Beruflich Dokumente

Kultur Dokumente

Submitted By: Vikrant Singh Pawar Roll No: 57.: Q1: According To Me Taking Up PBI Offer Had Following Advantages

Hochgeladen von

Rachit Pradhan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

41 Ansichten2 SeitenNICT case details

Originaltitel

PGP2_NICT_2013PGPM057

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenNICT case details

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

41 Ansichten2 SeitenSubmitted By: Vikrant Singh Pawar Roll No: 57.: Q1: According To Me Taking Up PBI Offer Had Following Advantages

Hochgeladen von

Rachit PradhanNICT case details

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Submitted by: Vikrant Singh Pawar

Roll No: 57.

Q1: According to me taking up PBI offer had following advantages:

It would be a huge source of revenue for the Mukesh and his company NICT.

It offered advantages of moving to more locations and all India presence.

Growth opportunities in form of new operations, scale and learning.

NICT had matching competencies similar to what PBI wanted like experience in

dealing with SBI and BOI.

If the offer isnt taken by NICT then the offer would be taken up by another company

and they would get the contract.

If NICT can successfully execute the project then it will might get licenses from

similar banks for a kiosk banking approach ushering in more revenue.

However there are certain challenges like:

Huge amount of scaling up would be needed. There is a possibility of failure in the

process.

If the expectations of PBI arent met then NICT might end up losing big time.

Considering the advantages and challenges I would like to advise them to go ahead and take

up the PBI offer. However they should be ready to face the challenges that they might come

across ad mitigate the risks. I would like to conclude by saying these lines by John Augustus

Shedd A ships is safe in the shipyard but is that what they are made for?

Q2: Its relationships with SBI and BOI would not get affected as already they are doing the

services for BoI and SBI without affecting their work.

So if NICT is able to continue to provide the banks with same level of service as they are

providing currently, addressing their concerns of security then SBI and BoI wouldnt have

problem in NICT being a vendor to PBI.

We have seen many examples of cases where same IT vendor like TCS provides IT services to

different banks competing like Deutsche Bank and BNP Paribas, HSBC and Citi Bank.

However there need to be proper governance mechanisms like contractual agreements in

form of an NDA (Non-Disclosure Agreement).

Q3: Justification of choices already covered in the above two questions.

Das könnte Ihnen auch gefallen

- PGP2 Nict 2013PGPM043Dokument2 SeitenPGP2 Nict 2013PGPM043Rachit PradhanNoch keine Bewertungen

- PGP2 Nict 2013PGPM010Dokument3 SeitenPGP2 Nict 2013PGPM010Rachit PradhanNoch keine Bewertungen

- GSDE Assignment: 1) Do You Think NICT Should Take Up PBI Offer?Dokument2 SeitenGSDE Assignment: 1) Do You Think NICT Should Take Up PBI Offer?Rachit PradhanNoch keine Bewertungen

- PGP2 Nict 2013PGPM049Dokument3 SeitenPGP2 Nict 2013PGPM049Rachit PradhanNoch keine Bewertungen

- PGP2 Nict 2013PGPM039Dokument5 SeitenPGP2 Nict 2013PGPM039Rachit PradhanNoch keine Bewertungen

- BankingDokument4 SeitenBankingRehaan DanishNoch keine Bewertungen

- NBFC-2 BCGDokument34 SeitenNBFC-2 BCGvamsi.iitkNoch keine Bewertungen

- To Diversify or To consolidate-NICT at Crossroads: Gsde AssignmentDokument3 SeitenTo Diversify or To consolidate-NICT at Crossroads: Gsde AssignmentRachit PradhanNoch keine Bewertungen

- GD Topics & PI Questions - 2022Dokument44 SeitenGD Topics & PI Questions - 2022Madhav MantriNoch keine Bewertungen

- Msme Question PDFDokument9 SeitenMsme Question PDFNiranjan ReddyNoch keine Bewertungen

