Beruflich Dokumente

Kultur Dokumente

Valuing An Option To Abandon A Project: Inputs Relating The Underlying Asset

Hochgeladen von

mfaisalidreis0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten2 Seitenab

Originaltitel

Abandon

Copyright

© © All Rights Reserved

Verfügbare Formate

XLS, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenab

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

9 Ansichten2 SeitenValuing An Option To Abandon A Project: Inputs Relating The Underlying Asset

Hochgeladen von

mfaisalidreisab

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

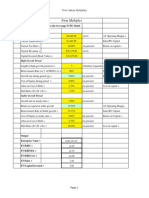

OPTION WORKSHEET: LONG TERM OPTIONS

VALUING AN OPTION TO ABANDON A PROJECT

This program calculates the value of an abandonment option.

Inputs relating the underlying asset

Enter the present value of cash flows from continuing project =

$254.00

(in currency)

Entet the annualized standard deviation in ln(present value of CF)

30.00%

(in %)

25

(in years)

$150.00

(in currency)

10

(in years)

7.00%

(in %)

Enter the remaining life of the project =

Enter the value received on abandonment =

Enter the number of years that you have rights to abandon project

General Inputs

Enter the riskless rate that corresponds to the option lifetime =

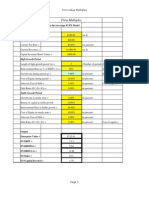

VALUING A LONG TERM OPTION/WARRANT

Stock Price=

$254.00

T.Bond rate=

Strike Price=

$150.00

Variance=

Expiration (in years) =

10

Annualized dividend yield=

7.00%

0.09

4.00%

(Net out any abandonment costs)

(< or = project life)

OPTION WORKSHEET: LONG TERM OPTIONS

d1 =

1.34575888

N(d1) =

0.910809855

d2 =

0.397075582

N(d2) =

0.654344137

Value of Option to Abandon =

$10.56

Das könnte Ihnen auch gefallen

- Valuing An Option To Abandon A Project: Inputs Relating The Underlying AssetDokument3 SeitenValuing An Option To Abandon A Project: Inputs Relating The Underlying AssetPro ResourcesNoch keine Bewertungen

- ExpandDokument2 SeitenExpandPro ResourcesNoch keine Bewertungen

- ExpandDokument2 SeitenExpandapi-3763138Noch keine Bewertungen

- OptltDokument3 SeitenOptltapi-3763138Noch keine Bewertungen

- EquityDokument8 SeitenEquityapi-3701114Noch keine Bewertungen

- DelayDokument2 SeitenDelayapi-3763138Noch keine Bewertungen

- Valuing An Expansion Option This Program Calculates The Value of An Expansion Option in An Investment AnalysisDokument2 SeitenValuing An Expansion Option This Program Calculates The Value of An Expansion Option in An Investment AnalysisAlok P SinghNoch keine Bewertungen

- Straight Bond Value $834.79 Conversion Option $325.49 Value of Convertible Bond $1,160.28Dokument6 SeitenStraight Bond Value $834.79 Conversion Option $325.49 Value of Convertible Bond $1,160.28J RodriguezNoch keine Bewertungen

- Calculate Value of Convertible Bond and Conversion OptionDokument6 SeitenCalculate Value of Convertible Bond and Conversion Optionnitin vermaNoch keine Bewertungen

- Financial Management Bruce HonniballDokument3 SeitenFinancial Management Bruce HonniballjanelleNoch keine Bewertungen

- NatresDokument3 SeitenNatresapi-3701114Noch keine Bewertungen

- DelayDokument2 SeitenDelayPro ResourcesNoch keine Bewertungen

- Year FCFF Terminal Value Present Value 1 2 3 4 5 6 7 8 9 10 $318.13 $60,899.33 $19,986.47 $16,041.34Dokument19 SeitenYear FCFF Terminal Value Present Value 1 2 3 4 5 6 7 8 9 10 $318.13 $60,899.33 $19,986.47 $16,041.34api-3763138Noch keine Bewertungen

- CHAPTER 9 - Investment AppraisalDokument37 SeitenCHAPTER 9 - Investment AppraisalnaurahimanNoch keine Bewertungen

- EBW1063 Managerial Finance Tutorial - StockValuation - AnswerDokument3 SeitenEBW1063 Managerial Finance Tutorial - StockValuation - AnswerJune JoysNoch keine Bewertungen

- Firm Multiples: Current InputsDokument2 SeitenFirm Multiples: Current InputssambarocksNoch keine Bewertungen

- FirmmultDokument2 SeitenFirmmultPro ResourcesNoch keine Bewertungen

- Firm Multiples: Current InputsDokument2 SeitenFirm Multiples: Current InputszNoch keine Bewertungen

- Capital Budgeting PDFDokument2 SeitenCapital Budgeting PDFqwertNoch keine Bewertungen

- Capital Budgeting and FinancingDokument21 SeitenCapital Budgeting and FinancingCérine AbedNoch keine Bewertungen

- fM-Cost of CapitalDokument46 SeitenfM-Cost of CapitalParamjit Sharma100% (8)

