000)

$662,930.72

$79,202.64

$583,728.08

276 - 1976 CURRENT EXPENSE

$1,622,045.07

$211,135.77

$1,410,909.30

291 - 1991 CURRENT EXPENSE

$620,606.92

$78,137.80

$542,469.12

292 - 1992 CURRENT EXPENSE

$624,582.05

$77,531.50

$547,050.55

392 - 1992 CURRENT EXPENSE

$913,347.66

$113,376.97

$799,970.69

452 - 2001 CLASSROOM FACILITY

521 - 2012 EMERGENCY ($3,126,190)

Totals for: 42 - LORAIN CITY/LORAIN CSD

Totals for: 22970 - LORAIN CSD

Copyright (C) 1997-2014 DEVNET Incorporated

$60,006.80

$7,118.96

$52,887.84

$721,532.57

$86,204.05

$635,328.52

$5,645,032.07

$702,884.26

$4,942,147.81

$5,645,032.07

$702,884.26

$4,942,147.81

SCHUSTER

Page 4 of 14

Tax Year: 2013

Lorain County

09/25/2014 11:14:16 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

23420 - MIDVIEW LSD

22 - CARLISLE TWP/MIDVIEW LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

033 - PERMANENT IMPROVEMENT

$17,602.59

$3,726.17

$13,876.42

112 - 2013 EMERGENCY ($1,600,000)

$18,037.85

$3,818.28

$14,219.57

276 - 1976 CURRENT EXPENSE

$70,213.78

$14,548.41

$55,665.37

278 - 1978 CURRENT EXPENSE

$11,642.02

$2,460.92

$9,181.10

286 - 1986 CURRENT EXPENSE

$28,117.81

$5,957.96

$22,159.85

531 - 2013 EMERGENCY ($4,600,000)

$51,840.67

$10,973.75

$40,866.92

$197,454.72

$41,485.49

$155,969.23

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

033 - PERMANENT IMPROVEMENT

$28,676.43

$4,208.35

$24,468.08

112 - 2013 EMERGENCY ($1,600,000)

$29,385.51

$4,312.40

$25,073.11

276 - 1976 CURRENT EXPENSE

$115,448.53

$16,765.56

$98,682.97

278 - 1978 CURRENT EXPENSE

$18,977.81

$2,783.10

$16,194.71

286 - 1986 CURRENT EXPENSE

$45,786.75

$6,722.66

$39,064.09

531 - 2013 EMERGENCY ($4,600,000)

$84,453.75

$12,393.83

$72,059.92

$322,728.78

$47,185.90

$275,542.88

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

$2,839.51

$533.96

$2,305.55

Totals for: 22 - CARLISLE TWP/MIDVIEW LSD

Tax District:

28 - EATON TWP/MIDVIEW LSD

Fund Description

Totals for: 28 - EATON TWP/MIDVIEW LSD

Tax District:

34 - ELYRIA CITY/MIDVIEW LSD

Fund Description

033 - PERMANENT IMPROVEMENT

112 - 2013 EMERGENCY ($1,600,000)

$2,909.73

$547.16

$2,362.57

276 - 1976 CURRENT EXPENSE

$11,737.68

$2,220.55

$9,517.13

278 - 1978 CURRENT EXPENSE

$1,882.55

$354.15

$1,528.40

286 - 1986 CURRENT EXPENSE

$4,528.00

$851.22

$3,676.78

531 - 2013 EMERGENCY ($4,600,000)

$8,362.52

$1,572.54

$6,789.98

$32,259.99

$6,079.58

$26,180.41

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

033 - PERMANENT IMPROVEMENT

$10,714.71

$1,424.97

$9,289.74

112 - 2013 EMERGENCY ($1,600,000)

$10,979.68

$1,460.21

$9,519.47

276 - 1976 CURRENT EXPENSE

$44,279.89

$5,907.92

$38,371.97

278 - 1978 CURRENT EXPENSE

$7,103.58

$944.93

$6,158.65

286 - 1986 CURRENT EXPENSE

$17,086.35

$2,271.98

$14,814.37

531 - 2013 EMERGENCY ($4,600,000)

$31,555.51

$4,196.60

$27,358.91

$121,719.72

$16,206.61

$105,513.11

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

$8,882.33

$1,692.32

$7,190.01

Totals for: 34 - ELYRIA CITY/MIDVIEW LSD

Tax District:

35 - GRAFTON TWP/MIDVIEW LSD

Fund Description

Totals for: 35 - GRAFTON TWP/MIDVIEW LSD

Tax District:

36 - GRAFTON VILL/MIDVIEW LSD

Fund Description

033 - PERMANENT IMPROVEMENT

112 - 2013 EMERGENCY ($1,600,000)

$9,101.92

$1,734.15

$7,367.77

276 - 1976 CURRENT EXPENSE

$33,380.48

$6,436.44

$26,944.04

278 - 1978 CURRENT EXPENSE

$5,851.90

$1,115.79

$4,736.11

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 5 of 14

Tax Year: 2013

Lorain County

09/25/2014 11:14:16 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

23420 - MIDVIEW LSD

36 - GRAFTON VILL/MIDVIEW LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

286 - 1986 CURRENT EXPENSE

$14,226.89

$2,709.15

$11,517.74

531 - 2013 EMERGENCY ($4,600,000)

$26,158.93

$4,983.95

$21,174.98

$97,602.45

$18,671.80

$78,930.65

$771,765.66

$129,629.38

$642,136.28

Totals for: 36 - GRAFTON VILL/MIDVIEW LSD

Totals for: 23420 - MIDVIEW LSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 2 of 8

Tax Year: 2013

Lorain County

09/25/2014 11:14:54 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

23680 - NEW LONDON LSD

51 - ROCHESTER TWP/NEW LONDON LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$2,227.90

$385.02

$1,842.88

115 - 2011 EMERGENCY ($152,000)

$767.39

$132.62

$634.77

116 - 1998 BOND ($3,252,000)

$1,237.73

$213.90

$1,023.83

276 - 1976 CURRENT EXPENSE

$7,793.30

$1,334.06

$6,459.24

$205.84

$35.24

$170.60

$12,232.16

$2,100.84

$10,131.32

450 - 2001 CLASSROOM FAC. MAINT.