- Successful Firms Struggle With Succession: Placement Boot Camp - C11 Assignment - 03Dokument9 SeitenSuccessful Firms Struggle With Succession: Placement Boot Camp - C11 Assignment - 03Amber JainNoch keine Bewertungen

- (Kotak) Banks, Diversified Financials, March 30, 2020Dokument40 Seiten(Kotak) Banks, Diversified Financials, March 30, 2020maki takrNoch keine Bewertungen

- Q&A - Anand AgrwaalDokument3 SeitenQ&A - Anand AgrwaalPooja GuptaNoch keine Bewertungen

- Financing MicroDokument2 SeitenFinancing MicroKNOWLEDGE CREATORSNoch keine Bewertungen

- The Morning Context 1 - 14th July '21Dokument10 SeitenThe Morning Context 1 - 14th July '21manmath91Noch keine Bewertungen

- The Personal Network: A New Trust Model and Business Model For Personal FinanceDokument19 SeitenThe Personal Network: A New Trust Model and Business Model For Personal FinancekasyapNoch keine Bewertungen

- Fs 2Dokument2 SeitenFs 2absharaliks82Noch keine Bewertungen

- Document 1Dokument3 SeitenDocument 1Anonymous f068mgxBcNoch keine Bewertungen

- Insights Into Editorial: Say No' To Corporate Houses in Indian BankingDokument5 SeitenInsights Into Editorial: Say No' To Corporate Houses in Indian BankingNikita NimbalkarNoch keine Bewertungen

- BC Retreat ReportDokument30 SeitenBC Retreat ReportAmrit SinghNoch keine Bewertungen

- Answer 1 (1) : The Insolvency and Bankruptcy Code, 2016 Innoventive Industries Ltd. vs. ICICI Bank & Anr (2017) 1 SCC 356Dokument6 SeitenAnswer 1 (1) : The Insolvency and Bankruptcy Code, 2016 Innoventive Industries Ltd. vs. ICICI Bank & Anr (2017) 1 SCC 356Usmaa HashmiNoch keine Bewertungen

- On-Tap' Bank Licences: To What Purpose?Dokument2 SeitenOn-Tap' Bank Licences: To What Purpose?SHARK20051Noch keine Bewertungen

- CBDC Public Comments 8 20220624Dokument871 SeitenCBDC Public Comments 8 20220624hustNoch keine Bewertungen

- Bancassurance Implementing Bancassurance: Key Challenges in The Indian ContextDokument3 SeitenBancassurance Implementing Bancassurance: Key Challenges in The Indian ContextBitecl MesraNoch keine Bewertungen

- Case 1Dokument5 SeitenCase 1camille70% (10)

- Guide To Preparing For Bond Issuance in NigeriaDokument21 SeitenGuide To Preparing For Bond Issuance in NigeriaIfeNoch keine Bewertungen

- NBFC's - An OverviewDokument5 SeitenNBFC's - An OverviewneerajtikuNoch keine Bewertungen

- Bancassurance in India: Its Prospects & Implications: D. KousikDokument5 SeitenBancassurance in India: Its Prospects & Implications: D. KousikKousik DharNoch keine Bewertungen

- Eco CrisisDokument10 SeitenEco CrisisAbhijeet MehrotraNoch keine Bewertungen

- LenDenClub - New Product Development in The Digital SpaceDokument10 SeitenLenDenClub - New Product Development in The Digital SpacePrabhat BistNoch keine Bewertungen

- Mundra PSLDokument7 SeitenMundra PSLdineshjain11Noch keine Bewertungen

- Q&A - Ashok MittalDokument4 SeitenQ&A - Ashok MittalPooja GuptaNoch keine Bewertungen

- Bank. New Mission. New India.: Idfc First Bank LimitedDokument7 SeitenBank. New Mission. New India.: Idfc First Bank LimitedPrasanth RajuNoch keine Bewertungen

- Ambit - Disruption Vol 3Dokument10 SeitenAmbit - Disruption Vol 3Vishal ChakkaNoch keine Bewertungen