- Cost-Volume Analysis and Breakeven OptimizationDokument28 SeitenCost-Volume Analysis and Breakeven OptimizationthuaiyaalhinaiNoch keine Bewertungen

- An Introduction To Security Valuation: Dr. Amir RafiqueDokument34 SeitenAn Introduction To Security Valuation: Dr. Amir RafiqueUsman MahmoodNoch keine Bewertungen

- IEDA 3230: Engineering Economy Evaluating An Engineering Project (Deterministic Models)Dokument32 SeitenIEDA 3230: Engineering Economy Evaluating An Engineering Project (Deterministic Models)jnfzNoch keine Bewertungen

- Real Options Teaching NotesDokument11 SeitenReal Options Teaching NotesTwinkle ChettriNoch keine Bewertungen

- FMECO CONCEPT NOTES by Ca Test SeriesDokument329 SeitenFMECO CONCEPT NOTES by Ca Test SeriesTanvirNoch keine Bewertungen

- FirmmultDokument2 SeitenFirmmultapi-3763138Noch keine Bewertungen

- Capital Budgeting Techniques for Evaluating Investment ProjectsDokument41 SeitenCapital Budgeting Techniques for Evaluating Investment ProjectsAsif Islam SamannoyNoch keine Bewertungen

- Paper14 SolutionDokument25 SeitenPaper14 SolutionGregorio VidadNoch keine Bewertungen

- The Valuation of Long-Term SecuritiesDokument54 SeitenThe Valuation of Long-Term SecuritiesRuman MahmoodNoch keine Bewertungen

- Valuation of SecuritiesDokument71 SeitenValuation of Securitieskuruvillaj2217Noch keine Bewertungen

- Capital Budgeting April2021Dokument28 SeitenCapital Budgeting April2021MikhailNoch keine Bewertungen

- Bonds and Stock ValuationDokument82 SeitenBonds and Stock ValuationAli Khan100% (2)

- Basics of Capital Budgeting AnalysisDokument30 SeitenBasics of Capital Budgeting AnalysisChandra HimaniNoch keine Bewertungen

- Cash Flow Estimation and Risk AnalysisDokument63 SeitenCash Flow Estimation and Risk AnalysisAli JumaniNoch keine Bewertungen

- Lecture Organization: OCF Scenario Analysis Cost AnalysisDokument21 SeitenLecture Organization: OCF Scenario Analysis Cost AnalysisCindy SU YuNoch keine Bewertungen

- Ch10 Returns & Risk 2020 Corporate Prof - KhaledDokument18 SeitenCh10 Returns & Risk 2020 Corporate Prof - KhaledMhmood Al-saadNoch keine Bewertungen

- Bab 5 Pengurusan Kewangan 2 (Payback Period, NPV, IRR)Dokument27 SeitenBab 5 Pengurusan Kewangan 2 (Payback Period, NPV, IRR)emma lenaNoch keine Bewertungen

- NPV Comparison of Investment OptionsDokument4 SeitenNPV Comparison of Investment OptionsБота ОмароваNoch keine Bewertungen

- Formula SheetDokument7 SeitenFormula SheetanasfinkileNoch keine Bewertungen

- Capital Budgeting Techniques ExplainedDokument35 SeitenCapital Budgeting Techniques ExplainedGaurav gusaiNoch keine Bewertungen

- DVM STOCK VALUATIONSDokument11 SeitenDVM STOCK VALUATIONSDayaan ANoch keine Bewertungen

- The Basics of Capital Budgeting: Should We Build This Plant?Dokument70 SeitenThe Basics of Capital Budgeting: Should We Build This Plant?Jithin NairNoch keine Bewertungen

- FIN 531 Corporate Finance Cheat Sheet HighlightsDokument2 SeitenFIN 531 Corporate Finance Cheat Sheet HighlightsZulfiana SetyaningsihNoch keine Bewertungen

- BFD - Sensitivity Analysis by Taha PopatiaDokument4 SeitenBFD - Sensitivity Analysis by Taha PopatiaMuhammad TaimoorNoch keine Bewertungen

- Cost of CapitalDokument31 SeitenCost of CapitalMadhuram Sharma100% (1)

- Type of CostDokument38 SeitenType of CostNabeel BashirNoch keine Bewertungen

- An Introduction To Security Valuation: Dr. Amir RafiqueDokument51 SeitenAn Introduction To Security Valuation: Dr. Amir RafiqueUmar AliNoch keine Bewertungen

- Exam 4210 Spring 2020 Key ConceptsDokument3 SeitenExam 4210 Spring 2020 Key ConceptsTotrinh BuiNoch keine Bewertungen

- CH 04Dokument70 SeitenCH 04mujtabanaqvi11Noch keine Bewertungen

- 4.chapter 8 - Stock ValuationDokument40 Seiten4.chapter 8 - Stock ValuationMohamed Sayed FadlNoch keine Bewertungen

- December 20 FTFM PracticeDokument54 SeitenDecember 20 FTFM PracticerajanikanthNoch keine Bewertungen

- Lecture 4 - Analysis of Cost EstimationDokument93 SeitenLecture 4 - Analysis of Cost EstimationRayan AlShehriNoch keine Bewertungen