Totals for: 51 - ROCHESTER TWP/NEW LONDO

Tax District:

54 - ROCHESTER TWP/ROCHESTER VILL/NEW LONDON LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$505.07

$42.27

$462.80

115 - 2011 EMERGENCY ($152,000)

$173.97

$14.56

$159.41

116 - 1998 BOND ($3,252,000)

$280.60

$23.48

$257.12

$1,750.05

$146.45

$1,603.60

$46.23

$3.87

$42.36

$2,755.92

$230.63

$2,525.29

$14,988.08

$2,331.47

$12,656.61

276 - 1976 CURRENT EXPENSE

450 - 2001 CLASSROOM FAC. MAINT.

Totals for: 54 - ROCHESTER TWP/ROCHESTER

Totals for: 23680 - NEW LONDON LSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 2 of 5

Tax Year: 2013

Lorain County

09/25/2014 11:15:48 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

23880 - NORTH RIDGEVILLE CSD

50 - NO RIDGEVILLE CITY/NO RIDGEVILLE CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$104,766.82

$22,715.92

$82,050.90

119 - 1992 BOND ($5,350,000)

$8,587.18

$1,861.92

$6,725.26

120 - 2013 EMERGENCY ($1,717,171)

$43,280.22

$9,384.21

$33,896.01

121 - 2010 EMERGENCY ($2,710,100)

$68,355.87

$14,821.20

$53,534.67

276 - 1976 CURRENT EXPENSE

$213,758.18

$45,366.83

$168,391.35

290 - 1990 CURRENT EXPENSE

$56,523.85

$12,237.00

$44,286.85

490 - 1985 PERMANENT IMPROVEMENT-ONGOING

$19,349.08

$4,397.51

$14,951.57

499 - 2010 EMERGENCY ($1,900,000)

$47,917.48

$10,389.68

$37,527.80

522 - 2012 EMERGENCY ($4,317,030)

$109,059.89

$23,646.83

$85,413.06

$76,427.89

$16,571.41

$59,856.48

$8,509.23

$1,844.20

$6,665.03

Totals for: 50 - NO RIDGEVILLE CITY/NO RIDGE $756,535.69

$163,236.71

$593,298.98

$163,236.71

$593,298.98

532 - 2013 BOND ($58,100,000)

533 - 2013 PERMANENT IMPROVEMENT-GENERAL

Totals for: 23880 - NORTH RIDGEVILLE CSD

Copyright (C) 1997-2014 DEVNET Incorporated

$756,535.69

SCHUSTER

Page 3 of 13

Tax Year: 2013

Lorain County

09/25/2014 11:17:01 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

24100 - OBERLIN CSD

24 - CARLISLE TWP/OBERLIN CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$611.05

$98.00

$513.05

061 - 2007 EDUCATION TECHNOLOGY

$147.11

$23.59

$123.52

168 - 2006 PERMANENT IMPROVEMENT

$225.15

$36.11

$189.04

276 - 1976 CURRENT EXPENSE

$1,605.42

$257.46

$1,347.96

277 - 1977 CURRENT EXPENSE

$283.05

$45.39

$237.66

509 - 2011 EMERGENCY ($940,000)

$608.79

$97.63

$511.16

$3,480.57

$558.18

$2,922.39

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$8,634.54

$976.36

$7,658.18

061 - 2007 EDUCATION TECHNOLOGY

$2,067.65

$234.46

$1,833.19

Totals for: 24 - CARLISLE TWP/OBERLIN CSD

Tax District:

48 - PITTSFIELD TWP/OBERLIN CSD

168 - 2006 PERMANENT IMPROVEMENT

$3,161.77

$358.69

$2,803.08

276 - 1976 CURRENT EXPENSE

$21,644.44

$2,509.77

$19,134.67

277 - 1977 CURRENT EXPENSE

$3,951.21

$449.68

$3,501.53

509 - 2011 EMERGENCY ($940,000)

$8,602.57

$972.73

$7,629.84

$48,062.18

$5,501.69

$42,560.49

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$20,443.47

$3,243.17

$17,200.30

$4,135.08

Totals for: 48 - PITTSFIELD TWP/OBERLIN CSD

Tax District:

58 - NEW RUSSIA TWP/OBERLIN CSD

061 - 2007 EDUCATION TECHNOLOGY

$4,915.39

$780.31

168 - 2006 PERMANENT IMPROVEMENT

$7,521.49

$1,194.16

$6,327.33

$53,126.62

$8,477.83

$44,648.79

276 - 1976 CURRENT EXPENSE

277 - 1977 CURRENT EXPENSE

$9,442.54

$1,500.29

$7,942.25

$20,367.78

$3,231.17

$17,136.61

Totals for: 58 - NEW RUSSIA TWP/OBERLIN CS $115,817.29

$18,426.93

$97,390.36

509 - 2011 EMERGENCY ($940,000)