- Debt Reduction - Large Indian Companies Are Now Obsessed With Debt ReductionDokument5 SeitenDebt Reduction - Large Indian Companies Are Now Obsessed With Debt ReductionVijay IyerNoch keine Bewertungen

- What Are The Things That Will Make LIC A Good Banking InstitutionDokument9 SeitenWhat Are The Things That Will Make LIC A Good Banking InstitutionSunil VadheraNoch keine Bewertungen

- Where Are The DFIsDokument2 SeitenWhere Are The DFIsNoor FatimaNoch keine Bewertungen

- Impact of Placement With Qip Vs Public OfferDokument44 SeitenImpact of Placement With Qip Vs Public OfferRomit Rakesh0% (1)

- Padmashri Annasaheb Jadhav Bharatiya Samaj Unnati Mandal'SDokument6 SeitenPadmashri Annasaheb Jadhav Bharatiya Samaj Unnati Mandal'SMandal SagarNoch keine Bewertungen

- Silicon India Feb 12 IssueDokument25 SeitenSilicon India Feb 12 IssuenaaznNoch keine Bewertungen

- Gujarat Technological UniversityDokument3 SeitenGujarat Technological UniversityShyamsunder SinghNoch keine Bewertungen

- ManagementOfFinancialServices MB055 QuestionDokument38 SeitenManagementOfFinancialServices MB055 QuestionAiDLoNoch keine Bewertungen

- Black Book Payment BankDokument62 SeitenBlack Book Payment BankVicky VishwakarmaNoch keine Bewertungen

- 8107 End Term Question 2020 MBA PTDokument3 Seiten8107 End Term Question 2020 MBA PTgaurav jainNoch keine Bewertungen

- Assigment On Module 1 of Banking and Insurance Law PDFDokument21 SeitenAssigment On Module 1 of Banking and Insurance Law PDFShashwat MishraNoch keine Bewertungen

- Case of ICICI and Bank of Madura MergerDokument6 SeitenCase of ICICI and Bank of Madura MergerAkash SinghNoch keine Bewertungen

- Neo Banks - Neo Banks in India Are Rising But Will Take Some Time To Disrupt, BFSI News, ET BFSIDokument10 SeitenNeo Banks - Neo Banks in India Are Rising But Will Take Some Time To Disrupt, BFSI News, ET BFSIShachin ShibiNoch keine Bewertungen

- SIDBI NASSCOM Financing Initiative FAQsDokument2 SeitenSIDBI NASSCOM Financing Initiative FAQsgvs_2000Noch keine Bewertungen

- Review of Framework For Borrowings by Large CorporatesDokument7 SeitenReview of Framework For Borrowings by Large CorporatesNEEL KAITHNoch keine Bewertungen

- Insolvency and Bankruptcy Code 2016Dokument14 SeitenInsolvency and Bankruptcy Code 2016Parth SharmaNoch keine Bewertungen

- Taniya Pandey FT-B 1121213103Dokument13 SeitenTaniya Pandey FT-B 1121213103taniya pandeyNoch keine Bewertungen

- Submitted By: S Mouneesh: (17040142015) - BBA - LLB (HONS) 2017-22Dokument13 SeitenSubmitted By: S Mouneesh: (17040142015) - BBA - LLB (HONS) 2017-22MouneeshNoch keine Bewertungen

- New Provision For NBFCDokument4 SeitenNew Provision For NBFCpratikshaNoch keine Bewertungen

- January 22, 2019 All Employees IDBI Bank LTDDokument2 SeitenJanuary 22, 2019 All Employees IDBI Bank LTDTamal ChakravartyNoch keine Bewertungen

- Fifth Trimester Examination - 2009 Banking ManagementDokument7 SeitenFifth Trimester Examination - 2009 Banking Managementhianshu1985Noch keine Bewertungen

- RBIs Conservatism TriumphsDokument1 SeiteRBIs Conservatism TriumphsVivekKumarNoch keine Bewertungen