- Guide To Engineering EconomicsDokument94 SeitenGuide To Engineering Economicsagricultural and biosystems engineeringNoch keine Bewertungen

- Two-Stage FCFF Model Excel FileDokument2 SeitenTwo-Stage FCFF Model Excel FilenadeemamNoch keine Bewertungen

- FBL5Dokument12 SeitenFBL5FaleeNoch keine Bewertungen

- Accounting and Finance Formulas: A Simple IntroductionVon EverandAccounting and Finance Formulas: A Simple IntroductionBewertung: 4 von 5 Sternen4/5 (8)

- Corporate Finance Formulas: A Simple IntroductionVon EverandCorporate Finance Formulas: A Simple IntroductionBewertung: 4 von 5 Sternen4/5 (8)

- Cody - Smith - Chap 5Dokument24 SeitenCody - Smith - Chap 5api-3763138Noch keine Bewertungen

- SchwartzMoon (2000) Rational Pricing Internet CpyDokument14 SeitenSchwartzMoon (2000) Rational Pricing Internet Cpyapi-3763138Noch keine Bewertungen

- Cody - Smith - Chap 4Dokument36 SeitenCody - Smith - Chap 4api-3763138100% (1)

- Estimating Growth Rates (Teaching Model)Dokument4 SeitenEstimating Growth Rates (Teaching Model)api-3763138Noch keine Bewertungen

- Optimal Portfolio Assignment FINA 515 2005 Ray Guo (P)Dokument76 SeitenOptimal Portfolio Assignment FINA 515 2005 Ray Guo (P)api-3763138Noch keine Bewertungen

- Stiglitz Weiss 1981 Implementation by Kurt HessDokument20 SeitenStiglitz Weiss 1981 Implementation by Kurt Hessapi-3763138Noch keine Bewertungen

- Optimal Portfolio Assignment Solution StrudwickDokument10 SeitenOptimal Portfolio Assignment Solution Strudwickapi-3763138Noch keine Bewertungen

- Contact - Main 2006Dokument89 SeitenContact - Main 2006api-3763138Noch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Relative Value Models (Feb04)Dokument18 SeitenRelative Value Models (Feb04)api-3763138Noch keine Bewertungen

- Endowment - Warrant - Valuer (McVerry) DDokument244 SeitenEndowment - Warrant - Valuer (McVerry) Dapi-3763138Noch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Δr=α b−r Δt+σε Δt: Simulation of short-term interest ratesDokument19 SeitenΔr=α b−r Δt+σε Δt: Simulation of short-term interest ratesapi-3763138Noch keine Bewertungen

- Refresh Worksheet ListDokument14 SeitenRefresh Worksheet Listapi-3763138Noch keine Bewertungen

- Term Structure JP Morgan Model (Feb04)Dokument7 SeitenTerm Structure JP Morgan Model (Feb04)api-3763138Noch keine Bewertungen

- BbandsDokument12 SeitenBbandsapi-3763138Noch keine Bewertungen

- Stock Price Random ProcessesDokument63 SeitenStock Price Random Processesapi-3763138Noch keine Bewertungen

- Spline Basis Function Approximating Discount Function Fitting Bond UniverseDokument5 SeitenSpline Basis Function Approximating Discount Function Fitting Bond Universeapi-3763138Noch keine Bewertungen

- Bond Pricing - Dynamic ChartDokument4 SeitenBond Pricing - Dynamic Chartapi-3763138Noch keine Bewertungen

- Longstaff Schwartz (95) Risky Debt (P)Dokument18 SeitenLongstaff Schwartz (95) Risky Debt (P)api-3763138Noch keine Bewertungen

- Degree Polynomial:: Generic Yield Interpolation ChartDokument9 SeitenDegree Polynomial:: Generic Yield Interpolation Chartapi-3763138Noch keine Bewertungen

- Bond Pricing - BasicsDokument2 SeitenBond Pricing - Basicsapi-3763138Noch keine Bewertungen

- Bond Pricing - Dynamic ChartDokument4 SeitenBond Pricing - Dynamic Chartapi-3763138Noch keine Bewertungen

- Bond Price With Excel FunctionsDokument6 SeitenBond Price With Excel Functionsapi-3763138Noch keine Bewertungen

- Converts PrimerDokument6 SeitenConverts Primerjunjun07_01Noch keine Bewertungen

- RV YTM Model PDFDokument47 SeitenRV YTM Model PDFAllen LiNoch keine Bewertungen

- Bond Pricing - System of Five Bond VariablesDokument2 SeitenBond Pricing - System of Five Bond Variablesapi-3763138Noch keine Bewertungen

- Bond Duration - Price Sensitivity Using DurationDokument3 SeitenBond Duration - Price Sensitivity Using Durationapi-3763138Noch keine Bewertungen

- Bond Pricing - by Yield To MaturityDokument3 SeitenBond Pricing - by Yield To Maturityapi-3763138Noch keine Bewertungen

- Bond Duration - Dynamic ChartDokument3 SeitenBond Duration - Dynamic Chartapi-3763138Noch keine Bewertungen