Tax District:

60 - OBERLIN CITY/OBERLIN CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$39,813.22

$8,906.19

$30,907.03

$9,519.20

$2,128.54

$7,390.66

061 - 2007 EDUCATION TECHNOLOGY

168 - 2006 PERMANENT IMPROVEMENT

$14,552.75

$3,253.84

$11,298.91

276 - 1976 CURRENT EXPENSE

$98,429.93

$21,933.85

$76,496.08

277 - 1977 CURRENT EXPENSE

$18,154.94

$4,057.30

$14,097.64

509 - 2011 EMERGENCY ($940,000)

$39,665.77

$8,873.20

$30,792.57

$220,135.81

$49,152.92

$170,982.89

$387,495.85

$73,639.72

$313,856.13

Totals for: 60 - OBERLIN CITY/OBERLIN CSD

Totals for: 24100 - OBERLIN CSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 2 of 5

Tax Year: 2013

Lorain County

09/25/2014 11:17:35 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

24150 - OLMSTED FALLS CSD

26 - COLUMBIA TWP/OLMSTED FALLS CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$14,097.61

$1,169.73

$12,927.88

016 - 1994 CURRENT EXPENSE (5705.212)

$5,457.15

$452.81

$5,004.34

029 - 2001 CLASSROOM FAC. ($7,000,000)

$1,347.05

$111.77

$1,235.28

034 - 1995 CURRENT EXPENSE (5705.212)

$6,343.61

$526.36

$5,817.25

037 - 1996 CURRENT EXPENSE (5705.212)

$6,375.93

$529.04

$5,846.89

129 - 1994 BOND ($10,500,000)

$6,202.83

$514.68

$5,688.15

130 - 2007 BOND ($17,000,000)

$5,920.94

$491.29

$5,429.65

276 - 1976 CURRENT EXPENSE

$20,930.78

$1,736.73

$19,194.05

285 - 1985 CURRENT EXPENSE

$5,205.02

$431.88

$4,773.14

$10,287.73

287 - 1987 CURRENT EXPENSE

$11,218.59

$930.86

291 - 1991 CURRENT EXPENSE

$12,885.92

$1,069.21

$11,816.71

299 - 1999 CURRENT EXPENSE

$31,572.47

$2,619.72

$28,952.75

501 - 2010 CURRENT EXPENSE

$24,529.58

$2,035.33

$22,494.25

$7,894.64

$655.06

$7,239.58

Totals for: 26 - COLUMBIA TWP/OLMSTED FAL $159,982.12

$13,274.47

$146,707.65

$13,274.47

$146,707.65

512 - 2011 PERMANENT IMPROVEMENT

Totals for: 24150 - OLMSTED FALLS CSD

Copyright (C) 1997-2014 DEVNET Incorporated

$159,982.12

SCHUSTER

Page 2 of 6

Tax Year: 2013

Lorain County

09/25/2014 11:18:33 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

24890 - SHEFFIELD-SHEFFIELD LAKE CSD

64 - SHEFFIELD LAKE CITY/SHEFFIELD LAKE CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$41,388.86

$5,255.85

$36,133.01

033 - PERMANENT IMPROVEMENT

$10,891.69

$1,383.10

$9,508.59

132 - 2010 EMERGENCY ($2,300,000)

$83,211.98

$10,566.85

$72,645.13

134 - 2010 EMERGENCY ($1,894,000)

$70,141.98

$8,907.13

$61,234.85

276 - 1976 CURRENT EXPENSE

$150,713.98

$19,103.06

$131,610.92

293 - 1993 CURRENT EXPENSE

$56,592.87

$7,200.67

$49,392.20

504 - 2011 BOND ($31,000,000)

$62,299.96

$7,911.30

$54,388.66

Totals for: 64 - SHEFFIELD LAKE CITY/SHEFFIE $475,241.32

$60,327.96

$414,913.36

Tax District:

65 - SHEFFIELD VILLAGE/SHEFFIELD LAKE CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$34,366.64

$7,260.62

$27,106.02

033 - PERMANENT IMPROVEMENT

$9,043.77

$1,910.68

$7,133.09

132 - 2010 EMERGENCY ($2,300,000)

$69,093.89

$14,597.44

$54,496.45

134 - 2010 EMERGENCY ($1,894,000)

$58,241.47

$12,304.67

$45,936.80

276 - 1976 CURRENT EXPENSE

$119,705.63

$24,283.38

$95,422.25

293 - 1993 CURRENT EXPENSE

$49,140.71

$10,779.95

$38,360.76

504 - 2011 BOND ($31,000,000)

$51,729.96

$10,928.97

$40,800.99

Totals for: 65 - SHEFFIELD VILLAGE/SHEFFIEL $391,322.07

$82,065.71

$309,256.36

Totals for: 24890 - SHEFFIELD-SHEFFIELD LAKE C $866,563.39

$142,393.67

$724,169.72

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 2 of 5

Tax Year: 2013

Lorain County

09/25/2014 11:19:05 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

25190 - STRONGSVILLE CSD

27 - COLUMBIA TWP/STRONGSVILLE CSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$791.93

$179.75

$612.18

038 - 2002 CURRENT EXPENSE (5705.212)

$661.41

$150.13

$511.28

052 - 2003 CURRENT EXPENSE (5705.212)