- A Summer Training Project Report ON Comparative Analysis of Sbi & IciciDokument19 SeitenA Summer Training Project Report ON Comparative Analysis of Sbi & IciciSTAR PRINTINGNoch keine Bewertungen

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsVon EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNoch keine Bewertungen

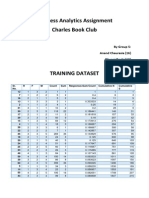

- Business Analytics Assignment Charles Book Club: by Group 5: Anand Chaurasia (16) Dhyani DoshiDokument4 SeitenBusiness Analytics Assignment Charles Book Club: by Group 5: Anand Chaurasia (16) Dhyani DoshiRachit PradhanNoch keine Bewertungen

- UGG - Valuation Stand Alone and With Synergies PDFDokument7 SeitenUGG - Valuation Stand Alone and With Synergies PDFRachit PradhanNoch keine Bewertungen

- Library - Due Date SlipDokument1 SeiteLibrary - Due Date SlipRachit PradhanNoch keine Bewertungen

- To Diversify or To consolidate-NICT at Crossroads: Gsde AssignmentDokument3 SeitenTo Diversify or To consolidate-NICT at Crossroads: Gsde AssignmentRachit PradhanNoch keine Bewertungen

- SAPM Technical AnalysisDokument1 SeiteSAPM Technical AnalysisRachit PradhanNoch keine Bewertungen

- Case: Natureview Farm: Submitted byDokument3 SeitenCase: Natureview Farm: Submitted byRachit PradhanNoch keine Bewertungen

- Sm-II Course Wrap UpDokument27 SeitenSm-II Course Wrap UpRachit PradhanNoch keine Bewertungen

- A New Mandate For Human Resources: Article SummaryDokument7 SeitenA New Mandate For Human Resources: Article SummaryRachit PradhanNoch keine Bewertungen

- P&G LDLDokument6 SeitenP&G LDLRachit PradhanNoch keine Bewertungen

- Performance Management at Vitality HealthDokument7 SeitenPerformance Management at Vitality HealthRachit Pradhan33% (3)

- Airthread Connections Case (Work Sheet)Dokument66 SeitenAirthread Connections Case (Work Sheet)bachandas75% (4)

- Barilla SpaDokument3 SeitenBarilla SpaRachit PradhanNoch keine Bewertungen

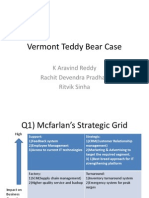

- Vermont Teddy Bear CaseDokument4 SeitenVermont Teddy Bear CaseRachit Pradhan0% (1)

- Jean-Jacques Nattiez Analyses Et Interpr PDFDokument5 SeitenJean-Jacques Nattiez Analyses Et Interpr PDFJosé Rafael Maldonado AbarcaNoch keine Bewertungen

- Transpo Cases 1Dokument27 SeitenTranspo Cases 1Christine Joy EstropiaNoch keine Bewertungen

- Guidelines For Students Association in Manonmaniam Sundaranar University DepartmentsDokument2 SeitenGuidelines For Students Association in Manonmaniam Sundaranar University DepartmentsDavid MillerNoch keine Bewertungen

- Mactan - Cebu International Airport Authority vs. InocianDokument1 SeiteMactan - Cebu International Airport Authority vs. InocianremoveignoranceNoch keine Bewertungen

- Case Study: TEAM-2Dokument5 SeitenCase Study: TEAM-2APARNA SENTHILNoch keine Bewertungen

- Media Ethic Chapter 3 Presentation Final PrintDokument17 SeitenMedia Ethic Chapter 3 Presentation Final PrintfutakomoriNoch keine Bewertungen

- Lesson 1 Introduction1.Pptx 1Dokument28 SeitenLesson 1 Introduction1.Pptx 1Hannah Nicole ParaisoNoch keine Bewertungen

- Civil Suit For Permanent Prohibitory InjunctionDokument2 SeitenCivil Suit For Permanent Prohibitory InjunctiongreenrosenaikNoch keine Bewertungen