$132.56

$30.09

$102.47

217 - 2007 CURRENT EXPENSE

$919.20

$208.65

$710.55

276 - 1976 CURRENT EXPENSE

$867.90

$197.00

$670.90

278 - 1978 CURRENT EXPENSE

$289.00

$65.60

$223.40

286 - 1986 CURRENT EXPENSE

$697.68

$158.37

$539.31

290 - 1990 CURRENT EXPENSE

$579.96

$131.65

$448.31

294 - 1994 CURRENT EXPENSE

$448.24

$101.75

$346.49

470 - 2000 PERMANENT IMPROVEMENT

$120.83

$27.43

$93.40

516 - 2012 BOND ($81,000,000)

$410.10

$93.09

$317.01

$5,918.81

$1,343.51

$4,575.30

$5,918.81

$1,343.51

$4,575.30

Totals for: 27 - COLUMBIA TWP/STRONGSVILL

Totals for: 25190 - STRONGSVILLE CSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 3 of 12

Tax Year: 2013

Lorain County

09/25/2014 11:20:10 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

25600 - VERMILION LSD

14 - BROWNHELM TWP/VERMILION LSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$28.12

$0.00

$28.12

141 - 2011 EMERGENCY ($4,250,000)

$73.53

$0.00

$73.53

$3.60

$0.00

$3.60

276 - 1976 CURRENT EXPENSE

$56.51

$0.00

$56.51

289 - 1989 CURRENT EXPENSE

$20.28

$0.00

$20.28

292 - 1992 CURRENT EXPENSE

$23.39

$0.00

$23.39

293 - 1993 CURRENT EXPENSE

$28.05

$0.00

$28.05

$0.72

$0.00

$0.72

$234.20

$0.00

$234.20

Delinquent Tax Paid

Outstanding Balance Due

142 - 2007 BOND/LIBRARY ($3,500,000)

471 - LIBRARY

Totals for: 14 - BROWNHELM TWP/VERMILION

Tax District:

16 - BROWNHELM TWP/VERMILION CTY/VERMILION LSD

Fund Description

Delinquent Tax Due

001 - GENERAL FUND

$47,658.72

$5,861.90

$41,796.82

$124,646.20

$15,331.25

$109,314.95

$6,110.13

$751.53

$5,358.60

276 - 1976 CURRENT EXPENSE

$206,556.14

$22,426.04

$184,130.10

289 - 1989 CURRENT EXPENSE

$57,740.54

$6,473.52

$51,267.02

292 - 1992 CURRENT EXPENSE

$60,501.54

$6,880.46

$53,621.08

293 - 1993 CURRENT EXPENSE

$71,835.98

$8,182.34

$63,653.64

$1,221.91

$150.29

$1,071.62

$576,271.16

$66,057.33

$510,213.83

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$10,224.48

$1,483.09

$8,741.39

141 - 2011 EMERGENCY ($4,250,000)

$26,740.88

$3,878.89

$22,861.99

$1,310.84

$190.14

$1,120.70

276 - 1976 CURRENT EXPENSE

$58,919.69

$8,546.55

$50,373.14

289 - 1989 CURRENT EXPENSE

$15,467.70

$2,243.66

$13,224.04

292 - 1992 CURRENT EXPENSE

$15,729.99

$2,281.71

$13,448.28

293 - 1993 CURRENT EXPENSE

$18,613.68

$2,699.99

$15,913.69

$262.14

$38.03

$224.11

$147,269.40

$21,362.06

$125,907.34

$723,774.76

$87,419.39

$636,355.37

141 - 2011 EMERGENCY ($4,250,000)

142 - 2007 BOND/LIBRARY ($3,500,000)

471 - LIBRARY

Totals for: 16 - BROWNHELM TWP/VERMILION

Tax District:

44 - LORAIN CITY/VERMILION LSD

142 - 2007 BOND/LIBRARY ($3,500,000)

471 - LIBRARY

Totals for: 44 - LORAIN CITY/VERMILION LSD

Totals for: 25600 - VERMILION LSD

Copyright (C) 1997-2014 DEVNET Incorporated

SCHUSTER

Page 4 of 17

Tax Year: 2013

Lorain County

09/25/2014 11:21:33 AM

Outstanding Delinquent Report by Political Subdivision with Funds

As Of 09/23/2014

REAL ESTATE PUBLIC UTILITY

Tax District:

Political

Subdivision:

Tax District:

25790 - WELLINGTON EVSD

12 - BRIGHTON TWP/WELLINGTON EVSD

Fund Description

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

001 - GENERAL FUND

$3,387.44

$957.98

$2,429.46

276 - 1976 CURRENT EXPENSE

$17,108.28

$4,838.32

$12,269.96

510 - 2011 EMERGENCY ($970,000)

$4,989.58

$1,411.09

$3,578.49

517 - 2012 BOND($11,575,000)

$2,764.87

$781.92

$1,982.95

$457.60

$129.41

$328.19

$28,707.77

$8,118.72

$20,589.05

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

523 - 2012 PERMANENT IMPROVEMENT

Totals for: 12 - BRIGHTON TWP/WELLINGTON

Tax District:

49 - PITTSFIELD TWP/WELLINGTON EVSD

Fund Description

001 - GENERAL FUND

$4,052.79

$470.92

$3,581.87

$20,468.64

$2,378.38

$18,090.26

510 - 2011 EMERGENCY ($970,000)

$5,969.62

$693.65

$5,275.97

517 - 2012 BOND($11,575,000)

$3,307.94

$384.37

$2,923.57

$547.48

$63.62

$483.86

$34,346.47

$3,990.94

$30,355.53

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

276 - 1976 CURRENT EXPENSE

523 - 2012 PERMANENT IMPROVEMENT

Totals for: 49 - PITTSFIELD TWP/WELLINGTON

Tax District:

53 - ROCHESTER TWP/WELLINGTON EVSD

Fund Description

001 - GENERAL FUND

$413.35

$90.29

$323.06

$2,087.63

$456.05

$1,631.58

510 - 2011 EMERGENCY ($970,000)

$608.85

$133.01

$475.84

517 - 2012 BOND($11,575,000)

$337.38

$73.70

$263.68

$55.84

$12.20

$43.64

$3,503.05

$765.25

$2,737.80

Delinquent Tax Due

Delinquent Tax Paid

Outstanding Balance Due

276 - 1976 CURRENT EXPENSE

523 - 2012 PERMANENT IMPROVEMENT

Totals for: 53 - ROCHESTER TWP/WELLINGTO

Tax District:

66 - WELLINGTON TWP/WELLINGTON EVSD

Fund Description

001 - GENERAL FUND

$6,305.40

$1,257.07

$5,048.33

$31,307.07

$6,322.07

$24,985.00

510 - 2011 EMERGENCY ($970,000)

$9,287.69

$1,851.63

$7,436.06

517 - 2012 BOND($11,575,000)

$5,146.58

$1,026.05

$4,120.53

$849.62

$169.71

$679.91

$52,896.36

$10,626.53

$42,269.83

Delinquent Tax Paid

Outstanding Balance Due

276 - 1976 CURRENT EXPENSE

523 - 2012 PERMANENT IMPROVEMENT

Totals for: 66 - WELLINGTON TWP/WELLINGTO

Tax District:

67 - WELLINGTON TWP/WELLINGTON VILL/WELLINGTON EVSD

Fund Description

001 - GENERAL FUND

Delinquent Tax Due

$27,137.23

$4,967.31

$22,169.92

$132,055.04

$23,723.98

$108,331.06

510 - 2011 EMERGENCY ($970,000)

$39,972.29

$7,316.69

$32,655.60

517 - 2012 BOND($11,575,000)

$22,149.80

$4,054.38

$18,095.42

$3,645.74

$665.52

$2,980.22

Totals for: 67 - WELLINGTON TWP/WELLINGTO $224,960.10

$40,727.88

$184,232.22

$64,229.32

$280,184.43

276 - 1976 CURRENT EXPENSE

523 - 2012 PERMANENT IMPROVEMENT

Totals for: 25790 - WELLINGTON EVSD

Copyright (C) 1997-2014 DEVNET Incorporated

$344,413.75

SCHUSTER

Das könnte Ihnen auch gefallen

- File 5 of 12 - CRA Presentation 17 August 2012Dokument18 SeitenFile 5 of 12 - CRA Presentation 17 August 2012Commission on Revenue AllocationNoch keine Bewertungen

- Lorain County Taxing District Res/ag Value Comparison, 2013-14Dokument4 SeitenLorain County Taxing District Res/ag Value Comparison, 2013-14The Morning JournalNoch keine Bewertungen

- Brevard Mims Prop Tax 10Dokument2 SeitenBrevard Mims Prop Tax 10LWCitizenNoch keine Bewertungen

- 2022HowCountiesCompareFULL 2Dokument68 Seiten2022HowCountiesCompareFULL 2MariaNoch keine Bewertungen

- St. Clair County 2024 BudgetDokument170 SeitenSt. Clair County 2024 BudgetLexi CortesNoch keine Bewertungen

- Recall Stewart Final ReportDokument8 SeitenRecall Stewart Final ReportTucsonSentinelNoch keine Bewertungen

- Resolution of Emergency Temporary Appropriation April 2010Dokument3 SeitenResolution of Emergency Temporary Appropriation April 2010Ewing Township, NJNoch keine Bewertungen

- 2010-06-22 Resolution of Temporary Budget Sfy 2011Dokument3 Seiten2010-06-22 Resolution of Temporary Budget Sfy 2011Ewing Township, NJNoch keine Bewertungen

- Exhibits For FEC Complaint Re: DISHDokument173 SeitenExhibits For FEC Complaint Re: DISHCause of ActionNoch keine Bewertungen

- LIESP White Paper-Nov 14 FINAL - Layout 1Dokument12 SeitenLIESP White Paper-Nov 14 FINAL - Layout 1Long Island Business NewsNoch keine Bewertungen

- Notice of Discovery in Paul Hildwin Adv State of Florida With JAC Appropriations TablesDokument4 SeitenNotice of Discovery in Paul Hildwin Adv State of Florida With JAC Appropriations TablesReba KennedyNoch keine Bewertungen

- 2011-2012 BudgetDokument126 Seiten2011-2012 BudgetletscurecancerNoch keine Bewertungen

- FB County Tax Statement-2022Dokument1 SeiteFB County Tax Statement-2022Sageer AbdullaNoch keine Bewertungen

- Giglio July 2012 PeriodicDokument4 SeitenGiglio July 2012 PeriodicRiverheadLOCALNoch keine Bewertungen

- Hubbard County Truth-in-Taxation Hearing PresentationDokument19 SeitenHubbard County Truth-in-Taxation Hearing PresentationShannon GeisenNoch keine Bewertungen

- PRR 3878Dokument5 SeitenPRR 3878RecordTrac - City of OaklandNoch keine Bewertungen