- The Cowards of WarDokument9 SeitenThe Cowards of WarJess Willox100% (1)

- Beltran v. Secretary of HealthDokument25 SeitenBeltran v. Secretary of HealthLyka Lim PascuaNoch keine Bewertungen

- Jsa CPBDokument3 SeitenJsa CPBmd maroofNoch keine Bewertungen

- Unit 3 Motivation: DEFINITIONS OF MOTIVATION: According To Robert Dubin, "Motivation Is TheDokument12 SeitenUnit 3 Motivation: DEFINITIONS OF MOTIVATION: According To Robert Dubin, "Motivation Is TheHarpreet SinghNoch keine Bewertungen

- Tattoos On The Heart RRDokument5 SeitenTattoos On The Heart RRapi-2914360670% (1)

- Acct4131 AuditingDokument2 SeitenAcct4131 AuditingWingyan ChanNoch keine Bewertungen

- R4. Sexual Ethics: by Arielle P. Schwartz, Holley Law Fellow, National Gay and Lesbian Task ForceDokument5 SeitenR4. Sexual Ethics: by Arielle P. Schwartz, Holley Law Fellow, National Gay and Lesbian Task ForceBrylle Garnet DanielNoch keine Bewertungen

- Ra 3844 UncDokument26 SeitenRa 3844 UncRogelineNoch keine Bewertungen

- The Virtues of Al-Madeenah - Shaikh 'Abdul Muhsin Al-Abbad Al-BadrDokument20 SeitenThe Virtues of Al-Madeenah - Shaikh 'Abdul Muhsin Al-Abbad Al-BadrMountainofknowledgeNoch keine Bewertungen

- Mary Main and Erik Hesse - Disorganized AttachmentDokument20 SeitenMary Main and Erik Hesse - Disorganized AttachmentadamiamNoch keine Bewertungen

- TikTok Brochure 2020Dokument16 SeitenTikTok Brochure 2020Keren CherskyNoch keine Bewertungen

- FAMILY LAW-II (NOTES For Exam) 2Dokument38 SeitenFAMILY LAW-II (NOTES For Exam) 2sarveshNoch keine Bewertungen

- Eusebio de La Cruz vs. Apolonio Legaspi & Concordia Samperoy, G.R. No. L-8024. November 29, 1955.Dokument2 SeitenEusebio de La Cruz vs. Apolonio Legaspi & Concordia Samperoy, G.R. No. L-8024. November 29, 1955.Fides DamascoNoch keine Bewertungen

- Pasikkad Action PlanDokument3 SeitenPasikkad Action PlanwilsonNoch keine Bewertungen

- Futrell3e Chap10Dokument27 SeitenFutrell3e Chap10anitasengarphdNoch keine Bewertungen

- Lesson #2 Self-Awareness and Self-ManagementPageDokument7 SeitenLesson #2 Self-Awareness and Self-ManagementPageAlejandro GamingNoch keine Bewertungen

- Types of Case StudiesDokument2 SeitenTypes of Case Studiespooja kothariNoch keine Bewertungen

- Applications of Theory To Rehabilitation Counselling PracticDokument49 SeitenApplications of Theory To Rehabilitation Counselling PracticShahinNoch keine Bewertungen

- IMPRESSIVE CONVEYANCING NOTES - by Onguto and KokiDokument89 SeitenIMPRESSIVE CONVEYANCING NOTES - by Onguto and Kokikate80% (5)

- LEGAL ETHICS BAR EXAM With Suggested Answers.Dokument5 SeitenLEGAL ETHICS BAR EXAM With Suggested Answers.Blake Clinton Y. Dy91% (11)

- Iain McLean - Gift Relationship PDFDokument2 SeitenIain McLean - Gift Relationship PDFJmaceroNoch keine Bewertungen

- HCRA - OAHI - Feb.25 v3Dokument13 SeitenHCRA - OAHI - Feb.25 v3albertNoch keine Bewertungen