- Sullivan County Enacts Cuts, Including Staff ReductionsDokument11 SeitenSullivan County Enacts Cuts, Including Staff ReductionsLissa HarrisNoch keine Bewertungen

- Pinellas County Property Appraiser 6 PDFDokument2 SeitenPinellas County Property Appraiser 6 PDFJoshua HuntNoch keine Bewertungen

- 2017 Economic CensusDokument7 Seiten2017 Economic CensusTodd HerbstNoch keine Bewertungen

- 2011-2012 County RevenuesDokument23 Seiten2011-2012 County RevenuesMichael ToddNoch keine Bewertungen

- Harrisburg School District Budget SY 19-20Dokument23 SeitenHarrisburg School District Budget SY 19-20PennLiveNoch keine Bewertungen

- Ithaca Mayor's Program BudgetDokument109 SeitenIthaca Mayor's Program BudgetTime Warner Cable NewsNoch keine Bewertungen

- UBL 2020 SampleDokument9 SeitenUBL 2020 SampleAli AlqaritiNoch keine Bewertungen

- Commercial Invoice South AfricaDokument2 SeitenCommercial Invoice South Africaadelbenmehdia9Noch keine Bewertungen

- Fy 2014 Mayors Budget WebsiteDokument437 SeitenFy 2014 Mayors Budget WebsiteHelen BennettNoch keine Bewertungen

- Jordan Stryder's ATT BillDokument4 SeitenJordan Stryder's ATT BillEmilyFykNoch keine Bewertungen

- Tra May 2013 AttachmentDokument10 SeitenTra May 2013 AttachmentJeremiah TrinidadNoch keine Bewertungen

- Steele Property MNDokument3 SeitenSteele Property MNJ DoeNoch keine Bewertungen

- Nº 222, Sexta-Feira, 26 de Novembro de 2021 ISSN 1677-7042Dokument1 SeiteNº 222, Sexta-Feira, 26 de Novembro de 2021 ISSN 1677-7042Danielli PadovaniNoch keine Bewertungen

- HB 4210 Revenue ImpactDokument2 SeitenHB 4210 Revenue ImpactSinclair Broadcast Group - EugeneNoch keine Bewertungen

- Truenorth 7 5 MillionDokument3 SeitenTruenorth 7 5 MillionRob CooperNoch keine Bewertungen

- Plate No: 123NQL: Official ReceiptDokument1 SeitePlate No: 123NQL: Official ReceiptIan Benedict SorianoNoch keine Bewertungen

- Jazmonique Strickland Arraignment, 10 A.m., Jan. 25, 2021Dokument7 SeitenJazmonique Strickland Arraignment, 10 A.m., Jan. 25, 2021WWMTNoch keine Bewertungen

- 8555 403 417 Hospitality Expenses All Departments - Part1Dokument320 Seiten8555 403 417 Hospitality Expenses All Departments - Part1jamesvalckeNoch keine Bewertungen

- Lipinsky 32-Day PreDokument2 SeitenLipinsky 32-Day PreRiverheadLOCALNoch keine Bewertungen

- PAx 21 X 0002678431Dokument2 SeitenPAx 21 X 0002678431Vic MaldoNoch keine Bewertungen

- PAx 21 X 0002678431Dokument2 SeitenPAx 21 X 0002678431Vic MaldoNoch keine Bewertungen

- James Leggett TBI Criminal BackgroundDokument8 SeitenJames Leggett TBI Criminal BackgroundFOX 17 NewsNoch keine Bewertungen

- 190910323P1 Criminal Disclosure PackageDokument89 Seiten190910323P1 Criminal Disclosure PackageWes SwensonNoch keine Bewertungen

- How To Use This Form.: You Must Fill Out The Claim Sheet As Described Below. The Other Sheets AreDokument5 SeitenHow To Use This Form.: You Must Fill Out The Claim Sheet As Described Below. The Other Sheets Are07tpearceNoch keine Bewertungen

- May Financial Report 2016Dokument26 SeitenMay Financial Report 2016Anonymous Jrvijv4bRANoch keine Bewertungen

- 12th Annual Cavalier King Charles Spaniel Beach Party 04-02-13 PDFDokument26 Seiten12th Annual Cavalier King Charles Spaniel Beach Party 04-02-13 PDFL. A. PatersonNoch keine Bewertungen

- Jones Grant 3-31-14Dokument2 SeitenJones Grant 3-31-14api-245944168Noch keine Bewertungen

- Capital Equipment BudgetDokument20 SeitenCapital Equipment BudgetbstockusNoch keine Bewertungen

- Filed: State Board of Accounts 302 West Washington Street Room E418 INDIANAPOLIS, INDIANA 46204-2769Dokument42 SeitenFiled: State Board of Accounts 302 West Washington Street Room E418 INDIANAPOLIS, INDIANA 46204-2769sivaganesh1903Noch keine Bewertungen

- FILE STAMPED VOL 02 A159823 Respondent Findleton Motion To Request Judicial NoticeDokument109 SeitenFILE STAMPED VOL 02 A159823 Respondent Findleton Motion To Request Judicial Noticedario575Noch keine Bewertungen

- A Bill: For An Act To Be EntitledDokument35 SeitenA Bill: For An Act To Be EntitledKarl HillsNoch keine Bewertungen

- LepageDokument2 SeitenLepagegerald7783Noch keine Bewertungen

- United States Bankruptcy Court Central District of California Riverside DivisionDokument52 SeitenUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsNoch keine Bewertungen

- SalesUseTaxSC c-287 - 20131113 PDFDokument5 SeitenSalesUseTaxSC c-287 - 20131113 PDFAnonymous uqhSfwUENoch keine Bewertungen

- Tab 5Dokument3 SeitenTab 5Ian Terence SheltonNoch keine Bewertungen

- 09050313-Windshield Quote CoveredDokument2 Seiten09050313-Windshield Quote CoveredJaineNoch keine Bewertungen

- E Shore DR, Willis, TX 77318-6634, Montgomery County: Multiple Building Property SummaryDokument6 SeitenE Shore DR, Willis, TX 77318-6634, Montgomery County: Multiple Building Property SummaryBot makerNoch keine Bewertungen

- Approval of Warrants For October 2014 12-02-14Dokument14 SeitenApproval of Warrants For October 2014 12-02-14L. A. PatersonNoch keine Bewertungen

- The Sherando Times: October 6, 2010Dokument16 SeitenThe Sherando Times: October 6, 2010Dan McDermottNoch keine Bewertungen

- Aguiar 11 Day Pre GeneralDokument7 SeitenAguiar 11 Day Pre GeneralRiverheadLOCALNoch keine Bewertungen

- Los Angeles County Counsel Annual Litigation Cost Report - Fiscal Year 2012-2013Dokument6 SeitenLos Angeles County Counsel Annual Litigation Cost Report - Fiscal Year 2012-2013Southern California Public RadioNoch keine Bewertungen

- The 2004 CIA World FactbookVon EverandThe 2004 CIA World FactbookNoch keine Bewertungen

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Von EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Noch keine Bewertungen

- Updated Election ResultsDokument9 SeitenUpdated Election ResultsLorainCountyPrintingNoch keine Bewertungen

- Directors Stay Safe Ohio OrderDokument14 SeitenDirectors Stay Safe Ohio OrderCincinnatiEnquirer100% (1)

- Deshaun Watson Suspension Ruling - Sue L. RobinsonDokument16 SeitenDeshaun Watson Suspension Ruling - Sue L. RobinsonWKYC.comNoch keine Bewertungen

- Director's+Order+ - +Stay+At+Home+03 22 20Dokument12 SeitenDirector's+Order+ - +Stay+At+Home+03 22 20LorainCountyPrintingNoch keine Bewertungen

- Updated Election ResultsDokument9 SeitenUpdated Election ResultsLorainCountyPrintingNoch keine Bewertungen

- Updated Election ResultsDokument9 SeitenUpdated Election ResultsLorainCountyPrintingNoch keine Bewertungen

- Updated Election ResultsDokument9 SeitenUpdated Election ResultsLorainCountyPrintingNoch keine Bewertungen

- Reagan Nominates O'ConnorDokument1 SeiteReagan Nominates O'ConnorLorainCountyPrintingNoch keine Bewertungen

- Bonnie and Clyde Meet Their EndDokument1 SeiteBonnie and Clyde Meet Their EndLorainCountyPrintingNoch keine Bewertungen

- Summary Zero Report Primary & Special Election May 7, 2019 Unofficial Results Lorain County, OhioDokument10 SeitenSummary Zero Report Primary & Special Election May 7, 2019 Unofficial Results Lorain County, OhioLorainCountyPrintingNoch keine Bewertungen

- Manson Murders Front PageDokument1 SeiteManson Murders Front PageLorainCountyPrintingNoch keine Bewertungen

- Cavs ScheduleDokument1 SeiteCavs ScheduleLorainCountyPrintingNoch keine Bewertungen

- Updated Election ResultsDokument9 SeitenUpdated Election ResultsLorainCountyPrintingNoch keine Bewertungen

- Landon, Knox Nominated For GOP TicketDokument1 SeiteLandon, Knox Nominated For GOP TicketLorainCountyPrintingNoch keine Bewertungen

- The Death of Warren HardingDokument1 SeiteThe Death of Warren HardingLorainCountyPrintingNoch keine Bewertungen

- Cohen LetterDokument1 SeiteCohen LetterLorainCountyPrintingNoch keine Bewertungen

- Cohen LetterDokument1 SeiteCohen LetterLorainCountyPrintingNoch keine Bewertungen

- RFK AssassinationDokument1 SeiteRFK AssassinationLorainCountyPrinting100% (1)

- The Last Sports Title in ClevelandDokument1 SeiteThe Last Sports Title in ClevelandLorainCountyPrintingNoch keine Bewertungen

- Pope Assassination AttemptDokument1 SeitePope Assassination AttemptLorainCountyPrintingNoch keine Bewertungen

- 100 Years Ago TodayDokument1 Seite100 Years Ago TodayLorainCountyPrintingNoch keine Bewertungen

- Cavs Parade Rally MapDokument1 SeiteCavs Parade Rally Mapwews webstaffNoch keine Bewertungen

- Mt. St. HelensDokument1 SeiteMt. St. HelensLorainCountyPrintingNoch keine Bewertungen

- Reagan Assassination AttemptDokument1 SeiteReagan Assassination AttemptLorainCountyPrintingNoch keine Bewertungen

- Proposed Lorain BudgetDokument64 SeitenProposed Lorain BudgetLorainCountyPrintingNoch keine Bewertungen

- April 28, 1967 Chronicle Front PageDokument1 SeiteApril 28, 1967 Chronicle Front PageLorainCountyPrintingNoch keine Bewertungen

- Medina County History Day MapDokument2 SeitenMedina County History Day MapLorainCountyPrintingNoch keine Bewertungen

- Chronicle Front Page - Ohio Penitentiary FireDokument1 SeiteChronicle Front Page - Ohio Penitentiary FireLorainCountyPrintingNoch keine Bewertungen

- Feller No HitterDokument1 SeiteFeller No HitterLorainCountyPrintingNoch keine Bewertungen

- The Fight That Inspired RockyDokument1 SeiteThe Fight That Inspired RockyLorainCountyPrintingNoch keine Bewertungen

- Kidnapping in Nigeria MainDokument8 SeitenKidnapping in Nigeria MainPhred Woko0% (1)

- 6 TH Justa Causa National Moot Court Com PDFDokument29 Seiten6 TH Justa Causa National Moot Court Com PDFadv suryakant jadhavNoch keine Bewertungen

- PBM Employees Organization Vs PBM Company. Inc.: G.R. No. L-31195 June 5, 1973 Ponente: Makasiar, J.Dokument3 SeitenPBM Employees Organization Vs PBM Company. Inc.: G.R. No. L-31195 June 5, 1973 Ponente: Makasiar, J.claire beltranNoch keine Bewertungen

- Taule v. Santos, G.R. No. 90336, August 12, 1991Dokument6 SeitenTaule v. Santos, G.R. No. 90336, August 12, 1991JamieNoch keine Bewertungen

- Criminal Law Book 1 ModuleDokument163 SeitenCriminal Law Book 1 ModuleMandanas GabrielNoch keine Bewertungen

- CPCDokument3 SeitenCPCSathvik ReddyNoch keine Bewertungen

- Tabuena V Sandiganbayan, 268 Scra 332Dokument117 SeitenTabuena V Sandiganbayan, 268 Scra 332MykaNoch keine Bewertungen

- Basic Concepts of Criminal Law FinalDokument70 SeitenBasic Concepts of Criminal Law FinalCglu NemNoch keine Bewertungen

- CASES Criminal Law 2Dokument97 SeitenCASES Criminal Law 2Tollie Mar GarciaNoch keine Bewertungen

- CT Court Employees Face Tough Questions Over Conflicts of Interest-Washington TimesDokument22 SeitenCT Court Employees Face Tough Questions Over Conflicts of Interest-Washington TimesJournalistABCNoch keine Bewertungen

- Rosterwef 1104202292Dokument2 SeitenRosterwef 1104202292PraveenNoch keine Bewertungen

- Cases 1 - Election Laws Case DigestDokument44 SeitenCases 1 - Election Laws Case DigestLiz Zie100% (1)

- Indictment - YG Part 1Dokument48 SeitenIndictment - YG Part 1The Saratogian and Troy RecordNoch keine Bewertungen

- SECTION 4. Scope of Application. - This CodeDokument3 SeitenSECTION 4. Scope of Application. - This Codethornapple25Noch keine Bewertungen

- Asturias Sugar v. Commissioner of CustomsDokument1 SeiteAsturias Sugar v. Commissioner of Customs8111 aaa 1118Noch keine Bewertungen

- Gilded Age Newspaper ProjectDokument5 SeitenGilded Age Newspaper ProjectmarybarcroftNoch keine Bewertungen

- PS2082 VleDokument82 SeitenPS2082 Vlebillymambo0% (1)

- Doing Your Research Project 5th Edition 42 To 78Dokument37 SeitenDoing Your Research Project 5th Edition 42 To 78Afiani Astuti100% (2)

- Richard H. Pildes - Dworkin's Two Conceptions of Rights PDFDokument8 SeitenRichard H. Pildes - Dworkin's Two Conceptions of Rights PDFIoan GurgilaNoch keine Bewertungen

- Barangay Check FormDokument3 SeitenBarangay Check FormRonz RoganNoch keine Bewertungen

- Jelena Rasic Bribed Zuhdija Tabakovic To Lie in CourtDokument2 SeitenJelena Rasic Bribed Zuhdija Tabakovic To Lie in CourtSrebrenica Genocide LibraryNoch keine Bewertungen

- Smart. Savvy. Successful.: Media Kit 2018Dokument11 SeitenSmart. Savvy. Successful.: Media Kit 2018apschabbaNoch keine Bewertungen

- CR PCDokument18 SeitenCR PCPri YamNoch keine Bewertungen

- Criminal Law I Case Digests: Submitted By: 1B S.Y. 2017-2018Dokument150 SeitenCriminal Law I Case Digests: Submitted By: 1B S.Y. 2017-2018Josiah Balgos75% (4)

- The Preamble - The National Constitution CenterDokument3 SeitenThe Preamble - The National Constitution CenterAndreaFiorellaCheshireNoch keine Bewertungen

- Hot PursuitDokument66 SeitenHot PursuitRex Del ValleNoch keine Bewertungen

- Direction Application-151 CPCDokument10 SeitenDirection Application-151 CPCVaibhav Kharbanda100% (1)

- WFH - Celine Francisco - Content StrategyDokument44 SeitenWFH - Celine Francisco - Content StrategyCeline Hautea FranciscoNoch keine Bewertungen

- Sinn Féin and The Politics of Left Republicanism (Irish Left Republicanism)Dokument353 SeitenSinn Féin and The Politics of Left Republicanism (Irish Left Republicanism)LuxFridayNoch keine Bewertungen

- United States v. Gordon Kidder, 89 F.3d 825, 2d Cir. (1995)Dokument3 SeitenUnited States v. Gordon Kidder, 89 F.3d 825, 2d Cir. (1995)Scribd Government DocsNoch keine Bewertungen